TIDMBIOM

RNS Number : 9408Z

Biome Technologies PLC

24 September 2020

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information for the purposes of Article 7 under the Market Abuse

Regulation (EU) No. 596/2014 ("MAR"). With the publication of this

announcement, this information is now considered to be in the

public domain.

24 September 2020

Biome Technologies plc

("Biome", "the Company" or "the Group")

Interim Results

Biome Technologies plc announces its unaudited Interim Results

for the six months ended 30 June 2020.

Highlights

-- The Group generated revenues of GBP2.5m (H1 2019: GBP3.4m(1)

) and gross profit of GBP0.8m (H1 2019: GBP1.5m)

-- The Biome Bioplastics division has now become the principal

revenue generator for the Group with growth of 71% on H1 2019

-- Biome Bioplastics has continued to grow its revenues from both developed and new products

-- Stanelco RF division saw a sharp decline in revenues as the

impact of Covid-19 exacerbated weak market demand

Paul Mines, Chief Executive Officer said:

"The Bioplastics division performed exceptionally well in the

first half despite the upheaval caused by Covid-19, with a 71%

increase in revenues compared with the same period in the prior

year. As previously reported, the revenues of the Stanelco RF

division, however, were compromised by both over-capacity in the

fibre optic market and the slow-down in industrial activity caused

by Covid-19. The Bioplastics division has now therefore become the

principal revenue generator for the Group, and we expect this to be

maintained into the future."

(1) Grant income was classified as Revenue in the Group's

interim results for the period ended 30 June 2019, and as Other

operating income in the Group's Annual Report and Financial

Statements for the year ended 31 December 2019. The comparatives

for 30 June 2019 have correspondingly been restated in these

interim results. Group income including grant income for the period

ended 30 June 2020 was GBP2.6m (H1 2019: GBP3.6m). Bioplastics

income including grant income for the period ended 30 June 2020 was

GBP2.2m (H1 2019: GBP1.4m).

- Ends -

For further information please contact: Biome Technologies plc

Paul Mines, Chief Executive Officer

info@biometechnologiesplc.co.uk Tel: +44 (0) 2380 867

100

Allenby Capital

David Hart/Alex Brearley (Nominated Adviser)

Kelly Gardiner (Broker)

www.allenbycapital.com Tel: +44 (0) 20 3328

5656

About Biome

Biome Technologies plc (Ticker: BIOM) is an AIM listed,

growth-orientated, commercially driven technology group. Our

strategy is founded on building market-leading positions based on

patented technology and serving international customers in valuable

market sectors. We have chosen to do this by developing products in

application areas where value-added pricing can be justified and

that are not reliant on government legislation. These products are

driven by customer requirements and are compatible with existing

manufacturing processes. They are market rather than

technology-led.

The Group comprises two divisions, Biome Bioplastics Limited and

Stanelco RF Technologies Limited. Biome Bioplastics is a leading

developer of highly-functional, bio-based and biodegradable

plastics. The company's mission is to produce bioplastics that

challenge the dominance of oil-based polymers. Stanelco RF

Technologies designs, builds and services advanced radio frequency

(RF) systems. Dielectric and induction heating products are at the

core of a product offering that ranges from portable sealing

devices to large furnaces for the fibre optics markets.

www.biometechnologiesplc.com

www.biomebioplastics.com and www.thinkbioplastic.com

www.stanelcorftechnologies.com

#ThinkBioplastic is our digital educational platform, launched

in October 2018 in response to the emerging global plastic

conversation. It speaks to a wide audience, highlighting

bioplastics as a leading solution among several to reduce the

negative impact of plastic manufacture and disposal. Following the

much acclaimed first series of short videos, the second series was

recently released.

Chairman's Statement

During the first half of 2020, the Group's two divisions

performed in line with the expectations set out by the Board in

April 2020 during the early stages of the lockdown due to the

Covid-19 pandemic.

Group revenues for the period were GBP2.5m (H1 2019: GBP3.4m).

Including grant income, Group income was GBP2.6m (H1 2019:

GBP3.6m). Grant income was classified as Revenue in the Group's

interim results for the period ended 30 June 2019, and as Other

operating income in the Group's Annual Report and Financial

Statements for the year ended 31 December 2019. The comparatives

for 30 June 2019 have correspondingly been restated in these

interim results.

The Bioplastics division continued its strong growth trajectory

despite the impact of Covid-19, delivering an increase in revenues

of 71% on the comparable period, and has become the principal

revenue generator for the Group. Revenues in the Stanelco RF

Technologies division sharply reduced by 82% due to weak market

demand and the impact of Covid-19.

