AssetCo PLC Completion of acquisition (0493H)

July 30 2021 - 2:00AM

UK Regulatory

TIDMASTO

RNS Number : 0493H

AssetCo PLC

30 July 2021

30 July 2021

AssetCo plc

("AssetCo" or the "Company")

Completion of acquisition of Saracen Fund Managers Limited

On 14 May 2021, the Company announced that it had reached

agreement to acquire the entire issued share capital of Saracen

Fund Managers Limited ("Saracen") (the "Acquisition") for an

effective total consideration of GBP2.75 million (the

"Consideration"). The Acquisition was conditional on, inter alia,

approval by the FCA to the change of controller and the admission

of the Consideration Shares to trading on AIM. The Consideration

for the Acquisition was to be satisfied by the issue of 166,904 new

ordinary shares of 10p each in the Company, fully paid (the

"Consideration Shares") and GBP664,774 in cash.

The Company is pleased to announce that the conditions

pertaining to the Acquisition have been satisfied and that

completion of the Acquisition took place earlier today.

The Acquisition follows on from the completion of the

acquisition of an effective 63% equity interest in ETF Rize Limited

from J&E Davy Holdings, which took place on 27 July.

Peter McKellar, Deputy Chairman and CEO of AssetCo,

commented:

"The completion of the acquisition of Saracen Fund Managers is

part of AssetCo's overall strategy of investing in, building and

managing asset and wealth management businesses. Saracen is a small

fund management firm with great potential. Our aim is to grow the

business through marketing its existing funds and, over time,

broadening its product range to meet the evolving needs of

investors.

"The acquisition of Saracen, alongside the completion of the

acquisition of a majority equity interest in Rize ETF, comes a

little over three months since AssetCo's new strategy was approved

by shareholders. There are numerous structural shifts taking place

within the asset and wealth management industry, including

demographics and the use of technology. These are presenting

challenges and opportunities for incumbent firms. Without the

constraints of a legacy business, we believe we can capitalise on

these shifts to generate significant value and to deliver

successful outcomes for clients and shareholders."

Enquiries:

AssetCo plc

Peter McKellar, Deputy Chairman and CEO

James Thorneley, Head of Communications

Tel: +44 (0) 7958 005 141

Arden Partners plc

Nominated adviser and broker

John Llewellyn-Lloyd / Louisa Waddell / Akhil Shah

Tel: +44 (0) 20 7614 5900

Maitland/AMO

Neil Bennett

Rachel Cohen

Tel: +44 (207) 379 5151

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQZZGFNVGRGMZG

(END) Dow Jones Newswires

July 30, 2021 03:00 ET (07:00 GMT)

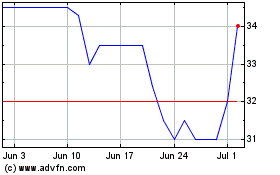

Assetco (LSE:ASTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assetco (LSE:ASTO)

Historical Stock Chart

From Apr 2023 to Apr 2024