TIDMBIOM

RNS Number : 7810L

Biome Technologies PLC

15 September 2021

This announcement contains inside information for the purposes

of Regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

15 September 2021

Biome Technologies plc

("Biome", "the Company" or "the Group")

Interim Results

Biome Technologies plc announces its unaudited Interim Results

for the six months ended 30 June 2021.

Highlights

-- The Group generated revenues of GBP2.6m (H1 2020: GBP2.5m)

and gross profit of GBP0.9m (H1 2020: GBP0.8m)

-- The Biome Bioplastics division was the principal revenue

generator for the Group, with growth of 7.3% on H1 2020 despite the

logistics disruption caused by ongoing issues in the global

shipping industry

-- Biome Bioplastics continued to grow its end-customer base and

received a contractual commitment to accelerate the

commercialisation of its proprietary compostable filtration mesh

with a US customer. Whilst implementation was constrained by a site

utility issue, an engineering solution is being implemented and we

expect to see the acceleration of offtake during Q4 2021

-- The Stanelco RF Technologies division saw tendering activity

increase, contract wins in induction heating and an improvement in

the leading demand indicators of the cyclical fibre optic

market

-- Current trading continues in line with the Board's

expectations set out in the trading updates of 1 and 29 July

2021

Paul Mines, Chief Executive Officer said:

"We continue to see a healthy level of orders and enquiries for

Biome Bioplastics' products and our opportunity pipeline is

increasing. The ongoing delays in shipping and transportation

constrained the first half and we have been investing in inventory

to mitigate the effects as we progress through H2. Demand for our

biodegradable filtration mesh from our new end-customer is already

encouraging and the further conversion of this customer in Q4 2021

should provide significant long-term benefits. We continue to trade

in line with the Board's expectations set out in the trading

updates of 1 and 29 July 2021."

For further information please contact:

Biome Technologies plc

Paul Mines, Chief Executive Officer

Rob Smith, Chief Financial Officer

Tel: +44 (0) 2380 867 100

info@biometechnologiesplc.co.uk

Allenby Capital

David Hart/Alex Brearley (Nominated Adviser)

Kelly Gardiner (Sales and Corporate Broking)

Tel: +44 (0) 20 3328 5656

About Biome

Biome Technologies plc (Ticker: BIOM) is an AIM listed,

growth-orientated, commercially driven technology group. Our

strategy is founded on building market-leading positions based on

patented technology and serving international customers in valuable

market sectors. We have chosen to do this by developing products in

application areas where value-added pricing can be justified and

that are not reliant on government legislation. These products are

driven by customer requirements and are compatible with existing

manufacturing processes. They are market rather than

technology-led.

The Group comprises two divisions, Biome Bioplastics Limited and

Stanelco RF Technologies Limited. Biome Bioplastics is a leading

developer of highly-functional, bio-based and biodegradable

plastics. The company's mission is to produce bioplastics that

challenge the dominance of oil-based polymers. Stanelco RF

Technologies designs, builds and services advanced radio frequency

(RF) systems. Dielectric and induction heating products are at the

core of a product offering that ranges from portable sealing

devices to large furnaces for the fibre optics markets.

www.biometechnologiesplc.com www.biomebioplastics.com and

www.thinkbioplastic.com www.stanelcorftechnologies.com

#ThinkBioplastic is our digital educational platform, launched

in October 2018 in response to the emerging global plastic

conversation. It speaks to a wide audience, highlighting

bioplastics as a leading solution to reduce the negative impact of

plastic manufacture and disposal. Following the much acclaimed

first series of short videos, the second series was recently

released.

Chairman's Statement

During the first half of 2021, the Group's two divisions saw a

continuance of recent trends. An increase in revenue in the Biome

Bioplastics Division ("Bioplastics"), with a slight decrease in

sales in Stanelco RF Technologies Division ("RF Technologies"),

resulted in Group revenues for the period of GBP2.6m, slightly

ahead of the previous half year (H1 2020: GBP2.5m).

