TIDMBAG

RNS Number : 6408Z

Barr(A.G.) PLC

22 September 2020

22 September 2020

A.G. BARR p.l.c. ("A.G. BARR" or the "Group")

INTERIM RESULTS FOR THE SIX MONTHSED 25 JULY 2020

A.G. BARR p.l.c., which produces and markets some of the UK's

leading drink brands, including IRN-BRU, Rubicon and Funkin,

announces its interim results for the six months ended 25 July

2020.

Financial summary

July 2020 July 2019 Change

Revenue GBP113.2m GBP122.5m (7.6)%

---------- ---------- ----------

Profit before tax (before exceptional

items)* GBP16.6m GBP13.9m 19.4%

---------- ---------- ----------

Statutory profit before tax GBP5.1m GBP13.5m (62.2)%

---------- ---------- ----------

Operating margin before exceptional

items* 15.1% 11.7% 343 bps

---------- ---------- ----------

Earnings per share before exceptional

items* 10.52p 9.83p 7.0%

---------- ---------- ----------

Net cash flow from operating

activities GBP24.0m GBP11.7m 105.1%

---------- ---------- ----------

Net cash at bank GBP30.4m GBP4.6m +GBP25.8m

---------- ---------- ----------

Covid-19 response

-- Successfully introduced range of enhanced safety and hygiene measures across all operations

-- Swift action taken to control costs, conserve cash and underpin financial stability

-- Maintained continuity of production and continued to deliver

high levels of service and quality

-- Brought to a close use of the Government's Job Retention Scheme by end July

-- Strong teamwork across the Group supporting our year to date performance

Performance headlines

-- Barr Soft Drinks : Value share of total UK soft drinks market up 1.2%

-- Funkin : Sales decline of 34% driven by very challenging

hospitality sector - within this retail and on-line sales grew by

over 170%

-- Pre-tax exceptional charge of GBP11.5m related to ongoing

business re-engineering programme and impairment of Strathmore

brand and assets

-- Cash flow generated from operations of GBP30.1m

-- Strong balance sheet and with GBP30.4m of net cash at bank

-- Dividend position remains under review - dividend payments are expected to resume in 2021

Roger White, Chief Executive , commented:

"We remain on course to deliver a full year performance in line

with the revised expectations we communicated in the July 2020

trading update. We have continued to invest in our core brand

equity for the long term, maintained our quality and service

standards and remain a profitable and cash generative business in a

robust drinks sector. We are confident that our business will

continue to prove its resilience for the balance of this year and

beyond."

For more information, please contact :

A.G. BARR 0330 390 3900 Instinctif Partners 020 7457 2020

Roger White, Chief Executive Justine Warren

Stuart Lorimer, Finance Director Matthew Smallwood

* Items marked with an asterisk are non-GAAP measures.

Definitions and relevant reconciliations are provided at the end of

this announcement.

Interim statement

The first 8 weeks of the new financial year continued the strong

momentum with which we exited the 2019/20 financial year. However,

the circumstances which have arisen as a result of the COVID-19

pandemic have significantly impacted life and business in the UK

and beyond.

As previously communicated, the UK lockdown measures introduced

on 23 March 2020, and the resultant changes in consumer purchasing

and consumption patterns, have unsurprisingly had an adverse impact

on the Group's trading.

For the six months ended 25 July 2020 the Group delivered

revenue of GBP113.2m (2019/20 : GBP122.5m).

In March 2020, as the crisis began to unfold, we took swift

action to conserve cash and underpin our financial stability.

Despite the difficult prevailing circumstances and subsequent

impact on our revenue and product mix, the business generated

positive cashflow for the 26 weeks ended 25 July 2020 and, as a

result of our cost control measures, delivered profit before tax

and exceptional items(*) of GBP16.6m, a 19.4% increase on the same

period in the prior year (H1 2019/20 : GBP13.9m). Taking into

account exceptional items, detailed below, statutory profit before

tax was GBP5.1m, a 62.2% decrease on the prior year. (H1 2019/20 :

GBP13.5m).

Soft drinks market

IRI Marketplace data for the 26 weeks to 26 July 2020 records

the total UK soft drinks market increasing in value by 0.2% and in

volume by 0.6%. While the overall market has proven resilient in

the circumstances, there is a notable difference between the value

growth in carbonates (up 7.3%) and the value decline in stills

(down 7.8%).

Despite our revenue decline across the past 26 weeks, we have

grown our market value share of soft drinks, both in Scotland and

in England and Wales, reflecting the unusual market dynamics being

experienced. The closure of the hospitality sector, where

availability of market data is more limited, has contributed

significantly to our fall in revenue. Our strong performance in the

more widely measured channels, such as take-home, has driven our

improved market share position. Against this backdrop our broad and

balanced coverage across the full spectrum of shopping channels and

formats has proven effective.

Safety, wellbeing and operational resilience

As the COVID-19 pandemic has evolved, safety and wellbeing have

been our number one priority. Having successfully introduced a

range of enhanced safety and hygiene measures across all our

operations, we have maintained continuity of production and

continued to deliver a high level of customer service and

quality.

We would like to thank our colleagues and teams across the

business who have worked tirelessly to support our customers and

consumers in these challenging times.

Business performance

As detailed in our July 2020 trading update, during lockdown we

saw significant changes in consumption and purchasing patterns

across our customer channels as well as notable shifts in sales

mix, related to brand and product formats. As lockdown measures

eased we began to see a gradual return to pre-COVID-19 shopping and

consumer dynamics.

We are pleased to report that the IRN-BRU brand has grown

revenue by 1% in the first half of the financial year versus the

corresponding period in 2019/20, continuing the positive momentum

which the brand delivered across the second half of the prior year.

We have continued to invest in a range of IRN-BRU focused consumer

marketing activities both prior to and during lockdown, including

digital and social activity and a Scottish TV advertising

campaign.

Following a difficult 2019 for the fruit drinks sub category, to

which our Rubicon brand was not immune, we have continued our

Rubicon brand recovery plan including introducing reformulated

products, new packaging design, and delivering a national marketing

campaign focused on our Rubicon carbonated products. Despite our

actions, Rubicon sales declined by 9% over the first 6 months of

the financial year, reflecting the COVID-19 market disruption and

in particular the impact on the key Ramadan trading period. We will

continue to pursue our recovery strategy and remain confident in

our long term approach.

The Barr Flavours carbonated range has continued to build on the

strong growth it delivered last year, with sales up 13% benefiting

from further increased levels of distribution.

Our contract with Rockstar terminated on 23 August 2020 and,

while we will continue to manufacture, sell and distribute Rockstar

energy drinks up to 1 November 2020, thereafter the brand will

cease to be part of the Barr Soft Drinks portfolio. We have now

agreed that we will continue to manufacture Rockstar products on a

contract packing basis until the end of January 2021. In accordance

with the terms of the contract, a one-off compensation payment,

currently being finalised, will be received by the Group in the

second half of the current financial year.

Our business re-engineering programme, which commenced in

2019/20, identified a number of actions to simplify our operations

and reshape our internal supply chain by rationalising and reducing

the complexity of our portfolio and routes to market. As part of

this programme, we will cease to produce and sell the franchise

brand Snapple during the first half of 2021/22. Snapple accounted

for less than 1% of revenue in 2019/2020.

Clearly, the hospitality sector has been significantly

challenged by the lockdown measures over recent months. Across the

first six months of the financial year, Group sales to our

hospitality customers fell by c.65%, peaking at c.95% during the

full lockdown period.

