TIDMBIDS

RNS Number : 5810T

Bidstack Group PLC

26 March 2021

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR") as applied in

the United Kingdom. Upon publication of this Announcement, this

information is now considered to be in the public domain.

26 March 2021

Bidstack Group Plc

("Bidstack" or "the Company")

Preliminary Results for the year ended 31 December 2020

Annual Report & Accounts 2020

Strong tangible progress: campaigns undertaken globally with ROI

for brands demonstrated.

Confident of further material growth in 2021

Bidstack Group Plc (LON: BIDS), the native in-game advertising

group, is pleased to announce the publication of its Annual Report

and Accounts for the year ended 31 December 2020 ("Annual

Report").

The Annual Report is available for immediate download at

https://www.bidstack.com/2020-annual-report and

www.bidstackgroup.com .

Financial Performance

-- Revenue of GBP1.7m (FY 2019: GBP0.14m) - in excess of market expectations

-- Cash balance at 31 December 2020 of GBP2.3m (31 December

2019: GBP3.1m) - in line with market expectations

-- Adjusted loss before tax GBP6.99m (FY 2019: GBP5.4m) - in line with market expectations

-- Successful oversubscribed placing raising gross proceeds of GBP5.7m in June 2020

Operational Performance

-- Ran over 40 in-game advertising campaigns

-- Added 25 new partners, covering over 30 markets, to Bidstack's Approved Partner Network

-- Signed agreements with some of the world's largest

international advertising agency holding groups including

Interpublic, Omnicom, Publicis and WPP

-- Ran over 10 direct campaigns for brands across five key

verticals: luxury, consumer packaged goods, financial services,

automotive and retail

-- 6 new esports team collaborations and 2 franchises signed

-- Currently working with 20 games including 5 games from 3 AAA game studios

-- An additional 6 AAA games covered by partnership agreements

Outlook and Prospects

In 2021 Bidstack intends to continue building its technology to

unlock the potential of gaming for advertisers by focusing on

raising awareness with global agency holding groups and

advertisers, showing evidence of return on investment with ad

measurement and through increasing the ease of purchase with

premium inventory.

In addition, the Company will be stepping up its investment in

growing its robust pipeline of AAA and high-fidelity game portfolio

and mobile publisher base, diversifying its product offering to

publishers, rolling out its Pubguard security product and enhancing

its SDK integration.

Bidstack's focus on execution will accelerate in 2021-2022

ensuring the Company's performance builds on what was achieved in

2020 and supports its long-term plans by focusing on building an

open exchange industry standard and infrastructure for advertisers

to buy in-game ads seamlessly, continuing to build Bidstack's

proprietary self-serve technology features and strengthening its

safety features with Pubguard.

Bidstack will also continue working to define the taxonomy of

in-game advertising including formats, sizing, copy and best

practices.

The Company ended 2020 with cash reserves of GBP2.3 million

(2019: GBP3.1 million) and no debt. As always cash management

remains a key focus within the business as the Board expects

Bidstack to continue to have negative cash flows in 2021. However,

the Company is now aided by regular cash receipts arising in the

ordinary course of trading which are having a positive impact on

our monthly burn rate. In addition, the Company has also received a

non-trading cash payment in January 2021 in excess of GBP0.5m and

expects to receive a further similar receipt in late Q2 2021.

The Board expects that revenues for 2021, while materially

greater than 2020, will continue to be significantly second half

weighted.

James Draper, CEO of Bidstack, said:

"The journey so far, our future growth strategy and near term

deliverables are clearly presented in our 2020 Annual Report which

I urge all shareholders to read given the incremental detail that

it provides. The Annual Report is published today and can be

downloaded from https://www.bidstack.com/2020-annual-report and

www.bidstackgroup.com ."

