TIDMAYM

Anglesey Mining plc

Half yearly report for the six months to 30 September 2020

Chairman's Statement and Management Report

The period since our Annual Report in September has been very encouraging for

the minerals industry in general and for Anglesey Mining in particular. We

have made good advances on a number of fronts and the prices of all the main

metals in which we are interested have advanced significantly. Two of our

projects have moved forward through the commissioning of development studies

and the results of both these should be available in the coming weeks.

Share Issue and Financings

In August we reported on a private placing that raised GBP200,000. Associated

with that placing was the issue of a matching number of warrants and I am

pleased to report that these warrants have all now been exercised raising an

additional GBP225,000, for a total of GBP425,000. The support shown by the new

incoming investors has been most welcome and the Company's share price has

moved forward substantially from below 2p a share at the time of the placing.

We believe that this demonstrates increasing support from the market and that

investors are beginning to recognise the value and potential of Anglesey's

assets.

Covid-19

Despite the continuing and pervasive presence of Covid-19 throughout the world,

the effect is proving quite positive for commodity prices. We believe that

encouraging developments with vaccines will lead to stability in general

economic and operating conditions and the inevitable stimulus relief and

infrastructure programmes will bolster demand for all metals.

Commodity Prices

Over the period, all the metals in which we have an interest have continued to

increase in price, some of them substantially. This applies to both base

metals and precious metals and also to iron ore.

With the continuing pressure on current operating mines in some countries

because of Covid, a shortfall in supply is dominating the base metal markets

and this is likely to continue for some time to come. This shortfall is

accompanied by increasing demand from major infrastructure and Covid relief

programmes, particularly in China, which are likely to continue through 2021

and into 2022 and provide ongoing support for base metal and iron ore prices.

Of particular importance to Parys Mountain is the price of copper which will be

the mainstay of the project in the long term. Copper has made significant

recent gains and now trades at over $3.50 per pound, the highest level for more

than 7 years. This is significantly higher than the price of $2.50 per pound

that was used in the 2017 Micon study. Similarly, zinc is now back up to the

$1.25 per pound price used in the 2017 study. A mine at Parys Mountain would

also produce meaningful quantities of gold and silver, the prices of which

reached multi-year highs in 2020 before easing somewhat after the US

presidential election. The price outlook for these metals remains very bullish

in the face of expected worldwide deficit spending by many governments.

Iron ore has been showing good strength over the last two years but has been

particularly strong in 2020 with 62% Fe iron fines, which would be the main

product from Labrador Iron Mines Houston project, now trading at over $145 per

tonne CFR China. This is an increase of over 57% for the current year. Of

more importance to the Grangesberg project in Sweden is that the premiums for

higher grade >65% Fe products continue to be supported and have grown by over

20% during the last month.

We expect this support for all the commodities that are of interest to Anglesey

to continue as the lingering effects of the Covid crisis, coupled with the

continuation of the stimulus programme in China and similar projects being

launched in other countries, all begin to take effect.

Parys Mountain

At the beginning of October, we awarded a contract to Micon International

Limited (Micon) to prepare a Preliminary Economic Assessment Report (PEA) on

the Parys Mountain copper, zinc, lead, gold and silver project located on the

island of Anglesey in North Wales. This PEA follows on from the optimisation

studies carried out by QME Mining Technical Services during the last two years

and will utilise the outcomes from the QME studies, including capital and

operating cost estimates as well as the up to 10 million tonnes of potentially

mineable material identified by QME. We hope that the PEA will confirm a

mining and production plan at a higher daily throughput and over a longer total

production life than demonstrated in Micon's 2017 Scoping Study. This should

lead to improved financial forecasts for the Parys Mountain project from those

generated in 2017.

Micon has made good progress with this PEA and we expect to be in a position to

release details of Micon's findings before or just after the Christmas break.

Iron Ore

Grangesberg - Sweden

Anglesey continues to manage Grangesberg Iron AB ("GIAB") which holds the

Grangesberg iron ore project in Central Sweden. We have made two further cash

investments into GIAB and Anglesey now holds 20% of the company directly,

together with a right of first refusal on a further 50% holding.

Site activities have been kept at a low level but the growing support for

higher-grade iron ore like the premium product that Grangesberg would produce

have encouraged us to now actively seek out alternative development and

corporate strategies to move the project and GIAB forward.