The Strathmore brand in particular has been impacted given the

significance of its sales in this sector. Whilst we are seeing some

recovery across hospitality, it will take time for the sector to

regain momentum and as such we do not anticipate Strathmore

returning to pre-COVID-19 sales levels in the foreseeable future.

Regrettably, as a consequence we have reduced our manufacturing

workforce at our Forfar site and the brand and asset valuations

have been impaired, as outlined below.

For the Funkin business, sales declined by 34% reflecting the

hospitality sector challenges, however within this retail and

on-line sales grew by over 170%, with the nitro infused

ready-to-drink cocktails in particular delivering a strong

performance. The Funkin brand remains a significant long-term

growth opportunity in both the recovering on-trade and in the

retail channel, where the brand is gaining momentum. In support of

our drive to build Funkin into a relevant consumer brand we will

deliver, during the second half of the financial year, our first

Funkin TV advertising campaign in partnership with Sky alongside

the launch of a number of new and exciting products across the

Funkin portfolio.

Exceptional items

In the period, we have reported a pre-tax exceptional charge of

GBP11.5m (GBP10m non-cash and GBP1.5m cash). This covers :

-- our ongoing business re-engineering programme, which

commenced in 2019 and has been extended in 2020 in light of the

impact of COVID-19. In the first 6 months of the current financial

year GBP1.5m costs are primarily associated with redundancy

payments related to this programme which will complete in January

2021; and

-- following a review of our intangible asset brand valuations,

a GBP10m impairment of our Strathmore brand and assets which has

been significantly affected by the challenges in the hospitality

sector.

The 2019/20 comparator was a GBP0.4m net cash charge.

Cash Flow

Cash flow generated from operations* of GBP30.1m was GBP14.1m

higher than the corresponding period in the prior year. This was

driven by higher operating profit, before non-cash exceptional

items, and inflows driven from working capital.

Capital expenditure in the half year was GBP2.8m (GBP8.4m in the

first half of the prior year), reflecting our decision to put all

discretionary capital programmes on hold. Full year capital

expenditure is estimated to be in the region of GBP6-8m (2019/20:

GBP14.8m) as we recommence our capital investment programme in the

second half of the financial year.

The combination of operational cash conservation, the temporary

suspension of dividends, the lower capital expenditure and the

drawdown of credit facilities has resulted in a closing cash

position of GBP90.4m.

Balance sheet

We closed the 2019/20 financial year with a strong balance sheet

and with GBP10.9m of net cash at bank. We recognised quickly the

uncertainty and disruption that could result from COVID-19 and took

prudent steps to protect our business including the full draw down

of our GBP60m revolving credit facilities, the implementation of

cash conservation measures, such as pausing all discretionary

capital programmes, suspending our dividends and further

strengthening our working capital controls.

Our total working capital* has reduced from GBP25.2m as at 27

July 2019 to GBP13.2m as at 25th July 2020. This reflects the

impact of lower trading and improved inventory management following

the first phases of our business re-engineering programme in the

prior year, as well as the benefit of deferred VAT payments as part

of the Government's COVID response measures. To date our bad debt

and overdue balances remain minimal, despite having extended credit

to some of our smaller customers and having agreed repayment plans

with others who have been particularly impacted by the on-trade

lock down.

Dividend

We continue to keep our dividend position under review and, on

the basis of our current underlying assumptions related to the UK's

COVID-19 recovery, it is expected that we will resume dividend

payments in 2021.

Outlook

Given the difficult prevailing circumstances the business has

responded well to the challenges we have faced and has delivered a

creditable performance in the first six months of trading,

notwithstanding the relatively weaker comparatives of the prior

year.

While UK-wide lockdown measures have been gradually lifted,

there remains a continued high degree of uncertainty associated

with further potential COVID-19 outbreaks, such as significant

localised lockdowns, and the resulting impacts.

Our current scenario planning, based on an underlying assumption

that the UK will not enter into a further significant period of

lockdown, continues to indicate that our full year revenue

performance for the year ending January 2021 will be in the region

of 12-15% below the prior year, with a modest reduction in

operating profit margin reflecting the impact of adverse sales mix

and operational de-leverage, mitigated by our strong delivery of

ongoing overhead cost savings.

Despite the challenging environment, we have continued to invest

in our core brand equity for the long term, maintained our quality

and service standards and remain a profitable and cash generative

business in a robust drinks sector. We are confident that our

business will continue to prove its resilience for the balance of

this year and beyond.

John Nicolson Roger White

Chairman Chief Executive

Consolidated Condensed Income Statement

Unaudited Unaudited Audited

6 months ended 25 July 2020 6 months ended 27 July 2019 Year ended 25 January 2020

================================ ================================ =================================

Before Before Before

exceptional Exceptional exceptional Exceptional exceptional Exceptional

items items* Total items items* Total items items* Total

Note GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------ ---- ----------- ----------- ------ ----------- ----------- ------ ----------- ----------- -------

Revenue 6 113.2 - 113.2 122.5 - 122.5 255.7 - 255.7

Cost of sales (64.9) (0.3) (65.2) (71.8) - (71.8) (149.6) (1.1) (150.7)

------------------ =========== ----------- ====== ----------- =========== ====== ----------- =========== =======

Gross profit 6 48.3 (0.3) 48.0 50.7 - 50.7 106.1 (1.1) 105.0

Other Income - - - - - - - 1.8 1.8

Operating expenses (31.2) (11.2) (42.4) (36.4) (0.4) (36.8) (68.0) (0.7) (68.7)

================== =========== =========== ====== =========== =========== ====== =========== =========== =======

Operating

profit 8 17.1 (11.5) 5.6 14.3 (0.4) 13.9 38.1 - 38.1

Finance costs (0.4) - (0.4) (0.3) - (0.3) (0.6) - (0.6)

Share of results

of associate (0.1) - (0.1) (0.1) - (0.1) (0.1) - (0.1)

================== =========== =========== ====== =========== =========== ====== =========== =========== =======

Profit

before tax 16.6 (11.5) 5.1 13.9 (0.4) 13.5 37.4 - 37.4

Income tax

expense 9 (4.9) 1.7 (3.2) (2.8) 0.1 (2.7) (7.6) - (7.6)

------------ ---- =========== ----------- ====== =========== =========== ====== =========== =========== =======

Profit

attributable to

equity holders 11.7 (9.8) 1.9 11.1 (0.3) 10.8 29.8 - 29.8

------------------ =========== =========== ====== =========== =========== ====== =========== =========== =======

Earnings per share (p)

============================================ ====== =========== =========== ====== =========== =========== =======

Basic

earnings

per share 10 1.71 9.57 26.50

Diluted

earnings

per share 10 1.71 9.55 26.49

Earnings per

share

before

exceptional

items 10 10.52 9.83 26.50

============ ==== =========== =========== ====== =========== =========== ====== =========== =========== =======

* Refer to Note 8

Consolidated Condensed Statement of Comprehensive Income

Unaudited Unaudited Audited

6 months ended 25 July 2020 6 months ended 27 July 2019 Year ended 25 January 2020

GBPm GBPm GBPm

================================ =========================== =========================== ==========================

Profit for the period 1.9 10.8 29.8

Other comprehensive income

Items that will not be

reclassified to profit or loss

Remeasurements on defined

benefit pension plans (Note 17) (0.8) 1.3 1.2

Deferred tax movements on items

above 0.2 (0.2) (0.2)

Remeasurement to deferred tax

for change in deferred tax rate 0.5 - -

Items that will be or have been

reclassified to profit or loss

Cash flow hedges:

Gains arising during the period - 0.5 0.3

Deferred tax movements on items

above - (0.1) (0.1)

================================ =========================== =========================== ==========================

