TIDMAUK

RNS Number : 8494Q

Aukett Swanke Group PLC

24 June 2020

Aukett Swanke Group Plc

Interim results

For the six months ended 31 March 2020

Aukett Swanke Group Plc (the "Group"), the international

practice of architects, interior designers and engineers, is

pleased to announce its interim results for the six month period

ended 31 March 2020.

Highlights

The management's restructuring and reorganisation produced

further substantial progress in the first half.

Group profit before tax was GBP136k reversing a loss of GBP371k

in the same period in 2019.

All operations showed improved profit performance before central

costs.

In the final month of the period a series of actions were

rapidly taken to mitigate Covid-19 impact:

-- Salaries and other costs reduced or deferred

-- Rapid and effective instigation of remote working across the Group

-- Work on existing projects was soon back in progress after initial disruption

Commenting on the interim results, CEO Nicholas Thompson

said:

"It is pleasing to see the investment made over the past few

years, to improve the business model, resulting in a return to

operational profitability.

The early action taken to mitigate the impact of the Covid-19

virus has helped protect the business.

While the immediate future is less than certain, the level of

new business enquires in the circumstances remains

encouraging."

Enquiries

Aukett Swanke Group Plc - 020 7843 3000

Nicholas Thompson, Chief Executive Officer

Antony Barkwith, Group Finance Director

finnCap - 020 7220 0500

Corporate Finance: Julian Blunt; Giles Rolls / Corporate

Broking: Alice Lane

Investor/Media enquiries

Chris Steele 07979 604687

Interim statement

Overview

The results for the six months to 31 March 2020 show a

progressive return to underlying profitability. Whilst revenue rose

by a modest GBP74k to GBP7.37m (2019: GBP7.30m) our focus on

efficient working resulted in a pre-tax profit of GBP136k,

reversing the loss in 2019 of GBP371k by GBP507k - a significant

turnaround.

All geographies were in profit before recharged central costs

and all reported an improvement over the prior period result.

Covid-19

The Covid-19 pandemic had little impact on our results in the

period under review.

Over a 10 working day period in late March we moved to remote

working without any significant disruption. Much of this was down

to the various IT teams around the Group supporting the transition

and all staff committing to this new way of working in a positive

and comprehensive way.

Whilst we initially experienced some delays in collecting cash

due, resulting in period end cash falling to GBP183k at 31 March

(GBP1.1m 30 September 2019) with a small net debt position of

GBP11k (2019: net cash GBP820K); the position has since reversed

with cash and net debt at the end of May 2020 standing at GBP692k

and GBP498k, respectively.

In the UK and UAE we have reduced salaries and other costs. In

particular, the Plc Directors have taken a 20% pay reduction. All

operations, including the Group, were successful in deferring some

operational cash flows into the next financial year to provide

short term support to our working capital and therefore avoid any

new external borrowings and limited use of existing facilities.

As the longer term nature of Covid-19 remains uncertain, our

planning is based on each operation trading on earnings from near

term secure income and contract extensions. This ensures that we

sustain a cost base at the minimum level, which we can supplement

with temporary or returning staff as project conversions are

achieved. We have taken a number of steps to achieve this

including: furloughing permanent staff; releasing temporary or

freelance staff; encouraging unpaid leave and part time working;

and pay cuts of varying percentages and durations - all of which

provides management with a range of tools that can be implemented

at short notice and with immediate effect. We have also sought to

remove non-essential or deferrable expenditure.

United Kingdom

The UK operation improved its half year revenues by GBP362k to

GBP4.09m (2019: GBP3.73m) and its profit by GBP56k to GBP311k

(2019: GBP255k) based on a number of continuing projects plus a

growing number of new instructions. At the half way stage and, as

the coronavirus took hold the UK had 18 projects on site, all of

which suffered some form of temporary closure immediately after the

half year end; but this was all short-lived as sites are now

operating at between 30% to 50% capacity.