We believe that the superior geographic location of the Grangesberg deposit and

its projected premium product specification could enable such alternative

approaches to be beneficial for the group in the coming periods.

Labrador - Canada

The group continues to hold a 12% interest in Labrador Iron Mines Holdings

Limited (LIM) which owns extensive iron ore resources in the Schefferville area

of Labrador and Quebec in Canada.

LIM holds direct shipping mineral resources of approximately 55 million tonnes

at an average grade of 56.8% in the Houston project. In addition LIM holds the

Elizabeth Taconite Project which has a current inferred mineral resource

estimated at 620 million tonnes at an average grade of 31.8% Fe.

LIM has recently appointed RPA of Toronto to carry out a PEA on the Houston

direct shipping iron ore project. Houston, which lies approximately 30

kilometres south of LIM's previous James Mine operation, will be very similar

in design and operational characteristics to James and is therefore well

understood. It is expected that the PEA will look at an operation producing

approximately 2 million tonnes per year. The PEA is due for completion early

in 2021 and could provide the impetus to move Houston forward to financing and

production.

LIM's former James Mine and the Silver Yards processing facility have been in a

progressive reclamation since the termination of mining at the James Mine in

2014. This work is now virtually complete and has resulted in the release of

several reclamation bonds previously provided to regulatory authorities.

LIM's Elizabeth Project represents an opportunity to develop a major new

taconite operation in the Schefferville region of the Labrador Trough which

would produce a high-grade saleable iron ore product. This would attract

premium prices in the current iron ore market.

Operations

As always, we have kept our corporate and operating costs at the lowest level

consistent with maintaining our assets in good order. We will continue this

policy going forward but we expect there will be some increase in costs as

project development activities continue. The recent private placing and warrant

exercise financings have put Anglesey in a position to support its base

operations for the immediate future.

Financial results

The group had no revenue for the period. The loss for the six months to 30

September 2020 was GBP152,882 (2019 GBP156,600) and the expenditures on the mineral

property in the period were GBP27,827 compared to GBP26,527 in the comparative

period. Net current assets at 30 September 2020 were GBP94,895 compared to GBP

13,572 at 31 March 2020. Since the period end a further GBP225,000 gross has been

raised from the exercise of warrants.

Outlook

We have been much encouraged by the positive commodity price outlook and

increased investor interest over the last few months as we have been moving all

our projects forward. We are confident that this recent progress will

continue. We believe that the fundamentals that have driven commodity prices

upwards will continue for the foreseeable future and will provide solid support

for our projects. We look forward to completion by Micon of the PEA on Parys

Mountain, which should see that project move to the next development stage

during 2021. We are also confident that both LIM's Houston and GIAB's

Grangesberg iron ore projects will be advanced in the coming year.

We are also actively reviewing two other base metal projects in established

geographical locations and we hope that we should be able to come to suitable

working arrangements with one of these in the coming months.

All in all, we are confident of the way forward and positive on the outlook for

Anglesey Mining for 2021.

I would like to thank shareholders for their continued and renewed support.

John F Kearney

Chairman

10th December 2020

Unaudited condensed consolidated income statement

Notes Unaudited six months ended Unaudited six

30 September 2020 months ended 30

September 2019

All operations are continuing

GBP

GBP

Revenue - -

Expenses (68,439) (71,493)

Equity-settled employee benefits - -

Investment income 50 60

Finance costs (84,460) (85,190)

Foreign exchange movement (33) 23

Loss before tax (152,882) (156,600)

Taxation 8 - -

Loss for the period 7 (152,882) (156,600)

Loss per share

Basic - pence per share (0.1)p (0.1)p

Diluted - pence per share (0.1)p (0.1)p

Unaudited condensed consolidated statement of comprehensive income

Loss for the period (152,882) (156,600)

Other comprehensive income

Items that may subsequently be reclassified to profit or

loss:

Exchange difference on 8,747 (22,397)

translation of foreign

holding

Total comprehensive loss for the (144,135) (178,997)

period

All attributable to equity holders of the company

Unaudited condensed consolidated statement of financial position

Notes 30 September 31 March 2020

2020

GBP GBP

Assets

Non-current assets

Mineral property exploration and 9 15,243,550 15,215,723

evaluation

Property, plant and equipment 204,687 204,687

Investments 10 105,527 100,099

Deposit 123,798 123,748

15,677,562 15,644,257

Current assets

Other receivables 21,957 16,505

Cash and cash equivalents 206,309 95,311

228,266 111,816

Total assets 15,905,828 15,756,073

Liabilities

Current liabilities

Trade and other payables (133,371) (98,244)

