TIDMATG

RNS Number : 7432V

Auction Technology Group PLC

15 December 2021

15 December 2021

Auction Technology Group plc

(the "Company" or "ATG")

Publication of 2021 Annual Report and Accounts and

Notice of 2022 Annual General Meeting

Following the release on 2 December 2021 of its preliminary

results for the year ended 30 September 2021, the Company announces

that it is today publishing its 2021 Annual Report and Accounts.

The Company also announces that its Annual General Meeting ("AGM")

will be held at 10.00 a.m. on Tuesday 25 January 2022 at the

offices of Travers Smith LLP, 10 Snow Hill, London EC1A 2AL.

At the present time, it is expected that UK Government rules and

advice relating to the COVID-19 pandemic will permit a physical

meeting to be held, but this may be subject to change at short

notice. Any change affecting the holding of the AGM will be posted

on the Company's website ( www.auctiontechnologygroup.com ) and by

way of announcement to the London Stock Exchange. Shareholders are

advised to regularly check the Company's website for updates in

relation to the AGM and to carefully consider the Government advice

in effect at the time of the AGM. Due to the ongoing uncertainty in

respect of the COVID-19 pandemic we strongly encourage shareholders

to appoint the chair of the meeting as their proxy, irrespective of

whether or not they plan to attend in person.

In accordance with Listing Rule 9.6.1 of the UK Financial

Conduct Authority ("FCA") a copy of the Annual Report and Accounts,

the Notice of AGM and Proxy Form have been submitted to the

National Storage Mechanism and will shortly be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

C opies of the Annual Report, Notice of AGM and Proxy Form will

also be shortly available to view on the Company's website at

www.auctiontechnologygroup.com/investors/ .

Compliance with DTR 6.3.5R

The information included in the final results announcement

released on 2 December 2021, together with the information in the

Appendix to this announcement which is extracted from the 2021

Annual Report and Accounts , constitute the materials required by

the FCA's Disclosure Guidance and Transparency Rule 6.3.5R. T his

announcement is not a substitute for reading the 2021 Annual Report

and Accounts in its entirety.

Enquiries

Tulchan Communications +44 (0) 207 353 4200

(Public relations advisor to ATG@tulchangroup.com

ATG)

Tom Murray, Sunni Chauhan, Matt

Low, Laura Marshall

ATG

For investor enquiries investorrelations@auctiontechnologygroup.com

For media enquiries press@auctiontechnologygroup.com

APPIX

Statement of Directors' Responsibilities

Page 87 of the Annual Report contains the following statement

regarding responsibility for the financial statements and the

management report included in the Annual Report.

The Directors are responsible for preparing the Annual Report

and the Group and parent Company financial statements in accordance

with applicable law and regulations.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the Directors

are required to prepare the Group Consolidated Financial Statements

in accordance with International Financial Reporting Standards

("IFRSs") as adopted by the European Union and Article 4 of the IAS

Regulation and have elected to prepare the parent Company Financial

Statements in accordance with United Kingdom Generally Accepted

Accounting Practice (United Kingdom Accounting Standards and

applicable law), including FRS 101 "Reduced Disclosure Framework".

Under company law the Directors must not approve the accounts

unless they are satisfied that they give a true and fair view of

the state of affairs of the Company and of the profit or loss of

the Company for that period.

In preparing the parent Company financial statements, the

Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable,

relevant, reliable and prudent;

-- state whether applicable UK Accounting Standards have been

followed, subject to any material departures disclosed and

explained in the parent Company financial statements; and

-- prepare the Financial Statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

In preparing the Group Consolidated Financial Statements,

International Accounting Standard 1 requires the Directors to:

-- properly select and apply accounting policies;

-- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

-- provide additional disclosures when compliance with the

specific requirements in IFRSs are insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the entity's financial position and financial

performance; and

-- make an assessment of the Company's ability to continue as a going concern.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements comply with the Companies Act 2006. They

are also responsible for safeguarding the assets of the Company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the United Kingdom governing the

preparation and dissemination of financial statements may differ

from legislation in other jurisdictions.

Responsibility statement of the Directors in respect of the

annual financial report

We confirm that to the best of our knowledge:

-- the Financial Statements, prepared in accordance with the

relevant financial reporting framework, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole;

-- the Strategic Report includes a fair review of the

development and performance of the business and the position of the

Company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face; and

-- the Annual Report and the Consolidated Financial Statements,

taken as a whole, are fair, balanced and understandable and provide

the information necessary for shareholders to assess the Company's

position and performance, business model and strategy.

This responsibility statement was approved by the Board of

Directors on 1 December 2021 and is signed on its behalf by:

John-Paul Savant Tom Hargreaves

Chief Executive Officer Chief Financial Officer

Principal Risks and Uncertainties

Pages 52 to 55 of the Annual Report contain the following

statement on principal risks and uncertainties faced by the

Group.

