TIDMBKY

RNS Number : 0399X

Berkeley Energia Limited

29 April 2021

BERKELEY ENERGIA LIMITED

NEWS RELEASE | 29 April 2021

Quarterly Report March 2021

Summary:

Permitting Update:

Berkeley Energia Limited's ("Berkeley" or the "Company") focus

continues to be on progressing the approvals required to commence

construction of the Salamanca mine and bring it into

production.

With more than 120 previous permits and favourable reports

granted by the relevant authorities at the local, regional, federal

and European Union levels, the Authorisation for Construction for

the uranium concentrate plant as a radioactive facility ("NSC II")

is the only pending approval required to commence full construction

of the Salamanca mine.

During the quarter, the Company received, and promptly submitted

formal submitted formal responses to, two additional requests for

information in relation to the NSC II from the Nuclear Safety

Council ("NSC"). All documentation submitted by the Company in

relation to NCS II has been prepared following advice from

independent, internationally recognised advisors and consultants

who are experts in their field .

The next step in the process is for the NSC technical team to

finalise their report and submit it to the NSC Board for

ratification which it expects in the coming months following a

statement made by the NSC in April 2021.

The Company continues to engage with the relevant authorities

and maintain strong engagement with all key stakeholders in Spain

in relation to permitting for the Salamanca project.

Uranium Market:

The uranium spot price declined 6% during the first two months

of 2021 to reach US$28.20 per pound by the end of February 2021 but

then strengthened to US$30.65 per pound at the end of March 2021,

an increase of almost 9% for the month.

The month of March saw a surge in spot market volumes as several

potential uranium producers implemented a revised strategy

incorporating the near-term purchasing of physical uranium in

addition to pursuing the restart/development of uranium production

facilities.

There was strong investor interest in uranium during the quarter

as evidenced by a number of significant capital raises totalling

A$840 million. The market has been further buoyed during the

quarter due to recent events including:

o US President Biden's announcement on 31 March that the

proposed "American Jobs Plan," (proposed to be budgeted at US$2.25

trillion) would incentivise clean electricity providing funding for

the development of advanced nuclear reactors and supporting the

existing U.S. commercial nuclear power fleet;

o The European Commission's Research Centre draft report

concluded that nuclear energy does not harm the European Green Deal

sustainability objectives and that there is no science-based

evidence that nuclear energy does more harm to human health or to

the environment than other electricity production technologies

already included in the Taxonomy as activities supporting climate

change mitigation; and

o Russia's state nuclear power corporation, Rosatom, revealed

its future plans for new reactor construction within Russia which

may require the construction of 24 new commercial nuclear reactors

to increase energy provided by nuclear source to 25% by 2045.

Spanish Regulatory Regime:

Subsequent to the end of the quarter, the Company noted that at

a meeting of the Commission of Ecological Transition of the

Parliament in Spain ("Commission"), the Commission approved an

amendment to the draft climate change and energy transition bill

relating to the investigation and exploitation of radioactive

minerals (e.g. uranium).

The Commission reviewed and approved the modified amendment

proposed by the Ecological Transition Ponencia ("Ponencia") in

February 2021. At a meeting held subsequent to the quarter, the

Spanish Senate also approved this amendment.

As previously reported by the Company, under the modified

amendment proposed by the Ponencia (which has now been approved by

the Commission and the Senate):

o New applications for exploration, investigation or direct

exploitation concessions for radioactive materials, nor their

extensions, would not be accepted as of the entry into force of

this law.

o Existing concessions, and open proceedings and applications

related to these, would continue as per normal based on the current

legislation.

Importantly, existing rights for exploration, investigation and

exploitation concessions would remain in force during their

validity period. Existing proceedings underway would also continue

under the legal framework set up by the current regulations.

All amendments to the draft climate change and energy transition

bill approved by the Senate must now be reviewed and voted on by

the Parliament, as the Senate approved changes to a number of the

amendments previously approved by the Commission (note that the

amendment relating to the investigation and exploitation of

radioactive minerals was unchanged). Accordingly, the amendment

relating to the investigation and exploitation of radioactive

minerals may or may not be included in the final draft of the

climate change and energy transition bill.