(133,371) (98,244)

Net current assets 94,895 13,572

Non-current liabilities

Loans (4,056,656) (3,981,893)

Long term provision (50,000) (50,000)

(4,106,656) (4,031,893)

Total liabilities (4,240,027) (4,130,137)

Net assets 11,665,801 11,625,936

Equity

Share capital 11 7,505,591 7,380,591

Share premium 10,317,309 10,258,309

Currency translation reserve (71,719) (80,466)

Retained losses (6,085,380) (5,932,498)

Total shareholders' funds 11,665,801 11,625,936

All attributable to equity holders of the company

Unaudited condensed consolidated statement of cash flows

Notes Unaudited six months ended Unaudited six months

30 September 2020 ended 30 September

2019

GBP GBP

Operating activities

Loss for the period (152,882) (156,600)

Adjustments for:

Investment income (50) (60)

Finance costs 84,460 85,190

Foreign exchange movement 33 (23)

(68,439) (71,493)

Movements in working capital

(Increase) in receivables (5,153) (4,733)

Increase/(decrease) in payables 27,862 (7,751)

Net cash used in operating (45,730) (83,977)

activities

Investing activities

Mineral property exploration and (21,811) (30,487)

evaluation

Investment (5,428) -

Net cash used in investing activities (27,239) (30,487)

Financing activities

Issue of share capital 184,000 170,000

Loan received - 100,000

Net cash generated from financing 184,000 100,000

activities

Net increase in cash and cash equivalents 111,031 155,560

Cash and cash equivalents at start 95,311 6,012

of period

Foreign exchange movement (33) 23

Cash and cash equivalents at end 206,309 161,595

of period

All attributable to equity holders of the company

Unaudited condensed consolidated statement of changes in group equity

Share Share Currency Retained Total

capital premium translation losses GBP

GBP GBP reserve GBP

GBP

Equity at 1 April 2020 - 7,380,591 10,258,309 (80,466) 11,625,936

audited (5,932,498)

Total comprehensive

income for the

period:

Exchange difference on - - 8,747 - 8,747

translation of

foreign holding

Loss for the period - - - (152,882) (152,882)

Total comprehensive - - 8,747 (152,882) (144,135)

income for the

period

Shares issued 125,000 75,000 - - 200,000

Share issue expenses - (16,000) - - (16,000)

Equity at 7,505,591 10,317,309 (71,719) 11,665,801

30 September 2020 - (6,085,380)

unaudited

Comparative period

Equity at 1 April 2019 - 7,286,914 10,171,986 (57,116) 11,773,796

audited (5,627,988)

Total comprehensive

income for the

period:

Exchange difference on - - (22,397) - (22,397)

translation of

foreign holding

Loss for the period - - - (156,600) (156,600)

Total comprehensive - - (22,397) (156,600) (178,997)

income for the

period

Shares issued 93,677 106,323 - - 200,000

Share issue expenses - (30,000) - - (30,000)

Equity at 7,380,591 10,248,309 (79,513) 11,764,799

30 September 2019 - (5,784,588)

unaudited

All attributable to equity holders of the company

Notes to the accounts

1. Basis of preparation

This half-yearly financial report comprises the unaudited condensed

consolidated financial statements of the group for the six months ended 30

September 2020. It has been prepared in accordance with the Disclosure and

Transparency Rules of the Financial Conduct Authority, the requirements of IAS

34 - Interim financial reporting (as adopted by the European Union) and using

the going concern basis. The directors are not aware of any events or

circumstances which would make this inappropriate. It was approved by the board

of directors on 10 December 2020. It does not constitute financial statements

within the meaning of section 434 of the Companies Act 2006 and does not

include all of the information and disclosures required for annual financial

statements. It should be read in conjunction with the annual report and

financial statements for the year ended 31 March 2020 which is available on

request from the company or may be viewed at www.angleseymining.co.uk.

The financial information contained in this report in respect of the year ended

31 March 2020 has been extracted from the report and financial statements for

that year which have been filed with the Registrar of Companies. The report of

the auditors on those accounts did not contain a statement under section 498(2)

or (3) of the Companies Act 2006 and was not qualified. The half-yearly results

for the current and comparative periods have not been audited or reviewed.

