TIDMBMK

RNS Number : 8057P

Benchmark Holdings PLC

22 February 2021

22 February 2021

Information within this announcement is deemed by the Company to

constitute inside information under the Market Abuse Regulations

(EU) No. 596/2014.

Benchmark Holdings plc

("Benchmark", the "Company" or the "Group")

Q1 Results

(3 months ended 31 December 2020)

Positive start to the year with good trading and strategic

progress across all business areas

Benefits from restructuring and focus on aquaculture

In compliance with the terms of the Company's senior secured

bond which requires it to publish quarterly financial information,

Benchmark, the aquaculture biotechnology business, announces its

unaudited results for the 3 months ended 31 December 2020 (the

"period") . All Q1 2021 and Q1 2020 figures quoted in this

announcement are based on unaudited accounts.

GBPm Q1 2021 Q1 2020 FY2020

(unaudited) Restated* (audited)

(unaudited)

--------------------------------------- ------------- ------------- -----------

Adjusted

--------------------------------------- ------------- ------------- -----------

Revenue from continuing operations 29.0 24.7 105.6

--------------------------------------- ------------- ------------- -----------

Adjusted EBITDA(2) from continuing

operations 3.0 0.4 14.5

--------------------------------------- ------------- ------------- -----------

Adjusted Operating Profit/(Loss)(3)

from continuing operations 1.3 (1.1) 7.9

--------------------------------------- ------------- ------------- -----------

Exceptional restructuring, disposal

and acquisition related items (0.6) (0.1) (2.1)

--------------------------------------- ------------- ------------- -----------

EBITDA(1) from continuing operations 2.4 0.3 12.4

--------------------------------------- ------------- ------------- -----------

Statutory

--------------------------------------- ------------- ------------- -----------

Loss before tax from continuing

operations (0.5) (3.2) (22.6)

--------------------------------------- ------------- ------------- -----------

Loss for the period from continuing

operations (0.2) (2.6) (22.8)

--------------------------------------- ------------- ------------- -----------

Loss for the period - total incl.

discontinued operations (0.2) (5.4) (31.9)

--------------------------------------- ------------- ------------- -----------

Basic loss per share (p) - continuing

operations (0.11) (0.51) (3.80)

--------------------------------------- ------------- ------------- -----------

Net debt(4) (51.9) (91.3) (37.6)

--------------------------------------- ------------- ------------- -----------

(1) EBITDA is earnings/(loss) before interest, tax, depreciation

and amortisation and impairment.

(2) Adjusted EBITDA is EBITDA(1) , before exceptional items

including disposal and acquisition related expenditure.

(3) Adjusted Operating Profit/(Loss) is operating loss before

exceptional items including disposal and acquisition related items

and amortisation of intangible assets excluding development

costs.

(4) Net debt is cash and cash equivalents less loans, borrowings

and lease obligations excluding balances held for sale.

* Q1 2020 results have been restated to reflect changes to the

ongoing continuing business since they were previously

reported.

Divisional summary (Continuing operations)

GBPm Q1 2021 Q1 2020 FY 2020

(unaudited) Restated* (audited)

(unaudited)

-------------------- ------------- ------------- -----------

Revenue

-------------------- ------------- ------------- -----------

Advanced Nutrition 15.1 11.4 59.4

-------------------- ------------- ------------- -----------

Genetics 12.6 12.1 41.5

-------------------- ------------- ------------- -----------

Health 1.3 1.4 5.2

-------------------- ------------- ------------- -----------

Adjusted EBITDA(2)

-------------------- ------------- ------------- -----------

Advanced Nutrition 1.0 (0.3) 6.4

-------------------- ------------- ------------- -----------

Genetics 3.9 3.5 14.4

-------------------- ------------- ------------- -----------

Health (1.1) (1.8) (3.7)

-------------------- ------------- ------------- -----------

(1) EBITDA is earnings/(loss) before interest, tax, depreciation

and amortisation and impairment.

(2) Adjusted EBITDA is EBITDA(1) , before exceptional, disposal

and acquisition related expenditure.

* Q1 2020 results have been restated to reflect changes to the

ongoing continuing business since they were previously

reported.

Financial Highlights - Significant increase in revenues and

Adjusted EBITDA

-- Revenues from continuing operations were 18% ahead of the prior year resulting from:

o 32% higher revenues in Advanced Nutrition following slight

improvement in certain markets where Covid-19 restrictions have

eased and timing of restocking at distributors year on year

o Continued good performance in Genetics with revenues 4% ahead

of prior year

o Health revenues in line with the prior year with solid sales

of Salmosan

-- Adjusted EBITDA from continuing operations was GBP3.0m

against GBP0.4m in Q1 2020 reflecting higher revenues, the benefit

from cost reduction measures taken in 2020 and ongoing control of

operating costs and R&D expenses

-- Net cash outflow in the quarter was GBP14.6m (Q1 2020: inflow

GBP2.2m) as a result of planned capex in the period and expected

higher investment in working capital from increased activity; prior

year benefitted from a GBP6.7m inflow from the dissolution of the

Chilean JV

-- Net debt was GBP51.9m at 30 December 2020 (30 September 2020:

GBP37.6m; 31 December 2019: GBP91.3m) as a result of planned

investments in capex and working capital

-- Liquidity (cash and available facility) of c.GBP67.4m (cash

and available facility (30 September 2020: GBP83.2m))

Market environment

-- The salmon industry continues to be resilient through the

ongoing pandemic with continued investment in the emerging

land-based salmon farming segment

-- The shrimp market remains challenging due to ongoing Covid-19

lockdown restrictions; there are partial signs of recovery in

certain Asian markets as restrictions are eased while conditions in

the Americas continue to be difficult

-- The Mediterranean sea bass / bream market is stable

-- The 2020/21 Artemia harvest is underway with normalised

volumes although oversupply from previous harvests remains

Operational highlights

-- BMK08/CleanTreat(R) on track for commercial launch in Q2 of

calendar year 2021 with progress towards regulatory approval and

firm customer interest

-- First local production of salmon eggs from new genetics facility in Chile

-- New client wins in land-based salmon farming segment

consolidating our leading position in this emerging sector

Current trading and outlook

-- Trading in line with market expectations

-- Resilient trading in Advanced Nutrition in continued challenging market conditions

-- Good visibility of revenues in Genetics for the year

underpinned by long production cycle in salmon and a resilient

salmon industry

Trond Williksen, CEO, commented:

"We have had a positive start to 2021 with good trading,

improved Q1 profitability and delivery against our strategic

priorities in each of our three business areas. The benefits of

operating as a streamlined, increasingly integrated aquaculture

business are starting to be realised. Our focus remains on becoming

sustainably profitable, maintaining financial strength through the

ongoing pandemic and continuing to invest selectively in our

business to deliver future growth."

Details of analyst / investor call today

There will be a call at 10:00am UK time today for analysts and

investors. Please note this change of time from the Notice of

Results announcement on 9 February 2021. To register for the call

please contact MHP Communications on +44 (0)20 3128 8990 or 8742,

or by email on benchmark@mhpc.com

Enquiries

For further information, please contact:

Benchmark Holdings plc Tel: 020 3696 0630

Trond Williksen, CEO

Septima Maguire, CFO

Ivonne Cantu, Investor Relations

Numis (Broker and NOMAD) Tel: 020 7260 1000

James Black, Freddie Barnfield, Duncan Monteith

MHP Communications Tel: 020 3128 8742

Katie Hunt, Reg Hoare, Alistair de Kare-Silver benchmark@mhpc.com

About Benchmark

Benchmark's mission is to enable aquaculture producers to

improve their sustainability and profitability.

