TIDMBLVN

RNS Number : 8655T

Bowleven plc

30 March 2021

30 March 2021

Bowleven plc

('Bowleven' or 'the Group' or 'the Company')

Interim Results

Bowleven, the Africa focused oil and gas, Exploration and

Production Company with key interests in Cameroon, today announces

its unaudited interim results for the six months ended 31 December

2020.

HIGHLIGHTS

-- The Operating Committee through its resolution dated 11

December 2020 has given the JV partners permission to negotiate a

new Etinde Exclusive Exploitation Authorisation ('EEA' or 'EEEA').

The current EEA will continue until replaced.

-- Group cash balance at 31 December 2020 was circa $6.4 million

with a further $2.1 million held in financial investments, with no

debt and material financial commitments.

-- Front End Engineering Design ('FEED') completed in January

2021 marking a very significant milestone in progressing Etinde

towards FID and development approval.

-- Ongoing market volatility caused by the COVID-19 global

pandemic in 2020, and the associated fall in global oil prices, has

continued to slow down and impact negatively on progressing Etinde

development overall. This has particularly impacted various

commercial and legal/regulatory approval negotiation processes. As

a result, FID is likely to slip into 2022.

-- The recent oil price recovery significantly helps project economics.

-- The JV partners continue to place a high priority on

maximising project NPV and minimising capital development costs as

we conclude Etinde development and commercial options.

Operational

Etinde

-- In December 2020 the Operating Committee gave the JV partners

permission to apply for and negotiate a replacement EEA. The

current licence continues to be in force until replaced. The new

agreement would reflect a change in the development plan, focussing

on the Cameroon gas thermal power generation sector as the base

level use of Etinde gas.

-- During 2020, the JV partners completed:

o FEED on the development facilities and associated pipeline

infrastructure combined with Health, Safety, Security and

Environment ('HSSE'), pipeline route surveys, reservoir risk

analysis and mitigation and the preparation of the initial

sub-surface drilling plan

o FEED builds on previously completed extensive pre-FEED studies

undertaken in 2019

o Reprocessed the Seismic data for the entire licence area.

-- The JV partners have also undertaken to continue commercial

activities focused around a liquids-based development alongside

discussion of sales terms with potential gas, condensate and LPG

off-takers.

-- New Age and Bowleven jointly appointed Cofarco (a Paris based

financial advisory business) as lead advisor in relation to raising

debt finance to fund Etinde development.

Corporate

-- Group cash balance at 31 December 2020 was circa $6.4 million

with a further $2.1 million held in financial investments, with no

debt and material financial commitments.

-- Bowleven considers the value of cash and investment of $8.5

million to be sufficient to meet the Group's financial requirements

for at least the next 12 months.

-- The loss for the 6 month period was $0.9 million compared to

$1.4 million in the equivalent period last year.

-- Management continues to diligently manage costs and minimise

cash burn to support G&A up to FID, focused on continuing to

work alongside the Etinde JV partners during the rest of 2021 to

explore both commercial opportunities and related development

engineering designs and costs, with a view to having a sufficiently

detailed, costed development plan to reach FID before end of Q1

2022.

Eli Chahin, Chief Executive Officer of Bowleven plc, said:

"During 2020, we were pleased with the progress made towards

achieving FID at Etinde. We have completed a significant number of

the most important technical work streams and made strong progress

on a number of other important project development related work

streams. Certain hurdles persist, predominantly around agreeing the

many commercial aspects of the development with SNH, the Government

of Cameroon and other interested parties. The principal outstanding

requirements to achieving FID are now almost entirely commercial

and regulatory approvals relating to the development concept we

will propose.

Currently, the facilities development cost, relative to the

production levels we can achieve due to commercial and regulatory

approval issues relating to the sale or utilisation of methane gas

production, can be improved upon. Whilst the proposed 'Base Case'

development concept tested by FEED provides a positive outcome, the

economic value is lower than the minimum level the JV partners

consider desirable. The JV Partners are confident that further

discussions with the Government of Cameroon, represented by SNH,

can progress to a stage whereby a development concept with

significantly increased economics for all parties can be agreed

upon.

At a time of considerable market turbulence, we are fortunate to

benefit from a robust financial position, with in excess of $8

million of cash and investments on the balance sheet and no debt.

Coupled with our low-cost base, we remain well funded to reach FID,

after which we will be in a position to receive the $25 million

contingent consideration from the JV partners, instantly giving the

Company a significant cash injection.

Although the ongoing macro-economic conditions seen in 2020 and

beyond have negatively impacted the timing of the Etinde project,

we welcome the recent oil price strength and we continue to work

towards achieving FID as quickly as possible. We look forward to

keeping all of our stakeholders appraised on progress over the

coming months."