-S-

Contacts

Bidstack Group PLC

James Draper, CEO via Buchanan

SPARK Advisory Partners Limited (Nomad)

Mark Brady / Neil Baldwin / James Keeshan +44 (0) 203 368 3550

Stifel Nicholas Europe Limited (Broker)

Fred Walsh/Luisa Orsini Baroni +44 (0) 20 7710 7600

Buchanan Communications Limited

Chris Lane / Stephanie Watson / Kim van

Beeck

bidstack@buchanan.uk.com +44 (0) 20 7466 5000

Extracts from the Chairman's Statement in the Annual Report

Introduction

2020 has been a year of immense progress for Bidstack. While the

significant increase in revenues in the second half are a

distinctly tangible sign of progress, it does not do justice to the

full extent of the evolution of the Company over the period.

Progress in 2020

We have set out in considerable detail our progress in having

in-game advertising accepted as a new and recognised media channel

throughout our Annual Report, which can be accessed here at

https://www.bidstack.com/2020-annual-report and

www.bidstackgroup.com . Key points to note include:

-- we are working closely with some of the largest global

advertising agencies in the world including Dentsu, Havas,

Interpublic, Omnicom, Publicis and WPP,

-- our successful brand uplift studies for brands including

Acer, Burberry, Coca-Cola, Jimmy Dean, McDonalds, MG, Paco Rabanne,

Santander, TalkTalk and VW show that our in-game ads deliver better

results than other traditional channels,

-- our technology supports Unity, Unreal, C++, Linux, iOS and Android,

-- we have created a proprietary ad server for in-game ad inventory (AdConsole),

-- we are working with leading independent digital and audience

measurement experts Moat by Oracle, Comscore and Nielsen to provide

verification of delivery of our ads, and

-- we have played a leading role in the IAB's efforts to define

in-game advertising as a channel, as outlined in their recently

published "Guide to Gaming" whitepaper.

Outlook and Prospects

In 2020, Bidstack made strong and tangible progress towards our

ambition to become the global leading advertising and monetisation

platform for interactive entertainment. Bidstack has proven its

initial concept through bringing premium advertisers into the world

of gaming, securing exclusive contracts with household name game

developers and building the technology infrastructure to enable

both sides to seamlessly transact.

Our strategy has been to take no shortcuts from either a

technological or commercial perspective. This is now paying off,

with significant advertising agencies and brands planning around

our premium inventory and with our technology providing transparent

reporting on campaign performance.

We believe that Bidstack is now well established across its

three key pillars of advertisers, publishers & platforms and

product development. It is vital for Bidstack to continue to

consolidate its leading position through execution and scaling its

value proposition into new markets.

The Board expects that revenues for 2021, while materially

greater than 2020, will continue to be second half weighted.

With the commercial, operational, proprietary data and

technology we have at hand, I believe Bidstack is well positioned

for the journey ahead.

Donald Stewart

Chairman

Consolidated statement of comprehensive income

for the year ended 31 December 2020

Year ended Year ended

31 December 31 December

2020 2019

GBP GBP

Revenue 1,695,620 140,391

Cost of sales (1,470,389) (106,697)

----------- -----------

Gross profit 225,231 33,694

Administrative expenses (7,218,789) (5,353,375)

----------- -----------

Operating loss before acquisition

related costs (6,993,558) (5,319,681)

Transaction costs - (44,833)

Share based payment on reverse

acquisition - -

----------- -----------

Operating (loss) (6,993,558) (5,364,514)

Finance income 2,525 8,060

Finance costs (1,179) (967)

(Loss) before taxation (6,992,212) (5,357,421)

Taxation 597,035 148,141

----------- -----------

(Loss) for the year (6,395,177) (5,209,280)

Other comprehensive income

Total other comprehensive income - -

----------- -----------

Total comprehensive (loss) for

the year (6,395,177) (5,209,280)

=========== ===========

Loss per share - basic and diluted

(pence) (1.65) (2.26)

The notes to the accounts published in the Annual Report form

part of the financial statements.

