TIDMATYM

RNS Number : 9907E

Atalaya Mining PLC

13 July 2021

13 July 2021

Atalaya Mining Plc.

("Atalaya" or the "Company")

Second Quarter 2021 Operations Update

Atalaya Mining Plc (AIM:ATYM, TSX:AYM) is pleased to announce

its operations update for the second quarter of 2021 ("Q2 2021" or

the "Period").

Proyecto Riotinto Operating Highlights

Q2 Q1 Full year

2021 2020 2021 2021 Guidance

------- ------- ------- --------------

Ore mined (M tonnes) 3.3 3.2 3.3 15.1

------------ ------- ------- ------- --------------

Waste mined (M tonnes) 8.0 5.7 7.4 25.9

------------ ------- ------- ------- --------------

Ore milled (M tonnes) 4.0 3.6 4.0 15.0 - 15.5

------------ ------- ------- ------- --------------

Cu grade (%) 0.42 0.44 0.41 0.42

------------ ------- ------- ------- --------------

Cu recovery (%) 84.83 85.89 84.90 82 - 84

------------ ------- ------- ------- --------------

52,000 -

Cu production (tonnes) 14,353 13,635 13,979 54,000

------------ ------- ------- ------- --------------

-- Copper production in Q2 2021 was 14,353 tonnes, 2.7 % higher

than Q1 2021 and 5.3 % higher than Q2 2020.

-- The plant processed 4.03 million tonnes of ore during Q2 2021

equivalent to a throughput rate of approximately 16 Mtpa. Low grade

stockpiles added extra tonnage.

-- The increase in copper production, when compared with the

Company's guidance, is mainly attributable to higher throughput

and, to a lesser extent, to better recoveries than planned.

-- Despite ongoing COVID-19 restrictions, mining operations have

continued normally with higher production levels compared with

previous quarters.

-- On-site copper concentrate inventories at the end of Q2 2021

were approximately 15,103 tonnes. All concentrate in stock at the

beginning of the Period was delivered to the port at Huelva.

-- Copper prices increased during the Period compared with the

previous quarter. Average spot prices increased from US$3.85/lb in

Q1 2021 to US$4.40/lb in Q2 2021. The average realised price per

pound of copper payable was $ 4.27 /lb compared with $ 3.62 /lb in

the previous quarter. The realised price during Q2 2021 excluding

QPs was approximately $ 4.40 /lb.

-- Cash operating costs for the Period are expected to be below

full year 2021 cost guidance owing mainly to the Euro/U.S. dollar

exchange rate of 1.2058 compared with 1.22 budgeted by the Company

in its 2021 guidance, together with higher copper production and

better recoveries. Further details on costs will be provided with

the Q2 Financial Statements due to be reported in August.

Proyecto Riotinto Optimisation

-- During Q2 2021 some cost reduction initiatives were

implemented such as the commissioning of a tailings thickener and

changes to the lime circuit, both of which resulted in lower lime

and energy consumption as well as a reduction in CO2 emissions.

-- Permitting of a 50 Mw solar plant for self-consumption

advanced significantly and final construction permits are expected

imminently.

-- New initiative focused on increased recoveries using

different grinding media in the regrind mill.

Reserves and Resources Updates at Proyecto Riotinto

-- Following an independent reserve estimate which confirmed the

status of a long life at the Cerro Colorado open pit, studies have

advanced around the addition of further resources at Proyecto

Riotinto.

-- A sizeable resource has been identified at San Dionisio

deposit that is potentially mineable by open pit. Further

polymetallic mineralization could be exploited using underground

mining methods at the San Antonio and San Dionisio deposits.

-- Work has started on the preparation of an NI 43-101 compliant

technical report which will be followed by PEA or PFS studies.

Outlook for 2021

-- The Company maintains its 2021 guidance but now expects to be

towards the high end of production guidance and the lower end of

costs guidance.

Growth Projects

Proyecto Touro

-- The Company is finalising a new project to be presented to

the Xunta de Galicia during Q3 2021. The new project for Touro

includes a new design to address and resolve all the concerns

previously raised by stakeholders during the Environmental Impact

Evaluation Assessment.

-- The Company continues to be confident that its approach to

Proyecto Touro is in line with international best practice and

includes fully plastic lined tailings with zero discharge which

will satisfy the most stringent environmental conditions that may

be imposed by the authorities prior to development of the

project.

