TIDMAVAP

RNS Number : 4798Q

Avation PLC

26 February 2021

AVATION PLC

("Avation" or "the Company")

UNAUDITED INTERIM Financial Results for the SIX MONTHS ended 31

December 2020 and Interim Management Statement

Avation PLC (LSE: AVAP), the commercial passenger aircraft

leasing company, announces unaudited interim financial results for

the six months ended 31 December 2020.

Key Financial Results

-- Revenue and Other income decreased by 6% to $63.3 million;

-- Impairment loss on aircraft of $46.7 million;

-- Expected credit loss on receivables and accrued revenue of $12.9 million;

-- Loss before tax of $60.5 million;

-- Loss per share of 97.9 cents; and

-- Net asset value per share is $2.38.

COVID-19 Strategy

-- Focus on preservation of liquidity and cashflow;

-- Rent deferrals totalling $25.9 million provided to airline customers;

-- Loan repayment deferrals totalling $31.0 million obtained from secured lenders;

-- Agreement with bondholders to extend maturity of Avation

Capital S.A. 6.5% senior notes to October 2026; and

-- Capital expenditure and dividends have been temporarily suspended.

Executive Chairman, Jeff Chatfield, said:

"The half year ended 31 December 2020 represents a complex

period for the airline industry and Avation. Avation has been

working diligently and with success on its COVID-19 strategy

implemented early in the crisis to preserve liquidity. Recently the

Company announced an agreement to extend the maturity of the

unsecured bonds by over 5 years until October 2026.

"The pandemic related disruption to the airline industry has

impacted aircraft valuations and Avation has impaired the value of

its fleet and provided for credit losses on receivables. These

impairments are largely related to aircraft leased to Philippines

Airlines, Virgin Australia and Braathens who have all been subject

to formal or informal restructuring processes. There was also a

negative adjustment to the value of purchase rights held for ATR

aircraft. The impairment loss dominates the financial result.

"We believe that global immunisation programmes should lead to

an end to the pandemic. Assuming that Avation's customers continue

to meet their contractual obligations to pay rent and arrears the

Company believes that it is unlikely that there will be further

significant impairments to asset values in future. The underlying

business remains profitable.

"The past six months has seen most of Avation's customers

returning to operating at above 50% of pre-COVID levels. At the

current date, 12 of Avation's 19 customers are being charged normal

monthly rentals. The Company has been fortunate that some of its

largest customers are based in countries where there has been a

less severe impact from the pandemic including VietJet, airBaltic,

EVA Air and Mandarin Airlines. These airlines combined represent

over 60% of Avation's future unearned contracted revenue.

"The Company will position itself for a return to growth through

opportunistic aircraft trading and deliveries from its orderbook in

the post pandemic environment. "

Financial Highlights and Analysis

6 mths to 6 mths to

31 Dec 31 Dec Change

2020 2019

US$ 000's US$ 000's

Revenue 61,340 67,606 (9%)

Depreciation (23,652) (24,232) (2%)

Administrative expense (5,542) (6,145) (10%)

Other income and expenses (net) excluding

Expected credit losses on receivables and

accrued revenue 896 (1,127)

--------------------------------------------- ------------- -----------

Operating Profit excluding Unrealised gain

on purchase rights, Gains on disposal and

impairment loss on aircraft 33,042 36,102 (8%)

Finance Expenses (net of finance income) (25,968) (27,527) (6%)

--------------------------------------------- ------------- -----------

Profit before tax excluding Unrealised gain

on purchase rights, Gains on disposal of

aircraft and Impairment loss on aircraft 7,074 8,575 (17%)

Unrealised gain on aircraft purchase rights (7,930) 36,980

Gains on disposal of aircraft - 2,229

Impairment loss on aircraft (46,652) (2,456)

Expected credit loss on receivables and

accrued revenue (12,945) (123)

--------------------------------------------- ------------- -----------

(Loss)/Profit before taxation (60,453) 45,205 (234%)

Taxation (883) (7,051)

--------------------------------------------- ------------- -----------

Total profit after tax (61,336) 38,154 (261%)

EPS (97.9) cents 60.0 cents

Dividend per share - 2.1 cents

As at As at

31 Dec 30 June

2020 2020

US$ 000's US$ 000's

Fleet assets (1) 1,163,263 1,242,176 (6%)

Total assets 1,350,632 1,415,584 (5%)

Cash and bank balances 117,661 114,585 3%

Net asset value per share (US$) (2) $2.38 $3.53 (33%)

Net asset value per share (GBP) (3) GBP1.74 GBP2.86 (39%)

1. Fleet assets are defined as property, plant and equipment

plus assets held for sale plus finance lease receivables.

2. Net asset value per share is total equity divided by the

total number of shares in issue, excluding treasury shares, at

period end.

3. Based on GBP:USD exchange rate as at 31 December 2020 of 1.37 (30 June 2020 : 1.23)

Aircraft Fleet

Aircraft Type 31 December

2020

Boeing 777-300ER 1

Airbus A330-300 1

Airbus A321-200 7

Boeing 737-800NG 1

Airbus A320-200 2

Airbus A220-300 6

ATR 72-600 22

ATR 72-500 6

------------

Total 46

As at 31 December 2020, Avation's fleet comprised 46 aircraft,

including three aircraft on finance lease. The weighted average age

of the fleet is 4.6 years (30 June 2020: 4.1 years) and the

weighted average remaining lease term is 6.5 years (30 June 2020:

6.9 years).

Fleet assets decreased 6.4% to $1,163.3 million (30 June 2020:

$1,242.2 million). Two Fokker 100 aircraft were transferred to the

lessee airline upon completion of their finance leases. Narrowbody

aircraft make up 49% of fleet assets as at 31 December 2020.

Avation had orders for eight ATR72-600 aircraft and purchase

rights for a further 25 aircraft as at 31 December 2020. The

Company is in discussions with ATR regarding its current order

book.

Virgin Australia Update

On 20 April 2020, Virgin Australia entered into voluntary

administration. Avation had two Fokker 100 aircraft on finance

lease and 11 ATR 72 aircraft on operating lease to Virgin

Australia, two of which were subleased to another airline. The two

Fokker 100 aircraft were sold at the end of their leases in

September 2020. Of the 11 ATRs, four have been re-leased at market

rates, three are being actively marketed for sale or lease, and the

remaining four are being marketed for sale or lease but have not

yet been through maintenance. Avation's claim against Virgin

Australia has been mitigated by the transactions noted above and is

expected to be approximately US$56 million. The administrators have

advised an expected pay-out of 9.5-13 cents on the dollar for

unsecured claims.