We bring together biology and technology, to develop innovative

products which improve yield, quality and animal health and welfare

for our customers. We do this by improving the genetic make-up,

health and nutrition of their stock - from broodstock and hatchery

through to nursery and grow out.

Benchmark has a broad portfolio of products and solutions,

including salmon eggs, live feed (Artemia), diets and probiotics

and sea lice treatments. Find out more at www.benchmarkplc.com

Management Report

The Company had a positive start to the year despite the ongoing

challenges from Covid-19, with trading in Q1 delivering a

significant 18% increase in revenues and an uplift in Adjusted

EBITDA from GBP0.4m in Q1 2020 to GBP3.0m in Q1 2021. This reflects

both the good trading performance and the benefits of our ongoing

cost control.

Operating costs of GBP9.3m in Q1 were 5% below the prior period

(Q1 2020: GBP9.8m) as a result of a groupwide effort to reduce

operating costs and a reduction in marketing and travel expenses in

the period as a result of Covid-19 restrictions.

R&D expenses of GBP1.7m were 43% down (Q1 2020: GBP3.0m) and

total R&D investment including capitalised development costs

(excluding discontinued operations) was GBP2.8m (Q1 2020: GBP3.9m).

By business area, total R&D saw a 28% reduction in Advanced

Nutrition and a 61% reduction in Health while Genetics was 5% below

the prior year. Genetics R&D spend includes the cost of

maintaining our breeding programmes which are fixed.

Overall, our main end markets saw a continuation of the trends

reported in our year end results with a resilient salmon industry,

stable sea bass/bream market and shrimp markets continuing to be

affected by the pandemic, particularly in the Americas. We expect

this scenario to continue with some recovery when restrictions ease

in the main shrimp consuming and producing countries which include

China, the US, India, Vietnam and Ecuador.

We continue to operate our business with the health, wellbeing

and safety of our employees as a priority while providing

continuity of supply and service to our customers. We recognise the

challenges on wellbeing from the prolonged pandemic and have given

additional focus to our wellbeing programme, an important element

of our ESG programme. We are maintaining our focus on cost and cash

management, which together with our tried and tested flexible

operating processes, give us resilience through the ongoing

pandemic.

Genetics

Genetics revenues in Q1 2021 were 4% (GBP0.5m) higher than the

prior year, reflecting higher egg sales volumes in Norway from our

Salten facility, partially offset by expected lower sales to

Scotland from our Icelandic facility and lower harvest revenues as

a result of lower salmon prices.

Adjusted EBITDA for Q1 2021 of GBP3.9m was 11% higher than prior

year (Q1 2020: GBP3.5m) due to higher overall sales, lower

operating costs and lower R&D expenses. Excluding fair value

movements of GBP1.3m in the period, Adjusted EBITDA was GBP2.6m,

10% above the prior year (Q1 2020: GBP2.4m).

Investment in our SPR shrimp production and commercial

capabilities continues ahead of full commercial launch. During the

period we continued to supply shrimp breeders from our US facility

in Fellsmere, Florida to markets in Asia as part of our test market

ahead of a gradual roll-out of our SPR shrimp in H2 FY2021. The

opening of the multiplication centre in Thailand has suffered

delays as a result of lockdown restrictions in the region which

slowed down construction. Capitalised development costs from shrimp

genetics amounted to GBP0.6m in the period (Q1 2020: GBP0.3m) and

Adjusted EBITDA loss was GBP0.1m in the shrimp segment (Q1 2020:

Adjusted EBITDA profit of GBP0.1m).

We continue to invest in our tilapia breeding programme with

operating costs of GBP0.4m, in line with Q1 2020.

Construction to increase incubation capacity in Iceland

commenced in Q1 2021. This investment will enable us to meet

seasonal peak demand and strengthen our ability to serve

international customers, including new land-based salmon farms,

delivering high biosecure eggs year round in the coming years. Post

period end, we recorded our first local production of salmon eggs

from our new facility in Chile.

Advanced Nutrition

Advanced Nutrition had a good quarter, reporting revenues of

GBP15.1m in Q1, 32% above the prior year (Q1 2020: GBP11.4m),

following a slight recovery in selected markets where Covid-19

restrictions are easing and reflecting our enhanced commercial

effort. Revenues grew against last year in all product areas:

Artemia (+69%), Diets (+14%) and Health (+10%). By region, sales in

Asia were ahead of last year partially offset by a drop in the

Americas which have been more significantly affected by Covid-19.

Revenues from Europe were in line with 2020.

Adjusted EBITDA in Q1 was GBP1.0m (Q1 2020: loss GBP0.3m) as a

result of increased sales volumes and lower operating costs from

reduced travel and marketing as a result of Covid-19

restrictions.

While we expect ongoing volatility in the shrimp markets, we are

encouraged by a partial recovery in certain markets which is

expected to continue as consumption levels improve with a lifting

of lockdowns.

Operational efficiencies which commenced during FY20 have been

completed, including formulation improvements to key product lines

and the installation of a new Artemia mixer at our US production

site to improve customer lead times.

Health

Revenues from continuing operations in Q1 2021 were marginally

below the previous year at GBP1.3m (Q1 2020: GBP1.4m). Sales of

Salmosan were solid, reflecting our ability to maintain strong

technical support through the pandemic. The restructuring of our

Health business area has resulted in a more agile, commercially

focused team.

Adjusted EBITDA from continuing operations in Q1 2021 was a loss

of GBP1.1m (Q1 2020: loss GBP1.8m). The reduced operating loss

reflects cuts in operating costs following the restructuring and

disposals, and lower R&D investment.

During the period we continued to prepare for the commercial

launch of BMK08 and CleanTreat(R) in Q2 calendar year 2021,

progressing through the regulatory approval process, building

operational strength and capacity, and continuing to implement our

commercial plan with firm interest from potential customers.

Construction of a second CleanTreat(R) system is expected to

complete in line with our planned launch positioning us for maximum

utilisation of capacity in the months following the launch. The

next milestones towards commercialisation are the ratification of

the Maximum Residue Level for food safety (MRL) in EU and Norwegian

law and the Marketing Authorisation grant in Norway. All are

progressing in line with expectations and we are planning to

generate revenues in H2 FY 2021.

Finance costs, cashflow and net debt

Net finance income for the quarter was GBP2.7m (Q1 2020:

GBP2.4m) primarily driven by interest expense of GBP1.8m (Q1 2020:

GBP1.7m) more than offset by foreign exchange gains of GBP2.6m (Q1

2020: GBP3.2m) and revaluation of financial derivatives of GBP2.3m

(Q1 2020: GBP0.9m).