ENQUIRIES

For further information, please contact:

Bowleven plc

Eli Chahin, Chief Executive 00 44 203 327 0150

Camarco (Financial PR)

Owen Roberts

Oliver Head 00 44 203 757 4980

Shore Capital (NOMAD and Broker)

Antonio Bossi 00 44 207 601 6100

A copy of this announcement is available on the Bowleven website

www.bowleven.com

Notes to Editors:

Bowleven plc is an African focused oil and gas group, based in

London and traded on AIM. It is dedicated to realising material

shareholder value from its Etinde asset in Cameroon, whilst

maintaining capital discipline and employing a rigorously selective

approach to other value-enhancing opportunities. Bowleven holds a

strategic equity interest in the offshore, shallow water Etinde

permit (operated by New Age) in Cameroon.

Notes to Announcement:

The information in this release reflects the views and opinions

of Bowleven and has not been reviewed in advance by its joint

venture partners.

CEO's REVIEW

Calendar year 2020 has been one of mixed fortunes for the Etinde

development project. The current COVID-19 pandemic environment,

with its global reduction in economic activity and, widespread

lockdown measures has left us and the wider industry facing a

difficult operational environment. When this is combined with the

reduction in global hydrocarbon demand and pricing and the

increasing political and commercial priority to seek a faster

global transition to a greener energy generation future,

circumstances have created challenging economic conditions. In many

ways, this has actually acted to clarify much of our thinking, as

our development work has factored in the tough market conditions

seen in 2020; when taking into account recent oil price strength,

this puts the Etinde project in a stronger position.

We have seen significant technical progress made during the

year, which has brought the commencement of development closer.

Although there has also been limited movement on many of the

critical commercial issues, along with disruptions on the economic

front, we are confident of the Company's ability to progress during

2021 and progress Etinde towards FID.

The technical aspects of the surface and sub-surface development

and facilities aspects of the Etinde development concept have

progressed well during 2020. FEED has been completed on the gas

processing facilities alongside related environmental and pipeline

route studies, where the sea floor was surveyed for potential

geo-hazards along the planned routes for the sea floor surface

pipeline infrastructure. Combined with this, we have made further

advances on de-risking the geotechnical aspects of the development,

which we expect to further enhance during 2021 by the application

of the newly reprocessed seismic data.

With FEED completed, the financial, engineering and construction

aspects of the gas, LPG and condensate processing and storage

facilities are now very well understood from a planning and

budgetary cost point of view. Indeed, the JV partners stand ready

to proceed to the next stage of the process, which would be to seek

pre-qualification from potential EPCI providers and the

identification of construction and engineering partners. In

addition, we now have a very clear understanding of the likely cost

of the initial and subsequent capital investment demand, how these

may be financed and the likely ongoing operating cost of the

facilities.

Although significant advancements were seen from a technical

aspect in the period, much less progress has been made than we had

expected regarding the various open commercial issues. In part,

this is due to the impact of COVID-19 related measures adversely

impacting on the JV partners and other Government and interested

commercial parties due to the difficulty of arranging face to face

meetings and international travel. It also reflects the large

number of different Cameroon and international partners involved in

different aspects of the Cameroon domestic environment for

utilising natural gas. Progress has continued nonetheless, and we

look forward to making further progress during 2021 as COVID-19

restrictions abate.

The Etinde JV partners, SNH and the Government of Cameroon have

agreed that the first priority for Etinde gas will be given to

supplying the domestic marketplace and that 'surplus' gas can be

exported. However, limited progress has been made on filling out

the commercial details around this broad understanding during 2020.

For the Etinde JV partners, we require firm long-term gas demand

projections and supporting commercial agreements with minimal

technical or commercial uncertainty before FID. Moving from

conceptual understanding to commercial agreements remains a slow

and exacting process. The JV Partners remain committed to advancing

these during the year.

As a result of the challenging conditions the hydrocarbon sector

experienced during the period, we are re-evaluating our existing

development concepts with a view to seeking to further de-risk the

economic and financial aspects of the development. This can be

achieved by seeking to further reduce the initial capital

investment cost and/or increasing the initial and long-term

production levels and lower corporate taxation payments.

All JV partners agree that higher than previously expected

initial production levels are now necessary and that generating

this increase has become an immediate priority. There are several

different options, which could be used to accommodate our

requirements, but they will be subject to regulatory approval and

commercial agreements, which remain the subject of much multi-party

discussion. With positive, ongoing discussions between the JV

Partners, SNH and the Government of Cameroon, we are encouraged

that a commercially beneficial development plan can be agreed upon

for all stakeholders in the coming months.

Final Investment Decision for Etinde

We continue to make significant progress towards this very

important milestone. For the issues which the JV partners are

solely responsible, progress has been steady and significant. The

ongoing global COVID-19 response is likely to continue to impede

faster process on resolving commercial issues than we would prefer,

however we are monitoring the situation closely.

In addition, many of the most important considerations relating

to the domestic gas marketplace involve a wide range of different

national and international partners, of which we are not the most

significant in controlling the future timetable.