2. Significant accounting policies

The accounting policies applied in these unaudited condensed consolidated

financial statements are consistent with those set out in the annual report and

financial statements for the year ended 31 March 2020.

New accounting standards

Standards, amendments and interpretations adopted in the current financial

period:

The adoption of the following standards, amendments and interpretations in the

current financial period has not had a material impact on the financial

statements of the group or the company.

IFRS 9 Financial Instruments (Amendment)

IFRS 16 Leases

IFRIC 23 Uncertainty over Income Tax Treatments

IAS 19 Employee Benefits (Amendment) Plan Amendment

IAS 28 Investments in Associates and Joint Ventures (Amendment)

Standards, amendments and interpretations in issue but not yet effective:

Effective date

Amendments to IAS 1 and IAS 8: Definition of 1 January 2020

Material

Amendment to IFRS 3 Business Combinations: 1 January 2020

Definition of a Business

Conceptual Framework (Revised) and amendments to 1 January 2020

related references in IFRS Standards

IFRS 17 Insurance Contracts Expected date not

available

The adoption of the above standards and interpretations is not expected to lead

to any changes to the group's accounting policies or have any other material

impact on the financial position or performance of the group.

There have been no other new or revised International Financial Reporting

Standards, International Accounting Standards or Interpretations that are in

effect since that last annual report that have a material impact on the

financial statements.

3. Risks and uncertainties

The principal risks and uncertainties set out in the group's annual report and

financial statements for the year ended 31 March 2020 remain the same for this

half-yearly financial report and can be summarised as: development risks in

respect of mineral properties, especially in respect of permitting and metal

prices; liquidity risks during development; and foreign exchange risks. More

information is to be found in the 2020 annual report - see note 1 above.

4. Statement of directors' responsibilities

The directors confirm to the best of their knowledge that:

(a) the unaudited condensed consolidated financial statements have been

prepared in accordance with the requirements of IAS 34 Interim financial

reporting (as adopted by the European Union); and

(b) the interim management report includes a fair review of the information

required by the FCA's Disclosure and Transparency Rules (4.2.7 R and 4.2.8 R).

This report and financial statements were approved by the board on 10 December

2020 and authorised for issue on behalf of the board by Bill Hooley, chief

executive officer and Danesh Varma, finance director.

5. Activities

The group is engaged in mineral property development and currently has no

turnover. There are no minority interests or exceptional items.

6. Earnings per share

The loss per share is computed by dividing the loss attributable to ordinary

shareholders of GBP0.153 million (loss to 30 September 2019 GBP0.157m), by

189,571,360 (2019 - 184,569,825) - the weighted average number of ordinary

shares in issue during the period. Where there are losses the effect of

outstanding share options is not dilutive.

7. Business and geographical segments

There are no revenues. The cost of all activities charged in the income

statement relates to exploration and development of mining properties. The

group's income statement and assets and liabilities are analysed as follows by

geographical segments, which is the basis on which information is reported to

the board.

Income statement analysis

Unaudited six months ended 30 September

2020

UK Sweden - Canada -

investment investment Total

GBP GBP GBP GBP

Expenses (68,439) - - (68,439)

Investment income 50 - - 50

Finance costs (77,117) (7,343) - (84,460)

Exchange rate movements - (33) - (33)

Loss for the period (145,506) (7,376) - (152,882)

Unaudited six months ended 30 September

2019

UK Sweden - Canada -

investment investment Total

GBP GBP GBP GBP

Expenses (71,493) - - (71,493)

Investment income 60 - - 60

Finance costs (77,048) (8,142) - (85,190)

Exchange rate movements - 23 - 23

Loss for the period (148,481) (8,119) - (156,600)

Assets and liabilities

` 30 September 2020

UK Sweden Canada

investment investment Total

GBP GBP

GBP GBP

Non current assets 15,572,035 105,526 1 15,677,562

Current assets 227,117 1,149 - 228,266

Liabilities (318,751) -

(3,921,276) (4,240,027)

Net assets/ 11,877,876 (212,076) 1 11,665,801

(liabilities)

Audited 31 March 2020

UK Sweden Canada Total

investment investment

GBP GBP

GBP GBP

Non current assets 15,544,158 100,098 1 15,644,257

Current assets 110,716 1,100 - 111,816

Liabilities (321,105) -

(3,809,032) (4,130,137)

Net assets/ 11,845,842 (219,907) 1 11,625,936

(liabilities)

8. Deferred tax

There is an unrecognised deferred tax asset of GBP1.3 million (31 March 2020 - GBP

1.3m) which, in view of the group's results, is not considered to be

recoverable in the short term. There are also capital allowances, including

mineral extraction allowances, exceeding GBP12.8 million (unchanged from 31 March

2020) unclaimed and available. No deferred tax asset is recognised in the

condensed financial statements.