Berkeley's position on any adverse changes that may be included

in the final draft of the climate change and energy transition bill

is clear: prohibition of economic activities in Spain with no

justified reasons is contrary to the Spanish Constitution and to

the legal rights recognised by other international instruments. In

particular, it must be taken into account that the Company

currently holds legal, valid and consolidated rights for the

investigation and exploitation of its mining projects, including a

valid 30-year mining licence (renewable for two further periods of

30 years) for the Salamanca mine. The approval of any amendment

which would imply a retroactive measure which expropriates the

legal rights of Berkeley with no justification is not

acceptable.

For further information please contact:

Robert Behets Franciso Bellón

Acting Managing Director Chief Operations Officer

+61 8 9322 6322 +34 91 555 1380

info@berkeleyenergia.com

Permitting Update:

During the quarter, the Company received, and promptly submitted

formal responses to, two additional requests for information in

relation to the NSC II from the NSC. The Company continued to

communicate with the NSC, and has requested the opportunity to meet

with the appropriate NSC representative/s to discuss and clarify

any queries on the documentation submitted by the Company, in order

to facilitate the timely completion of the NSC II process.

The NSC II process commenced in 2016 following the Company's

award of the Initial Authorisation for the uranium concentrate

plant as a radioactive facility ("NSC I") at the end of 2015. All

documentation submitted by the Company in relation to NCS II has

been prepared following advice from independent, nationally and

internationally recognised advisors and consultants who are experts

in their field.

Since the commencement of the process in 2016, the NSC has to

date held six meetings with the Company and on seven occasions

requested additional information in relation to NSC II; which the

Company has promptly responded to with updated information. The

overall time to work though the additional NSC information requests

and submit formal responses has accumulated to approximately three

and a half months in total, which is substantially shorter than the

approximate four and half years the NSC has had the NSC II file

for. It is also important to note that, in the Company's view, a

large part of the additional information requested by the NSC

relates to the Authorisation for Operation for the uranium

concentrate plant as a radioactive facility ("NSC III") which

should only have been dealt with following the award of NSC II.

However, to ensure the process was conducted in a collaborative

manner, the Company provided its responses to the NSC as

requested.

The next step in the process is for the NSC technical team to

finalise their report for NSC II and submit it to the NSC Board for

ratification which it expects in the coming months following a

statement made by the Chairman of the NSC at a hearing before the

Commission of Ecological Transition and Demographic Challenge of

the Spanish Parliament in April 2021.

The Company continues to engage with the relevant authorities

and maintain strong engagement with all key stakeholders in Spain,

as it progresses the approval process required to commence full

construction of the Salamanca mine and bring it into

production.

Project Update:

The Company's Salamanca mine is being developed to the highest

international standards and the Company's commitment to health,

safety and the environment is a priority. The Company currently

holds certificates in Sustainable Mining (UNE 22470-80),

Environmental Management (ISO 14001), and Health and Safety (ISO

45001) which were awarded by AENOR, an independent Spanish

government agency.

These management systems ensure that Company procedures are

compliant with current regulations, ensure that the environment is

protected, the project is sustainable, and that all activities are

carried out with respect for and in collaboration with the local

communities.

The Company also strives to uphold the United Nation's

Sustainable Development Goals ("SDGs"). A recent detailed review of

the Company's business strategy and activities in Spain has shown a

close alignment with the SDGs (compliance with 14 out of the 17

SDGs) demonstrating a commitment to the sustainable development

that will continue throughout the execution of the entire

project.

The Company's sustainability strategy is driven by a Programme

of Objectives defined in 2020, which strongly contributes to the

achievement of the SDGs. The Company is working according to the

following key focuses:

Ecodesign: The choice of transfer mining that minimises the

footprint of the project, the closed circuit of industrial water

and zero discharge, as well as heap leaching (that does not

generate tailings in the form of sludge) are some examples of

ecodesign.

Eco-Innovation: The re-use of waste-water and sludge from

municipalities for industrial use will minimise the flow of water

captured from streams and produce materials for the revegetation of

the site.

Circular Economy: Concerned with the Life Cycle perspective, the

objective is maximum efficiency of resources used. This strategy

focuses on responsible consumption, minimising waste, optimising

important resources such as water and energy, as well as reducing

CO(2) emissions. The objective is to minimise the environmental

footprint of activities.

