TIDMBIOM

RNS Number : 2206A

Biome Technologies PLC

22 September 2022

This announcement contains inside information for the purposes

of Regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

22 September 2022

Biome Technologies plc

("Biome", "the Company" or "the Group")

Interim Results

Biome Technologies plc announces its unaudited Interim Results

for the six months ended 30 June 2022.

Highlights

-- The Group generated revenues of GBP2.4m (H1 2021: GBP2.6m)

and gross profit of GBP0.9m (H1 2021: GBP0.9m)

-- The Biome Bioplastics division was the principal revenue

generator for the Group. However, raw material availability limited

revenues achieved in H1

-- New customers for Biome Bioplastics, gained in the last few

years in both North America and Europe, grew three-fold in terms of

revenue contribution in the period and now count for 32% of

revenues (H1 2021: 10%)

-- Anticipated H2 2022 revenues from Biome Bioplastics'

increased supply of biodegradable coffee filter material to a

second large US customer are now expected to be significantly lower

than previously anticipated, impacting expected revenues from this

customer in 2022 and 2023

-- Biome Bioplastics is also experiencing other customer launch

delays related to raw material supply, logistics and uncertainty of

end-consumer behaviour in the current economic climate, all of

which have and will have an impact on the revenue generation of

this division

-- The Stanelco RF Technologies division is working to deliver

the major contracts announced previously. Elongated lead-times for

critical components, particularly electronics, have delayed some

shipments. However, key issues have been resolved and these

shipments have or are expected to occur in H2 2022 with revenues

from this division in the second half expected to be above previous

Board expectations

-- The Board now believes that Group revenues for the years

ending 31 December 2022 and 2023 will be substantially below

current market expectations with a consequential substantial impact

on the Group's loss/profit before interest, taxation, depreciation,

amortisation and share option charges in those years

-- Despite trading conditions deteriorating significantly, the

Board believes the Group has sufficient working capital for the

foreseeable future

-- Accounts receivable financing agreement signed in August 2022

provides new working capital finance of up to GBP600k as

required

ul Mines, Chief Executive Officer said:

"Growth has been limited in both divisions in the first half by

ongoing supply challenges. The trading environment for Biome

Bioplastics is becoming more difficult with a number of factors

impacting our revenue expectations for this year and 2023. We

continue to work with our customers on new products that we believe

will unlock more value and I am particularly encouraged by the

diversification of our customer base and applications in both

divisions."

For further information please contact:

Biome Technologies plc

Paul Mines, Chief Executive Officer

Rob Smith, Chief Financial Officer

Tel: +44 (0) 2380 867 100

info@biometechnologiesplc.co.uk

Allenby Capital

David Hart/Alex Brearley (Nominated Adviser)

Kelly Gardiner (Sales and Corporate Broking)

Tel: +44 (0) 20 3328 5656

About Biome

Biome Technologies plc (Ticker: BIOM) is an AIM listed,

growth-orientated, commercially driven technology group. Our

strategy is founded on building market-leading positions based on

patented technology and serving international customers in valuable

market sectors. We have chosen to do this by developing products in

application areas where value-added pricing can be justified and

that are not reliant on government legislation. These products are

driven by customer requirements and are compatible with existing

manufacturing processes. They are market rather than

technology-led.

The Group comprises two divisions, Biome Bioplastics Limited and

Stanelco RF Technologies Limited. Biome Bioplastics is a leading

developer of highly functional, bio-based and biodegradable

plastics. The company's mission is to produce bioplastics that

challenge the dominance of oil-based polymers. Stanelco RF

Technologies designs, builds and services advanced radio frequency

(RF) systems. Dielectric and induction heating products are at the

core of a product offering that ranges from portable sealing

devices to large furnaces for the fibre optics markets.

www.biometechnologiesplc.com www.biomebioplastics.com and

www.thinkbioplastic.com www.stanelcorftechnologies.com

Chairman's Statement

As mentioned in our last trading update, the Group's two

divisions were challenged by supply constraints in the global

economy during the first half of 2022. For the Biome Bioplastics

Division ("Bioplastics") the realisation of ambition was limited by

the challenges of procuring raw materials in a timely manner and by

end-customers struggling with their own production schedules. For

Stanelco RF Technologies Division ("RF Technologies") the problems

related to sourcing specific electronic components and

sub-assemblies, which limited revenues despite a good order book

backlog. The net result was Group revenues for the period of

GBP2.4m, slightly behind the previous half year (H1 2021:

GBP2.6m).