Other comprehensive

(expense)/income for the

period, net of tax (0.1) 1.5 1.2

Total comprehensive income

attributable to equity holders

of the parent 1.8 12.3 31.0

-------------------------------- --------------------------- --------------------------- --------------------------

Consolidated Condensed Statement of Changes in Equity (Unaudited)

Share premium Share options

Share capital account reserve Other reserves Retained earnings Total

GBPm GBPm GBPm GBPm GBPm GBPm

=================== ============= ================== =================== ============== ================= ======

At 25 January 2020 4.7 0.9 1.4 - 201.3 208.3

Profit for the

period - - - - 1.9 1.9

Other comprehensive

expense - - - - (0.1) (0.1)

------------------- ------------- ------------------ ------------------- -------------- ----------------- ------

Total comprehensive

income for the

period - - - - 1.8 1.8

Company shares

purchased for use

by employee

benefit trusts

(Note 18) - - - - (0.1) (0.1)

Recognition of

share-based

payment costs - - (0.1) - - (0.1)

At 25 July 2020 4.7 0.9 1.3 - 203.0 209.9

------------------- ------------- ------------------ ------------------- -------------- ----------------- ------

Consolidated Condensed Statement of Changes in Equity (Unaudited)

At 26 January 2019

as previously

reported 4.7 0.9 2.4 (0.2) 202.0 209.8

Impact of IFRS 16 - - - - (0.3) (0.3)

=================== ============= ================== =================== ============== ================= ======

At 26 January 2019

restated 4.7 0.9 2.4 (0.2) 201.7 209.5

Profit for the

period - - - - 10.8 10.8

Other comprehensive

income - - - 0.4 1.1 1.5

------------------- ------------- ------------------ ------------------- -------------- ----------------- ------

Total comprehensive

income for the

period - - - 0.4 11.9 12.3

Company shares

purchased for use

by employee

benefit trusts

(Note 18) - - - - (1.0) (1.0)

Recognition of

share-based

payment costs - - 0.5 - - 0.5

Transfer of reserve

on share award - - (0.6) - 0.6 -

Deferred tax on

items taken

directly to

reserves - - (0.1) - - (0.1)

Repurchase and

cancellation of

shares - - - - (2.5) (2.5)

Dividends paid - - - - (14.4) (14.4)

------------------- ------------- ------------------ ------------------- -------------- ----------------- ------

At 27 July 2019 4.7 0.9 2.2 0.2 196.3 204.3

------------------- ------------- ------------------ ------------------- -------------- ----------------- ------

Consolidated Condensed Statement of Changes in Equity (Audited)

Share premium

Share capital account Share options reserve Other reserves Retained earnings Total

GBPm GBPm GBPm GBPm GBPm GBPm

================= ============= ================ ====================== ================= ================= ======

At 26 January

2019 previously

reported 4.7 0.9 2.4 (0.2) 202.0 209.8

Impact of IFRS 16 - - - - (0.3) (0.3)

================= ============= ================ ====================== ================= ================= ======

At 26 January

2019 restated 4.7 0.9 2.4 (0.2) 201.7 209.5

Profit for the

year - - - - 29.8 29.8

Other

comprehensive

income - - - 0.2 1.0 1.2

----------------- ------------- ---------------- ---------------------- ----------------- ----------------- ------

Total

comprehensive

income for the

year - - - 0.2 30.8 31.0

Company shares

purchased for

use by employee

benefit trusts

(Note 18) - - - - (1.4) (1.4)

Proceeds on

disposal of

shares by

employee benefit

trusts (Note 18) - - - - 0.1 0.1

Recognition of

share-based

payment costs - - (0.2) - - (0.2)

Transfer of

reserve on share

award - - (0.6) - 0.6 -

Deferred tax on

items taken

direct to

reserves - - (0.2) - - (0.2)

Repurchase and

cancellation of

shares - - - - (11.5) (11.5)

Dividends paid - - - - (19.0) (19.0)

----------------- ------------- ---------------- ---------------------- ----------------- ----------------- ------

At 25 January

2020 4.7 0.9 1.4 - 201.3 208.3

----------------- ------------- ---------------- ---------------------- ----------------- ----------------- ------

Consolidated Condensed Statement of Financial Position

Unaudited Unaudited Audited

As at 25 July As at 25 January

2020 As at 27 July 2019 2020

Note GBPm GBPm GBPm

----------------- ------------- ---------------- ---------------------- -------------------

Non-current

assets

Intangible assets 12 92.3 102.4 101.8

Property, plant

and equipment 13 97.0 98.5 101.2

Right-of-use

assets 6.4 7.9 7.6

Investment in

associates 0.8 0.9 0.9

----------------- ------------- ---------------- ---------------------- -------------------

196.5 209.7 211.5

----------------- ------------- ---------------- ---------------------- -------------------

Current assets

Inventories 18.4 23.6 18.3

Trade and other

receivables 54.3 56.4 57.2

Derivative

financial

instruments 15 0.1 0.1 -

Assets classified

as held for sale 14 0.4 - -

Current tax asset 0.4 - -

Cash and cash

equivalents 90.4 9.0 10.9

----------------- ------------- ---------------- ---------------------- -------------------

164.0 89.1 86.4

----------------- ------------- ---------------- ---------------------- -------------------

Total assets 360.5 298.8 297.9

----------------- ------------- ---------------- ---------------------- -------------------

Current

liabilities

Loans and other

borrowings 16 59.9 4.4 -

Trade and other

payables 59.5 54.8 52.4

Derivative

financial

instruments 15 0.1 - 0.1

Lease liabilities 16 3.0 3.0 3.2

Provisions 0.3 0.4 1.2

Current tax

liabilities - 2.0 3.0

----------------- ------------- ---------------- ---------------------- -------------------

122.8 64.6 59.9

----------------- ------------- ---------------- ---------------------- -------------------

Non-current

liabilities

Deferred tax

liabilities 14.5 14.1 14.5

Lease liabilities 16 3.6 5.1 4.7

Retirement

benefit

obligations 17 9.7 10.7 10.5

----------------- ------------- ---------------- ---------------------- -------------------

27.8 29.9 29.7

----------------- ------------- ---------------- ---------------------- -------------------

Capital and

reserves

attributable to

equity holders

Share capital 4.7 4.7 4.7

Share premium

account 0.9 0.9 0.9

Share options

reserve 1.3 2.2 1.4

Other reserves - 0.2 -

Retained earnings 203.0 196.3 201.3

----------------- ------------- ---------------- ---------------------- -------------------

209.9 204.3 208.3

----------------- ------------- ---------------- ---------------------- -------------------

Total equity and

liabilities 360.5 298.8 297.9

----------------- ------------- ---------------- ---------------------- -------------------

Consolidated Condensed Cash Flow

Statement

Unaudited Unaudited Audited

6 months ended 25 July 2020 6 months ended 27 July 2019 Year ended 25 January 2020

GBPm GBPm GBPm

================================ =========================== =========================== ==========================

Operating activities

Profit for the period before tax 5.1 13.5 37.4

Adjustments for:

Interest payable 0.4 0.3 0.6

Depreciation of property, plant

and equipment 5.4 5.4 11.7

Amortisation of intangible

assets 0.6 0.7 1.3

Share-based payment costs (0.1) 0.5 (0.2)

Share of results of associates 0.1 0.1 0.1

Impairment of intangibles assets 8.9 - -

Impairment of fixed assets 1.1 - -

Exceptional income - - (0.2)

================================ =========================== =========================== ==========================

