TIDMBEZ

RNS Number : 4471E

Beazley PLC

06 November 2020

Press

Release

Beazley plc trading statement for the nine months ended 30

September 2020

London, 6 November 2020

Overview

-- Gross premiums written increased by 16% to $2,534m (Q3 2019:

$2,192m), ahead of our expectations

-- Premium rates on renewal business increased by 14%

-- Covid-19 first party loss estimate remain unchanged at $340m net of reinsurance

-- Q3 catastrophe estimate of approximately $80m net of reinsurance

-- Investment return of $124m as at 30 September 2020 (Q3 2019: $215m)

Andrew Horton, Chief Executive Officer, said:

"We have seen strong, double-digit premium growth across our

business as a whole so far this year, driven primarily by rate

rises across all divisions. I am extremely proud of all Beazley

employees who have shown commitment and resilience throughout this

time whilst continuing to support our customers and deliver the

excellent claims service we pride ourselves on.

Pricing conditions are positive and we have the expertise and

the capital in place to take advantage of these market conditions.

We have great confidence in our ability to deliver mid-teens growth

next year and strong shareholder returns in 2021 and beyond."

30 September 30 September % increase

2020 2019

Gross premiums written

($m) 2,534 2,192 16

Investments and cash

($m) 6,511 5,657 15

Year to date investment

return 2.0% 4.0%

Rate increase 14% 6%

Premiums

Gross premiums written for the nine months ended 30 September

2020 increased by 16% year on year to $2,534m achieved through a

combination of rate increases, adding exposure in a number of areas

and taking underwriting remediation action on certain areas of

business. Growth has been achieved in most of our divisions.

Our performance to the end of September 2020 by business

division is:

Gross premiums written Gross premiums written

Year to date Rate

30 September 2020 30 September 2019 % increase/ (decrease) change

$m $m % %

Cyber & executive risk 686 567 21% 16%

Marine 256 231 11% 18%

Market facilities 96 34 182% 12%

Political, accident &

contingency 205 204 - 4%

Property 354 337 5% 16%

Reinsurance 192 191 - 11%

Specialty lines 745 628 19% 13%

OVERALL 2,534 2,192 16% 14%

From 1 January 2020, the market facilities business has been

split out of the specialty lines division to form a separate

division. The prior year comparatives have been re-presented to

allow comparison.

Our cyber & executive risk division achieved premium growth

of 21% with particularly strong rate rises driving the executive

risk side as the market continues to respond to the claims

environment in directors' & officers' and employment practice

liability.

Following a rebalancing of the account our marine division took

advantage of improved market conditions particularly in war, cargo

and aviation, growing overall by 11%.

Elsewhere, our market facilities division grew 182% year on year

albeit from a small base. At the start of 2020, we decided to split

out this business from specialty lines into its own division.

The political, accident & contingency division remained

steady year on year, with growth dampened by significant market

contractions particularly in political and contingency due to

COVID-19.

In the property division we saw an increase in premiums of 5%

being the net result of continued portfolio optimisation and growth

supported by market wide rate increases. The hardening of the

global property market continues to be bolstered by a variety of

events including the effects of COVID-19, Australian and US

wildfires and the active 2020 hurricane season.

Whilst benefiting strongly from rate rises, reinsurance was also

steady year on year driven by more selective underwriting.

Our specialty lines division saw premium growth of 19% when

excluding the prior year inclusion of market facilities business

which at the start of this year was established as a standalone

division. We have seen rate rises across the division combined with

strong volume growth particularly outside of the US.

Business update

We continue to actively engage in cycle management, ensuring we

maintain a balanced portfolio whilst fully capitalising on the

opportunities. Rates are increasing in most of our classes and in

many areas are now at levels where the risk reward ratio warrants

writing materially more business. This is particularly true in

directors' and officers' liability, despite the heightened risk

environment, and most marine classes of business where the teams

are significantly growing market share. Off-setting this, we

continue to restrict appetite where there is particular exposure to

the impacts of social inflation, pandemic claims or a recession.

The main areas impacted by this are employment practices liability

and some professional and healthcare liability classes.

Ransomware attacks have continued to rise in 2020 and are now

the dominant cyber exposure faced by our clients. Malicious attacks

are, unfortunately, not new but have been increasingly prevalent in

the last 18 months and we have been adjusting our underwriting and

risk management services accordingly. The investments we made in

using technology for threat detection are now being implemented and

this enables us, amongst other things, to scan our clients for

vulnerabilities and actively underwrite and help our clients

remediate them. The market is currently repricing and restricting

coverage in response to these issues.

Our 2021 business plan for our syndicates has been approved by

Lloyd's, together with the accompanying capital requirements. We

are planning for mid-teens percentage growth in 2021. We also plan

to use reinsurance to manage growth in some of the more volatile

lines, and so expect growth of around 10% net of reinsurance next

year.