Gross profit for the Group was GBP0.9m (H1 2021: GBP0.9m) on the

back of improved margins and mix of sales. Other income, in the

form of grant receipts in support of the Group's work on novel

bioplastics, was GBP0.2m (H1 2021: GBP0.1m). The overall gross

margin for the Group rose to 36% (H1 2021: 33%) reflecting an

improved mix of product sales and tight controls on purchase

pricing in both divisions.

Despite the context of inflationary pressures, administrative

expenses continued to be tightly controlled in the period and were

in line with the first half of 2021 at GBP1.7m (H1 2021: GBP1.7m).

The Group recorded a loss before interest, depreciation,

amortisation and share option charges for the six months to 30 June

2022 of GBP0.4m (H1 2021: GBP0.5m loss)(1) . The loss after

taxation was GBP0.6m (H1 2021: GBP0.7m loss), which equates to a

loss per share of 17 pence on both a basic and diluted basis (H1

2021: loss per share of 19 pence on a basic and diluted basis).

The Group's cash position as at 30 June 2022 was GBP0.7m (31

December 2021: GBP1.0m) reflecting the first half's losses. As at

30 June 2022, the Group continued to have no external bank

borrowings. Post period end, we were pleased to announce that the

Group has entered into a receivables financing agreement with

Accelerated Payments Limited.

Revenues in Bioplastics for the period fell just short of

internal expectations as the late delivery of raw materials to one

of the North American manufacturing sites limited the realisation

of some revenues towards the end of the second quarter. Sales for

H1 2022 of GBP2.0m (H1 2021: GBP2.3m) represented a decrease of

10.6% when compared to the corresponding period in the prior

year.

We are seeing some easing of the logistics issues that have

limited the business in the last 18 months albeit our customers are

experiencing volatility in their own production schedules and are

struggling to launch new products on defined timescales into

markets in which there is considerable demand and pricing

variability.

The revenue performance in the period remained underpinned by a

continuance of sales to existing customers for outer packaging for

the US coffee market, albeit limited by supply chain issues and

stocking reductions. However, of note is that revenues to new

customers in both North America and Europe grew three-fold in the

period and now represent 32% of revenues (H1 2021: 10%). A number

of these new customers are in the packaging film area where the

Company has been working on seven new customer projects that focus

on the conversion of flexible packaging to compostable formats. Six

of these projects are for the North American market and one is in

the UK.

In the first half of 2021, the business received a contractual

commitment from a second US end customer for conversion to our

biodegradable coffee filtration material. This has been referred to

in various trading statements. Whilst initial implementation

proceeded well and the end customer has been purchasing regularly

in the past year, the subsequent acceleration of revenues has been

constrained by various engineering matters within the customer's

facilities. After some work, we understand that these engineering

constraints have been addressed and we appear to be moving forward

again, albeit not at the pace previously envisaged.

In the winter of 2021/22 Biome launched materials designed to

allow tree shelters (plastic tubes around saplings) to be left in

the forest after use to biodegrade in a benign manner. Last year,

Biome announced the commencement of large-scale, UK-wide field

testing and initial commercial sales by Suregreen Ltd (Biome's UK

commercial partner) of biodegradable tree shelters using Biome's

proprietary bioplastics materials. Based on extensive field testing

of nearly 40,000 shelters, the Company is pleased that the

real-world biodegradable product has performed exactly as

expected.

Biome's scientists took samples of the biodegradable tree

shelters this summer and tested them for mechanical properties and

overall product performance. The product's tubes remain strong and

resistant, degrading at the expected rate for their respective time

periods. Comparing these lab-based field trial results against the

Company's predictive models showed that the biodegradable tree

shelters also performed as well as conventional counterparts. After

this considerable piece of product performance monitoring work, the

business is now preparing for a larger promotional campaign for the

2022/23 winter planting season in association with Suregreen Ltd

(UK commercial partner).