Operating cash flows before

movements in working capital 21.5 20.5 50.7

(Increase)/decrease in

inventories (0.1) (3.2) 1.8

Decrease in receivables 2.9 1.3 2.1

Increase/(decrease) in payables 7.5 (1.0) (4.5)

Difference between employer

pension contributions and

amounts recognised in the

income statement (1.7) (1.6) (2.1)

-------------------------------- --------------------------- --------------------------- --------------------------

Cash generated by operations 30.1 16.0 48.0

Tax on profit paid (6.1) (4.3) (7.9)

-------------------------------- --------------------------- --------------------------- --------------------------

Net cash from operating

activities 24.0 11.7 40.1

Investing activities

Acquisition of investment in

associate - (1.0) (1.0)

Purchase of property, plant and

equipment (2.8) (8.4) (14.8)

Proceeds on sale of property,

plant and equipment - - 0.1

Net cash used in investing

activities (2.8) (9.4) (15.7)

Financing activities

New loans received 60.0 12.0 29.5

Loans repaid - (12.0) (29.5)

Lease payments (1.6) (1.6) (3.3)

Purchase of Company shares by

employee benefit trusts (0.1) (1.0) (1.4)

Proceeds from disposal of

Company shares by employee

benefit trusts - - 0.1

Repurchase of own shares - (2.5) (11.5)

Dividends paid - (14.4) (19.0)

Interest paid - - (0.2)

-------------------------------- =========================== --------------------------- --------------------------

Net cash used in financing

activities 58.3 (19.5) (35.3)

Net increase/(decrease) in cash

and cash equivalents 79.5 (17.2) (10.9)

-------------------------------- --------------------------- --------------------------- --------------------------

Cash and cash equivalents at

beginning of period 10.9 21.8 21.8

================================ =========================== =========================== ==========================

Cash and cash equivalents at end

of period 90.4 4.6 10.9

-------------------------------- --------------------------- --------------------------- --------------------------

Notes to the Consolidated Condensed Financial Statements

1 General information

A.G. BARR p.l.c. ('the Company') and its subsidiaries (together 'the Group') manufacture,

market, distribute and sell soft drinks, ready to drink cocktails and cocktail solutions.

The Group has manufacturing sites in the UK and sells mainly to customers in the UK with some

international sales.

The Company is a public limited company, which is listed on the London Stock Exchange and

incorporated and domiciled in Scotland. The address of its registered office is A.G. BARR

p.l.c., Westfield House, 4 Mollins Road, Cumbernauld, G68 9HD.

This consolidated condensed interim financial information does not comprise statutory accounts

within the meaning of section 434 of the Companies Act 2006. Statutory accounts for the year

ended 25 January 2020 were approved by the Board of directors on 8 April 2020 and delivered

to the Registrar of Companies. The comparative figures for the financial year ended 25 January

2020 are an extract of the Company's statutory accounts for that year. The report of the auditor

on those accounts was unqualified, did not contain an emphasis of matter paragraph and did

not contain any statement under section 498 (2) or (3) of the Companies Act 2006.

This consolidated condensed interim financial information is unaudited but has been reviewed

by the Company's Auditor.

2 Basis of preparation

This consolidated condensed interim financial information for the six months ended 25 July

2020 has been prepared in accordance with the Disclosure and Transparency Rules of the Financial

Conduct Authority and with IAS 34, 'Interim Financial Reporting' as adopted by the European

Union. The consolidated condensed interim financial information should be read in conjunction

with the annual financial statements for the year ended 25 January 2020, which have been prepared

in accordance with IFRSs as adopted by the European Union.

Going concern basis

The directors have reviewed a number of future trading scenarios for the purposes of going

concern in light of the current environment. The Group has continued trading throughout the

COVID-19 period and the directors have used the experience gained through the last six months

to inform the reasonable variability of trading in these scenarios. In addition, although

we consider the likelihood of such a scenario arising remote, we have modelled a severe downturn

in sales in order to stress test the Group's liquidity. This scenario assumed a 50% reduction

in like for like sales compared to the base forecast, with no cost mitigation. This assessment

concluded that the Group would operate within its existing overdraft facilities over the 12

months to September 2021, and would not require access to any loan funding or government support.

The Group has a GBP60m revolving credit facility (RCF) which matures in February 2022 (GBP40m)

and February 2025 (GBP20m) all of which was drawn down as a prudent contingency measure but

which is currently unused. The Group is compliant with all covenants on this funding and,

under all reasonable forecasts, this remains the case for the going concern period. The next

testing of covenant compliance will be based on January 2021 results. The Group has cash funds

of GBP30.4m as at 27 July 2020 excluding the GBP60m RCF. In addition, in June 2020 the Group

qualified for, but have not accessed, GBP125m of Bank of England Covid Corporate Financing

Facilities (CCFF). It was not necessary to take access to CCFF or RCF funding into account

in forming the conclusion on going concern.

Based on this assessment, the directors have formed a judgement that there is a reasonable

expectation the Group will have adequate resources to continue in operational existence for

the foreseeable future. Furthermore the directors believe that the funding options available

to the Group provide a level of liquidity and flexibility that will allow both management

of the ongoing COVID situation and the continued investment in the business to support our

long term growth prospects.

3 Accounting policies

The accounting policies applied are consistent with those of the annual financial statements

for the year ended 25 January 2020 and corresponding interim reporting period. In addition

to these, the Group has also applied a new accounting policy following the receipt of government

grants during the six month period ended 25 July 2020 in the form of furlough income.

The Group recognises government grants in accordance with IAS 20. These grants are received

by the Group in the UK in the form of furlough payments made by the Government under the Coronavirus

Job Retention Scheme ('JRS'). The grants received by the Group are recognised in the income

statement and matched against the costs that the grants are intended to compensate and are

therefore shown net. Furlough income included under this JRS and included within the income

statement at 25 July 2020 amounted to GBP1.3 million.

A number of amended standards became applicable for the current reporting period. The application

of these amendments has not had any material impact on the disclosures, net assets or results

of the Group.

4 Principal risks and uncertainties

The directors consider that the principal risks and uncertainties which could have a material

impact on the Group's performance in the balance of the financial year remain the same as

those stated on pages 42 - 47 of the Group's annual financial statements as at 25 January

2020, which are available on our website, www.agbarr.co.uk. These are summarised below:

- Changes in consumer preferences, perception or purchasing behaviour

- Consumer rejection of reformulated products

- Loss of product integrity

- Loss of continuity of supply of major raw materials

- Adverse publicity in relation to the soft drinks industry, the Group or its brands

- Government intervention on climate change and environmental issues e.g. packaging waste

- Failure to maintain customer relationships or take account of changing market dynamics

- Inability to protect the Group's intellectual property rights

- Failure of the Group's operational infrastructure

- Failure of critical IT systems or a breach of cyber security

- Financial risks

- Third party relationships

- Impact of the current COVID-19 environment on the business

The volatile and uncertain economic environment created by the UK's decision to leave the

European Union ('EU') has continued over the past six months. Like many other businesses,

we have continued to monitor developments in this area. Overseen by the Risk Committee, the

Company Brexit working group has continued to monitor the potential impact of Brexit on the

Group and to take appropriate actions to ensure that the business is as well prepared as possible

for Brexit. The Brexit working group has prepared for a range of Brexit outcomes, including

"no deal". Given the continuing uncertainty regarding the outcome of Brexit, it is challenging

to quantify or determine the impact of Brexit on the Group. However, given that the Group

is a UK-based Group whose sales are predominantly made in the UK, our ongoing assessment is

that Brexit will not have a significant impact on the Group.

5 Financial risk management and financial instruments

The Group's activities expose it to a variety of financial risks: market risk (including foreign

exchange risk, cash flow and fair value interest rate risk and price risk), credit risk and

liquidity risk.

