TIDMAUK

RNS Number : 7306G

Aukett Swanke Group PLC

31 March 2022

Aukett Swanke Group Plc

Announcement of final audited results

for the year ended 30 September 2021

Announcement of final audited results for the year ended 30

September 2021

Aukett Swanke Group plc ("the Group"), the international group

of architects, interior designers and engineers announces its final

audited results for the year ended 30 September 2021.

Highlights

Revenue (less sub consultant costs) decreased by 22% to

GBP8,822k (2020: GBP11,336k) primarily due to the continuing impact

of COVID leading to uncertainty in decision making and inevitable

delays.

Businesses in both the UK and the Middle East were loss-making

however Continental Europe made a profit (excluding Group

management charges) of GBP330k.

The overall loss for the year was GBP1,136k (2020: loss GBP20k),

largely due to sup-optimal group plc costs and a one-off impairment

of GBP249k.

As the impacts of the pandemic subsided in the second half of

the year, revenue stabilised, increasing to GBP4,683k (H1:

GBP4,139k) and losses before impairment reduced to GBP265k (H1:

loss GBP1.017m).

Operations

Looking forward the Group are considering a range of structural

and geographic options to stabilise and improve the Group's

underlying financial position.

Following the retirement of Nicholas Thompson at the end of the

year, a new CEO will step in to lead the business in the next phase

of its operations.

Nicholas Thompson, CEO said

"The pandemic has continued to affect the operations of our

business, and any signs of recovery have been slow to emerge. The

efforts of the business to adapt to the current economic climate

has resulted in stabilised revenues in H2, higher than those in the

same period in 2020, however we still have more to do if we want to

return to the level of profit achieved pre-pandemic.

As stated in our interim accounts, H1 was strongly impacted by

the uncertainties created by COVID-19 in form of project delays and

deferments, and despite a more positive H2 than in 2020 there was

still a greater overall loss for the period.

I look forward to working with the Board until the end of 2022

and help the team address the range of options they are considering

in the operational review."

Enquiries

Aukett Swanke Group Plc - 020 7843 3000

-- Nicholas Thompson, Chief Executive Officer

-- Antony Barkwith, Group Finance Director

Arden Partners Plc - 020 7614 5900

-- Corporate Finance: John Llewellyn-Lloyd / Louisa Waddell / Benjamin Onyeama-Christie

Investor / Media Enquiries - 07979 604687

-- Chris Steele

30 March 2022

Extract from the Chairman's Statement

This is my third year as Non-Executive Chairman, and the

challenges that the business has experienced during this period

have been unprecedented: first Brexit, then the Covid pandemic, and

finally - at the time of writing - the ongoing tragedy taking place

in Ukraine.

During the last financial year, the world continued to suffer

the aftershocks of the worldwide pandemic, but the latest Omicron

variant appears to be considerably less lethal than the previous

ones. In consequence, many countries are starting to relax the

strict measures that have been in place for almost two years, and

there is a gradual return to many pre-pandemic activities,

including an uplift of international travel. Were this the

remaining major challenge, we would say with some confidence that

the services we provide would be determined by the market economics

that we were previously accustomed to and experienced in dealing

with.

However, the invasion of the Ukraine by Russian forces has

introduced a further challenge to the business. Leaving aside the

appalling humanitarian tragedy developing in front of our eyes, and

the obvious impossibility to predict either the nature of the

outcome or of its timing, these conditions will make exceptional

demands on our management and our talented professionals.

Despite these once-in-a-lifetime challenges, our executive team

and our highly motivated staff have continued to exercise their

considerable talents to work through these demanding environments.

They have retained their energy, optimism, and creativity to

provide the very highest levels of client service that is a key

part of our company's reputation.

Governments throughout the world will continue to use the

resources within their reach to power up their economies out of the

pandemic. It is axiomatic that the building industry is one of the

motors of the economy, and it is one of the few sectors that has

continued to operate even during periods of total lockdown. It is

thus not unreasonable to expect that demand for design services

will continue, albeit in a modified form.

During this financial year, we have seen a continuing level of

demand in all our markets, with a steady level of enquiries that

have often converted into commissions. As we said in last year's

Report and is equally applicable now: we remain focused on

maintaining our quality of service by adapting to changing

circumstances and until a more sustained market is evident.

This year's result, a loss of GBP1.5m which includes GBP249k

one-off non-cash impairment, is disappointing, given the

considerable efforts made by all parties to manage the Company in a

very difficult business environment. Nevertheless, I fully expect

our management team to continue to steer the Company around the

current difficulties, always looking for suitable business

opportunities.

Our CEO, Nicholas Thompson, has announced his retirement at the

end of this calendar year. His many accomplishments, as Chief

Executive Officer of the Company have been of the very highest

calibre, and the Company owes him a debt of gratitude for the

exceptional achievements during his long tenure. I would like to

take this opportunity to thank Nicholas for his service to the

Company throughout all these decades, for the excellence of his

leadership and the clarity of his commercial vision. As is to be

expected, the Board is addressing in a timely way the succession

issues arising from his departure

Raúl Curiel

Chairman

30 March 2022

Extracts from chief executive's statement, strategic and

directors' reports

This has been a difficult year for the Group. The whole of the

period was covered by the pandemic and as stated in previous

reports this has led to uncertainty in decision making and the

inevitable delays that this encourages. Notwithstanding this, we

continue to enjoy a level of repeat and new business instructions

albeit with some noticeable gaps in timing. We are, and continue to

be, appreciative of those clients who have supported us with

ongoing instructions during this period of uncertainty.

Our attention during the year has been on maintaining our

structure and ability to service those instructions that we have

which in turn has meant retaining a staff and overhead structure

that is sub optimal. This is essential to preserving critical mass

throughout our operations in advance of any meaningful recovery in

the demand for our services. At the same time, however, we have

addressed some longer-term fixed costs in the Plc company, the UK

and in the Middle East operations - the benefit of which is to be

seen in future periods and is further explained in the narrative

below.

Group Performance

The past two years has been a tale of four halves. The worst of

the pandemic was covered by the first six months in the current

year and our revenue performance for H2 2021 is now moving slowly

back to the early pandemic period covered by H2 2020.

H2 2021 H1 2021 H2 2020 H1 2020

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- --------- --------- --------- ---------

Revenue less sub

consultant costs 4,683 4,139 4,476 6,860

Total net expenditure (5,043) (5,227) (4,994) (6,830)

Impairment of intangibles (249) - - -

Share of results

of associate and

joint ventures 95 71 336 106

(Loss) / profit

before tax (514) (1,017) (182) 136

Notwithstanding this out-turned result, the situation mid-year

continued to indicate no immediate end to the pandemic and we

continued to take advantage of the UK Government's Coronavirus

Business Interruption Loan Scheme ("CBILS") and various employee

schemes that were available throughout the Group's UK and overseas

operations. This action provided the necessary working capital to

allow us to make an orderly return to pre pandemic levels of

trading.

