TIDMATM

RNS Number : 0587V

AfriTin Mining Ltd

12 April 2021

12 April 2021

AfriTin Mining Limited

("AfriTin" or the "Company")

Tantalum and Lithium By-Product Test Work Programme

AfriTin Mining Limited (AIM: ATM), an African tin mining company

with its flagship asset, the Uis Tin Mine ("Uis") in Namibia, is

pleased to provide an update on its metallurgical test work

programme for potential by-products to its current tin concentrate

product.

Highlights:

-- The Uis Tin Mine JORC(2012)-compliant mineral resource

estimate includes ancillary metals with an inventory of 6,091

tonnes of contained tantalum (Ta) and 450,265 tonnes of contained

lithium oxide ( Li (2) O ), grading at 85ppm Ta and 0.63% Li (2) O

respectively.

-- Major Li (2) O intersections include 86.51m grading at 1.22%

Li (2) O (drill hole V1V2017) and 109.32m with an average grade of

0.97% (drill hole V1V2010).

-- The Company is advancing a metallurgical test work programme

to investigate the by-product potential of the ancillary metals.

Test work for a Ta concentrate is at an advanced stage; Li (2) O

concentrate test work is progressing to a second stage.

Anthony Viljoen, CEO of AfriTin Mining Limited commented:

"Following the achievement of nameplate tin concentrate

production in November 2020, the Uis Tin Mine has exceeded

production forecasts. This provides the ideal platform for our

metallurgical test work programme to investigate the potential of

two major by-products, namely lithium oxide and tantalum.

Successful implementation of by-product streams may significantly

increase our profit margin and allow us to realise the goal of

positioning the company in the lowest quartile of the world tin

producer cost curve."

As set out in the announcement dated 16 September 2019, Uis has

a JORC(2012)-compliant measured, indicated and inferred mineral

resource estimate totalling 71.54 million tonnes of ore containing

95,539 tonnes of tin (Sn) metal at a grade of 0.134% tin. In

addition, the mineral resource estimate includes Tantalum (Ta) and

Lithium Oxide (Li-(2) O) as presented in Table 1.

Table 1 : AfriTin Mining inferred resource estimate (JORC-2012)

of ancillary metals within the Uis Tin Mine V1 and V2

pegmatites.

Gross Net Attribut Operator

able (85% * )

------------------- ------------------- ---------------

Ta (ppm) Li (2) Ta (ppm) Li (2)

Inferred Resource O (%) O (%)

--------- -------- --------- -------- ---------------

Grade 85 0.63 85 0.63 AfriTin Mining

--------- -------- --------- -------- ---------------

Tonnes (Mt) 71.54 71.54 60.81 60.81 AfriTin Mining

--------- -------- --------- -------- ---------------

Contained metal

(t) 6,091 450,265 5,177 382,725 AfriTin Mining

--------- -------- --------- -------- ---------------

Source: CSA Global

Note: Tabulated data have been rounded off. Contained metal for

lithium refers to lithium oxide (Li(2) O)

* AfriTin has an attributable ownership of 85% in Uis with the

remaining 15% owned by The Small Miners of Uis (SMU)

The presence of significant Tantalum and Lithium Oxide

mineralisation creates an opportunity for the development of

additional revenue streams. Therefore, the Company is advancing a

metallurgical test work programme aimed at developing the process

flow to efficiently produce Tantalum and Lithium Oxide

by-products.

Tantalum metallurgical investigations

Tantalum at Uis occurs in the form of the columbite group

minerals (CGM) which have a similar density to the Tin-bearing

mineral, cassiterite, and it is currently being recovered as part

of the Tin concentrate. At present, the Company does not receive

credits for the Tantalum present within the Tin concentrate.

Therefore, the aim is to extract the Tantalum bearing minerals from

the Tin concentrate into a separate saleable by-product.

Metallurgical test work for the production of a separate

Tantalum concentrate is at an advanced stage. Previous test work

focussed entirely on the differences in magnetic susceptibility

between CGM and cassiterite, since pure cassiterite is non-magnetic

whereas CGM are weakly magnetic. However, this test work found that

a portion of the cassiterite had a magnetic response similar to the

CGM. Further investigation found that inclusions, trace elements

and surface effects are the probable cause of this overlapping

magnetic response. Preliminary test work focused on roasting and

leaching the Company's concentrate to suppress the magnetic

response of cassiterite and this process has delivered encouraging

results. Further investigation and process flow development aims to

optimise a combination of leaching and roasting techniques to

improve the efficiency of magnetic separation and provide a

separate high value CGM by-product.

Lithium Metallurgical investigations

The primary Lithium Oxide-bearing mineral present in the orebody

at Uis has previously been identified through XRD analysis and thin

section investigation as petalite. The 2019 exploration drilling

campaign, which resulted in the mineral resource estimate of Table

1, yielded anomalous Lithium Oxide intersections that included

86.51m grading at 1.22% Li-(2) O (drill hole V1V2017) and 109.32m

grading at 0.97% Li-(2) O (drill hole V1V2010) (see announcement

dated 26 June 2019).

Test work for the production of a petalite concentrate

by-product has been initiated. Preliminary heavy liquid separation

(HLS) tests, utilising drill core samples, provided positive

indications that a saleable petalite concentrate can be produced.

The petalite is naturally low in deleterious compounds, in

particular iron oxide (Fe(2) O(3) ) and potassium oxide (K(2) O),

and may be suitable feedstock for the production of technical grade

lithium concentrate for the glass and ceramics industries. The

Company will also investigate the suitability of its petalite

concentrate for the production of battery-grade lithium products in

this work programme.