Whilst a late 2021 FID decision remains a plausible outcome, we

consider that the relatively slow progress resolving commercial

issues that lie outside the JV partners' immediate remit, but upon

which we are dependent, will impact on the eventual date.

Accordingly, we consider 2022 to be more likely. It is also

important to remember that once these decisions are finalised,

dealing with the likely impact of the financial aspects of the

Etinde development as well as agreeing all of the necessary

regulatory permissions and approvals we require, will still take

some months to resolve.

OPERATIONS REVIEW

Etinde Exploitation, Offshore Cameroon (25% equity interest)

Etinde Exclusive Exploitation Authorisation ( ' EEA ' or ' EEEA

' )

SNH, acting as regulator, has supported the JV partners'

application to negotiate a new EEA to replace the existing

Authorisation, which came into legal force in January 2015. We

expect the terms of the new agreement to largely follow those set

out in the existing agreement, but with a change in the authorised

basis of development from 2015's Fertiliser project based

development to one focused on supplying gas to domestic power

generation projects once the necessary infrastructure is available.

SNH's support is set out in the Operating Committee Resolution

stipulation:

"Authorise the Operator to apply for a new EEA for the

production of hydrocarbons including the delivery of gas to thermal

power plants, or any other projects confirmed by the State."

We also hope that we will receive permission to export 'surplus'

gas production. It is likely that the new EEA agreement will be

agreed alongside a revised field development plan and the Final

Investment Decision. SNH have reiterated that they have no

intention of taking steps to use the clauses in the existing EEA to

terminate the Etinde EEA. The current EEA remains in force until

replaced.

FEED

The JV partners appointed Technip after a competitive tender in

Spring 2020. FEED proper commenced in July 2020 and was completed

in early December 2020 except for some further work commissioned

under contract variation orders. This work was largely completed in

January 2021.

FEED was managed by the Operator using a joint project team

comprising a mixture of New Age and LUKOIL staff and individual

specialist consultants hired by New Age for the project. New Age's

geological and reservoir engineering specialists and New Age's

existing Drilling advisors supported FEED activity. FEED focused on

detailed design and development implementation planning of the

proposed Limbe gas processing facility concept. Earlier pre-FEED

studies concluded that this development concept was the optimum

solution based on our economic and technical assumptions.

The facilities concept is designed around either 1 or 2 wet gas

processing lines within a common support infrastructure. The design

is intended to be modular to allow a phased development based,

initially, on a single gas processing train. The two-train facility

is designed to have a name plate capacity to process c150 mmscf/d

of wet gas. However, the modular design allows a single processing

train, when fully optimised, to process up to 90 mmscf/d of wet

gas. Allowing for shrinkage and the different condensate/gas ratios

of the reservoir fluids (which also vary over time with production)

a single train facility will produce around 75 mmscf/d of dry

gas.

The initial 'base case' field development concept studied during

FEED comprised an IM only development with a single well head

platform, field gathering system and a high pressure pipeline to

transport wet gas to the Limbe processing facility. The Limbe

facility is designed to process wet gas into dry natural gas

(mostly comprising Methane), LPG, Propane and Condensate as well as

handling water and other by-products arising from processing. The

facility also includes storage capacity for condensate. The design

assumes that any storage for LPGs and methane gas will be the

responsibility of the end users. The initial design concept would

use a small amount of produced gas to self-generate electricity and

to utilise an Etinde specific Conventional Buoy Mooring ('CBM')

facility to load condensate onto Tankers. The Limbe facilities

condensate storage capacity would be flexed based on the likely

condensate offtake schedule and tanker capacity. We have placed an

illustrative video representation of the Limbe facility and

associated design, prepared by Technip as part of FEED, on our

website.

FEED is based around specific commercial assumptions provided by

SNH. The most important of these is that 20 to 25 mmscf/d of gas

production would initially be supplied to the domestic Cameroon

market to provide gas for the proposed thermal power station to be

designed and run by Aksa at Bekoko near to the city of Douala, some

60 km from Limbe depending on pipeline route. In addition, SNH has

indicated their intention to acquire all LPG production to supply

to the domestic market to reduce current LPG imports. The domestic

requirement would require SNH or others to build further facilities

to store and transport LPG and gas from our Limbe facility. Whilst

there will be a certain level of Etinde owned facilities (such as

metering and connectivity), FEED assumed the point of sale would be

at the Limbe facility itself. SNH has further indicated that they

see Etinde gas being provided to the proposed Limbe 350 MW thermal

power generation project, which was subject to an Expression of

Interest process initiated by the Government in Spring 2020.

The IM well head platform has been designed to minimise

installation and logistics costs using suction piles and a 3-leg

jacket design with 6 well slots. Two further well slots would be

added by the combination of using splitter well technology and

36-inch diameter conductor fixed onto the external support

framework of the platform, giving a design capacity to drill 8 to 9

wells.

Sub-sea Pipeline route surveys and environmental studies were

initiated during 2020 as part of the wider FEED related development

activity. The route surveys and a significant proportion of the

environmental studies were completed during 2020. This information

will feed into the Field Development Plan and other regulatory

approval processes during 2021.