The Bioplastics division will continue to benefit from the move

to more sustainable materials. Future near-term growth is expected

to be underpinned by several of the Division's customers which are

planning product launches in H1 2023. Some of these launches are

based on our new "home compostable" bio-based and biodegradable

plastic grades ('BiomeHC') that are subject to the protection of a

pending patent. The key "end-of-life" functionality of such

materials is that they degrade much faster in conditions akin to a

home compost bin rather than those materials designed to biodegrade

in the controlled and higher temperature environments of industrial

composting facilities. Biome's team has been working on this new

range of materials for some three years and they are now ready for

commercial service with a number of customers.

However, notwithstanding the various positive matters and

initiatives described above, Biome Bioplastics is experiencing

various customer launch delays related to raw material supply,

logistics and uncertainty of end-consumer behaviour in the current

economic climate. Some of these delays are significant and

considered unlikely to resolve quickly, resulting in the Board's

conclusion that Group revenues for the years ending 31 December

2022 and 2023 will be substantially below current market

expectations.

Stanelco RF Technologies Division

Revenues for the first half of 2022 in RF Technologies were

GBP0.4m (H1 2021: GBP0.3m), representing an increase of 24.8%.

The RF Technologies division has made good progress in securing

business both in the latter half of 2021 and during H1 2022 across

different industry sectors including food packaging and medical

applications. In addition, we won a contract for two fibre-optic

furnaces in late 2021 that are due for shipment in 2022. Like many

businesses we have seen supply side challenges. This has affected

deliveries of some critical long-lead time components and in

particular, those items that contain semiconductors are on extended

lead-times. Consequently, some of the orders that we had

anticipated completing in H1 2022 have now or are now expected to

ship in H2. Whilst this is frustrating, customers are understanding

of such delays in the current environment.

Enquiry levels remain encouraging, and we continue to tender for

contracts over a range of industry sectors and despite the

requirement for new capacity in the fibre optic furnace market

remaining modest there are pockets of activity for upgrades and

spares that we are addressing. New order intake, during the

year-to-date, has continued to be positive and an improving

opportunity pipeline in sectors other than fibre optics gives us

confidence that management's expectations for the RF Technologies

division will be achieved.

With the medium to longer-term trend for the RF Technologies

division improving, we have commenced recruitment to improve the

range of internal technical resources required to achieve our

growth targets whilst ensuring overhead expenditure remains

controlled.

Outlook

The RF Technologies Division has been progressively overcoming

the supply constraints that delayed customer deliveries during the

first half of the year and the Board now expects that shipments in

relation to all previously announced contracts will occur in H2

2022.

Biome Bioplastics' trading is seeing significantly increased

risks and uncertainties surrounding the timing and scale of revenue

opportunities as evidenced by the slower ramp of revenues from its

second US customer. Whilst the Board is confident that new products

to be launched in 2023 utilising Biome's Home Compostable materials

will meet market approval, given the economic outlook generally and

its impact on the Group's customers, the Board is taking a very

cautious approach and considers that further delays and a scaling

back of volumes are inevitable in the shorter term.

As a consequence of the challenging trading conditions described

above, the Board now believes that Group revenues for the years

ending 31 December 2023 and 2023 will be substantially below

current market expectations with a consequential substantial impact

on the Group's loss/profit before interest, taxation, depreciation,

amortisation and share option charges.

Despite trading conditions deteriorating significantly, we

believe we have sufficient working capital for the foreseeable

future.

