TIDMBME

RNS Number : 3700D

B&M European Value Retail S.A.

28 October 2020

28 October 2020

B&M European Value Retail S.A.

("B&M" or the "Company")

Notice of Extraordinary General Meeting

("EGM")

B&M has posted to shareholders today a notice of an EGM to

be held to on 03 December 2020 to amend the Company's Articles of

Association, to address changes to the regulatory regime applicable

to the Company following the expiry of the transitional period in

relation to UK's exit from the EU on 31 December 2020 ("Exit-Day").

The Board of B&M recommends that sharehoders vote in favour of

all the resolutions.

A key element of this process is that the current shares in the

Company will be digitalised, which means those shares in paper

certificated form will be dematerialised and the share register

will be replaced by the shares being registered in an account with

a central securities depository. Shareholders rights and

entitlements (including dividend and voting rights) will not be

affected by these changes.

The other changes are to preserve as far as practicable the

legal and regulatory provisions in relation to takeovers and

transparency disclosures which currently apply to the Company, by

including them in our Articles of Association. These provisions

will continue to apply after Exit-Day without any uncertainty

impacting the Company whatever the outcome of the final Brexit

negotiations may be at a UK governmental level.

A summary of each of the changes are set out as follows

below.

Firstly, as a result of changes to the securities settlement

regime applicable to the Company as a consequence of Brexit, and to

ensure that settlements in the trading in B&M's shares continue

to be made in the London market without any disruption after the

Exit-Day, it will be necessary for B&M's shares to be

registered with an EU member state central securities depository

("CSD"). The Board therefore proposes that LuxCSD, the central

securities depository in Luxembourg, be appointed as the relevant

EU member state CSD. This will require shareholders to approve a

resolution to dematerialise B&M's shares so that they can be

held in book entry form in LuxCSD. The necessary arrangements will

be implemented through Euroclear Bank, acting as the account holder

of B&M's shares with LuxCSD. On the approval of the

dematerialisation process the depository interests ("DI")

programme, which is currently in place in relation to B&M's

shares, will be substituted with a CREST depository interests

("CDI") programme in which the shares in B&M will be held

indirectly in dematerialised form, and notice to terminate the DI

programme will be given by the depository to all DI holders. It is

envisaged that the dematerialisation of shares will commence,

following the expiry of the period specified in the notice of

termination, on or about 10 December 2020. Subject to the

resolutions being passed at the EGM, DI holders will not need to

take any further action in relation to this process, and the

Company will be writing to each holder of certificated ordinary

shares with the form which they will then need to complete with

their broker.

Secondly, the current shared jurisdiction of the UK Panel on

Takeovers and Mergers (the "UK Takeover Panel") and the Commission

de Surveillance du Secteur Financier (the "CSSF") in Luxembourg in

relation to any takeover offer for the Company will cease to apply

to the Company after the Exit-Day. The Board therefore proposes

that the Articles of Association of the Company be amended to

include provisions requiring shareholders and the Company to adhere

to the City Code on Takeovers and Mergers as far as practicable in

relation to any bid for the Company after the Exit-Day. In relation

to mandatory takeover offer, squeeze-out and sell-out thresholds

they are proposed to remain the same as those which have applied to

the Company since the IPO.

Thirdly, the Luxembourg law of 11 January 2008 (the "Luxembourg

Transparency Law") which implemented the EU Transparency Directive

2004/109/EC will also cease to apply to the Company following the

Exit-Day. The Board therefore proposes that the Articles of

Association of the Company be amended to include so far as

practicable similar obligations on shareholders who acquire or

dispose of voting rights in B&M to those under the Luxembourg

Transparency Law in relation to the disclosures of relevant

interests as if such law continued to apply. The actual percentage

thresholds requiring disclosure are proposed to remain the same as

those which have applied to the Company since the IPO under the

Luxembourg Transparency Law.

B&M has therefore posted to shareholders today a Notice of

EGM. The purpose of the EGM is to propose the necessary resolutions

for shareholders to approve a decision to dematerialise the shares

in the Company, to make changes to the Articles of Association of

the Company to implement the dematerialisation process, and to

adopt the takeover, squeeze-out, sell-out and transparency

provisions (each as referred to above and in the Appendix 1 to this

announcement below, and set out in more detail in the Notice of

EGM).

A copy of the Notice of EGM will shortly be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism . A copy of

the Notice of EGM along with a copy of the Articles of Association

of the Company which has been marked-up to show the proposed

amendments, are available on the Company's website at

www.bandmretail.com/investors/egm.aspx A summary form of the Notice

of EGM is also set out in Appendix 1 to this announcement.

As many shareholders will not be able to attend the EGM and also

in view of the Covid-19 impacts on travel, we encourage

shareholders to cast their votes by proxy as soon as possible. The

quorum for the EGM requires that at least 50% of the issued share

capital of the Company is represented in person or by proxy. We

therefore strongly encourage all our shareholders to vote. The EGM

will be held at 9, Allée Scheffer, L-2520 Luxembourg on Thursday 03

December 2020, commencing at 12:00 noon (CET).

Enquiries

B&M European Value Retail S.A.

For further information please contact +44 (0) 151 728 5400

Simon Arora, Chief Executive

Paul McDonald, Chief Financial Officer

investor.relations@bandmretail.com

Media

For media please contact +44 (0) 207 379 5151

Maitland

Jonathan Cook

bmstores-maitland@maitland.co.uk

APPIX 1

B&M European Value Retail S.A.

Société Anonyme

Registered office: 9, Allée Scheffer, L-2520 Luxembourg

Grand-Duchy of Luxembourg

R.C.S. Luxembourg: B 187275

Notice of the Extraordinary General Meeting of B&M European

Value Retail S.A. to be held at 12:00 noon (CET) on Thursday 03

December 2020 at 9, Allée Scheffer, L-2520 Luxembourg before a

Luxembourg notary.