Debt summary

31 December 30 June 2020

2020 US$000's

US$000's

Loans and borrowings 1,065,096 1,071,738

Unrestricted cash and bank

balances 25,424 35,290

Net indebtedness (1) 1,039,672 1,036,448

Net debt to assets (2) 77.0% 73.2%

Weighted average cost of secured

debt (3) 3.7% 3.6%

Weighted average cost of total

debt (4) 4.6% 4.5%

1. Net indebtedness is defined as loans and borrowings less unrestricted cash and bank balances.

2. Net debt to assets is defined as net indebtedness divided by total assets.

3. Weighted average cost of secured debt is the weighted average

interest rate for secured loans and borrowings at period end.

4. Weighted average cost of total debt is the weighted average

interest rate for total loans and borrowings at period end.

The weighted average cost of total debt increased slightly to

4.6% as at 31 December 2020 (30 June 2020: 4.5%).

The weighted average cost of secured debt increased to 3.7% at

31 December 2020 (30 June 2020: 3.6%).

At the end of the financial period, Avation's net debt to total

assets ratio has increased to 77.0% (30 June 2020: 73.2%). As at 31

December 2020, 90.7% of total debt was at fixed or hedged interest

rates (30 June 2020: 90.7%). The proportion of unsecured debt to

total debt was 32.1% (30 June 2020: 32.3%).

During the period Avation initiated a process to extend the date

of maturity of the $342.6 million outstanding Avation Capital S.A

6.5% senior notes due May 2021 to October 2026. The Company

recently announced that it reached agreement with sufficient

bondholders to vote in favour of the extension and the consent

solicitation exercise was launched on 23 February 2021. The Company

expects the extension will be completed on 16 March 2021.

Market Positioning

Avation's long-term strategy is to target growth and

diversification by adding new airline customers, while maintaining

a low average aircraft age and long remaining lease term metrics.

Avation focuses on new and relatively new commercial passenger

aircraft on long-term leases. Avation is capable of owning,

managing and leasing turboprop, narrowbody and twin-aisle aircraft

and engines.

The Company's business model involves rigorous investment

criteria that seeks to mitigate the risks associated with the

aircraft leasing sector. Avation will typically sell mid-life and

older aircraft and redeploy capital to newer assets. This approach

is intended to mitigate technology change risk, operational and

financial risk, support sustained growth and deliver long-term

shareholder value.

Avation is an active trader of aircraft and from time to time

will consider the acquisition or sale of individual or smaller

portfolios of aircraft, based on prevailing market opportunities

and consideration of risk and revenue concentrations.

Interim Management Statement

The Company's continuing focus for the remainder of the 2021

financial year is to preserve liquidity.

Avation instituted a programme of support for its airline

customers by agreeing to defer payment of a portion of their rent

in the short-term. The cashflow impact of this support programme

has been mitigated by adjusting the amortisation profiles of

related financings with the agreement of lenders. Since the start

of the pandemic the Company has also reduced administration costs

and temporarily suspended capital expenditure.

The Company believes that airlines will require significant

number of leased aircraft in the post pandemic phase due to the

vast number of older aircraft that have been retired and the impact

of the pandemic on airline balance sheets, reducing their ability

to purchase aircraft directly. This supports the Company strategy

of being focussed on relatively new and popular commercial aircraft

types.

In addition to operational cash flows, funding is traditionally

sourced from capital markets, asset-backed bank lending and

disposals of selected aircraft. Access to acceptably priced funding

is a risk, which is common to all capital-intensive businesses.

Specific risks which are inherent to the aircraft leasing industry

include, but are not limited to, ongoing pandemic impacts on

travel, the creditworthiness of airline customers, over-production

of new aircraft and market saturation, technology change, residual

value risks, competition from other lessors and the risk of

impairment of aircraft assets.

Results Conference Call

Avation's senior management team will host a conference call on

26 February 2021, at 1pm GMT (UK) / 8am EST (US) / 9pm SGT

(Singapore), to discuss the Company's financial results. Investors

can participate in the conference call by using the following

link:

https://avation.emincote.com/avapHY2021/vip_connect

You will need to register your name and email address. You will

receive a telephone number, a passcode and an individual PIN

number. The conference call will also be webcast live through the

following link:

https://avation.emincote.com/avapHY2021

To view the webcast, you will need to register your name and

email address . A replay of the broadcast will be available on the

Investor Relations page of the Avation Plc website.

Forward Looking Statements

This release contains certain "forward looking statements".

Forward looking statements may be identified by words such as

"expects," "intends," "anticipates," "plans," "believes," "seeks,"

"estimates," "will," or words of similar meaning and include, but

are not limited to, statements regarding the outlook for Avation's

future business and financial performance. Forward looking

statements are based on management's current expectations and

assumptions, which are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict. Actual

outcomes and results may differ materially due to global political,

economic, business, competitive, market, regulatory and other

factors and risks. Further information on the factors and risks

that may affect Avation's business is included in Avation's

regulatory announcements from time to time, including its Annual

Report, Full Year Financial Results and Half Year Results

announcements. Avation expressly disclaims any obligation to update

or revise any of these forward-looking statements, whether because

of future events, new information, a change in its views or

expectations, or otherwise.

Basis of presentation

This announcement covers the unaudited results of Avation PLC

for the financial period ended 31 December 2020.

Financial information presented in this announcement is being

published for the purposes of providing preliminary Group financial

results for the half year ended 31 December 2020. The financial

information in this preliminary announcement is not audited and

does not constitute statutory financial statements of Avation PLC

within the meaning of section 434 of the Companies Act 2006. The

Board of Directors approved this financial information on 26

February 2021. Avation PLC's most recent statutory financial

statements for the purposes of Chapter 7 of Part 15 of the

Companies Act 2006 for the year ended 30 June 2020 , upon which the

auditors have given an unqualified audit report (with reference to

a material uncertainty related to going concern), were published on

30 October 2020 and have been annexed to the annual return and

delivered to the Registrar of Companies.

All "$" amounts in this release are US Dollar amounts unless

stated otherwise. Certain comparative amounts have been

reclassified to conform with current year presentation.

-S -

Enquiries:

Avation PLC - Jeff Chatfield, Executive Chairman +65 6252 2077

Avation welcomes shareholder questions and comments and advises

the email address is: investor@avation.net

More information on Avation is available at www.avation.net.

