TIDMAUGM

LEI: 213800OTQ44T555I8S71

8 July 2021

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR INDIRECTLY, IN WHOLE

OR IN PART, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, THE REPUBLIC OF

SOUTH AFRICA, SINGAPORE, JAPAN OR ANY EEA STATE (OTHER THAN ANY MEMBER STATE OF

THE EEA WHERE THE COMPANY'S SECURITIES MAY BE LEGALLY MARKETED) OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS

OR REGULATIONS OF SUCH JURISDICTION. PLEASE SEE THE SECTION ENTITLED

"DISCLAIMER" TOWARDS THE OF THIS ANNOUNCEMENT.

Augmentum Fintech plc

Increase in Initial Issue Size

Further to the Company's announcement on 17 June 2021, the Board of Augmentum

Fintech plc (LSE: AUGM) (the "Company" or "Augmentum"), the UK's only publicly

listed investment company focussing on the fintech sector, having considered

both the strong level of support received from potential investors in the

Initial Issue and the depth of the Portfolio Manager's pipeline of investment

opportunities, has decided to increase the target size of the Initial Issue

from approximately £40 million to up to £55 million. The Board will cap the

Initial Issue at £55 million. All valid applications received in respect of

Qualifying Shareholders' Open Offer Entitlements under the Open Offer are

expected to be met in full, and any oversubscription under the Initial Placing,

Excess Application Facility, Offer for Subscription and Intermediaries Offer

subscription will be dealt with by a scaling back exercise.

The timetable for the Initial Issue remains as follows:

Latest time and date for receipt of completed Open Offer 11.00 a.m. on 8 July

Application Forms and payment in full under the Open Offer or 2021

settlement of relevant CREST instructions

Latest time and date for receipt of completed Application Forms in 11.00 a.m. on 8 July

respect of the Offer for Subscription 2021

Latest time and date for receipt of completed applications from the 3.00 p.m. on 8 July

Intermediaries in respect of the Intermediaries Offer 2021

Latest time and date for commitments under the Initial Placing 5.00 p.m. on 8 July

2021

Publication of results of the Initial Issue 9 July 2021

Admission and dealings in Ordinary Shares issued pursuant to the 8.00 a.m. on 13 July

Initial Issue commence 2021

CREST accounts credited with uncertificated new Ordinary Shares 13 July 2021

Where applicable, definitive share certificates despatched by post 19 July 2021

in the week commencing*

*Underlying Applicants who apply to Intermediaries for Ordinary Shares under

the Intermediaries Offer will not receive share certificates.

The Initial Issue is conditional, inter alia, on the New Ordinary Shares being

admitted to listing on the premium listing segment of the Official List of the

FCA, and to trading on the main market for listed securities of the London

Stock Exchange (together, "Admission"). It is expected that Admission will

become effective on, and that dealings for normal settlement in the New

Ordinary Shares will commence on the London Stock Exchange by, 8.00 a.m.

on 13 July 2021.

For further information, please contact:

Augmentum Fintech +44 (0)20 3961 5420

Tim Levene, Portfolio Manager +44 (0)7802 362088

Nigel Szembel, Investor Relations nigel@augmentum.vc

Peel Hunt LLP +44 (0)20 7418 8900

(Joint Sponsor, Joint Bookrunner and Intermediaries Offer

Adviser)

Liz Yong, Luke Simpson, Huw Jeremy, Tom Pocock

(Investment Banking)

Alex Howe, Chris Bunstead, Ed Welsby, Richard Harris (Sales)

Sohail Akbar, Max Irwin (Syndicate)

Alistair Boyle (Intermediaries)

Nplus1 Singer Advisory LLP +44 (0)20 7496 3000

(Joint Sponsor and Joint Bookrunner)

Harry Gooden, Robert Peel, James Moat, Alaina Wong

(Investment Banking)

Frostrow Capital LLP +44 (0)20 3709 8733

Paul Griggs, Company Secretary

Terms used but not defined in this announcement shall have the meaning given to

them in the tripartite prospectus (comprising a summary, a registration

document and a securities note) published by Augmentum Fintech plc on 17 June

2021.

About Augmentum Fintech

Augmentum invests in fast growing fintech businesses that are disrupting the

financial services sector. Augmentum is the UK's only publicly listed

investment company focusing on the fintech sector in the UK and wider Europe,

having launched on the main market of the London Stock Exchange in 2018, giving

businesses access to patient capital and support, unrestricted by conventional

fund timelines and giving public markets investors access to a largely

privately held investment sector during its main period of growth.

Neither the content of any website referred to in this announcement nor the

content of any website accessible from hyperlinks is incorporated into, or

forms part of, this announcement.