Gross profit for the Group was GBP0.8m (H1 2019: GBP1.5m)

impacted by the effect of the reduced revenues highlighted above.

The overall gross margin for the Group was 30% (H1 2019: 44%)

reflecting the increased weighting of sales towards the Bioplastics

division.

Vigorous cost cutting measures, including a voluntary reduction

of Directors' remuneration and accessing government support

schemes, contributed to reduced administrative expenses in the

period to GBP1.7m (H1 2019: GBP2.2m). As a result, the Group

recorded a loss before interest, depreciation, amortisation and

share option charges for the six months to 30 June 2020 of GBP0.5m

(H1 2019: GBP0.2m loss). The loss after taxation was GBP0.8m (H1

2019: GBP0.5m loss), which equates to a loss per share of 29 pence

on a basic and diluted basis (H1 2019: loss per share of 20 pence

on a basic and diluted basis).

The Group's cash position as at 30 June 2020 was GBP1.1m (31

December 2019: GBP2.1m) reflecting the first half losses and an

increase in working capital requirements in the Bioplastics

division. The Group had no debt as at 30 June.

Biome Bioplastics Division

Revenues in the Bioplastics division continued to grow during H1

2020, reaching GBP2.1m for the period (H1 2019: GBP1.2m). Revenue

in the second quarter was GBP1.2m and represented a new record for

the division, despite the disruption caused by the pandemic.

The strong performance in the period was underpinned by

increased sales of outer packaging for the US coffee market and by

growing revenues for rigid ring materials for the coffee-pod

application. Despite the lockdown and supply chain constraints in

both Europe and the US, the Bioplastics division's workflows proved

resilient and production output met customer requirements

throughout the first half.

As well as increased sales to existing customers, the

Bioplastics division is working with an expanding list of potential

new customers particularly in the US and developmental work related

to this continues with some vigour. The business is well positioned

to exploit further opportunities in this growing market as

consumers and brands continue to move to reduce the impact of waste

from oil-based persistent plastics, driving recognition of the

benefits of novel bio-based polymers.

These prospects include:

-- Filtration mesh - implementation is underway with a second

end-use customer in the coffee filtration market

-- Coffee pod material - the Company's heat stable material,

developed for coffee pods, is attracting new customers within the

US market and commercial sales of this product are gaining

momentum

-- Packaging film - the Company is working on seven new customer

projects that focus on the conversion of flexible packaging to

compostable formats. Six of these projects are for the North

American market

The division's medium term research activities in Industrial

Biotechnology continue, which include the development of a new

range of performance polymers with properties which are expected to

improve the existing generation of products. This work, taking

place at the universities of Nottingham and York, is supported by

government grants. Whilst university closures have slowed this

work, post period end, the division has received an Innovate UK

Continuity Grant of GBP63,000 to support the recovery of time

lost.

Stanelco RF Technologies Division

Revenues for the first half of 2020 in the Stanelco RF division

were GBP0.4m (H1 2019: GBP2.2m).

A substantial proportion of the Stanelco RF division's revenues

are typically derived from the production and maintenance of

furnaces for the manufacture of fibre optic cable. Overcapacity in

the fibre optic cable market, apparent from late 2018, has been

exacerbated by the pandemic as telecommunication companies have

suffered restrictions on cable deployment activity and

international trade disputes have slowed the deployment of 5G.

These factors have led to temporary shutdowns of a number of

manufacturing facilities at Stanelco RF's customers, with a

consequential reduction in the requirement for Stanelco RF to

provide equipment, spares and service support. The expectation is

that in the long term, the fibre optic market will benefit from the

pandemic through the enhanced pace of global digitisation required

to meet the demands of, for example, increased home working and the

5G roll-out. However, in the short term, demand is likely to remain

weak.

The division also provides induction heating and welding

equipment to various end markets in the UK and continental Europe.

Activity in these markets in the second quarter was very weak, with

many facilities closed and customers deferring the purchase of

capital goods.

The division has accordingly reduced costs and cash outflows

where possible as well as reviewing possible alternative markets

for its technologies.

The Board is pleased that in the last few weeks, the enquiry

level has increased and there have been some small contract wins,

albeit overall demand levels remain subdued.

Other matters

To protect the Group's cash resources, the Directors and other

staff salary reductions, agreed during quarter two, have been

continued in quarter three of 2020, and use of the UK government's

furlough scheme has been made where appropriate.