AGA

Extraordinary resolutions

1. To approve the amendments set out below to the Articles of

Association of the Company, with immediate effect and without

amending the corporate object of the Company:

(i) By amending article 5.1 (Issued share capital) to no longer

permit fractional shares in the share capital of the Company by

deleting the words " Shares may be divided in fractions, an

appropriate number thereof conferring the same rights as a share. "

at the end of the first paragraph of that article and inserting in

place of them the words " Shares may not be divided in

fractions."

(ii) By amending articles 5.2(2) and 9 to read as follows to

reflect that there will no longer be fractional shares in the share

capital of the Company:

" (2) in connection with such arrangements as the Board of

Directors considers necessary or appropriate, in the context of

otherwise pre-emptive issues of shares, to deal with treasury

shares, fractional entitlements, record dates and legal, regulatory

or practical problems in, or under the laws of, any territory or

any other matter. In the case of fractional entitlements, the Board

of Directors shall round these up or down to the nearest whole

number of shares as it sees fit in its absolute discretion; or"

"9. Several owners.

9.1 If there are several owners of a share, the Company is

entitled to suspend the exercise of the rights attaching thereto

until one person is designated as being the owner, vis-à-vis the

Company, of the share. If there are several owners of a share, and

unless otherwise notified to the Company by those holders, the

person whose name first stands in the share register or who is

recorded in the relevant book-entry in case of dematerialised

shares shall be considered as being the designated owner for these

purposes towards the Company.

9.2 If, as the result of consolidation and division or

sub-division of shares, holders of shares would become entitled to

fractions of a share, the shareholders' meeting of the Company may

decide on how such fractions shall be dealt with including by way

of rounding up or down the holding."

(iii) By replacing article 6 with the following amended version

in order to provide for the possibility of the Company issuing

dematerialised shares, as well as the voluntary and compulsory

dematerialisation of the existing shares in the share capital of

the Company:

"6. Form of the shares, Dematerialisation and Transfer of

shares.

6.1 Form of the Shares

6.1.1 Until the Voluntary Effective Date (as defined in article

6.4 below), all new shares shall be issued in registered form.

Registered shares may not be converted into bearer shares.

6.1.2 Upon the Voluntary Effective Date (inclusive), all new

shares shall be issued in dematerialised form in accordance with

article 430-7 of the 1915 Law and the Luxembourg law on

dematerialised securities of 6 April 2013 (the "2013 Law").

6.2 Registered shares - Share register

6.2.1 This article 6.2 shall apply to the extent that the shares

are in registered form.

6.2.2 A register of the registered shares shall be maintained at

the registered office of the Company and every shareholder may

examine it. The register shall specify:

(a) the precise designation of each shareholder and the number

of shares held by him;

(b) the payments made on the shares; and

(c) transfers and the dates thereof or the date of conversion of

the registered shares into dematerialised form.

Subject to the provisions of article 6.6, ownership of

registered shares shall be established by an entry in the share

register.

6.2.3 Share certificates and replacement share certificates

6.2.3.1 Shares may be provided at the owner's request and at the

owner's option, in certificates representing single shares or in

certificates representing two or more shares.

6.2.3.2 Replacement share certificates may be issued in the

following circumstances:

(a) Where a holder holds two or more certificates for shares,

the Board of Directors may at his request, on surrender of the

original certificates and without charge, cancel the certificates

and issue a single replacement certificate.

(b) At the request of a holder of shares, the Board of Directors

may cancel a certificate and issue two or more in its place

(representing shares in such proportions as the holder may

specify), on surrender of the original certificate and on payment

of such reasonable sum as the Board of Directors may decide.

(c) Where a certificate is worn out or defaced the Board of

Directors may require the certificate to be delivered to it before

issuing a replacement and cancelling the original.

(d) If a certificate is lost or destroyed, the Board of

Directors may cancel it and issue a replacement certificate on such

terms as to provision of evidence and indemnity and to payment of

any exceptional out of pocket expenses incurred by the Company in

the investigation of that evidence and the preparation of that

indemnity as the Board of Directors may decide.

6.3 Dematerialised shares

6.3.1 All the shares in the Company shall be dematerialised, in

accordance with the provisions of this article 6.

6.3.2 All dematerialised shares are registered in a single

issuance account opened with the following clearing institution:

LuxCSD, with its registered address at 42, Avenue J.F. Kennedy,

L-1855 Luxembourg.

6.3.3 The dematerialised shares are not in registered or bearer

form and are only represented, and the property rights of the

Shareholder on the dematerialised shares are only established, by

book-entry with the clearing institution in Luxembourg.

6.3.4 For the purpose of identifying the Shareholder, the

Company may, at its own cost, request from the clearing

institution, the name or corporate name, the nationality, date of

birth or date of incorporation and the address of the holders in

its books which immediately confers or may confer in the future

voting rights at the Company's shareholders' meeting, as well as

the number of shares held by each of them and, if applicable, the

restrictions the shares may have. The clearing institution provides

to the Company the identification data it holds on the holders of

securities accounts in its books and the number of shares held by

each of them.

The same information concerning the holders of shares on own

account are gathered by the Company through the securities

depositary or other persons, which directly or indirectly keep a

securities account with the clearing institution at the credit of

which appear the relevant shares.

The Company as issuer may request confirmation from the persons

appearing on the lists so provided that they hold the shares for

their own account.

When a person has not provided the information requested by the

Company in accordance with this article 6.3.4 within two (2) months

following the request or if it has provided incomplete or erroneous

information in respect of its quality, or the quality of the shares

it holds, the Company may, until such time that the information has

been provided, suspend the voting rights of such holder of shares

pro rata to the proportion of shares for which the requested

information has not been obtained.