AVATION PLC

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS

FOR THE SIX MONTHSED 31 DECEMBER 2020

31 Dec 31 Dec

Note 2020 2019

US$'000s US$'000s

Continuing operations

Revenue 5 61,340 67,606

Other income 6 1,997 113

63,337 67,719

Depreciation 11 (23,652) (24,232)

Gain on disposal of aircraft 11 - 2,229

Unrealised (loss)/gain on aircraft purchase

rights 16 (7,930) 36,980

Impairment loss on aircraft 11 (46,652) (2,456)

Administrative expenses (5,542) (6,145)

Other expenses 7 (14,046) (1,363)

Operating (loss)/profit (34,485) 72,732

Finance income 8 2,175 717

Finance expenses 9 (28,143) (28,244)

(Loss)/Profit before taxation (60,453) 45,205

Taxation (883) (7,051)

(Loss)/Profit from continuing operations (61,336) 38,154

(Loss)/Profit attributable to:

Equity holders of the Company (61,337) 38,153

Non-controlling interests 1 1

(61,336) 38,154

--------- ---------

Earnings per share for (loss)/profit

attributable to equity holders of the Company

(97.87) 60.04

Basic earnings per share cents cents

(97.87) 59.67

Diluted earnings per share cents cents

--------- ---------

AVATION PLC

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 31 DECEMBER 2020

31 Dec 31 Dec

Note 2020 2019

US$'000s US$'000s

(Loss)/Profit from continuing operations (61,336) 38,154

Other comprehensive income:

Items may be reclassified subsequently to profit

or loss:

Net (loss)/gain on cash flow hedge (10,249) 1,730

(10,249) 1,730

Items may not be reclassified subsequently

to profit or loss:

Revaluation loss on property, plant and equipment,

net of tax (858) (793)

Other comprehensive income, net of tax (11,107) 937

Total comprehensive income for the period (72,443) 39,091

--------- ---------

Total comprehensive income attributable to:

Equity holders of the Company (72,444) 39,090

Non-controlling interests 1 1

(72,443) 39,091

--------- ---------

AVATION PLC

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2020

31 Dec 30 June

Note 2020 2020

US$'000s US$'000s

ASSETS:

Non-current assets

Property, plant and equipment 11 1,110,980 1,057,901

Trade and other receivables 12 12,052 11,601

Finance lease receivables 13 48,455 85,019

Goodwill 14 1,902 1,902

Aircraft purchase rights 16 19,180 27,110

Lease incentive assets 6,753 -

---------- ----------

1,199,322 1,183,533

Current assets

Trade and other receivables 12 28,731 18,210

Finance lease receivables 13 3,828 7,988

Cash and bank balances 17 117,661 114,585

Lease incentive assets 1,090 -

---------- ----------

151,310 140,783

Assets held for sale 18 - 91,268

---------- ----------

151,310 232,051

---------- ----------

Total assets 1,350,632 1,415,584

---------- ----------

EQUITY AND LIABILITIES

Equity

Share capital 19 1,108 1,108

Share premium 57,747 57,747

Treasury shares 19 (7,811) (7,811)

Merger reserve 6,715 6,715

Asset revaluation reserve 29,304 30,162

Capital reserve 8,876 8,876

Other reserves (34,282) (24,302)

Retained earnings 87,397 148,455

---------- ----------

Equity attributable to equity holders of the

parent 149,054 220,950

Non-controlling interest 68 72

---------- ----------

Total equity 149,122 221,022

---------- ----------

Non-current liabilities

Loans and borrowings 20 627,305 534,755

Trade and other payables 15,602 11,725

Derivative financial liabilities 15 24,035 27,928

Maintenance reserves 21 57,529 57,141

Lease maintenance contribution 8,908 -

Deferred tax liabilities 1,469 698

---------- ----------

734,848 632,247

Current liabilities

Loans and borrowings 20 437,791 536,983

Trade and other payables 12,246 10,155

Derivative financial liabilities 15 105 -

Maintenance reserves 21 15,238 3,836

Income tax payables 1,282 1,058

---------- ----------

466,662 552,032

Liabilities directly associated with assets

held for sale 18 - 10,283

---------- ----------

466,662 562,315

---------- ----------

Total equity and liabilities 1,350,632 1,415,584

---------- ----------

AVATION PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 31 DECEMBER 2020

Attributable to shareholders of the parent

Note Share Share Treasury Merger Asset Capital Other Retained Total Non-controlling Total

capital premium Shares reserve revaluation reserve reserves earnings interest equity

reserve

US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s

Balance at1 July

2020 1,108 57,747 (7,811) 6,715 30,162 8,876 (24,302) 148,455 220,950 72 221,022

Loss for the period - - - - - - - (61,337) (61,337) 1 (61,336)

Other comprehensive

income - - - - (858) - (10,249) - (11,107) - (11,107)

--------- --------- --------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Total comprehensive

income - - - - (858) - (10,249) (61,337) (72,444) 1 (72,443)

--------- --------- --------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Dividends paid

to non-controlling

interest of a

subsidiary - - - - - - - - - (5) (5)

Share warrant

expense - - - - - - 548 - 548 - 548

--------- --------- --------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Total transactions

with owners recognised

directly in equity - - - - - - 548 - 548 (5) 543

--------- --------- --------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Expiry of share

warrants - - - - - - (279) 279 - - -

--------- --------- --------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Total others - - - - - - (279) 279 - - -

--------- --------- --------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Balance at 31

December 2020 1,108 57,747 (7,811) 6,715 29,304 8,876 (34,282) 87,397 149,054 68 149,122

--------- --------- --------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Other reserves consist of capital redemption reserve, warrant

reserve, fair value reserve and foreign currency translation

reserve.