The Board has considered the effect of Brexit on the Group's

future performance. As the majority of the Group's revenues and

manufacturing are located in North America the Board believes any

impact will be relatively limited. Similarly, the majority of raw

material purchases are sourced from outside the EU.

The Group exports the majority of its products and therefore

fluctuations in exchange rates may affect product demand. The Board

are informed regularly of any potential impact of exchange rate

movements and act to mitigate any adverse movements wherever

possible.

The Board has considered the going concern basis for the

preparation of these Interim Results. The outlook for trading and

the availability of funds have been forecast for the period to

September 2021.

The Company intends to raise total proceeds of GBP1.1m before

costs, representing GBP1.0m net of costs, via a placing and

subscription of new ordinary shares, as explained in the outlook

section below and in Note 4. The Directors are satisfied that the

Group has sufficient resources to continue in operational existence

for at least one year from the date of approval of these Interim

Results.

KPIs

The Board adopted ambitious Key Performance Indicators (KPIs)

for the 2018 - 2020 objective cycle. These will now be adjusted and

extended to the end of 2023 reflecting the continued progress of

the Bioplastics division (with the addition of an EBITDA KPI), the

headwinds facing the Stanelco RF division and the impact of the

Covid-19 virus to date:

-- 40% annual revenue growth in the Biome Bioplastics division

-- Bioplastics division's profitable revenue growth to achieve a

10%-12.5% EBITDA margin by the end of the KPI period

-- Continued diversification of the Group's turnover by product

and market to ensure that no single product or end customer

contributes more than 15% of revenues by 2023

-- Continued investment in the Group's next generation of

products by spending significantly more per annum on average than

the GBP0.3m per annum average spend over the previous strategic

objective cycle

The Group's segmental EBITDA will be based on a revised

allocation of Central Costs. This revision will enable a better

understanding of Divisional performance and is explained in some

detail in Note 5 to the interim financial statements below.

The Board will continue to measure the Group's performance

against these KPIs and report to shareholders annually on

progress.

Outlook

Current trading continues in line with the Board's expectations

set out in the Trading Statement of 30 July 2020.

Looking further forward, the Bioplastics division's orderbook

remains strong with a range of products with a more predictable and

improving growth profile, particularly in the US market. An

encouraging list of prospects for 2021 and strong customer

engagement has enabled the Board to form its expectations of

continued vigorous growth in this division for 2021. Delivering

this growth will require continued investment in resources and

working capital.

The Board believes that the Stanelco RF division's prospects for

2021 will remain moderated by continued overcapacity in the fibre

optic cable market and Covid-19 related uncertainties around demand

and capital expenditure in the industrial markets that the division

serves. The Board's expectations have been set accordingly. As

mentioned above the expectation is that, in time, the fibre optic

market will benefit from global digitisation (accelerated by the

pandemic).

The Company intends to raise total proceeds of GBP1.1m before

costs, representing GBP1.0m net of costs, via a placing and

subscription of new ordinary shares. This will provide support for

the ambitious growth plans of the Bioplastics division. New and

existing shareholders have confirmed their intention to participate

in this fundraising which is expected to be announced shortly.

John Standen

Chairman

CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

For the period ended 30 June 2020

6 Months 6 Months Year

Ended Ended Ended

30 June 30 June 31 December

2020 2019 2019

As restated

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------------------- ----- ------------ ------------ ------------

REVENUE 5 2,500 3,398 6,957

Cost of sales (1,746) (1,890) (3,933)

GROSS PROFIT 754 1,508 3,024

Other operating income 87 207 436

Administrative expenses (1,668) (2,210) (4,480)

LOSS FROM OPERATIONS (827) (495) (1,020)

Loss from operations before share options

charges (657) (424) (884)

Share options charges (170) (71) (136)

Finance charges (19) - (9)

Investment revenue 2 3 6

Foreign exchange gain 23 8 -

LOSS BEFORE TAXATION (821) (484) (1,023)

Taxation 6 - - 146

TOTAL COMPREHENSIVE LOSS FOR THE PERIOD

ATTRIBUTABLE TO THE EQUITY HOLDERS

OF THE PARENT (821) (484) (877)

============ ============ ============

Basic loss per share - pence 7 (29) (20) (35)

Diluted loss per share - pence 7 (29) (20) (35)

CONSOLIDATED STATEMENT

OF FINANCIAL POSITION

As at 30 June 2020

At At At

30 June 30 June 31 December

2020 2019 2019

As restated

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

--------------------------------------- ----- ------------ ------------ ------------

