TIDMBIRD

RNS Number : 8955U

Blackbird PLC

08 December 2021

This announcement contains Inside Information for the purposes

of Article 7 of EU Regulation 596/2014 (which forms part of

domestic UK law pursuant to the European Union (Withdrawal) Act

2018). Upon the publication of this announcement this Inside

Information is now considered to be within the public domain.

8 December 2021

Blackbird plc

(the "Company")

Placing to raise approximately GBP8.0 million before expenses to address new market opportunities

Blackbird plc (AIM:BIRD, OTCQX: BBRDF), the technology licensor,

developer and seller of the market-leading cloud native video

editing platform, Blackbird, is pleased to announce a placing of

28,571,429 new ordinary shares of 0.8 pence each in the Company

(the "Placing Shares") at a price of 28 pence per share (the

"Placing Price") to raise approximately GBP8.0 million before

expenses (the "Placing"). Allenby Capital Limited ("Allenby

Capital") is acting as sole broker in connection with the

Placing.

The Placing has been conducted as a private placement under the

Company's existing allotment and pre-emption disapplication

authorities and participation has not been made available to

members of the public.

Blackbird plc CEO, Ian McDonough, said:

"With our core business in rude health we are incredibly excited

to announce a placing to raise GBP 8.0 million to enter new markets

with our "Powered by Blackbird" intellectual property.

"Recent contract wins for the Company include Univision,

Eurovision Sport and a further expansion with TownNews to 80

regional US stations. "Powered by Blackbird" already has its first

customer in our current sector focus of professional Media and

Entertainment. The Company has also recently been awarded "Best

Tech Company 2021" by the SportsPro OTT awards.

"While our reputation builds in the professional Media and

Entertainment vertical, our technology has advanced through API

development and the first "Powered by Blackbird" licence deal has

shown our applicability to companies across multiple video markets.

The creator economy, enterprise video and content distribution

markets are of huge scale and have attractive growth rates offering

a massive opportunity built around our existing intellectual

property."

Transaction highlights

-- The Placing Shares have been placed with existing and new investors.

-- Certain members of the Company's board (the "Board") and

associated family members are subscribing for an aggregate of

approximately GBP0.41 million in the Placing, of which GBP0.38

million will be subscribed by Ian McDonough, Chief Executive

Officer of the Company, and members of his family.

-- The Placing Shares will represent approximately 7.8 per cent.

of the issued share capital of the Company, as enlarged by the

issue of the Placing Shares.

-- The Company plans to develop its existing "Powered by

Blackbird" ("PBB") intellectual property to take advantage of the

opportunities within the creator economy, enterprise video and

content distribution markets (the "New Markets").

-- The estimated net proceeds of the Placing, which will be

GBP7.6 million, will be used by the Company to:

o develop the Company's technology offering in the New

Markets;

o grow its software engineering, product and business

development teams;

o expand the Company's patent portfolio; and

o conduct appropriate research, prototyping and market testing

of new technology developments.

Background to and reasons for the Placing

The Company is seeking funds to help utilise its PBB

intellectual property and develop further technology to take

advantage of the opportunities within the New Markets. These

opportunities are evidenced by the creator economy, which in May

2021 had an estimated size of $104.2 billion (source: Creator

Earnings: Benchmark Report 2021 - Influencer Marketing Hub ). The

Board believes that the New Markets suffer from inefficient video

creation, cumbersome video distribution and low monetisation. These

are all issues which the Board believes, through further

development of the PBB intellectual property, the Company can

solve. The Company's recent PBB licence deal is testament to the

capabilities of the technology.

Details of the Placing

A total of 28,571,429 Placing Shares are to be issued at a price

of 28 pence per Placing Share. The Placing has been conducted

utilising the Company's existing share authorities to issue shares

for cash on a non-pre-emptive basis. Allenby Capital acted as the

Company's sole broker in connection with the Placing. The Placing

is conditional, inter alia, on admission of the Placing Shares to

trading on AIM ("Admission") becoming effective.

The Company has entered into a Placing Agreement with Allenby

Capital under which Allenby Capital has agreed to use its

reasonable endeavours to procure subscribers for the Placing Shares

at the Placing Price. The Placing has not been underwritten.

The Placing Agreement contains, inter alia, customary

undertakings and warranties given by the Company in favour of

Allenby Capital as to the accuracy of information contained in this

document and other matters relating to the Company. Allenby Capital

may terminate the Placing Agreement in specified circumstances

prior to Admission, including, inter alia, for material breach of

the Placing Agreement or any other warranties contained in it and

in the event of certain force majeure events occurring.

The Placing Shares will represent approximately 7.8 per cent. of

the Company's enlarged share capital. The Placing Price represents

a discount of approximately 8.2 per cent. to the closing mid-market

price on AIM of 30.5 pence per existing ordinary share of 0.8 pence

each in the Company ("Ordinary Shares") on 7 December 2021.

The Placing Shares will be credited as fully paid and will rank

equally in all respects with the Company's existing Ordinary

Shares.

The Placing Shares have been placed with certain existing and

new investors. The Directors value the Company's retail

shareholders, but due to the size of the Placing, the small

discount to the prevailing bid price of an Ordinary Share and the

cost of undertaking a retail offer, the Board determined that it

was not in the Company's interest to make the Placing available to

all existing shareholders. However, this will be kept under review

should the Company seek to raise further funds in the future.

It is expected that CREST accounts will be credited on the

relevant day of Admission and that share certificates (where

applicable) will be dispatched within 10 working days of

Admission.