The Operator has proposed that c50 mmscf/d of dry gas produced

could be re-injected back into the Upper Isongo and Intra-Isongo

reservoirs in a dry gas reinjection and recycling scheme. Gas

reinjection has the advantage of increasing condensate recovery

rates but comes at a substantial additional capital cost. This

would include 2 gas reinjection wells, gas compression system and a

high-pressure dry gas pipeline from Limbe to the IM well head

platform. Reservoir engineering modelling suggests that gas

breakthrough is likely to be relatively quick for the Upper Isongo

reservoir (2 to 3 years). Whilst gas breakthrough is much less

likely for the Intra-Isongo reservoir, which has higher condensate

levels, the higher initial pressure would require the Intra-Isongo

reservoir to be produced for 1 to 2 years to reduce reservoir

pressure to enable gas reinjection to occur.

During FEED a number of potential design changes and other

design optimisation considerations were identified. The FEED team

has currently identified these potential optimisation changes to

potentially reduce capital costs.

Following an initial consideration, the JV partners have

collectively agreed that the capital cost of initial base case

development scenario, based on IM only and 1 processing train, is

too high for the given level of production resulting in a

sub-optimal project NPV and too low rate of return on investment in

the current economic environment.

Collectively, we agree that the initial investment cost must be

further reduced and ideally production and revenue increased

significantly to the benefit of the project and Bowleven's

shareholders. There are multiple options available to the JV

partners depending on commercial and regulatory approval

considerations. These include negotiating commercial and fiscal

terms with SNH, a different approach to the development of the

field, export of excess gas and bringing forward the development of

the IE field combined with higher volumes of dry gas reinjection

than currently proposed.

As we suggested in the 2020 annual report, we always envisaged a

significant and uncertain period post FEED completion due to the

number of different work streams and the need to complete

commercial negotiations with SNH and other potential offtakers. The

legal and regulatory steps alone comprised the replacement EEA, the

Field Development Plan documentation and regulatory approval, the

participation agreement with SNH and the Government to permit SNH

to take up its potential 20% share of the Etinde field ownership

amongst other steps. We now envisage this commercial and regulatory

approval process to take some additional months in respect of some

of the potential ways we might opt to mitigate development costs.

We consider FID is now more likely to occur during 2022 than 2021

with the final decision reliant on the unanimity of the Joint

Venture partners and the decisions reached by the Government of

Cameroon.

Seismic reprocessing project

The seismic reprocessing project was completed on budget in

December 2020. The COVID-19 pandemic slightly delayed completion

due to its delaying of project initialisation and additional

processing activities undertaken following better than expected

results from earlier data processing steps.

The reprocessed data has significantly reduced the noise and

other data artifacts (mostly arising from the presence of younger

volcanic deposits), which significantly reduced the quality of the

seismic data from an analysis standpoint. Removal of seismic

reflection multiples alongside much better imaging of faults and

stratigraphical structures should allow a significant enhancement

in the accuracy of the seismic and geological interpretation for

the various Etinde fields. The immediate priority for 2021 is to

revisit the IM field interpretation with an aim to using the

improved seismic data quality to enhance the analysis of the field

and hopefully provide new data that mitigates or eliminates the

known uncertainties that exist in the data. This will provide more

accurate reservoir analysis, improve the accuracy of reserve and

resource estimates and help de-risk the subsurface development

plan.

Later in 2021, we intend to use the improved data to re-analyse

the various ID/IE well discoveries. The improved data quality

should enable us to correlate wells more accurately and to identify

and trace the extent of uncertain reservoir horizons (especially in

the IE 3 and IE 4 wells where there are multiple discoveries). The

thin bed study completed in 2020 focused on the ID and IE wells,

has already provided strong evidence that there is higher

hydrocarbon content than previously estimated in certain

horizons.

It is also hoped that further analysis of the higher quality

data will permit water and hydrocarbon bearing reservoirs to be

better identified using the seismic data itself.

Commercial developments

Domestic Gas sales

The Government of Cameroon has stated its preference for a mixed

hydroelectricity/gas power thermal electricity generation system

with roughly 70% of electricity generation supply coming from the

hydrothermal sector. To this end the Government launched an

expression of interest in early 2020 for a contract under which a

third party would build and operate a 350 MW power plant close to

Limbe. Whilst we understand several bids were submitted by the end

of August 2020, there has not been any further public comment.

Encouragingly, SNH informed us in mid-2020 that they and the

Government seek to utilise Etinde gas to supply this facility.

On the previously approved Aksa 150 MW thermal power plant based

at Bekoko, close to the city of Douala, we understand there have

been detailed discussions between Aksa, SNH, ENEO and Victoria Oil

and Gas plc ('VOG'). We understand that an electricity price may

have been agreed and that some commercial discussions have been

undertaken on matters such as gas demand and pipeline tariffs. As

part of the Gas Master Plan for the country, SNH have confirmed

they will build a pipeline between Limbe and Bekoko to transport

gas purchased from Etinde to supply to the Aksa power plant in

Bekoko and other potential customers in the Port of Douala

vicinity. There have been no discussions on gas supply agreements

between us, SNH, Aksa and VOG. We expect these to progress in

2021.