NON-CURRENT ASSETS

Other intangible assets 8 778 931 883

Property, plant and equipment 9 611 179 653

------------ ------------ ------------

1,389 1,110 1,536

------------ ------------ ------------

CURRENT ASSETS

Inventories 10 997 548 555

Trade and other receivables 11 1,781 1,232 1,885

Cash and cash equivalents 1,074 1,731 2,126

------------ ------------ ------------

3,852 3,511 4,566

------------ ------------ ------------

TOTAL ASSETS 5,241 4,621 6,102

============ ============ ============

CURRENT LIABILITIES

Trade and other payables 12 (1,245) (1,281) (1,381)

Lease liabilities (35) - (76)

(1,280) (1,281) (1,457)

------------ ------------ ------------

NON-CURRENT LIABILITES

Lease liabilities (401) - (438)

------------ ------------ ------------

(401) - (438)

TOTAL LIABILITIES (1,681) (1,281) (1,895)

------------ ------------ ------------

NET ASSETS 3,560 3,340 4,207

============ ============ ============

EQUITY

Share capital 140 118 140

Share premium 1,250 805 1,250

Capital redemption reserve 4 4 4

Share options reserve 548 314 377

Translation reserve (85) (85) (85)

Retained profits 1,703 2,184 2,521

EQUITY ATTRIBUTABLE TO EQUITY HOLDERS

OF THE PARENT AND TOTAL EQUITY 3,560 3,340 4,207

============ ============ ============

The interim statements were approved by the Board on 23

September 2020.

Signed on behalf of the Board of Directors

Paul R Mines

Chief Executive

23 September 2020

CONSOLIDATED STATEMENT

OF CASH FLOWS

For the period ended 30 June 2020

6 Months 6 Months Year

Ended Ended ended

30 June 30 June 31 December

2020 2019 2019

As restated

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------------- ------------ ------------ ------------

Loss from operations (827) (495) (1,020)

Adjustment for:

Amortisation of intangible assets 142 148 317

Depreciation of property, plant and

equipment 44 29 77

Share based payments 170 71 136

Foreign exchange 23 5 9

------------ ------------ ------------

Operating cash flows before movement

of working capital (448) (242) (481)

(Increase)/decrease in inventories (442) 407 400

(Increase)/decrease in receivables 104 (414) (1,087)

Decrease in payables (214) (512) (405)

------------ ------------ ------------

Cash utilised in operations (1,000) (761) (1,573)

Corporation tax received - 59 205

Interest paid - - (2)

------------ ------------ ------------

Net cash outflow from operating activities (1,000) (702) (1,370)

------------ ------------ ------------

Cash flows from investing activities

Interest received 2 3 6

Investment in intangible assets (37) (161) (282)

Purchase of property, plant and equipment (2) (23) (27)

------------ ------------ ------------

Net cash used in investing activities (37) (181) (303)

------------ ------------ ------------

Cash flows from financing activities

Proceeds of issue of ordinary share

capital - - 1,300

Costs of issue of ordinary share

capital - - (104)

Repayment of obligations under leasing

activities (15) - (11)

------------ ------------ ------------

Net cash used in investing activities (15) - 1,185

Net decrease in cash and cash equivalents (1,052) (883) (488)

Cash and cash equivalents at beginning

of period 2,126 2,614 2,614

Cash and cash equivalents at end

of period 1,074 1,731 2,126

============ ============ ============

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

For the period ended 30 June 2020

1. CORPORATE INFORMATION

The financial information for the year ended 31 December 2019

set out in this interim report does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006. The

Group's statutory financial statements for the year ended 31

December 2019 have been filed with the Registrar of Companies. The

auditor's report on those financial statements was unqualified and

did not contain statements under Section 498 of the Companies Act

2006. The interim results are unaudited. Biome Technologies plc is

a public limited company incorporated and domiciled in England

& Wales. The Company's ordinary shares are publicly traded on

the AIM market of the London Stock Exchange.

2. BASIS OF PREPARATION

These interim consolidated financial statements (the interim

financial statements) are for the six months ended 30 June 2020.

They have been prepared in accordance with International Financial

Reporting Standards (IFRSs) as adopted by the European Union. They

do not include all of the information required for full annual

financial statements and should be read in conjunction with the

consolidated financial statements of the Group for the year ended

31 December 2019.

The comparative figures for the first half of 2019 have been

restated to reclassify grant income from Revenue to Other operating

income in accordance with IAS 20 (Accounting for Government

Grants).