The UK won its largest project for some time being a

290,000ft(2) speculative new build office in South London for an

existing client. In addition our work in the hybrid market

continued to expand with a commission to planning comprising

90,000ft(2) of wharf and residential use in a protected area at

Orchard Wharf for Regal London and, three further hybrid

commissions for Segro were won; a significant interior design

project for a major banking dynasty and; the EQ building in Bristol

for CEG continued apace.

Veretec, our executive architecture company, continued with

instructions on a range of projects including Nova East (Lynch

Architects), a 260,000ft(2) new build office for Land Securities in

London's West End; the 112,500ft(2) Featherstone Building (Morris

& Co) for Skanska and long standing client Derwent; a

32,000ft(2) entertainment centre for Labtech at Hawley Wharf; the

final stage of Regent House, a mixed-use residential and office

development for Osborne, designed by Stiff & Trevillion/MSMR

and; increased instructions on Labtech Holborn new commercial

offices - a project designed by DSDHA.

The impact of Covid-19 on the UK had little impact in H1 as much

of the current work was in the pre-construction phases. As we

progress through H2, sites remain open and we have adjusted our

role accordingly with limited or no physical presence, the use of

video cameras for inspections, and concentrating on those

activities that can be done remotely. The transition to remote

working (which was already being trialled) was achieved in less

than one week and to date there seems to have been no real loss in

overall efficiency in this new mode. However, new instructions with

new clients will be sparse for a while and it is that factor that

will influence our H2 result. We have tempered our outlook as Q3

reflects the full impact of the lockdown and is prior to any form

of return to normal working practices which we do not anticipate

before Q4.

We have taken temporary cost reductions into our business model

and have reduced salaries across the board in order to limit the

forward position as much as possible.

Middle East

Our United Arab Emirates operations were around six months

behind the UK in their recovery plans. As such the impact of

Covid-19 has had a more significant impact particularly in cash

recoveries at the period end.

For the first half revenues were down by GBP201k at GBP3.14m

(2019: GBP3.34m) but, prior period losses of GBP151k had been

reversed and a profit of GBP103k achieved. Much of this improvement

was based on a range of smaller projects in the site works stage

and continuation of the reduction in expenditure.

The Lesso Mall (Samanea Market) reached tender stage shortly

before the lockdown and The Grove project was about to be launched.

As such these two larger projects are on hold. Elsewhere we are

supporting the US and Australia Pavilions and completing the Expo

Media Centre.

More regular income came from completion of the Atlantis The

Palm refurbishment of 1,539 suites; completion of the Mercure hotel

refurbishment; continuing work at two cultural projects in Al Ain:

the Al Ain Museum and Sheikh Khalifa House; The Viva City, Sports

Society Mall in Dubai continued on site; newer instructions came

from Etisalat for new store openings, the Du Al Qudra broadcasting

station, and a number of post contract commissions.

For Miral the exciting zip wire rides and Ferrari World roof

walkway neared completion and the refurbishment of the corporate

offices for the F1 Marina reached tender stage, both on Yas Island,

Abu Dhabi.

Whilst we can see the site works continuing (and there is daily

personnel testing in place) there is a dearth of new and larger

instructions. Given the steep fall in the oil price, little or no

tourism and a potential exodus of labour once travel restrictions

are lifted, we see this geography taking some time to recover and

as such we have re-structured our three operations to assume a much

lower level of income in the aftermath of Covid-19.

It is too early to predict how the year will end for our Middle

East operations.

Continental Europe

With only one wholly owned subsidiary remaining following the

disposal of our Moscow operation last year, revenues fell to

GBP147k (2019: GBP234k). However, profit before central costs

increased to GBP247k (2019: GBP135k) - with all joint ventures and

associates producing positive results.