SNH has also indicated that they consider there may be some

further supply opportunities that they are discussing. We believe

these may relate to conversion of existing heavy oil fuelled power

stations to gas and other industrial developments. Whilst supply

logistics infrastructure, pricing and demand considerations are

likely to be significant in assessing whether these projects can be

supplied by Etinde gas at a commercially viable domestic gas price,

we are encouraged by this development. SNH anticipates the Bekoko

and Limbe projects to ultimately require about 70 mmscf/d with each

contract likely to be 20 years in duration.

COVID-19 and its associated delays have hampered progress during

the year, along with the complex and multi-faceted set of

commercial negotiations between different commercial organisations,

various parties in the Government of Cameroon and SNH.

Whilst we anticipate significant further progress in 2021, it is

clear that New Age and Bowleven need to raise external finance to

fund the Etinde development. Factors, which must be agreed before

FID, include the timetable for implementation and development, all

Governmental approvals, agreed commercial terms for gas supply and

certainty over project financing.

In respect of LPG supply, we have had preliminary discussions

with SNH who have set out their key parameters on pricing (in

general terms) and their requirement to be the sole customer for

Etinde LPG, to substitute some existing LPG imports. Whilst we have

pressed for more substantive commercial discussions, these have yet

to happen.

Bowleven and New Age jointly appointed Cofarco to act as lead

advisor in respect of potential debt financing requirements. They

have undertaken some preliminary economic modelling for valuation

purposes and had some 'no name' discussions with several potential

finance sources regarding the general position. One strong theme

was the importance of environmental and social issues as part of

our development, up to and including the need for any development

to be Carbon neutral in the long-term. These discussions were

preliminary in nature and there is an ongoing Operator led work

stream looking to appoint an advisor to support the environmental

development aspect of our field development plan.

Bomono, Onshore Cameroon (100% equity interest)

The Government of Cameroon has formally withdrawn the Bomono

licence. Legally, we may continue to have some potential

liabilities until we have had a formal licence closeout meeting

with SNH. This was expected to occur during 2020 but has not been

scheduled as yet due to COVID-19 and other time constraints.

Updates will be provided as and when appropriate.

Volumetric Update

P50 (C2) net contingent resources to Bowleven on the current 25%

licence interest are 61 mmboe following the Resource reassessment

undertaken by D&M in late 2019. The next resource update is

likely to be undertaken as part of the field development plan

process to formerly re-categorise Etinde IM field Contingent

Resources to Reserves. Following completion of the seismic

reprocessing of the IC and IE areas, later in 2021 or thereafter,

there may be an associated update to the contingent resources of

those fields as well.

FINANCE REVIEW

The Group reports a loss of $0.9 million (H1 2019: loss $1.4

million) for the six months ended 31 December 2020.

The Group's current G&A charge was $1.3 million compared to

$2.3 million for the equivalent period last year. This includes

$0.4 million of G&A costs relating to the Etinde project (H1

2019: $0.5 million) charged by the Operator. This represents a

decrease of $0.9 million on Bowleven controllable G&A

expenditure in the first half of FY2020/21 compared to the

equivalent period last year in line with our strong focus on cost

control.

The reduction in the Etinde Opex cost recharge from the Operator

is principally due to lower corporate activity combined with cost

reductions due to office closures following COVID-19 lockdown

measures in Cameroon and the UK. In addition, Expat staff based in

Cameroon were repatriated throughout the period.

Bowleven is likely to incur slightly higher costs going forward

reflecting both our in-house activity and the Etinde Operators

G&A relating to the pre-FID Etinde development project.

Finance income comprises interest and dividend income of $0.1

million (H1 2019: $0.2 million), foreign exchange gain of $0.2

million (H1 2019: gain $0.2 million) and a mark to market gain of

$0.1 million (H1 2019: gain $0.6 million) arising from the

revaluation of the Group's financial investment.

Capital expenditure cash flows during the 6 month period were

$1.8 million (H1 2019: $0 million) all of which relates to

Bowleven's share of the Etinde geological and FEED related project

expenditure recharged by the Operator.

The main elements of FEED expenditure incurred during the

calendar year 2020 after allowing for the forecast costs to

complete in early 2021 was around $12.5 million in total, which is

less than budgeted and broadly in agreement with the approved

project AFEs. Bowleven's total share of the main FEED elements will

be around $3.1 million in total. Environmental and pipeline route

studies alongside reservoir engineering and geological risk

mitigation studies and development of the field drilling plan

concepts added a further c$4 million of FEED related capital

expenditure during this calendar year.

