TIDMBIOM

RNS Number : 4152T

Biome Technologies PLC

25 March 2021

The information contained within this announcement is deemed by

the Company to constitute inside information for the purposes of

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310.

25 March 2021

Biome Technologies plc

("Biome", "the Company" or "the Group")

Final Results 2020

Biome Technologies plc announces its audited Final Results for

the year ended 31 December 2020.

Highlights:

Final Results

-- Another strong year for the Bioplastics division with revenue

growth of 65% building on the 81% revenue growth achieved in 2019.

The division enters 2021 with a healthy pipeline of customer

positions and prospects.

-- RF Technologies division revenues reduced to GBP0.8m due to

the o ngoing over-capacity in the division's core fibre optics

manufacturing market.

-- Reported Group loss before interest, interest, taxation and

amortisation (LBITDA) of GBP0.9m (2019: LBITDA of GBP0.5m), in line

with market expectations, with Group operating loss of GBP1.6m

(2019: loss of GBP1.0m).

-- Group cash position as at 31 December 2020 was GBP1.7m (31

December 2019: GBP2.1m) with no debt.

Paul Mines, Chief Executive Officer said: "2020 saw further

strong revenue growth from the Group's Bioplastics division

reflecting the conversion of the pipeline of opportunities that it

entered the year with. New opportunities from both existing and new

customers continue to present themselves both for bioplastic

packaging from the coffee sector and other segments of the food and

beverage packaging market. We will continue to work our cash

resources to maximise our ability to overcome the challenges posed

by Covid-19 and deliver good medium-term growth for

shareholders".

- Ends -

For further information please contact: Biome

Technologies plc

Paul Mines, Chief Executive Officer

Rob Smith, Chief Financial Officer

www.biometechnologiesplc.com Tel: +44 (0) 2380 867

100

Allenby Capital

David Hart/Alex Brearley (Nominated Adviser)

Kelly Gardiner (Sales and Corporate Broking)

www.allenbycapital.com Tel: +44 (0) 20 3328

5656

About Biome

Biome Technologies plc is an AIM listed, growth-orientated,

commercially driven technology group. Our strategy is founded on

building market-leading positions based on patented technology and

serving international customers in valuable market sectors. We have

chosen to do this by developing products in application areas where

the value-added pricing can be justified and are not reliant on

government legislation. These products are driven by customer

requirements and are compatible with existing manufacturing

processes. They are market rather than technology-led.

The Group comprises two divisions, Biome Bioplastics Limited

("Bioplastic") and Stanelco RF Technologies Limited ("RF

Technologies").

Biome Bioplastics is a leading developer of highly-functional,

bio-based and biodegradable plastics. The company's mission is to

produce bioplastics that challenge the dominance of oil- based

polymers.

Stanelco RF Technologies designs, builds and services advanced

radio frequency (RF) systems. Dielectric and induction heating

products are at the core of a product offering that ranges from

portable sealing devices to large furnaces for the fibre optics

markets.

www.biometechnologiesplc.com www.biomebioplastics.com and

www.thinkbioplastic.com www.stanelcorftechnologies.com

Chairman's Statement

Business performance

2020 was a pivotal year for the Group with its Bioplastics

division's sales growing to a record GBP4.9m (65% increase over

2019), as we continue to benefit from the momentum in supplying

compostable bioplastics to growing market sectors. By contrast, our

RF Technologies division was, as anticipated, adversely affected by

overcapacity in the fibre optic cable manufacturing sector.

Both businesses operated against the ongoing backdrop of the

Covid-19 pandemic and lockdowns, which, whilst hindering our

efforts to diversify the RF Technologies division's customer base,

demonstrated the resilience of the bioplastics market and the

strength of Biome's offering and relevance to this rapidly

expanding compostable materials market.

As a result of these trends, Bioplastics represented 86% of

Group revenues in the year.

During the year we completed an equity placing and subscription

that raised an additional GBP1.0m, net of costs, to strengthen our

balance sheet to support the continued expectations of growth in

Bioplastics.

Bioplastics division

In our placing circular to shareholders last year, we laid out

four growth drivers which we believed would deliver significant

value for shareholders and maintain our KPI target of 40% revenue

growth in the Bioplastics division through 31 December 2023. I

would like to mention these growth drivers again specifically and

update you on progress in each of them:

1. Continued growth from existing customers with existing

products, especially flexible film in both industrial and

particularly home compostable formats, in the North American

market.

Growth from our existing customers and products remains

positive. We expect growth in flexible film in North America to be

more pronounced in the medium term.

2. Filtration mesh: The Company envisages growth with a second

end-customer with a material that has been proven with an existing

customer over the last three years. Implementation of this project

is underway.

This project is going well, and we confidently expect

implementation to complete later this year. As recently announced,

our second end-customer has placed orders for equipment that

increases their capacity to utilise Biome's filtration mesh on a

significant proportion of their installed capacity. Revenues will

become significant and recurring from H2 2021 and for the whole of

2022, thus delivering a major part of our KPI target.

3. Coffee pod material: The Company launched a project for a

heat stable material for coffee pods within the US at the end of

2019. Commercial sales of this product are gaining momentum.

In addition to continued demand from the lead customer (as

previously announced) this material is now being trialled at

several other end-user organisations. We expect significant

commercial progress in this area in H2 this year and beyond.

4. Packaging film: The Company is working on seven new customer

projects that focus on the conversion of flexible packaging to

compostable formats. Six of these projects are for the North

American Market.

Six of these original projects continue at pace with trials

either taking place in Q1 or expected for Q2 2021. One project with

an end-user in the USA has been suspended due to the pandemic. A

further pipeline of new customer projects of scale has been added

to this growth driver and trial orders have been placed by

customers in Q1 this year. We expect two or three of these to

become commercially meaningful and generate recurring revenue

towards the end of this year.

Over the last seven years, Biome Bioplastics has coordinated

significant research and development funding in conjunction with

leading universities, in pursuit of bringing a new family of novel

bio-based and biodegradable polyesters to market. Exciting new

materials are now emerging, and we have recently announced our

success in partnering with Innovate UK, the UK's innovation agency

and a leading manufacturer to bring a biodegradable tree-guard to

market. This project is still at a relatively early stage and it is

therefore too early to predict the scale or timing of production

orders. However, the Board is encouraged by the support and

reception that this initiative has already gained.

We believe that the progress described above highlights the

growing reputation of our Bioplastics business for innovative

materials and how it is leading to market success and penetration,

particularly in the USA.