Proyecto Masa Valverde

-- Exploration at Masa Valverde has started with ground

geophysics and two rigs currently drilling around the new Majadales

and the historic Masa Valverde deposits.

-- NI 43-101 compliant resource estimates have been started for these two properties.

Proyecto Riotinto Este

-- The Los Herreros investigation permit was granted in May and

the Company now has access to two of the three investigation

permits at Riotinto Este, Cerro Negro and Los Herreros. The third

investigation permit, Peñas Blancas, is expected to be granted in

the coming months.

-- A proposal and quotes for an electromagnetic airborne

geophysics survey covering Cerro Negro and Peñas Blancas

investigation permits at Riotinto Este have been requested from

three geophysical operators and the Company will provide a further

update on activity for this area in due course.

E-LIX Update

-- A feasibility study continues for an industrial plant using

the third party-patented E-LIX System followed by conventional

SX-EW to produce cathodes on site. Results of the feasibility study

are expected in Q3 2021.

-- The E-LIX pilot plant is fully operational and continues

gathering real data to be incorporated in the copper and zinc

concentrates leaching section of the feasibility studies.

-- The work at the pilot plant continues to support the

viability of the E-LIX system and further details will be provided

in due course.

Astor Update

-- As previously announced by the Company, the hearing of the

summary Judgment application took place on 14(th) and 15(th) June

2021. The application for the summary Judgment was based on

evidence given in a witness statement by Astor's Chief Executive,

Ashwath Mehra.

-- The Court dismissed Astor's application and the question as

to whether any residual interest is payable to Astor therefore

remains to be resolved at trial. Astor is required to pay Atalaya's

costs of the application (the fourth time Astor has been ordered to

pay costs in this long-running case).

-- Trial will take place in February 2022 and Atalaya continues

to be confident in its case, reinforced by this judgment in which

the Judge concluded by saying, "it is obvious from what I have said

in this judgment that I expect Astor's case to fail at trial and

they will no doubt consider carefully whether they wish to pursue

this case to trial".

Alberto Lavandeira, CEO commented:

"Our mining operations continue to perform strongly with higher

production levels compared with previous quarters. Adding to this

continued robust performance, our team continues to focus on

delivering new efficiencies and growth projects, which includes

cost reduction initiatives at Proyecto Riotinto and additional

exploration across prospective landholdings to create shareholder

value.

"The Company maintains its 2021 guidance but now expects to be

towards the high end of production guidance and the lower end of

costs guidance."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) no 596/2014.

Contacts:

Elisabeth Cowell / Adam Lloyd / + 44 20 3757

SEC Newgate UK Tom Carnegie 6880

+44 20 3170

4C Communications Carina Corbett 7973

----------------------------------- -------------

Canaccord Genuity

(NOMAD and Joint Henry Fitzgerald-O'Connor / James +44 20 7523

Broker) Asensio 8000

----------------------------------- -------------

BMO Capital Markets +44 20 7236

(Joint Broker) Tom Rider / Andrew Cameron 1010

----------------------------------- -------------

Peel Hunt LLP +44 20 7418

(Joint Broker) Ross Allister / David McKeown 8900

----------------------------------- -------------

About Atalaya Mining Plc

Atalaya is an AIM and TSX-listed mining and development group

which produces copper concentrates and silver by-product at its

wholly owned Proyecto Riotinto site in southwest Spain. Atalaya's

current operations include the Cerro Colorado open pit mine and a

modern 15 Mtpa processing plant, which has the potential to become

a centralised processing hub for ore sourced from its wholly owned

regional projects around Riotinto that include Proyecto Masa

Valverde and Proyecto Riotinto East. In addition, the Group has a

phased, earn-in agreement for up to 80% ownership of Proyecto

Touro, a brownfield copper project in the northwest of Spain. For

further information, visit www.atalayamining.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBRGDRLBBDGBD

(END) Dow Jones Newswires

July 13, 2021 02:00 ET (06:00 GMT)

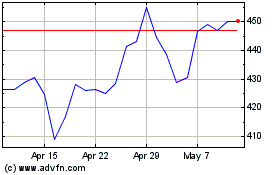

Atalaya Mining (LSE:ATYM)

Historical Stock Chart

From Mar 2024 to Apr 2024

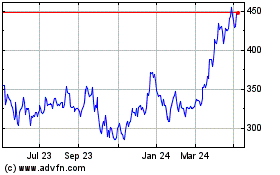

Atalaya Mining (LSE:ATYM)

Historical Stock Chart

From Apr 2023 to Apr 2024