Disclaimer

This announcement is an advertisement for the purposes of the Prospectus

Regulation Rules of the UK Financial Conduct Authority (the "FCA") and does not

constitute a prospectus. Investors should not subscribe for or purchase any

shares referred to in this announcement except on the basis of information

contained in the tripartite prospectus (comprising a summary, a registration

document and a securities note) published by Augmentum Fintech plc (the "

Prospectus") on 17 June 2021 and not in reliance on this announcement. Approval

of the Prospectus by the FCA should not be understood as an endorsement of the

securities that are the subject of the Prospectus. Potential investors should

read the Prospectus and in particular the risk factors set out therein before

making an investment decision in order to fully understand the potential risks

and rewards associated with the decision to invest in the Company's securities.

This announcement does not constitute, and may not be construed as, an offer to

sell or an invitation or recommendation to purchase, sell or subscribe for any

securities or investments of any description, or a recommendation regarding the

issue or the provision of investment advice by any party. Copies of the

Prospectus, subject to certain access restrictions, will be available shortly

for viewing at the National Storage Mechanism at https://data.fca.org.uk/#/nsm/

nationalstoragemechanism and on the Company's website (www.augmentum.vc).

Copies of the Prospectus may, subject to certain access restrictions, be

obtained from the registered office of the Company and at the National Storage

Mechanism at https://data.fca.org.uk/#/nsm/nationalstoragemechanism and on the

Company's website, www.augmentum.vc. Neither the content of the Company's

website, nor the content on any website accessible from hyperlinks on its

website for any other website, is incorporated into, or forms part of, this

announcement nor, unless previously published by means of an RIS announcement,

should any such content be relied upon in reaching a decision as to whether or

not to acquire, continue to hold, or dispose of, securities in the Company.

This announcement does not constitute, and may not be construed as, an offer to

sell or an invitation to purchase investments of any description or a

recommendation regarding the issue or the provision of investment advice by any

party. No information set out in this announcement is intended to form the

basis of any contract of sale, investment decision or any decision to purchase

shares in the Company.

This announcement is not for publication or distribution, directly or

indirectly, in or into the United States of America. This announcement is not

an offer of securities for sale into the United States. The securities referred

to herein have not been and will not be registered under the U.S. Securities

Act of 1933, as amended, or under any applicable securities laws of any state,

county or other jurisdiction of the United States and may not be offered or

sold in the United States, except pursuant to an applicable exemption from

registration under the U.S. Securities Act of 1933 and in compliance with the

securities laws of any state, county or any other jurisdiction of the United

States. No public offering of securities is being made in the United States.

Furthermore, any securities that may be issued in connection to the matters

referred to herein may not be offered or sold directly or indirectly in, into

or within the United States or to or for the account or benefit of U.S. Persons

except under circumstances that would not result in the Company being in

violation of the U.S. Investment Company Act of 1940, as amended.

Further, this announcement is not for release, publication or distribution into

Australia, New Zealand, Canada, Singapore, the Republic of South Africa, Japan

or any member state of the EEA (other than any member state of the EEA where

the Company's securities may be lawfully marketed) or any other jurisdiction

where such distribution is unlawful.

The distribution of this announcement may be restricted by law in certain

jurisdictions and persons into whose possession this announcement and/or any

document and/or other information referred to herein comes should inform

themselves about and observe any such restriction. Any failure to comply with

these restrictions may constitute a violation of the securities laws of any

such jurisdiction.

Each of Peel Hunt LLP, Nplus1 Singer Capital Markets Limited and Nplus1 Singer

Advisory LLP (the "Banks") is authorised and regulated in the United Kingdom by

the FCA, is acting exclusively for the Company and for no-one else and will not

regard any other person (whether or not a recipient of this announcement or the

Prospectus) as its client in relation to the Share Issuance Programme

(including the Initial Issue) and the other arrangements referred to in the

Prospectus and this announcement and will not be responsible to anyone other

than the Company for providing the protections afforded to its clients, nor for

providing advice in connection with the Share Issuance Programme (including the

Initial Issue), any Admission and the other arrangements referred to in this

announcement and in the Prospectus.

Apart from the liabilities and responsibilities, if any, which may be imposed

on a Bank by FSMA or the regulatory regime established thereunder, or under the

regulatory regime of any other jurisdiction where exclusion of liability under

the relevant regulatory regime would be illegal, void or unenforceable, none of

the Banks nor any person affiliated with any of the Banks makes any

representation, express or implied, in relation to, nor accepts any

responsibility whatsoever for, the contents of this announcement or the

Prospectus including its accuracy, completeness or verification, nor for any

other statement made or purported to be made by it or on its behalf, or on

behalf of the Company or any other person in connection with the Company, the

Shares, the Share Issuance Programme (including the Initial Issue) or any

Admission and nothing contained in the Prospectus is or shall be relied upon as

a promise or representation in this regard. The Banks (together with their

respective affiliates) accordingly, to the fullest extent permitted by law,

disclaim all and any liability whether arising in tort, contract or which they

might otherwise have in respect of this announcement, the Prospectus or any

other statement.