There was a net cash outflow in the quarter of GBP14.6m (Q1

2020: inflow GBP2.2m) with the main impact on cashflow derived from

investing activities. Net cashflow from investing activities in the

period was an outflow of GBP4.2m (Q1 2020: inflow GBP4.5m),

primarily from investment in PPE related to the new facility in

Chile and fire safety equipment in Thailand, whereas there was a

GBP6.7m inflow in the prior year from the dissolution of the

Chilean JV. Net cash outflow from operating activities was GBP6.4m

(Q1 2020: GBP3.6m outflow) with higher investment in working

capital in the period from higher activity offsetting the improved

result for the year.

Net debt at the quarter end was GBP51.9m (December 2020:

GBP37.6m). Liquidity at the end of the period was GBP67.4m

providing GBP57.4m of headroom against our minimum liquidity

covenant.

Summary and Outlook

The Company has made a positive start to the year and is trading

in line with market expectations. We have good visibility of

revenues in Genetics for the full financial year with normal

seasonality, underpinned by a long production cycle in salmon and a

resilient salmon industry, together with the ramp up and expansion

of capacity. We expect the shrimp market to remain volatile through

the coming months with some recovery in the Asian markets likely

but challenging conditions continuing in the Americas. In Health,

we also expect to see the first revenues from BMK08/CleanTreat (R)

during H2 FY 2021 subject to regulatory approvals.

The benefits of operating as a streamlined, aquaculture focused,

increasingly integrated organisation are starting to be realised.

Our focus remains on becoming sustainably profitable, maintaining

financial strength through the ongoing pandemic and continuing to

invest selectively in our business to deliver future growth.

Benchmark Holdings plc

Consolidated Income Statement for the period ended 31 December

2020

Q1 2020

Q1 2021 Restated* FY 2020

All figures in GBP000's Notes (unaudited) (unaudited) (audited)

-------------------------------------------- ------ -------------- -------------- ------------

Revenue 4 29,030 24,691 105,565

Cost of sales (14,359) (11,752) (50,603)

-------------------------------------------- ------

Gross profit 14,671 12,939 54,962

Research and development costs (1,745) (2,972) (7,282)

Other operating costs (9,285) (9,778) (33,337)

Share of (loss)/profit of equity-accounted

investees, net of tax (611) 211 150

-------------------------------------------- ------ -------------- -------------- ------------

Adjusted EBITDA(2) 3,030 400 14,493

Exceptional - restructuring, disposal

and acquisition related items 6 (593) (134) (2,114)

-------------------------------------------- ------ -------------- -------------- ------------

EBITDA(1) 2,437 266 12,379

Depreciation and impairment (1,771) (1,453) (6,640)

Amortisation and impairment (3,918) (4,355) (16,613)

-------------------------------------------- ------ -------------- -------------- ------------

Operating loss (3,252) (5,542) (10,874)

Finance cost (2,149) (2,010) (12,779)

Finance income 4,886 4,368 1,082

-------------------------------------------- ------ -------------- -------------- ------------

Loss before taxation (515) (3,184) (22,571)

Tax on loss 7 290 600 (204)

-------------------------------------------- ------ -------------- ------------

Loss from continuing operations (225) (2,584) (22,775)

-------------------------------------------- ------ -------------- -------------- ------------

Discontinued operations

Loss from discontinued operations,

net of tax 5 - (2,858) (9,174)

-------------------------------------------- ------ -------------- -------------- ------------

(225) (5,442) (31,949)

-------------------------------------------- ------ -------------- -------------- ------------

Loss for the year attributable to:

- Owners of the parent (717) (5,716) (32,923)

- Non-controlling interest 492 274 974

-------------------------------------------- ------ --------------

(225) (5,442) (31,949)

-------------------------------------------- ------ -------------- -------------- ------------

Earnings per share

Basic loss per share (pence) 8 (0.11) (1.02) (5.26)

Diluted loss per share (pence) 8 (0.11) (1.02) (5.26)

Earnings per share - continuing

operations

Basic loss per share (pence) 8 (0.11) (0.51) (3.80)

Diluted loss per share (pence) 8 (0.11) (0.51) (3.80)

GBP000 GBP000 GBP000

-------------------------------------------- ------ -------------- -------------- ------------

Adjusted EBITDA from continuing

operations 3,030 400 14,493

Adjusted EBITDA from discontinued

operations 5 - (1,987) (8,726)

-------------------------------------------- ------ -------------- -------------- ------------

Total Adjusted EBITDA 3,030 (1,587) 5,767

-------------------------------------------- ------ -------------- -------------- ------------

1 EBITDA - Earnings/loss before interest, tax, depreciation,

amortisation and impairment

2 Adjusted EBITDA - EBITDA before exceptional, disposal and

acquisition related items

* Q1 2020 numbers have been restated to reflect changes to the

ongoing continuing business since it was previously reported (note

5)

Benchmark Holdings plc

Consolidated Statement of Comprehensive Income for the period

ended 31 December 2020

Q1 2020

Q1 2021 Restated* FY 2020

All figures in GBP000's (unaudited) (unaudited) (audited)

------------------------------------------- ---- -------------- -------------- ------------

Loss for the period (225) (5,442) (31,949)

Other comprehensive income

Items that are or may be reclassified

subsequently to profit or loss

Foreign exchange translation differences (8,714) (23,560) (20,327)

Cash flow hedges - changes in fair value 2,898 (1,660) (5,932)

Cash flow hedges - reclassified to profit

or loss 156 (75) (153)

Total comprehensive income for the period (5,885) (30,737) (58,361)

------------------------------------------------- -------------- -------------- ------------

Total comprehensive income for the period

attributable to:

- Owners of the parent (6,624) (30,810) (58,532)

- Non-controlling interest 739 73 171

------------------------------------------------- ------------

(5,885) (30,737) (58,361)

------------------------------------------------ -------------- -------------- ------------

Total comprehensive income for the period

attributable to owners of the parent:

- Continuing operations (6,624) (28,058) (50,604)

- Discontinued operations - (2,752) (7,928)

-------------------------------------------------

(6,624) (30,810) (58,532)

------------------------------------------------ -------------- -------------- ------------

* Q1 2020 numbers have been restated to reflect changes to the

ongoing continuing business since it was previously reported note

5)

Benchmark Holdings plc

Consolidated Balance Sheet for the period ended 31 December

2020

31 December 31 December 30 September

2020 2019 2020

All figures in GBP000's Notes (unaudited) (unaudited) (audited)

---------------------------------- ------ ------------- ------------- --------------

Assets

Property, plant and equipment 68,820 85,204 65,601

Right-of-use assets 11,371 4,421 10,347

Intangible assets 235,644 255,006 247,003

Equity-accounted investees 3,069 3,488 3,690

Other investments 24 24 23

Biological and agricultural

assets 15,929 10,090 16,621

Non-current assets 334,857 358,233 343,285

---------------------------------- ------ ------------- ------------- --------------

Inventories 17,197 23,544 18,926

Biological and agricultural

assets 19,118 17,483 15,848

Trade and other receivables 35,248 34,211 39,371

Cash and cash equivalents 56,428 17,020 71,605

---------------------------------- ------ ------------- ------------- --------------

127,991 92,258 145,750

Assets held for sale - 17,088 -

Current assets 127,991 109,346 145,750

---------------------------------- ------ ------------- ------------- --------------

Total assets 462,848 467,579 489,035

---------------------------------- ------ ------------- ------------- --------------