Encouragingly, we have seen a continuance of improving sales

enquiry levels, with a notable customer win for Bioplastics and an

upturn in enquiries and tender activity in RF Technologies.

However, we, like many businesses, have been constrained by the

disruption in the international sea container industry affecting

Bioplastics and to a lesser extent a shortage of electronic

components for RF Technologies. The direct effect of Covid 19 have

been marginal on both divisions.

Gross profit for the Group was GBP0.9m (H1 2020: GBP0.8m)

reflecting the improved revenues. The overall gross margin for the

Group was 33% (H1 2020: 30%) reflecting an improved mix of product

sales in the first half of the year.

Administrative expenses continued to be tightly controlled in

the period and were broadly in line with the first half of 2020 at

GBP1.7m (H1 2020 restated: GBP1.6m). The Group recorded a loss

before interest, depreciation, amortisation and share option

charges for the six months to 30 June 2021 of GBP0.5m (H1 2020

restated: GBP0.4m loss)(1) . The loss after taxation was GBP0.7m

(H1 2020: GBP0.8m loss), which equates to a loss per share of 19

pence on both a basic and diluted basis (H1 2020: loss per share of

29 pence on a basic and diluted basis).

The Group's cash position as at 30 June 2021 was GBP1.4m (31

December 2020: GBP1.7m) reflecting the first half's losses. As at

30 June 2021, the Group continued to have no external bank

borrowings.

(1) Loss before interest, taxation, depreciation and

amortisation is an alternative profit measure as detailed in Note

7.

Biome Bioplastics Division

Revenues in Bioplastics reflected increasing demand for

biodegradable plastics. Sales for H1 2021 of GBP2.3m (H1 2020:

GBP2.1m) represented an increase of 7.3% when compared to the

corresponding period in the prior year.

The performance in the period was underpinned by a continuance

of sales of outer packaging for the US coffee market and by growing

revenues for rigid ring materials for coffee-pod applications.

A major milestone in the period was the receipt of a contractual

commitment from a second US end customer for conversion to our

biodegradable filtration material. This was referred to in our

trading updates of 1 and 29 July 2021, where we reported that this

implementation had been constrained by an issue relating to the

provision of a utility. An engineering solution addressing this

constraint is now underway and our understanding is that the work

required will be completed shortly and that we can expect to see

the acceleration of offtake during Q4 2021.

The division's opportunity pipeline has continued to expand,

with sales to existing customers being supplemented with

development work together with sample and pre-production sales

being made in H1 2021 to a greater number of customers both in

North America and the UK. We anticipate a number of these

opportunities moving into larger scale production during H2 2021

underwriting our growth expectations.

These prospects include:

-- Filtration mesh - implementation is underway with a second

end-use customer in the coffee filtration market

-- Coffee pod material - the Company's heat stable material,

developed for coffee pods, is attracting new customers within the

US market and commercial sales of this product are gaining

momentum

-- Packaging film - the Company is working on seven new customer

projects that focus on the conversion of flexible packaging to

compostable formats. Six of these projects are for the North

American market and one is in the UK

-- Tree shelters (see below) - favourable market feedback is

leading to accelerated development activity and initial production

is planned for H2 2021.

In H1 2021, the division announced that it had secured

GBP248,000 of further Innovate UK funding to complete the

development phase and reach commercial production of its

biodegradable tree shelter project. Activity on this project

accelerated significantly in the period, in cooperation with

Suregreen, a UK end customer. With further extensive laboratory

testing of materials now completed, UK-wide field trials are

expected to commence later this year.

Stanelco RF Technologies Division

Revenues for the first half of 2021 in RF Technologies were

GBP0.3m (H1 2020: GBP0.4m).

The cyclical downturn in the demand for furnaces used in the

manufacture of fibre optic cable, first seen in 2018, has continued

to limit the opportunities for RF Technologies. However, during the

first half we saw customers increasing orders for spares and some

early signs that the fibre optic market is seeing recovery with

reduced inventory and higher pricing for fibre optic cable being

reported. We have provided quotations to a number of our

long-established clients as they begin to consider further capacity

expansion. We are encouraged by the improvement in these leading

indicators.