Consolidated statement of financial position

as at 31 December 2020

31 December 31 December

2020 2019

ASSETS GBP GBP

Non-current assets

Intangible assets 279,955 310,960

Property, plant and equipment 28,388 22,377

Right of use asset 7,577 26,710

============ ============

Total non-current assets 315,920 360,047

============ ============

Current assets

Trade and other receivables 2,391,300 533,207

Cash and cash equivalents 2,347,114 3,148,540

------------ ------------

Total current assets 4,738,414 3,681,747

============ ============

Total assets 5,054,334 4,041,794

============ ============

EQUITY AND LIABILITIES

Equity

Share capital 6,234,261 5,516,759

Share premium account 27,984,716 23,283,880

Share-based payment reserve 1,282,556 734,365

Merger relief reserve 6,508,673 6,508,673

Reverse acquisition reserve (23,320,632) (23,320,632)

Warrant reserve 71,480 71,480

Retained losses (15,578,902) (9,183,725)

------------ ------------

Total equity 3,182,152 3,610,800

============ ============

Non-current liabilities

Lease liability - 8,300

------------ ------------

Total non-current liabilities - 8,300

============ ============

Current liabilities

Trade and other payables 1,863,739 406,672

Lease liability 8,443 16,022

Total current liabilities 1,872,182 422,692

============ ============

Total equity and liabilities 5,054,334 4,041,794

============ ============

The notes to the accounts published in the Annual Report form

part of the financial statements.

Consolidated statement of changes in equity

for the year ended 31 December 2020

Share-based Merger Reverse

Share Share payment relief acquisition Warrant Retained

capital premium reserve reserve reserve reserve losses Total equity

GBP GBP GBP GBP GBP GBP GBP GBP

Balance as at

1

January 2019 5,286,429 18,000,247 258,060 6,213,021 (23,320,632) 71,480 (3,974,445) 2,534,160

Issue of

shares 225,982 5,541,549 - - - - - 5,767,531

Issue of

consideration

shares 4,348 - - 295,652 - - - 300,000

Costs of

raising

equity - (257,916) - - - - - (257,916)

Share-based

payments - - 476,305 - - - - 476,305

Loss and total

comprehensive

income for

the year - - - - - - (5,209,280) (5,209,280)

Balance as at

31

December 2019 5,516,759 23,283,880 734,365 6,508,673 (23,320,632) 71,480 (9,183,725) 3,610,800

=========== ============ =========== =========== ============== ======== ============== =============

Issue of

shares 717,502 5,032,518 - - - - - 5,750,020

Issue of - - - - - - - -

consideration

shares

Costs of

raising

equity - (331,682) - - - - - (331,682)

Share-based

payments - - 548,191 - - - - 548,191

Loss and total

comprehensive

income for

the year - - - - - - (6,395,177) (6,395,177)

Balance as

at 31

December

2020 6,234,261 27,984,716 1,282,556 6,508,673 (23,320,632) 71,480 (15,578,902) 3,182,152

=========== ============ =========== =========== ============== ======== ============== =============

The notes to the accounts published in the Annual Report form

part of the financial statements.

Consolidated statement of cash flows

for the year ended 31 December 2020

31 December 31 December

2020 2019

GBP GBP

Cash flows from operating activities

(Loss) before taxation (6,992,212) (5,357,421)

Adjustments for:

Amortisation - Intangibles 31,574 18,859

Amortisation - Right of use asset 19,621 5,337

Depreciation 13,021 8,330

Equity settled share-based payments 548,191 476,305

Doubtful debts expenses (19,265) 325,200

Interest received (2,525) (8,060)

Interest paid 1,179 967

(6,400,416) (4,530,483)

Changes in working capital

Decrease/(increase) in trade and other

receivables (1,241,792) 151,646

(Decrease)/increase in trade and other

payables 1,457,069 (80,204)

----------- -----------

Cash used in operations (6,185,103) (4,459,041)

Net cash used in operations (6,185,103) (4,459,041)

Cash flow from investing activities

Investment in intangible assets (570) (370)