United Kingdom

Much of the income during the year resulted from long term

project work plus two sizeable new instructions: 457 apartments at

Vulcan Wharf for London Square and a state-of-art redevelopment

project for UCB with Heatherwick studio, both in our Veretec

business. The Veretec business has performed well throughout the

pandemic period. A number of projects were on site including: the

Asticus building in London; EQ, an Head office building for CEG in

Bristol; The STEAMhouse development for Birmingham City University;

Nova or n2 in Victoria for Land Securities; the Featherstone

building for Skanska in the City; and completion of the UK Pavilion

at Dubai's' Expo 2020. The second half also saw a raft of new

enquiries at the concept stage. With much of this work progressing

into the second half the operation returned a profit before tax

(excluding Group management charges) in H2 of GBP259k.

With the need to maintain our critical mass, attention was

focused on overhead cost savings. Two fixed cost areas have been

addressed, both under the property head. We have reduced our

archiving storage cost and have appointed Agents to re-structure

our head office location and find sub tenants - we are seeking cost

savings of between GBP250k pa and GBP350k pa on an annualised

basis, part of which has already been achieved.

The UK is expecting to significantly increase revenues net of

sub consultants in the next financial year. Current secure work for

2022 already totals more than the 2021 outturn result.

Middle East

With less work opportunities a proportion of our time was spent

in reducing our structural costs as the market for our services

began to shrink. This has involved reducing our Licence network

from seven down to (eventually) one and then terminating the linked

property and manager cost requirements. This does not restrict our

ability to work across all of the seven emirates but will require

some partnering of services through our network of trusted sub

consultant providers. As a result of this re-structuring we have

impaired our remaining investment in Shankland Cox Limited and this

is shown as a separate line in the results.

During the year we were on site with a number of projects

including the Leader Sports Mall, Kyber, Safa Community and

Pristine Schools, two projects on Expo: Nissan Café and the

Pakistan Pavilion, two projects for WSP and three villas on

Jumeriah Park. As well as the further rollout of Etisalat retail

stores, and three projects in the Emirate of Al-Ain, a Mall and a

Museum along with the Sheikh Mohammed bin Khalifa House

refurbishment.

Notwithstanding the initiatives stated above, with revenues down

14% in H2, a larger loss before tax (excluding Group management

charges and impairment provision) than H1 was recorded at GBP210k.

The forward position indicates a continuing fall in revenue, but

offset by the savings regime that is in place.

Continental Europe

The Continental group of operations has again been the best

performing of all three operations this year with profits

(excluding Group management charges) of GBP330k (2020: GBP657k).

The main contributor was our associate office Aukett + Heese in

Berlin, which with its sister joint venture company in Frankfurt,

managed to navigate around the worst impacts of the pandemic for

the second year running.

The smaller operations of Istanbul and Prague were impacted to

differing degrees this year with Istanbul, a wholly owned

subsidiary, recording a profit (excluding Group management charges)

of GBP35k despite a turbulent year of political and economic

instability in Turkey. The severe impact of the pandemic on the

Czech Republic market led to a substantial fall in projected

workload resulting in the local directors implementing an orderly

closure of this joint venture operation by agreement with the Plc

Board.

Significant project completions in Berlin this year included the

topping out of the 56,000 sqm mixed use Am Tacheles project and the

entrance areas of the historic KaDeWe department store. The 34

storey Edge East Side Tower, the tallest building in Berlin and let

to Amazon, is now rising above 5(th) floor level and will complete

in 2023.

In Frankfurt completions included several fit-outs for corporate

and financial sector tenants alongside further landlord upgrades in

the iconic Messeturm building. A major new refurbishment project

has begun for an international bank in Frankfurt together with a

new building for a Tata Group subsidiary company in Bonn in

collaboration with the Berlin office.

The Istanbul office completed major corporate sector fit-out

projects for LC Waikiki, Google, Allianz and Vakifbank in Istanbul

and VM Ware in Bulgaria. A series of residential villa designs were

completed for DAAX in Erbil, Iraq and concept studies for further

buildings on the Cengis Campus.

The Moscow licensee completed a 37,500 sqm 500 apartment

residential project in Tyumen and, in collaboration with London,

concept designs for mixed use projects in Moscow including the

Skolkovo Educational Hub project and an international medical

centre on a nearby site. The Moscow operation's third year as a

licensee business continues to make a positive contribution to

Group other operating income. This latter project, being designed

in the UK studio, reached a work stage milestone pre Ukraine

conflict and a payment has been received since that time. No

further services are being performed. Any delay in receiving the

Licence fee is not material and is only recognised on receipt.

Group/Plc costs

As the Group has been reducing in size the Board is cognisant of

the disproportionate central cost in relation to the ability of the

underlying operations to generate sufficient profit to cover it. In

2020 we made some one-off savings which are not carried into 2021

resulting in a higher central cost charge this year. We are

expecting this total cost to be under GBP1m in the forthcoming year

with a further reduction in executive salaries. However, this

assumes that the underlying operations can achieve more than this

in profit generation to make the plc structure viable. With the

pandemic abating or at least becoming a normal course of business

event the Board is considering various structural changes to

mitigate the central cost impact.

Going Concern

We expected this year to present a continuing set of challenges

arising out of the pandemic and this has been the case. The main

challenge has been in relation to working capital which has reduced

over the period along with Group net assets as a result of losses

in our main trading operations and in administering the listed

company structure.

During the second half of the financial year, we saw our

revenues becoming more stable as project uncertainty became the

norm with our risk management procedures focusing on cost controls

where this was possible.

In February 2022 the Group received a 3 month covenant waiver to

avoid the risk of a breach on the net gearing covenant from

February to April 2022. The Group will then attend the scheduled 6

monthly review with Coutts & Co in May 2022 to discuss the

Groups' financing needs. The Group is therefore currently reliant

on the ongoing support of Coutts & Co.

The Directors are considering a range of options regarding our

strategy for the Group structure and geographic footprint to

stabilise and improve the Groups' underlying financial position.

With this in mind, the board has a reasonable expectation that the

Group will have adequate resources to operate for the foreseeable

future, however we face the usual uncertainties that occur in our

market regarding the future levels and timing of work that are made

by client decisions which are beyond our control, which could

result in the Group requiring additional external financing.

The going concern statement in the Directors report and

corresponding section in note 1 provide a summary of the

assessments made by the directors to establish the financial risk

to the Group over the next 12 months. This is further supplemented

by the principal risks and uncertainties section in the strategic

report.

Prospects and Operational Review

With the pandemic becoming a feature of commercial life we now

have more visibility on what the future holds, and this is now

factored into our plans. We are considering a range of options

about our future particularly in the context of the size and

ownership structure of the underlying entities and consequent

regulatory cost. In this context we shall be seeking a replacement

for the position of CEO to lead the delivery of the next phase of

the Group's plans.

