TIDMBOD

RNS Number : 7058T

Botswana Diamonds PLC

29 March 2021

29(th) March 2021

Botswana Diamonds PLC ("Botswana Diamonds" or the "the

Company")

Unaudited Interim Statement and Financial Results for the Six

Months Ended 31 December 2020

Botswana Diamonds (AIM: BOD) is pleased to announce its

unaudited interim results for the six months ended 31 December 2020

("Period") during which time the Company has made significant

progress on its diamond development projects in both Botswana and

South Africa.

Highlights

-- A new Diamond bearing kimberlite discovered at Thorny River.

A three-dimensional model of the newly discovered River Kimberlite

pipe on the Thorny River property in South Africa was published in

December following a successful reverse circulation drilling

campaign. A sample of these drill chips produced eleven diamonds

and abundant kimberlitic indicators including G10 and eclogitic

garnets.

-- Following the Period end, the company entered into a

cooperation agreement to fund exploration of its prospecting

licence assets in Botswana with Diamexstrat Botswana Pty Ltd

("DESB"), which in turn has an alliance agreement with Burgundy

Diamond Mines Limited ("Burgundy" ASX: BDM).

-- Progress has been made on the Maibwe joint venture with core

being further sampled for fresh microdiamond work.

Botswana

-- Following the Period end, the company entered into a

cooperation agreement to fund exploration of its prospecting

licence assets in Botswana with Diamexstrat Botswana Pty Ltd

("DESB"), which in turn has an alliance agreement with Burgundy

Diamond Mines Limited ("Burgundy" ASX: BDM).

-- BOD's prospecting assets comprise the recently acquired

Sekaka Diamonds Exploration Pty Ltd ('Sekaka') database and

Prospecting Licenses, as well as the Prospecting Licences held by

BOD's subsidiary, Sunland Minerals Pty Ltd ("Sunland Minerals").

Highlights of this agreement include:

o DESB (and its partner, Burgundy) can earn up to a 70% interest

in BOD's Botswana Sunland Minerals and Sekaka's Prospecting

Licences.

o BOD can earn a 15% interest in Prospecting Licences held by

DESB (and partners) on the first US$1.5m spent on exploration by

DESB where BOD's database assists in the discovery of a primary

kimberlite.

o On 3rd party Prospecting Licences where targets are identified

in BOD's database, a joint earn-in will be negotiated at the

time.

o For new Botswana Prospecting Licences, DESB (and its partner,

Burgundy) can earn up to 70%.

o The KX36 diamond discovery is not part of the agreement and

remains 100% BOD owned.

-- Progress has been made on the Maibwe joint venture with core

being further sampled for fresh microdiamond work being undertaken

in Canada. The results of this microdiamond work will enable the

liquidator to make a decision on the value of the joint venture so

it can progress.

South Africa

-- A three-dimensional model of the newly discovered kimberlite

pipe on Thorny River, known as the River Kimberlite was published

in December following a high resolution ground gravity survey and a

reverse circulation drilling campaign. The best fit model showed an

East - West trending body gently dipping to the east with a surface

expression of 80 x 40m.

-- Samples from this drilling campaign were taken at one metre

intervals and twenty of these totalling about 500kg were selected

and submitted to an independent processing facility for assessment

through screening, dense media separation and hand sorting.

-- Following the Period end, the Company announced that 11

diamonds, 172 G10 pyrope garnets, 623 G9 pyrope garnets, 555

eclogitic garnets, 438 chromites and 268 chromium diopsides

(clinopyroxene) were recovered at sizes between -1.0+0.3mm.

Recoveries of a specific mineral species were capped at 20 grains

and thus this picture is a snapshot of the overall sample indicator

content.

-- Importantly, all the samples contained abundant kimberlitic

indicators. The diamonds are all notably of good colour and clarity

and are of commercial quality and in high demand by the market.

-- The next step is a detailed core drilling programme which is planned for the dry season.

Corporate

In January 2021 the company arranged a placing with existing and

new investors to raise GBP363,000 via the issue of 60,500,000 new

ordinary shares at a placing price of 0.6p per placing share.Each

placing share had one warrant attached with the right to subscribe

for one new ordinary share at 0.6p per new ordinary share for a

period of two years from 22 January 2021.