RF Technologies division

The downturn in demand for capital goods in the fibre optic

cable manufacturing sector that the division first saw in 2019

continued throughout 2020. The division's efforts to diversify its

revenue stream were hampered by the ongoing Covid-19 pandemic, as

it became difficult to engage with new customers and a number of

potential opportunities were put on hold as our clients deferred

capital expenditure. In the face of the ongoing difficulties in the

fibre optic market and other sectors, it was necessary to implement

a number of cost reduction measures. 2021 has started with some

glimmers of recovery in the fibre optic sector and we have started

receiving more enquiries both for new fibre optic furnaces as well

as spares and service orders, although we do not expect to see a

material pickup in the near future.

Covid-19

The Group continues to monitor the ongoing impact of the

Covid-19 epidemic and places high importance on caring for its

staff and customers. Adjustments made in 2020 to commercial and

manufacturing activities remain in force and are continually

reviewed to ensure they provide a safe operating environment.

With a year's experience of working with the varying

restrictions in both in the UK and overseas, the Group has a better

understanding of the commercial impact of the pandemic and has

adapted accordingly to meet the opportunities and risks

presented.

We have only experienced minor supply chain issues in the

Bioplastics division but continue to be vigilant in case of any

disruption. Business development has been successfully managed

remotely with use of video conferencing to regularly interface with

customers.

The RF Technologies division was more adversely impacted by

Covid-19. The division's ongoing activity to widen the markets that

it sells into has been frustrated by a slowdown in capital

expenditure and restrictions placed on travelling to and meeting

with potential customers.

A number of cost saving actions have been taken to reduce the RF

Technologies division's overhead expenditure including a reduction

in the number of staff and use of the Coronavirus Job Retention

Scheme to maintain operational capabilities.

Whilst we expect to see a continuing impact from Covid-19, the

business has adapted to the challenges that the pandemic has

presented, and we look forward to a more normal environment in the

future.

Results

The Group's results were in line with the market forecast for

the year ended 31 December 2020.

Consolidated Group revenue for the year was GBP5.7m (2019:

GBP7.0m) reflecting the increase in Bioplastics sales offset by the

decline in those from the RF Technologies division. Group gross

margins for the year were 29.4% (2019: 43.5%) reflecting the

changing mix of sales towards volume Bioplastics.

The Group loss before interest, taxation, depreciation and

amortisation (LBITDA) was in line with market expectations at

GBP0.9m (2019: GBP0.5m LBITDA). A Group operating loss of GBP1.6m

for the year was incurred (2019: GBP1.0m loss).

During 2020, the Board concluded that, to gain a more accurate

representation of the costs and profits associated with the

Bioplastics and RF Technologies divisions, certain costs previously

accounted for as part of the Central Costs division would be

allocated, to the operating divisions. These costs include

insurance, accounting, administration, facilities, and executive

management activities attributable to the operating divisions. A

restatement of the segmental information for 2019 has been made to

allow users of this information to compare it on a consistent

basis.

The Bioplastics division achieved an increase in sales to

GBP4.9m (2019: GBP3.0m) representing 65.4% growth as the division

grew its sales with both new and existing customers and demand for

compostable products strengthened. The division recorded a LBITDA

of GBP0.1m which was an improvement over the prior year (2019:

GBP0.8m LBITDA restated) as sales revenue increased. The resulting

operating loss also narrowed to GBP0.5m (2019: GBP1.2m loss

restated).

The RF Technologies division's revenues were GBP0.8m (2019:

GBP4.0m) reflecting the hiatus in demand in the fibre optic market

compounded by the effects of the Covid-19 pandemic. The division

reported a LBITDA of GBP0.4m (2019: GBP0.8m EBITDA restated) and an

operating loss of GBP0.5m (2019: GBP0.7m profit restated). These

results reflect management actions to reduce costs where possible

in the light of market conditions and benefiting from the UK

Government's Coronavirus Job Retention scheme.

The Group's cash balances as at 31 December 2020 were GBP1.7m

(31 December 2019: GBP2.1m) reflecting trading losses for the year

offset by the net equity fund raise of GBP1.0m in the year. The

Group had no debt as at 31 December 2020. Capitalised product

investment in the Bioplastics division was GBP0.3m (2019:

GBP0.3m).

Strategy

The Group continues to execute on its strategy to be a leading

player in its chosen markets. In both markets addressed by the

Group our products are developed to meet our customers' demanding

requirements and incorporate a high level of technological knowhow

that differentiates our offerings from the competition.

In the Chairman's statement, made as part of the interim results

for 2020, we updated and restated our high level Key Performance

Indicators (KPIs) to extend the period they cover to 31 December

2023 and to reflect the continued growth in the Bioplastics

division as well as the market headwinds facing the RF Technologies

division. The revised KPIs and the progress made as at 31 December

2020 is set out below: -

-- 40% annual revenue growth in the Bioplastics division.

During the year ended 31 December 2020, the division exceeded

this target with revenue growth of 65.4%.

-- Bioplastics division's profitable revenue growth to achieve

a 10%-12.5% EBITDA margin by the end of the KPI period.

Good progress was made towards this KPI as the Bioplastics division's

LBITDA narrowed to 2.4% for 2020 compared with 27.4% LBITDA

in 2019 (calculated on a like-for-like basis).

-- Continued diversification of the Group's turnover by product

and market to ensure that no single product or end customer

contributes more than 15% of revenues by 2023.

The Group had two customers (2019: two customers) who each accounted

for more than 15% of Group revenues. In 2020, both of these

customers were in the Bioplastics division as their use of Biome

products continued to grow. The two customers referred to are

converters of material for a further number of end customers.

Good progress is being made to diversify the number of end customers

and the variety of products being sold.

-- Continued investment in the Group's next generation of products

by spending significantly more per annum on average than the

GBP0.3m per annum average spend over the previous strategic

objective cycle.

The Group met this target with GBP0.7m R&D investment in the

year.

Board and personnel changes

In October 2020, we were pleased to announce the appointment of

Rob Smith as Chief Financial Officer. Rob is an experienced

'C-level' executive with many years' service with technology-based

AIM listed SMEs both as CFO and CEO and having most recently been

CEO at Filtronic plc.

Post year-end Michael Kayser confirmed his decision to retire

from his role as non-executive director and chairman of both the

Remuneration and Audit Committees. Michael has served Biome

exceedingly well during a very exciting 10 years for the

business.

We are pleased to welcome the appointment of Simon Herrick, as a

non-executive director. He will be a member of the Nominations

Committee and will chair both the Audit and Remuneration

Committees. Simon qualified as a Chartered Accountant with Price

Waterhouse and has held a number of executive director roles with

listed companies including Northern Foods plc, Debenhams plc and

Blancco Technology Group plc. Simon is currently NED and chair of

Audit and Remuneration Committees at both Ramsdens Holdings PLC and

FireAngel Safety Technology Group plc.

Race to Zero

As recently announced, Biome Technologies has signed up to the

United Nations Race to Zero Climate Campaign and is committed to

reducing its carbon emissions in line with publicly disclosed

targets. We will commence reporting on our progress on this vital

subject in our results for the year ending 31 December 2021.