Strategy

We are a professional services group that principally provides

architectural design services along with specialisms in master

planning, interior design, executive architecture and some

engineering services.

Our strategic objective is to provide a range of high-quality

design orientated solutions to our clients that allow us to create

shareholder value over the longer term and at the same time

provides a pleasant and rewarding working environment for our

staff. In addition, we undertake to deliver projects throughout the

technical drawing stages and, onto site and up to practical

completion and handover.

Our markets are subject to cyclical and other economic and

political influences in the geographies in which we operate, which

gives rise to peaks and troughs in our financial performance.

Management is cognisant that our business model needs to reflect

these variable factors in both our decision making and expectation

of future performance. The recent pandemic, which affected all our

operations, is an event that has required specific responses.

Similarly, the current conflict in Ukraine creates an uncertain

outlook in terms of both continuity of project instructions and new

business activity. However, the business and the component parts

have been through many sustained crises before and whilst losses

have been incurred the business has been able to respond positively

by adopting new business models along with re-structuring the

operational costs.

Business Model

We operate through a 'three hub' structure covering: the United

Kingdom with our office in London; the Middle East with a main

office in Dubai; and Continental Europe with three offices in

Berlin, Frankfurt and Istanbul; along with a Licensee operation in

Moscow. This model has remained unchanged for several years.

The presentation of the results of our operations is at local,

underlying, trading level and before the allocation of central

costs in order to provide a level playing field in terms of

comparable performance across the hubs as many only incur a small

management charge.

The United Kingdom hub comprises three principal service offers:

comprehensive architectural design including master planning,

interior design and fit-out capability and an executive

architectural delivery service operating under the 'Veretec'

brand.

Our Middle East business in the United Arab Emirates ("UAE")

comprises several registered companies marketed under the common

brand 'Aukett Swanke'. The service offers within the region include

architectural and interior design, post contract delivery services

including architect of record and engineering design and site

services. Increasingly these separate activities are being combined

as a single multidisciplinary service as demanded by this market

and we are now better placed to offer such a 'one-stop shop'

service. Following an internal review of the future cost structure

relating to the underlying entities the business will operate under

a single company in the region.

Our Continental European operations provide services offered

that are consistent with the other two hubs. Entities within this

hub can provide additional drawing services to the larger

operations in order to optimise both local and group wide

resources.

Management of the operations is delegated to locally based

Directors who are, in most instances, indigenous to the country

with oversight on a regular basis by the Group's executive

management.

As a Group we now have a total average full time equivalent

("FTE") staff contingent of 256 (2020: 291) throughout our

organisation which includes both wholly owned and joint venture

operations. We are ranked by professional staff in the 2022 World

Architecture 100 at number 63 (2021 WA100 number 54).

Nicholas Thompson Antony Barkwith

Chief Executive Officer Group Finance Director

30 March 2022

Consolidated income statement

For the year ended 30 September 2021

Note 2021 2020

GBP'000 GBP'000

------------------------------------------ ------ ---------- ----------

Revenue 2 12,014 12,166

Sub consultant costs (3,192) (830)

------------------------------------------ ------ ---------- ----------

Revenue less sub consultant costs 2 8,822 11,336

Personnel related costs (7,806) (9,600)

Property related costs (1,238) (1,295)

Other operating expenses (1,492) (1,324)

Other operating income 360 455

Operating loss (1,354) (428)

Finance costs (94) (112)

------------------------------------------ ------ ---------- ----------

Loss after finance costs (1,448) (540)

Gain on disposal of subsidiary - 52

Impairment of intangibles (249) -

Share of results of associate

and joint ventures 166 442

------------------------------------------ ------ ---------- ----------

Loss before tax (1,531) (46)

Tax credit 4 395 26

------------------------------------------ ------ ---------- ----------

Loss for the year 2 (1,136) (20)

------------------------------------------ ------ ---------- ----------

(Loss) / profit attributable to:

Owners of Aukett Swanke Group

Plc (1,123) 5

Non-controlling interests (13) (25)

------------------------------------------ ------ ---------- ----------

(1,136) (20)

------------------------------------------ ------ ---------- ----------

Basic and diluted earnings per

share for (loss)/profit attributable

to the ordinary equity holders

of the Company:

From continuing operations (0.69p) 0.00p

Total (loss)/profit per share 3 (0.69p) 0.00p

------------------------------------------ ------ ---------- ----------

Consolidated statement of comprehensive income

For the year ended 30 September 2021

2021 2020

GBP'000 GBP'000

------------------------------------------ ---------- ----------

Loss for the year (1,136) (20)

Currency translation differences (157) (38)

Other comprehensive loss for the

year (157) (38)

Total comprehensive loss for the

year (1,293) (58)

------------------------------------------- ---------- ----------

Total comprehensive loss for the

year is attributable to:

Owners of Aukett Swanke Group

Plc (1,280) (33)

Non-controlling interests (13) (25)

(1,293) (58)

------------------------------------------ ---------- ----------

Consolidated statement of financial position

At 30 September 2021

Note 2021 2020

GBP'000 GBP'000

-------------------------------- ------ --------- ---------

Non current assets

Goodwill 7 2,370 2,392

Other intangible assets 8 324 653

Property, plant and equipment 155 272

Right-of-use assets 2,546 2,929

Investment in associate 9 587 927

Investments in joint ventures 10 209 317

Deferred tax 241 214

-------------------------------- ------ --------- ---------

Total non current assets 6,432 7,704

Current assets

Trade and other receivables 3,975 3,527

Contract assets 982 628

Cash at bank and in hand 515 992

-------------------------------- ------ --------- ---------

Total current assets 5,472 5,147

Total assets 11,904 12,851

Current liabilities

Trade and other payables (3,747) (3,333)

Contract liabilities (829) (606)

Borrowings (83) (155)

Lease liabilities (539) (539)

Total current liabilities (5,198) (4,633)

Non current liabilities

Borrowings (417) -

Lease liabilities (2,350) (2,805)

Deferred tax (40) (47)

Provisions (832) (992)

-------------------------------- ------ --------- ---------

Total non current liabilities (3,639) (3,844)

Total liabilities (8,837) (8,477)

Net assets 3,067 4,374

-------------------------------- ------ --------- ---------

Capital and reserves

Share capital 11 1,652 1,652

Merger reserve 1,176 1,176

Foreign currency translation

reserve (173) (16)

Retained earnings (1,082) 41

Other distributable reserve 1,494 1,494

-------------------------------- ------ --------- ---------

Total equity attributable to

equity holders of the Company 3,067 4,347

-------------------------------- ------ --------- ---------

Non-controlling interests - 27

-------------------------------- ------ --------- ---------

Total equity 3,067 4,374

-------------------------------- ------ --------- ---------

Consolidated statement of cash flows

For the year ended 30 September 2021

Note 2021 2020

GBP'000 GBP'000

----------------------------------------- ------ ---------- ----------

Cash flows from operating activities

Cash (expended by) / generated

from operations 5 (896) 151

Income taxes received 262 218

----------------------------------------- ------ ---------- ----------

Net cash (outflow)/inflow from

operating activities (634) 369

Cash flows from investing activities

Purchase of property, plant and

equipment (33) (245)