Liabilities

Trade and other payables (28,318) (27,054) (45,692)

Loans and borrowings 9 (4,209) (2,951) (5,339)

Corporation tax liability (3,919) (2,606) (4,344)

Provisions - (144) -

---------------------------------- ------ ------------- ------------- --------------

(36,446) (32,755) (55,375)

Liabilities directly associated - (12,757) -

with the assets held for sale

-------------

Current liabilities (36,446) (45,512) (55,375)

---------------------------------- ------ ------------- ------------- --------------

Loans and borrowings 9 (104,077) (105,366) (103,819)

Other payables (1,822) (1,952) (1,754)

Deferred tax (30,450) (34,742) (32,647)

Non-current liabilities (136,349) (142,060) (138,220)

---------------------------------- ------ ------------- ------------- --------------

Total liabilities (172,794) (187,572) (193,595)

---------------------------------- ------ ------------- ------------- --------------

Net assets 290,053 280,007 295,440

---------------------------------- ------ ------------- ------------- --------------

Issued capital and reserves

attributable to owners of the

parent

Share capital 10 668 559 668

Additional paid-in share capital 399,803 358,044 399,601

Capital redemption reserve 5 5 5

Retained earnings (142,591) (116,354) (142,170)

Hedging reserve (6,596) (5,301) (9,651)

Foreign exchange reserve 31,716 36,843 40,678

Equity attributable to owners

of the parent 283,005 273,796 289,131

Non-controlling interest 7,048 6,211 6,309

---------------------------------- ------

Total equity and reserves 290,053 280,007 295,440

---------------------------------- ------ ------------- ------------- --------------

The notes to these statements are an integral part of this

consolidated financial information

Benchmark Holdings plc

Consolidated Statement of Changes in Equity for the period ended

31 December 2020

Total

attributable

Additional to equity

paid-in holders Non-

Share share Other Hedging Retained of controlling Total

capital capital* reserves reserve earnings parent interest equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

As at 1

October 2020

(audited) 668 399,601 40,683 (9,651) (142,170) 289,131 6,309 295,440

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

Comprehensive

income for

the period

(Loss)/profit

for the

period - - - - (717) (717) 492 (225)

Other

comprehensive

income - - (8,962) 3,055 - (5,907) 247 (5,660)

Total

comprehensive

income

for the

period - - (8,962) 3,055 (717) (6,624) 739 (5,885)

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

Contributions

by and

distributions

to owners

Share issue - 202 - - - 202 - 202

Share-based

payment - - - - 296 296 - 296

Total

contributions

by

and

distributions

to owners - 202 - - 296 498 - 498

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

Total

transactions

with

owners of the

Company - 202 - - 296 498 - 498

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

As at 31

December 2020

(unaudited) 668 399,803 31,721 (6,596) (142,591) 283,005 7,048 290,053

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

As at 1

October 2019

(audited) 559 358,044 60,207 (3,566) (110,916) 304,328 6,138 310,466

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

Comprehensive

income for

the period

(Loss)/profit

for the

period - - - - (5,716) (5,716) 274 (5,442)

Other

comprehensive

income - - (23,359) (1,735) - (25,094) (201) (25,295)

Total

comprehensive

income

for the

period - - (23,359) (1,735) (5,716) (30,810) 73 (30,737)

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

Contributions

by and

distributions

to owners

Share-based

payment - - - - 278 278 - 278

Total

contributions

by

and

distributions

to owners - - - - 278 278 - 278

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

Total

transactions

with

owners of the

Company - - - - 278 278 - 278

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

As at 31

December 2019

(unaudited) 559 358,044 36,848 (5,301) (116,354) 273,796 6,211 280,007

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

As at 1

October 2019

(audited) 559 358,044 60,207 (3,566) (110,916) 304,328 6,138 310,466

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

Comprehensive

income for

the period

(Loss)/profit

for the

period - - - - (32,923) (32,923) 974 (31,949)

Other

comprehensive

income - - (19,524) (6,085) - (25,609) (803) (26,412)

Total

comprehensive

income

for the

period - - (19,524) (6,085) (32,923) (58,532) 171 (58,361)

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

Contributions

by and

distributions

to owners

Share issue 109 42,869 - - - 42,978 - 42,978

Share issue

costs

recognised

through

equity - (1,312) - - - (1,312) - (1,312)

Share-based

payment - - - - 1,669 1,669 - 1,669

Total

contributions

by

and

distributions

to owners 109 41,557 - - 1,669 43,335 - 43,335

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

Total

transactions

with

owners of the

Company 109 41,557 - - 1,669 43,335 - 43,335

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

As at 30

September

2020

(audited) 668 399,601 40,683 (9,651) (142,170) 289,131 6,309 295,440

--------------- --------- ------------ ---------- ---------- ---------- -------------- ------------- ---------

*Other reserves in this statement is an aggregation of capital

redemption reserve and foreign exchange reserve

Benchmark Holdings plc

Consolidated Statement of Cash Flows for the period ended 31

December 2020

Q1 2021 Q1 2020 FY 2020

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

-------------------------------------------- ---- -------------- -------------- ------------

Cash flows from operating activities

Loss for the year (225) (5,442) (31,949)

Adjustments for:

Depreciation and impairment of

property, plant and equipment 1,772 1,910 9,138

Amortisation and impairment of

intangible fixed assets 3,918 4,389 19,402

Gain on sale of property, plant

and equipment (68) (3) (1,140)

Gain on sale of subsidiaries - - (14,120)

Finance income (22) (963) (111)

Finance costs (165) 2,049 9,695

Other adjustments for non-cash

items - - 200

Share of loss/(profit) of equity-accounted

investees, net of tax 611 (211) (150)

Foreign exchange gains (3,480) (4,351) (132)

Share based payment expense 296 278 1,669

Tax credit (291) (571) 314

-------------------------------------------------- -------------- -------------- ------------

2,346 (2,915) (7,184)

Decrease in trade and other receivables 4,563 10,606 4,202

Decrease/(increase) in inventories 1,799 (1,810) 3,741

Increase in biological and agricultural

assets (2,038) (373) (7,474)

(Decrease)/increase in trade and

other payables (11,846) (8,301) 5,006

Decrease in provisions (10) (18) (260)

-------------------------------------------------- -------------- -------------- ------------

(5,186) (2,811) (1,969)

Income taxes paid (1,241) (827) (2,087)

-------------------------------------------------- -------------- -------------- ------------

Net cash flows used in operating

activities (6,427) (3,638) (4,056)

-------------------------------------------------- -------------- -------------- ------------

Investing activities

Proceeds from sale of subsidiaries,

net of cash disposed of - - 17,487

Purchase of investments - - (522)

Receipts from disposal of investments - 6,932 6,932

Purchases of property, plant and

equipment (3,424) (1,576) (5,851)

Proceeds from sales of intangible

assets - - 261

Purchase of intangibles (1,128) (952) (5,563)

Purchase of held for sale assets - - (402)

Proceeds from sale of fixed assets 286 - 16,147

Proceeds from sales of other long-term

assets - - 1,776

Interest received 21 69 111

-------------------------------------------------- -------------- -------------- ------------

Net cash flows (used in)/from

investing activities (4,245) 4,473 30,376

-------------------------------------------------- -------------- -------------- ------------

Financing activities

Proceeds of share issues 203 - 42,978

Share-issue costs recognised through

equity - - (1,312)

Proceeds from bank or other borrowings - 4,174 8,387

Repayment of bank or other borrowings (1,664) (201) (10,141)

Interest and finance charges paid (1,800) (2,100) (7,659)

Repayments of lease liabilities (689) (535) (2,120)

-------------------------------------------------- -------------- -------------- ------------

Net cash (outflow)/inflow from

financing activities (3,950) 1,338 30,133

-------------------------------------------------- -------------- -------------- ------------

Net (decrease)/increase in cash

and cash equivalents (14,622) 2,173 56,453

Cash and cash equivalents at beginning

of year 71,605 16,051 16,051

Effect of movements in exchange

rate (555) (960) (899)

-------------------------------------------------- -------------- -------------- ------------

Cash and cash equivalents at end

of year 56,428 17,264 71,605

-------------------------------------------------- -------------- -------------- ------------

The Consolidated Statement of Cash Flows presents cash flows

from both Continuing and Discontinued operations in the

comparatives.