Eco-efficiency: Digitisation of the Company contributes to the

optimisation of resources, which translates into minimising the

environmental impact. Likewise, installing LED lighting and

implementing Fleet Control for the optimisation of material

movement will help protect the environment while improving economic

performance.

Sustainable performance: Committed to creating employment in the

province of Salamanca, the project will create 500 jobs during

construction, and over 1000 direct and indirect jobs in the

operational phase - compatible with existing activities (since 2012

the Company has allowed neighbours to make temporary use of its

land for agricultural activity).

Environmental and sustainability training: Berkeley has set up a

training centre for staff and local people to be trained in new

skills. An interactive space will be created for environmental

education and the dissemination of information regarding the

importance of sustainability.

The Company closely monitors and evaluates its performance

against the targets implemented on as part of this process an

annual basis to ensure a high level of performance in the areas of

environmental management, health and safety, and sustainability is

maintained.

During the quarter, an assessment of the Company's performance

against key indicators and targets during 2019 and 2020

demonstrated that significant improvement had been achieved,

including a 63% reduction in fuel consumption, a 28% reduction in

energy consumption, a 50% reduction in water consumption, a 85%

reduction in paper consumption, and a 49% reduction in CO(2)

emissions. The Company notes that its 'work from home' policy which

was maintained for much of 2020 has positively impacted the 2020

data however, a longer-term trend of continuous improvement is

clearly evident.

Monitoring Programs

The monitoring programs associated with the NSC approved

pre-operational Surveillance Plan for Radiological and

Environmental Affections and pre-operational Surveillance Plan for

the Control of the Underground Water continued during the

quarter.

Exploration

A region exploration program which comprised soil sampling and

ground radon gas concentration and exhalation rate surveys covering

three Investigation Permits (Castaños 2, Alcornoques and Barquilla)

was undertaken during the quarter. An assessment of this regional

exploration program will be completed once all results are returned

and interpreted.

Spanish Regulatory Regime Update:

Subsequent to the end of the quarter, the Company noted that at

a meeting of the Commission, an amendment to the draft climate

change and energy transition bill relating to the investigation and

exploitation of radioactive minerals (e.g. uranium) was

approved.

The Commission reviewed and approved the modified amendment

proposed by the Ponencia in February 2021 (see ASX announcement

dated 25 February 2021). At a meeting held subsequent to the end of

the quarter, the Spanish Senate also approved this amendment.

As previously reported by the Company, under the modified

amendment proposed by the Ponencia (which has now been approved by

the Commission and the Senate):

-- New applications for exploration, investigation or direct

exploitation concessions for radioactive materials, nor their

extensions, would not be accepted as of the entry into force of

this law.

-- Existing concessions, and open proceedings and applications

related to these, would continue as per normal based on the current

legislation.

Importantly, existing rights for exploration, investigation and

exploitation concessions would remain in force during their

validity period. Existing proceedings underway would also continue

under the legal framework set up by the current regulations.

All amendments to the draft climate change and energy transition

bill approved by the Senate must now be reviewed and voted on by

the Parliament, as the Senate approved changes to a number of the

amendments previously approved by the Commission (note that the

amendment relating to the investigation and exploitation of

radioactive minerals was unchanged). Accordingly, the amendment

relating to the investigation and exploitation of radioactive

minerals may or may not be included in the final draft of the

climate change and energy transition bill.

Berkeley's position on any adverse changes that may be included

in the final draft of the climate change and energy transition bill

is clear: prohibition of economic activities in Spain with no

justified reasons is contrary to the Spanish Constitution and to

the legal rights recognised by other international instruments. In

particular, it must be taken into account that the Company

currently holds legal, valid and consolidated rights for the

investigation and exploitation of its mining projects, including a

valid 30 year mining licence (renewable for two further periods of

30 years) for the Salamanca mine. The approval of any amendment

which would imply a retroactive measure which expropriates the

legal rights of Berkeley with no justification is not

acceptable.

Uranium market:

The uranium spot price declined 6% during the first two months

of 2021 to reach US$28.20 per pound by the end of February 2021 but

then strengthened to US$30.65 per pound at the end of March 2021,

an increase of almost 9% for the month.

The month of March 2021 saw a surge in spot market volumes as

several potential uranium producers implemented a revised strategy

incorporating the near-term purchasing of physical uranium in

addition to pursuing the restart/development of uranium production

facilities.