Petalite is the lowest density mineral present within the ore

mined at Uis, whereas, Tin and Tantalum-bearing minerals represent

more dense fractions. Investigations will focus on incorporating

technologies and methods currently employed at the processing

plant, including dense medium separation (DMS) and magnetic

separation. The petalite characterisation will incorporate HLS of

bulk samples taken from run-of-mine feed, followed by concentrate

cleaning through magnetic separation, and ultimately pilot-scale

processing runs.

Ore processing metallurgical investigations

An investigation into the pre-concentration potential of Tin,

Tantalum, and Lithium Oxide-bearing minerals using sensor-based ore

sorting has commenced. This process involves the use of X-ray, or

hyperspectral imaging technologies, to characterise ore particles

and manually or pneumatically sort them. The methodology is

suitable for ore streams of a relatively high top size (typically

20 to 80 mm) and has the potential to allow mineral concentration

or waste rejection early in the process, thereby increasing

downstream processing capacity and reducing processing costs.

Initial test work will investigate the potential applicability of

various X-ray imaging methods and sensors at Uis. Furthermore,

successful discrimination of minerals may be followed by bulk

material tests.

Further updates will be provided in due course.

Competent Person Statement :

The technical data in this announcement has been reviewed by

Laurence Robb, a Non-Executive Director of AfriTin. Laurence Robb

(BScHons, MSc, PhD, FGS, FGSSA, FRSSA) has more than 40 years of

industry-related mineral project development experience. He is

registered as a Professional Natural Scientist with The South

African Council for Natural Scientific Professions, Chartered

Geologist with the Geological Society of London, and European

Geologist with the European Federation of Geologists. He was

Professor of Economic Geology and Director of the Economic Geology

Research Institute in the University of the Witwatersrand's School

of Geosciences. He is currently based at Oxford University as a

Visiting Professor, and holds additional distinguished visiting

professorships at the University of Johannesburg and the University

of Witwatersrand. He consults widely throughout Africa and holds

various other corporate directorships. He has reviewed the

technical disclosures in this release and consents to the release

of the information contained herein.

Glossary of abbreviations

Fe(2) Iron oxide

O(3)

K(2) Potassium oxide

O

---------------------------------------------------

Li Elemental symbol for Lithium

---------------------------------------------------

Li (2) Lithium oxide

O

---------------------------------------------------

Li -> Conversion factor of 2.153

Li (2)

O

---------------------------------------------------

JORC The Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves

---------------------------------------------------

Mt Millions of tonnes

---------------------------------------------------

ppm Parts Per Million

---------------------------------------------------

Sn Elemental symbol for Tin

---------------------------------------------------

t Metric tonne

---------------------------------------------------

Ta Elemental symbol for Tantalum

---------------------------------------------------

Glossary of Technical Terms

Indicated Mineral The part of a Mineral Resource for which

Resource quantity, grade, quality, etc., can be

estimated with a level of confidence sufficient

to allow the appropriate application of

technical and economic parameters, to

support mine planning and evaluation of

economic viability

Inferred Mineral The part of a Mineral Resource for which

Resource quantity and grade or quality can be estimated

on the basis of geological evidence and

limited sampling and reasonably assumed,

but not verified, geological and grade

continuity

-------------------------------------------------

Measured Mineral The part of a Mineral Resource for which

Resource quantity, grade or quality, etc., are

well enough established that they can

be estimated with confidence sufficient

to allow the appropriate application of

technical parameters to support production

planning and evaluation of economic viability

-------------------------------------------------

Mineral Resources Mineral Resources are sub-divided, in

order of increasing geological confidence,

into Inferred, Indicated and Measured

categories. An Inferred Mineral Resource

has a lower level of confidence than that

applied to an Indicated Mineral Resource.

An Indicated Mineral Resource has a higher

level of confidence than an Inferred Mineral

Resource but has a lower level of confidence

than a Measured Mineral Resource

-------------------------------------------------

Pe talite A lithium aluminium phyllosilicate mineral

LiAlSi (4) O (10)

-------------------------------------------------

For further information, please visit www.afritinmining.com or

contact:

AfriTin Mining Limited

Anthony Viljoen, CEO +27 (11) 268 6555

Nominated Adviser

WH Ireland Limited

Katy Mitchell

James Sinclair-Ford +44 (0) 207 220 1666

Corporate Advisor and Joint Broker

Hannam & Partners

Andrew Chubb

Jay Ashfield

Nilesh Patel +44 (0) 20 7907 8500

Joint Broker

Turner Pope Investments

Andy Thacker

Zoe Alexander +44 (0) 203 657 0050

Financial PR (United Kingdom)

Tavistock +44 (0) 207 920 3150

Jos Simson

Emily Moss

Oliver Lamb

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining Limited is the first pure tin company listed in

London and its vision is to create a portfolio of globally

significant, conflict-free, tin-producing assets. The Company's

flagship asset is the Uis Tin Mine in Namibia, formerly the world's

largest hard-rock opencast tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current two-fold strategy: fast-track Uis

Tin Mine in Namibia to commercial production as Phase 1, and ramp

up to 5,000 tonnes of concentrate per annum in a Phase 2 expansion.

The Company strives to capitalise on the solid supply/demand

fundamentals of tin by developing a critical mass of tin resource

inventory, achieving production in the near term and further

scaling production by consolidating tin assets in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFZGMDRMGGMZM

(END) Dow Jones Newswires

April 12, 2021 02:00 ET (06:00 GMT)

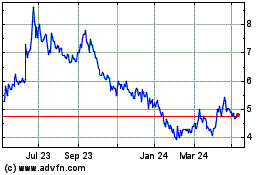

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Mar 2024 to Apr 2024

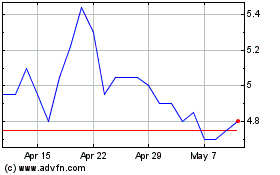

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Apr 2023 to Apr 2024