AVATION PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 31 DECEMBER 2019

Attributable to shareholders of the parent

Note Share Share Treasury Merger Asset Capital Other Retained Total Non-controlling Total

capital premium Shares reserve revaluation reserve reserves earnings interest equity

reserve

US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s US$'000s

Balance at 1

July

2019 1,104 56,912 (1,147) 6,715 34,392 8,876 (11,809) 145,644 240,687 70 240,757

Effect of

adoption

of IFRS 16

Leases - - - - - - (199) (199) - (199)

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- -----------

As at 1 July

2019

(adjusted) 1,104 56,912 (1,147) 6,715 34,392 8,876 (11,809) 145,445 240,488 70 240,558

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- -----------

Profit for the

period - - - - - - - 38,153 38,153 1 38,154

Other

comprehensive

income - - - - (793) - 1,730 - 937 - 937

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- -----------

Total

comprehensive

income - - - - (793) - 1,730 38,153 39,090 1 39,091

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- -----------

Dividends paid 24 - - - - - - - (5,454) (5,454) - (5,454)

Issue of new

shares 19 4 835 - - - - (69) - 770 - 770

Purchase of

treasury

shares 19 - - (6,548) - - - - - (6,548) - (6,548)

Share warrant

expense - - - - - - 299 - 299 - 299

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- -----------

Total

transactions

with owners

recognised

directly in

equity 4 835 (6,548) - - - 230 (5,454) (10,933) - (10,933)

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- -----------

Expiry of

share

warrants - - - - - - (2) 2 - - -

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- -----------

Total others - - - - - - (2) 2 - - -

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- -----------

Balance at 31

December 2019 1,108 57,747 (7,695) 6,715 33,599 8,876 (9,851) 178,146 268,645 71 268,716

--------- --------- ---------- --------- ------------ --------- --------- ---------- ----------- ---------------- -----------

AVATION PLC

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 31 DECEMBER 2020

31 Dec 31 Dec

Note 2020 2019

US$'000s US$'000s

Cash flows from operating activities:

(Loss)/Profit before taxation (60,453) 45,205

Adjustments for:

Amortisation of lease incentive asset 5 541 -

Depreciation expense 11 23,652 24,232

Depreciation of right-of-use assets 108 109

Expected credit loss on receivables and

accrued revenue 7 12,945 123

Finance income 8 (2,175) (717)

Finance expense 9 28,143 28,244

Gain on disposal of aircraft - (2,229)

Interest income from finance lease 5 (765) (1,318)

Impairment loss on aircraft 11 46,652 2,456

Share warrants expense 548 299

Unrealised loss/(gain) on aircraft purchase

rights 7,930 (36,980)

--------- ---------

Operating cash flows before working capital

changes 57,126 59,424

Movement in working capital:

Trade and other receivables and finance

lease receivables (24,969) 8,009

Trade and other payables 4,914 3,573

Maintenance reserves 11,655 16,947

--------- ---------

Cash from operations 48,726 87,953

Finance income received 1,066 1,631

Finance expense paid (24,836) (25,540)

Income tax paid (46) (1,930)

--------- ---------

Net cash from operating activities 24,910 62,114

--------- ---------

Cash flows from investing activity:

Purchase of property, plant and equipment - (56,676)

--------- ---------

Net cash used in investing activity - (56,676)

--------- ---------

Cash flows from financing activities:

Net proceeds from issuance of ordinary shares - 770

Dividends paid to shareholders 24 - (5,454)

Dividends paid to non-controlling interest (5) -

of a subsidiary

Purchase of treasury shares - (6,548)

Placement of restricted cash balances (12,942) (20,679)

Proceeds from loans and borrowings, net

of transactions costs 11,815 76,875

Repayment of loans and borrowings (33,644) (38,480)

--------- ---------

Net cash (used in)/from financing activities (34,776) 6,484

--------- ---------

Net (decrease)/increase in cash and cash

equivalents (9,866) 11,922

Cash and cash equivalents at beginning of

financial period 35,290 61,689

--------- ---------

Cash and cash equivalents at end of financial

period 17 25,424 73,611

--------- ---------

AVATION PLC

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 31 DECEMBER 2020

This interim condensed consolidated financial statements for

Avation PLC for the six months ended 31 December 2020 were

authorised for issue in accordance with a resolution of the

Directors on 26 February 2021.

1 CORPORATE INFORMATION

Avation PLC is a public limited company incorporated in England

and Wales under the Companies Act 2006 (Registration Number

05872328) and is listed as a Standard Listing on the London Stock

Exchange.

The Group's principal activity is aircraft leasing.

2 BASIS OF PREPARATION AND ACCOUNTING POLICIES

These interim condensed consolidated financial statements have

been prepared in accordance with the Disclosure and Transparency

Rules (DTR) of the Financial Conduct Authority and in accordance

with International Accounting Standard (IAS) 34 'Interim

Reporting'.

The interim condensed consolidated financial statements do not

include all the notes of the type normally included within the

annual report and therefore cannot be expected to provide as full

an understanding of the financial performance, financial position

and financial and investing activities of the consolidated entity

as the annual report.

It is recommended that the interim condensed consolidated

financial statements be read in conjunction with the annual report

for the year ended 30 June 2020 and considered together with any

public announcements made by Avation PLC during the six months

ended 31 December 2020.

The accounting policies and methods of computation are the same

as those adopted in the annual report for the year ended 30 June

2020 except for the adoption of new accounting standards effective

as of 1 July 2020.

The preparation of the interim condensed consolidated financial

statements requires management to make estimates and assumptions

that affect the reported income and expenses, assets and

liabilities and disclosure of contingencies at the date of the

Interim Report, actual results may differ from these estimates.

The statutory financial statements of Avation PLC for the year

ended 30 June 2020, which carried an unqualified audit report, have

been delivered to the Registrar of Companies and did not contain

any statements under section 498 of the Companies Act 2006.

The interim condensed consolidated financial statements are

unaudited.

The interim condensed consolidated financial statements do not

constitute statutory financial statements within the meaning of

section 434 of the Companies Act 2006.

3 NEW STANDARDS AND INTERPRETATIONS NOT APPLIED AND STANDARDS IN EFFECT IN 2020

(a) New standards and interpretations not applied

The Group has not adopted the following new or amended standards

and interpretations which are relevant to the Group that have been

issued but are not yet effective:

(b)

Description Effective date

(period beginning)

-----------------------------------

Interest Rate Benchmark Reform - Phase 2: Amendments to IFRS 9, IAS 39, IFRS 7, 1 January 2021

IFRS 4 and

IFRS 16 (Not yet endorsed for use in the EU.)