6.3.5 The Company shall make all dividend and other payments

with respect to the dematerialised shares, whether in cash, shares

or other assets, to LuxCSD or in accordance with the instructions

of LuxCSD, and such payment shall release the Company from any

further obligations with respect to such dividend or other

payment.

6.4 Voluntary dematerialisation

As from (i) the next calendar day immediately following the date

of the expiry of any notice of termination given to any person by

or on behalf of any professional depository of securities (or its

nominee or agent) in relation to any depository interest program

that has been established at any time with respect to the Company

(a "DI Program") or (ii) such later date as may otherwise be

determined by the Board, the holders of any shares in the Company

(including without limitation any professional depository of

securities (or its nominee or agent) being the holder of any shares

in the Company relating to such a DI Program) may proceed with the

voluntary dematerialisation of their shares (the "Voluntary

Effective Date").

6.5 Compulsory dematerialisation

6.5.1 Either of the general shareholders' meeting or the Board

is authorised to (i) proceed with a compulsory dematerialisation of

the shares of the Company in accordance with this article 6.5 and

the 2013 Law as of the Compulsory Commencement Date (as defined in

article 6.5.2 below) and (ii) following the compulsory

dematerialisation of all shares and, to the extent applicable, the

transfer of shares by the Company in accordance with article 6.5.6,

amend the articles of association in order to remove those

provisions relating to the shares being in registered form

(including, but not limited to, articles 5.1, 6.1.1, 6.2, 6.6(i),

second paragraph of 6.6, 6.7.1.1, 9.1 and 24.3.5) and reference to

the Voluntary Effective Date in article 6.1.2.

6.5.2 The compulsory dematerialisation of the existing shares

will be effective three (3) months after the date of publication of

the decision of the extraordinary general shareholders' meeting

approving the compulsory dematerialisation and these Articles in

the Recueil électronique des sociétés et associations (the "RESA")

(the "Compulsory Commencement Date").

6.5.3 As from the Compulsory Commencement Date, shares held via

book entry through any securities settlement system may no longer

be directly registered in the register of shareholders of the

Company and all such shares will be dematerialised and registered

in the issuance account kept at LuxCSD.

6.5.4 Holders directly recorded in the register of shareholders

shall provide the Company with the required data allowing their

shares to be credited to their securities account, no later than

the date which is two (2) years after the Compulsory Commencement

Date (the "Compulsory Conversion Date"). Upon each such conversion,

the register of shareholders shall be updated.

6.5.5 Voting rights attached to shares which have not been

dematerialised by the Compulsory Conversion Date shall thereafter

be automatically suspended until their dematerialisation. Any

distributions on such shares after the Compulsory Conversion Date

shall be held in escrow by the Company and, subject to

prescription, shall be paid (without interest) after such

dematerialisation has occurred. Such shares for which the voting

rights have been suspended in accordance with this article 6.5.5

shall not be taken into account for the calculation of the quorum

and of the majorities during the general meetings of shareholders.

The holders of such shares in relation to which the voting rights

are suspended shall not be admitted to such general meetings.

6.5.6 Shares which have not been converted into dematerialised

form within two (2) years as from the Compulsory Commencement Date

may be converted by the Company into dematerialised shares and

recorded by the Company in a securities account under its name.

Shares converted in this manner shall be recorded in the name of

the Company until the holder comes forward and has such shares

recorded in its name. The costs for opening and holding the account

shall be incurred by the Company. Article 6.5.5 and the two

preceding sentences of this article shall continue to apply until

the day when the shares are recorded in an account in the name of

the holder. The record of the shares in the securities account in

the name of the Company made pursuant to this article 6.5.6 does

not make the Company the holder of rights in relation to these

shares.

6.5.7 To the extent that any shares of holders directly

registered in the register of shareholders have not been

dematerialised within eight (8) years as from the Compulsory

Commencement Date, they may be sold by the Company with at least

three (3) months prior notice published in the same way as the

convening notices for the shareholders' meeting.

6.6 Indirect holdings of shares

Where shares are either (i) recorded in the register of

shareholders on behalf of one or more persons or (ii) held in

dematerialised form on behalf of one or more persons (the "Indirect

Holders") in the name of a securities settlement system or the

operator of such a system or in the name of a professional

depository of securities or any other depository (such systems,

professionals or other depositories being referred to hereinafter

as "Depositories" and each a "Depository") or of a sub-depository

designated by one or more Depositories, the Company will permit the

Indirect Holders to exercise the rights attaching to those shares,

including admission to and voting at or in relation to

shareholders' meetings in accordance with any rules or arrangements

established from time to time by or in relation to any central

securities depository or otherwise in accordance with any

procedures which may otherwise be established by the Company

(subject always to producing such evidence of their identity and

interests in any such securities to the satisfaction of the

Company), and shall consider those persons to be the shareholders

for the purposes of article 8. The Board of Directors may determine

the formal requirements with

which such certificates must comply.

Notwithstanding the foregoing, in the case of registered shares,

the Company will make payments, by way of dividends or otherwise,

in cash, shares or other assets only into the hands of the

Depository or sub-depository recorded in the share register of the

Company or in accordance with their instructions, and that payment

shall release the Company from any and all obligations for such

payment.

6.7 Transfer of shares

6.7.1 General

The shares of the Company are free from restrictions on transfer

subject to the provisions below.

6.7.1.1 To the extent that the shares are in registered form

prior to the Voluntary Effective Date, transfers shall be carried

out by means of a declaration of transfer entered in the share

register of the Company, dated and signed by the transferor and the

transferee or by their duly authorised representatives, and in

accordance with the rules on the assignment of claims laid down in

article 1690 of the Civil Code. The Company may accept and enter in

the register a transfer on the basis of correspondence or other

documents recording the agreement between the transferor and the

transferee.

The above is without prejudice to the transfers by Indirect

Holders, in the case provided for in article 6.6, in accordance

with the applicable rules and procedures applicable to such

transfers.