These interim financial statements have been prepared under the

historical cost convention. The Directors have considered the

impact of IFRS 3 and IFRS 9 and have concluded that no adjustments

are required.

These interim financial statements have been prepared in

accordance with the accounting policies adopted in the last annual

financial statements for the year to 31 December 2019.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of the interim

financial statements.

3. BASIS OF CONSOLIDATION

The Group's interim financial statements consolidate the results

of the Company and all of its subsidiary undertakings drawn up to

30 June 2020. As at 30 June 2020, the subsidiary undertakings were

Biome Bioplastics Limited, Stanelco RF Technologies Limited,

Aquasol Limited and InGel Technologies Limited.

4. GOING CONCERN

The Directors have reviewed forecasts for the period to

September 2021. These have been prepared with appropriate regard

for the current macroeconomic environment including the impact of

Covid-19 and the circumstances in which the Group operates. In

particular the Directors have considered the continuing growth of

the Bioplastics Division, its need for continued investment in

development resource and working capital, the steps they can take

to improve the efficiency of the working capital deployed and the

availability of future funding.

The model has assumed little growth in the period from the

Stanelco RF Division and the Directors have already taken steps to

ensure resources meet current demand.

The Directors believe that the model is resilient to further

limitations arising as a consequence of Covid-19. Other than the

current furlough scheme ending in October 2020 no other

government-backed funding has been assumed in the model.

The Company intends to raise total proceeds of GBP1.1m before

costs, representing GBP1.0m net of costs, via a placing and

subscription of new ordinary shares, comprising a first tranche of

new ordinary shares which would be issued to raise approximately

GBP308,000 pursuant to the Directors' existing share allotment

authorities, with two subsequent tranches of new ordinary shares

which would be issued to raise GBP742,000 and GBP50,000

respectively, subject to, inter alia, approval of shareholders at a

general meeting.

The Directors are satisfied that the Group has sufficient

resources to continue in operational existence for at least one

year from the date of approval of these Interim Results.

5. SEGMENTAL INFORMATION

Biome Stanelco

Revenue from external customers Bioplastics RF Technologies Total

GBP'000 GBP'000 GBP'000

For the 6 months to 30 June 2020

- unaudited 2,117 383 2,500

-------------- ----------------- --------

For the 6 months to 30 June 2019,

as restated - unaudited 1,235 2,163 3,398

------ ------ ------

For the 12 months to 31 December

2019 - audited 2,991 3,966 6,957

====== ====== ======

From the end of the current financial year, the Group intends to

amend its presentation of segmental information by allocating

certain Central Costs to its divisions.

Segmental information has previously treated shared costs e.g.

site rent, as Central Costs. These costs will, in the future, be

reallocated to the business' divisions on a proportionate basis,

using appropriate drivers for allocation based on use. Central

Costs will therefore no longer include the costs associated with

running the operational businesses, and divisional results will be

reported on a fully costed basis. This change is designed to

allowing users of the financial statements to better understand

divisional performance.

6. TAXATION

The Group's policy is to recognise tax credits resulting from

tax research and development claims on a cash received basis. The

claim in respect of the year ended 31 December 2019 has not yet

been settled.

7. LOSS PER SHARE

The calculation of basic earnings per share is based on the loss

attributable to the equity holders of the parent for the period of

GBP821,000 (H1 2019: loss of GBP484,000, FY 2019: loss of

GBP877,000) and a weighted average of 2,798,525 ordinary shares in

issue (H1 2019: 2,365,188, FY 2019: 2,472,038). The calculation

uses the same weighted average number of shares under the basic and

diluted basis in the current and comparative periods due to a loss

being made.

8. OTHER INTANGIBLE ASSETS

Other intangible assets decreased in the period as a result of

the capitalisation of product development costs of GBP37,000 being

lower than the amortisation charge of GBP142,000.

9. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment decreased in the period as a

result of the acquisition of property, plant and equipment of

GBP2,000 being lower than the depreciation charge of GBP44,000.

10. INVENTORIES

The increase in inventories in the period reflects the increase

in raw material orders to support the growth of the Bioplastics

division.

11. TRADE AND OTHER RECEIVABLES

Trade and other receivables have decreased in the period due to

the collection of some large balances in the first quarter, partly

offset by the growth of the Bioplastics division and the timing of

invoicing and shipments around the period end.

12. TRADE AND OTHER PAYABLES

The decrease in trade and other payables during the period

primarily reflects the decrease in activity levels, and equipment

sale deposits, within the Stanelco RF division.