Outlook

We believe that the growth phase that the Bioplastics division

has entered represents a permanent move to more sustainable

materials and confirmation that our strategy is working. We expect

that the opportunities we have secured, and that are starting to

turn into repeat business, are only the beginning of a market shift

to more sustainable products. The RF Technologies division remains

susceptible to market disruption caused by Covid-19 but we are

encouraged by a slight improvement in its outlook; we will continue

to closely monitor the ongoing progress of the division.

Trading in the first quarter of 2021 was in line with our

expectations and the outlook for the year remains unchanged. We

continue to manage our cash resources to ensure that we are able to

achieve sustainability for the Group.

John Standen

Chairman

Strategic Report

Biome Technologies plc is a growth orientated, commercially

driven technology group. Its strategy is founded on building

market-leading positions based on patented technology and serving

international customers in the bioplastics and radio frequency

heating sectors. We have chosen to do this by developing products

in application areas where value-added pricing can be justified and

that are not reliant on government legislation. The growing

portfolio of products is driven by customer requirements and

compatible with existing manufacturing processes. They are market

rather than technology led.

The directors consider its shareholders, employees, customers

and suppliers as its key stakeholders and the divisional analysis

below outlines the strategies that have been adopted to promote the

success of the Group and to meet its objectives.

Biome Bioplastics Division

The Bioplastics division achieved sales revenue of GBP4.9m

(2019: GBP3.0m), an increase of 65.4%. This increase in reported

revenues related to existing products as well as new product

launches and reflects the continuing increased activity and enquiry

levels that currently exist both in the Bioplastics division and

also the wider market. Staffing and resourcing levels were adjusted

accordingly to accommodate this increased activity, which is

anticipated to maintain its upward trajectory over the coming

years. The net effect of the increase in revenues was to decrease

the division's operating loss to GBP0.5m (2019: GBP1.2m loss

restated).

Markets

Plastics and their use or misuse by humanity remains a key

environmental topic for both the UK and overseas markets. There is

sustained pressure from consumers, media and governments to reduce

the environmental impact of plastics. In recent years, the focus of

this pressure has been on the "end-of-life" of such materials, how

they are disposed of and the consequence of fugitive release to the

environment. In addition, with rising concerns regarding climate

change, there is greater interest in how such materials might also

be manufactured with lower carbon footprints.

The compelling case for compostable (biodegradable) bioplastics

lies in their ability to ensure that organic food waste reaches

appropriate treatment (e.g. industrial scale anaerobic digestion

and composting facilities) and that the resulting digestate and

compost does not contain persistent plastic contamination when

spread to soils. This is driving the growth of the compostable

packaging market in sectors such as food waste bags, coffee pods,

tea bags and other food contaminated packaging formats.

The growth of the compostable plastics market is facilitated

when there is a clear route for food waste and food contaminated

packaging to reach appropriate sorting and treatment facilities.

This requires appropriate labelling, user education, collection,

sorting and treatment capacity. The quality of such disposal supply

chains varies considerably by geographic territory and often within

countries although there is, in general, a move to improve and

scale-up such activity.

Arguably, the consumer desire to change the plastic model is

pulling through increased demand for compostable plastics at a rate

that is faster than the disposal supply chains are able to adapt

to. As a result, there is increased demand from the market for

bioplastics that can be composted at home. Whilst it is a minority

of the population that has the access and/or desire to treat

organic waste and packaging at home, those that are are highly

motivated to treat such waste appropriately. This is driving the

compostable plastics market to producing and certifying products

that are suitable for this end-of-life solution. Such products are

required to compost at lower temperatures and in less well managed

conditions than can be expected at industrial facilities.

The case for bio-based bioplastics is driven by the growing

scientific evidence that the use of biogenic inputs reduces the

carbon footprint of such materials and will in time lead to a more

sustainable plastics industry. There are a limited number of

territories that legislatively require bio-based inputs in some

plastics, but it might be expected that this trend is likely to

accelerate. There is some evidence that some consumers will choose

bio-based materials when offered a choice, but this appears, at

present, to sit behind the desire for compostable

functionality.

The UK market has been somewhat slower to embrace compostable

and bio-based materials than some other territories. Whilst there

is considerable focus on plastic waste, there is still a continuing

debate of how best to manage the problem. The local council control

of the disposal supply chain and its wide variability is seen by

some as part of the problem and a move in England towards universal

food waste collection by 2023 presents an opportunity for

compostable plastics. At present, the UK market remains a smaller

part of the Bioplastics division's short-term focus with the more

immediate sales opportunities and growth being in the US

market.

Cost and functionality will remain key hurdles over the

widespread adoption of bioplastics over petro-chemical plastics.

Current adoption is therefore driven by consumer pull, and their

willingness to pay a premium for biodegradability/compostability,

or government legislation. To overcome these hurdles the

Bioplastics division focuses on areas of the market where there is

a high technical performance requirement, the cost of the

biomaterial is a small fraction of the end product price, and where

there is a consumer willingness to convert to a biodegradable

material.

Research and development within the Bioplastics division is

therefore focussed on these three areas and in particular targeted

towards customer requirements for a biodegradable solution. The

commercial lifecycle of our product developments can be categorised

in the following stages of the product lifecycle:

-- Research phase - technology and product development occurring

within Biome's own laboratories or at external support facilities

-- Development phase - the product is being developed and tested

with small scale supplies to customers for end use testing

-- Initial manufacturing phase - the product is signed off by the

customer as suitable for its requirements and is now undergoing

significant long-term testing to ensure the end product can

be run in commercial quantities across the supply chain

-- Commercial phase - the product has been through the above phases

with the customer and is now achieving regular and significant

sales with the end product being purchased and used by the final

consumer

Technical Development

Biome Bioplastic's development work remains focussed on

innovative developments where there is a customer requirement for

the product and a willingness to pay a premium for the

environmental attributes. During 2020, the development team worked

on a variety of technical challenges that included the development

of home compostable materials, the improvement of oxygen and vapour

barrier performance, the soil degradability of materials to be used

in tree shelters and the improvement of temperature performance for

a variety of end-uses.

The Bioplastics division also continued its work in medium term

Industrial Biotechnology research into the transformation of

lignocellulose (often sourced from agricultural waste) into low

cost bioplastics using microbial and enzymatic routes. If

successful, it is anticipated that this work will result in

bioplastics with improved functionality at a cost comparable to

current petro-based plastics. This development work continues to be

supported by research grants and much of the work is undertaken in

collaboration with leading UK universities.

Stanelco RF Technologies division

The RF Technologies division is a specialist engineering

business focused on the design and manufacture of

electrical/electronic systems based on advanced radio frequency

technology.