6.7.1.2 All dematerialised shares are freely transferable.

Transfers of dematerialised shares are realised by

account-to-account transfers.

6.7.2 On death

Transmission, in the case of death, shall be validly established

vis-à-vis the Company, provided that no objection is lodged, on

production of a death certificate, the certificate of registration

and an affidavit (acte de notoriété) attested by a juge de paix or

a notary.

The Company shall recognise only the personal representative or

representatives of a deceased holder as having title to a share

held by that holder alone or to which he alone was entitled. In the

case of a share held jointly by more than one person, the Company

may recognise only the survivor or survivors as being entitled to

it.

Nothing in the Articles releases the estate of a deceased holder

from liability in respect of a share which has been solely or

jointly held by him."

(iv) By amending article 24.3.4 to read as follows in light of

the intended dematerialisation of the shares:

"24.3.4 The Convening Notice is sent within the thirty (30) day,

or seventeen (17) day period, as applicable, referred to in Article

24.3.1, to the shareholders, the members of the Board of Directors

and the approved independent auditors (réviseurs d'entreprises

agréés) (the "Addressees"). This communication shall be sent by

letter to the Addressees, unless the Addressees (or any one of

them) have expressly and in writing agreed to receive communication

by other means, in which case such Addressee(s) may receive the

convening notice by such other means of communication."

(v) By amending articles 24.3.5 and 24.6.10 to read as follows

in light of the intended dematerialisation of the shares:

"24.3.5 Until the Voluntary Effective Date and to the extent

that all the shares are in registered form and represent the entire

share capital, the Convening Notice needs to be sent only by

registered letters to the Addressees, unless the Addressees (or any

one of them) have expressly and in writing agreed to receive

communication by other means, in which case such Addressee(s) may

receive the convening notice by such other means of

communication."

"24.6.10 The rights of a shareholder to sell or otherwise

transfer his shares during the period between the Record Date (as

defined in Article 24.6.11) and the shareholders' meeting to which

it applies are not subject to any restriction to which they are not

subject to at other times."

(vi) By removing article 24.6.11 and renumbering the subsequent

articles accordingly.

(vii) By amending the last paragraph of article 28.2 to read as

follows in light of the intended dematerialisation of the

shares:

"In addition to any applicable laws relating to the public

disclosure of annual accounts, the annual accounts, as well as the

report of the statutory auditors or of the independent auditors

réviseur(s) d'entreprises agréé(s), the annual report and the

observations of the Board of Directors shall be made available to

the shareholders at the same time as the convening notice. Every

shareholder shall be entitled to obtain free of charge, upon

production of his title, fifteen (15) days before the meeting, a

copy of the documents referred to in the foregoing paragraph."

2. To approve:

(i) that all new shares issued in the share capital of the

Company shall be in dematerialised form as from the Voluntary

Effective Date (as defined in article 6 as amended by the

resolution 1 (the " Amended Article 6 ") );

(ii) that the holder of any shares in the Company, including

without limitation any professional depository of securities (or

its nominee or agent) being the holder of any shares in the Company

relating to such a DI Program (as defined in the Amended Article 6

), may proceed with the voluntary dematerialisation of their shares

as of the Voluntary Effective Date (as defined in the Amended

Article 6); and

(iii) the compulsory dematerialisation of any shares in the

Company as from the Compulsory Commencement Date and no later than

the Compulsory Conversion Date (as such terms are defined in the

Amended Article 6) pursuant to the terms for such compulsory

dematerialisation set forth in the Amended Article 6.

3. To approve the following amendments to article 8 (Rights and

Obligations of shareholders) of the Articles of Association of the

Company as set out below with immediate effect:

(i) by deleting the first sentence of Article 8.1.1 and

inserting in place of it the following sentence:

" For so long as the shares (or transferable securities carrying

voting rights) of the Company are admitted to trading on either (i)

a regulated market as defined in the markets in financial

instruments law dated 30 May 2018, as amended, and/ or (ii) the

main market for listed securities of the London Stock Exchange plc,

the Company will comply with the provisions of the law of 11

January 2008, as amended (the "Transparency Law") to the fullest

extent possible as if the Company met the criteria set forth in

article 2 (Scope) of the Transparency Law."

(ii) by deleting the last sentence of Article 8.1.1 and

inserting in place of it the following sentence:

"Any notification to the Company of Important Participations

Thresholds shall be made as soon as possible on a basis consistent

with the disclosure requirements and within the time limits of the

Transparency Law, mutatis mutandis."

(iii) by deleting in Article 8.1.3 the words "in accordance with

the requirements of the Transparency Law." and inserting in place

of them the words "on a basis consistent with the requirements of

the Transparency Law, mutatis mutandis."

(iv) by deleting in Article 8.1.6 the words "In addition to the

reporting requirements imposed by the Transparency Law," and

inserting in place of them the words "In addition to the reporting

requirements imposed by the foregoing paragraphs of this Article

8,"

4. To approve amending the articles of association of the

Company by including a new Chapter X (Takeover provisions,

squeeze-out and sell-out) as set out below with immediate

effect:

"Chapter X - Takeover provisions, squeeze-out and sell-out

35.1 Definitions

For the purposes of this article 35.1 and articles 35.2 to 35.12

(inclusive) of these Articles:

"acting in concert" shall have the meaning given to that term in

the City Code;

"City Code" means The City Code on Takeovers and Mergers and as

amended or replaced from time to time (which for the avoidance of

any doubt includes the introduction, the General Principles, the

definitions, the rules and the related notes and appendices which

are all contained in the City Code) issued by or on behalf of the

Panel, as supplemented by guidance published by the Panel from time

to time, save that for the purposes of articles 35.1 to 35.10

(inclusive):

