AssetCo PLC Acceleration of GBP7.5m Share Repurchase Programme (5492C)

October 12 2022 - 1:00AM

UK Regulatory

TIDMASTO

RNS Number : 5492C

AssetCo PLC

12 October 2022

12 October 2022

LEI: 213800LFMHKVNTZ7GV45

AssetCo plc ("AssetCo" or the "Company")

Acceleration of existing GBP7.5m Share Repurchase Programme

On 29 September 2022, the Company appointed Panmure Gordon to

independently manage the Programme to repurchase Ordinary Shares on

the Company's behalf. Panmure Gordon have acquired 354,976 Ordinary

Shares pursuant to the Programme. The Company has now resolved to

appoint Numis Securities Limited ("Numis") to continue with the

Programme as set out below.

About the Programme

-- The Programme will be financed through existing cash resources.

-- The aggregate number of Ordinary Shares acquired by the

Company pursuant to the Programme shall not exceed the maximum

number of Ordinary Shares which the Company is authorised to

purchase pursuant to the General Authority, being up to 14,929,297

Ordinary Shares.

-- The Programme will operate in accordance with and under the

terms of the relevant General Authority, and within the regulatory

limit on the quantity of Ordinary Shares the Company may purchase

on a single day. The Programme will be conducted within the

parameters of the Market Abuse Regulation 596/2014/EU and the

delegated regulations made pursuant to it.

-- However, to accelerate the Programme there may be

circumstance where the Company conducts share repurchases such that

they exceed 25 per cent of the average daily volume in Ordinary

Shares for the 20 trading days prior to the share repurchase.

-- The Company confirms that it currently has no unpublished inside information.

-- The Programme will commence on the date of this announcement

and will continue until the earlier of either the expiration of the

General Authority or until the maximum pecuniary amount has been

purchased under the Programme. The Company expects the Programme to

be completed over the next three to six months.

-- The purchased Ordinary Shares will be held by the Company in

treasury at the Company's discretion for later reissue or

cancellation. Shares held in treasury are not entitled to dividends

and have no voting rights at the Company's general meetings.

-- Share repurchases will take place in open market transactions

and may be made from time to time depending on market conditions,

share price and trading volume. The maximum price paid per Ordinary

Share will be no more than the higher of the price of the last

independent trade and the highest current independent purchase bid

for Ordinary Shares on the trading venue where the purchase is

carried out.

-- In accordance with the General Authority, the maximum price

paid per Ordinary Share acquired by the Company pursuant to the

Programme is to be no more than 105% of the average middle market

closing price of an Ordinary Share on AIM for the five business

days preceding the date of purchase.

-- As at 12 October 2022, the Company's total issued share

capital consisted of 149,292,970 Ordinary Shares, with one voting

right per share. The Company holds 354,976 Ordinary Shares in

treasury. Therefore, the total number of voting rights in the

Company was 148,937,994.

Defined terms above are as defined in the announcement titled

'Share Repurchase Programme and Result of General Meeting' made by

the Company on 29 September 2022.

For further information, please contact:

AssetCo plc Numis Securities Limited

Campbell Fleming, CEO Nominated adviser and joint

Peter McKellar, Deputy Chairman broker

Tel: +44 (0) 785 0464 301 Giles Rolls / Charles Farquhar

Tel: +44 (0) 20 7260 1000

Panmure Gordon (UK) Limited Maitland/AMO

Joint broker Neil Bennett

Charles Leigh-Pemberton / Atholl Rachel Cohen

Tweedie Tel: +44 (0) 20 7379 55151

Tel: +44 (0) 20 7886 2500

For further details, visit the website, www.assetco.com

Ticker: AIM: ASTO.L

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAKEFFLSAFFA

(END) Dow Jones Newswires

October 12, 2022 02:00 ET (06:00 GMT)

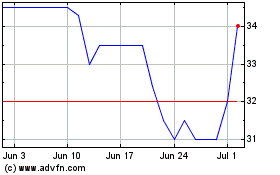

Assetco (LSE:ASTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assetco (LSE:ASTO)

Historical Stock Chart

From Apr 2023 to Apr 2024