Cash acquired with subsidiary - 6,683

Investment in property, plant and equipment (19,033) (14,272)

----------- -----------

Net cash flow (used in)/generated from

investing activities (19,603) (7,959)

Cash flow from financing activities

Proceeds from issue of share capital 5,750,020 5,767,531

Cost of issue (331,682) (257,916)

Interest paid (1,215) (967)

Principal paid on finance leases (16,368) (7,725)

Interest received 2,525 8,060

Net cash generated from financing activities 5,403,280 5,508,983

Increase in cash and cash equivalents

in the year (801,426) 1,041,983

Cash and cash equivalents at beginning

of year 3,148,540 2,106,557

Cash and cash equivalents at the end of

the year 2,347,114 3,148,540

=========== ===========

The notes to the accounts published in the Annual Report form

part of the financial statements.

Extracts from the notes to the financial statements

2 Summary of significant accounting policies

Basis of preparation

The consolidated financial statements consolidate those of the

Company and its subsidiary (together the "Group"). The financial

statements have been prepared on a going concern basis in

accordance with International Financial Reporting Standards (IFRSs)

and International Financial Reporting Interpretation Committee

(IFRIC) interpretations as endorsed by the European Union

("IFRS-EU"), and those parts of the Companies Act 2006 applicable

to companies reporting under IFRS.

Management has implemented logistical and organisational changes

to underpin the Group's resilience to the impact felt by the

COVID-19 pandemic, with the key focus being protecting all

personnel, minimising the impact on critical work streams and

ensuring business continuity. The effect on the economy may impact

the Group in varying ways, which could lead to a direct bearing on

the Group's ability to generate future cash flows for working

capital purposes. The inability to gauge the length of such

disruption further adds to this uncertainty. For these reasons the

generation of sufficient operating cash flows remain a risk.

Management is closely monitoring commercial and technical aspects

of the Group's operations to mitigate risk, and believes the Group

will have access to sufficient working capital to continue

operations for the foreseeable future.

Consolidation

The consolidated financial statements consolidate the financial

statements of the Company and the results of its subsidiary

undertakings Bidstack Limited, Minimised Media 'Pubguard' and

Bidstack SIA, made up to 31 December 2020.

Subsidiaries are entities over which the Group has control. The

Group controls an entity when the Group is exposed to, or has

rights to, variable returns from its involvement with the entity

and has the ability to affect those returns through its power over

the entity. Subsidiaries are fully consolidated from the date on

which control is transferred to the Group. They are deconsolidated

from the date that control ceases.

Going concern

The Board continues to adopt the going concern basis to the

preparation of the financial statements as it is confident of the

Group continuing operations into the foreseeable future. The

Board's forecasts for the Group include due consideration of future

capital in-flows, continued operating losses, projected increase in

revenues and cash-burn of the Group (and taking account of

reasonably possible changes in trading performance and also changes

outside of expected trading performance) for a minimum period of at

least twelve months from the date of approval of these financial

statements. This assessment has been arrived at after the Board has

considered various alternative operating strategies should these be

necessary in the light of actual trading performance not matching

the Group's forecasts given the current macro-economic conditions,

and are satisfied that such revised operating strategies could be

adopted, if and when necessary. Specific attention needs to drawn

to the comments made under principal risks and uncertainties in

respect of the impact the Coronavirus pandemic on Going Concern and

the approaches being taken by the Group to manage and mitigate such

additional operational and financial risk the environment presents.

Therefore, the Directors consider the going concern basis

appropriate.

The Directors have stress tested the Group's cash projections,

which involves preserving cash flows and adopting a policy of

minimal cash spending for a period of at least 12 months from the

date of approval of these financial statements. The Directors

believe the measures they have put in place and will result in

sufficient working capital and cash flows to continue in

operational existence.

The financial statements have been prepared on a going concern

basis and do not include the adjustments that would be required

should the going concern basis of preparation no longer be

appropriate. The Group's business activities, together with the

factors likely to affect its future development, performance and

position are set out in the Chairman's statement above.