-----------------------------------

Amendments to IAS 1: Classification of Liabilities as Current or Non-current 1 January 2022

-----------------------------------

Amendments to IAS 37: Onerous Contracts - Cost of Fulfilling a Contract 1 January 2022

-----------------------------------

Amendments to IAS 16: Property, Plant and Equipment, Proceeds before Intended 1 January 2022

Use

-----------------------------------

AIP (2018-2020 cycle): IFRS 9 Financial Instruments - Fees in the '10 per cent' 1 January 2022

Test for Derecognition

of Financial Liabilities

-----------------------------------

Amendments to IFRS 3: Reference to the Conceptual Framework 1 January 2022

-----------------------------------

Amendments to IFRS 10 and IAS 28: Sale or Contribution of Assets between an No effective date

Investor and its

Associate or joint venture

-----------------------------------

Based on a preliminary assessment using currently available

information, the Group does not expect the adoption of the above

standards to have a material impact on the financial statements in

the period of initial application. These preliminary assessments

may be subject to changes arising from ongoing analyses when the

Group adopts the standards. The Group plans to adopt the above

standards on the effective date.

(b) Standard in effect in 2020

The Group has adopted all new standards that have come into

effect during the six months ended 31 December 2020. The adoptions

do not have an impact on the Group's interim condensed consolidated

financial statements.

4 FAIR VALUE MEASUREMENT

The fair value of a financial instrument is the price that would

be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement

date.

The carrying amounts of cash and bank balances, trade and other

receivables, finance lease receivables - current, trade and other

payables - current, loans and borrowings - current are a reasonable

approximation of fair value either due to their short-term nature

or because the interest rate charged closely approximates market

interest rates or that the financial instruments have been

discounted to their fair value at a current pre-tax interest

rate.

The fair value of the maintenance reserves is not disclosed in

the table below as the timing and cost of the maintenance reserves

cannot be determined with certainty in advance and hence the fair

value of the maintenance reserve cannot be measured.

31 Dec 2020 30 Jun 2020

Carrying Carrying

amount Fair value amount Fair value

US$'000s US$'000s US$'000s US$'000s

--------------------------------------------------------------- --------- ----------- ---------- -----------

Financial assets:

Finance lease receivables - non-current 48,455 47,331 85,019 82,631

Financial liabilities:

Deposits collected - non-current 12,956 11,507 9,185 8,639

Loans and borrowings other than unsecured notes - non-current 627,305 593,400 534,755 502,534

Unsecured notes 341,371 254,525 346,656 261,143

Derivative financial liabilities 24,140 24,140 27,928 27,928

The fair values (other than the unsecured notes and derivative

financial assets and liabilities) above are estimated by

discounting expected future cash flows at market incremental

lending rate for similar types of lending, borrowing or leasing

arrangements at the end of the reporting period.

The fair value of the unsecured notes are based on level 1

quoted prices (unadjusted) in active market that the Group can

access at measurement date.

The fair value of the derivative financial instruments is

determined by reference to marked-to-market values provided by

counterparties. The fair value measurement of all derivative

financial instruments under the Group is classified under Level 2

of the fair value hierarchy, for which inputs other than quoted

prices that are observable for the asset or liability, either

directly (that is, as prices) or indirectly (that is, derived from

prices) are included as inputs for the determination of fair

value.

4 FAIR VALUE MEASUREMENT (continued)

Non-financial assets measured at fair value:

31 Dec 30 Jun

2020 2020

US$'000s US$'000s

-------------------------------------------------------------- ---------- ----------

Fair value measurement using significant unobservable inputs

Aircraft 1,109,342 1,055,970

Aircraft purchase rights 19,180 27,110

Aircraft were valued at 30 June 2020. Refer to Note 11 for the

details on the valuation technique and significant inputs used in

the valuation.

Classification of financial instruments:

31 Dec 30 Jun

2020 2020

US$'000s US$'000s

----------------------------------------------------- --- ---------- ----------

Financial assets measured at

amortised cost:

Cash and cash balances 117,661 114,585

Trade and other receivables 33,148 19,800

Finance lease receivables 52,283 93,007

203,092 227,392

---------- ----------

Financial liabilities measured at amortised cost:

Trade and other payables 20,285 15,282

Loans and borrowings 1,065,096 1,071,738

Maintenance reserves 72,767 60,977

1,158,148 1,147,997

---------- ----------

Derivative used for hedging:

Derivative financial liabilities (24,140) (27,928)

Financial assets fair value through profit or loss:

Aircraft purchase rights 19,180 27,110

5 REVENUE

31 Dec 31 Dec

2020 2019

US$'000s US$'000s

--------------------------------------------- --------- ---------

Lease rental revenue 60,174 65,046

Less: amortisation of lease incentive asset (541) -

--------- ---------

59,633 65,046

Interest income on finance leases 765 1,318

Deposits released revenue 726 -

Maintenance reserves revenue 216 1,242

61,340 67,606

Geographical analysis

Europe Asia Pacific Total

US$'000s US$'000s US$'000s

-------------- ----- --------- ------------- ---------

31 Dec 2020 15,919 45,421 61,340

31 Dec 2019 21,115 46,491 67,606

Operating lease commitments

The Group leases out aircraft under operating leases. The

maturity analysis of the undiscounted lease payments to be received

under operating leases are as follows:

31 Dec 31 Dec

2020 2019

US$'000s US$'000s

----------------------- --------- ---------

Within one year 100,572 129,744

One to two years 108,300 125,529

Two to three years 111,335 104,790

Three to four years 97,924 91,386

Four to five years 88,339 89,224

Later than five years 249,806 287,665

--------- ---------

6 OTHER INCOME

31 Dec 31 Dec

2020 2019

US$'000s US$'000s

----------------------------------------- --------- ---------

Aircraft purchase option activation fee 1,182 -

Foreign currency exchange gain 384 42

Others 431 71

1,997 113

--------- ---------

7 OTHER EXPENSES

31 Dec 31 Dec

2020 2019

US$'000s US$'000s

--------------------------------------------------------- --------- ---------

Aircraft repossession expenses 205 1,237

Aircraft maintenance expenses 896 -

Expected credit loss on receivables and accrued revenue 12,945 123

Others - 3

14,046 1,363

--------- ---------

8 FINANCE INCOME

31 Dec 31 Dec

2020 2019

US$'000s US$'000s

-------------------------------------------------------------------- --------- ---------

Interest income from financial institution 4 503

Interest income from non-financial institutions 68 -

Finance income from discounting non-current deposits to fair value 230 214

Gain on early cancellation of unsecured note 1,873 -

2,175 717

--------- ---------

9 FINANCE EXPENSES

31 Dec 31 Dec

2020 2019

US$'000s US$'000s

---------------------------------------------------------- --------- ---------

Interest expense on borrowings 13,123 13,935

Interest expense on unsecured notes 11,199 11,375

Amortisation of loan transaction costs 3,134 2,554

Amortisation of interest expense on non-current deposits 217 220

Others 470 160

28,143 28,244

--------- ---------

10 RELATED PARTY TRANSACTIONS

Significant related party transactions:

31 Dec 31 Dec

2020 2019

US$'000s US$'000s

------------------------------------------------- --------- ---------

Entities controlled by key management personnel

(including directors):

Rental expenses paid (125) (145)

Consulting fee paid (42) (174)

Service fee received 51 52

--------- ---------

11 PROPERTY, PLANT AND EQUIPMENT

Furniture Aircraft Jet Turboprop

and equipment engine aircraft aircraft Total

US$'000s US$'000 US$'000s US$'000s US$'000s

--------------- -------------- ----------------------- ---------- ---------- ----------

31 December

2020:

Cost or

valuation:

At 1 July 2020 92 1,940 814,749 441,799 1,258,580

Additions - - - - -

Reclassified

from

held under

finance

leases - - - 41,434 41,434

Reclassified

from

asset held

for sale - - 106,124 - 106,124

Impairment

recognised

in equity - - (934) - (934)

At 31 December

2020 92 1,940 919,939 483,233 1,405,204

Representing:

At cost 92 1,940 - - 2,032

At valuation - - 919,939 483,233 1,403,172

92 1,940 919,939 483,233 1,405,204

Accumulated

depreciation

and

impairment:

At 1 July 2020 60 41 97,542 103,036 200,679

Depreciation

expense 8 43 16,609 6,992 23,652

Reclassified

from

asset held

for sale - - 23,241 - 23,241

Impairment

loss - - 32,318 14,334 46,652

At 31 December

2020 68 84 169,710 124,362 294,224

Net book

value:

At 1 July 2020 32 1,899 717,207 338,763 1,057,901

-------------- ---------- ----------------------- ---------- ----------

At 31 December

2020 24 1,856 750,229 358,871 1,110,980

-------------- ---------- ----------------------- ---------- ----------

11 PROPERTY, PLANT AND EQUIPMENT (continued)

Furniture Aircraft Jet Turboprop

and equipment engine aircraft aircraft Total

US$'000s US$'000 US$'000s US$'000s US$'000s

--------------- -------------- ----------------------- ---------- ---------- ----------

30 June 2020:

Cost or

valuation:

At 1 July 2019 80 - 916,534 450,439 1,367,053

Additions 12 1,940 - 57,737 59,689

Reclassified

as held

under finance

leases - - - (57,047) (57,047)

Reclassified

as asset

held for sale - - (106,124) - (106,124)

Impairment

recognised

in equity - - 4,339 (9,330) (4,991)

At 30 June

2020 92 1,940 814,749 441,799 1,258,580

Representing:

At cost 92 1,940 - - 2,032

At valuation - - 814,749 441,799 1,256,548

92 1,940 814,749 441,799 1,258,580

Accumulated

depreciation

and

impairment:

At 1 July 2019 41 - 73,065 68,623 141,729

Depreciation

expense 19 41 31,928 14,678 46,666

Reclassified

as asset

held for sale - - (16,189) - (16,189)

Impairment

loss - - 8,738 19,735 28,473

At 30 June

2020 60 41 97,542 103,036 200,679

Net book

value:

At 1 July 2019 39 - 843,469 381,816 1,225,324

-------------- ---------- ----------------------- ---------- ----------

At 30 June

2020 32 1,899 717,207 338,763 1,057,901

-------------- ---------- ----------------------- ---------- ----------

Assets pledged as security

The Group's aircraft with carrying values of US$ 1,080.2 million

(30 June 2020 : US$1,083.6 million) are mortgaged to secure the

Group's borrowings (Note 20).

Additions and disposals

During the six months ended 31 December 2020, two turboprop

aircraft held under finance leases were reclassified to property,

plant and equipment.

During the six months ended 31 December 2020, two jet aircraft

were reclassified to property, plant and equipment from assets held

for sale.

11 PROPERTY, PLANT AND EQUIPMENT (continued)

Valuation

The Group's aircraft were valued in June 2020 by independent

valuers on a lease-encumbered value basis ("LEV'). LEV takes into

account the current lease arrangements for the aircraft and

estimated residual values at the end of the lease. These amounts

have been discounted to present value using discount rates ranging

from 5.50% to 8.00% (2019: 5.75% to 7.75%) per annum for jet

aircraft and 5.50% to 9.00% (2019: 6.00% to 9.25%) per annum for

turboprop aircraft. Different discount rates are considered

appropriate for different aircraft based on their respective risk

profiles.

During the six months ended 31 December 2020, a downward

revaluation of US$0.9 million to equity and an impairment loss of

US$46.6 million was recognised during the year.

If the aircraft were measured using the cost model, carrying

amounts would be as follows:

31 Dec 2020 30 Jun 2020

Turbo Turbo

Jets props Jets props

US$'000s US$'000s US$'000s US$'000s

----------------------------------------- ---------- ---------- --------- ---------

Cost 899,015 471,701 792,891 430,267

Accumulated depreciation and impairment (167,924) (120,388) (97,291) (99,149)

Net book value 731,091 351,313 695,600 331,118

---------- ---------- --------- ---------

Geographical analysis

31 Dec 2020 Europe Asia Pacific Total

US$'000s US$'000s US$'000s

--------------------------- --------- ------------- ----------

Capital expenditure - - -

Net book value - aircraft

and aircraft engines 356,459 754,497 1,110,956

30 Jun 2020 Europe Asia Pacific Total

US$'000s US$'000s US$'000s

--------------------------- --------- ------------- ----------

Capital expenditure 59,583 106 59,689

Net book value - aircraft

and aircraft engines 331,651 726,218 1,057,869

12 TRADE AND OTHER RECEIVABLES

31 Dec 30 Jun

2020 2020

US$'000s US$'000s

---------------------------------------- --------- ---------

Current

Trade receivables 34,294 7,900

Less:

Allowance for expected credit loss for

trade receivables (12,874) (205)

--------- ---------

21,420 7,695

Accrued revenue 4,506 8,522

Less:

Allowance for expected credit loss for

accrued revenue (393) (137)

--------- ---------

4,113 8,385

Other receivables 2,519 1,922

Less:

Allowance for expected credit loss for

other receivables (670) (670)

--------- ---------

1,849 1,252

Interest receivables 82 217

Less:

Allowance for expected credit loss for

interest receivables (29) (9)

--------- ---------

53 208

Deposits 50 46

Prepaid expenses 1,246 624

28,731 18,210

--------- ---------

Non-current:

Other receivables 652 -

Deposits for aircraft 10,599 10,599

Prepaid expenses 191 279

Right-of-use assets 610 723

12,052 11,601

------- -------

13 FINANCE LEASE RECEIVABLES

Future minimum lease payments receivable under finance leases

are as follows:

31 Dec 2020 31 Jun 2020

Present Present

Minimum value of Minimum value of

lease payments payments lease payments payments

US$'000s US$'000s US$'000s US$'000s

-------------------------------------------- ---------------- ---------- ---------------- ----------

Within one year 5,793 3,828 11,126 7,988

One to two years 5,793 4,014 8,785 6,167

Two to three years 5,793 4,210 8,785 6,443

Three to four years 33,825 31,287 8,785 6,728

Four to five years 9,295 8,944 62,546 57,545

Later than five years - - 8,185 8,136

Total minimum lease payments 60,499 52,283 108,212 93,007

Less: amounts representing interest income (8,216) - (15,205) -

Present value of minimum lease payments 52,283 52,283 93,007 93,007

---------------- ---------- ---------------- ----------

14 GOODWILL

The Group performs its annual impairment test in June and when

circumstances indicate the carrying value may be impaired. For the

purpose of these financial statements there was no indication of

impairment. The key assumptions used to determine the recoverable

amount for the different cash generating units were disclosed in

the annual consolidated financial statements for the year ended 30

June 2020.

15 DERIVATIVE FINANCIAL LIABILITIES

Contract/ Fair value

notional amount

31 Dec 30 Jun 31 Dec 30 Jun

2020 2020 2020 2020

US$'000s US$'000s US$'000s US$'000s

----------------------------------- --------- --------- --------- ---------

Current liability

Interest rate swap 11,113 - (105) -

--------- --------- --------- ---------

Non-current liability

Interest rate swap 282,619 304,507 (23,554) (27,458)

Cross-currency interest rate swap 4,000 4,000 (481) (470)

--------- --------- --------- ---------

286,619 308,507 (24,035) (27,928)

--------- --------- --------- ---------

Hedge accounting has been applied for interest rate swap

contracts and cross-currency interest rate swap contracts which

have been designated as cash flow hedges.

The Group pays fixed rates of interest of 1.0% to 2.6% per annum

and receives floating rate interest equal to 1-month to 3-month

LIBOR under the interest rate swap contracts.

The Group pays fixed rates of interest of 3.1% to 4.9% per annum

and receives floating interest equal to 3-month LIBOR under the

cross-currency interest rate swap contracts.

The swap contracts mature between 23 September 2021 and 21

November 2030.

Changes in the fair value of these interest rate swap and

cross-currency interest rate swap contracts are recognised in the

fair value reserve. The net fair value gain net of tax of US$3.6

million (31 December 2019: loss of US$0.5 million) on these

derivative financial instruments was recognised in the fair value

reserve for the six month period ended 31 December 2020.

The fair value of the derivative financial instruments is

determined by reference to marked-to-market values provided by

counterparties. The fair value measurement of all derivative

financial instruments under the Group is classified under Level 2

of the fair value hierarchy, for which inputs other than quoted

prices that are observable for the asset or liability, either

directly (that is, as prices) or indirectly (that is, derived from

prices) are included as inputs for the determination of fair

value.

The Group has also designated certain Euro denominated loans as

cash flow hedges of foreign currency exchange risk derived from

Euro denominated leases. Unrealised foreign exchange gains and

losses arising on Euro denominated loans designated as cash flow

hedges are recognised in the foreign currency hedge reserve.

Unrealised foreign exchange gains and losses recorded in the

foreign currency hedging reserve are systematically re-cycled

through profit or loss over the remaining term of the related loan

on a straight-line basis.

16 AIRCRAFT PURCHASE RIGHTS

31 Dec 30 Jun

2020 2020

US$'000s US$'000s

----------------------------------------- --------- ---------

Aircraft purchase rights, at fair value 19,180 27,110

--------- ---------

17 CASH AND BANK BALANCES

31 Dec 30 Jun

2020 2020

US$'000s US$'000s

------------------------------ --------- ---------

Fixed deposits - 10,067

Other cash and bank balances 117,661 104,518

--------- ---------

Total cash and bank balances 117,661 114,585

Less: restricted (92,237) (79,295)

--------- ---------

Cash and cash equivalents 25,424 35,290

--------- ---------

The Group's restricted cash and bank balances have been pledged

as security for certain loan obligations.

In the consolidated statement of cash flows, cash and cash

equivalents comprises unrestricted cash and bank balances.

18 ASSETS HELD FOR SALE

The Group's aircraft which met the criteria to be classified as

assets held for sale and the associated liabilities were as

follows:

31 Dec 30 Jun

2020 2020

US$'000 US$'000s

------------------------------------------------------------ ---------- ---------

Assets held for sale:

Property, plant and equipment - aircraft

At 1 July 2020/ 1 July 2019 82,884 -

Additions - 89,935

Impairment loss - (7,051)

Transfer to property, plant and equipment (82,884) -

At 31 Dec/30 June - 82,884

Lease incentive asset - 8,384

-------- ---------

- 91,268

----------------------------------------------------------------------- ---------

Liabilities directly associated with assets held for sale:

Deposit collected - 1,240

Lessor maintenance contribution - 8,908

Maintenance reserves - 135

- 10,283

----------------------------------------------------------------------- ---------

19 SHARE CAPITAL AND TREASURY SHARES

(a) Share capital

31 Dec 2020 30 Jun 2020

No of shares US$'000s No of shares US$'000s

-------------------- ------------- --------- ------------- -----------

Allotted, called

up and fully paid

Ordinary shares

of 1 penny each:

At 1 July 2020/

1 July 2019 64,879,942 1,108 64,609,939 1,104

Issue of shares - - 270,003 4

At 31 Dec/30 June 64,879,942 1,108 64,879,942 1,108

------------- --------- ------------- ---------

The holders of ordinary shares (except for treasury shares) are

entitled to receive dividends as and when declared by the Company.

All ordinary shares carry one vote per share without

restrictions.