Identifying, monitoring and managing the Group's principal

risks

The Board has carried out a robust assessment of the principal

risks facing the Group, including those that would threaten its

business model, future performance, solvency or liquidity. This

included an assessment of the likelihood and impact of each risk

identified, and the mitigating actions being taken. Risk levels

were modified to reflect the current view of the relative

significance of each risk.

The principal risks and uncertainties identified are detailed in

this section. Additional risks and uncertainties to the Group,

including those that are not currently known or that the Group

currently deems immaterial, may individually or cumulatively also

have a material effect on the Group's business, results of

operations and/or financial condition.

Whilst we operate in an evolving environment with several clear

risks, we take a proactive and robust approach to identifying any

new risks, and evaluating and mitigating all known risks through a

regular review process. Climate change is not currently considered

to be a principal risk for the Group given the nature of our

business. The Board will continue to monitor the environmental

impact of our business on the environment and the potential impact

of climate change.

COVID-19

The COVID-19 pandemic caused unprecedented levels of disruption

globally, with periods of national and local lockdowns in each of

the territories we operate. However, the Group has continued to

trade strongly and has experienced accelerated growth during the

COVID-19 pandemic, in part due to acceleration of the shift from

offline to online auctions. As restrictions have started to ease,

we have not seen a significant change in behaviour of auctioneers

and bidders returning to the use of physical auctions away from

online however, there is a risk this could happen therefore

reducing the number of auctioneers and/or bidders using the

marketplaces or platform. The pandemic may also have longer-term

impacts on other stakeholders such as employees, customers,

suppliers and the wider economy which in turn may impact the

Group.

The safety of our employees has been a priority, with staff

supported in their need to work from home according to their

personal circumstances. Intra-company communication has continued

at regular intervals using accessible technology with regular town

hall streaming of communications to all staff including real time

Q&A sessions. We have ensured our supplier payments have

continued to be made in accordance with supplier payment terms.

1. IT infrastructure - stability and business continuity of

auction platforms

Description of risk Mitigating action/controls

--------------------------------------------

An inability to maintain a consistently The Group maintains a scalable

high-quality experience, including and resilient IT infrastructure

network or server failure for with real-time monitoring and

the Group's auction house and alerting. Processes are in place

bidder customers across its to ensure that dedicated technical

marketplaces or platform, could and client operations teams

affect the Group's reputation, are mobilised to minimise client

increase its operational costs impact.

and cause losses.

--------------------------------------------

2. IT infrastructure - inability to keep pace with innovation

and changes

Description of risk Mitigating action/controls

--------------------------------------------

If the Group fails to keep pace The Group has a dedicated team

with innovation and changes of product managers responsible

in technology this could result for keeping pace with changes

in fewer auction houses and/or in customer expectations and

bidders using the marketplaces technology, and defining the

or platform and therefore a roadmap of features for the

loss of revenue. platform and marketplaces. New

functionality is tested with

a subset of the user base, to

gather real-time usage data

and feedback, to then optimise

the user experience.

--------------------------------------------

3. Data security/data loss

Description of risk Mitigating action/controls

--------------------------------------------

A key asset to our business The Group has an internal governance

is our data. Like many technology framework for data protection

businesses, the risk of security and security policies and procedures

breaches and/or targeted attacks in place along with robust IT

and other disruptions is ever and security controls. Annual

present. Whilst we design security penetration tests are performed

into the way we operate, we on all proprietary systems along

are acutely aware that any compromise with security recommendations

to our systems could disrupt from third-party security providers

the Group's business, compromise which are reviewed each month.

sensitive and confidential information, The Group appointed an experienced

affect the Group's reputation, Data Protection Officer during

increase its operational costs the year to oversee all data

and cause potential financial protection matters and work

losses in the form of penalties. with stakeholders across the

Group to review, develop and

improve our data practices and

procedures.

Further details are set out

in the governance section of

the ESG report on page 40.

--------------------------------------------

4. Competition

Description of risk Mitigating action/controls

--------------------------------------------

The Group's business model may The combination of our leadership,

come under significant pressure people, agile way of working

should a significant number and strong industry knowledge

of auction houses choose to and networks helps to ensure

take bidder generation, technology that we stay up-to-date with

development and customer service the competitive landscape within

(amongst other things) in-house which we operate.

and so bypass the marketplaces We are constantly innovating

or platform, including as a with our technology and engaging

result of auction houses who our customers for feedback.

use the Group's white label We also undertake regular horizon-scanning

offering attempting to maintain activities to understand competitive

their own platforms rather than threats and opportunities.

using the Group's platform.