At 31 December 2020, Bowleven had $6.4 million of cash and cash

equivalents and no debt (H1 2019: $10.9 million and no debt) plus

$nil (H1 2019: $0.5 million) of bank deposits relating to security

for bank guarantees issued in respect of the Bomono licence.

Bowleven continues to own $2.1 million of financial investment in

preference shares (H1 2019: $2.2 million), which generates a

reasonable financial return at relatively low investment risk.

Under the terms of the Etinde farm-out transaction in March

2015, the Group also has access to a further $25 million, which is

receivable on achieving Etinde FID. This is held as a contingent

asset pending further clarity around the sanctioning of the Etinde

project.

OUTLOOK

During the remainder of 2021, the Group expects to continue to

work alongside the other Etinde JV partners, exploring both

commercial opportunities and related development engineering

designs and costs, with a view to having a sufficiently detailed,

costed development plan to reach FID. The level of capital

expenditure is expected to remain at a relatively low level during

2021, although it may well increase later in the year as we

approach FID. Such costs will be associated with the preparation of

legal agreements, the revised field development plan and project

finance documentation.

PRINCIPAL RISKS AND UNCERTAINTIES

The ultimate development of the Etinde wet gas and light oil

discoveries is likely to be technically and commercially dependent

on the extent to which the JV will be able to fully utilise the

volume of gas potentially produced by onshore processing of the

production gas and liquids as this is the most significant

controlling factor, which governs project NPV. The most significant

associated risks are:

-- Raising sufficient debt and equity finance by both Bowleven

and our JV partners, to finance the initial cost of the

development,

-- Sufficiency of gas reinjection and recycling,

-- Domestic market demand for natural gas and the ability to monetise this demand,

-- Commercial terms and government permission to export gas, and

-- Governmental approval of a revised field development plan.

Finalising the Bomono licence hand back may give rise to a

potential charge(s) being levied by SNH.

RESPONSIBILITY STATEMENT

The Directors confirm that to the best of their knowledge, the

interim management report includes a fair review of the important

events during the first six months and description of principal

risks and uncertainties for the remaining six months of the

year.

Eli Chahin

Chief Executive Officer

29 March 2021

GROUP INCOME STATEMENTS

6 months 6 months

ending

31 December ending Year ending

2020

(unaudited) 31 December 30 June

2019

$000 (unaudited) 2020

$000 (audited)

$000

-------------------------------------- ---- ------------- ------------- -------------

Revenue - - -

Administrative expenses (1,284) (2,399) (3,260)

Impairment - - -

-------------------------------------- ---- ------------- ------------- -------------

Operating loss before financing (1,284) (2,399) (3,260)

Finance and other income 350 1,022 635

-------------------------------------------- ------------- ------------- -------------

Loss from operations before taxation (934) (1,377) (2,625)

Taxation - - -

Loss for the period/year from

continuing operations (934) (1,377) (2,625)

-------------------------------------------- ------------- ------------- -------------

Basic and diluted loss per share

($/share) from continuing operations (0.00) (0.00) (0.01)

-------------------------------------------- ------------- ------------- -------------

GROUP STATEMENTS OF COMPREHENSIVE INCOME

6 months 6 months

ended ended Year ended

31 December 31 December 30 June

2020 2019 2020

(unaudited) (unaudited) (audited)

$000 $000 $000

---------------------------------------------- ------------- ------------- -----------

Loss for the year (934) (1,377) (2,625)

---------------------------------------------- ------------- ------------- -----------

Prior year adjustment - IFRS 16 adoption - - (5)

Total comprehensive loss for the period/year (934) (1,377) (2,630)

---------------------------------------------- ------------- ------------- -----------

GROUP BALANCE SHEETS

31 December 31 December 30 June

2020 2019 2020

(unaudited) (unaudited) (audited)

$000 $000 $000

=============================== ============= ============= ===========

Non-current assets

Intangible exploration assets 153,749 150,646 152,104

Property, plant and equipment 58 18 67

------------------------------- ------------- ------------- -----------

153,807 150,664 152,171

Current assets

Financial investments 2,133 2,284 2,010

Inventory 2,577 1,545 2,577

Trade and other receivables 1,165 1,253 1,272

Bank deposits - 500 -

Cash and cash equivalents 6,409 10,927 9,102

------------------------------- ------------- ------------- -----------

12,284 16,509 14,961

Total assets 166,091 167,173 167,132

------------------------------- ------------- ------------- -----------

Current liabilities

Trade and other payables (1,339) (365) (1,478)

Lease liabilities (13) - (34)

------------------------------- ------------- ------------- -----------

Total current liabilities (1,352) (365) (1,512)

Long-term Liabilities

Lease liabilities (2) - (2)

------------------------------- ------------- ------------- -----------

Total liabilities (1,354) (365) (1,514)

------------------------------- ------------- ------------- -----------

Net assets 164,737 166,808 165,618

------------------------------- ------------- ------------- -----------

Equity

Called-up share capital 56,517 56,517 56,517

Share premium 1,599 1,599 1,599

Foreign exchange reserve (69,857) (69,857) (69,857)