(b) Treasury shares

31 Dec 2020 30 Jun 2020

No of treasury No of treasury

shares US$'000s shares US$'000s

----------------------------- --------------- --------- --------------- ---------

At 1 July 2020/ 1 July 2019 2,210,000 7,811 300,000 1,147

Acquired during the period - - 1,910,000 6,664

At 31 Dec/30 June 2,210,000 7,811 2,210,000 7,811

--------------- --------- --------------- ---------

(c) Net asset value per share

31 Dec 30 Jun

2020 2020

------------------------------------- --- -------- --------

Net asset value per share (US$) (1) $2.38 $3.53

Net asset value per share (GBP) (2) GBP1.74 GBP2.86

-------- --------

(1) Net asset value per share is total equity divided by the total number of shares issued and outstanding at period end.

(2) Based on GBP:US$ exchange rate as at 31 Dec 2020 of 1.37 (30 June 2020 : 1.23).

20 LOANS AND BORROWINGS

31 Dec 30 Jun

2020 2020

US$'000s US$'000s

---------------------------------- ---------- ----------

Secured borrowings 723,725 725,082

Unsecured notes 341,371 346,656

Total loans and borrowings 1,065,096 1,071,738

Less: current portion (437,791) (536,983)

Non-current loans and borrowings 627,305 534,755

---------- ----------

Weighted average

interest rate per

Maturity annum

31 Dec 30 Jun 31 Dec 30 Jun

2020 2020 2020 2020

US$'000s US$'000s % %

-------------------- ----------- ----------- ---------- ---------

Secured borrowings 2021-2031 2021-2031 3.7% 3.6%

Unsecured notes 2021 2021 6.5% 6.5%

Secured borrowings are secured by first ranking mortgages over

the relevant aircraft, security assignments of the Group's rights

under leases and other contractual agreements relating to the

aircraft, charges over bank accounts in which lease payments

relating to the aircraft are received and charges over the issued

share capital of certain subsidiaries.

21 MAINTENANCE RESERVES

31 Dec 30 Jun

2020 2020

US$'000s US$'000s

------------------------------------------------------------------ --------- ---------

Current 15,238 3,836

Non-current 57,529 57,141

Total maintenance reserves 72,767 60,977

--------- ---------

31 Dec 30 Jun

2020 2020

US$'000s US$'000s

------------------------------------------------------------------ --------- ---------

At 1 July 2020/ 1 July 2019 60,977 32,491

Contributions 14,168 34,503

Utilisations (2,297) (4,399)

Released to profit or loss (216) (1,618)

Transferred from liabilities associated with asset held for sale 135 -

At 31 Dec/30 June 72,767 60,977

--------- ---------

22 CAPITAL COMMITMENTS

Capital expenditure contracted for at the reporting date but not

recognised in the financial statements is as follows:

31 Dec 30 Jun

2020 2020

US$'000s US$'000s

------------------------------- --------- ---------

Property, plant and equipment 155,140 155,140

--------- ---------

Capital commitments represent amounts due under contracts

entered into by the group to purchase aircraft. The company has

paid deposits towards the cost of these aircraft which are included

in trade and other receivables.

As at 31 December 2020, the Group has commitments to purchase

eight ATR 72-600 aircraft from the manufacturer with expected

delivery dates over a three-year period.

The Company is currently in discussion with the manufacturer

regarding a reduction in the number of ATR 72-600 aircraft on order

and re-scheduling of delivery dates.

23 CONTINGENT LIABILITIES

There were no material changes in contingent liabilities since

30 June 2020.

24 DIVIDENDS

31 Dec 31 Dec

2020 2019

US$'000s US$'000s

----------------------------------------------------------------------------- ---------- ---------

Dividends declared and/or paid during the six months ended 31 December 2020

Dividends on ordinary shares

* First interim exempt (one-tier) dividend for Nil US

cents (31 Dec 2019 : 8.50 US cents) per share - 5,454

* Second interim exempt (one-tier) dividend for Nil US

cents (31 Dec 2019 : 2.10 US cents) per share - 1,319

---------- ---------

- 6,773

---------------------------------------------------------------------------------------- ---------

Dividends are recorded directly in equity when they are

paid.

25 SUBSEQUENT EVENTS

On 8 February 2021, the Group has entered into a new lease for

an ATR 72-600 with an existing Asian client airline for eight years

lease at current market rates.

On 9 February 2021, the Group advises that it has reach an

agreement with a group of bond holders on the terms of a maturity

extension in relation to the Avation Capital S.A. 6.5% senior notes

due May 2021 issued under Avation's global medium term note

programme.

PRINCIPAL RISKS

The Group's risk management processes bring greater judgement to

decision making as they allow management to make better, more

informed and more consistent decisions based on a clear

understanding of risk involved. We regularly review the risk

assessment and monitoring process as part of our commitment to

continually improve the quality of decision-making across the

Group.

The principal risks and uncertainties which may affect the Group

in the second half of the financial year will include the typical

risks associated with the aviation business, including but not

limited to any downturn in the global aviation industry, fuel

costs, finance costs, pandemics, war and radicalism and the like

which may affect our airline customers' ability to fulfil their

lease obligations.

The business also relies on its ability to source finance on

favourable terms. Should this supply of finance contract, it would

limit our fleet expansion and therefore growth.

GOING CONCERN

After making enquiries, the directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. For this reason

they continue to adopt the going concern basis in preparing the

financial statements. The financial risk management objectives and

policies of the Group and the exposure of the Group to credit risk

and liquidity risk are discussed in the annual report for the Group

for the year ended 30 June 2020.

DIRECTORS

The directors of Avation PLC are listed in its Annual Report for

the year ended 30 June 2020. A list of the current directors is

maintained on the Avation PLC website: www.avation.net

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors confirm that, to the best of their knowledge, this

condensed consolidated interim financial information have been

prepared in accordance with IAS 34 as adopted by the European Union

and that the interim management report herein includes a fair

review of the information required by DTR 4.2.7 and DTR 4.2.8

namely

-- an indication of important events that have occurred during

the first six months and their impact on the Interim Report, and a

description required by the principal risks and uncertainties for

the remaining six months of the financial year; and

-- material related party transactions in the first six months

and any material changes in the related party transactions

described in the last annual report.

By order of the Board

Jeff Chatfield

Executive Chairman

Singapore, 26 February 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GZGZZNVKGMZG

(END) Dow Jones Newswires

February 26, 2021 02:15 ET (07:15 GMT)

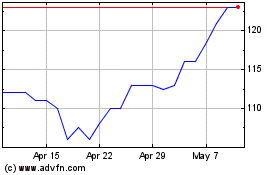

Avation (LSE:AVAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avation (LSE:AVAP)

Historical Stock Chart

From Apr 2023 to Apr 2024