(i) references to thirty per cent (30%) in the City Code

(including in the definition of "control" therein) shall be read

and construed to mean thirty-three and one-third per cent (33 1/3%)

and, unless the context requires otherwise, references to "control"

in the City Code shall be read and construed accordingly mutatis

mutandis;

(ii) references to "voting rights" in the City Code shall be

interpreted in a manner consistent with the Luxembourg Takeover Law

as if the Luxembourg Takeover Law applied to the Company; and

(iii) disclosure forms for the purposes of compliance with Rule

8 of the City Code in so far as they relate to the Company shall be

such forms as are approved for such purpose by the Board of

Directors;

"City Code Transaction" means a transaction falling within the

scope of paragraph 3(b) (Transactions) of the introduction section

of the City Code in respect of which (had the Company been subject

to the full jurisdiction of the City Code, subject always to the

provisions of these Articles) the Company would be an offeree;

"Depository" shall have the meaning given to that term as

defined in article 6.6 of these Articles;

"Effective Time" shall have the meaning given to "exit day" in

section 20 of the European Union (Withdrawal) Act 2018 of the

United Kingdom, and as amended, replaced or substituted from time

to time;

"General Principles" means the General Principles set out in the

City Code (and as the same may be amended or replaced from time to

time);

"interest in Shares" or similar expressions shall have the

meaning given to "interest in securities" in the City Code and, for

purposes of articles 35.1 to 35.10 (inclusive), shall include where

a person has received an irrevocable commitment in respect of the

relevant Shares to accept or not to accept (or to vote or not to

vote in favour of) an offer for the Company;

"Luxembourg Takeover Law" means Law of 19 May 2006 transposing

Directive 2004/25/EC of the European Parliament and of the Council

of 21 April 2004 on takeover bids, as amended;

"Panel" means the Panel on Takeovers and Mergers in the United

Kingdom (and any immediate or remoter successor to that body from

time to time);

"Permitted Acquisition" means an acquisition of an interest in

Shares where any of the following apply:

(i) the Board of Directors consents to the acquisition (even if,

in the absence of such consent, the acquisition of such interest

would be a Prohibited Acquisition);

(ii) the acquisition arises from repayment of a stock-borrowing

arrangement (on arm's length normal commercial terms);

(iii) the acquisition is made in circumstances in which, had the

Company been subject to the full jurisdiction of the City Code

(subject always to the provisions of these Articles), the City Code

would have required an offer to be made as a consequence and such

offer is made in accordance with Rule 9 of the City Code (subject

always to the provisions of these Articles), as if it had so

applied; or

(iv) a person breaches a Limit (as such term is defined in

article 35.6(b) of these Articles) only as a result of the

circumstances referred to in article 35.10 of these Articles;

"Practice Statements" means the practice statements issued by

the Executive body of the Panel from time to time;

"Prohibited Acquisition" means an acquisition, other than a

Permitted Acquisition, where Rules 4, 5, 6, 7.1, 8 or 11 of the

City Code would in whole or part have applied to it if the Company

were subject to the full jurisdiction of the City Code (subject

always to the provisions of these Articles) and the acquisition was

made (or, if not yet made, would if and when made be) in breach of

or otherwise would not comply with Rules 4, 5, 6, 7.1, 8 or 11 of

the City Code (subject always to the provisions of these

Articles);

"Shares" means transferable shares carrying voting rights in the

Company including depository receipts in respect of any shares in

the Company carrying the possibility to give voting instructions;

and

"voting rights" shall be interpreted in a manner consistent with

the Luxembourg Takeover Law as if the Luxembourg Takeover Law

applied to the Company.

Reference to a "person" in this article 35.1 and any of the

provisions of articles 35.2 to 35.12 (inclusive) shall mean any

natural or legal person, partnership, corporate or unincorporated

body whatsoever which existing in any jurisdiction in the world,

and any such person's personal representatives, successors or

assigns.

35.2 Applicability of the City Code

On and from the Effective Time and for so long as, and to the

extent that, the Company shall not be subject to the jurisdiction

of either the City Code or the Luxembourg Takeover Law or a

combination thereof, the provisions of articles 35.2 to 35.10 shall

apply subject to the 1915 Law or any other applicable law. In

managing and conducting the business of the Company and in

exercising or refraining from exercising any and all powers, rights

and privileges from time to time vested in it, the Board of

Directors shall use its reasonable endeavours:

(a) to apply and to have the Company abide by the General

Principles mutatis mutandis as though the Company were subject to

the full jurisdiction of the City Code subject always to the

provisions of these Articles;

(b) in respect of any City Code Transaction (including where the

Company is the subject of an approach or the subject of a third

party's statement of possible or firm intention to make an offer),

to comply with and to procure that the Company complies with the

provisions of the City Code applicable to an offeree company and

the board of directors of an offeree company mutatis mutandis as

though the Company were subject to the full jurisdiction of the

City Code subject always to the provisions of these Articles;

and

(c) in the event that (and in any case for so long as) the Board

of Directors intends to recommend to the shareholders of the

Company or any class thereof any City Code Transaction from time to

time, to obtain the undertaking of the offeror(s) to comply with

the provisions of the City Code in the conduct and execution of the

relevant offer(s) mutatis mutandis as though the Company were

subject to the full jurisdiction of the City Code subject always to

the provisions of these Articles,

but recognising that the Panel would not have jurisdiction (if

and for so long as such may be the case) and provided that nothing

in these Articles shall prohibit any third party from making a

takeover offer for any Shares which is or may not be recommended by

the Board of Directors to shareholders of the Company.

