British American Tobacco Pretax Profit Rises in 2020

February 17 2021 - 1:54AM

Dow Jones News

By Adria Calatayud

British American Tobacco PLC said Wednesday that pretax profit

for 2020 rose, driven by better-than-expected organic revenue

growth and cost savings, and that it expects a continuing impact

from the coronavirus pandemic this year.

The FTSE 100 cigarette maker--which houses the Kent, Dunhill and

Lucky Strike brands--said pretax profit for last year was 8.67

billion pounds ($12.06 billion), compared with GBP7.91 billion in

2019.

Adjusted profit from operations was GBP11.37 billion, up 4.8%,

BAT said.

Revenue for the full year was GBP25.78 billion, compared with

GBP25.88 billion. On a constant-currency adjusted basis, revenue

was up 3.3%, ahead of the company's expectations for organic

revenue at the high end of its 1% to 3% range, it said.

BAT said it expects constant-currency revenue growth of 3% to 5%

this year, and constant-currency adjusted earnings-per-share growth

in the mid-single figures, reflecting continued coronavirus

impacts.

The company said it is ahead of schedule in its plan to deliver

GBP1 billion of annualized cost savings by 2022 to fund investment

in new categories.

The board declared a full-year dividend of 215.6 pence a share,

up 2.5% on year.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

February 17, 2021 02:39 ET (07:39 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

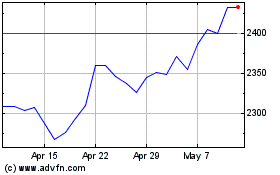

British American Tobacco (LSE:BATS)

Historical Stock Chart

From Mar 2024 to Apr 2024

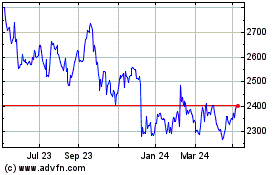

British American Tobacco (LSE:BATS)

Historical Stock Chart

From Apr 2023 to Apr 2024