The value of the Shares and the income from them is not guaranteed and can fall

as well as rise due to stock market and currency movements. When you sell your

investment you may get back less than you originally invested. Figures refer to

past performance and past performance is not a reliable indicator of future

results. Returns may increase or decrease as a result of currency fluctuations.

This announcement contains forward looking statements, including, without

limitation, statements including the words "believes", "estimates",

"anticipates", "expects", "intends", "may", "will" or "should" or, in each

case, their negative or other variations or comparable terminology. Such

forward looking statements involve unknown risks, uncertainties and other

factors which may cause the actual results, financial condition, performance or

achievements of the Company, or industry results, to be materially different

from any future results, performance or achievements expressed or implied by

such forward-looking statements. These forward-looking statements speak only

as at the date of this announcement and cannot be relied upon as a guide to

future performance. The Company, the Portfolio Manager and the Banks expressly

disclaim any obligation or undertaking to update or revise any forward-looking

statements contained herein to reflect actual results or any change in the

assumptions, conditions or circumstances on which any such statements are based

unless required to do so by FSMA, the Prospectus Regulation Rules, UK Market

Abuse Regulation or other applicable laws, regulations or rules.

The information in this announcement is for background purposes only and does

not purport to be full or complete. None of the Banks nor any of their

respective affiliates, accepts any responsibility or liability whatsoever for,

or makes any representation or warranty, express or implied, as to this

announcement, including the truth, accuracy or completeness of the information

in this announcement (or whether any information has been omitted from the

announcement) or any other information relating to the Company or associated

companies, whether written, oral or in a visual or electronic form, and

howsoever transmitted or made available or for any loss howsoever arising from

any use of the announcement or its contents or otherwise arising in connection

therewith. Each of the Banks and its affiliates, accordingly disclaim all and

any liability whether arising in tort, contract or otherwise which they might

otherwise be found to have in respect of this announcement or its contents or

otherwise arising in connection therewith.

Information to distributors

Solely for the purposes of the product governance requirements contained

within: (a) the UK's implementation of EU Directive 2014/65/EU on markets in

financial instruments, as amended ("UK MiFID II"); and (b) the UK's

implementation of Articles 9 and 10 of Commission Delegated Directive (EU) 2017

/593 supplementing UK MiFID II, and in particular Chapter 3 of the Product

Intervention and Product Governance Sourcebook of the FCA (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any liability,

whether arising in tort, contract or otherwise, which any "manufacturer" (for

the purposes of the MiFID II Product Governance Requirements) may otherwise

have with respect thereto, the Shares have been subject to a product approval

process, which has determined that such securities are: (i) compatible with an

end target market of retail investors and investors who meet the criteria of

professional clients and eligible counterparties, each as defined in UK MiFID

II; and (ii) eligible for distribution through all distribution channels as are

permitted by UK MiFID II (the "Target Market Assessment").

Notwithstanding the Target Market Assessment, distributors (such term to have

the same meaning as in the MiFID II Product Governance Requirements) should

note that: the price of the Shares may decline and investors could lose all or

part of their investment; the Shares offer no guaranteed income and no capital

protection; and an investment in the Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who (either alone or

in conjunction with an appropriate financial or other adviser) are capable of

evaluating the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result therefrom. The Target

Market Assessment is without prejudice to the requirements of any contractual,

legal or regulatory selling restrictions in relation to the Share Issuance

Programme (including the Initial Issue). Furthermore, it is noted that,

notwithstanding the Target Market Assessment, Peel Hunt LLP and Nplus1 Singer

Capital Markets Limited will only procure investors who meet the criteria of

professional clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does not constitute:

(a) an assessment of suitability or appropriateness for the purposes of UK

MiFID II; or (b) a recommendation to any investor or group of investors to

invest in, or purchase, or take any other action whatsoever with respect to the

Shares.

Each distributor is responsible for undertaking its own target market

assessment in respect of the Shares and determining appropriate distribution

channels.

END

(END) Dow Jones Newswires

July 08, 2021 02:00 ET (06:00 GMT)

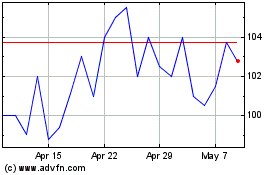

Augmentum Fintech (LSE:AUGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

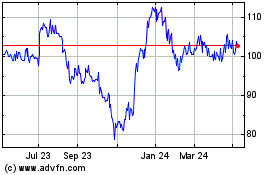

Augmentum Fintech (LSE:AUGM)

Historical Stock Chart

From Apr 2023 to Apr 2024