TIDMBIRG

RNS Number : 4498D

Bank of Ireland Group PLC

28 October 2020

Bank of Ireland Group plc (the "Group")

Interim Management Statement - Q3 2020 update

28 October 2020

Comment: Francesca McDonagh, Bank of Ireland Group CEO:

"As we navigate COVID-19 we continue to support our customers at

each stage of the pandemic, playing our part in the reboot of the

economy, and staying focused on our strategic objectives.

We are delivering good progress on transformation, customer

delivery, and operating cost. Examples include the roll-out of our

new Mobile App to iOS customers which follows the successful launch

to Android users in May. Our cloud-based personal current account

journey is now the largest channel for customers opening a current

account, and we launched a fully digitised mortgage application

process for first time buyers in July. We also completed a

bank-wide voluntary redundancy scheme, which will deliver a

step-change reduction to the bank's cost base.

The third quarter saw generally better trading conditions

compared to quarter two. Business volumes and activity in Ireland

improved including a c.30% increase in our Irish mortgage drawdowns

compared to the second quarter of 2020 and we also experienced

improved business activity in our UK business, including Bespoke

mortgages where drawdowns doubled quarter on quarter. While there

has been improvement in the third quarter, recently announced

COVID-19 restrictions by the Irish and UK governments combined with

Brexit present continued uncertainty. Against this backdrop, our

capital position remains strong."

Key highlights:

-- Strong capital position; fully loaded CET1 capital ratio

13.5%, regulatory CET1 capital ratio 14.8%

-- Higher activity levels in Q3 compared to prior quarter; new

lending up 59% and business income (including share of

associates/JVs) up 25%

-- Net interest income (NII) 2% lower in the 9 months to September vs prior year; NIM of 2.00%

-- New lending of EUR9 billion to September; 25% lower compared to prior year

-- Business income (including share of associates/JVs); 19%

lower in the 9 months to September vs prior year

-- Continued strong cost discipline; net reduction of 4% in the

9 months to September vs prior year

-- Restructuring charge of EUR169 million taken in September

reflecting the results of the Group's voluntary redundancy scheme

and supporting a step-change reduction in costs

-- No material increase in actual Stage 3 loan losses in the 3 months to September 2020

Income

NII is 2% lower in the 9 months to September 2020, when compared

to the same period in 2019. This reflects lower new lending volumes

and the on-going impact of lower interest rates. Lower funding

costs, including the impact of applying negative interest rates to

certain deposits, has supported interest income. In addition,

higher mortgage and revolving credit facilities (RCFs) activity has

been positive. The Group continues to maintain strong commercial

pricing discipline with loan asset spreads remaining stable.

While the third quarter has seen an improvement, business

income, including share of associates and JVs, is 19% lower in the

9 months to September 2020, when compared to the same period in

2019.

Costs and voluntary redundancy

The Group continues to maintain tight control over the cost base

while investing in transformation and absorbing cost inflation.

Operating expenses (excluding levies and regulatory charges) are 4%

lower in the first 9 months of 2020 compared to the same period in

2019. The net reduction of 4% includes on-going COVID-19 related

costs incurred during 2020.

The voluntary redundancy scheme, which concluded in the third

quarter, will result in c.1450 FTE exits commencing in 2020 and

continuing over the course of 2021. When completed the financial

impact is a c.EUR114 million reduction in annual staff costs,

equivalent to 14% of September 2020 annualised staff costs. The

restructuring charge of EUR169 million is captured within the

Group's broader EUR1.4 billion investment programme to 2021 and

will further help to achieve our target cost base of less than

EUR1.65 billion by 2021, and lower again beyond 2021.

Balance Sheet

Customer loan volumes were EUR76.3 billion at the end of

September 2020, a decrease of EUR3.2 billion since December 2019

(EUR0.8 billion reduction on a constant currency basis). New

lending of EUR9 billion, excluding RCFs of EUR0.9 billion, declined

25% compared to prior year while loan redemptions were EUR10.1

billion.

The Group's market share of new mortgage lending in Ireland

averaged c.25% in the first 9 months of 2020 capturing increased

customer activity in the third quarter .

The Group's liquid assets of EUR30.8 billion have increased by

EUR3.6 billion since December 2019 reflecting lower loan volumes

and increased customer deposits of EUR3.2 billion since the start

of the year.

Customer deposits were EUR87.2 billion (EUR88.1 billion on a

constant currency basis) and wholesale funding was EUR9.7 billion

at the end of September 2020. The Group successfully issued EUR300

million of AT1 securities in August and has now issued AT1

securities of EUR975 million in 2020, filling the Group's Pillar 1

and P2R requirements for AT1.

Asset Quality

The Group has not experienced a material increase in loan losses

since June 2020, in line with expectations. Macroeconomic scenarios

impacting credit impairment will be refreshed to reflect updated

market forecasts and captured as part of the Group's year-end

credit impairment process.