Sale of property, plant and equipment 16 16

Purchase of investments (123) -

Dividends received from associates

& joint ventures 528 211

----------------------------------------- ------ ---------- ----------

Net cash received in / (expended

on) investing activities 388 (18)

Net cash (outflow)/inflow before

financing activities (246) 351

Cash flows from financing activities

Principal paid on lease liabilities (455) (211)

Interest paid on lease liabilities (91) (103)

Proceeds from bank loans 500 -

Repayment of bank loans (155) (154)

Interest paid (3) (9)

Net cash outflow from financing

activities (204) (477)

Net change in cash and cash equivalents (450) (126)

Cash and cash equivalents at start

of year 992 1,145

Currency translation differences (27) (27)

Cash and cash equivalents at end

of year 515 992

----------------------------------------- ------ ---------- ----------

Cash and cash equivalents are comprised

of:

Cash at bank and in hand 515 992

Cash and cash equivalents at end

of year 515 992

------------------------------------------ ---- ----

Consolidated statement of changes in equity

For the year ended 30 September 2021

Share Foreign Retained Other Merger Total Non-controlling Total

capital currency earnings distributable reserve interests equity

translation reserve

reserve GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ------------ --------- -------------- --------- --------- ---------------- ---------

At 1 October

2019 1,652 22 36 1,494 1,176 4,380 133 4,513

Profit/(loss)

for the year - - 5 - - 5 (25) (20)

Acquisition of

minority

interest - - - - - - (81) (81)

Other

comprehensive

income - (38) - - - (38) - (38)

--------------- --------- ------------ --------- -------------- --------- --------- ---------------- ---------

Total

comprehensive

income - (38) 5 - - (33) (106) (139)

At 30

September

2020 1,652 (16) 41 1,494 1,176 4,347 27 4,374

Loss for the

year - - (1,123) - - (1,123) (13) (1,136)

Acquisition of

minority

interest - - - - - - (14) (14)

Other

comprehensive

income - (157) - - - (157) - (157)

--------------- --------- ------------ --------- -------------- --------- --------- ---------------- ---------

Total

comprehensive

income - (157) (1,123) - - (1,280) (27) (1,307)

At 30

September

2021 1,652 (173) (1,082) 1,494 1,176 3,067 - 3,067

--------------- --------- ------------ --------- -------------- --------- --------- ---------------- ---------

The other distributable reserve was created in September 2007

during a court and shareholder approved process to reduce the

capital of the Company.

The merger reserve was created through a business combination in

December 2013 representing the issue of 19,594,959 new ordinary

shares at a price of 7.00 pence per share.

Notes to the audited final results

1 Basis of preparation

The financial statements for the Group and parent have been

prepared in accordance with international accounting standards in

conformity with the requirements of the Companies Act 2006.

Going concern

During the year the Group repaid the final GBP155k ($200k)

balance of the USD Dollar loan.

The Group currently meets its day to day working capital

requirements through its cash balances. It maintains an overdraft

facility for additional financial flexibility and foreign currency

hedging purposes.

In May 2021 the Group also secured additional funding by way of

GBP500k from the Coronavirus Business Interruption Loan Scheme

("CBILS"), which is in addition to the overdraft facility. The

arrangement fees for this loan and the first year of interest are

paid for by the UK Government and the funds will mainly be used

instead of the current bank overdraft facility as and when it is

necessary. The loan has a duration of three years with interest at

4.05% over the Coutts base rate (currently 0.75%) in years two and

three. We expect to repay the CBILS loan before the expiry of the

term.

The overdraft facility is renewed annually and was renewed for a

further 12 months in November 2021, with a review in May 2022.

The facility was initially renewed at GBP500k (unchanged from

the prior year). However, as in prior years, the facility includes

a net gearing covenant which assesses the ratio of financial

indebtedness (cash at bank, less overdraft balances, loans and

finance lease liabilities, excluding the UK office lease

capitalised on adoption of IFRS16) to tangible net worth (net

assets less goodwill and other intangible assets). This covenant is

measured at each month end. The reduction in tangible net worth

following the loss in the year means that the Group is unable to

fully utilise the overdraft and CBILS loan at the end of each month

without breaching the covenant.

In February 2022 the Group made a request to Coutts & Co,

which was accepted, to waiver the net gearing covenant for the

February, March and April 2022 month ends. The Group similarly

agreed to temporarily reduce the overdraft facility to GBP250k

until the end of May 2022. This provides the Group greater freedom

in the short term to utilise the GBP500k CBILS loan and reduced

GBP250k overdraft. The Group will then attend the scheduled 6

monthly review with Coutts & Co in May 2022 to discuss the

Groups' financing needs whilst reviewing the preliminary half year

management accounts and 12 month cashflow forecast.

The processes the directors have undertaken, and the reasons for

the conclusions they have reached, regarding the applicability of a

going concern basis are explained below. In undertaking their

assessment the directors have followed the guidance issued in March

2020 by the Financial Reporting Council, "FRC guidance for

companies and auditors during the COVID-19 crisis".

Forecasts for the Group have been prepared on a monthly basis

through to the end of March 2023, which comprise detailed income

statements, statements of financial position and cash flow

statements for each of the Group's operations, as well as an

assessment of covenant tests.

As the COVID-19 pandemic developed through 2020 and into 2021 it

continued to affect all of the territories in which the Group

operates to varying extents and other countries in which the Group

has clients and projects. Having moved to remote working without

any significant disruption in the prior financial year, in the year

to September 2021, the Group adapted flexibly on an

office-by-office basis in accordance with local government advice.

All of the offices re-opened with varying levels occupancy as staff

continued to operate on a mix of office, project site and home

based working.

As economic uncertainty surrounding the pandemic continued, the

Groups' operational management took measures including encouraging

unpaid leave and part time working in the UAE operations for staff

not fully utilised, furloughing UK permanent staff; flexing the

number of temporary or freelance staff based on project workload

and a limited number of technical and admin staff redundancies.

These provided management with a range of tools implemented at

short notice and with immediate effect.

The Group continued to remove non-essential expenditure.

Deferred operational cash flows from the prior financial year began

to unwind through the year to September 2021, and as a result the

Group felt it was appropriate to drawdown the GBP500k CBILS loan to

offset the impact of these catch-up payments. In the UK the most

significant of these deferrals had been 1 quarter of VAT deferred

in the prior financial year in accordance with UK government

support. In the year to September 2021 the UK operation began

repaying this in monthly instalments. The last instalment has since

been repaid on time in January 2022.

The Groups' principal banker is Coutts & Co with whom the

Group has an excellent long-term relationship extending through

previous business cycles. Coutts & Co has again renewed the

Group's overdraft facility as described above, and have temporarily

waived the gearing covenant for 3 months. We have no reason not to

expect that the overdraft facility would not be renewed again in

November 2022.