The condensed interim financial statements should be read in conjunction with the Group's

annual financial statements as at 25 January 2020 as they do not include all financial risk

management information and disclosures contained within the annual financial statements. There

have been no changes in the risk management policies since the year end.

6 Segment reporting

The Group's Executive Committee has been identified as the chief operating decision-maker.

The Executive Committee reviews the Group's internal reporting in order to assess performance

and allocate resources. The Executive Committee has determined the operating segments based

on these reports.

The Executive Committee considers the business from a product perspective. This led to the

operating segments identified in the table below: there has been no change to the segments

during the period (after aggregation).

The performance of the operating segments is assessed by reference to their gross profit.

6 months ended 25 July 2020

Carbonates Still drinks and water Funkin Total

GBPm GBPm GBPm GBPm

-------------------------------------- --------------- ------------------------------ -------- -------

Total revenue 93.6 13.1 6.5 113.2

Gross profit 42.7 2.9 2.7 48.3

----------------------------------------- --------------- ------------------------------ -------- =======

6 months ended 27 July 2019

Carbonates Still drinks and water Funkin Total

GBPm GBPm GBPm GBPm

-------------------------------------- --------------- ------------------------------ -------- -------

Total revenue 91.2 21.7 9.6 122.5

Gross profit 40.8 5.3 4.6 50.7

----------------------------------------- --------------- ------------------------------ -------- =======

Year ended 25 January 2020

Carbonates Still drinks and water Funkin Total

GBPm GBPm GBPm GBPm

-------------------------------------- --------------- ------------------------------ -------- -------

Total revenue 196.4 40.1 19.2 255.7

Gross profit 88.6 8.6 8.9 106.1

----------------------------------------- --------------- ------------------------------ -------- -------

There are no material intersegment sales. All revenue is in relation to product sales, which

is recognised at point in time, upon delivery to the customer.

"Carbonates" segments represent the sale of carbonates and other soft drink related items.

The gross profit from the segment reporting is stated before exceptional costs.

The gross profit before exceptional items from the segment reporting is reconciled to the

total profit before income tax as shown in the consolidated condensed income statement.

All of the assets and liabilities of the Group are managed by the Executive Committee on a

central basis rather than at a segment level. As a result no reconciliations of segment assets

and liabilities to the consolidated condensed statement of financial position has been disclosed

for any of the periods presented.

Included in revenues arising from Carbonates, Still drinks and water and Funkin are revenues

of approximately GBP22m which arose from sales to the Group's largest customer. In the year

ended 25 January 2020 and six months ended 27 July 2019, revenues of approximately GBP41m

and GBP21m respectively arose from sales to the Group's largest customer. No other single

customers contributed 10 per cent or more to the Group's revenue in the comparative period

to July 2019 or January 2020.

All of the segments included within "Carbonates" and "Still drinks and water" meet the aggregation

criteria set out in IFRS 8 Operating Segments.

7 Seasonality of operations

Revenues and reported profits are affected by weather conditions, the timing of marketing

investment and execution of promotional activity. As a result it is anticipated that the reported

profits for the second half of the year to January 2021 will be higher than those for the

six months ended 25 July 2020.

8 Operating profit

The following items have been charged to operating profit during the period:

6 months ended 25 July 2020 6 months ended 27 July 2019 Year ended 25 January 2020

GBPm GBPm GBPm

---------------------------- --------------------------- --------------------------- --------------------------

Impairment of inventories 0.1 0.2 0.8

Impairment of brands 7.0 - -

Impairment of goodwill 1.9 - -

Impairment of property, plant

and equipment 1.1 - -

Foreign exchange gains

recognised (0.2) (0.1) (0.2)

------------------------------- --------------------------- --------------------------- --------------------------

Inventories are stated at the lower of cost and net realisable value. Net realisable value

is the estimated selling price in the ordinary course of business less the estimated costs

of completing production and selling expenses.

The items discussed below have been classified as exceptional. The Group identifies items

as exceptional where the nature or scale of the items requires to be separately presented

in order to better understand trading performance.

The items that have been included in exceptional items have been analysed in the table below:

6 months ended 25 July 2020 6 months ended 27 July 2019 Year ended 25 January 2020

GBPm GBPm GBPm

---------------------------- --------------------------- --------------------------- --------------------------

Wind turbine removal - - (1.8)

Simplification and

standardisation of operations - - 1.1

Impairment of Strathmore brand

(Note 8) 7.0 - -

Impairment of Strathmore

goodwill (Note 8) 1.9 - -

Impairment of Strathmore

property, plant and equipment

(Note 9) 1.1 - -

Redundancy costs for business

reorganisation and restructure 1.5 0.4 0.7

=============================== =========================== =========================== ==========================

Net exceptional charge 11.5 0.4 -

------------------------------- --------------------------- --------------------------- --------------------------

During the six months ended 25 July 2020 costs of GBP1.5m were incurred relating to the ongoing

change programme within the business which commenced in the year to 25 January 2020 noted

below.

In addition, the hospitality sector has been significantly challenged by the lockdown measures

over recent months. This has impacted on Strathmore performance given a significant proportion

of Strathmore sales are made in this sector. As a result, an impairment review of the Strathmore

Water business operations was undertaken which resulted in the impairment of the Strathmore

brand of GBP7.0m, goodwill of GBP1.9m and property, plant and equipment of GBP1.1m. Due to

their nature management believes that these are required to be separately presented in trading

performance so as not mislead the users of the financial statements. These costs are included

in 'Operating expenses' in the income statement.

In the year to 25 January 2020 income of GBP1.8m was received for compensation for the removal

of a wind turbine at our Cumbernauld site. Management believe that this should be treated

as exceptional due to the non-recurring nature and size of the income received. Additionally,

the Group embarked on a change programme with the aim of returning the soft drinks business

to long-term sustainable growth. The programme had two main objectives:

- to simplify and standardise our operations by significantly rationalising our portfolio

including simplifying our core brand ranges and routes to market. This involved discontinuing

certain product lines and formats at a cost of GBP0.6m and the closure of our Sheffield sales

depot in March 2020 at a cost of GBP0.5m (primarily redundancy costs).

- to strategically restructure and refocus the business so that resources and investment

target those areas with the greatest profitable growth opportunities. This initiative will

deliver a more contribution focussed Commercial team prioritised on our core brands and a

Supply Chain organisation that optimises the balance between agility, resilience and capacity.

As a result the Group has incurred exceptional costs related to employee severance of GBP0.7m.

During the six months ended 27 July 2019 costs of GBP0.4m were incurred relating to the initial

costs of the ongoing reorganisation within the business.

9 Tax on profit

The total tax charge is GBP3.2m (six months ended 27 July 2019: GBP2.7m; year ended 25 January

2020: GBP7.6m) which equated to an effective tax rate of 62.7% (six months ended 27 July 2019:

20.0%; year ended 25 January 2020: 20.3%). The effective tax rate in the current year has

increased as a result of the remeasurement of deferred tax balances. In March 2020, the UK

government announced that the corporation tax rate would remain at 19% effective from 1 April

2020 (previously 17%) which was substantively enacted on 17 March 2020. The impact of this

was a one-off increase in the deferred tax charge of GBP2.2m. Excluding this adjustment the

effective tax rate for the six months ended 25 July 2020 was 20.1%.