Wholly owned operation

The Turkish operation has continued to build upon the success of

the previous year having completed several interior fit-out

projects for significant corporate clients, including LC Waikiki,

Google, 3M and Credit Suisse. New projects include a series of

architectural Villa designs for a new town masterplan site in

Erbil, a fit-out in Ankara for the Turkish Trade Council TUSIAD, a

private villa in Istanbul and a new two floor extension to the VM

Ware HQ in Sofia completed last year.

Joint venture and associate operations

The operations in Berlin and Frankfurt have enjoyed buoyant

market conditions.

Project completions for the Berlin office include the "Winx"

tower in Frankfurt and the first phase of the KaDeWe-Department

Store refurbishment in Berlin.

Newly won projects commencing shortly include the preliminary

infrastructure measures for a 15,000m(2), 100 apartment, new-build

housing development for local authority approval, the conversion of

a heritage listed cinema to co-working offices and a concept study

for a heritage listed-building refurbishment and new-build

extension in central Hamburg totalling 12,000m(2). The construction

of the 140m high EDGE tower has commenced with Amazon as the main

tenant.

The Frankfurt office continues to complete ongoing phases of

refurbishment of the iconic MesseTurm building including also

fit-outs for incoming tenants such as GAC, Regus and Tata. Nearing

completion is the Sparda Bank facade refurbishment and new

commissions include the fit-out designs for an American bank in two

locations in Germany.

The Prague office has recovered strongly after two challenging

years and has completed the technical document stages of the OC

Repy Shopping Centre refurbishment and has begun design work on the

16,000m(2) fit-out of the 1934 modern movement office building at

Bubenska for WPP and the 14,000m(2) fit-out of Exxon Mobil's HQ.

Technical due diligence is under way on the Chrpa Shopping Centre

and Archa Plaza projects in Prague. Works on site include the DB

Schenker logistics building and extension works successfully

negotiated with the authorities.

Licensee operation

The licensee operation of Aukett Swanke Moscow in the Russian

Federation completed a concept masterplan for a 730,000m(2) science

and technology complex on an 80 hectare site in Surgut, Siberia and

feasibility study for an 18,000m(2) mixed use development in

Tyumen.

Group costs

We have continued to lower the organisation's central costs with

direct costs reduced by GBP32k in the half year; the gain on

disposal of the Moscow business (GBP53k) accounting for the balance

of the reduction in Group costs.

We have adopted IFRS 16 within these results. This made a

significant impact on the consolidated statement of financial

position, in particular grossing up non current assets and non

current liabilities, however has immaterial impact on the result

for the 6 months to 31 March 2020

Prospects

At this stage it is impractical to predict with any certainty

how the year will end.

We nevertheless remain confident that we have the right business

model and that we have taken pro-active steps to protect the

business from the obvious uncertainties in our markets.

Nicholas Thompson

Chief Executive Officer

23 June 2020

Consolidated income statement

For the six months ended 31 March 2020

Note Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Revenue 3 7,375 7,301 15,492

Sub consultant costs (515) (725) (1,781)

---------------------------------- ----- ------------- ------------- --------------

Revenue less sub consultant

costs 6,860 6,576 13,711

Personnel related costs (5,430) (5,644) (11,294)

Property related costs (650) (812) (1,542)

Other operating expenses (867) (725) (1,294)

Other operating income 4 142 154 371

---------------------------------- ----- ------------- ------------- --------------

Operating profit / (loss) 55 (451) (48)

Finance costs (78) (14) (42)

---------------------------------- ----- ------------- ------------- --------------

Loss after finance costs (23) (465) (90)

Gain on disposal of subsidiary 53 - -

Share of results of associate

and joint ventures 106 94 382

---------------------------------- ----- ------------- ------------- --------------

Profit / (loss) before tax 3 136 (371) 292

Tax (charge) / credit (34) 17 40

---------------------------------- ----- ------------- ------------- --------------

Profit / (loss) for the period 102 (354) 332

---------------------------------- ----- ------------- ------------- --------------

Profit / (loss) attributable

to:

Owners of Aukett Swanke Group

Plc 96 (315) 346

Non-controlling interests 6 (39) (14)

---------------------------------- ----- ------------- ------------- --------------

Profit / (loss) for the period 102 (354) 332

---------------------------------- ----- ------------- ------------- --------------

Basic and diluted earnings

per share for profit/(loss)

attributable to the ordinary

equity holders of the Company:

From continuing operations 0.06p (0.19)p 0.21p

---------------------------------- ----- ------------- ------------- --------------

Total profit / (loss) per

share 5 0.06p (0.19)p 0.21p

---------------------------------- ----- ------------- ------------- --------------

Consolidated statement of comprehensive income

For the six months ended 31 March 2020

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Profit / (loss) for the period 102 (354) 332

Other comprehensive income:

Currency translation differences 4 (16) 46

----------------------------------- -------------

Other comprehensive income for

the period 4 (16) 46

Total comprehensive profit /

(loss) for the period 106 (370) 378

----------------------------------- ------------- ------------- --------------

Total comprehensive profit /

(loss) is attributable to:

Owners of Aukett Swanke Group

Plc 100 (343) 392

Non-controlling interests 6 (27) (14)

----------------------------------- ------------- ------------- --------------

Total comprehensive profit /

(loss) for the period 106 (370) 378

----------------------------------- ------------- ------------- --------------

Consolidated statement of financial position

At 31 March 2020

Note Unaudited Unaudited Audited

at 31 at 31 at 30

March March September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Non current assets

Goodwill 2,403 2,374 2,412

Other intangible assets 714 773 762

Property, plant and equipment 314 91 590

Right-of-use assets 8 2,882 - -

Investment in associate and

joint ventures 1,009 793 988

Deferred tax 155 391 193

-------------------------------- ----- ---------- ---------- -----------

Total non current assets 7,477 4,422 4,945

Current assets

Trade and other receivables 5,157 4,049 4,904

Contract assets 716 980 663

Cash at bank and in hand 7 315 705 1,145

-------------------------------- ----- ---------- ---------- -----------

Total current assets 6,188 5,734 6,712

Total assets 13,665 10,156 11,657

Current liabilities

Trade and other payables (3,194) (4,209) (4,528)

Contract liabilities (1,012) (748) (836)

Current tax - - -

Borrowings 7 (326) (322) (331)

Lease liabilities 8 (537) - -

Total current liabilities (5,069) (5,279) (5,695)

Non current liabilities

Borrowings 7 - (184) (272)

Lease liabilities 8 (3,099) - -

Deferred tax (48) (56) (53)

Provisions (865) (871) (1,123)

Total non current liabilities (4,012) (1,111) (1,448)

Total liabilities (9,081) (6,390) (7,143)

Net assets 4,584 3,766 4,514

-------------------------------- ----- ---------- ---------- -----------

Capital and reserves

Share capital 1,652 1,652 1,652

Merger reserve 1,176 1,176 1,176

Foreign currency translation

reserve 26 (52) 22

Retained earnings 97 (624) 37

Other distributable reserve 1,494 1,494 1,494

-------------------------------- ----- ---------- ---------- -----------

Total equity attributable

to

equity holders of the Company 4,445 3,646 4,381

-------------------------------- ----- ---------- ---------- -----------

Non-controlling interests 139 120 133

-------------------------------- ----- ----------

Total equity 4,584 3,766 4,514

-------------------------------- ----- ---------- ---------- -----------

Consolidated statement of cash flows

For the six months ended 31 March 2020

Note Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Cash (expended by) / generated

from operations 6 (836) (4) 647

Interest paid (15) (14) (42)

Income taxes credits received

/ (paid) 218 (1) (1)

---------------------------------- ----- ------------- ------------- --------------

Net cash (outflow) / inflow

from operating activities (633) (19) 604

Cash flows from investing

activities

Purchase of property, plant

and equipment (214) (5) (90)