There was strong investor interest in uranium during the quarter

as evidenced by a number of significant capital raises totalling

A$840 million which included raisings from Paladin Energy (A$192

million), Yellow Cake (A$182 million), Nexgen Energy (A$ 154

million) and Denison Mines (A$144 million).

The market has been further buoyed during the quarter due to

recent events including:

-- US President Biden's announcement on 31 March that the

proposed "American Jobs Plan," (proposed to be budgeted at US$2.25

trillion) would incentivise clean electricity providing funding for

the development of advanced nuclear reactors and supporting the

existing U.S. commercial nuclear power fleet;

-- The European Commission's Research Centre draft report

concluded that nuclear energy does not harm the European Green Deal

sustainability objectives and that there is no science-based

evidence that nuclear energy does more harm to human health or to

the environment than other electricity production technologies

already included in the Taxonomy as activities supporting climate

change mitigation; and

-- Russia's state nuclear power corporation, Rosatom, revealed

its future plans for new reactor construction within Russia which

may require the construction of 24 new commercial nuclear reactors

to increase energy provided by nuclear source to 25% by 2045.

COVID-19:

The ongoing nationwide state of emergency remains in effect

until at least 9 May 2021, which empowers the government to limit

certain rights, including freedom of movement. Accordingly, social

gatherings are limited to six people nationwide and a 11pm to 6am

curfew is in effect throughout Spain. Facemasks are mandatory in

enclosed public spaces and in outdoor areas where social distancing

cannot be maintained. Where businesses are permitted to remain

open, they must implement strict hygiene and social distancing

measures.

Many regional authorities have also implemented tighter

restrictions including their own entry and exit restrictions,

permitting travel out of the locality for essential reasons

only.

Spanish authorities have extended certain international entry

restrictions, in particular for any travellers flying from

locations where highly transmissible COVID-19 variants are in

general circulation who are required to self-isolate for 10 days on

arrival. A ban on non-essential travel from countries outside the

European Union and Schengen Area also remains in effect.

Other international travel to and from Spain is still possible,

subject to travellers possessing a negative COVID-19 test which

must be taken within 72 hours prior to arrival.

All of the Berkeley team based in Spain are safe and well.

Consistent with current Government guidelines, the Company has

continued its 'work from home' policy. Regular communication has

however, been maintained with the relevant officials from the NSC

and the federal, regional and local governments to ensure the

permitting processes continues to advance.

Balance Sheet:

The Company is in a strong financial position with A$80 million

in cash.

Forward Looking Statements

Statements regarding plans with respect to Berkeley's mineral

properties are forward-looking statements. There can be no

assurance that Berkeley's plans for development of its mineral

properties will proceed as currently expected. There can also be no

assurance that Berkeley will be able to confirm the presence of

additional mineral deposits, that any mineralisation will prove to

be economic or that a mine will successfully be developed on any of

Berkeley mineral properties. These forward-looking statements are

based on Berkeley's expectations and beliefs concerning future

events. Forward looking statements are necessarily subject to

risks, uncertainties and other factors, many of which are outside

the control of Berkeley, which could cause actual results to differ

materially from such statements. Berkeley makes no undertaking to

subsequently update or revise the forward-looking statements made

in this announcement, to reflect the circumstances or events after

the date of that announcement.

Appendix 1: Summary of Mining Tenements

As at 31 March 2021, the Company had an interest in the

following tenements:

Location Tenement Name Percentage Status

Interest

--------------- ----------------------------- ----------- --------

Spain

Salamanca D.S.R Salamanca 28 (Alameda) 100% Granted

D.S.R Salamanca 29 (Villar) 100% Granted

E.C. Retortillo-Santidad 100% Granted

E.C. Lucero 100% Pending

I.P. Abedules 100% Granted

I.P. Abetos 100% Granted

I.P. Alcornoques 100% Granted

I.P. Alisos 100% Granted

I.P. Bardal 100% Granted

I.P. Barquilla 100% Granted

I.P. Berzosa 100% Granted

I.P. Campillo 100% Granted

I.P. Casta ñ os 100% Granted

2

I.P. Ciervo 100% Granted

I.P. Conchas 100% Granted

I.P. Dehesa 100% Granted

I.P. El Á guila 100% Granted

I.P. El Vaqueril 100% Granted

I.P. Espinera 100% Granted

I.P. Horcajada 100% Granted

I.P. Lis 100% Granted

I.P. Mailleras 100% Granted

I.P. Mimbre 100% Granted

I.P. Pedreras 100% Granted

E.P. Herradura 100% Granted

C á ceres I.P. Almendro 100% Granted

I.P. Ibor 100% Granted

I.P. Olmos 100% Granted

Badajoz I.P. Don Benito Este 100% Granted

I.P. Don Benito Oeste 100% Granted

--------------- ----------------------------- ----------- --------

During the quarter ended 31 March 2020, no tenements were

issued, expired or lapsed during the quarter ended. There were no

other changes to beneficial interest, acquired or disposed of, in

any mining tenements due to farm-in or farm-out agreements.

Appendix 2: Related Party Payments

During the quarter ended 31 March 2021, the Company made

payments of $93,750 to related parties and their associates. These

payments relate to existing remuneration arrangements (director and

consulting fees plus statutory superannuation).

Appendix 3: Exploration and Mining Expenditure

During the quarter ended 31 March 2021, the Company made the

following payments in relation to exploration and development

activities:

Activity $000

---------------------------------------- ------

Radiological protection and monitoring 243

Permitting related expenditure 609

Consultants and other expenditure 305

Total as reported in the Appendix 5B 1,157

---------------------------------------- ------

There were no mining or production activities and expenses

incurred during the quarter ended 31 March 2021.

To view this announcement in full, including all infographics

and figures, please refer to the Company's website at

www.berekeleyenergia.com .

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

Name of entity

---------------------------------------------------------------

Berkeley Energia Limited

ABN d Quarter ended ("current quarter")

--------------- ----------------------------------

40 052 468 569 31 March 2021

----------------------------------

Consolidated statement of cash Current quarter Year to date

flows

$A'000 (9 months)

$A'000

1. Cash flows from operating

activities

1.1 Receipts from customers - -

1.2 Payments for

(a) exploration & evaluation (1,157) (3,090)

(b) development - -

(c) production - -

(d) staff costs (334) (1,055)

(e) administration and corporate

costs (212) (797)

1.3 Dividends received (see note - -

3)

1.4 Interest received 8 16

1.5 Interest and other costs of - -

finance paid

1.6 Income taxes paid - -

1.7 Government grants and tax - -

incentives

1.8 Other (provide details if

material) - -

---------------- -------------

Net cash from / (used in)

1.9 operating activities (1,695) (4,926)

----- ----------------------------------- ---------------- -------------

2. Cash flows from investing

activities

2.1 Payments to acquire or for:

(a) entities - -

(b) tenements - -

(c) property, plant and equipment - -

(d) exploration & evaluation - -

(e) investments - -

(f) other non-current assets - -

2.2 Proceeds from the disposal

of:

(a) entities - -

(b) tenements - -

(c) property, plant and equipment - -

(d) investments - -

(e) other non-current assets - -

2.3 Cash flows from loans to other - -

entities

2.4 Dividends received (see note - -

3)

2.5 Other (provide details if - -

material)

---------------- -------------

2.6 Net cash from / (used in)

investing activities - -

----- ----------------------------------- ---------------- -------------

3. Cash flows from financing

activities

3.1 Proceeds from issues of equity

securities (excluding convertible

debt securities) - -

3.2 Proceeds from issue of convertible

debt securities - -

3.3 Proceeds from exercise of - -

options

Transaction costs related

to issues of equity securities

3.4 or convertible debt securities - (17)

3.5 Proceeds from borrowings - -

3.6 Repayment of borrowings - -

3.7 Transaction costs related

to loans and borrowings - -

3.8 Dividends paid - -

3.9 Other (provide details if - -

material)

---------------- -------------

Net cash from / (used in)

3.10 financing activities - (17)

----- ----------------------------------- ---------------- -------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 79,757 91,764

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (1,695) (4,926)

4.3 Net cash from / (used in)

investing activities (item

2.6 above) - -

Net cash from / (used in)

financing activities (item

4.4 3.10 above) - (17)

Effect of movement in exchange

4.5 rates on cash held 1,042 (7,717)

---------------- -------------

Cash and cash equivalents

4.6 at end of period 79,104 79,104

----- ----------------------------------- ---------------- -------------

5. Reconciliation of cash and Current quarter Previous quarter

cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 79,054 79,707

5.2 Call deposits 50 50

5.3 Bank overdrafts - -

5.4 Other (provide details) - -

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 79,104 79,757

---- ----------------------------------- ---------------- -----------------

6. Payments to related parties of the entity Current quarter

and their associates $A'000

Aggregate amount of payments to related

parties and their associates included in

6.1 item 1 (94)

-----------------

6.2 Aggregate amount of payments to related

parties and their associates included in

item 2 -

-----------------

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly

activity report must include a description of, and an explanation

for, such payments.