6 months ended 25 July 2020 6 months ended 27 July 2019 Year ended 25 January 2020

Analysis of tax charge GBPm GBPm GBPm

---------------------------- --------------------------- --------------------------- --------------------------

Current income tax charge 2.6 2.7 6.9

Deferred income tax charge 0.6 - 0.7

=============================== =========================== =========================== ==========================

Total tax charge in the

condensed income statement 3.2 2.7 7.6

------------------------------- --------------------------- --------------------------- --------------------------

10 Earnings per share

Basic earnings per share has been calculated by dividing the earnings attributable to equity

holders of the parent by the weighted average number of shares in issue during the year, excluding

shares held by the employee share scheme trusts.

6 months ended 25 July 2020 6 months ended 27 July 2019 Year ended 25 January 2020

=========================== =========================== =========================== ==========================

Profit attributable to equity

holders of the Company (GBPm) 1.9 10.8 29.8

Weighted average number of

ordinary shares in issue 111,175,040 112,895,598 112,452,517

------------------------------- --------------------------- --------------------------- --------------------------

Basic earnings per share

(pence) 1.71 9.57 26.50

------------------------------- --------------------------- --------------------------- --------------------------

For diluted earnings per share, the weighted average number of ordinary shares in issue is

adjusted to assume conversion of all potentially dilutive ordinary shares. These represent

share options granted to employees where the exercise price is less than the average market

price of the Company's ordinary shares during the period. The number of shares calculated

as above is compared with the number of shares that would have been issued assuming the exercise

of the share options.

6 months ended 25 July 2020 6 months ended 27 July 2019 Year ended 25 January 2020

=========================== =========================== =========================== ==========================

Profit attributable to equity

holders of the Company (GBPm) 1.9 10.8 29.8

Weighted average number of

ordinary shares in issue 111,175,040 112,895,598 112,452,517

Adjustment for dilutive effect

of share options - 141,506 57,931

------------------------------- --------------------------- --------------------------- --------------------------

Diluted weighted average number

of ordinary shares in issue 111,175,040 113,037,104 112,510,448

------------------------------- --------------------------- --------------------------- --------------------------

Diluted earnings per share

(pence) 1.71 9.55 26.49

------------------------------- --------------------------- --------------------------- --------------------------

The adjusted EPS figure is calculated by using profit attributable to equity holders before

exceptional items:

6 months ended 25 July 2020 6 months ended 27 July 2019 Year ended 25 January 2020

=========================== =========================== =========================== ==========================

Profit attributable to equity

holders of the Company before

exceptional items (GBPm) 11.7 11.1 29.8

Weighted average number of

ordinary shares in issue 111,175,040 112,895,598 112,452,517

------------------------------- --------------------------- --------------------------- --------------------------

Earnings per share before

exceptional items (pence) 10.52 9.83 26.50

------------------------------- --------------------------- --------------------------- --------------------------

This measure has been included in the financial statements as it provides a closer guide to

the underlying financial performance as the calculation excludes the effect of exceptional

items.

11 Dividends paid and proposed

6 months ended 6 months ended Year ended 25 6 months ended 6 months ended Year ended 25

25 July 2020 27 July 2019 January 2020 25 July 2020 27 July 2019 January 2020

per share per share

(p) (p) per share (p) GBPm GBPm GBPm

---------------- -------------- -------------- -------------- -------------- -------------- ---------------

Paid final dividend - 12.74 12.74 - 14.4 14.5

Paid interim

dividend - - 4.00 - - 4.5

-------------------- ============== ============== ============== ============== ============== ===============

- 12.74 16.74 - 14.4 19.0

-------------------- ============== ============== ============== ============== ============== ===============

The Board reviews the Group's capital allocation policy annually. The Group's capital allocation

framework defines its priorities for uses of cash, underpinned by its principle to maintain

a strong balance sheet with solid investment grade credit metrics. The framework has four

priorities for the use of cash generated from operations:

- re-investment in the business to drive organic growth;

- maintaining a progressive dividend policy;

- continuing to pursue selective strategic investment; and

- to the extent that there is surplus capital to these needs, provide additional returns

to shareholders.

While the capital allocation policy will remain in place for the long term, as a result of

the impact of COVID-19 the Board has reviewed actions to safeguard the business as a temporary

modification of the policy. While funding organic growth remains the Board's first priority,

pressure on profit and cash in the short term requires a reduction in operating and capital

expenditure. With a focus on capital retention and sourcing of capital during the current

period, the Board has decided to suspend capital returns to shareholders until there is greater

visibility on market recovery.

12 Intangible assets

6 months ended 25 July 2020 6 months ended 27 July 2019 Year ended 25 January 2020

GBPm GBPm GBPm

----------------------- ---------------------------- --------------------------- --------------------------

Opening net book value 101.8 103.1 103.1

Impairment (8.9) - -

Amortisation (0.6) (0.7) (1.3)

--------------------------- ---------------------------- --------------------------- --------------------------

Closing net book value 92.3 102.4 101.8

--------------------------- ---------------------------- --------------------------- --------------------------

The amortisation charge for the six months ended 25 July 2020 represents GBP0.6m (six months

ended 27 July 2019: GBP0.7m; year ended 25 January 2020: GBP1.3m) of charges in relation to

the Business Process Redesign project and GBPnil (six months ended 27 July 2019: GBP0.1m;

year ended 25 January 2020: GBP0.1m) of charges for Funkin customer lists.

The Group tests whether there has been any impairment of intangibles assets on an annual basis

or when there is an indication of impairment. The recoverable amount of a CGU is determined

based on value in use calculations. These calculations use pre-tax cash flow projections based

on financial forecasts approved by management which cover a three year period. Cash flows

beyond the three years are extrapolated using the growth rates and other key assumptions.

In light of COVID-19 a full impairment exercise has been completed on all CGUs as at 25 July

2020. The hospitality sector has been significantly challenged by the lockdown measures over

recent months. This has impacted on Strathmore performance given a significant proportion

of Strathmore sales are made in this sector and as a result the assets of the Strathmore operating

unit have been impaired by GBP7.0m of brand and GBP1.9m of goodwill being the total value

of the assets. The impairment reviews did not identify any other areas of impairment. The

following growth rates and key assumptions were used for the Strathmore operating unit:

Key assumptions 6 months ending 25 July 2020 6 months ended 27 July 2019 Year ended 25 January 2020

----------------------- ---------------------------- --------------------------- --------------------------

Gross margin (%) 19.8 32.2 32.2

Growth rate (%) - 2.5 2.5

Discount rate (%) 11.1 11.1 11.1

--------------------------- ---------------------------- --------------------------- --------------------------

13 Property, plant and equipment

The closing balance includes GBP13.6m (as at 27 July 2019: GBP10.0m; as at 25 January 2020:

GBP14.4m) of assets under construction.

The Strathmore Water business was tested for impairment resulting in the impairment of land

and buildings of GBP0.4m and plant and equipment of GBP0.7m. Further details are included

in Note 12.

14 Assets held for sale

The property related to the distribution depot at Sheffield has been presented as held for

sale following the closure of the site in March 2020. The property is currently under offer.

15 Financial instruments

Current assets of GBP0.1m (at 27 July 2019: GBP0.1m; 25 January 2020: GBPnil) relate to forward

foreign currency contracts with a maturity of less than 12 months and are recognised at fair

value through the cash flow hedge reserve, included within other reserves.

Current liabilities of GBP0.1m (at 27 July 2019: GBPnil; 25 January 2020: GBP0.1m) relate

to forward foreign currency contracts with a maturity of less than 12 months and are recognised

as fair value through the cash flow hedge reserve, included within other reserves.