The financial statements as at 31 December 2020 show that the

Group generated an operating loss for the year of GBP6.4 million

(2019: GBP5.2 million) after accounting for the costs directly

related to the issue of shares of GBP0.033 million (2019:

GBP0.025million); with cash used in operating activities of GBP6.2

million (2019: GBP4.5 million). Group balance sheet also showed

cash reserves as at 31 December 2020 of GBP2.3 million (2019:

GBP3.1 million). The Group is dependent on further equity

fundraising in order to operate as a going concern for at least

twelve months from the date of approval of the financial

statements. Although the entity has had past success in fundraising

and continues to attract interest from investors, making the Board

confident that such fundraising will be available to provide the

required capital, there can be no guarantee that such fundraising

will be available. Accordingly, this constitutes a material

uncertainty over going concern.

The Board has considered various alternative operating

strategies should these be necessary in the light of actual trading

performance not matching the Group's forecasts given the current

macro-economic conditions, and are satisfied that such revised

operating strategies could be adopted, if and when necessary.

Specific attention needs to drawn to the comments made in respect

of the impact the COVID-19 pandemic on Going Concern and the

approaches being taken by the Group to manage and mitigate the

additional operational and financial challenges the environment

presents.

Revenue Recognition

Revenue represents amounts receivable for goods and services

provided in the normal course of business, and excludes intragroup

sales, Value Added Tax and trade discounts. Revenue comprises:

-- Sale of advertising space: the value of goods and services is

recognised across the period of use.

-- Sale of reseller rights: the value of goods and services is

recognised upon agreement.

-- Sale of development programmes and content creation: the

value of goods and services supplied is recognised on delivery of

content and accepted by customers.

-- Sponsorship income: the value of goods and services is

recognised over the time period to which it relates.

Net finance costs

Finance costs comprise interest on bank loans and other interest

payable. Interest on bank loans and other interest is charged to

the Statement of Comprehensive Income over the term of the debt

using the effective interest rate method so that the amount charged

is at a constant rate on the carrying amount.

Finance income comprises interest receivable on loans to related

parties. Interest income is recognised in the Statement of

Comprehensive Income as it accrues using the effective interest

method.

Tax on the profit or loss for the year comprises current and

deferred tax. Tax is recognised in the Statement of Comprehensive

Income except to the extent that it relates to items recognised

directly in equity, in which case it is recognised in equity.

Taxation

Current tax is recognised as the amount of corporation tax

payable in respect of taxable profit for the current or past

reporting periods using tax rates and laws that have been enacted

or substantively enacted by the reporting date.

Deferred tax is recognised in respect of all timing differences

at the reporting date, except as otherwise indicated.

Deferred tax assets are only recognised to the extent that it is

probable that they will be recovered against the reversal of

deferred tax liabilities or other future taxable profits.

Deferred tax is calculated using the tax rates and laws that

have been enacted or substantively enacted by the reporting date

that are expected to apply to the reversal of the timing

difference.

With the exception of changes arising on initial recognition of

a business combination, the tax expense/(income) is presented

either in the income statement, other comprehensive income or

equity depending on the transaction that resulted in the tax

expense/(income).

Deferred tax liabilities are presented within provisions for

liabilities and deferred tax assets within debtors. Deferred tax

assets and deferred tax liabilities are offset only if:

- the company has a legally enforceable right to set off current

tax assets against current tax liabilities, and

- the deferred tax assets and deferred tax liabilities relate to

corporation tax levied by the same taxation authority on either the

same taxable entity or different taxable entities which intend

either to settle current tax liabilities and assets on a net basis,

or to realise the assets and settle the liabilities

simultaneously.

Research and Development tax credits are recognised as

receivables when an inflow of economic benefit is certain, until

then a contingent asset in respect of probable Corporation Tax is

disclosed.