John Standen

Chairman

(1) Loss before interest, taxation, depreciation and

amortisation is an alternative profit measure as detailed in Note

7.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the period ended 30 June

2022

Note 6 Months 6 Months Year

Ended Ended Ended

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------- ----- ---------- ---------- -------------

Revenue 5 2,428 2,589 5,734

Cost of goods sold (1,562) (1,731) (3,794)

---------- ---------- -------------

Gross Profit 866 858 1,940

Other operating income 203 110 364

Administrative expenses (1,718) (1,739) (3,439)

---------- ---------- -------------

Loss from operations (649) (771) (1,135)

Finance and similar charges (18) (19) (34)

---------- ---------- -------------

Loss before taxation (667) (790) (1,169)

Taxation 30 90 29

Total comprehensive loss for

the period (637) (700) (1,140)

---------- ---------- -------------

Basic loss per share - pence (17)p (19)p (30)p

Diluted loss per share - pence (17)p (19)p (30)p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2022

At At At

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------- ---------- ---------- -------------

NON-CURRENT ASSETS

Other intangible assets 765 797 726

Property, plant and equipment 473 541 502

---------- ---------- -------------

1,238 1,338 1,228

CURRENT ASSETS

Inventories 1,552 1,205 920

Trade and other receivables 861 1,228 1,377

Taxation receivable 109 90 79

Cash and cash equivalents 652 1,390 996

---------- ---------- -------------

3,174 3,913 3,372

TOTAL ASSETS 4,412 5,251 4,600

---------- ---------- -------------

CURRENT LIABILITIES

Trade and other payables (1,761) (1,587) (1,298)

Lease liabilities (47) (43) (40)

---------- ---------- -------------

(1,808) (1,630) (1,338)

NON-CURRENT LIABILITIES

Lease liabilities (340) (381) (361)

---------- ---------- -------------

(340) (381) (361)

TOTAL LIABILITIES (2,148) (2,011) (1,699)

---------- ---------- -------------

NET ASSETS 2,264 3,240 2,901

---------- ---------- -------------

EQUITY

Share capital 189 189 189

Share premium 2,282 2,282 2,282

Capital redemption reserve 4 4 4

Share options reserve 487 647 487

Translation reserve (85) (85) (85)

Treasury shares reserve (55) (55) (55)

Retained earnings (558) 258 79

TOTAL EQUITY 2,264 3,240 2,901

---------- ---------- -------------

The interim statements were approved by the Board on 21

September 2022.

Signed on behalf of the Board of Directors

Paul R Mines Rob Smith

Chief Executive Officer Chief Financial Officer

CONSOLIDATED STATEMENT OF CASH FLOWS

For the period ended 30 June 2022

At At At

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------- ---------- ---------- -------------

Loss after taxation: (637) (700) (1,140)

Adjustments for: -

Taxation (30) (90) (29)

Finance charges 18 19 34

Loss from operations (649) (771) (1,135)

Adjustments for: -

Amortisation and impairment of

intangible assets 174 169 353

Depreciation of property, plant

and equipment 44 44 88

Share based payments - equity settled - 38 48

---------- ---------- -------------

Operating cash flows before movement

in working capital (431) (520) (646)

Increase in inventories (632) (459) (174)

Decrease in receivables 516 211 13

Increase in payables 463 538 230

----------

Cash utilised in operations (84) (230) (577)

Taxation received - 155 239

Interest paid (18) (19) (34)

---------- -------------

Net cashflow from operating activities (102) (94) (372)

---------- ---------- -------------

Investing activities

Investment in intangible assets (213) (145) (258)

Purchase of property, plant and

equipment (7) (10) (8)

Net cash used in investing activities (220) (155) (266)

---------- ---------- -------------

Financing activities

Proceeds from issue of share capital - 1 1

Repayment of obligations under

leasing activities (22) (40) (45)

Net cash from financing activities (22) (39) (44)

---------- ---------- -------------

Net decrease in cash and cash

equivalents (344) (288) (682)

Cash and cash equivalents at the

beginning of the period 996 1,678 1,678

Cash and cash equivalents at the

end of the period 652 1,390 996

---------- ---------- -------------

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

For the period ended 30 June 2022

1. CORPORATE INFORMATION

The financial information for the period ended 30 June 2022 set

out in this interim report does not constitute statutory accounts

as defined in Section 434 of the Companies Act 2006. The Group's

statutory financial statements for the year ended 31 December 2021

have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified and did not

contain statements under Section 498 of the Companies Act 2006. The

interim results are unaudited. Biome Technologies plc is a public

limited company incorporated and domiciled in England & Wales.