The division has made a concerted effort to gain new customers

for induction heating and welding equipment from various end

markets in the UK and continental Europe. Some encouraging new

orders have been received, from large customers, for delivery in H2

2021.

The division continues to keep a tight rein on costs and cash

whilst maintaining its operational capability to meet future

demand.

KPI Targets

The Board restated its ambitious Key Performance Indicators

("KPIs") for the period to 2023 in the 2020 interim report

published on 24 September 2020. These KPIs considered the effects

of the Covid-19 Pandemic to the extent that these were known at

that point in time and the cyclical downturn in the fibre optic

manufacturing industry.

Whilst H1 2021 saw relatively modest gains, we remain committed

to the delivery of these targets and continue to strive to meet

them over the required period. The KPI targets remain: -

-- 40% annual revenue growth in Bioplastics

-- Bioplastics profitable revenue growth to achieve a 10%-12.5%

EBITDA margin by the end of the KPI period

-- Continued diversification of the Group's turnover by product

and market to ensure that no single product or end customer

contributes more than 15% of revenues by 2023

-- Continued investment in the Group's next generation of

products by spending significantly more per annum on average than

the GBP0.3m per annum average spend over the previous strategic

objective cycle

The Board will continue to measure the Group's performance

against these KPIs and report to shareholders annually on

progress.

Outlook

Current trading continues in line with the Board's expectations

referred to in the trading updates of 1 and 29 July 2021.

Positive progress continues in Bioplastics. Order intake has

been good and as the engineering limitations are removed at our

second end customer for filtration mesh and as global sea container

freight normalises, we expect to see sales growth accelerate.

The prospects for RF Technologies in 2021 will remain

constrained, but with a reasonable expectation for an improvement

in order intake in H2 2021 and the potential for an improved

outlook for 2022.

John Standen

Chairman

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the period ended 30 June 2021

6 Months 6 Months Year

Ended Ended Ended

30 June 30 June 31 December

Note 2021 2020 2020

Restated Restated

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------- ----- -------------------- -------------------- -------------------

Revenue 5 2,589 2,500 5,705

Cost of goods sold (1,731) (1,746) (4,029)

-------------------- -------------------- -------------------

Gross Profit 858 754 1,676

Other operating income 110 87 300

Administrative expenses (1,739) (1,645) (3,639)

-------------------- -------------------- -------------------

Loss from operations (771) (804) (1,663)

Investment income - 2 2

Finance and similar charges (19) (19) (38)

-------------------- -------------------- -------------------

Loss before taxation (790) (821) (1,699)

Taxation 90 - 155

Total comprehensive loss for the

period (700) (821) (1,544)

-------------------- -------------------- -------------------

Basic loss per share - pence (19)p (29)p (51)p

Diluted loss per share - pence (19)p (29)p (51)p

Restatement

The consolidated statement of comprehensive income has been

restated to include foreign exchange gains and losses as part

of administrative expenses.

-----------------------------------------------------------------------------------------------------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2021

At At At

30 June 30 June 31 December

2021 2020 2020

Restated

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------- --------------------- --------------------- ---------------------

NON-CURRENT ASSETS

Other intangible assets 797 778 821

Property, plant and equipment 541 611 574

--------------------- --------------------- ---------------------

1,338 1,389 1,395

CURRENT ASSETS

Inventories 1,205 997 746

Trade and other receivables 1,228 1,781 1,439

Taxation receivable 90 - 155

Cash and cash equivalents 1,390 1,074 1,678

--------------------- --------------------- ---------------------

3,913 3,852 4,018

TOTAL ASSETS 5,251 5,241 5,413

--------------------- --------------------- ---------------------

CURRENT LIABILITIES

Trade and other payables (1,587) (1,245) (1,076)

Lease liabilities (43) (35) (38)

--------------------- --------------------- ---------------------

(1,630) (1,280) (1,114)