Claims update

We announced in September that our first party COVID-19 claims

estimate was $340m net of reinsurance, with almost all of the

increase compared to our previous expectations being caused by

further event cancellation losses. This figure assumes a resumption

to some form of normality in the second half of 2021. Were this not

to be the case, we estimate that there is potential for a further

$50m of claims net of reinsurance to the end of 2021.

We have also considered the recent FCA judgement on business

interruption wording and do not expect this outcome to have a

material impact on Beazley's insurance business.

Our initial estimate of the costs of the third quarter

catastrophe events including hurricanes Laura and Sally and the

wildfires in California is approximately $80m net of reinsurance

and reinstatement premiums.

We have chosen to open our cyber reserves higher in response to

the current claims trends discussed in the business update. Our

prudent and consistent approach to reserving continues and taking

all the above into account we are expecting a full year combined

ratio of around 110% assuming normalised claims levels for the

remainder of the year.

Capital update

Capital surplus is measured with reference to the Lloyd's

economic capital requirement (ECR), which considers requirements on

an ultimate basis as well as incorporating a further 35% uplift.

This number already allows for the business we expect to write

through to the end of 2021 and the current forecast places us

within our preferred range of 15-25% above the ECR at the end of

the year. We have a further unutilised $225m banking facility which

is available in addition.

Investments

Our portfolio allocation was as follows:

30 September 2020 30 September 2019

Assets Allocation Assets Allocation

$m % $m %

Cash and cash equivalents 305.8 4.7 423.0 7.5

Fixed and floating rate

debt securities

- Government, quasi-government

and supranational 2,726.0 41.8 2,003.0 35.4

- Corporate bonds

- Investment grade 2,598.8 39.9 2,411.6 42.6

- High yield 154.3 2.4 182.0 3.2

Syndicate loans 17.0 0.3 7.4 0.1

Derivative financial assets 18.4 0.3 3.0 0.1

Core portfolio 5,820.3 89.4 5,030.0 88.9

Equity funds 121.7 1.9 105.0 1.9

Hedge funds 364.3 5.6 311.0 5.5

Illiquid credit assets 204.5 3.1 211.0 3.7

Capital growth assets 690.5 10.6 627.0 11.1

Total 6,510.8 100.0 5,657.0 100.0

The year to date investment return to 30 September 2020 was

$124m, or 2.7% annualised. Risk assets continued to rally for much

of the third quarter, helping add 0.6% to our return in this

period. US Sovereign bond yields remain very low, such that our

high quality fixed income assets are not likely to contribute

materially to returns in the near future. Our investment strategy

remains cautious in view of continuing uncertainty in the economic

outlook. The yield on our core portfolio as at 30 September 2020

was 0.5% (31 December 2019: 2.1%).

The weighted average duration of our fixed income portfolio was

2.0 years at 30 September 2020 (30 September 2019: 1.9 years).

Conference call

We will be hosting a conference call at 8am this morning, dial

in details are below, please join 5 minutes before the start:

Tel number: +44 (0) 20 3003 2666

Quote Beazley when prompted by the operator.

ENDS

For further information, please contact:

Beazley plc

Sally Lake

+44 (0) 207 6747375

Note to editors:

Beazley plc (BEZ.L), is the parent company of specialist

insurance businesses with operations in Europe, North America,

Latin America and Asia. Beazley manages six Lloyd's syndicates and,

in 2019, underwrote gross premiums worldwide of $3,003.9 million.

All Lloyd's syndicates are rated A by A.M. Best.

Beazley's underwriters in the United States focus on writing a

range of specialist insurance products. In the admitted market,

coverage is provided by Beazley Insurance Company, Inc., an A.M.

Best A rated carrier licensed in all 50 states. In the surplus

lines market, coverage is provided by the Beazley syndicates at

Lloyd's.

Beazley's European insurance company, Beazley Insurance dac, is

regulated by the Central Bank of Ireland and is A rated by A.M.

Best and A+ by Fitch.

Beazley is a market leader in many of its chosen lines, which

include professional indemnity, cyber liability, property, marine,

reinsurance, accident and life, and political risks and contingency

business.

For more information please go to: www.beazley.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUPGCPGUPUGBA

(END) Dow Jones Newswires

November 06, 2020 13:40 ET (18:40 GMT)

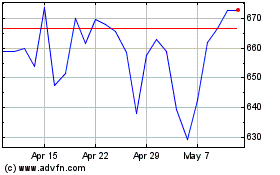

Beazley (LSE:BEZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beazley (LSE:BEZ)

Historical Stock Chart

From Apr 2023 to Apr 2024