The Company's ordinary shares are publicly traded on the AIM market

of the London Stock Exchange.

2. BASIS OF PREPARATION

These interim consolidated financial statements (the interim

financial statements) are for the six months ended 30 June 2022.

They have been prepared in accordance with UK-adopted international

accounting standards. They do not include all of the information

required for full annual financial statements and should be read in

conjunction with the consolidated financial statements of the Group

for the year ended 31 December 2021.

These interim financial statements have been prepared in

accordance with the accounting policies adopted in the last annual

financial statements for the year to 31 December 2021.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of the interim

financial statements.

3. BASIS OF CONSOLIDATION

The Group's interim financial statements consolidate the results

of the Company and all of its subsidiary undertakings drawn up to

30 June 2022. As at 30 June 2022, the subsidiary undertakings were

Biome Bioplastics Limited, Biome Bioplastics Inc., Stanelco RF

Technologies Limited, Aquasol Limited and InGel Technologies

Limited.

4. GOING CONCERN

The Directors have reviewed forecasts for the period to December

2023. These have been prepared with appropriate regard for the

difficult current macroeconomic environment including the ongoing

impact of Covid-19 "lockdowns" in China affecting supply chains and

the markets and circumstances in which the Group operates. The

forecasts included assumptions on exchange rates, supplier lead

times and receipts from customers being broadly in line with agreed

terms. The directors believe the assumptions to be reasonable but

fundamental to the forecasts.

The Directors have considered the future growth of the

Bioplastics Division, its need for continued investment in

development resource and working capital, the steps they can take

to improve the efficiency of the working capital deployed and the

availability of future funding.

The model has assumed growth in the period from the Stanelco RF

Division and the Directors have already taken steps to ensure

resources meet current demand.

On the basis of the above, the Directors are satisfied that the

Group has sufficient working capital to continue as a going concern

for at least one year from the date of approval of these Interim

Results.

5. SEGMENTAL INFORMATION

Revenue from external customers

For the period ended 30 June 2022

6 Months 6 Months Year

Ended Ended Ended

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------- ---------- ---------- -------------

Biome Bioplastics Division 2,031 2,271 4,797

Stanelco RF Technologies Division 397 318 937

---------- ---------- -------------

Total Revenue 2,428 2,589 5,734

---------- ---------- -------------

6. LOSS PER SHARE

The calculation of basic earnings per share is based on the loss

attributable to the equity holders of the parent for the period of

GBP637,000 (H1 2021: loss of GBP700,000, FY 2021: loss of

GBP1,140,000) and a weighted average of 3,755,930 ordinary shares

in issue (H1 2021: 3,729,527, FY 2021: 3,742,655). The calculation

uses the same weighted average number of shares under the basic and

diluted basis in the current and comparative periods due to a loss

being made.

7. ALTERNATIVE PROFIT MEASURE

The Group measures and reports on Earnings (Loss) Before

Interest, Taxation, Amortisation and Depreciation (E(L)BITDA). The

following table sets out the calculation of E(L)BITDA.

For the period ended 30 June 2022

6 Months 6 Months Year

Ended Ended Ended

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------- ---------- ---------- -------------

Biome Bioplastics Division 2,031 2,271 4,797

Stanelco RF Technologies Division 397 318 937

---------- ---------- -------------

Total Revenue 2,428 2,589 5,734

---------- ---------- -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEFFWFEESEIU

(END) Dow Jones Newswires

September 22, 2022 02:01 ET (06:01 GMT)

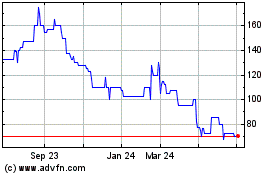

Biome Technologies (LSE:BIOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

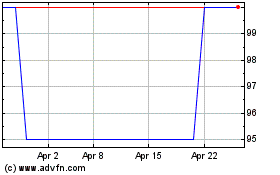

Biome Technologies (LSE:BIOM)

Historical Stock Chart

From Apr 2023 to Apr 2024