Berkeley Energia Limited ASX Response to Price and Volume Query (3472Q)

June 18 2020 - 1:00AM

UK Regulatory

TIDMBKY

RNS Number : 3472Q

Berkeley Energia Limited

18 June 2020

Berkeley Energia Limited

ASX Response to Price and Volume Query

Please find below a copy of Berkeley Energia Limited's (Company)

response to a price and volume query from the Australian Securities

Exchange (ASX):

18 June 2020

Wade Baggot

Australia Securities Exchange

Level 40, Central Park

152-158 St Georges terrace

Perth WA 6000

By email: Wade.Baggott@asx.com.au

Dear Wade,

Response to Price and Volume Query

In response to your correspondence dated 18 June 2020 regarding

an increase in the Company's share price and in the volume of

trading securities, the Company's response is as follows:

1. The Company is not aware of any information that has not been

announced which, if known, could be an explanation for recent

trading in the securities of the Company.

2. Not applicable.

3. The Company notes the recent increase in trading of its

shares on the Madrid Stock Exchange, which has seen an increase in

the Company's share price by over 70% since 15 June 2020 with over

115 million shares traded.

As previously announced, the Company's focus continues to be on

progressing the approvals required to commence construction of the

Salamanca mine and bring it into production.

The Company continues to engage with the relevant authorities in

a collaborative manner in order to facilitate the timely resolution

of the pending approvals required to commence construction of the

mine.

In late March, the Company formally submitted the updated

official documentation in relation to the Authorisation for

Construction ("NSC II") to the Nuclear Safety Council ("NSC"). The

next step in the process is for the NSC technical team to complete

its report and submit it to the NSC Board for ratification.

The Company further notes the strengthening of the uranium spot

price which stands at US$32.85 per pound and represents a year to

date increase of over 30%.

During the year, COVID-19 related supply disruptions have been

announced by Kazatomprom (Kazakhstan operations), Cameco (Cigar

Lake mine), CNNC (Rössing mine) and Swakop Uranium (Husab mine),

with analysts expecting further tightening of market conditions as

the current structural supply deficit in the global uranium market

is exacerbated by these and possible other COVID-19 supply

disruptions.

This increase in uranium prices has also generated increased

media interest and corporate activity, which has improved the

general sentiment in the uranium sector in recent months.

4. The Company confirms that it is in compliance with the

listing rules, in particular, Listing Rule 3.1.

5. The Company confirms that its responses to the questions

above have been authorised and approved in accordance with its

published continuous disclosure policy or otherwise by its board or

an officer of the Company with delegated authority from the board

to respond to ASX on disclosure matters.

Yours faithfully

[sent electronically without signature]

Dylan Browne

Company Secretary

For further information please contact:

Robert Behets Franciso Bellón

Acting Managing Director Chief Operations Officer

+61 8 9322 6322 +34 91 555 1380

info@berkeleyenergia.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

RSPZVLBFBQLZBBB

(END) Dow Jones Newswires

June 18, 2020 02:00 ET (06:00 GMT)

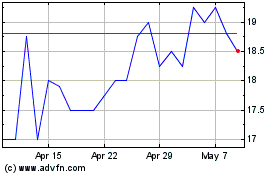

Berkeley Energia (LSE:BKY)

Historical Stock Chart

From Mar 2024 to Apr 2024

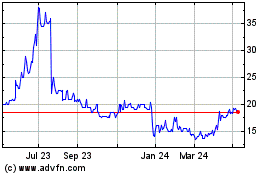

Berkeley Energia (LSE:BKY)

Historical Stock Chart

From Apr 2023 to Apr 2024