NON-CURRENT LIABILITIES

Lease liabilities (381) (401) (400)

--------------------- --------------------- ---------------------

(381) (401) (400)

TOTAL LIABILITIES (2,011) (1,681) (1,514)

--------------------- --------------------- ---------------------

NET ASSETS 3,240 3,560 3,899

--------------------- --------------------- ---------------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION continued

As at 30 June 2021

At At At

30 June 30 June 31 December

2021 2020 2020

Restated

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------ --------------------- -------------------- -----------------------

EQUITY

Share capital 189 140 186

Share premium 2,283 1,250 2,200

Capital redemption reserve 4 4 4

Share options reserve 647 548 617

Translation reserve (85) (85) (85)

Treasury shares reserve (55) - -

Retained earnings 257 1,703 977

TOTAL EQUITY 3,240 3,560 3,899

--------------------- -------------------- -----------------------

Restatement

The consolidated statement of financial position has been

restated to disclose taxation receivable as a separate amount

in the position as at 31 December 2020, previously it was

included within trade and other receivables.

----------------------------------------------------------------------------------------------------

The interim statements were approved by the Board on 14

September 2021.

Signed on behalf of the Board of Directors

Paul R Mines

Chief Executive

CONSOLIDATED STATEMENT OF CASH FLOWS

For the period ended 30 June 2021

At At At

30 June 30 June 31 December

2021 2020 2020

Restated Restated

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------- --------------------- --------------------- ----------------------

Loss after taxation: (700) (821) (1,544)

Adjustments for: -

Taxation (90) - (155)

Finance charges 19 19 38

Investment income - (2) (2)

--------------------- --------------------- ----------------------

Loss from operations (771) (804) (1,663)

Adjustments for: -

Amortisation and impairment of

intangible assets 169 142 320

Depreciation of property, plant

and equipment 44 44 98

Share based payments - equity settled 38 170 240

--------------------- --------------------- ----------------------

Operating cash flows before movement

in working capital (520) (448) (1,005)

(Increase)/decrease in inventories (459) (442) (191)

Decrease in receivables 211 104 293

Increase/(decrease) in payables 538 (214) (152)

---------------------

Cash utilised in operations (230) (1,000) (1,055)

Taxation received 155 - -

Interest paid (19) - (38)

--------------------- ----------------------

Net cashflow from operating activities (94) (1,000) (1,093)

--------------------- --------------------- ----------------------

Investing activities

Interest received - 2 2

Investment in intangible assets (145) (37) (258)

Purchase of property, plant and

equipment (10) (2) (19)

Net cash used in investing activities (155) (37) (275)

--------------------- --------------------- ----------------------

Financing activities

Proceeds from issue of share capital 1 - 1,100

Costs of issue of ordinary share

capital - - (104)

Repayment of obligations under

leasing activities (40) (15) (76)

Net cash from financing activities (39) (15) 920

--------------------- --------------------- ----------------------

Net decrease in cash and cash equivalents (288) (1,052) (448)

Cash and cash equivalents at the

beginning of the period 1,678 2,126 2,126

Cash and cash equivalents at the

end of the period 1,390 1,074 1,678

--------------------- --------------------- ----------------------

Restatement

The consolidated statement of cash flows has been restated

to reflect the inclusion of foreign exchange gains and losses

as part of administrative expenses.

-----------------------------------------------------------------------------------------------------------------

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

For the period ended 30 June 2021

1. CORPORATE INFORMATION

The financial information for the year ended 31 December 2020

set out in this interim report does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006. The

Group's statutory financial statements for the year ended 31

December 2020 have been filed with the Registrar of Companies. The

auditor's report on those financial statements was unqualified and

did not contain statements under Section 498 of the Companies Act

2006. The interim results are unaudited. Biome Technologies plc is

a public limited company incorporated and domiciled in England

& Wales. The Company's ordinary shares are publicly traded on

the AIM market of the London Stock Exchange.

