TIDMBKY

RNS Number : 5438U

Berkeley Energia Limited

30 July 2020

BERKELEY ENERGIA LIMITED

NEWS RELEASE | 30 July 2020

Quarterly Report June 2020

Summary:

-- Permitting Update:

The Company's focus continues to be on progressing the approvals

required to commence construction of the Salamanca mine and bring

it into production.

The Company continued to engage with the relevant authorities in

a collaborative manner to facilitate the timely resolution of the

pending approvals required to commence construction of the

mine.

The Company's Spanish executives and advisors have met and

continued to have constructive dialogue with officials from the

Nuclear Safety Council ("NSC"), the Federal Government, the

Regional Government of Castilla y Leon and the Municipality of

Retortillo, as well as other key stakeholders, during the

quarter.

In late March, the Company formally submitted the updated

official documentation in relation to the Authorisation for

Construction ("NSC II") to the NSC. During the quarter, the Company

held a number of teleconference meetings with the NSC technical

team to discuss and clarify minor queries on the updated

documentation. The Company also provided written responses and/or

additional technical information to the NSC when requested. The

next step in the process is for the NSC technical team to finalise

its report and submit it to the NSC Board for ratification.

In late July, the NSC issued a favourable report for the

extension of the validity of the Initial Authorisation ("NSC I").

NSC I was granted in September 2015, with a 5-year validity period.

The next step is for the Ministry for Ecological Transition and the

Demographic Challenge ("MITECO") to approve this authorisation and

set its duration period.

With regard to the Urbanism Licence ("UL"), the Ministry of

Environment and Development of the Regional Government of Castilla

y León informed the Municipality of Retortillo and the Company in

March that the previously granted Authorisation of the Exceptional

Land Use, a prerequisite for the award of the UL, remains fully

valid and enforceable. This resolution allows the Municipality of

Retortillo to advance the processing of the Company's UL

application. The Company has met with the relevant officials of the

Municipality of Retortillo during the quarter to ensure that they

have all the required information to be able to award the UL.

-- Uranium Market:

During the quarter, the uranium spot price rose to a high of

US$33.40 per pound and currently stands at US$32.20 per pound which

represents a year to date price increase of 30%.

Uncertainty surrounding COVID-19 impacts to the nuclear fuel

supply chain continued, with supply disruptions being experienced

by a number of major uranium producers including Kazatomprom

(Kazakhstan operations), Cameco (Cigar Lake mine), CNNC (Rössing

mine) and Swakop Uranium (Husab mine).

Analysts expect further tightening of market conditions as the

current structural supply deficit in the global uranium market is

exacerbated by these, and possible other, COVID-19 supply

disruptions. The current market uncertainty is also expected to

heighten concerns about the security of future supply and continued

upward movement in the spot price may be a trigger for increased

term market activity.

-- COVID-19:

During the quarter, the Spanish Government declared that the

National 'State of Alarm' relating to the COVID-19 pandemic, which

began on 14 March, would end on 21 June with its borders reopening

to Europe and free movement being allowed within the country.

Towards the end of July, Spain began experiencing another surge

in COVID-19 cases, with spikes in new daily infection rates forcing

the Government to reinstate both voluntary guidelines and mandatory

restrictions and place parts of the country, particularly in the

north-eastern region of Catalonia, under temporary lockdown

again.

All of the Berkeley team based in Spain are safe and well.

Consistent with current Government guidelines, the Company has

maintained a 'work from home' policy. Subject to the status of the

COVID-19 pandemic and related Government policy and guidelines, it

is expected that the team will recommence working from the Madrid

and Retortillo offices following the end of the European

summer.

Despite the Spanish Government suspending the term of all

administrative and legal proceedings while the 'State of Alarm' was

active, the Spanish Administration was still functioning during

this time and Berkeley was able to maintain regular communication

with the relevant officials from the NSC and the federal, regional

and local governments to ensure the permitting processes continued

to advance.

For further information please contact:

Robert Behets Franciso Bellón

Acting Managing Director Chief Operations Officer

+61 8 9322 6322 +34 91 555 1380

info@berkeleyenergia.com

Project Update:

The Salamanca mine is being developed to the highest

international standards and the Company's commitment to health,

safety and the environment remains a priority. It holds

certificates in Sustainable Mining (UNE 22470-80), Environmental

Management (ISO 14001), and Health and Safety (OHSAS 18001) which

were awarded by AENOR, an independent Spanish government

agency.

During the quarter, planning continued in advance of the annual

internal and external audits of the Company's Sustainable Mining

and Environmental Management Systems which are scheduled to take

place in the coming months.

The annual evaluation of Environmental Aspects ("EA"), which was

completed during the quarter, highlighted that significant

reductions had been achieved in a number of target areas, including

a 38% reduction in fuel consumption, a 48% reduction in printer

toner consumption, and a 85% reduction in fluorescent residue. New

targets have been set for 2020-21, with a focus of further reducing

the consumption of electricity, water, paper and printer toner.