Sale of property, plant and

equipment - - 2

Dividends received 86 66 186

---------------------------------- ----- ------------- ------------- --------------

Net cash (paid) / received

in investing activities (128) 61 98

Net cash (outflow) / inflow

before financing activities (761) 42 702

Cash flows from financing

activities

Payments of lease liabilities (34) - (36)

Repayment of bank loans (123) (123) (250)

Net cash outflow from financing

activities (157) (123) (286)

Net change in cash and cash

equivalents (918) (81) 416

Cash and cash equivalents

at start of period 1,145 710 710

Currency translation differences (44) (1) 19

---------------------------------- ----- ------------- ------------- --------------

Cash and cash equivalents

at end of period 7 183 628 1,145

---------------------------------- ----- ------------- ------------- --------------

Cash and cash equivalents are comprised

of:

Cash at bank and in hand 315 705 1,145

Secured bank overdrafts (132) (77) -

Cash and cash equivalents at end

of year 183 628 1,145

----------------------------------------- ------ ----- ------

Consolidated statement of changes in equity

For the six months ended 31 March 2020

Share Foreign Retained Other Merger Total Non Total

capital currency earnings distributable reserve controlling equity

translation reserve interests

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

Balance at 30

September

2019

as originally

presented 1,652 22 37 1,494 1,176 4,381 133 4,514

Effect of

adoption

of IFRS16

(note

8) - - (36) - - (36) - (36)

Restated total

equity at 1

October

2019 1,652 22 1 1,494 1,176 4,345 133 4,478

Profit for the

period - - 96 - - 96 6 102

Other

comprehensive

income - 4 - - - 4 - 4

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

Total

comprehensive

profit - 4 96 - - 100 6 106

At 31 March

2020 1,652 26 97 1,494 1,176 4,445 139 4,584

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

For the six months ended 31 March 2019

Share Foreign Retained Other Merger Total Non Total

capital currency earnings distributable reserve controlling equity

translation reserve interests

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

At 1 October

2018 1,652 (24) (309) 1,494 1,176 3,989 147 4,136

Loss for the

period - - (315) - - (315) (39) (354)

Other

comprehensive

income - (28) - - - (28) 12 (16)

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

Total

comprehensive

loss - (28) (315) - - (343) (27) (370)

At 31 March

2019 1,652 (52) (624) 1,494 1,176 3,646 120 3,766

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

For the year ended 30 September 2019

Share Foreign Retained Other Merger Total Non Total

capital currency earnings distributable reserve controlling equity

translation reserve interests

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

At 1 October

2018 1,652 (24) (309) 1,494 1,176 3,989 147 4,136

Profit for the

year - - 346 - - 346 (14) 332

Other

comprehensive

income - 46 - - - 46 - 46

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

Total

comprehensive

income - 46 346 - - 392 (14) 378

At 30

September

2019 1,652 22 37 1,494 1,176 4,381 133 4,514

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

Notes to the Interim Report

1 Basis of preparation

The financial information presented in this Interim Report has

been prepared in accordance with the recognition and measurement

principles of International Financial Reporting Standards ('IFRS')

as adopted by the EU that are expected to be applicable to the

financial statements for the year ending 30 September 2020 and on

the basis of the accounting policies expected to be used in those

financial statements.

2 New accounting standards, amendments and interpretations applied

A number of new or amended standards and interpretations to

existing standards became applicable for the current reporting

period and the Group had to change its accounting policies to

correctly reflect the requirements of the following standards:

- IFRS 16 Leases, and

- IFRIC 23 Uncertainty over income tax treatments

The impact of the adoption of these standards and the new

accounting policies are disclosed in note 8 below.

3 Operating segments

The Group comprises a single business segment and three

separately reportable geographical segments (together with a Group

costs segment). Geographical segments are based on the location of

the operation undertaking each project. Turkey (and Russia in the

comparative periods) are included within Continental Europe

together with Germany and the Czech Republic.