The division's core offering is the supply of fibre optic

furnaces, although the business is also exploring other markets

where its expertise in induction heating can be utilised. Total

revenues in 2020 were significantly reduced at GBP0.8m (2019:

GBP4.0m). This reduction was caused by the combined effects of the

continued low level of capital goods expenditure in the division's

main telecoms fibre optic market due to the previously reported

excess capacity for fibre optic industry and the Covid-19 pandemic

that has caused delays in capital equipment purchases throughout

the UK industrial sector. As a consequence of the reduced sales,

the division incurred an operating loss for the period of GBP0.5m

(2019: GBP0.7m profit restated).

The business currently focuses on four key revenue streams:

Optical Fibre Furnace Systems

The RF Technologies division is a world leader in the design and

manufacture of induction furnace systems used in the manufacture

and processing of silica glass "preforms" to produce optical fibre.

Each system is bespoke to customers' exact requirements. There is

currently a continuing imbalance in the global demand for optical

fibre compared to the installed capacity base. This overcapacity

affected demand for furnaces in 2020 with no orders being received

during the year. It is expected that as demand for fibre optic

cable grows, the imbalance in manufacturing capacity will reverse

in the mid-term. The Group is receiving enquiries for specific

types of furnaces and spares that suggests that capacity

utilisation is increasing. Nonetheless, we do not expect to see a

significant change in market dynamics during 2021.

Plastic Welding Equipment

These units are used in a multitude of end-user applications

including the nuclear, medical and industrial sectors. The

equipment is provided in either hand-held, mobile or fully

automated static solutions, dependent on customers'

requirements.

Induction Heating Equipment

The division sells bespoke induction heating equipment mainly

into the UK industrial sector. Whilst this is a small part of the

division's sales, it is a strategic aim to increase the equipment

offering and expand sales of this type of equipment.

Service and Spares

The business continues to support its large installed equipment

base through the provision of maintenance support, system upgrades

and specialist spares across the globe.

Principal Risks and Uncertainties

Biome is subject to a number of risks. The Directors have set

out below the principal risks facing the business. The Directors

continually review the risks identified below and, where possible,

processes are in place to monitor or mitigate all of these risks.

Risks and uncertainties associated with the on-going Covid-19

pandemic are considered in a dedicated sub-section to the principal

risks and uncertainties.

Risk Nature Mitigation strategies

Political, The Group is subject to The Directors aim to focus

Economic political, economic and their product range on areas

and Regulatory regulatory factors in where demand is not reliant

Environment the various countries on government regulation.

in which it operates. The Group ensures its staff

There may be a change are well versed in the regulatory

in government regulation environment of its end-use

or policies which materially industries and regularly

and/or adversely affect reviews its product portfolio

the Group's ability to to ensure compliance with

successfully implement relevant regulations.

its strategy.

Some of the Group's products

are employed in the food

and pharmaceutical industries,

both of which are highly

regulated. There is a

risk that the Group may

lose contracts or be subject

to fines or penalties

for any non-compliance

with the relevant industry

regulations.

============================================================ ===================================

Exchange The Group exports the The Directors are informed

Rate Fluctuations majority of its products regularly of the potential

and therefore fluctuations impact of exchange rate

in exchange rates may movements on the business

affect product demand and act to mitigate any

in different regions and adverse movements wherever

may adversely affect the possible. In order to mitigate

profitability of products the medium term impact of

provided by the Group any adverse exchange rate

in foreign markets where movements, the Group will

payment is made for the look to move production

Group's products in local and match the currency of

currency. its input costs with those

of the contractual selling

price thereby reducing the

currency movement risk to

the gross margin of the

product.

============================================================ ===================================

Suppliers The Group's products and To mitigate this risk, the

and Raw manufacturing processes division is seeking to validate

Materials utilise a number of raw new materials coming onto

materials and other commodities. the market which may be

In particular, the Bioplastics used in substitution.

division requires a few,

key raw materials to manufacture

its biodegradable polymer

resins. There are very

few suppliers of these

key raw materials and

with the current increased

demand for biodegradable

products there is a risk

that the division may

not be able to purchase

the required volumes of

materials to meet customer

demand or that prices

may be increased at short

notice.

============================================================ ===================================

Intellectual Although the Group attempts The Group takes professional

Property to protect its intellectual advice from experienced

property, there is a risk patent attorneys and works

that patents will not hard to win patents applied

be issued with respect for and to ensure that the

to applications now pending. scope is sufficiently broad.

Furthermore, there is The Group keeps up-to-date

a risk that patents granted with its competitors' product

or licensed to Group companies developments and patent

may not be sufficiently portfolios and aims to ensure

broad in their scope to that no infringements occur.

provide protection against Professional advice is sought

other third party technologies. from experienced patent

Other companies are actively attorneys if there are any

engaged in the development concerns.

of bioplastics. There

is a risk that these companies

may have applied for (or

been granted) patents

which impinge on the areas

of activity of the Group.

This could prevent the

Group from carrying out

certain activities or,

if the Group manufactures

products which breach

(or may appear to breach)

such patents there is

a risk that the Group

could become involved

in litigation which could

be costly and protracted

and ultimately be liable

for damages if the breach

is proven.

============================================================ ===================================

Competition There is a risk that competitors The Group aims to be ahead

may be able to develop of the competition through

products and services working closely with customers

that are more attractive to produce products that

to customers, either through meet their exact requirements

price or technical performance, rather than offering "off

than the Group's products the shelf" solutions.

and services.

============================================================ ===================================

Commercialisation There is a risk that the The Directors ensure that

of New Products Group will not be successful regular reviews of product

in the commercialisation development are undertaken

of its products from early-stage so that unsuccessful developments

research and development can be terminated early

to full-scale commercial in their life cycle. Impairment

sales. The Group develops testing of the capitalised

a number of products and costs is performed twice

some may not prove to a year with any impaired

be successful. Specifically, capitalised costs written

the risks associated with off.

the product life cycle

are as follows:

* Research and Development phase - the development of

the products may prove not to be technically feasible

or do not exactly match the perceived customer need

* Initial manufacturing phase - whilst the product

matches the customer needs it may not be able to be

produced at the required commercial speeds and/or at

the required efficiency and quality

* Commercialisation phase - the product may be

superseded either through price or a competitor

product being more advanced

============================================================ ===================================

Customers The Group's ability to The Group works closely

and Customer generate revenues for with its customers with

Concentration a number of its products the aim of ensuring that

is reliant on a small its products evolve in line

number of customers. If with their requirements.

one of these customers In addition, the Group is

was to significantly reduce continually seeking to add

its orders, then this to its customer base and,

could have a significant as its revenues grow, seeks

impact on the Group's to become less dependent

results. on any single customer.