Due to the uncertainty in forecasting profits during the

COVID-19 pandemic Coutts & Co waived the debt servicing

covenant from the facility agreement for the year ending 30

September 2021. This has been reintroduced in the November 2021

renewal and is due for assessment following the year ending 30

September 2022 (assessed on completion of the annual audit,

anticipated in January 2023).

The other covenant applicable relates to maintaining a level of

UK eligible debtors.

The Group has managed cash flow within its facilities so far.

During the course of the next 12 month going concern review period,

our forecast assumes that no additional external financing is

received when measuring the Groups ability to continue to operate

and that the CBILS loan instalments commence their 24 monthly

repayments from June 2022.

The Groups' assessment of going concern is therefore focussed on

its ability to operate within the GBP250k overdraft limit to the

end of May 2022, then assuming a return to the GBP500k overdraft

limit thereafter.

The Group forecasts on the basis of earnings and billings from

i) secure contractual work, ii) known potential work which is

deemed to have a greater than 50% chance of being undertaken and is

predominantly follow on stages of currently instructed work, on

which a factoring is applied; and iii) new work from known sources

such as competitive tenders and submitted fee proposals, or new

work to be achieved based on historical experience of market

activity and timescales in which work can be converted from an

enquiry to an active project which varies by territory and the

service each office in the Group provides.

The risk of short term recessions and delays in clients making

financial investment decisions due to the COVID-19 pandemic appear

to have now largely abated. Across the Groups' business units the

forecasts assessed by the Directors therefore assume the businesses

continue to operate much as they have done in recent months and

without the reintroduction of any new COVID-19 government support

mechanisms.

However we note that the recent conflict in the Ukraine, rising

energy prices and inflation globally will have macro-economic

implications and could be a trigger for recession in the short to

medium term, and will have significant impact on clients decision

making, albeit as yet we have not experienced any material

indication to this effect.

The forecasts apply sensitivities based on levels of earnings

reductions sustained over the next 12 months, making controllable

adjustments to the cost base through structural adjustments to

staffing numbers and deferring and removing non-essential costs. We

also assess overall cash levels across the Group and how those can

be best deployed to ensure each of the entities in the Group has

sufficient cash to operate.

The above cost planning exercise and focus on near term secure

income and contract extensions has resulted in the Group

reforecasting based on cash inflows from turnover less sub

consultant costs reduced by an average of 11.7% against management

accounts over the next 12 months. This reforecasting ensures that

where the business is sensitive to expected declines in cash

inflows from work, management are able to plan ahead for this and

manage cost outflows effectively.

In the event that the level of turnover falls by more than the

11.7% indicated above, management have identified further cash flow

initiatives around the Group which could be utilised to generate

additional free cash to allow the company to continue to trade.

This includes options to sublet, administrative staff and

discretionary overhead cost savings and freeing up liquidity in our

German associate and joint venture.

In the shorter term, management reviewed a number of scenarios,

including a scenario modelling a pause on short term expected work

amounting to 14.2% of income for 3 months, then followed by the

same reductions in workload from the 12 month model (averaging out

to over 14.1% across 12 months). In this case the Group would

consistently fail the net gearing covenant and the eligible debtor

covenant and could exceed the limits of the assumed GBP500k

overdraft. This would necessitate the Group moving a level of cash

from the investments in joint ventures and associates into the

Group, improved debtor collection rate (which is reliant on client

processes and therefore not wholly within the Group's control) than

we normally forecast to remain within the limits of our facilities,

and then might require additional funding.

The Directors note that the UK and other governments in the

territories in which we operate, have been supportive in their

efforts to enable construction and infrastructure projects to

continue throughout the pandemic. With vaccine roll outs largely

completed and booster programs ongoing, we see the industry now

well positioned to reduce the risks of impact from further COVID-19

spikes.

With the impact the loss for the year has had on net assets and

working capital, the Directors are considering a range of options

regarding our strategy for the Group structure and geographic

footprint to stabilise and improve the Groups' underlying financial

position. With this in mind, the Board, after applying the

processes and making the enquiries described above, has a

reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future.

However there remains a risk that if the COVID-19 environment

worsened or the Ukraine conflict lead to macro-economic

uncertainty, the Group may find itself as the result of unexpected

levels of delays on project work beyond its control requiring

additional external financing.

For this reason, the Board considers it appropriate to prepare

the financial statements on a going concern basis, however given

the lack of certainty involved in preparing these cash flow

forecasts, there is a material uncertainty which may cast

significant doubt on the Group's and the Parent Company's ability

to continue as a going concern and therefore their ability to

realise their assets and discharge their liabilities in the normal

course of business.

The financial statements do not include the adjustments that

would result if the Group or the Parent Company was unable to

continue as a going concern.

2 Operating segments

The Group comprises three separately reportable geographical

segments ('hubs'), together with a group costs segment.

Geographical segments are based on the location of the operation

undertaking each project.

The Group's operating segments consist of the United Kingdom,

the Middle East and Continental Europe. Turkey is included within

Continental Europe together with Germany and the Czech

Republic.

Income statement segment information

Segment revenue 2021 2020

GBP'000 GBP'000

-------------------- --------- ---------

United Kingdom 8,871 7,106

Middle East 2,822 4,823

Continental Europe 321 237

Revenue 12,014 12,166

--------------------- --------- ---------

Segment revenue less sub consultant 2021 2020

costs GBP'000 GBP'000

------------------------------------- --------- ---------

United Kingdom 6,063 6,990

Middle East 2,517 4,122

Continental Europe 242 224

Revenue less sub consultant

costs 8,822 11,336

-------------------------------------- --------- ---------

2021 Before goodwill Fair value Sub-total Reallocation Total

Segment result and acquisition gains on GBP'000 of group GBP'000

adjustments deferred management

GBP'000 consideration charges

and acquisition GBP'000

settlement

GBP'000

----------------- ----------------- ----------------- ---------- ------------- ---------

United Kingdom (848) - (848) 540 (308)

Middle East (936) - (936) 398 (538)

Continental

Europe 149 - 149 181 330

Group costs 104 - 104 (1,119) (1,015)

----------------- ----------------- ----------------- ---------- ------------- ---------

Loss before

tax (1,531) - (1,531) - (1,531)

----------------- ----------------- ----------------- ---------- ------------- ---------

2020 Before goodwill Fair value Sub-total Reallocation Total

Segment result and acquisition gains on GBP'000 of group GBP'000

adjustments deferred management

GBP'000 consideration charges

and acquisition GBP'000

settlement

GBP'000

----------------- ----------------- ----------------- ---------- ------------- ---------

United Kingdom (282) - (282) 496 214

Middle East (472) - (472) 449 (23)

Continental

Europe 511 - 511 146 657

Group costs 197 - 197 (1,091) (894)