The Group continues to support our personal and business

customers in Ireland and the UK through Payment Breaks. The number

of customers availing of a Payment Break continues to reduce as

Payment Breaks expire. The Group approved c.106,000 initial 3-month

Payment Breaks in Ireland and the UK, with c.27,000 availing of a

further 3-month extension. As at 16 October 2020 there are a total

of c.20k outstanding Payment Breaks. The table below provides

details by geography and portfolio.

Payment Breaks - total balances outstanding as at 16 October 2020

Ireland Mortgages Consumer SME Total

------------- ----------- ----------- -----------

No. of accounts 6.4k 1.9k 2.8k 11.1k

------------- ----------- ----------- -----------

Exposure EUR1.1bn EUR28m EUR0.8bn EUR1.9bn

------------- ----------- ----------- -----------

% of accounts 4% 1% 2% 2%

------------- ----------- ----------- -----------

% of portfolio 5% 2% 9% 5%

------------- ----------- ----------- -----------

UK Mortgages Consumer SME Total

------------- ----------- ----------- -----------

No. of accounts 4.3k 3.9k 0.7k 8.9k

------------- ----------- ----------- -----------

Exposure EUR0.7bn EUR44m EUR19m EUR0.8bn

------------- ----------- ----------- -----------

% of accounts 3% 1% 1% 2%

------------- ----------- ----------- -----------

% of portfolio 3% 1% 1% 3%

------------- ----------- ----------- -----------

For those customers that have come off Payment Breaks, the

significant majority have resumed principal and interest

repayments. The number of customers requiring additional support is

in-line with our expectations. Non-performing exposures (NPEs) have

remained broadly stable since the end of June 2020, EUR4.5 billion

at the end of September 2020, equivalent to an NPE ratio of 5.8%.

The Group has a strong track record of credit risk management and

working with customers to implement sustainable solutions.

Capital Position

The Group's fully loaded CET1 ratio decreased by a net 10bps

from 13.6% at June 2020 to 13.5% at the end of September 2020. The

Group's organic capital generation was more than offset by

investments in our transformation programme, including c.30bps from

voluntary redundancy restructuring costs, and other movements.

The Group's regulatory CET1 ratio was 14.8% compared to current

regulatory requirements of 9.27%. The Group's regulatory Total

Capital ratio was 19.2% at the end of September 2020.

2020 Outlook

Third quarter trading was positive relative to expectations.

Taking into account this positive trading, the potential impact of

increased restrictions to control the pandemic and on-going

uncertainties in relation to Brexit, our overall expectation for

2020 performance is unchanged. The Group continues to maintain

strong capital with large capital buffers above regulatory minimum

requirements.

Ends

For further information please contact:

Bank of Ireland

Myles O'Grady, Group Chief Financial Officer +353 (0)766 23

4714

Darach O'Leary, Head of Group Investor Relations +353 (0)766 24

4224

Damien Garvey, Head of Group External Communications and Public

Affairs +353 (0)766 24 6716

Forward Looking Statement

This announcement contains forward-looking statements with

respect to certain of Bank of Ireland Group plc ('BOIG plc') and

its subsidiaries' (collectively the 'Group') plans and its current

goals and expectations relating to its future financial condition

and performance, the markets in which it operates and its future

capital requirements. These forward-looking statements often can be

identified by the fact that they do not relate only to historical

or current facts. Generally, but not always, words such as 'may,'

'could,' 'should,' 'will,' 'expect,' 'intend,' 'estimate,'

'anticipate,' 'assume,' 'believe,' 'plan,' 'seek,' 'continue,'

'target,' 'goal,' 'would,' or their negative variations or similar

expressions identify forward-looking statements, but their absence

does not mean that a statement is not forward-looking.

Examples of forward-looking statements include, among others:

statements regarding the Group's near term and longer term future

capital requirements and ratios, level of ownership by the Irish

Government, loan to deposit ratios, expected impairment charges,

the level of the Group's assets, the Group's financial position,

future income, business strategy, projected costs, margins, future

payment of dividends, the implementation of changes in respect of

certain of the Group's pension schemes, estimates of capital

expenditures, discussions with Irish, United Kingdom, European and

other regulators and plans and objectives for future operations.

Such forward-looking statements are inherently subject to risks and

uncertainties, and hence actual results may differ materially from

those expressed or implied by such forward-looking statements.

Nothing in this announcement should be considered to be a

forecast of future profitability, dividends or financial position

of the Group and none of the information in this announcement is or

is intended to be a profit forecast, dividend forecast or profit

estimate. Any forward-looking statement speaks only as at the date

it is made. The Group does not undertake to release publicly any

revision to these forward-looking statements to reflect events,

circumstances or unanticipated events occurring after the date

hereof.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUWANRRAURURA

(END) Dow Jones Newswires

October 28, 2020 03:01 ET (07:01 GMT)

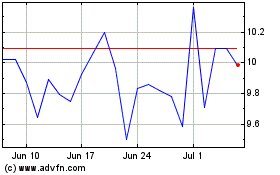

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

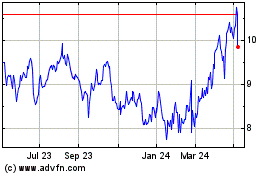

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Apr 2023 to Apr 2024