============================================================ ===================================

Brexit The UK left the European The Group has worked closely

Union during the year with import and export agents

under review and the transition as well as local advisers

arrangements ended on in Europe to ensure that

31 December 2020. The we are compliant with the

new trade deal entered various new regulations

into between the UK and now in force.

the European Union was The Group will continue

in negotiation until the to monitor local regulations

end of the transition as the new requirements

period and therefore we settle down and will introduce

have had to implement additional, proportionate

new processes with little mitigating policies as required.

forward notice of the

details of trading arrangements.

This has caused some minor

short-term disruption

of both exports to and

imports from countries

in the European Union.

The majority of the Bioplastics

products that are produced

in the European Union

are sold either locally

into the continental European

market or exported directly

to the US market. Whilst

deliveries of these goods

are not therefore transported

through the UK new local

documentation and compliance

procedures have been required

for us to export from

the EU.

============================================================ ===================================

Covid-19

The Covid-19 pandemic continues to significantly impact

individuals, businesses, markets and economies, but despite this

there has been minimal direct impact on the Group's operations. The

Group has continued its manufacturing and development operations in

accordance with Government advice.

New orders for products supplied by the RF Technologies division

have reduced as our customers have reduced their investment

activities. However, this must also be seen in the light of an

overall excess in capacity in our main fibre optic market that had

already seen suppressed sales in 2019.

The Biome Bioplastics division had to conduct some trials

virtually, where physical attendance was not possible or permitted

and it utilised the skills and expertise of a consultant in the US

to assist with some of these trials.

The table below details some of the key risks and the strategies

that we have introduced to mitigate the risks:

Risk Nature Mitigation strategies

Financial Increased market risk and The Group is tightly controlling

reduced revenues heighten overhead spend and actively

the liquidity risk whilst reducing spend where possible

deterioration of the economic and has used the UK Government's

market heightens credit Coronavirus Job Retention

risk. Scheme (Furlough) to offset

Economic disruption may employment costs where staff

also impact financial markets have not been able to work

including currencies, interest due to "lockdown" restrictions

rates, borrowing costs and disruptions to order

and the availability of flows from customers.

debt and equity finance. It was necessary to make

The impact of Covid-19 a number of staff redundant

on our customers and their in the RF division.

ability to continue to Some of the Group's customers

trade and pay invoices have experienced liquidity

on time and the consequential issues during the period

impact on the Group's cashflow. and this has meant that

Impact of going concern we have had to increase

assessment. our provision for slow moving

debts. As a result, the

Group has focussed its activities

on supplying customers with

stronger financial positions.

A thorough going concern

assessment was conducted

that considered a number

of scenarios and included

a reverse stress test. The

directors concluded that

there is sufficient working

capital for the Group to

meet present and future

obligations over the next

12 months.

================================= ====================================

Health and The health and safety of The Group was quick to set

safety our employees is of paramount up a Covid-19 response team

importance. There is a and implement a range of

risk that our colleagues measures to combat the risks

may come into contact with of Covid-19. This included

carriers of Covid-19 and asking all employees to

bring it in to our facilities. work from home that were

In order to manage the able to do so. This worked

risks and adhere to government well as our principal IT

guidelines the Group had systems are cloud based

to change the method of or accessible remotely.

operation and implement A proportion of our employees

measures to mitigate the were not able to work from

risk. home as they need to access

facilities at our Marchwood

facility. To this end, the

Group carried out risk assessments

and put in place a dedicated

`Covid Team', to ensure

compliance of the implemented

positive safety measures

and to undertake a continual

review of the effectiveness

and relevance of such measures.

Further risk assessments

will be carried out if deemed

necessary.

A Covid policy that was

communicated to staff remains

in force. Signage around

the building is displayed;

to inform staff of maximum

occupancy levels within

certain areas of the building,

as well as a reminder of

social distancing and the

frequency of hand washing.

There has been an increase

in the frequency and thoroughness

of the cleaning provided

by external contractors.

All staff have been issued

with a `Covid Pack', consisting

of hand sanitisers, anti-bacterial

wipes and face masks. Staff

are consulted with about

Covid and encouraged to

raise any concerns.

================================= ====================================

Cyber Security Covid-19 has increased Biome has effective cyber

cyber threats from cyber security controls and has

criminals and other malicious increased the focus on addressing

groups who are targeting security alerts as soon

businesses by deploying as they arise. Security

Covid-19 related scams education of employees has

and phishing emails. Employees been increased highlighting

working from home have security threats.

also heightened cyber security

risks.

================================= ====================================

Financial review

The KPIs which the Board uses to assess the performance of the

Group are detailed in the Chairman's Statement. The Chairman's

statement forms part of the Strategic Report.

The summary results for the Group are shown below:

Like-for-like comparisons 2020 2019 Growth

GBP'm GBP'm

Revenues

Bioplastics 4.9 3.0 65.4%

RF Technologies 0.8 4.0 (79.7%)

Reported Group revenues 5.7 7.0 (17.3%)

------------------------------------ --------------- --------------- --------

(L)/EBITDA Restated

Bioplastics (0.1) (0.8)

RF Technologies (0.4) 0.8

Central Costs (0.4) (0.5)

Reported (L)/EBITDA (0.9) (0.5)

------------------------------------ --------------- --------------- --------

less depreciation, amortisation

and equity share option charges: Restated

Bioplastics (0.4) (0.4)

RF Technologies (0.1) (0.1)

Central Costs (0.2) (0.1)

(0.7) (0.5)

(Loss)/Profit from Operations Restated

Bioplastics (0.5) (1.2)

RF Technologies (0.5) 0.7

Central Costs (0.6) (0.6)

Like-for-Like Operating Loss (1.6) (1.0)

------------------------------------ --------------- --------------- --------

Net Assets

Non-current assets 1.4 1.5

Inventories 0.7 0.6

Trade and other receivables 1.6 1.9

Cash 1.7 2.1

Trade and other payables (1.1) (1.5)

long term lease commitments (0.4) (0.4)

Net assets 3.9 4.2

------------------------------------ --------------- --------------- --------

Segmental information has been restated to allocate costs

previously accounted for as Central Costs to Bioplastics and RF

Technologies, see Note 2 for details.

Revenues

Reported Group revenues decreased in the year to GBP5.7m from

GBP7.0m due to the absence of orders for fibre optic furnaces sold

by the RF Technologies division exacerbated by lower demand for

capital goods resulting from the recession caused by Covid-19. The

Bioplastics division continued to see significant increases in

revenues as customers see the benefits of compostable packaging

particularly in the food and beverages sector.

(L)/EBITDA

Reported (Loss) / Earnings Before Interest, Taxation,

Depreciation and Amortisation ((L)/EBITDA) for the year was a loss

of GBP0.9m (2019: (GBP0.5m)). The increase in LBITDA is a direct

result of the lower revenues in the RF Technologies division. This

has been partially offset by increases in revenues in the

Bioplastics division as well as reduced overhead costs.