As part of its commitment to Sustainable Mining, the Company has

commenced a Life Cycle Analysis of its operational processes, in

order to determine the environmental impact of the products

associated with these processes from their origin (raw materials)

through to the end of their useful life. During the quarter, this

initiative has focused on the analysis of the environmental impact

of carbon dioxide ("CO(2) ") emissions generated by exploration

drilling activities.

To facilitate an enhanced understanding of the environmental

impact of CO(2) emissions and to determine which phase/activity of

the life cycle is responsible for generating the most CO(2)

emissions, a series of graphics providing visual representation of

the information were designed during the quarter.

The determination and quantification of the direct environmental

aspects derived from the consumption of raw materials and the

production of waste that occurs during the different phases of the

life cycle of exploration drilling activities was also

completed.

The Company continued the migration its Health and Safety

Management System from OHSAS 18001 to its replacement standard, ISO

45001, a process which is targeted for completion in the second

half of 2020. As part of this process, an internal audit is planned

for the first week of August, and the external audit (by AENOR) for

the first week of September.

The monitoring programs associated with the NSC approved

pre-operational Surveillance Plan for Radiological and

Environmental Affections and pre-operational Surveillance Plan for

the Control of the Underground Water continued during the

quarter.

Permitting Update:

The Company continues to engage with all relevant authorities in

a collaborative manner in order to facilitate the timely resolution

of the pending approvals required to commence construction of the

Salamanca mine.

During the quarter, the Company's Spanish executives and

advisors have met with (via teleconference calls or in person once

COVID-19 restrictions were lifted) and had constructive dialogue

with relevant officials from the NSC, the Federal Government, the

Regional Government of Castilla y León, the Municipality of

Retortillo, and other key stakeholders.

As previously reported, at the request of the NSC, Berkeley

consolidated the Company's responses to all of the NSC's technical

queries into the official documentation, expanded the description

of some sections (e.g. waste management, analysis of potential

accidents, environmental radiological impact assessment,

hydrological modelling), and formally submitted the updated

official documentation to the NSC at the end of March.

During the current quarter, the Company held a number of

meetings with the NSC technical team to discuss and clarify minor

queries on the updated documentation. The Company has also provided

written responses and/or additional technical information to the

NSC when requested.

The next step in this process is for the NSC technical team to

finalise their report and submit it to the NSC Board for approval.

Once approved by the NSC Board, the NSC report and recommendation

which is 'compulsory and binding on radiological matters' is

provided to MITECO, who is the substantive authority responsible

for the granting NSC II.

In late July, the NSC issued a favourable report for the

extension of the validity of NSC I for the process plant as a

radioactive facility at the Salamanca project. NSC I was granted by

the then Ministry of Industry, Energy and Tourism in September

2015, with a 5-year validity period. The favourable report issued

by NSC considered that the circumstances and characteristics of the

process plant are the same as those contained in the Initial

Authorisation issued in 2015. The next step is for the MITECO to

approve this authorisation and set its duration period.

With regard to the award of the UL, the Municipality of

Retortillo and the Company were informed by the Ministry of

Environment and Development of the Regional Government of Castilla

y León in March that the previously granted Authorisation of the

Exceptional Land Use (a prerequisite for the award of the UL)

remains fully valid and enforceable. This resolution by the

Minister of Environment and Development allows the Municipality of

Retortillo to advance the processing of the Company's UL

application. The Company has met with the relevant officials of the

Municipality of Retortillo during the quarter to ensure that they

have all the required information to be able to award the UL, and

to demonstrate that the application fulfils all technical and legal

requirements.

The Company will continue to maintain a consistent approach,

ensuring that the project complies with all applicable laws and

regulations, as it progresses the approvals required to commence

construction of the Salamanca mine and bring it into

production.

Uranium market:

Uranium spot price continues to rise on uncertainty surrounding

COVID-19 impacts to the nuclear fuel supply chain.

COVID-19 related supply disruptions have been experienced by a

number of major uranium producers, including by Kazatomprom

(Kazakhstan operations), Cameco (Cigar Lake mine), CNNC (Rössing

mine) and Swakop Uranium (Husab mine). As a result, the uranium

spot price increased to a high of US$33.40 per pound during the

quarter and currently stands at US$32.20 per pound, representing a

year to date increase of 30%.

Analysts expect further tightening of market conditions as the

current structural supply deficit in the global uranium market is

exacerbated by these, and possible other, COVID-19 supply

disruptions.

The current market uncertainty is also expected to heighten

concerns about the security of future supply. Continued upward

movement in the spot price may be a trigger for increased term

market activity. Nuclear fuel buyers for utilities typically look

to secure contracts a minimum of two years ahead of use. With a

number of contracts dropping off from 2021, buyers may step into

the market, providing another possible prop to uranium prices.