2. BASIS OF PREPARATION

These interim consolidated financial statements (the interim

financial statements) are for the six months ended 30 June 2021.

They have been prepared in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006. They do not include all of the information required for full

annual financial statements and should be read in conjunction with

the consolidated financial statements of the Group for the year

ended 31 December 2020.

These interim financial statements have been prepared in

accordance with the accounting policies adopted in the last annual

financial statements for the year to 31 December 2020, save that:

-

-- The consolidated statement of comprehensive income has been

restated to include foreign exchange gains and losses as part of

administrative expenses for the period ending 30 June 2020 and the

year ending 31 December 2020, and

-- The consolidated statement of financial position has been

restated to disclose taxation receivable as a separate amount as at

31 December 2020, previously it was included within trade and other

receivables.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of the interim

financial statements.

3. BASIS OF CONSOLIDATION

The Group's interim financial statements consolidate the results

of the Company and all of its subsidiary undertakings drawn up to

30 June 2021. As at 30 June 2021, the subsidiary undertakings were

Biome Bioplastics Limited, Stanelco RF Technologies Limited,

Aquasol Limited and InGel Technologies Limited.

4. GOING CONCERN

The Directors have reviewed forecasts for the period to December

2022. These have been prepared with appropriate regard for the

current macroeconomic environment including the ongoing impact of

Covid-19 and the circumstances in which the Group operates. In

particular, the Directors have considered the continuing growth of

the Bioplastics Division, its need for continued investment in

development resource and working capital, the steps they can take

to improve the efficiency of the working capital deployed and the

availability of future funding.

The model has assumed growth in the period from the Stanelco RF

Division and the Directors have already taken steps to ensure

resources meet current demand.

The Directors are satisfied that the Group has sufficient

resources to continue in operational existence for at least one

year from the date of approval of these Interim Results.

5. SEGMENTAL INFORMATION

Revenue from external customers

6 Months 6 Months Year

Ended Ended Ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------------- ----------------------- ----------------------- -----------------------

Biome Bioplastics Division 2,271 2,117 4,946

Stanelco RF Technologies Division 318 383 759

----------------------- ----------------------- -----------------------

Total Revenue 2,589 2,500 5,705

----------------------- ----------------------- -----------------------

6. LOSS PER SHARE

The calculation of basic earnings per share is based on the loss

attributable to the equity holders of the parent for the period of

GBP700,000 (H1 2020: loss of GBP821,000, FY 2020: loss of

GBP1,544,000) and a weighted average of 3,729,257 ordinary shares

in issue (H1 2020: 2,798,525, FY 2020: 3,035,740). The calculation

uses the same weighted average number of shares under the basic and

diluted basis in the current and comparative periods due to a loss

being made.

7. ALTERNATIVE PROFIT MEASURE

The Group measures and reports on Earnings (Loss) Before

Interest, Taxation, Amortisation and Depreciation (E(L)BITDA). The

following table sets out the calculation of E(L)BITDA.

6 Months 6 Months Year

Ended Ended Ended

30 June 30 June 31 December

2021 2020 2020

GBP'000s GBP'000s GBP'000s

Loss from operations (771) (804) (1,663)

Depreciation 44 44 98

Amortisation 169 142 320

Share based payments 38 170 240

Loss Before Interest, Taxation,

Depreciation and Amortisation (520) (448) (1,005)

-------------------- -------------------- ------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFMFALEFSEEU

(END) Dow Jones Newswires

September 15, 2021 02:00 ET (06:00 GMT)

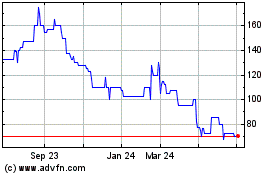

Biome Technologies (LSE:BIOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

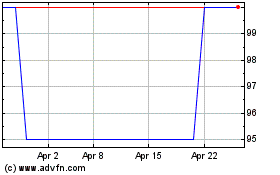

Biome Technologies (LSE:BIOM)

Historical Stock Chart

From Apr 2023 to Apr 2024