Biden Administration Resparks an Old Danger for Cigarette Stocks -- Heard on the Street

April 20 2021 - 10:07AM

Dow Jones News

By Carol Ryan

U.S. cigarette companies are caught between hawkish regulators

and the scarring experience of Marlboro-maker Altria's disastrous

investment in vaping brand Juul. What is surprising is that this

predicament still has the capacity to catch investors off

guard.

On Monday afternoon, The Wall Street Journal reported that the

Biden administration is considering tighter tobacco regulations.

The trigger is a petition that the U.S. Food and Drug

Administration must respond to later this month, stating whether or

not it plans to ban menthol cigarettes. The White House is also

weighing whether to reduce the nicotine content of cigarettes to

make them less addictive.

On Tuesday, Altria fell 6% at the open, having already lost 6%

shortly before the Monday close. Europe-listed peers British

American Tobacco and Imperial Brands dropped 7%. Philip Morris

International, which controls Marlboro overseas, has been less

impacted. The company spun out its American business -- now Altria

-- in 2008 precisely to fend off this kind of risk.

Investors now dumping tobacco stocks have been complacent. The

dangers of a menthol ban and lower nicotine levels have been around

since mid-2017, and the Democrats are traditionally more hawkish on

tobacco regulation. In the latest election cycle, two-thirds of all

cigarette industry donations went to the Republicans, data from

lobbying monitor OpenSecrets shows.

Some may have been lulled into believing that the issue had

slipped down the political agenda after a period of calm. This was

the first strong indication of the Biden administration's

intentions. And the tobacco business has fared well during the

pandemic: U.S. cigarette volumes were flat in 2020 for the first

time in years.

Cigarette companies can delay implementation for several years

by dragging any fresh rules through the courts. The bar for new

regulations also is high: The FDA must have science to prove that

the changes will benefit public health and not simply push demand

underground.

Still, the companies with most to lose from tougher regulation

have made little progress in managing the risk. In 2020, Altria

made 88% of net revenue from smokable products, just 1 percentage

point less than in 2017. The tobacco giant's $13 billion investment

in Juul Labs in 2018 is now worth just $1.6 billion, after several

write-downs.

British American Tobacco made a different kind of bad bet with

its almost $50 billion buyout of Reynolds American in 2017. It

makes more than four-fifths of overall sales from old-school

cigarettes, including through Reynolds's big menthol business,

although its exposure to the U.S. market is lower than

Altria's.

The news will likely sharpen investors' existing bias toward

tobacco companies that have large smokeless portfolios, such as

Swedish Match. Among the industry's giants, the irony is that the

company most insulated from the U.S. regulatory problems has the

most promising transition plan: Philip Morris, which reported

quarterly results Tuesday, said smokeless products like its IQOS

heated tobacco sticks generated 28% of sales over the three months

through March. The stock's forward earnings multiple was just 7%

higher than Altria's when the two split; now the premium is

42%.

To narrow the gap, Altria and British American need to double

down on smokeless products without being panicked into overpaying

for the next Juul. It isn't an easy task, nor a new one, but the

Biden administration's emerging stance underlines how necessary it

is.

Write to Carol Ryan at carol.ryan@wsj.com

(END) Dow Jones Newswires

April 20, 2021 10:52 ET (14:52 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

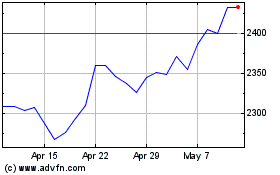

British American Tobacco (LSE:BATS)

Historical Stock Chart

From Mar 2024 to Apr 2024

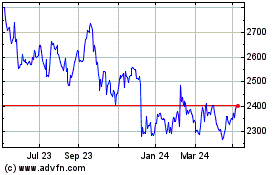

British American Tobacco (LSE:BATS)

Historical Stock Chart

From Apr 2023 to Apr 2024