7. Financing facilities Total facility

Note: the term "facility' amount at quarter Amount drawn

includes all forms of financing end at quarter end

arrangements available to $A'000 $A'000

the entity.

Add notes as necessary for

an understanding of the sources

of finance available to the

entity.

7.1 Loan facilities - -

------------------- ----------------

7.2 Credit standby arrangements - -

------------------- ----------------

7.3 Other (please specify) - -

------------------- ----------------

7.4 Total financing facilities - -

------------------- ----------------

7.5 Unused financing facilities available at -

quarter end

----------------

7.6 Include in the box below a description of each facility

above, including the lender, interest rate, maturity date

and whether it is secured or unsecured. If any additional

financing facilities have been entered into or are proposed

to be entered into after quarter end, include a note providing

details of those facilities as well.

---- ------------------------------------------------------------------------

Not applicable

----

8. Estimated cash available for future operating $A'000

activities

Net cash from / (used in) operating activities

8.1 (item 1.9) (1,695)

8.2 (Payments for exploration & evaluation classified

as investing activities) (item 2.1(d)) -

8.3 Total relevant outgoings (item 8.1 + item (1,695)

8.2)

8.4 Cash and cash equivalents at quarter end 79,104

(item 4.6)

8.5 Unused finance facilities available at quarter -

end (item 7.5)

--------

8.6 Total available funding (item 8.4 + item 79,104

8.5)

--------

8.7 Estimated quarters of funding available

(item 8.6 divided by item 8.3) >10

--------

Note: if the entity has reported positive relevant outgoings

(ie a net cash inflow) in item 8.3, answer item 8.7 as

"N/A". Otherwise, a figure for the estimated quarters

of funding available must be included in item 8.7.

8.8 If item 8.7 is less than 2 quarters, please provide answers

to the following questions:

8.8.1 Does the entity expect that it will continue to

have the current level of net operating cash flows for

the time being and, if not, why not?

--------------------------------------------------------------------------

Answer: Not applicable

--------------------------------------------------------------------------

8.8.2 Has the entity taken any steps, or does it propose

to take any steps, to raise further cash to fund its operations

and, if so, what are those steps and how likely does it

believe that they will be successful?

--------------------------------------------------------------------------

Answer: Not applicable

--------------------------------------------------------------------------

8.8.3 Does the entity expect to be able to continue its

operations and to meet its business objectives and, if

so, on what basis?

--------------------------------------------------------------------------

Answer: Not applicable

--------------------------------------------------------------------------

Note: where item 8.7 is less than 2 quarters, all of questions

8.8.1, 8.8.2 and 8.8.3 above must be answered.

--------------------------------------------------------------------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 29 April 2021

Authorised by: Company Secretary

(Name of body or officer authorising release - see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity's

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 6: Exploration for and Evaluation of

Mineral Resources and AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market

by your board of directors, you can insert here: "By the board". If

it has been authorised for release to the market by a committee of

your board of directors, you can insert here: "By the [name of

board committee - eg Audit and Risk Committee]". If it has been

authorised for release to the market by a disclosure committee, you

can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market

by your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council's Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTSEUSLUEFSESL

(END) Dow Jones Newswires

April 29, 2021 02:00 ET (06:00 GMT)

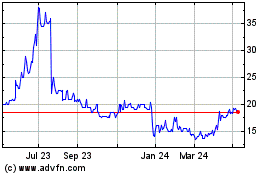

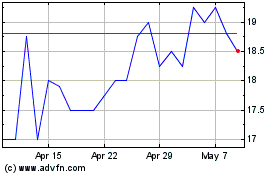

Berkeley Energia (LSE:BKY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Berkeley Energia (LSE:BKY)

Historical Stock Chart

From Apr 2023 to Apr 2024