--------------------------------------------

5. Failure to deliver expected benefits from acquisitions

and/or integrate the business into the Group effectively

Description of risk Mitigating action/controls

--------------------------------------------

The Group has in the past made Clear plans and route maps are

and in the future may undertake prepared to successfully integrate

further acquisitions and investments, newly acquired businesses into

which may prove unsuccessful the Group. It is important that

or divert its resources, result we retain key expertise in our

in operating difficulties, and newly acquired businesses. Post

otherwise disrupt the Group's the acquisitions completing

operations. we continue to review operational

structures to ensure they are

optimised globally.

Performance of the acquired

businesses is reviewed against

the initial investment cases

prepared to ensure their performance

is in line with original expectation.

--------------------------------------------

6. Attracting and retaining skills/capabilities and succession

planning

Description of risk Mitigating action/controls

--------------------------------------------

Our business depends on hiring During the year the Group has

and retaining first class talent recruited a number of senior

in the highly competitive tech hires, including a new Chief

industry. Inability to attract Marketing Officer.

and retain critical skills and Following the IPO, the Nomination

capabilities could hinder our Committee has been established

ability to deliver on our strategic to help review succession planning

objectives. for the Board and senior management.

A variety of techniques are

applied to attract, retain and

motivate our staff, with particular

attention to those in key roles.

These techniques include the

regular review of remuneration

packages, share incentive schemes,

training, regular communication

with staff, annual employee

surveys and a thorough performance

review process.

Further details on our people

can be found in the ESG section

on page 40.

--------------------------------------------

7. Regulatory compliance

Description of risk Mitigating action/controls

--------------------------------------------

The Group operates in a constantly Compliance for the Group is

changing and complex regulatory overseen by the Audit Committee

environment, increasingly so and the Board is ultimately

following its listing on the responsible. They are supported

LSE during the year. There is by our legal, company secretary,

a risk that the Group, or its finance, operations and technology

subsidiaries, fail to comply teams. We ensure that all our

with these requirements or to people are appropriately trained

respond to changes in regulations, in compliance, relative to their

including the Financial Conduct roles.

Authority's rules and guidance, We have developed a detailed

GDPR, or specific legislation governance framework to monitor

in the territories in which our legal and regulatory risks,

the Group operates including and to ensure that we comply

the Competition and Markets with the principles, rules and

Authority in the UK. guidance applicable to our regulated

This could lead to reputational activities. These are regularly

damage, financial or criminal reported upwards to the Audit

penalties and impact on our Committee and Board.

ability to do business.

--------------------------------------------

8. Governance and internal control

Description of risk Mitigating action/controls

--------------------------------------------

As a newly listed Group, establishing During the IPO process a complete

and maintaining corporate governance review of the Group's policies

standards, and an effective and procedures was conducted

and efficient risk management to ensure they were appropriate

and internal control system, for a listed Group. At the same

proportionate to the needs of time the Audit Committee was

the Group, is a key part of established to monitor these

our short and long-term success. and review progress against

Any failure and/or weakness the implementation of controls,

in this area (financial and as detailed in the Financial

non-financial) could have an Position and Prospects Procedures.

impact on the operations of The Board has ultimate responsibility

the Group. for ensuring compliance with

the Corporate Governance Code.

For further information on activities

undertaken by the Board and

Committees during the year see

pages 59 to 74.

--------------------------------------------

9. Economic and geo-political uncertainty

Description of risk Mitigating action/controls

--------------------------------------------

Group performance could be adversely This risk is mitigated by keeping

impacted by factors beyond our abreast of macroeconomic developments

control such as the economic and ensuring that the Group

conditions and political uncertainty responds swiftly to any as they

in key markets. materialise.

The macroeconomic climate including The Group has demonstrated through

the continued uncertainty following the ongoing pandemic, and last

Brexit on the UK economy and year in particular, that it

the US political landscape has has a strong business model

impacted the second-hand goods and its diversified revenue

markets both directly and indirectly. streams and geographical markets

More details on the impact in help to mitigate the impact

FY21 can found in the Market of political or economic instability

Overview section on page 26. in any particular country or

region.

--------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSEANASFLNFFEA

(END) Dow Jones Newswires

December 15, 2021 04:59 ET (09:59 GMT)

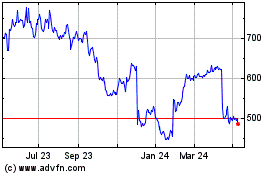

Auction Technology (LSE:ATG)

Historical Stock Chart

From Mar 2024 to Apr 2024

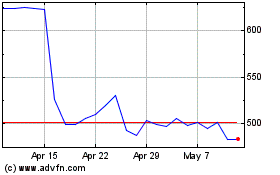

Auction Technology (LSE:ATG)

Historical Stock Chart

From Apr 2023 to Apr 2024