Of the cash balance at 31 December 2019 of GBP17,264,000,

GBP244,000 was classified as held for sale

Benchmark Holdings plc

Unaudited notes to the interim financial statements for period

ended 31 December 2020

1. Basis of preparation

Benchmark Holdings plc (the 'Company') is a company incorporated

domiciled in the United Kingdom. These consolidated quarterly

financial statements as at and for the three months ended 31

December 2020 represents that of the Company and its subsidiaries

(together referred to as the 'Group').

These quarterly financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting and should be

read in conjunction with the Group's consolidated financial

statements as at and for the year ended 30 September 2020. They do

not include all of the information required for a complete set of

IFRS financial statements. However, selected explanatory notes are

included to explain events and transactions that are significant to

an understanding of the changes in the Group's financial position

and performance since the last annual financial statements.

Statutory accounts for the year ended 30 September 2020 were

approved by the Directors on 27 November 2020 and will be delivered

to the Registrar of Companies. The audit report received on those

accounts was unqualified and did not make a statement under section

498 of the Companies Act 2006.

Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Management Report.

As at 31 December 2020 the Group had net assets of GBP290.1m (30

September 2020: GBP295.4m), including cash of GBP56.4m (30

September 2020: GBP71.6m) as set out in the consolidated balance

sheet. The Group made a loss for the period of GBP0.2m (30

September 2020: GBP31.9m).

As noted in the Management Report, the impact of the Covid-19

pandemic continues to affect parts of the Group's businesses to

varying degrees. The ultimate impact of the pandemic on industry,

the economy, Benchmark's markets and its businesses remains to some

extent uncertain. Our main markets have experienced mixed fortunes,

with weak shrimp markets, resilient salmon markets and sea

bass/bream markets which have experienced modest impact from

Covid-19. The Directors monitor available market analysis as this

situation continues into 2021. Whilst the outlook for the shrimp

market retains some uncertainty, the outlook for the salmon sector

(underpinning the Genetics and Health businesses) remains positive

and the Directors therefore believe that large parts of the Group

are well placed to deal with the uncertain global economic future

ahead.

The Directors prepared cash flow projections covering the period

to September 2022 to assess the Group's trading and cash flow

forecasts and the forecast compliance with the covenants included

within the Group's financing arrangements and year to date

performance is in line with these forecasts. Cash resources were

boosted by non-core business disposals during the previous year and

the ongoing cost base following these transactions has been

significantly reduced.

The uncertainty relating to the future impact on the Group of

the pandemic has been considered as part of the Directors'

assessment of the going concern assumption. The positive

preventative measures implemented by the Directors at an early

stage in response to the pandemic continue to be in force where

necessary. In the downside scenario analysis performed, the

Directors considered severe but plausible impacts of Covid-19 on

the Group's trading and cash flow forecasts, modelling reductions

in the revenues and cash flows in Advanced Nutrition, being the

segment most impacted by Covid-19 because of its exposure to global

shrimp markets, alongside modelling delays to new product launches

in the Health business area. Key downside sensitivities modelled

include assumptions that there is limited recovery in global shrimp

markets in FY21, affecting demand for Advanced Nutrition products

and a three-month potential delay in the launch of BMK08, pushing

commercial launch back to September 2021. Mitigating measures

within the control of management were implemented early in the

pandemic and remain in place and have been factored into the

downside analysis performed. These measures include reductions in

areas of discretionary spend, temporary furlough of certain staff

or reduced working hours, deferral of capital projects and

temporary hold on R&D for non-imminent products.

It remains difficult to predict the overall outcome and impact

of the pandemic, but under the severe but plausible downside

scenarios modelled, the Group has sufficient liquidity and

resources throughout the period under review whilst still

maintaining adequate headroom against the borrowing covenants. The

Directors therefore remain confident that the Group has adequate

resources to continue to meet its liabilities as and when they fall

due within the period of 12 months from the date of approval of

these financial statements. Accordingly, the financial statements

have been prepared on a going concern basis.

2. Accounting policies

The accounting policies adopted are consistent with those used

in preparing the consolidated financial statements for the

financial year ended 30 September 2020.

Taxes on income in the interim periods are accrued using the tax

rate that would be applicable to expected total earnings.

Alternative performance measures ('APMs')

The Directors measure the performance of the Group based on a

range of financial measures, including measures not recognised by

EU-adopted IFRS. These APMs may not be directly comparable with

other companies' APMs and the Directors do not intend these as a

substitute for, or superior to, IFRS measures.

Directors have presented the performance measures Adjusted

EBITDA, Adjusted Operating Profit and Adjusted Profit Before Tax

because it monitors performance at a consolidated level using these

and believes that these measures are relevant to an understanding

of the Group's financial performance (see note 11).

Use of estimates and judgements

The preparation of quarterly financial information requires

management to make certain judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

amounts may differ from these estimates.

In preparing these quarterly financial statements the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those applied to the consolidated financial

statements for the year ended 30 September 2020.

3. Segment information

Operating segments are reported in a manner consistent with the

reports made to the chief operating decision maker. It is

considered that the role of chief operating decision maker is

performed by the Board of Directors.

The Group operates globally and for management purposes is

organised into reportable segments based on the following business

areas:

-- Genetics - harnesses industry leading salmon breeding

technologies combined with state-of-the-art production facilities

to provide a range of year-round high genetic merit ova;

-- Advanced Nutrition - manufactures and provides technically

advanced nutrition and health products to the global aquaculture

industry.

-- Health - provided veterinary services, environmental services

diagnostics and health products to the global aquaculture market,

and manufactures licenced veterinary vaccines and vaccine

components; following the divestment programme the segment now

focusses on providing health products to the global aquaculture

market.

In addition to the above, reported as "all other segments" is

the Knowledge Services business area, the operations of which were

disposed of or discontinued in the two previous years. The business

area provided sustainable food production consultancy, technical

consultancy and assurance services and promotes sustainable food

production and ethics through online news and technical

publications for the international agriculture and food processing

sectors and through delivery of training courses to the

industries.

In order to reconcile the segmental analysis to the Consolidated

Income Statement, Corporate and Inter-segment sales are also shown.

C orporate represents revenues earned from recharging certain

central costs to the operating divisions, together with unallocated

central costs.