Fair value hierarchy

Fair value hierarchies 1 to 3 are based on the degree to which fair value is observable:

Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities

Level 2: inputs other than quoted prices included within Level 1 that are observable for the

asset or liability,

either directly (i.e. as

prices) or indirectly

(i.e. derived from

prices)

Level 3: inputs for the asset or liability that are not based on observable market data

The fair value of financial instruments that are not traded in an active market (for example,

over-the-counter derivatives) is determined by using valuation techniques. These valuation

techniques maximise the use of observable market data where it is available and rely as little

as possible on entity specific estimates. The fair value of the forward foreign exchange contracts

is determined using forward exchange rates at the date of the consolidated condensed statement

of financial position, with the resulting value discounted accordingly as relevant.

All financial instruments carried at fair value are Level 2.

Fair values of financial assets and financial liabilities

The following table shows the carrying amounts and fair values of financial assets and financial

liabilities. It does not include fair value information for financial assets and financial

liabilities not measured at fair value if the carrying amount is a reasonable approximation

of fair value.

Carrying amount

========================= ------------------------------------------------------------------------------------

Other financial

Fair value - hedging Other financial assets liabilities at amortised

instruments at amortised cost cost Total

As at 25 July 2020 GBPm GBPm GBPm GBPm

------------------------- ------------------------- ------------------------ ------------------------ -----

Financial assets

Foreign exchange contracts

used for hedging 0.1 - - 0.1

Trade receivables - 51.7 - 51.7

Cash and cash equivalents - 90.4 - 90.4

----------------------------- ------------------------- ------------------------ ------------------------ -----

0.1 142.1 - 142.2

----------------------------- ------------------------- ------------------------ ------------------------ -----

Financial liabilities

Foreign exchange contracts

used for hedging 0.1 - - 0.1

Lease liabilities - - 6.6 6.6

Unsecured bank borrowings - - 59.9 59.9

Trade payables - - 19.5 19.5

----------------------------- ------------------------- ------------------------ ------------------------ -----

0.1 - 86.0 86.1

----------------------------- ------------------------- ------------------------ ------------------------ -----

Carrying amount

=========================== -----------------------------------------------------------------------------------------

Other financial

Fair value - hedging Other financial assets at liabilities at amortised

instruments amortised cost cost Total

As at 27 July 2019 GBPm GBPm GBPm GBPm

--------------------------- -------------------------- -------------------------- -------------------------- -----

Financial assets

Foreign exchange contracts

used for hedging 0.1 - - 0.1

Trade receivables - 52.9 - 52.9

Cash and cash equivalents - 9.0 - 9.0

--------------------------- -------------------------- -------------------------- -------------------------- -----

0.1 61.9 - 62.0

--------------------------- -------------------------- -------------------------- -------------------------- -----

Financial liabilities

Lease liabilities - - 8.1 8.1

Unsecured bank borrowings - - 4.4 4.4

Trade payables - - 23.9 23.9

--------------------------- -------------------------- -------------------------- -------------------------- -----

- - 36.4 36.4

--------------------------- -------------------------- -------------------------- -------------------------- -----

Carrying amount

=========================== -----------------------------------------------------------------------------------------

Other financial

Fair value - hedging Other financial assets at liabilities at amortised

instruments amortised cost cost Total

As at 25 January 2020 GBPm GBPm GBPm GBPm

--------------------------- -------------------------- -------------------------- -------------------------- -----

Financial assets

Trade receivables - 55.1 - 55.1

Cash and cash equivalents - 10.9 - 10.9

--------------------------- -------------------------- -------------------------- -------------------------- -----

- 66.0 - 66.0

--------------------------- -------------------------- -------------------------- -------------------------- -----

Financial liabilities

Foreign exchange contracts

used for hedging 0.1 - - 0.1

Lease liabilities - - 7.9 7.9

Trade payables - - 14.3 14.3

--------------------------- -------------------------- -------------------------- -------------------------- -----

0.1 - 22.2 22.3

--------------------------- -------------------------- -------------------------- -------------------------- -----

16 Borrowings and loans

Movements in borrowings are analysed as follows:

6 months ended 25 July

2020 6 months ended 27 July 2019 Year ended 25 January 2020

GBPm GBPm GBPm

--------------------------- -------------------------- --------------------------- ---------------------------

Opening borrowings balance 7.9 - -

Adjustment on transition to

IFRS 16 - 9.4 9.4

Net lease payments (1.3) (1.3) (1.5)

Borrowings made 60.0 12.0 29.5

Amortisation of loan

arrangement fee (0.1) - -

Repayments of borrowings - (12.0) (29.5)

Bank overdrafts drawn - 4.4 -

------------------------------- -------------------------- --------------------------- ---------------------------

Closing borrowings balance 66.5 12.5 7.9

------------------------------- -------------------------- --------------------------- ---------------------------

The reconciliation of the above closing borrowings balance to the figures on the face of the

consolidated condensed statement of financial position is as follows:

As at 25 July 2020 As at 27 July 2019 As at 25 January 2020

GBPm GBPm GBPm

--------------------------- -------------------------- --------------------------- ---------------------------

Overdraft - 4.4 -

Closing loan balance 59.9 - -

Lease liabilities 6.6 8.1 7.9

------------------------------- -------------------------- --------------------------- ---------------------------

Total borrowings and loans 66.5 12.5 7.9

------------------------------- -------------------------- --------------------------- ---------------------------

Disclosed as

Current liabilities 62.9 7.4 3.2

Non-current liabilities 3.6 5.1 4.7

=============================== ========================== =========================== ===========================

The reconciliation to net debt is as follows:

As at 25 July 2020 As at 27 July 2019 As at 25 January 2020

GBPm GBPm GBPm

=========================== -------------------------- --------------------------- ---------------------------

Closing borrowings balance (66.5) (12.5) (7.9)

Cash and cash equivalents 90.4 9.0 10.9

------------------------------- -------------------------- --------------------------- ---------------------------

Net funds/(deficit) 23.9 (3.5) 3.0

------------------------------- -------------------------- --------------------------- ---------------------------

The drawn/undrawn facilities at 25 July 2020 are as follows:

Total facility Drawn Undrawn

GBPm GBPm GBPm

--------------------------- -------------------------- --------------------------- ---------------------------

Revolving credit facilities 60.0 60.0 -

Overdraft 5.0 - 5.0

------------------------------- -------------------------- --------------------------- ---------------------------

65.0 60.0 5.0

------------------------------- -------------------------- --------------------------- ---------------------------

During the year to 27 January 2018 the Group entered into three revolving credit facilities

of periods of 3 - 5 years with Royal Bank of Scotland plc, Bank of Scotland plc and HSBC plc.

These facilities provided GBP60m of sterling debt facilities to February 2020, reducing to

GBP20m from February 2020 to February 2022. The Group reached agreement with its lenders,

on 18 March 2019 to extend those facilities, due to expire in 2020 and 2022, to 2022 and 2024.

Further, in March 2020 the Group reached agreement to extend the facility due to expire in

2024 to 2025. This is summarised in the table below:

Date of agreement

January March March

2018 2019 2020

Maturity GBPm GBPm GBPm

--------------------------- -------------------------- --------------------------- ---------------------------

February 2020 40.0 - -

February 2022 20.0 40.0 40.0

February 2024 - 20.0 -

February 2025 - - 20.0

------------------------------- -------------------------- --------------------------- ---------------------------

In March 2020 the facilities were drawn down in full as a contingency measure as a result

of COVID-19.

A total arrangement fee of GBP0.3m was incurred and is being amortised over the life of the

loan facilities.

Retirement benefit

17 obligations

On 1 May 2016 the A.G. BARR p.l.c (2008) Pension and Life Assurance Scheme was closed to future

accrual following a negotiated agreement between the Company and the board of trustees.