----------------- ----------------- ----------------- ---------- ------------- ---------

Profit before

tax (46) - (46) - (46)

----------------- ----------------- ----------------- ---------- ------------- ---------

3 Earnings per share

The calculations of basic and diluted earnings per share are

based on the following data:

Earnings 2021 2020

GBP'000 GBP'000

---------------------------- --------- ---------

Continuing operations (1,123) 5

(Loss)/profit for the year (1,123) 5

---------------------------- --------- ---------

Number of shares 2021 2020

Number Number

-------------------------------------- ------------ ------------

Weighted average of ordinary shares

in issue 165,213,652 165,213,652

Effect of dilutive options - -

-------------------------------------- ------------ ------------

Diluted weighted average of ordinary

shares in issue 165,213,652 165,213,652

-------------------------------------- ------------ ------------

4 Tax charge

2021 2020

GBP'000 GBP'000

--------------------------------------- --------- ---------

Current tax - -

Adjustment in respect of previous (361) -

years

--------------------------------------- --------- ---------

Total current tax (361) -

Origination and reversal of temporary

differences (126) (26)

Adjustment in respect of previous 92 -

years

Changes in tax rates - -

--------------------------------------- --------- ---------

Total deferred tax (34) (26)

Total tax credit (395) (26)

---------------------------------------- --------- ---------

The standard rate of corporation tax in the United Kingdom is

applicable for the financial year was 19% (2020: 19%)

The tax assessed for the year differs from the United Kingdom

standard rate as explained below:

2021 2020

GBP'000 GBP'000

---------------------------------------------- --------- ---------

Loss before tax (1,531) (46)

Loss before tax multiplied by the standard

rate of corporation tax in the United

Kingdom of 19% (2020: 19%) (291) (9)

Effects of:

Other non tax deductible expenses/(credits) 60 (12)

Associate and joint ventures reported

net of tax (32) (84)

Tax losses not recognised 105 84

Current tax adjustment in respect of

previous years (361) -

Deferred tax adjustment in respect

of previous years 92 7

Income not taxable 32 (12)

----------------------------------------------- --------- ---------

Total tax credit (395) (26)

----------------------------------------------- --------- ---------

5 Cash generated from operations

Group 2021 2020

GBP'000 GBP'000

----------------------------------------- --------- ---------

Loss before tax - continuing operations (1,531) (46)

Finance costs 94 112

Share of results of associate and

joint ventures (166) (442)

Intangible amortisation 59 79

Intangible impairment 249 -

Depreciation 129 74

Amortisation of right-of-use assets 383 340

Profit on disposal of property, (2) -

plant & equipment

(Increase)/decrease in trade and

other receivables (843) 989

(Decrease) / increase in trade and

other payables 892 (794)

Change in provisions (160) (79)

Unrealised foreign exchange differences - (82)

Net cash (expended by) / generated

from operations (896) 151

------------------------------------------ --------- ---------

6 Analysis of net funds

Group 2021 2020

GBP'000 GBP'000

--------------------------- --------- ---------

Cash at bank and in hand 515 992

Cash and cash equivalents 515 992

Secured bank loan (500) (155)

Net funds 15 837

---------------------------- --------- ---------

7 Goodwill

Group GBP'000

---------------------- ---------

Cost

At 1 October 2019 2,683

Addition 19

Disposal (271)

Exchange differences (39)

At 30 September 2020 2,392

Addition 9

Disposal -

Exchange differences (31)

------------------------ ---------

At 30 September 2021 2,370

------------------------ ---------

Impairment

At 1 October 2019 271

Disposal (271)

Exchange differences -

At 30 September 2020 -

Disposal -

Exchange differences -

---------------------- ---------

At 30 September 2021 -

---------------------- ---------

Net book value

At 30 September 2021 2,370

At 30 September 2020 2,392

At 30 September 2019 2,412

------------------------ ---------

The disposal recorded in the prior year related to Goodwill on a

Russian subsidiary which was sold during the prior year. As the

Goodwill allocated to that entity had previously been fully

impaired no gain or loss was recognised on disposal of the

goodwill.

The addition recorded in the year related to Goodwill on the

acquisition of an additional 5% shareholding in John R Harris &

Partners Limited increasing the Group's shareholding from 95% to

100%.

The net book value of goodwill is allocated to the Group's cash

generating units ("CGU") as follows:

United Middle

Kingdom Turkey East Total

GBP'000 GBP'000 GBP'000 GBP'000

---------------------- --------- -------- -------- --------

At 30 September

2019 1,740 37 635 2,412

Addition - - 19 19

Exchange differences - (11) (28) (39)

----------------------- --------- -------- -------- --------

At 30 September

2020 1,740 26 626 2,392

Addition - - 9 9

Exchange differences - (4) (27) (31)

----------------------- --------- -------- -------- --------

At 30 September

2021 1,740 22 608 2,370

----------------------- --------- -------- -------- --------

An annual impairment test is performed over the cash generating

units ('CGUs') of the Group where goodwill and intangible assets

are allocable to those CGUs.

JRHP and SCL are identifiable as separate CGUs for the purposes

of performing an impairment review under IAS 36. The goodwill

relating to the Middle East CGU for reference purposes in the

disclosure table is wholly attributable to JRHP. Intangible assets

relating to both JRHP and SCL are included in the other intangible

asset tables in note 8.

The recoverable amount of a cash generating unit is determined

based on value in use calculations. These calculations use pre-tax

cash flow projections based on financial budgets and forecasts

covering a five year period. Cash flows beyond the five year period

are extrapolated using long term average growth rates.

The carrying value of goodwill allocated to the United Kingdom

and the Middle East is material. The total carrying value of

goodwill allocated to Turkey is not material.

The key assumptions in the discounted cash flow projections for

the United Kingdom operation are:

-- the future level of revenue, set at a compound growth rate of

8.31% over the next five years - which is based on knowledge of

past property development cycles and external forecasts such as the

construction forecasts published by Experian. Historically the

property development market has both declined more swiftly and

recovered more sharply than the economy as a whole. Management also

considers the level of future secured revenues at the point of

drawing up these calculations. Projections consider a return to

economic health in the year to September 2022, with assumption of a

return to relative economic normality following the COVID-19

pandemic. The compound growth rate is higher than prior years

modelling assumptions as it bases the starting point on the lower

earnings in the year 20/21 which were significantly lower than

prior years, and assumes an annualised inflation of earnings (and

costs) of a higher CPI assumption of 4.6%. Compound growth used in

the model compared to the 19/20 year revenue is 4.37%.

-- long term growth rate - which has been assumed to be 2.0%

(2020: 2.0%) per annum based on the average historical growth in

gross domestic product in the United Kingdom over the past fifty

years; and

-- the discount rate - which is the UK segment's pre-tax

weighted average cost of capital and has been assessed at 11.34%

(2020: 12.66%).