Segment revenue Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

United Kingdom 4,093 3,731 7,454

Middle East 3,135 3,336 7,522

Continental Europe 147 234 516

--------------------- -------------

Total 7,375 7,301 15,492

--------------------- ------------- ------------- --------------

Segment result before tax Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

United Kingdom 41 (15) (89)

Middle East (165) (438) (69)

Continental Europe 179 64 351

Group costs 81 18 99

---------------------------- ------------- ------------- --------------

Total profit/(loss) 136 (371) 292

---------------------------- ------------- ------------- --------------

Segment result before tax Unaudited Unaudited Audited

(before reallocation of group six months six months year to

management charges) to 31 March to 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

United Kingdom 311 255 451

Middle East 103 (151) 525

Continental Europe 247 135 495

Group costs (525) (610) (1,179)

--------------------------------- ------------- ------------- --------------

Total profit /(loss) 136 (371) 292

--------------------------------- ------------- ------------- --------------

4 Other operating income

Unaudited Unaudited Audited

six months six months year to

to 31 to 31 30 September

March March 2019

2020 2019 GBP'000

GBP'000 GBP'000

Property rental income 78 86 170

Management charges to associate

and joint ventures 54 55 114

Licence fee income 1 2 -

Other sundry income 9 11 33

Fair value gain on the reduction

of deferred consideration - - 54

Total other operating income 142 154 371

----------------------------------- ------------ ------------ --------------

5 Earnings per share

The calculations of basic and diluted earnings per share are

based on the following data:

Earnings Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Profit / (loss) for the period 96 (315) 346

--------------------------------- ------------- ------------- --------------

Number of shares Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2020 2019 2019

'000 '000 '000

Weighted average number of shares 165,214 165,214 165,214

Effect of dilutive options - - -

----------------------------------- ------------- ------------- --------------

Diluted weighted average number

of shares 165,214 165,214 165,214

------------------------------------ ------------- ------------- --------------

6 Reconciliation of profit before tax to net cash from operations

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Profit / (loss) before tax -

continuing operations 136 (371) 292

Finance costs 78 14 42

Share of results of associate

and joint ventures (106) (94) (382)

Intangible amortisation 40 40 81

Depreciation 159 30 150

Profit on disposal of property,

plant and equipment (2) (1) (3)

(Increase) / decrease in trade

and other receivables (500) 711 425

(Decrease) / increase in trade

and other payables (605) (282) 86

Change in provisions (38) (58) (68)

Unrealised foreign exchange

differences 2 7 24

------------------------------------- ------------- ------------- --------------

Net cash (expended by) / generated

from operations (836) (4) 647

------------------------------------- ------------- ------------- --------------

7 Analysis of net funds

Unaudited Unaudited Audited

at 31 March at 31 March at

2020 2019 30 September

GBP'000 GBP'000 2019

GBP'000

Cash at bank and in hand 315 705 1,145

Secured bank overdrafts (132) (77) -

---------------------------- ------------- ------------- --------------

Cash and cash equivalents 183 628 1,145

Secured bank loan (194) (429) (325)

---------------------------- -------------

Net funds/(debt) (11) 199 820

---------------------------- ------------- ------------- --------------

8 Changes in accounting policies

This note explains the impact of the adoption of IFRS 16 Leases

on the Group's financial statements and discloses the new

accounting policies that have been applied from 1 October 2019,

where they are different to those applied in prior periods.

The Group has adopted IFRS 16 retrospectively from 1 October

2019, but has not restated comparatives for the 2018-19 reporting

period, as permitted under the modified retrospective cumulative

catch-up transitional provisions in the standard. The

reclassifications and the adjustments arising from the new leasing

rules are therefore recognised in the opening balance sheet on 1

October 2019.