Valuation of investments

Investment in subsidiary undertakings are accounted for at cost

less impairment. Advances to subsidiaries are initially recorded at

fair value based on a market rate of interest and subsequently at

amortised cost. The difference between funds advanced and fair

value is recorded in investments.

Impairment of fixed asset investments

An impairment review of fixed asset investments is conducted

annually, and any resulting impairment loss is measured and

recognised on a consistent basis.

Leased assets

All leases are accounted for by recognising a right-of-use asset

and a lease liability except for:

- Leases of low value assets; and

- Leases with a duration of 12 months or less.

Lease liabilities are measured at the present value of the

contractual payments due to the lessor over the lease term, with

the discount rate determined by reference to the rate inherent in

the lease unless (as is typically the case) this is not readily

determinable, in which case the incremental borrowing rate on

commencement of the lease is used.

On initial recognition, the carrying value of the lease

liability also includes:

- amounts expected to be payable under any residual value guarantee;

- any penalties payable for terminating the lease, if the term

of the lease has been estimated on the basis of the termination

option being exercised.

Right of use assets are initially measured at the amount of the

lease liability, reduced for any lease incentives received, and

increased for:

- lease payments made at or before commencement of the lease;

- initial direct costs incurred; and

- the amount of any provision recognised where the Group is

contractually required to dismantle, remove or restore the leased

asset.

Subsequent to initial measurement, lease liabilities increase as

a result of interest charged at a constant rate on the balance

outstanding and are reduced for lease payments made. Right-of-use

assets are amortised on a straight-line basis over the remaining

term of the lease or over the remaining economic life of the asset

if, rarely, this is judged to be shorter than the lease term. When

the Group revises its estimate of the term of any lease (because,

for example, it re-assesses the probability of a lessee extension

or termination option being exercised), it adjusts the carrying

amount of the lease liability to reflect the payments to make over

the revised term, which are discounted at the same discount rate

that applied on lease commencement.

An equivalent adjustment is made to the carrying value of the

right-of-use asset, with the revised carrying amount being

amortised over the remaining (revised) lease term.

Goodwill

Goodwill represents the difference between amounts paid on the

cost of a business combination and the fair value of Bidstack

Group's share of the identifiable assets and liabilities of the

acquiree at the date of acquisition. Subsequent to initial

recognition, goodwill is measured at cost less accumulated

impairment losses.

Intangible assets

An intangible asset, which is an identifiable non-monetary asset

without physical substance, is recognised to the extent that it is

probable that the expected future economic benefits attributable to

the asset will flow to the Group and that its cost can be measured

reliably, the asset is deemed to be identifiable when it is

separable or when it arises from contractual or other legal

rights.

Amortisation is charged on a straight-line basis through the

profit or loss. The rates applicable, which represent the

directors' best estimate of the useful economic life, are:

- Website costs - 5 years

- Trademarks - 10 years

- Brand - 5 years

- Software - 5 years

Property, plant and equipment

Items of property, plant and equipment are initially recognised

at cost. As well as the purchase price, cost includes directly

attributable costs. Depreciation is provided on all items of

property, plant and equipment, so as to write off their carrying

value over their expected useful economic lives. It is provided at

the following rates:

- Computer equipment - 33.33% straight line

- Office equipment - 20% straight line

Cash and cash equivalents

Cash and cash equivalents include cash in hand, deposits held at

call with banks and other short-term highly liquid investments that

are readily convertible into known amounts of cash and which are

subject to an insignificant risk of changes in value.

Financial assets

The Group classifies all of its financial assets as loans and

other receivables. Financial assets do not comprise prepayments.

Management determines the classification of its financial assets at

initial recognition.

Loans and receivables are non-derivative financial assets with

fixed or determinable payments. They are initially recognised at

fair value and are subsequently stated at amortised cost using the

effective interest method, less any impairment. Interest income is

recognised by applying the effective interest rate, except for

short-term receivables when the recognition of interest would be

immaterial.