9. Mineral property exploration and evaluation costs

Mineral property exploration and evaluation costs incurred by the group are

carried in the unaudited condensed consolidated financial statements at cost,

less an impairment provision if appropriate. The recovery of these costs is

dependent upon the successful development and operation of the Parys Mountain

project which is itself conditional on finance being available to fund such

development. During the period expenditure of GBP27,827 was incurred (six months

to 30 September 2019 - GBP26,527). There have been no indicators of impairment

during the period.

10. Investments

Labrador Grangesberg

Total

GBP GBP GBP

At 1 April 2019 1 97,794 97,795

Change during the period - 2,304 2,304

At 31 March 2020 1 100,098 100,099

Change during the period - 5,428 5,428

At 30 September 2020 1 105,526 105,527

Labrador: The group's investment is classified as 'unquoted' and is held at a

nominal value of GBP1.

Grangesberg: At the date of these statements the group has a 20.0% (10% at 31

March 2020) holding in Grangesberg Iron AB (an unquoted Swedish company) and a

right of first refusal over shares amounting to a further 51% of that company.

This investment has been initially recognised and subsequently measured at

cost, on the basis that the shares are not quoted and a reliable fair value is

not able to be estimated. During the period the group subscribed for new shares

in GIAB and obtained further shares in exchange for services provided by it to

Grangesberg.

11. Share capital

Ordinary shares Deferred shares Total

of 1p of 4p

Issued and Nominal Number Nominal Number Nominal

fully paid value GBP value GBP value GBP

At 1 April 2020 1,869,758 186,975,732 5,510,833 137,770,835 7,380,591

Issued in the period 125,000 12,500,000 125,000

At 30 September 2020 1,994,758 199,475,732 5,510,833 137,770,835 7,505,591

The deferred shares are non-voting, have no entitlement to dividends and have

negligible rights to return of capital on a winding up.

On 24 August 2020 a placing of 12.500,000 new ordinary shares was made to an

institution, representing approximately 6.3% of the company's then current

issued share capital, at 1.6 pence per share to raise a total of GBP200,000 gross

and GBP184,000 net. Together with that placing warrants that could raise an

additional GBP225,000 gross during the following 12 months were granted to the

same institution. All of these warrants had been exercised by the date of these

statements.

12. Financial instruments

Group Financial assets Financial assets

classified at fair measured at amortised

value through other cost

comprehensive income

30 31 March 30 31 March

September 2020 September 2020

2020 2020

GBP GBP GBP GBP

Investments 105,527 102,403 - -

Deposit - - 123,798 123,748

Other receivables - - 21,957 16,505

Cash and cash - - 206,309 95,311

equivalents

- -

105,527 102,403 352,064 235,564

Financial liabilities

measured at amortised

cost

30 31 March

September 2020

2020

GBP GBP

Trade payables (12,299) (13,537)

Other payables (121,072) (84,707)

Loans

(4,056,656) (3,981,893)

(4,190,027) (4,080,137)

13. Events after the reporting period

None.

14. Related party transactions

None.

Anglesey Mining plc

Directors:

John Kearney Chairman

Bill Hooley Chief executive

Danesh Varma Finance director

Howard Miller Non executive

Parys Mountain site: Parys Mountain, Amlwch, Anglesey, LL68 9RE Phone 01407

831275

London office: Painter's Hall Chambers, 8 Little Trinity Lane, London, EC4V

2AN Phone 020 7062 3782

Registered office: Tower Bridge House, St. Katharine's Way, London, E1W 1DD

Web site: www.angleseymining.co.uk

E-mail: mail@angleseymining.co.uk

Shares listed on the London Stock Exchange - LSE:AYM Company

registration number 1849957

Share registrars: Link Asset Services www.linkassetservices.com

END

(END) Dow Jones Newswires

December 11, 2020 02:14 ET (07:14 GMT)

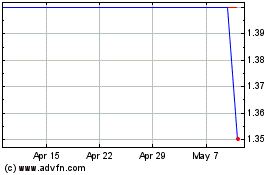

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Apr 2023 to Apr 2024