8(a) Adjustments recognised on adoption of IFRS 16

GBP'000

Operating lease commitments disclosed as at 30 September

2019 3,637

Adjustment for conditional rent free periods 193

(Less): short-term leases recognised on a straight-line

basis as expense (103)

(Less): low-value leases recognised on a straight-line

basis as expense (12)

---------

3,715

Discounted using the lessee's incremental borrowing

rate of at the date of initial application 3,120

Add: finance lease liabilities recognised as at

30 September 2019 488

Lease liability recognised as at 1 October 2019 3,608

------------------------------------------------------------ ---------

Of which are:

Current lease liabilities 303

Non-current lease liabilities 3,305

3,608

------------------------------------------------------------ ---------

The associated right-of-use assets for property leases were

measured on a retrospective basis as if the new rules had always

been applied. Other right-of-use assets were measured at the amount

equal to the lease liability, adjusted by the amount of any prepaid

or accrued lease payments relating to that lease recognised in the

balance sheet as at 30 September 2019. There were no onerous lease

contracts that would have required an adjustment to the

right-of-use assets at the date of initial application.

The recognised right-of-use assets relate to the following types

of assets:

31 March 1 October

2020 2019

GBP'000 GBP'000

Properties (operating lease type assets) 2,404 2,551

Leasehold improvements (finance lease

type assets) 478 466

Total right-of-use assets 2,882 3,017

--------------------------------------------- --------- ----------

Impact on the financial Statements

The following table shows the adjustments recognised for each

individual line item. Line items that were not affected by the

changes have not been included. As a result, the sub-totals and

totals disclosed cannot be recalculated from the numbers

provided.

30 Sep 1 Oct

2019 Finance Restoration Operating 2019

lease type costs lease

assets type assets

as originally

presented IFRS 16 IFRS 16 IFRS 16 as restated

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Property, plant & equipment 590 (278) (188) - 124

Right-of-use assets - 278 188 2,551 3,017

Total non current assets 4,945 - - 2,551 7,496

------------------------------- --------------- ------------ ------------ -------------- -------------

Total assets 11,657 - - 2,551 14,208

------------------------------- --------------- ------------ ------------ -------------- -------------

Current liabilities

Trade and other payables (4,528) - - 533 (3,995)

Borrowings (331) 71 - - (260)

Lease liabilities - (71) - (232) (303)

------------------------------- --------------- ------------ ------------ -------------- -------------

Total current liabilities (5,695) - - 301 (5,394)

------------------------------- --------------- ------------ ------------ -------------- -------------

Non current liabilities

Borrowings (272) 207 - - (65)

Lease liabilities - (207) (210) (2,888) (3,305)

Provisions (1,123) - 210 - (913)

------------------------------- --------------- ------------ ------------ -------------- -------------

Total non current liabilities (1,448) - - (2,888) (4,336)

Total liabilities (7,143) - - (2,587) (9,730)

------------------------------- --------------- ------------ ------------ -------------- -------------

Net assets 4,514 - - (36) 4,478

------------------------------- --------------- ------------ ------------ -------------- -------------

Retained Earnings 37 - - (36) 1

------------------------------- --------------- ------------ ------------ -------------- -------------

Total equity attributable

to equity holders of

the Company 4,381 - - (36) 4,345

------------------------------- --------------- ------------ ------------ -------------- -------------

Total equity 4,514 - - (36) 4,478

------------------------------- --------------- ------------ ------------ -------------- -------------

Practical expedients applied

In applying IFRS 16 for the first time, the group has used the

following practical expedients permitted by the standard:

- the accounting for operating leases with a remaining lease

term of less than 12 months as at 1 October 2019 as short-term

leases.

The group has also elected not to reassess whether a contract

is, or contains a lease at the date of initial application.

Instead, for contracts entered into before the transition date the

group relied on its assessment made applying IAS 17 and IFRIC 4

Determining whether an Arrangement contains a Lease.

As the Group has applied the modified retrospective transition

approach, for leases previously classified as finance leases the

lease liability on transition is unchanged, being the carrying

amount of the lease liability immediately before the date of

initial application.