The Group's financial assets held at amortised cost comprise

trade and other receivables and cash and cash equivalents in the

Statement of Financial Position.

Financial liabilities

Trade and other payables are recognised initially at fair value

and are subsequently measured at amortised cost,

using the effective interest method.

Share Capital

Ordinary shares are classified as equity. Incremental costs

directly attributable to the issue of new shares or options are

shown in equity as deductions net of tax, before proceeds.

Share-based payments

Where share options are awarded to employees, the fair value of

the options at the date of grant is charged to the income statement

over the vesting period. Non-market vesting conditions are taken

into account by adjusting the number of equity instruments expected

to vest at each balance sheet date so that, ultimately, the

cumulative amount recognised over the vesting period is based on

the number of options that eventually vest. Market vesting

conditions are factored into the fair value of the options

granted.

As long as all other vesting conditions are satisfied, a charge

is made irrespective of whether the market vesting conditions are

satisfied. The cumulative expense is not adjusted for failure to

achieve a market vesting condition.

Where the terms and conditions of options are modified before

they vest, the increase in the fair value of the options, measured

immediately before and after the modification, is also charged to

the income statement over the remaining vesting period. Where

equity instruments are granted to persons other than employees, the

income statement is charged with fair value of goods and services

received.

Functional and presentation currency

Items included in the financial statements of the Group are

measured using the currency of the primary economic environment in

which the Group operates ("the functional currency"). The financial

statements are presented in Pounds Sterling (GBP) which is also the

Group's functional currency.

Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions or valuation where items are re-measured. Foreign

exchange gains and losses resulting from the settlement of

transactions and from the translation at year-end exchange rates of

monetary assets and liabilities denominated in foreign currencies

are recognised in the Statement of Comprehensive Income.

10 Loss per share

The loss per share is based upon the loss of GBP6,395,177 (2019:

loss of GBP5,209,280) and the weighted average number of ordinary

shares in issue for the year of 387,633,342 (2019:

230,957,900).

The loss incurred by the Group means that the effect of any

outstanding warrants and options would be considered anti-dilutive

and is ignored for the purposes of the loss per share

calculation.

15 Share capital and reserves

Allotted, called up and fully Ordinary Share capital

paid 0.5p shares

No. GBP

At 1 January 2020 244,873,646 5,516,759

Exercised warrants 1,000,411 5,002

Exercised options - -

Issue of consideration shares - -

Issue of placing shares 142,500,000 712,500

As at 31 December 2020 388,374,057 6,234,261

================================ ============ =============

All ordinary shares are equally eligible to receive dividends

and the repayment of capital and represent equal votes at meetings

of shareholders.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 31 December 2020

or 31 December 2019, but is extracted from those accounts.

Statutory accounts for 2019 have been delivered to the Registrar of

Companies and those for 2020 will be delivered in due course. The

auditor has reported on those accounts; their reports were

unqualified but contained an emphasis of matter in respect of going

concern. Note 2 of the Statutory Accounts for the year ended 31

December 2020 describes how the business is dependent on further

equity funding to sustain itself over the following year. This

condition indicates that a material uncertainty exists that may

cast significant doubt on the entity's ability to continue as a

going concern. The auditor's opinion was not modified in respect of

this matter. The Statutory accounts did not contain statements

under s498(2) or (3) of the Companies Act 2006. Whilst the

financial information included in this preliminary announcement has

been computed in accordance with International Financial Reporting

Standards, this announcement does not itself contain sufficient

information to comply with IFRS.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GDGDXRXDDGBL

(END) Dow Jones Newswires

March 26, 2021 03:00 ET (07:00 GMT)

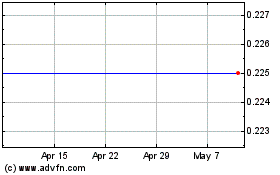

Bidstack (LSE:BIDS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bidstack (LSE:BIDS)

Historical Stock Chart

From Apr 2023 to Apr 2024