Biome Technologies PLC Trading Update (7531D)

July 01 2021 - 1:00AM

UK Regulatory

TIDMBIOM

RNS Number : 7531D

Biome Technologies PLC

01 July 2021

This announcement contains inside information for the purposes

of Regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310.

1 July 2021

Biome Technologies plc

("Biome", "the Company" or "the Group")

Trading Update

Biome Technologies plc, a leading bioplastics and radio

frequency technology business, today provides a Trading Update.

Bioplastics Division

On 23 March 2021, the Company announced that it had secured an

anticipated contractual commitment with a second US end-customer to

accelerate the commercialisation of its proprietary compostable

coffee-pod filtration material and that this important customer's

business would support a significant portion of the Group's

expected revenue growth in 2021 and beyond. At that time the

customer also ordered equipment from the Group to enable the

deployment of Biome's filtration material on a significant portion

of their production capacity. The initial installation of this

equipment proceeded rapidly and an uplift of filtration material

purchases began in the second quarter of 2021. Recently, however,

the customer has discovered an unexpected constraint within its

factory services that is currently limiting the scale of

deployment. Whilst the customer has already identified an

engineering solution to remove this constraint, it has become clear

to Biome that it will now take some months for the customer to

design and install the necessary modifications. The Board of Biome

(the "Board") now believes that this single delay will have a

significant impact on the Group's expected growth in the nearer

term.

The overwhelming majority of the revenues and development

opportunities for Biome's Bioplastics division lie in the United

States. The division's final products are manufactured both in

Europe and the USA with raw materials sourced from around the

world, which means that the business has a significant reliance on

containerised ocean shipping. The COVID-19 pandemic has resulted in

very significant disruption to the global shipping industry, with

significant ongoing delays and cancellations now occurring more

frequently. Biome is not immune to these forces, and the delays are

now proving a significant constraint on the division's ability to

quickly undertake the multiple development iterations that are

required to support growth with new customers. There is no sign

that the current severe level of disruption with shipping and ports

will be resolved soon and the Board believes that a more

conservative view is now required in relation to the rate of

commercialisation of a number of these opportunities under the

current circumstances.

It is pleasing that the demand for the division's products

remains robust and there have been important additions to the

customer list and the division's pipeline of development

opportunities in the first half of 2021. Whilst the division's rate

of growth will be constrained by the factors described above in the

shorter-term, the Board expects a return to the higher rates of

growth indicated in its Key Performance Indicators (KPIs) in due

course.

Stanelco RF Technologies Division

The encouraging signs of a modest pick-up of activity within

this division's core fibre optic furnace market continue and the

Board's expectations of its trading for the current year are

unchanged.

Group Outlook

As a consequence of the factors described above in relation to

the Bioplastics division coupled with the adverse impact of

exchange rates on this division's US Dollar revenues, the Board now

believes that Group revenues for the years ending 31 December 2021

and 2022 will be materially below current market expectations.

The Board also believes that Group losses before interest,

taxation, depreciation, amortisation and share option charges

("Underlying LBITDA") for the year ending 31 December 2021 will be

greater than current market expectations and that the Group will

make an Underlying LBITDA for the year ending 31 December 2022. The

Board believes that the anticipated year-end cash position as at 31

December 2021 will remain materially unchanged relative to current

market expectations, with the increased Underlying LBITDA being

offset by reduced administrative costs and less intensive working

capital utilisation. As at 30 June 2021, the Group had an unaudited

cash balance of GBP1.3 million and no debt.

The Board believes that Biome will continue to see growth in

both of its divisions during 2021 and 2022 relative to the year

ended 31 December 2020. Demand for our products remains strong and,

once our customer's factory constraint described above is removed,

the Board believes our high rates of growth will return.

- Ends -

For further information please contact: Biome Technologies

plc

Paul Mines, Chief Executive Officer

Rob Smith, Chief Financial Officer

info@biometechnologiesplc.co.uk

Tel: +44 (0) 2380 867 100

www.biometechnologiesplc.com

Allenby Capital

David Hart/Alex Brearley (Nominated Adviser)

Kelly Gardiner (Sales and Corporate Broking)

Tel: +44 (0) 20 3328 5656

www.allenbycapital.com

About Biome

Biome Technologies plc is an AIM listed, growth-orientated,

commercially driven technology group. Our strategy is founded on

building market-leading positions based on patented technology and

serving international customers in valuable market sectors. We have

chosen to do this by developing products in application areas where

the value-added pricing can be justified and are not reliant on

government legislation. These products are driven by customer

requirements and are compatible with existing manufacturing

processes. They are market rather than technology-led.

The Group comprises two divisions, Biome Bioplastics Limited and

Stanelco RF Technologies Limited.

Biome Bioplastics is a leading developer of highly-functional,

bio-based and biodegradable plastics. The company's mission is to

produce bioplastics that challenge the dominance of oil-based

polymers.

Stanelco RF Technologies designs, builds and services advanced

radio frequency (RF) systems. Dielectric and induction heating

products are at the core of a product offering that ranges from

portable sealing devices to large furnaces for the fibre optics

markets.

www.biometechnologiesplc.com

www.biomebioplastics.com and www.thinkbioplastic.com

www.stanelcorftechnologies.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDKKBBDBKBQAN

(END) Dow Jones Newswires

July 01, 2021 02:00 ET (06:00 GMT)

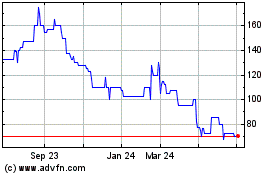

Biome Technologies (LSE:BIOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

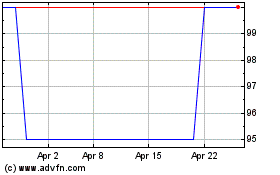

Biome Technologies (LSE:BIOM)

Historical Stock Chart

From Apr 2023 to Apr 2024