Bank of Cyprus Holdings PLC Issue of Tier 2 Capital Notes - Replacement (0666W)

April 20 2021 - 8:23AM

UK Regulatory

TIDMBOCH

RNS Number : 0666W

Bank of Cyprus Holdings PLC

20 April 2021

Announ cement

Issue of Tier 2 Capital Notes

Nicosia, 16 April 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014.

Bank of Cyprus Holdings Public Limited Company (the "Company" or

"BOC Holdings" and, together with its subsidiary, Bank of Cyprus

Public Company Limited (the "Bank"), and the Bank's subsidiaries,

the "Group") announces today that the Company has successfully

launched and priced an issue of EUR300 mn unsecured and

subordinated Tier 2 Capital Notes (the "Notes") under its EMTN

Programme.

The issue was met with strong demand, attracting interest from

more than 140 institutional investors , with the final order book

almost 4 times over-subscribed and final pricing 37.5 bps tighter

from initial pricing indication. A number of long term, fundamental

institutional investors participated in the offering for the first

time, re-establishing the successful return of the Company to the

institutional capital markets.

The Notes were priced at par with a fixed coupon of 6.625% per

annum, payable annually in arrears and resettable on 23 October

2026. The maturity date for the Notes is 23 October 2031. The

Company will have the option to redeem the Notes early on any day

during the six-month period from 23 April 2026 to 23 October 2026,

subject to applicable regulatory consents.

It is expected that settlement will occur on 23 April 2021. The

Notes will be listed on the Luxembourg Stock Exchange's Euro MTF

market.

In addition to the pricing of the issue of the Notes by the

Company, the Bank has announced that it intends to purchase up to

the total nominal amount of its EUR250 mn Fixed Rate Reset Tier 2

Capital Notes due January 2027 (ISIN: XS1551761569) at a purchase

price of 105.50%, as more particularly described in a Tender Offer

Memorandum dated 13 April 2021. Please click here for further

details.

The issuance of the Notes further optimises the Group's capital

structure and is expected to increase the Group's Total Capital

ratio by c.100 bps to 19.7% pro forma for Helix 2. The issuance is

expected to be fully MREL eligible, contributing towards the Bank's

MREL requirements.

The transaction has also enhanced the diversification of the

Group's investor base, and the pricing outcome evidences market

recognition of the significant progress made in evolving its

financial profile.

Goldman Sachs International and HSBC acted as Global

Coordinators and Dealer Managers, and together with BNP Paribas,

Bank of America and JP Morgan acted as Joint Lead Managers. The

Bank acted as Co-Manager.

For further information, please contact Investor Relations at

investors@bankofcyprus.com .

[1] Based on the Group financial results as at 31 December 2020

pro forma for Helix 2.

Group Profile

The Bank of Cyprus Group is the leading banking and financial

services group in Cyprus, providing a wide range of financial

products and services which include retail and commercial banking,

finance, factoring, investment banking, brokerage, fund management,

private banking, life and general insurance. The Bank of Cyprus

Group operates through a total of 95 branches in Cyprus, of which

11 operate as cash offices. Bank of Cyprus also has representative

offices in Russia, Ukraine and China. The Bank of Cyprus Group

employs 3,573 staff worldwide. At 31 December 2020, the Group's

Total Assets amounted to EUR21.5 bn and Total Equity was EUR2.1 bn.

The Bank of Cyprus Group comprises Bank of Cyprus Holdings Public

Limited Company, its subsidiary Bank of Cyprus Public Company

Limited and its subsidiaries.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IODSEDFDSEFSEFL

(END) Dow Jones Newswires

April 20, 2021 09:23 ET (13:23 GMT)

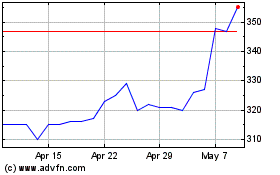

Bank Of Cyprus Holdings ... (LSE:BOCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

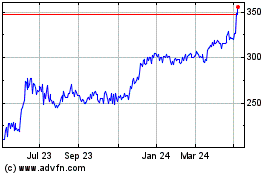

Bank Of Cyprus Holdings ... (LSE:BOCH)

Historical Stock Chart

From Apr 2023 to Apr 2024