35.3 The Board of Directors has full authority to determine the

application of any of the provisions of articles 35.1 to 35.10

(inclusive) of the Articles, including as to the deemed application

of the whole or any part of the City Code. Such authority shall

include all discretion vested in the Panel as if the whole or any

part of the City Code applied including, without limitation, the

determination of conditions and consents, the consideration to be

offered and any restrictions on the exercise of control. Any

resolution or determination of, or decision or exercise of any

discretion or power by, the Board of Directors or any Director or

by the chairman of any meeting acting in good faith (and having

received advice from an appropriate professional adviser

experienced in such matters) under or pursuant to any of the

provisions of articles 35.1 to 35.10 (inclusive) of the Articles

shall be final and conclusive; and anything done by, or on behalf

of, or on the authority of, the Board of Directors or any Director

acting in good faith (and having received advice from an

appropriate professional adviser experienced in such matters)

pursuant to any of the provisions of articles 35.1 to 35.10

(inclusive) of the Articles shall be conclusive, and in each case

(to the extent capable of being so in accordance with applicable

law and regulation) binding on all persons concerned and shall not

be open to challenge, whether as to its validity or otherwise on

any ground whatsoever, and, in the absence of fraud, neither the

Board of Directors nor any Director nor any person acting on their

behalf shall owe any duty of care to or have any liability to any

shareholder or person in respect of any cost, loss or expense

suffered directly or indirectly as a result of any such resolution

or determination, decision or exercise of discretion or power;

provided always that, for these purposes, any Director who is (or

may be) an offeror or who is (or is deemed or determined to be)

acting in concert with any person who is (or may be) an offeror or

who is otherwise deemed or determined by the Board of Directors to

be conflicted for such purposes shall not participate in or take

any decision or action relating to any of the foregoing

resolutions, determinations, decisions or actions and references to

the Board of Directors or to a Director in these articles 35.1 to

35.10 (inclusive) shall be read and construed accordingly. The

Board of Directors shall not be required to give any reasons for

any decision, determination or declaration taken or made in

accordance with any of the provisions of articles 35.1 to 35.10

(inclusive) of the Articles. Any notice which is required to be

given to the Panel under the City Code shall be given to the

Company at its registered office or as the Board of Directors

otherwise determines.

35.4 In applying articles 35.1 to 35.10 (inclusive), the Board

of Directors shall be entitled, without the consent of any

shareholder or offeror or potential offeror, to make all such

announcements as would be required or permitted under the City Code

(as if the full jurisdiction of the City Code applied to the

Company subject always to the provisions of these Articles)

notwithstanding that such announcement may make reference to, or

contain information about, shareholders, offerors, potential

offerors or persons acting (or deemed or determined by the Board of

Directors to be acting) in concert with them.

35.5 Shareholders and persons interested in or proposing to be

interested in any Shares of the Company shall comply with the

requirements of the City Code (as if the full jurisdiction of the

City Code applied to the Company, subject always to the provisions

of these Articles) in relation to any holdings or dealings in any

Shares or interests in Shares and in relation to their dealings

with the Company, including but not limited to compliance with the

disclosure obligations under Rule 8 (Disclosure of dealings and

positions) of the City Code during an offer period (as such term is

defined in the City Code) and the requirements of Rule 9 (The

mandatory offer and its terms) of the City Code.

35.6 A person must not (other than solely as a Depositary,

custodian or nominee of a Depository or custodian):

(a) effect or purport to effect a Prohibited Acquisition; or

(b) except as a result of a Permitted Acquisition:

(i) whether by themselves, or with persons determined by the

Board of Directors to be acting in concert with such person,

acquire after the Effective Time an interest in Shares which, taken

together with any interest in Shares held or acquired on or prior

to the Effective Time by persons determined by the Board of

Directors to be acting in concert with such person, carry

thirty-three and one-third per cent (33 1/3%) or more of the total

voting rights of the Company; or

(ii) whilst such person, together with persons determined by the

Board of Directors to be acting in concert with such person, holds

not less than thirty-three and one-third per cent (33 1/3%) but not

more than fifty per cent (50%) of the total voting rights of the

Company, acquires after the Effective Time, whether by themselves

or with persons determined by the Board of Directors to be acting

in concert with such person, additional interest in Shares which,

taken together with any interest in Shares held by persons

determined by the Board of Directors to be acting in concert with

such person, increases the percentage of their voting rights out of

the total voting rights of the Company,

(each of (i) and (ii) for the purpose of this article 35.6 being

a "Limit").

35.7 Where any person breaches any Limit, except as a result of

a Permitted Acquisition, or becomes interested in any Shares of the

Company as a result of a Prohibited Acquisition, that person is in

breach of these Articles, and no nominee of such person or persons

determined by the Board of Directors to be acting in concert with

such person may be appointed as a Director of the Company.

35.8 The Board of Directors may do all or any of the following

where it has reason to believe that any Limit is or may be breached

or any Prohibited Acquisition has been or may be effected:

(a) require, so far as it is reasonably able to do so, any

shareholder or person appearing or purporting to be interested in

any Shares of the Company to provide such information as the Board

of Directors considers appropriate to determine any of the matters

under any of the provisions of articles 35.1 to 35.10 (inclusive)

of the Articles;

(b) have regard to such public filings as it considers

appropriate to determine any of the matters under any of the

provisions of article 35.1 to 35.10 (inclusive) of the

Articles;

(c) make such determinations under any of the provisions of

article 35.1 to 35.10 (inclusive) of the Articles as it thinks fit,

either after calling for submissions from affected shareholders or

persons interested in any Shares of the Company or other persons or

without calling for such submissions;

(d) determine that the voting rights attached to such number of

Shares held by such persons as the Board of Directors may determine

are held, or in which such persons are or may be interested, in

breach of these Articles (for the purposes of this article 35.8

"Excess Shares") are from a particular time incapable of being

exercised for a definite or indefinite period;

(e) refuse to register such person or its nominee or custodian

or any person acting (or is deemed or determined by the Board of

Directors to be acting) in concert with such person as the holder

of the Excess Shares on the register of shareholders of the

Company;

(f) determine that some or all of the Excess Shares must be

sold; and

(g) take such other action as it thinks fit for the purposes of

any of the provisions of articles 35.1 to 35.10 (inclusive) of the

Articles including but not limited to:

(i) prescribing rules (not inconsistent with this article

35.8);

(ii) setting deadlines for the provision of information;

(iii) drawing adverse inferences where information requested is

not provided;

(iv) making determinations or interim determinations;

(v) executing documents on behalf of a shareholder or persons

interested in any Shares of the Company in relation to any Excess

Shares, including without limitation in relation to the sale and/or

transfer to any persons of any Excess Shares;

(vi) paying costs and expenses out of any proceeds of sale of

any Excess Shares; and

(vii) changing any decision or determination or rule previously

made.