Measurement of operating segment profit or loss

Inter-segment sales are priced along the same lines as sales to

external customers, with an appropriate discount being applied to

encourage use of Group resources at a rate acceptable to local tax

authorities. This policy was applied consistently throughout the

current and prior period.

3. Segment information (continued)

Segmental Revenue

Q1 2021 Q1 2020 FY 2020

All figures in GBP000's (unaudited) (unaudited) (audited)

--------------------------- --------------- --------------- -------------

Genetics 12,616 12,120 41,504

Advanced Nutrition 15,132 11,396 59,362

Health 1,293 3,420 10,799

All other segments - 3,373 9,257

Corporate 1,205 1,538 4,939

Inter-segment sales (1,216) (1,793) (5,469)

Total 29,030 30,054 120,392

--------------------------- --------------- --------------- -------------

Segmental Adjusted EBITDA

Q1 2021 Q1 2020 FY 2020

All figures in GBP000's (unaudited) (unaudited) (audited)

---------------------------- --------------- --------------- -------------

Genetics 3,879 3,455 14,442

Advanced Nutrition 993 (405) 6,266

Health (1,117) (4,021) (12,886)

All other segments - 196 244

Corporate (725) (812) (2,299)

Total 3,030 (1,587) 5,767

---------------------------- --------------- --------------- -------------

Reconciliations of segmental information to IFRS measures

Revenue

Q1 2020

Q1 2021 Restated* FY 2020

All figures in GBP000's (unaudited) (unaudited) (audited)

-------------------------------------------- --------------- --------------- -------------

Total revenue per segmental information 29,030 30,054 120,392

Less: revenue from discontinued operations

(note 5) - (5,363) (14,827)

--------------------------------------------

Consolidated revenue 29,030 24,691 105,565

-------------------------------------------- --------------- --------------- -------------

Reconciliation of Reportable Segments Adjusted EBITDA to

Loss before taxation from continuing operations

----------------------------------------------------------------------------------------------

Q1 2020

Q1 2021 Restated* FY 2020

All figures in GBP000's (unaudited) (unaudited) (audited)

--------------------------------------------- --------------- --------------- -------------

Total reportable segment Adjusted

EBITDA 3,755 (971) 7,822

Other Segment and Corporate Adjusted

EBITDA (725) (616) (2,055)

--------------------------------------------- --------------- --------------- -------------

3,030 (1,587) 5,767

Less: Adjusted EBITDA from discontinued

operations (note 5) - 1,987 8,726

--------------------------------------------- --------------- --------------- -------------

Adjusted EBITDA from continuing operations 3,030 400 14,493

Exceptional including disposal and

acquisition related items (593) (134) (2,114)

Depreciation and impairment (1,771) (1,453) (6,640)

Amortisation and impairment (3,918) (4,355) (16,613)

Net finance costs 2,737 2,358 (11,697)

Loss before taxation from continuing

operations (515) (3,184) (22,571)

--------------------------------------------- --------------- --------------- -------------

*See note 5.

4. Revenue

The Group's operations and main revenue streams are those

described in its financial statements to 30 September 2020. The

Group's revenue is derived from contracts with customers.

Disaggregation of revenue

In the following tables, revenue is disaggregated by primary

geographical market and by sales of goods and services. The table

includes a reconciliation of the disaggregated revenue with the

Group's reportable segments (see note 3).

Sale of goods and provision of services

3 months ended 31 December 2020 (unaudited)

---------------- -------------------------------------------------------------------------------------------------------------------

All

All figures Advanced other Inter-segment

in GBP000's Genetics Nutrition Health segments Corporate sales Total Discontinued Continued

---------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

Sale of

goods 11,489 15,127 1,278 - - - 27,894 - 27,894

Provision

of services 1,121 - 15 - - - 1,136 - 1,136

Inter-segment

sales 6 5 - - 1,205 (1,216) - - -

----------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

12,616 15,132 1,293 - 1,205 (1,216) 29,030 - 29,030

---------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

3 months ended 31 December 2019 (unaudited)

---------------- -------------------------------------------------------------------------------------------------------------------

All

All figures Advanced other Inter-segment Discontinued Continued

in GBP000's Genetics Nutrition Health segments Corporate sales Total Restated* Restated*

---------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

Sale of

goods 10,939 11,388 1,612 197 - - 24,136 620 23,516

Provision

of services 1,125 - 1,610 3,166 17 - 5,918 4,743 1,175

Inter-segment

sales 56 8 198 10 1,521 (1,793) - - -

----------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

12,120 11,396 3,420 3,373 1,538 (1,793) 30,054 5,363 24,691

---------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

12 months ended 30 September 2020 (audited)

---------------- -------------------------------------------------------------------------------------------------------------------

All

All figures Advanced other Inter-segment

in GBP000's Genetics Nutrition Health segments Corporate sales Total Discontinued Continued

---------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

Sale of

goods 37,555 59,301 6,529 547 - - 103,932 2,551 101,381

Provision

of services 3,909 - 3,846 8,683 22 - 16,460 12,276 4,184

Inter-segment

sales 40 61 424 27 4,917 (5,469) - - -

----------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

41,504 59,362 10,799 9,257 4,939 (5,469) 120,392 14,827 105,565

---------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

*See note 5.

4. Revenue (continued)

Primary geographical markets

3 months ended 31 December 2020 (unaudited)

---------------- -------------------------------------------------------------------------------------------------------------------

All

All figures Advanced other Inter-segment

in GBP000's Genetics Nutrition Health segments Corporate sales Total Discontinued Continued

---------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

Norway 7,710 66 163 - - - 7,939 - 7,939

UK 1,430 26 235 - - - 1,691 - 1,691

Faroe Islands 1,808 4 - - - - 1,812 - 1,812

Ecuador - 959 - - - - 959 - 959

India - 3,226 - - - - 3,226 - 3,226

Greece - 1,830 - - - - 1,830 - 1,830

Singapore - 941 - - - - 941 - 941

Chile 6 - 837 - - - 843 - 843

Rest of

Europe 1,160 1,438 2 - - - 2,600 - 2,600

Rest of

World 496 6,637 56 - - - 7,189 - 7,189

Inter-segment

sales 6 5 - - 1,205 (1,216) - - -

----------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

12,616 15,132 1,293 - 1,205 (1,216) 29,030 - 29,030

---------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

3 months ended 31 December 2019 (unaudited)

---------------- -------------------------------------------------------------------------------------------------------------------

All

All figures Advanced other Inter-segment Discontinued Continued

in GBP000's Genetics Nutrition Health segments Corporate sales Total Restated* Restated*

---------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

Norway 5,814 112 543 - - - 6,469 424 6,045

UK 2,343 19 693 2,106 17 - 5,178 2,694 2,484

Faroe Islands 2,160 - 25 - - - 2,185 - 2,185

Ecuador - 1,985 - - - - 1,985 - 1,985

India - 956 - - - - 956 - 956

Greece - 1,495 - - - - 1,495 - 1,495

Singapore - 679 - - - - 679 - 679

Chile 14 - 1,189 - - - 1,203 264 939

Rest of

Europe 1,209 1,487 538 999 - - 4,233 1,538 2,695

Rest of

World 524 4,655 234 258 - - 5,671 443 5,228

Inter-segment

sales 56 8 198 10 1,521 (1,793) - - -

----------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

12,120 11,396 3,420 3,373 1,538 (1,793) 30,054 5,363 24,691

---------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

12 months ended 30 September 2020 (audited)