13. RISKS AND UNCERTAINTIES

The principal risks and uncertainties affecting the business

activities of the Group are detailed in the Strategic Report which

can be found on pages 7-14 of the Annual Report and Financial

Statements for the year ended 31 December 2019 ("the Annual

Report"). A copy of the Annual Report is available on the Company's

website at www.biometechnologiesplc.com

The Directors consider that the risks affecting the business

remain similar to those listed in the Annual Report. In summary,

these risks include:

-- the uncertainty arising from the impact of Covid-19. This has

been considered elsewhere in this statement, in particular in the

Outlook section of the Chairman's statement and also in the going

concern review. The Directors believe that a further lockdown in

the UK due to Covid-19 will not significantly adversely impact the

Group but, if necessary, that they will be able to continue the

actions taken in 2020 to date to protect the business

-- changes in the regulatory environments in which the Group operates

-- fluctuations in exchange rates

-- volatility in raw material prices and supply

-- breach of intellectual property rights

-- competitors developing more attractive products

-- failure to commercialise products

-- reliance on a small number of customers for certain products

-- financial risks including exchange rate risk, liquidity risk,

interest rate risk and credit risk

Further details of how these risks impact the business and how

the Directors attempt to mitigate the risks can be found in the

Annual Report.

Copies of this interim report will shortly be available on the

Company's website at www.biometechnologiesplc.com .

Independent review report to Biome Technologies plc

Introduction

We have been engaged by the Company to review the financial

information in the half-yearly financial report for the six months

ended 30 June 2020 which comprises the Consolidated Statement of

Comprehensive Income, Consolidated Statement of Financial Position,

Consolidated Statement of Cashflows and the related explanatory

notes. We have read the other information contained in the half

yearly financial report which comprises only the Chairman's

Statement and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the Directors. The AIM rules of the London

Stock Exchange require that the accounting policies and

presentation applied to the financial information in the

half-yearly financial report are consistent with those which will

be adopted in the annual accounts having regard to the accounting

standards applicable for such accounts.

As disclosed in Note 2, the annual financial statements of the

Group are prepared in accordance with IFRSs as adopted by the

European Union. The financial information in the half-yearly

financial report has been prepared in accordance with the basis of

preparation in Note 2.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the financial information in the half-yearly financial report based

on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

The impact of macro-economic uncertainties on our audit

Our review of the condensed set of financial statements in the

half yearly financial report requires us to obtain an understanding

of all relevant uncertainties, including those arising as a

consequence of the effects of macro-economic uncertainties such as

Covid-19 and Brexit. Such reviews assess and challenge the

reasonableness of estimates made by the Directors and the related

disclosures and the appropriateness of the going concern basis of

preparation of the financial statements. All of these depend on

assessments of the future economic environment and the Company's

future prospects and performance.

Covid-19 and Brexit are amongst the most significant economic

events currently faced by the UK, and at the date of this report

their effects are subject to unprecedented levels of uncertainty,

with the full range of possible outcomes and their impacts unknown.

We applied a standardised firm-wide approach in response to these

uncertainties when assessing the Company's future prospects and

performance. However, no review of interim financial information

should be expected to predict the unknowable factors or all

possible future implications for a Company associated with these

particular events.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the financial information in the

half-yearly financial report for the six months ended 30 June 2020

is not prepared, in all material respects, in accordance with the

basis of accounting described in Note 2.

Use of our report

This report is made solely to the Company in accordance with

guidance contained in ISRE (UK and Ireland) 2410, 'Review of

Interim Financial Information performed by the Independent Auditor

of the Entity'. Our review work has been undertaken so that we

might state to the Company those matters we are required to state

to it in a review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company for our review work, for this

report, or for the conclusion we have formed.

Grant Thornton UK LLP

Statutory Auditor, Chartered Accountants

Southampton

23 September 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFFLARIVFII

(END) Dow Jones Newswires

September 24, 2020 02:00 ET (06:00 GMT)

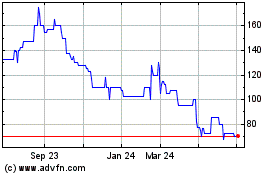

Biome Technologies (LSE:BIOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

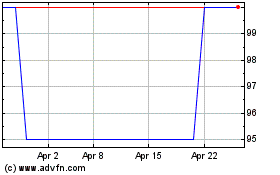

Biome Technologies (LSE:BIOM)

Historical Stock Chart

From Apr 2023 to Apr 2024