Operating Profits/(Losses)

The Group recorded an operating loss for the year of GBP1.6m

compared to an operating loss of GBP1.0m in the prior year.

Administrative costs across the Group in 2020 were GBP3.6m

(2019: GBP4.5m). When the non-cash effects of depreciation,

amortisation and equity settled share option charges are removed,

the cash administrative expenses in 2020 decreased to GBP2.9m

compared to prior year (2019: GBP4.0m). This decrease in expenses

is mainly attributable to reductions in expenditure within the RF

Technologies division, as costs were scaled back as a result of the

lower activity levels, and savings made by senior directors /

employees voluntarily accepting lower salaries to help mitigate the

financial impact of Covid-19.

Investment in product research and development was GBP0.7m in

the year (2019: GBP1.1m), which includes the research work in grant

backed Industrial Biotechnology, of which GBP0.3m (2019: GBP0.3m)

was capitalised in the year. The reduced level of research and

development expenditure in the year was attributable to a reduction

in the value of grant funded research activity. Tax R&D claims

resulted in a credit being recognised in the year of GBP0.2m with

cash being received after the year end (2019: credit of

GBP0.1m).

The Group recorded a loss after tax for the year of GBP1.5m

(2019: loss after tax of GBP0.9m), giving a basic loss per share of

51p (2019: loss per share of 35p).

Statement of Financial Position

The carrying value of intangible assets relates to capitalised

development costs predominantly within the Biome Bioplastics

division for development of the Group's own intellectual property

and product range.

As at 31 December 2020, there was GBP0.8m of capitalised

development costs (2019: GBP0.9m) within the Group's statement of

financial position, of which GBP0.4m relates to BiomeMesh. An

assessment is made at least annually which assumes future potential

market take up of the products and the margins achievable.

Cashflow

2020 2019

GBP'000 GBP'000

Loss from operations (1,575) (1,020)

adjustment for non-cash items 658 539

Movement in working capital (138) (1,092)

Cash utilised by operations (1,055) (1,573)

Investment activities (275) (303)

R&D Tax credit - 205

Interest paid (38) (2)

Financing activities 920 1,185

Net decrease in cash (448) (488)

Opening cash balance 2,126 2,614

Closing cash balance 1,678 2,126

--------------------------------- --------------------- ---------------------

The cash utilised in operations, before working capital

movements, was GBP0.9m (2019: cash utilisation of GBP0.5m). Working

capital movements of GBP0.1m utilisation in the year reflected the

increased utilisation in the Bioplastics division offset by a

further unwind of working capital in the RF Technologies

division.

Investment in the year in capitalised product development and

capex was flat at GBP0.3m (2019: GBP0.3m). Financing activities

principally represented the share issues in 2020 and 2019 with new

shares in the Company raising GBP1.0m net of costs (2019: GBP1.2m).

No R&D tax credits were received during 2020 as the claim for

2019 expenditure was not submitted until the end of the year (2019:

GBP0.2m). Post year-end a payment of GBP0.2m was received in

respect of 2019 R&D tax credits.

The resultant closing cash position was GBP1.7m (2019:

GBP2.1m).

Going Concern

The Group has operated for a year under Covid-19 pandemic

conditions and has had time to assess the impact that the pandemic

has had on its business. During 2020, the Group and specifically

the RF Technologies division has reduced its cost base. Further to

that, the Company successfully raised additional funding of GBP1m

(after expenses) by way of a placing and subscription of new equity

completed in the second half of 2020.

The key business risks and conditions that may impact the

Group's ability to continue as a going concern are the utilisation

of existing resources to finance growth, investment and

expenditure; the rates of growth and cash generated by group

revenues, the timing of breakeven and positive cashflow generation

and the ability to secure additional debt or equity financing in

future if this became necessary. The primary area of judgement that

the Board considered, in the going concern assessment, related to

revenue expectations and visibility.

The Board was mindful of the guidance surrounding a severe but

plausible assessment and, accordingly, considered a number of

scenarios in revenue reduction against the original plans. A

reverse stress test was constructed to identify at which point the

Group might run out of its available cash. The test was designed

specifically to understand how far revenue would need to fall short

of the base case forecast and does not represent the directors view

on current and projected trading. The test assumed the unlikely

scenario that (a) demand for RF products would decline to a lower

level than that seen in 2020 and (b) the sales growth achieved by

Bioplastics during the second half of 2020 would not be repeated in

the forecast period. For the reverse stress test, the Board

specifically excluded any significant upsides to this scenario.

This is despite strong incremental demand potential at both

existing and new customers for the Group's Bioplastic products and

excludes the potential of an improvement in the Fibre Optic furnace

market. This most severe scenario also excludes any mitigating

reduction in the cost base that the Board would clearly undertake

in this event. In all scenarios modelled, including the reverse

stress test, the Group has sufficient resources to operate and meet

its liabilities throughout the going concern review period without

the inclusion of the impact of mitigating actions.

At 31 December 2020, the Group had a net cash balance of GBP1.7m

and as at 24 March 2021 a balance of GBP1.7m. The 31 December 2020

balance exceeded market forecast and the 24 March 2021 balance was

better than predicted in all the going concern scenarios tested. On

a revised base case scenario adopted for their assessment, the

Board is comfortable that the Group can continue its operations for

at least a 12-month period following the approval of these

financial statements.

As a result of this review, which incorporated sensitivities and

risk analysis, the Directors believe that the Group has sufficient

resources and working capital to meet their present and foreseeable

obligations for a period of at least 12 months from the approval of

these financial statements.

By order of the Board.

Paul Mines

Chief Executive Officer

Consolidated statement of comprehensive income

For the year ended 31 December 2020

Note 2020 2019

GBP'000 GBP'000

REVENUE 5,705 6,957

Cost of goods sold (4,029) (3,933)

GROSS PROFIT 1,676 3,024

Other operating income 300 436

Administrative expenses (3,551) (4,480)

LOSS FROM OPERATIONS (1,575) (1,020)

Investment income 2 6

Finance charges (38) (9)

Foreign exchange gain/(loss) (88) -

LOSS BEFORE TAXATION (1,699) (1,023)

Taxation 6 155 146

LOSS AND TOTAL COMPREHENSIVE INCOME FOR

THE YEAR (1,544) (877)

------------------------------------------- ----- --------------- ---------------

Basic loss per share - pence 7 (51)p (35)p

Diluted loss per share - pence 7 (51)p (35)p

------------------------------------------- ----- --------------- ---------------