Other reserves 2,631 2,706 2,927

Retained earnings 173,847 175,843 174,432

------------------------------- ------------- ------------- -----------

Total equity 164,737 166,808 165,618

------------------------------- ------------- ------------- -----------

GROUP CASH FLOW STATEMENT

6 months 6 months

ended ended Year ended

31 December 31 December 30 June

2020 2019 2020

(unaudited) (unaudited) (audited)

$000 $000 $000

============================================== ============= ============= ===========

Cash Flows from Operating Activities

Loss before tax (934) (1,377) (2,625)

---------------------------------------------- ------------- ------------- -----------

Adjustments to reconcile Company loss before tax to net cash used

in operating activities:

Depreciation of property, plant and

equipment 27 5 50

Non-cash operating costs 20 216 -

Finance (income) (350) (1,015) (635)

Equity-settled share-based payment

transactions 53 62 112

Profit on disposal of financial investments - (7) (7)

Loss on disposal of fixed assets - (3) (3)

---------------------------------------------- ------------- ------------- -----------

Adjusted loss before tax prior to

changes in working capital (1,184) (2,119) (3,108)

Decrease/(increase) in trade and other

receivables 13 (48) 58

Decrease/(increase) in trade and other

payables 224 (105) (23)

Net (Cash used) in operating activities (947) (2,272) (3,073)

Cash flows used in investing activities

Proceeds from sale of Financial investments - 2,500 2,500

Proceeds from the sale of fixed assets - 3 -

Transfer from bank deposits - - 500

Purchase of intangible exploration

assets (1,824) - (1,602)

Purchase of property, plant and equipment - - (11)

Dividends received from financial

investments 110 149 259

Interest received 8 65 87

---------------------------------------------- ------------- ------------- -----------

Net Cash from/(used in) investing

activities (1,706) 2,717 1,733

---------------------------------------------- ------------- ------------- -----------

Cash flows used in/from financing

activities

Proceeds from issue of share capital - - -

Lease payments (40) - (40)

Net cash flows from financing activities (40) - 40

Net (decrease)/increase in cash and

cash equivalents (2,693) 445 (1,380)

---------------------------------------------- ------------- ------------- -----------

Cash and cash equivalents at the beginning

of the period/year 9,102 10,482 10,482

Net (decrease)/increase in cash and

cash equivalents (2,693) 445 (1,380)

---------------------------------------------- ------------- ------------- -----------

Cash and cash equivalents at the period/year

end 6,409 10,927 9,102

---------------------------------------------- ------------- ------------- -----------

GROUP STATEMENT OF CHANGES IN EQUITY

Foreign

Called-up exchange Other Retained Total

share capital Share Premium reserve reserves earnings equity

$000 $000 $000 $000 $000 $000

------------------------------------ --------------- ---------------- ---------- ---------- ---------- ---------

At 30 June 2019 56,517 1,599 (69,857) 2,354 177,510 168,123

Loss for the period - - - - (1,377) (1,377)

Other comprehensive income for - - - - - -

the period

Total comprehensive income for

the period - - - - (1,377) (1,377)

Proceeds from issue of share - - - - - -

capital

Share based payments - - - 62 - 62

Transfer between reserves - - - 290 (290) -

------------------------------------ --------------- ---------------- ---------- ---------- ---------- ---------

At 31 December 2019 56,517 1,599 (69,857) 2,706 175,843 166,808

------------------------------------ --------------- ---------------- ---------- ---------- ---------- ---------

Loss for the period - - - - (1,248) (1,248)

Other comprehensive income for

the period - - - - 8 8

------------------------------------ --------------- ---------------- ---------- ---------- ---------- ---------

Total comprehensive income for

the period - - - - (1,240) (1,240)

Special dividend - - - - - -

Share based payments - - - 50 50

Transfer between reserves - - - 171 (171) -

At 30 June 2020 56,517 1,599 (69,857) 2,927 174,432 165,618

------------------------------------ --------------- ---------------- ---------- ---------- ---------- ---------

Loss for the period - - - - (934) (934)

Other comprehensive income for - - - - - -

the period

------------------------------------ --------------- ---------------- ---------- ---------- ---------- ---------

Total comprehensive income for

the period - - - - (934) (934)

Share based payments - - - 53 53

Transfer between reserves - - - (349) 349 -

------------------------------------ --------------- ---------------- ---------- ---------- ---------- ---------

At 31 December 2020 56,517 1,599 (69,857) 2,631 173,847 164,737

------------------------------------ --------------- ---------------- ---------- ---------- ---------- ---------

NOTES TO THE INTERIM STATEMENTS

For the 6 months ended 31 December 2020

1. Accounting Policies

Basis of Preparation

This Interim Report has been prepared on a basis consistent with

the accounting policies applied to all the periods presented in

these consolidated financial statements.