35.9 Any one or more of the Directors may act as the attorney(s)

of any shareholder or persons interested in any Shares of the

Company in relation to the execution of documents and other actions

to be taken for the sale of Excess Shares determined by the Board

of Directors under any of the provisions of articles 35.1 to 35.10

(inclusive) of the Articles.

35.10 If as a consequence of the Company redeeming or purchasing

its own Shares, there is a resulting increase in the percentage of

the total voting rights attributable to the Shares in respect of

which a person or persons deemed or determined by the Board of

Directors to be acting in concert have an interest in and such an

increase would constitute a breach of any Limit, such an increase

shall be deemed a Permitted Acquisition.

35.11 From such time as the Law of 19 May 2006 transposing

Directive 2004/25/EC of the European Parliament and of the Council

of 21 April 2004 on takeover bids (as amended) ceases to apply to

the Company, the provisions of this article 35.11 and article 35.12

(and each of the sub-provision thereof) of the Articles shall be

effective and apply at all times thereafter.

35.12 Following a Takeover Offer being made on or at any time

after the date on which this article shall come into effect the

following provisions of this article shall then apply:

35.12.1 the offeror in relation to the Takeover Offer shall be

able to require the holders of (including persons with any interest

in) all the remaining Shares in the Company to which such offer

relates to sell to the offeror those Shares at a fair price per

Share (as defined in article 35.12.5 below) where the offeror holds

alone or together with persons acting in concert with the offeror

(which shall include by virtue of acceptances of the Takeover

Offer, having acquired or unconditionally contracted to acquire)

Shares representing not less than ninety-five per cent (95%) of the

capital carrying voting rights and not less than ninety-five per

cent (95%) of the voting rights in the Company (that right being

referred to in this article 35.12 as the "right of

squeeze-out");

35.12.2 where the Company has issued more than one class of

Shares, the right of squeeze-out can be exercised only in relation

to the class of Shares in which the threshold laid down in article

35.12.1 above has been reached;

35.12.3 if the offeror wishes to exercise the right of

squeeze-out under article 35.12.1 above, it shall do so by giving

notice in writing to any holder(s) of the Shares within three (3)

months of the end of the time allowed for acceptance of the offer

to which it relates under article 35.12.1 above.

35.12.4 the offeror's entitlement to give a notice exercising

its right of squeeze-out under the provisions of article 35.12.1

and 35.12.3 on any particular date shall be determined as if any

Shares allotted or ceasing to be held by the Company as treasury

shares had not been allotted or ceased to be held by the Company as

treasury shares at any time;

35.12.5 the "fair price per Share" shall be the same value per

Share as under the terms of the Takeover Offer. It shall take the

form of the consideration under the terms of the Takeover Offer and

cash shall be offered at least as an alternative;

35.12.6 any notice given to any holder(s) of Shares under

article 35.12.3 shall bind the offeror to acquire and the relevant

holder(s) to sell the Shares to it at the fair price per Share. The

consideration shall be deposited with the Company in trust for the

relevant holder(s) within six (6) weeks of the date of the notice

having been given and the Company will be bound to release the

consideration to the relevant holder(s) on the transfer of their

Shares to the offeror having been executed by the relevant

holder(s);

35.12.7 where an offeror, as a result of a Takeover Offer, holds

alone or together with persons acting in concert with the offeror,

Shares carrying more than ninety per cent (90%) of the voting

rights in the Company, any remaining holder of (including persons

with any interest in) Shares in the Company may require such

offeror to buy their Shares at a fair price per share (as defined

in article 35.12.5 above) payable in the form of the consideration

in the Takeover Offer but with the option for seller to require

that such price be settled in cash (that right being referred to in

this article 35.12.7 as the "right of sell-out"). The provisions of

articles 35.12.2 to 35.12.6 (inclusive) shall apply mutatis

mutandis also in relation to any right of sell-out under this

article 35.12.7; and

35.12.8 for the purposes of article 35.12 above (and each of the

sub-provisions thereof), reference to "Takeover Offer" shall mean

an offer:

(a) to acquire all the Shares in the Company (or where there is

more than one class of shares in the Company, all the shares of one

or more classes) other than the shares that at the date of the

offer are already held by the offeror;

(b) which is capable of acceptance by holders of Shares (or

persons with interests in them) and when so accepted would give

rise to a binding conditional or unconditional contract;

(c) where the terms of the offer are the same for all shares to

which the offer relates, or where there are separate classes of

shares the terms are the same for all the shares of the particular

class;

(d) whether or not the offer includes any of the following: (i)

all or any Shares that are allotted after the date of the offer but

before a specified date, (ii) all or any relevant treasury shares

that cease to be held as treasury shares before a specified date,

or (iii) all or any other relevant treasury shares. For the

purposes of this provision "specified date" means a date specified

in or determined in accordance with the terms of the offer, and,

"relevant treasury shares" means Shares that are held by the

Company as treasury shares at the date of the offer, or which

become shares held by the Company as treasury shares after that

date but before a specified date;

(e) whether or not the offer is extended to Shares that persons

acting in concert with the offeror hold or have contracted to

acquire;

(f) notwithstanding that (i) the offer may not have been

communicated to shareholders in certain countries or territories of

the world in order not to contravene the law of that country or

territory, provided that, the offer is published in the Recueil

Electronique des Sociétés et Associations, or (ii) there are

persons for whom by reason of the laws of certain countries or

territories of the world it is impossible to accept the offer, or

more difficult to do so than in other parts of the world;

35.12.9 if the terms of a Takeover Offer includes a provision

for the revision of the terms of the offer and for acceptances on

the previous terms to be treated as acceptances on the revised

terms, then, if the terms of the offer are revised in accordance

with that provision, the revision is not to be regarded as a new

offer for the purposes of this article 35 (and each of the

sub-provisions thereof)."