Based on the discounted cash flow projections, the recoverable

amount of the UK CGU is estimated to exceed carrying values by

GBP7,530k (546%). An 8% fall in all future forecast revenues

(applied as a smooth reduction to the compound growth rate noted

above) without a corresponding reduction in costs in the UK CGU, or

an increase in the discount rate to over 50%, would result in

carrying amounts exceeding their recoverable amount. A decrease in

the effective compound growth rate of revenue to 6.48% instead of

the 8.31% noted above, without a corresponding reduction in costs

in the UK CGU, would result in carrying amounts exceeding their

recoverable amount. Management believes that the carrying value of

goodwill remains recoverable despite this sensitivity given the

conservative nature of the underlying forecasts prepared.

The key assumptions in the discounted cash flow projections for

the Middle East operation are:

-- the future level of revenue, set at a compound growth rate of

4.3% (for JRHP) over the next five years - which is based on

knowledge of the current and expected level of construction

activity in the Middle East. For JRHP we assume earnings in the

year to September 2022 of AED 8.9m with earnings rising slowly to

AED 9.9m from the year 2025/26.

-- working capital requirements - which is based on management's

best in a geography where it is common to have high levels of trade

receivables;

-- long term growth rate - which has been assumed to be 3.15%

per annum based on the average historical growth in gross domestic

product in the Middle East over the past forty years; and

-- the discount rate - which is the Middle East segment's

pre-tax weighted average cost of capital, has been assessed at

10.1% (2020: 13.7%).

Based on the discounted cash flow projections, the recoverable

amount of JRHP within the Middle East CGU is estimated to exceed

carrying values by at least GBP2.43m (252%). A decrease in the

effective compound growth rate of revenue to 2.2% instead of the

4.3% noted above, without a corresponding reduction in costs in

JRHP, would result in carrying amounts exceeding their recoverable

amount. An increase in the discount rate to 29.2% would result in

carrying amounts exceeding their recoverable amount.

The carrying value of the Middle East CGU Goodwill is entirely

attributable to JRHP, whereas Other Intangible Assets (note 8)

includes both JRHP and SCL. As the operations of SCL are in the

process of being transferred across to JRHP, Management consider it

appropriate to impair the remaining balance of Other Intangible

Assets associated with SCL and this is commented on further in note

8.

Management believe that the carrying value of goodwill remains

recoverable for JRHP despite this sensitivity given the

conservative nature of the underlying forecasts prepared.

8 Other intangible assets

Group Trade Customer Order Trade

name relationships book licence Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- -------- --------------- -------- --------- --------

Cost

At 30 September 2019 701 404 - 80 1,185

Disposal - - - - -

Exchange differences (29) (31) - (4) (64)

---------------------- -------- --------------- -------- --------- --------

At 30 September 2020 672 373 - 76 1,121

Disposal - - - - -

Exchange differences (17) (19) - (3) (39)

---------------------- -------- --------------- -------- --------- --------

At 30 September 2021 655 354 - 73 1,082

---------------------- -------- --------------- -------- --------- --------

Amortisation

At 30 September 2019 152 237 - 34 423

Disposal - - - - -

Charge 26 45 - 8 79

Exchange differences (9) (23) - (2) (34)

---------------------- -------- --------------- -------- --------- --------

At 30 September 2020 169 259 - 40 468

Disposal - - - - -

Impairment 236 13 - - 249

Charge 25 26 - 8 59

Exchange differences (3) (13) - (2) (18)

---------------------- -------- --------------- -------- --------- --------

At 30 September 2021 427 285 - 46 758

---------------------- -------- --------------- -------- --------- --------

Net book value

At 30 September 2021 228 69 - 27 324

At 30 September 2020 503 114 - 36 653

At 30 September 2019 549 167 - 46 762

---------------------- -------- --------------- -------- --------- --------

Amortisation is included in other operating expenses in the

consolidated income statement.

Impairment

Following the Group's decision to restructure the UAE business,

Shankland Cox Limited ongoing contracts have been or are in the

process of being reassigned into John R Harris & Partners

Limited, with new work being contracted by John R Harris &

Partners Limited, and the remaining licences held by Shankland Cox

Limited being allowed to expire. Management therefore took the view

that remaining balance of intangible assets totalling GBP249k

should be impaired as at 30(th) September 2021. This impairment

charge is presented separately to the amortisation charge for the

year, on the face of the Consolidated Income Statement

Trade name

The trade name was acquired as part of the acquisition of Swanke

Hayden Connell Europe Limited ("SHC") in December 2013 and also on

the acquisition of Shankland Cox Limited ("SCL") in February 2016.

The SHC trade name reflects the inclusion of the Swanke name in the

enlarged Group. Trade names are amortised on a straight line basis

over a 25 year period from the acquisition date and have remaining

amortisation periods of 18 and 20 years, respectively.

Customer relationships

The customer relationships were acquired as part of the

acquisition of SHC in December 2013, on the acquisition of John R

Harris & Partners Limited ("JRHP") in June 2015 and on the

acquisition of SCL in February 2016. This represents the value

attributed to clients who provided repeat business to the Group on

the strength of these relationships. Customer relationships are

amortised on a straight line basis over a 7-10 year period from the

acquisition dates. The customer relationships acquired in December

2013 have a remaining amortisation period of 3 months. The customer

relationships acquired in June 2015 and February 2016 both have

remaining amortisation periods of 5 years.

Trade licence

The trade licence was acquired as part of the acquisition of

JRHP in June 2015. This represents the value of licences granted to

JRHP for architectural activities in the regions in which it

operates. The licence is amortised on a straight line basis over a

10 year period from the acquisition date and has a remaining

amortisation period of 5 years.

9 Investment in associate

The Group owns 25% of Aukett + Heese GmbH which is based in

Berlin, Germany. The table below provides summarised financial

information for Aukett + Heese GmbH as it is material to the Group.

The information disclosed reflects Aukett + Heese GmbH's relevant

financial statements and not the Group's share of those amounts

Summarised balance sheet 2021 2020

GBP'000 GBP'000

-------------------------- --------- ---------

Assets

Non current assets 289 280

Current assets 4,693 6,755

--------------------------- --------- ---------

Total assets 4,982 7,035

Liabilities

Current liabilities (2,635) (3,329)

Total liabilities (2,635) (3,329)

Net assets 2,347 3,706

--------------------------- --------- ---------

Reconciliation to carrying amounts:

2021 2020

GBP'000 GBP'000

--------------------------------- --------- ---------

Opening net assets at 1 October 3,706 2,842

Profit for the period 470 1,201

Other comprehensive income (185) 102

Dividends paid (1,644) (439)

---------------------------------- --------- ---------

Closing net assets 2,347 3,706

Group's share in % 25% 25%

Group's share in GBP'000 587 927

---------------------------------- --------- ---------

Carrying amount 587 927

---------------------------------- --------- ---------

Summarised statement of comprehensive 2021 2020

income GBP'000 GBP'000

--------------------------------------- --------- ---------

Revenue 12,243 13,208

Sub consultant costs (3,492) (3,764)

---------------------------------------- --------- ---------

Revenue less sub consultant costs 8,751 9,444

Operating costs (8,078) (7,724)

---------------------------------------- --------- ---------

Profit before tax 673 1,720

Taxation (203) (519)

---------------------------------------- --------- ---------

Profit for the period from continuing

operations 470 1,201

Other comprehensive income (185) 102

---------------------------------------- --------- ---------

Total comprehensive income 285 1,303

---------------------------------------- --------- ---------

The Group received dividends of GBP393,000 after deduction of

German withholding taxes (2020: GBP105,000) from Aukett + Heese

GmbH. The principal risks and uncertainties associated with Aukett

+ Heese GmbH are the same as those detailed within the Group's

Strategic Report.