---------------- -------------------------------------------------------------------------------------------------------------------

All

All figures Advanced other Inter-segment

in GBP000's Genetics Nutrition Health segments Corporate sales Total Discontinued Continued

---------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

Norway 19,709 633 1,608 - - - 21,950 1,145 20,805

UK 6,402 124 1,951 6,149 22 - 14,648 7,506 7,142

Faroe Islands 6,961 3 114 - - - 7,078 - 7,078

Ecuador - 6,822 - - - - 6,822 - 6,822

India - 6,452 6 - - - 6,458 3 6,455

Greece 61 5,666 - - - - 5,727 - 5,727

Singapore - 5,356 7 - - - 5,363 7 5,356

Chile 119 21 4,083 - - - 4,223 1,159 3,064

Rest of

Europe 5,421 4,554 1,566 2,549 - - 14,090 4,071 10,019

Rest of

World 2,791 29,670 1,040 532 - - 34,033 936 33,097

Inter-segment

sales 40 61 424 27 4,917 (5,469) - - -

----------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

41,504 59,362 10,799 9,257 4,939 (5,469) 120,392 14,827 105,565

---------------- ---------- ----------- -------- ---------- ----------- --------------- -------- -------------- ------------

*See note 5.

5. Discontinued activities

In June 2019, the Group announced a programme of structural

efficiencies which focused on the disposal and discontinuation of

non-core activities. This programme primarily included the

businesses within Knowledge Services (reported within 'all other

segments') and the veterinary services business within Health.

These operations were presented as discontinued and the sales of

the disposal group were completed during the previous year and

therefore continue to be shown as discontinued. During Q1 of the

prior year, as a continuation of the above programme, a small

non-core business within Advanced Nutrition was put up for sale and

sold and a business within the Corporate category was closed.

During the prior year but after 31 December 2019, a

restructuring of the Health business area saw the closure of the

research and development operations at two sites, the sale of the

Group's vaccine manufacturing facility and exit from non-core

vaccine development collaborations. Consequently, these operations

have been classified as discontinued with a corresponding

restatement of the consolidated income statement and consolidated

statement of comprehensive income for the quarter ended 31 December

2019 to reflect these changes.

Results from discontinued operations

Q1 2020

Q1 2021 Restated FY 2020

All figures in GBP000's (unaudited) (unaudited) (audited)

----------------------------------- ---- --------------- -------------- ------------

Revenue - 5,363 14,827

Cost of sales - (3,947) (13,000)

-----------------------------------------

Gross profit - 1,416 1,827

Research and development costs - (1,048) (2,725)

Other operating costs - (2,355) (7,828)

----------------------------------------- -------------- -------------- ------------

Adjusted EBITDA - (1,987) (8,726)

Exceptional items - (312) 5,086

----------------------------------------- -------------- -------------- ------------

EBITDA - (2,299) (3,640)

Depreciation and impairment - (457) (2,498)

Amortisation and impairment - (34) (2,789)

----------------------------------------- -------------- -------------- ------------

Operating loss - (2,790) (8,927)

Finance costs - (39) (137)

----------------------------------------- -------------- -------------- ------------

Loss before taxation - (2,829) (9,064)

Tax on loss - (29) (110)

----------------------------------------- -------------- -------------- ------------

Loss from discontinued operations - (2,858) (9,174)

----------------------------------------- -------------- -------------- ------------

5. Discontinued activities (continued)

Results from discontinued operations by segment

Advanced All other Total

Nutrition Health segments Corporate Discontinued

Q1 2021 Q1 2021 Q1 2021 Q1 2021 Q1 2021

All figures in

GBP000's (unaudited) (unaudited) (unaudited) (unaudited) (unaudited)

----------------- ---- -------------- -------------- -------------- -------------- --------------

Revenue - - - - -

Adjusted EBITDA - - - - -

Operating loss - - - - -

----------------- ---- -------------- -------------- -------------- -------------- --------------

Advanced All other Total

Nutrition Health segments Corporate Discontinued

Q1 2020 Q1 2020

Q1 2020 Restated Q1 2020 Q1 2020 Restated

All figures in

GBP000's (unaudited) (unaudited) (unaudited) (unaudited) (unaudited)

----------------- ---- -------------- -------------- -------------- -------------- --------------

Revenue 2 1,980 3,363 18 5,363

Adjusted EBITDA (118) (2,174) 389 (84) (1,987)

Operating loss (381) (2,597) 289 (101) (2,790)

----------------------- -------------- -------------- -------------- -------------- --------------

Advanced All other Total

Nutrition Health segments Corporate Discontinued

FY 2020 FY 2020 FY 2020 FY 2020 FY 2020

All figures in

GBP000's (audited) (audited) (audited) (audited) (audited)

----------------- ---- -------------- -------------- -------------- -------------- --------------

Revenue 2 5,573 9,230 22 14,827

Adjusted EBITDA (143) (9,151) 749 (181) (8,726)

Operating loss (394) (11,914) 3,818 (437) (8,927)

----------------------- -------------- -------------- -------------- -------------- --------------

6. Exceptional - restructuring, disposal and acquisition related items

Items that are material because of their size or nature,

non-recurring and whose significance is sufficient to warrant

separate disclosure and identification within the consolidated

financial statements are referred to as exceptional items. The

separate reporting of exceptional items helps to provide an

understanding of the Group's underlying performance.

Q1 2021 Q1 2020 FY 2020

All figures in GBP000's (unaudited) (unaudited) (audited)

----------------------------------------- ---- -------------- -------------- ------------

Acquisition related items - - 586

Exceptional disposal and restructuring

costs 593 134 1,528

Total exceptional items 593 134 2,114

----------------------------------------------- -------------- -------------- ------------

Exceptional restructuring expenses in Q1 2021 include GBP244,000

of staff costs relating to the Board's decision to make significant

changes to the Group's management team and bring in new management

, and GBP349,000 of costs including staff costs of GBP118,000

relating to disposals completed in the prior year.

7. Taxation

Q1 2021 Q1 2020 FY 2020

All figures in GBP000's (unaudited) (unaudited) (audited)

----------------------------------------- ---- -------------- -------------- ------------

Current tax expense

Analysis of charge in period

Current tax:

Current income tax expense on profits

for the period 755 864 3,141

Adjustment in respect of prior

periods - - 836

----------------------------------------------- -------------- -------------- ------------

Total current tax charge 755 864 3,977

Deferred tax expense

Origination and reversal of temporary

differences (1,045) (1,464) (3,490)

Deferred tax movements in respect

of prior periods - - (283)

----------------------------------------------- -------------- -------------- ------------

Total deferred tax credit (1,045) (1,464) (3,773)

Total tax (credit)/charge on continuing

operations (290) (600) 204

----------------------------------------------- -------------- -------------- ------------

8. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary equity holders of the Company by the

weighted average number of ordinary shares in issue during the

period.