Consolidated statement of financial

position

as at 31 December 2020

Note 2020 2019

GBP'000 GBP'000

NON-CURRENT ASSETS

Other intangible assets 8 821 883

Property, plant and equipment 9 574 653

1,395 1,536

CURRENT ASSETS

Inventories 746 555

Trade and other receivables 10 1,594 1,885

Cash and cash equivalents 1,678 2,126

4,018 4,566

TOTAL ASSETS 5,413 6,102

------------------------------------- ----- ---------------- ---------------

CURRENT LIABILITIES

Trade and other payables 11 1,076 1,381

Lease liabilities 12 38 76

1,114 1,457

NON-CURRENT LIABILITIES

Lease liabilities 12 400 438

------------------------------------- ----- ---------------- ---------------

400 438

TOTAL LIABILITIES 1,514 1,895

------------------------------------- ----- ---------------- ---------------

NET ASSETS 3,899 4,207

------------------------------------- ----- ---------------- ---------------

EQUITY

Share capital 186 140

Share premium account 2,200 1,250

Capital redemption reserve 4 4

Share options reserve 617 377

Translation reserves (85) (85)

Retained earnings 977 2,521

TOTAL EQUITY 3,899 4,207

------------------------------------- ----- ---------------- ---------------

The financial statements were approved by the Board on 25 March

2021.

Signed on behalf of the Board of Directors

Paul Mines (Chief Executive)

Rob Smith (Chief Financial Officer)

25 March 2021

Consolidated statement of changes in

equity

AS AST 31

DECEMBER

2020

Share Capital Share

Share premium redemption options Translation Retained TOTAL

capital account reserve reserve reserve earnings EQUITY

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January

2020 140 1,250 4 377 (85) 2,521 4,207

--------------- -------------- -------------- --------------- -------------- ------------------ --------------- --------------

Share options

issued

in share

based

payments - - - 240 - - 240

Issue of share

capital 46 950 - - - - 996

Cancellation

of expired

options - - - - - - -

Transactions

with

owners 186 2,200 4 617 (85) 2,521 5,443

--------------- -------------- -------------- --------------- -------------- ------------------ --------------- --------------

Loss for the

year - - - - - (1,544) (1,544)

--------------- -------------- -------------- --------------- -------------- ------------------ --------------- --------------

Total

comprehensive

loss for the

year - - - - - (1,544) (1,544)

--------------- -------------- -------------- --------------- -------------- ------------------ --------------- --------------

Balance at 31

December

2020 186 2,200 4 617 (85) 977 3,899

--------------- -------------- -------------- --------------- -------------- ------------------ --------------- --------------

Balance at 1

January

2019 118 77 4 316 (85) 3,323 3,753

--------------- -------------- -------------- --------------- -------------- ------------------ --------------- --------------

Share options

issued

in share

based

payments - - - 136 - - 136

Issue of share

capital 22 1,173 - - - - 1,195

Cancellation

of expired

options - - - (75) - 75 -

Transactions

with

owners 22 1,173 - 61 - 75 1,331

--------------- -------------- -------------- --------------- -------------- ------------------ --------------- --------------

Loss for the

year - - - - - (877) (877)

--------------- -------------- -------------- --------------- -------------- ------------------ --------------- --------------

Total

comprehensive

income for

the year - - - - - (877) (877)

--------------- -------------- -------------- --------------- -------------- ------------------ --------------- --------------

Balance at 31

December

2019 140 1,250 4 377 (85) 2,521 4,207

--------------- -------------- -------------- --------------- -------------- ------------------ --------------- --------------

Consolidated statement of cash flows

For the year ended 31 December 2020

2020 2019

GBP'000 GBP'000

Loss after taxation (1,544) (877)

Adjustments for: -

Taxation (155) (146)

Foreign exchange loss/(gain) 88 -

Finance charges 38 9

Investment income (2) (6)

--------------------------------------------------- ----------------- -----------------

Loss from operations (1,575) (1,020)

Adjustments for: -

Amortisation and impairment of intangible

assets 320 317

Depreciation of property, plant and equipment 98 77

Share based payments - equity settled 240 136

Foreign exchange gain/(loss) - 9

--------------------------------------------------- ----------------- -----------------

Operating cash flows before movement in working

capital (917) (481)

Decrease/(increase) in inventories (191) 400

Decrease/(increase) in receivables 293 (1,087)

(Decrease)/increase in payables (240) (405)

Cash utilised in operations (1,055) (1,573)

Corporate tax received - 205

Interest paid (38) (2)

Net cash outflow from operating activities (1,093) (1,370)

--------------------------------------------------- ----------------- -----------------

Investing activities

Interest received 2 6

Investment in in intangible assets (258) (282)

Purchase of property, plant and equipment (19) (27)

Net cash used in investing activities (275) (303)

--------------------------------------------------- ----------------- -----------------

Financing activities

Proceeds from issue of share capital 1,100 1,300

Costs of issue of ordinary share capital (104) (104)

Repayment of obligations under leasing activities (76) (11)

Net cash from financing activities 920 1,185

--------------------------------------------------- ----------------- -----------------

Net decrease in cash and cash equivalents (448) (488)

Cash and cash equivalents at the beginning

of the year 2,126 2,614

Cash and cash equivalents at the end of the

year 1,678 2,126

--------------------------------------------------- ----------------- -----------------

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2020

1. NON-STATUTORY FINANCIAL STATEMENTS

The financial information set out in this preliminary results

announcement does not constitute the Group's statutory financial

statements for the year ended 31 December 2020 or 2019 but is

derived from those financial statements. Statutory financial

statements for 2019 have been delivered to the Registrar of

Companies. Those for 2020 will be delivered following the Company's

Annual General Meeting on 21 April 2021. The auditors have reported

on those accounts: their reports on those financial statements were

unqualified and did not contain statements under Section 498 of the

Companies Act 2006.

The financial statements, and this preliminary statement, of the

Group for the year ended 31 December 2020 were authorised for issue

by the Board of Directors on 24 April 2020 and the statement of

financial position was signed on behalf of the Board by Paul Mines

and Rob Smith.

2. BASIS OF PREPARATION

The Group's financial statements have been prepared in

accordance with International accounting standards in conformity

with the requirements of the Companies Act 2006.

3. BASIS OF CONSOLIDATION

The Group financial statements consolidate the results of the

Company and all of its subsidiary undertakings drawn up to 31

December 2020. Subsidiaries are entities over which the Group has

control. Control comprises an investor having power over the

investee and is exposed, or has rights, to variable returns from

its involvement with the investee and has the ability to affect

those returns through its power. At 31 December 2020 the subsidiary

undertakings were Biome Bioplastics Limited, Stanelco RF

Technologies Limited, Aquasol Limited, and InGel Technologies

Limited (dormant).

The assets and liabilities of the Biome Technologies plc

Employee Benefit Trust ("EBT") are included within the consolidated

statement of financial position on the basis that the Group has the

ability to exercise control over the EBT.