10 Investments in joint ventures

Frankfurt

The Group owns 50% of Aukett + Heese Frankfurt GmbH which is

based in Frankfurt, Germany.

GBP'000

---------------------- --------

At 30 September 2019 277

Share of profits 117

Dividends paid (110)

Exchange differences 8

------------------------ --------

At 30 September 2020 292

Share of profits 65

Dividends paid (142)

Exchange differences (14)

------------------------ --------

At 30 September 2021 201

------------------------ --------

The Group received dividends of GBP135,000 after deduction of

German withholding taxes (2020: GBP106,000) from Aukett + Heese

Frankfurt GmbH. The following amounts represent the Group's 50%

share of the assets and liabilities, and revenue and expenses of

Aukett + Heese Frankfurt GmbH.

2021 2020

GBP'000 GBP'000

--------------------- --------- ---------

Assets

Non current assets 12 18

Current assets 288 500

---------------------- --------- ---------

Total assets 300 518

Liabilities

Current liabilities (99) (226)

Total liabilities (99) (226)

Net assets 201 292

---------------------- --------- ---------

2021 2020

GBP'000 GBP'000

----------------------------------- --------- ---------

Revenue 919 1,233

Sub consultant costs (267) (451)

------------------------------------ --------- ---------

Revenue less sub consultant costs 652 782

Operating costs (541) (610)

------------------------------------ --------- ---------

Profit before tax 111 172

Taxation (46) (55)

------------------------------------ --------- ---------

Profit after tax 65 117

------------------------------------ --------- ---------

The principal risks and uncertainties associated with Aukett +

Heese Frankfurt GmbH are the same as those detailed within the

Group's Strategic Report.

Prague

The Group owns 50% of Aukett sro which is based in Prague, Czech

Republic.

GBP'000

---------------------- --------

At 30 September 2019 -

Share of profits 25

Exchange differences -

---------------------- --------

At 30 September 2020 25

Share of losses (16)

Exchange differences (1)

At 30 September 2021 8

------------------------ --------

The following amounts represent the Group's 50% share of the

assets and liabilities, and revenue and expenses of Aukett sro.

2021 2020

GBP'000 GBP'000

--------------------- --------- ---------

Assets

Current assets 11 105

---------------------- --------- ---------

Total assets 11 105

Liabilities

Current liabilities (3) (80)

Total liabilities (3) (80)

Net assets 8 25

---------------------- --------- ---------

2021 2020

GBP'000 GBP'000

----------------------------- --------- ---------

Revenue 165 347

Sub consultant costs (78) (141)

------------------------------ --------- ---------

Revenue less sub consultant

costs 87 206

Operating costs (103) (172)

------------------------------ --------- ---------

(Loss) / profit before tax (16) 34

Taxation - (4)

(Loss) / profit after tax (16) 30

------------------------------ --------- ---------

In the prior year the carrying value of the investment in the

joint venture brought forward was limited to GBPnil as the company

had net liabilities at the start of the prior year. The prior year

share of profit was therefore reduced by GBP5k so that the carrying

value of the investment in joint venture matched the Groups' share

of the entities' net assets being GBP25k as at 30 September

2020.

The principal risks and uncertainties associated with Aukett sro

are the same as those detailed within the Group's Strategic

Report.

11 Share capital

Group and Company 2021 2020

GBP'000 GBP'000

------------------------------------------ --------- ---------

Allocated, called up and fully paid

165,213,652 (2020: 165,213,652) ordinary

shares of 1p each 1,652 1,652

------------------------------------------ --------- ---------

Number

---------------------- ------------

At 1 October 2019 165,213,652

No changes -

At 30 September 2020 165,213,652

No changes -

At 30 September 2021 165,213,652

---------------------- ------------

The Company's issued ordinary share capital comprises a single

class of ordinary share. Each share carries the right to one vote

at general meetings of the Company.

12 Status of final audited results

This announcement of final audited results was approved by the

Board of Directors on 30 March 2022.

The financial information presented in this announcement has

been extracted from the Group's audited statutory accounts for the

year ended 30 September 2021 which will be delivered to the

Registrar of Companies following the Company's Annual General

Meeting.

The auditor's report on these accounts was unqualified, and did

not contain a statement under section 498 of the Companies Act

2006. The auditor's report for the year ended 30 September 2021 did

not draw attention to any matters by way of emphasis, but it did

include reference to a material uncertainty related to going

concern, drawing attention to the fact that the Group may find

itself, as a result of unexpected levels of delays on project work

beyond its control, requiring additional financing. The opinion was

not modified in respect of this matter.

Statutory accounts for the year ended 30 September 2020 have

been delivered to the registrar of companies and the auditors'

report on these accounts was unqualified, and did not contain a

statement under section 498 of the Companies Act 2006. The

auditor's report for the year ended 30 September 2021 did not draw

attention to any matters by way of emphasis, but it did include

reference to a material uncertainty related to going concern,

drawing attention to the fact that the Group may find itself, as a

result of unexpected levels of delays on project work beyond its

control, requiring additional financing. The opinion was not

modified in respect of this matter.

The financial information presented in this announcement of

final audited results does not constitute the Group's statutory

accounts for the year ended 30 September 2021.

13 Annual General Meeting

The Annual General Meeting will be held at 10.00am on Thursday

31 March 2022 at 10 Bonhill Street, London, EC2A 4PE.

14 Annual report and accounts

Copies of the 2021 audited accounts will be available today on

the Company's website ( www.aukettswankeplc.com ) for the purposes

of AIM rule 26 and will be posted to shareholders who have elected

to receive a printed version in due course.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EFLBXLXLFBBZ

(END) Dow Jones Newswires

March 31, 2022 02:01 ET (06:01 GMT)

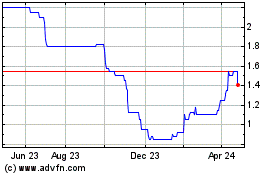

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Mar 2024 to Apr 2024

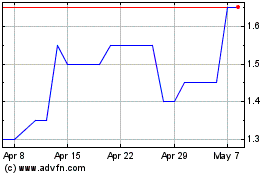

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Apr 2023 to Apr 2024