Q1 2020

Q1 2021 Restated* FY 2020

(unaudited) (unaudited) (audited)

--------------------------------- -------------- -------------- ------------

Loss attributable to equity

holders of the parent (GBP000)

Continuing operations (717) (2,858) (23,749)

Discontinued operations - (2,858) (9,174)

Total (717) (5,716) (32,923)

--------------------------------- -------------- -------------- ------------

Weighted average number of

shares in issue (thousands) 667,926 558,891 625,466

Basic loss per share (pence)

Continuing operations (0.11) (0.51) (3.80)

Discontinued operations - (0.51) (1.47)

Total (0.11) (1.02) (5.26)

--------------------------------- -------------- -------------- ------------

* see note 5.

Diluted earnings/loss per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. This is done

by calculating the number of shares that could have been acquired

at fair value (determined as the average market price of the

Company's shares for the period) based on the monetary value of the

subscription rights attached to outstanding share options and

warrants. The number of shares calculated above is compared with

the number of shares that would have been issued assuming the

exercise of the share options and warrants.

Therefore, the Company is required to adjust the earnings per

share calculation in relation to the share options that are in

issue under the Company's share-based incentive schemes, and

outstanding warrants. However, as any potential ordinary shares

would be anti-dilutive due to losses being made there is no

difference between Basic loss per share and Diluted loss per share

for any of the periods being reported.

At 31 December 2020, a total of 2,944,955 potential ordinary

shares have not been included within the calculation of statutory

diluted loss per share for the period (30 September 2020:

1,426,663) as they are anti-dilutive. These potential ordinary

shares could dilute earnings/loss per share in the future.

9. Loans and borrowings

The Group's borrowing facilities includes a USD 15m RCF provided

by DNB Bank ASA (50%) and HSBC UK Bank PLC (50%). At 31 December

2020 the whole facility (USD 15m) was undrawn.

10. Share capital and share premium

Additional

paid-in

Share share

Number Capital capital

Allotted, called up and fully paid GBP000 GBP000

------------------------------------ ------------ --------- -----------

Ordinary shares of 0.1p each

Balance at 30 September 2019 667,685,612 668 399,601

Exercise of share options 705,887 - 202

Balance at 30 September 2020 668,391,499 668 399,803

------------------------------------ ------------ --------- -----------

During the period ended 31 December 2020, the Company issued a

total of 705,887 shares of 0.1p each to certain employees of the

Group relating to share options. Of which, 228,366 were exercised

at a price of 0.1 pence and 477,521 were exercised at a price of

42.5 pence.

11. Alternative profit measures and other metrics

Management has presented the performance measures Adjusted

EBITDA, Adjusted Operating Profit and Adjusted Profit Before Tax

because it monitors performance at a consolidated level using these

and believes that these measures are relevant to an understanding

of the Group's financial performance.

Adjusted EBITDA which reflects underlying profitability, is

earnings before interest, tax, depreciation, amortisation,

impairment, exceptional items including disposal and acquisition

related expenditure and is shown on the Income Statement.

Adjusted Operating Profit/Loss is operating loss before

exceptional items including disposal and acquisition related items

and amortisation and impairment of intangible assets excluding

development costs as reconciled below.

Adjusted Profit/Loss Before Tax is earnings before tax,

amortisation and impairment of intangibles assets excluding

development costs, exceptional items including disposal and

acquisition related expenditure as reconciled below. These measures

are not defined performance measures in IFRS. The Group's

definition of these measures may not be comparable with similarly

titled performance measures and disclosures by other entities.

Reconciliation of Adjusted Operating Profit/Loss to Operating

Loss

Continuing operations

FY 2020

Q1 2020

Q1 2021 Restated* Restated

All figures in GBP000's (unaudited) (unaudited) (audited)

------------------------------------------ ---- -------------- -------------- ------------

Revenue 29,030 24,691 105,565

Cost of sales (14,359) (11,752) (50,603)

------------------------------------------------ -------------- -------------- ------------

Gross profit 14,671 12,939 54,962

Research and development costs (1,745) (2,972) (7,282)

Other operating costs (9,285) (9,778) (33,337)

Depreciation and impairment (1,771) (1,453) (6,640)

Amortisation of capitalised development - - -

costs

Share of profit of equity accounted

investees net of tax (611) 211 150

------------------------------------------------ -------------- -------------- ------------

Adjusted Operating Profit/(Loss) 1,259 (1,053) 7,853

Exceptional - restructuring,

disposal and acquisition related

items (593) (134) (2,114)

Amortisation and impairment of

intangible assets excluding development

costs (3,918) (4,355) (16,613)

------------------------------------------------ -------------- -------------- ------------

Operating loss (3,252) (5,542) (10,874)

------------------------------------------------ -------------- -------------- ------------

Reconciliation of Loss Before Taxation to Adjusted Profit/Loss

Before Tax

Continuing operations

FY 2020

Q1 2020

Q1 2021 Restated* Restated

All figures in GBP000's (unaudited) (unaudited) (audited)

------------------------------------------ ---- -------------- -------------- ------------

Loss before taxation (515) (3,184) (22,571)

Exceptional - restructuring,

disposal and acquisition related

items 593 134 2,114

Amortisation and impairment of

intangible assets excluding development

costs 3,918 4,355 16,613

------------------------------------------------ -------------- -------------- ------------

Adjusted Profit/(Loss) Before

Tax 3,996 1,305 (3,844)

------------------------------------------------ -------------- -------------- ------------

* See note 5.

Other Metrics

FY 2020

Q1 2020

Q1 2021 Restated* Restated

All figures in GBP000's (unaudited) (unaudited) (audited)

---------------------------------- ---- -------------- -------------- ------------

Total R&D Investment

Research and development costs

- Continuing operations 1,745 2,972 7,282

- Discontinued operations - 1,048 2,725

---------------------------------------- -------------- -------------- ------------

1,745 4,020 10,007

Internal capitalised development

costs 1,060 897 4,583

------------

Total R&D investment 2,805 4,917 14,590

---------------------------------------- -------------- -------------- ------------

Liquidity

Following the refinancing in June 2019 a key financial covenant

is a minimum liquidity of GBP10m, defined as cash plus undrawn

facilities.

31 December

2020

All figures in GBP000's (unaudited)

--------------------------- -------------

Cash and cash equivalents 56,428

Undrawn bank facility 10,978

67,406

--------------------------- -------------

12. Net debt

Net debt is cash and cash equivalents less loans and borrowings

excluding balances held for sale.

31 December 31 December 30 September

2020 2019 2020

All figures in GBP000's (unaudited) (unaudited) (audited)

------------------------------------ ------------- ------------- --------------

Cash and cash equivalents 56,428 17,020 71,605

Loans and borrowings - current (4,209) (2,951) (5,339)

Loans and borrowings - non-current (104,077) (105,366) (103,819)

(51,858) (91,297) (37,553)

------------------------------------ ------------- ------------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFGPUBWPUPGGRB

(END) Dow Jones Newswires

February 22, 2021 02:00 ET (07:00 GMT)

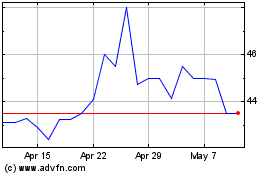

Benchmark (LSE:BMK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Benchmark (LSE:BMK)

Historical Stock Chart

From Apr 2023 to Apr 2024