The defined retirement benefit scheme had a deficit of GBP9.7m as at 25 July 2020 (as at 27

July 2019: GBP10.7m, 25 January 2020: GBP10.5m). The reconciliation of the closing deficit

is as follows:

6 months ended 25 July 2020 6 months ended 27 July 2019 Year ended 25 January 2020

GBPm GBPm GBPm

=========================== --------------------------- --------------------------- --------------------------

Opening present value of

obligation (127.3) (115.1) (115.1)

Current service cost -- (0.2)

Interest cost (1.1) (1.5) (3.0)

Remeasurement - changes in

financial assumptions (5.2) (12.5) (15.2)

Benefits paid 2.8 2.3 6.2

------------------------------- =========================== =========================== ==========================

Closing position (130.8) (126.8) (127.3)

------------------------------- =========================== =========================== ==========================

Opening fair value of plan

assets 116.8 101.6 101.6

Interest income 1.0 1.4 2.7

Remeasurement - actuarial

return on assets 4.4 13.8 16.4

Employer contributions 1.7 1.6 2.3

Benefits paid (2.8) (2.3) (6.2)

------------------------------- =========================== =========================== ==========================

Closing fair value of plan

assets 121.1 116.1 116.8

------------------------------- =========================== =========================== ==========================

As at 25 July 2020 As at 27 July 2019 As at 25 January 2020

GBPm GBPm GBPm

=========================== --------------------------- --------------------------- --------------------------

Closing present value of

obligation (130.8) (126.8) (127.3)

Closing fair value of plan

assets 121.1 116.1 116.8

------------------------------- =========================== =========================== ==========================

Closing net deficit (9.7) (10.7) (10.5)

------------------------------- =========================== =========================== ==========================

The key financial assumptions used to value the liabilities were as follows:

As at 25 July 2020 As at 27 July 2019 As at 25 January 2020

%% %

--------------------------- --------------------------- -------------------------- --------------------------

Discount rate 1.4 2.1 1.7

Inflation assumption 2.9 3.4 3.0

------------------------------- --------------------------- --------------------------- --------------------------

18 Movements in own shares held by employee benefit trusts

During the six months to 25 July 2020 the employee benefit trusts of

the Group acquired 22,763 (six months to 27 July 2019: 132,659; year

to 25 January 2020: 191,794) of the Company's shares. The total amount

paid to acquire the shares has been deducted from shareholders' equity

and is included within retained earnings. At 25 July 2020 the shares

held by the Company's employee benefit trusts represented 857,078 (27

July 2019: 799,725; 25 January 2020: 844,151) shares at a purchased

cost of GBP5.2m (27 July 2019: GBP4.9m; 25 January 2020: GBP5.1m).

9,836 (six months to 27 July 2019: 131,410; year to 25 January 2020:

146,119) shares were utilised in satisfying share options from the

Company's employee share schemes during the same period.

There have been no sales in the six months to 25 July 2020. The related

weighted average share price at the time of exercise for the six months

to 27 July 2019 was GBP8.13 per share and the year to 25 January 2020

GBP7.13 per share.

19 Contingencies and commitments

As at 25 July 2020 As at 27 July 2019 As at 25 January 2020

GBPm GBPm GBPm

---------------------------------- ------------------ ------------------ ---------------------

Commitments for the acquisition

of property, plant and equipment 1.4 5.0 1.7

-------------------------------------- ------------------ ------------------ ---------------------

20 Related party transactions

There have been no related party transactions in the first 26 weeks

of the current financial year which have materially affected the financial

position or performance of the Group.

Statement of Directors' Responsibilities

The directors confirm that these consolidated condensed interim financial statements have

been prepared in accordance with International Accounting Standard 34 Interim Financial Reporting,

as adopted by the European Union. The interim management report includes a fair review of

the information required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during the first six months and their

impact on the condensed set of financial statements, and a description of the principal risks

and uncertainties for the remaining six months of the financial year; and

-- material related party transactions in the first six months and any material changes in

the related party transactions described in the last annual report.

The directors of A.G. BARR p.l.c. are listed in the Annual Report and Accounts for the 52

weeks ended 25 January 2020.

For and on behalf of the Board of directors

Roger White Stuart Lorimer

Chief Executive Finance Director

22 September 2020 22 September 2020

Glossary

Non-GAAP measures are provided because they are tracked by management to assess the Group's

operating performance and to inform financial, strategic and operating decisions.

Definition of non-GAAP measures used are provided below:

Capital expenditure is a non-GAAP measure and is defined as the cash purchases of property,

plant and equipment and is disclosed in the consolidated condensed cash flow statement.

Cash flow generated from operations is a non-GAAP measure and is defined as cash generated

from operations and appears on the cash flow statement.

Earnings per share before exceptional items is a non-GAAP measure calculated by dividing

profit attributable to equity holders before exceptional items by the weighted average number

of shares in issue.

Net cash at bank is a non-GAAP measure deducting loan balances from cash and cash equivalents.

Operating margin before exceptional items is a non-GAAP measure calculated by dividing operating

profit before exceptional items by revenue.

Profit attributable to equity holders after exceptional items is a non-GAAP measure calculated

as profit attributable to equity holders less any exceptional items. This figure appears on

the consolidated condensed income statement.

Profit before tax and exceptional items is a non-GAAP measure calculated as profit before

tax less any exceptional items. This figure appears on the consolidated condensed income statement.

Working capital is a non-GAAP measure calculated inventories plus trade and other receivables

less trade and other payables.

Reconciliation of non-GAAP measures

Profit before tax and exceptional items 6 months ended 25 July 2020 6 months ended 27 July 2019

------------------------------------------ --------------------------- ---------------------------

Profit before tax 5.1 13.5

Exceptional items 11.5 0.4

------------------------------------------ --------------------------- ---------------------------

Profit before tax and exceptional items 16.6 13.9

------------------------------------------ --------------------------- ---------------------------

Operating profit before exceptional items 6 months ended 25 July 2020 6 months ended 27 July 2019

------------------------------------------ --------------------------- ---------------------------

Operating profit 5.6 13.9

Exceptional items 11.5 0.4

------------------------------------------ --------------------------- ---------------------------

Operating profit before exceptional items 17.1 14.3

------------------------------------------ --------------------------- ---------------------------

Operating margin before exceptional items 6 months ended 25 July 2020 6 months ended 27 July 2019

------------------------------------------ --------------------------- ---------------------------

Revenue 113.2 122.5

Operating profit before exceptional items 17.1 14.3

------------------------------------------ --------------------------- ---------------------------

Operating margin before exceptional items 15.1% 11.7%

------------------------------------------ --------------------------- ---------------------------

Working capital 6 months ended 25 July 2020 6 months ended 27 July 2019

------------------------------------------ --------------------------- ---------------------------

Inventories 18.4 23.6

Trade and other receivables 54.3 56.4

Trade and other payables (59.5) (54.8)

------------------------------------------ --------------------------- ---------------------------

Working capital 13.2 25.2

------------------------------------------ --------------------------- ---------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFSRALILFII

(END) Dow Jones Newswires

September 22, 2020 02:00 ET (06:00 GMT)

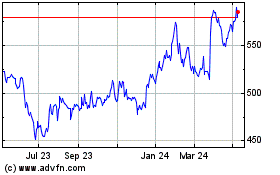

Barr (a.g.) (LSE:BAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

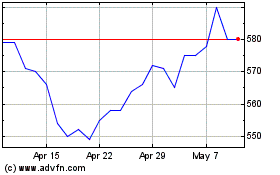

Barr (a.g.) (LSE:BAG)

Historical Stock Chart

From Apr 2023 to Apr 2024