COVID-19:

During the quarter, the Spanish Government declared that the

National 'State of Alarm' relating to the COVID-19 pandemic, which

began on 14 March, would end on 21 June with its borders reopening

to Europe and free movement being allowed within the country.

Towards the end of July, Spain began experiencing another surge

in COVID-19 cases, with spikes in new daily infection rates forcing

the Government to reinstate both voluntary guidelines and mandatory

restrictions and place parts of the country, particularly in the

north-eastern region of Catalonia, under temporary lockdown

again.

Specifically, with regard to Berkeley, all of its Spanish team

are safe and well. Consistent with current Government guidelines,

the Company has maintained its 'work from home' policy. Subject to

the status of the COVID-19 pandemic and related Government policy

and guidelines, it is expected that the Berkeley team will

recommence working from the Madrid and Retortillo offices following

the end of the European summer.

Despite the Spanish Government suspending the term of all

administrative and legal proceedings while the 'State of alarm' was

active, the Spanish Administration was still functioning during

this time and Berkeley and its advisors were able to maintain

regular communication with the NSC, federal, regional and local

government officials, and other key stakeholders, to ensure the

permitting processes continued to advance.

Balance Sheet:

The Company is in a strong financial position with A$92 million

in cash.

Forward Looking Statements

Statements regarding plans with respect to Berkeley's mineral

properties are forward-looking statements. There can be no

assurance that Berkeley's plans for development of its mineral

properties will proceed as currently expected. There can also be no

assurance that Berkeley will be able to confirm the presence of

additional mineral deposits, that any mineralisation will prove to

be economic or that a mine will successfully be developed on any of

Berkeley mineral properties. These forward-looking statements are

based on Berkeley's expectations and beliefs concerning future

events. Forward looking statements are necessarily subject to

risks, uncertainties and other factors, many of which are outside

the control of Berkeley, which could cause actual results to differ

materially from such statements. Berkeley makes no undertaking to

subsequently update or revise the forward-looking statements made

in this announcement, to reflect the circumstances or events after

the date of that announcement.

This announcement has been authorised for release by Mr Robert

Behets, Director.

To view the full report including all figures and illustrations,

please visit

https://www.berkeleyenergia.com/investor-relations/company-reports/

.

Appendix 1: Summary of Mining Tenements

As at 30 June 2020, the Company had an interest in the following

tenements:

Location Tenement Name Percentage Status

Interest

--------------- ------------------------- ------------ --------

Spain

Salamanca D.S.R Salamanca 28 100% Granted

(Alameda)

D.S.R Salamanca 29 100% Granted

(Villar)

E.C. Retortillo-Santidad 100% Granted

E.C. Lucero 100% Pending

I.P. Abedules 100% Granted

I.P. Abetos 100% Granted

I.P. Alcornoques 100% Granted

I.P. Alisos 100% Granted

I.P. Bardal 100% Granted

I.P. Barquilla 100% Granted

I.P. Berzosa 100% Granted

I.P. Campillo 100% Granted

I.P. Casta ñ 100% Granted

os 2

I.P. Ciervo 100% Granted

I.P. Dehesa 100% Granted

I.P. El Á guila 100% Granted

I.P. El Vaqueril 100% Granted

I.P. Espinera 100% Granted

I.P. Horcajada 100% Granted

I.P. Lis 100% Granted

I.P. Mailleras 100% Granted

I.P. Mimbre 100% Granted

I.P. O ñ oro 100% Granted

I.P. Pedreras 100% Granted

E.P. Herradura 100% Granted

I.P. Conchas Application Pending

C á ceres I.P. Almendro 100% Granted

I.P. Ibor 100% Granted

I.P. Olmos 100% Granted

Badajoz I.P. Don Benito Este 100% Granted

I.P. Don Benito Oeste 100% Granted

--------------- ------------------------- ------------ --------

No tenements were acquired or disposed of during the quarter

ended 30 June 2020. There were no other changes to beneficial

interest, acquired or disposed of, in any mining tenements due to

farm-in or farm-out agreements.

Appendix 2: Related Party Payments

During the quarter ended 30 June 2020, the Company made payments

of $172,029 to related parties and their associates. These payments

relate to existing remuneration arrangements (director and

consulting fees plus statutory superannuation).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTKKKBPDBKKKON

(END) Dow Jones Newswires

July 30, 2020 02:00 ET (06:00 GMT)

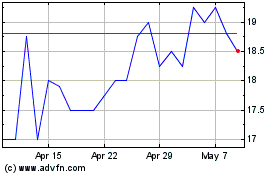

Berkeley Energia (LSE:BKY)

Historical Stock Chart

From Mar 2024 to Apr 2024

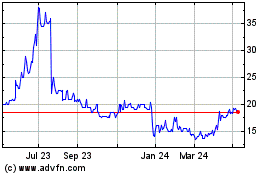

Berkeley Energia (LSE:BKY)

Historical Stock Chart

From Apr 2023 to Apr 2024