8(b) The group's leasing activities and how these are accounted

for

The group leases various offices, leasehold improvements

relating to office fit-out costs, and IT equipment. Rental

contracts are typically made for fixed periods of 3 to 5 years.

Lease terms are negotiated on an individual basis and contain a

wide range of different terms and conditions. The lease agreements

do not impose any covenants, but leased assets may not be used as

security for borrowing purposes.

Until the financial year ended 30 September 2019, leases of

property, plant and equipment were classified as either finance or

operating leases. Payments made under operating leases (net of any

incentives received from the lessor) were charged to profit or loss

on a straight-line basis over the period of the lease.

From 1 October 2019, leases are recognised as a right-of-use

asset and a corresponding liability at the date at which the leased

asset is available for use by the group. Each lease payment is

allocated between the liability and finance cost. The finance cost

is charged to profit or loss over the lease period so as to produce

a constant periodic rate of interest on the remaining balance of

the liability for each period. The right-of-use asset is

depreciated over the shorter of the asset's useful life and the

lease term on a straight-line basis.

Assets and liabilities arising from a lease are initially

measured on a present value basis. Lease liabilities include the

net present value of the following lease payments:

- fixed payments (including in-substance fixed payments), less

any lease incentives receivable;

- variable lease payment that are based on an index or a rate;

- amounts expected to be payable by the lessee under residual value guarantees;

- the exercise price of a purchase option if the lessee is

reasonably certain to exercise that option, and

- payments of penalties for terminating the lease, if the lease

term reflects the lessee exercising that option.

The lease payments are discounted using the interest rate

implicit in the lease. If that rate cannot be determined, the

lessee's incremental borrowing rate is used, being the rate that

the lessee would have to pay to borrow the funds necessary to

obtain an asset of similar value in a similar economic environment

with similar terms and conditions.

Right-of-use assets are measured at cost comprising the

following:

- the amount of the initial measurement of lease liability;

- any lease payments made at or before the commencement date

less any lease incentives received;

- any initial direct costs; and

- restoration costs.

Payments associated with short-term leases and leases of

low-value assets are recognised on a straight-line basis as an

expense in profit or loss. Short-term leases are leases with a

lease term of 12 months or less. Low-value assets comprise IT

equipment with a value when new of GBP4,000 or less.

9 Status of Interim Report

The Interim Report covers the six months ended 31 March 2020 and

was approved by the Board of Directors on 23 June 2020. The Interim

Report is unaudited.

The interim condensed set of consolidated financial statements

in the Interim Report are not statutory accounts as defined by

Section 434 of the Companies Act 2006.

Comparative figures for the year ended 30 September 2019 have

been extracted from the statutory accounts of the Group for that

period.

The statutory accounts for the year ended 30 September 2019 have

been reported on by the Group's auditors and delivered to the

Registrar of Companies. The audit report thereon was unqualified,

did not include references to matters to which the auditors drew

attention by way of emphasis without qualifying the report, and did

not contain a statement under Section 498 of the Companies Act

2006.

Where comparative figures have subsequently been restated

following the adoption of new accounting policies as explained in

notes 2 and 8, adjustments have not been audited by the Group's

auditors.

10 Further information

An electronic version of the Interim Report will be available on

the Group's website (www.aukettswanke.com).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FLFLRRDIVFII

(END) Dow Jones Newswires

June 24, 2020 02:00 ET (06:00 GMT)

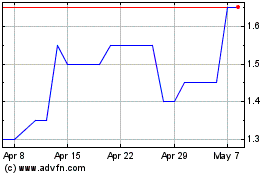

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Mar 2024 to Apr 2024

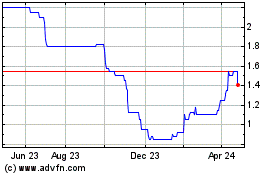

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Apr 2023 to Apr 2024