4. SEGMENTAL INFORMATION FOR YEARED 31 DECEMBER 2020

2020 2019 (Restated)*

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Bioplastics RF Central Total Bioplastics RF Central Total

Revenue from sales 4,946 804 - 5,750 2,991 3,966 - 6,957

Removal of inter-segment

sales - (45) - (45) - - - -

Total external sales 4,946 759 - 5,705 2,991 3,966 - 6,957

--------------------------- ------------------- ------------- ---------------- ------------ ---------------- ------------- ---------------- ---------------

(Loss)/profit from

operations (517) (461) (597) (1,575) (1,176) 748 (592) (1,020)

--------------------------- ------------------- ------------- ---------------- ------------ ---------------- ------------- ---------------- ---------------

Interest received - - 2 2 - - 6 6

Finance charges - - (38) (38) - - (9) (9)

Foreign exchange loss (88) - - (88) - - - -

Loss before taxation (605) (461) (633) (1,699) (1,176) 748 (595) (1,023)

--------------------------- ------------------- ------------- ---------------- ------------ ---------------- ------------- ---------------- ---------------

Taxation 155 - - 155 146 - - 146

Loss for the year (450) (461) (633) (1,544) (1,030) 748 (595) (877)

--------------------------- ------------------- ------------- ---------------- ------------ ---------------- ------------- ---------------- ---------------

Reconciliation to Loss Before Interest Tax Depreciation

and Amortisation (LBITDA)

(Loss)/profit from

operations (517) (461) (597) (1,575) (1,176) 748 (592) (1,020)

Depreciation/amortisation (364) (50) (4) (418) (340) (52) (2) (394)

Share based payments (35) (16) (189) (240) (17) (22) (97) (136)

LBITDA (118) (395) (404) (917) (819) 822 (493) (490)

--------------------------- ------------------- ------------- ---------------- ------------ ---------------- ------------- ---------------- ---------------

Other segmental

information

Capital Expenditure

Property, plant and

equipment 9 9 1 19 254 265 26 545

Intangible assets 258 - - 258 320 - - 320

Total Capital Expenditure 267 9 1 277 574 265 26 865

--------------------------- ------------------- ------------- ---------------- ------------ ---------------- ------------- ---------------- ---------------

Total Assets 3,886 1,414 113 5,413 3,291 2,183 628 6,102

--------------------------- ------------------- ------------- ---------------- ------------ ---------------- ------------- ---------------- ---------------

The Bioplastics division comprises of Biome Bioplastics Limited

and Aquasol Limited.

*During 2020 the board concluded that, to gain a more accurate

representation of the costs and profits associated with Bioplastics

and RF Technologies, certain costs previously accounted for as part

of the Central division would be allocated, to the operating

divisions. These costs include insurance, accounting,

administration, facilities, and executive management activities

attributable to the operating divisions. A restatement of segmental

information for 2019 has been made to allow users of these account

to compare information on a consistent basis.

5. (LOSS)/EARNINGS BEFORE INTEREST, TAXATION, DEPRECIATION, AND

AMORTISATION

The Group, and divisions, define earnings before interest,

taxation, depreciation and amortisation ("EBITDA") as the operating

profit or loss adjusted for share option charges, depreciation, and

amortisation. The Group (L)/EBITDA is reconciled as follows:

(L)/EBITDA 2020 2019

GBP'000 GBP'000

Loss from operations per consolidated

statement of comprehensive income (1,575) (1,020)

Amortisation 320 317

Depreciation 98 77

Share option charges - equity

settled 240 136

(917) (490)

--------------------------------------- --------------- --------------

6. TAXATION

The Group's normal policy is to recognise tax credits resulting

from tax R&D claims on a cash received basis. However, the

claim in respect of the year ended 31 December 2019 was not

received until after the year-end but was settled prior to the

report date the value has been accrued as if received in 2020. A

tax credit has, therefore, been recognised in the Group's financial

statements in respect of that claim.

7. EARNINGS PER SHARE

The calculation of loss per share is based on the loss

attributable to the equity holders of the parent for the year of

GBP1,544,000 (2019: loss of GBP877,000) and a weighted average of

3,033,457 (2019: 2,472,038) ordinary shares in issue for basic

earnings per share and a weighted average of 3,033,457 (2019:

2,472,038) ordinary shares in issue for diluted earnings per

share.

8. OTHER INTANGIBLE ASSETS

During the year there was a capitalisation of GBP258,000 of

product development costs (2019: GBP282,000). The amortisation

charge for the year was GBP320,000 (2019: GBP317,000).

9. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment of GBP19,000 were acquired in the

year (2019: GBP545,000 of which GBP518,000 was in respect of right

of use assets capitalised in accordance with IFRS 16). The

depreciation charge for the year was GBP98,000 (2019:

GBP77,000).

10. TRADE AND OTHER RECEIVABLES

Trade and other receivables reduced in the year due to lower

sales within the RF Technologies division.

11. TRADE AND OTHER PAYABLES

Trade and other payables decreased in the year due mainly to

lower levels of sales revenue resulting in lower purchases of

materials and reduced customer deposits within the RF Technologies

division compared to the prior year.

12. LEASE LIABILITIES

IFRS 16 was adopted in the year ending 31 December 2019. The

leases have been reflected on the statement of financial position

under property, plant and equipment as right-of-use assets as

follows:

Opening Depreciation Closing

Book Value Additions Charge book value

GBP'000 GBP'000 GBP'000 GBP'000

Premises 483 - (21) 462

Motor vehicles 13 - (12) 1

Total 496 - (33) 463

----------------- ------------------ -------------------- ------------- -------------------

Lease liabilities are presented in the statement of financial

position as follow:

GBP'000

Lease liability as at 1 January

2020 514

New leases entered into during

the year -

Interest charged during the

year 38

Payments made during the

year (114)

Lease liability as at 31

December 2020 438

------------------------------------ ------------------- --------------------

2020 2019

GBP'000 GBP'000

Lease liability payable in

less than a year 38 76

Lease liability payable in

more than one year 400 438

Total 438 514

------------------------------------ ------------------- --------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DBGDXSSDDGBS

(END) Dow Jones Newswires

March 25, 2021 03:01 ET (07:01 GMT)

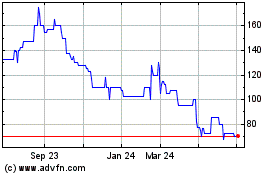

Biome Technologies (LSE:BIOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

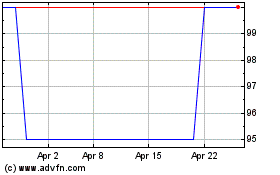

Biome Technologies (LSE:BIOM)

Historical Stock Chart

From Apr 2023 to Apr 2024