The disclosed figures are not statutory accounts in terms of

section 435 of the Companies Act 2006. Statutory accounts for the

year ended 30 June 2020, on which the auditors gave an unqualified

opinion and no statements under section 498 (2) or (3), have been

filed with the Registrar of Companies.

2. Going Concern

The financial statements have been prepared on a going concern

basis as the Directors are of the opinion that the Group has

sufficient funds to meet their ongoing working capital and

committed capital expenditure requirements. In making this

assessment, the Directors considered the Group budgets, the cash

flow forecasts and associated risks.

3. Subsequent events

There have been no significant post balance sheet events other

than the appointment of a new Director and Chairman following the

retirement of the former Chairman.

4. Other Notes

a) The basic earnings per ordinary share is calculated on a loss

of $934,000 (H1 2019: loss $1,377,000) on a weighted average of

327,465,652 (H1 2020: 327,465,652) ordinary shares.

b) In respect of the 6 months to 31 December 2020 the diluted

earnings per share is calculated on a loss of $934,000 on

327,465,652 ordinary shares. The loss attributable to ordinary

shareholders and the number of ordinary shares for the purpose of

calculating the diluted earnings per share are identical to those

used for the basic earnings per share.

c) No dividend has been declared (January 2019: special dividend

$63.1 million).

5. Electronic Shareholder Communication

As per the prior year Interim Results and recognising increased

automation in shareholder communications, the Group no longer

produces hard copy Interim Reports. The Annual Report will also be

distributed electronically unless shareholders specifically elect

to receive a hard copy. Copies can be obtained from the Company on

request.

6. Interim Report

This announcement represents the Interim Report and half yearly

results of Bowleven plc. The announcement will be available to

download from the Company website www.bowleven.com .

GLOSSARY

AGM annual general meeting

AIM the market of that name operated by the London

Stock Exchange

Board of Directors the Directors of the Company

boe barrels of oil equivalent

Bomono Permit the production sharing contract between the

Republic of Cameroon and EurOil Limited, dated

12 December 2007, in respect of the area of

approximately 2,328km(2) comprising former

blocks OLHP-1 and OLHP-2 onshore Cameroon;

or, as the context may require, the contract

area to which that production sharing contract

relates

Bowleven Bowleven plc (LSE: BLVN) and/or its subsidiaries

as appropriate

Companies Act 2006 the United Kingdom Companies Act 2006 (as amended)

('the Act')

Company Bowleven plc

Contingent resources those quantities of hydrocarbons that are estimated

to be potentially recoverable from known accumulations,

but which are not currently considered to be

commercially recoverable

D&M DeGolyer and MacNaughton, International Petroleum

consultants

EBT employee benefit trust

Etinde Permit the Etinde Exploitation Authorisation (EA or

EEA). The Etinde EA, granted on 29 July 2014,

covers an area of approximately 461km(2) (formerly

block MLHP-7) and is valid for an initial period

of 20 years. Currently SNH have exercised their

right to back into this licence, but this is

subject to completion

FEED Front end engineering design processes. Basic

Engineering which is conducted after completion

of Conceptual Design or Feasibility Study.

At this stage, before start of EPC (Engineering,

Procurement and Construction), various studies

take place to figure out technical issues and

estimate rough investment cost.

FID final investment decision

FLNG floating liquefied natural gas

G&A general and administration

GIIP Gas initially in place, the volume of gas in

a reservoir before production

Group the Company and its direct and indirect subsidiaries

H1, H2 etc. first half of the financial year, second half

of the financial year etc.

IM, IE, etc Specific locations or areas where Miocene aged

Intra-Isongo reservoirs horizons have been

identified as actual or potential oil and gas

condensate fields

HSSE Health, Safety, Security and Environmental

matters

IFRS International Financial Reporting Standards

km(2) square kilometres

LNG liquefied natural gas

mmboe million barrels of oil equivalent

New Age NewAge (African Global Energy) Limited, a privately

owned oil and gas company

ordinary shares ordinary shares of 10p each in the capital

of the Company

PEA provisional exploitation authorisation

PSC production sharing contract

P50 50% probability that volumes will be equal

to or greater than stated volumes

P90 90% probability that volumes will be equal

to or greater than stated volumes

Q1, Q2 etc. First quarter, second quarter etc.

SNH Société Nationale des Hydrocarbures,

the national oil and gas company of the Republic

of Cameroon

tcf trillion cubic feet

US United States of America

$ or US Dollars United States of America Dollars

GBP or GB Pounds Great Britain Pounds Sterling

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR ZZGZFVLFGMZM

(END) Dow Jones Newswires

March 30, 2021 02:00 ET (06:00 GMT)

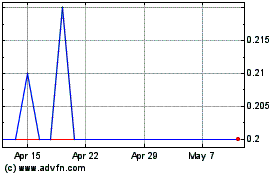

Bowleven (LSE:BLVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bowleven (LSE:BLVN)

Historical Stock Chart

From Apr 2023 to Apr 2024