Admission to trading and total voting rights

Application has been made to the London Stock Exchange plc for

the Placing Shares to be admitted to trading on AIM. It is expected

that Admission will become effective and that dealings in the

Placing Shares on AIM will commence at 8:00 a.m. on or around 13

December 2021.

On Admission, the Company's issued ordinary share capital will

consist of 367,565,521 Ordinary Shares, with one vote per share.

The Company does not hold any Ordinary Shares in treasury.

Therefore, on Admission, the total number of Ordinary Shares and

voting rights in the Company will be 367,565,521. With effect from

Admission, this figure may be used by shareholders in the Company

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the share capital of the Company under

the FCA's Disclosure Guidance and Transparency Rules.

Related Party Transaction

Premier Miton Group plc ("Premier Miton"), which currently owns

60,670,559 Ordinary Shares representing 17.9 per cent. of the

Company's issued share capital at the date of this announcement,

has agreed to subscribe for 3,428,571 Placing Shares as part of the

Placing. As a substantial shareholder of the Company, Premier Miton

is to be treated as a 'related party' in accordance with the AIM

Rules for Companies (the "AIM Rules") and its participation is a

related party transaction pursuant to Rule 13 of the AIM Rules. The

Directors of the Company, having consulted with Allenby Capital,

consider the terms of Premier Miton's participation in the Placing

to be fair and reasonable insofar as shareholders are

concerned.

Directors' Participation

Some of the Directors of the Company have agreed to subscribe

for 465,714 Placing Shares. In addition, members of Ian McDonough's

family have agreed to subscribe for 1,000,000 Placing Shares. Set

out below are details of the Directors and related family interests

in the share capital of the Company as at the date of this

announcement and following Admission:

At the date of this announcement Following Admission

Percentage Percentage

No. of existing of existing No. of Ordinary of enlarged

Ordinary Shares Ordinary Shares Shares share capital

McDonough

family 26,179,016 7.74% 27,536,159 7.49%

Stephen White 363,164 0.11% 416,735 0.11%

Stephen Streater 62,660,000 18.48% 62,660,000 17.05%

Andrew Bentley 295,154 0.09% 350,154 0.10%

David Main 1,162,143 0.34% 1,162,143 0.32%

Dawn Airey 71,429 0.02% 71,429 0.02%

John Honeycutt 50,460 0.01% 50,460 0.01%

Enquiries:

Blackbird plc

Ian McDonough, Chief Executive Officer

Steve White, Chief Operating and Finance Officer

Tel: +44 (0)20 8879 7245

Allenby Capital Limited (Nominated Adviser

and Broker)

Nick Naylor/Piers Shimwell (Corporate Finance)

Amrit Nahal (Sales and Corporate Broking)

Tel: +44 (0)20 3328 5656

About Blackbird plc

Blackbird plc operates in the fast-growing SaaS and cloud video

market. It has created Blackbird(R), a market-leading suite of

cloud native computing applications for video, all underpinned by

its lightning-fast codec. Blackbird plc's patented technology

allows for frame accurate navigation, playback, viewing and editing

in the cloud. Blackbird(R) enables multiple applications, which are

used by rights holders, broadcasters, sports and news video

specialists, esports, live events and content owners,

post-production houses, other mass market digital video channels

and corporations.

Since it is cloud native, Blackbird(R) removes the need for

costly, high end workstations and can be used from almost anywhere

on almost any device. It also allows full visibility on

multi-location digital content, improves time to market for live

content such as video clips and highlights for digital

distribution, and ultimately results in much more effective

monetisation.

Blackbird plc is a licensor of its core video technology under

its "Powered by Blackbird" licensing model, enabling video

companies to accelerate their path to true cloud business models.

Licensees benefit from power and carbon reductions, cost and time

savings, less hardware and bandwidth requirements and easy

scalability.

www.blackbird.vide o

www.linkedin.com/company/blackbird-cloud

www.twitter.com/blackbirdcloud

www.facebook.com/blackbirdplc

www.youtube.com/c/Blackbirdcloud

Notice to Distributors

Solely for the purposes of the product governance requirement

contained in Chapter 3 of the FCA Product Intervention and Product

Governance Sourcebook (together, the "UK Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacturer"

(for the purposes of the UK Product Governance Requirements) may

otherwise have with respect thereto, the Placing Shares have been

subject to a product approval process, which has determined that

the Placing Shares are: (i) compatible with an end target market of

retail investors and investors who meet the criteria of

professional clients and eligible counterparties, as defined under

the FCA Handbook Conduct of Business Sourcebook, and (ii) eligible

for distribution through all permitted distribution channels (the

"Target Market Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

Shares offer no guaranteed income and no capital protection; and an

investment in the Placing Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who

(either alone or in conjunction with an appropriate financial or

other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom. The Target Market

Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Placing Shares. Furthermore, it is noted that,

notwithstanding the Target Market Assessment, Allenby Capital

Limited will only procure investors who meet the criteria of

professional clients and eligible counterparties. For the avoidance

of doubt, the Target Market Assessment does not constitute: (a) an

assessment of suitability or appropriateness for the purposes of

the FCA Handbook Conduct of Business Sourcebook COBS 9A and 10A

respectively; or (b) a recommendation to any investor or group of

investors to invest in, or purchase, or take any other action

whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOETRBPTMTJMBJB

(END) Dow Jones Newswires

December 08, 2021 02:00 ET (07:00 GMT)

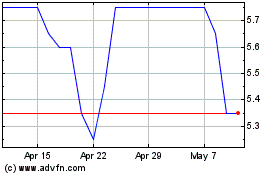

Blackbird (LSE:BIRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackbird (LSE:BIRD)

Historical Stock Chart

From Apr 2023 to Apr 2024