Explanation of Business to be considered at the Extraordinary

General Meeting

Extraordinary Resolution 1

In light of changes to the settlement system regime applicable

to the Company, it is intended that the shares of the Company will

be converted from registered form (i.e. their current form) to

dematerialised form evidenced by book-entry in a single issuance

account opened with the following clearing institution: LuxCSD. In

approving this first resolution, the shareholders will adopt

changes to the Articles of Association to (i) permit B&M's

shares to be in dematerialised form and reflect the provisions of

the Luxembourg law of 6 April 2013 on dematerialised securities,

(ii) provide for the voluntary dematerialisation of the shares

following the termination of the DI programme (or such later date

as otherwise decided by the Board), (iii) provide for compulsory

dematerialisation of those shares that have not been dematerialised

in connection with the voluntary dematerialisation, and (iv)

reflect throughout the Articles of Association that the shares

shall be in dematerialised form. For more information please refer

to the explanatory note to resolution 1 included in the Notice of

the EGM.

Extraordinary Resolution 2

In the second extraordinary resolution, the shareholders will

approve the dematerialisation of the shares in two phases: (i) a

first voluntary phase and (ii) a second compulsory phase. The first

voluntary phase will begin as from the next calendar day

immediately following the date of the expiry of any notice of

termination given in relation to any DI programme or such later

date as may otherwise be determined by the Board. The second

compulsory phase will begin three (3) months from the date of the

publication of the decision of the EGM of 3 December 2020 on the

Luxembourg electronic platform for official publications (Recueil

électronique des sociétés et associations) (the "Compulsory

Commencement Date") and will run until the second anniversary of

the Compulsory Commencement Date. For more information please refer

to the explanatory note to resolution 2 included in the Notice of

the EGM.

Extraordinary Resolution 3

Following the Exit-Day, the Luxembourg Transparency Law will

cease to apply to the Company. This third extraordinary resolution

proposes amendments to article 8 (Rights and Obligations of

shareholders) of the Articles of Association which will provide

that the Company and shareholders shall, to the fullest extent

possible, continue to comply with the provisions of the Luxembourg

Transparency Law which are currently applicable to it for so long

as the shares (or transferable securities carrying voting rights)

of the Company are admitted to trading on either (i) a regulated

market as defined in the Luxembourg markets in financial

instruments law dated 30 May 2018, as amended, and/or (ii) the main

market for listed securities of the London Stock Exchange plc. For

more information please refer to the explanatory note to resolution

3 included in the Notice of the EGM.

Extraordinary Resolution 4

As a consequent of Brexit, the current shared jurisdiction of

the UK Takeover Panel and the Luxembourg CSSF in relation to any

takeover offer for the Company will cease to apply to the Company

after the Exit-Day. The fourth resolution will amend the Articles

of Association by inserting a new Chapter X (Takeover provisions,

squeeze-out and sell-out) which will require that, the Company and

shareholders adhere to the City Code on Takeovers and Mergers in

relation to any takeover offer for the Company after the Exit-Day.

This new Chapter X will also provide that mandatory offer,

squeeze-out and sell-out thresholds under the Luxembourg takeover

law of 19 May 2006 which currently apply to the Company will be

similarly applied after the Exit-Day as if the Company was still

subject to that law. For more information please refer to the

explanatory note to resolution 4 included in the Notice of the

EGM.

Notes

Quorum and voting

The quorum for the EGM is shareholder(s) represented in person

or by proxy at the meeting who hold at least one half of the issued

share capital of the Company.

If this quorum condition is not satisfied a second meeting may

be convened, following notices being given of that second meeting

under the Articles of Association of the Company. At any second

meeting the quorum requirement of the original meeting does not

apply, and the quorum is at least one shareholder present in person

or represented by proxy.

In accordance with Article 24.6.3 of the Articles of Association

of the Company, all decisions taken at the EGM will be passed by at

least two thirds of the votes cast at the meeting on each

resolution.

Each holder of ordinary shares has one vote in respect of each

ordinary share held.

Total voting rights

As at 27 October 2020 (being the last business day prior to the

publication of this notice) the Company's issued ordinary share

capital consists of 1,000,733,147 (one billion seven hundred and

thirty-three thousand one hundred and forty-seven) ordinary shares,

carrying one vote each. The Company holds no treasury shares,

therefore the total voting rights in the Company as at 27 October

2020 is 1,000,733,147 (one billion seven hundred and thirty-three

thousand one hundred and forty-seven) .

Poll

All items in the Notice of the EGM will be decided by a poll of

shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGLDLFLBBLEFBE

(END) Dow Jones Newswires

October 28, 2020 03:00 ET (07:00 GMT)

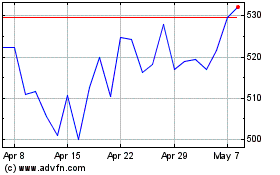

B&m European Value Retail (LSE:BME)

Historical Stock Chart

From Mar 2024 to Apr 2024

B&m European Value Retail (LSE:BME)

Historical Stock Chart

From Apr 2023 to Apr 2024