John Teeling

Chairman

29(th) March 2021

This release has been approved by James Campbell, Managing

Director of Botswana Diamonds plc, a qualified geologist

(Pr.Sci.Nat), a Fellow of the Southern African Institute of Mining

and Metallurgy, a Fellow of the Institute of Materials, Metals and

Mining (UK) and with over 34-years' experience in the diamond

sector.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014. The person who arranged

for the release of this announcement on behalf of the Company was

James Campbell, Director

A copy of this announcement is available on the Company's

website, at www.botswanadiamonds.co.uk

S

Enquiries:

Botswana Diamonds PLC

John Teeling, Chairman +353 1 833 2833

James Campbell, Managing Director +27 83 457 3724

Jim Finn, Director +353 1 833 2833

Beaumont Cornish - Nominated Adviser

Michael Cornish

Roland Cornish +44 (0) 020 7628 3396

Beaumont Cornish Limited - Broker

Roland Cornish

Felicity Geidt +44 (0) 207 628 3396

First Equity Limited - Joint Broker

Jason Robertson +44 (0) 207 374 2212

Blytheweigh - PR +44 (0) 207 138 3206

Megan Ray +44 (0) 207 138 3553

Rachael Brooks +44 (0) 207 138 3206

Said Izagaren +44 (0) 207 138 3206

Naomi Holmes +44 (0) 207 138 3206

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

Ross Murphy +353 (0) 1 661 4055

www.botswanadiamonds.co.uk

Botswana Diamonds plc

Financial Information (Unaudited)

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

Six Months Six Months Year

Ended Ended Ended

31 Dec 31 Dec 30 Jun

20 19 20

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

( 195 ( 194 ( 357

Administrative expenses ) ) )

Impairment of exploration and evaluation ( 34

assets - - )

-------------------- -------------------- ----------------

( 195 ( 194 ( 391

OPERATING LOSS ) ) )

( 195 ( 194 ( 391

LOSS BEFORE TAXATION ) ) )

Income tax

expense - - -

-------------------- -------------------- ----------------

( 195 ( 194 ( 391

LOSS AFTER TAXATION ) ) )

Exchange difference on translation ( 104

of foreign operations 48 - )

TOTAL COMPREHENSIVE INCOME FOR THE ( 147 ( 194 ( 495

PERIOD ) ) )

==================== ==================== ================

LOSS PER SHARE - basic and

diluted (0.03p) (0.03p) (0.06p)

==================== ==================== ================

CONDENSED CONSOLIDATED BALANCE

SHEET

31 Dec 31 Dec 30 Jun

20 19 20

unaudited unaudited audited

ASSETS: GBP'000 GBP'000 GBP'000

NON-CURRENT ASSETS

Intangible

assets 8,287 8,134 8,087

-------------------- -------------------- ----------------

8,287 8,134 8,087

-------------------- -------------------- ----------------

CURRENT ASSETS

Trade and other receivables 5 21 25

Cash and cash equivalents 39 13 18

-------------------- -------------------- ----------------

44 34 43

TOTAL ASSETS 8,331 8,168 8,130

-------------------- -------------------- ----------------

LIABILITIES:

CURRENT

LIABILITIES

( 486 ( 425 ( 433

Trade and other payables ) ) )

-------------------- -------------------- ----------------

TOTAL ( 486 ( 425 ( 433

LIABILITIES ) ) )

NET ASSETS 7,845 7,743 7,697

==================== ==================== ================

EQUITY

Share capital - deferred

shares 1,796 1,796 1,796

Share capital - ordinary

shares 1,803 1,569 1,678

Share premium 10,734 10,418 10,564

Share based payments

reserve 111 111 111

Retained ( 5,427 ( 5,035 ( 5,232

Deficit ) ) )

Translation ( 189 ( 133 ( 237

Reserve ) ) )

( 983 ( 983 ( 983

Other reserves ) ) )

-------------------- -------------------- ----------------

TOTAL EQUITY 7,845 7,743 7,697

==================== ==================== ================

CONDENSED CONSOLIDATED STATEMENT OF CHANGES

IN EQUITY

Share

based

Share Share Payment Retained Translation Other Total

Capital Premium Reserves Deficit Reserve Reserve Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30 June ( 4,841 ( 133 ( 983

2019 3,237 10,300 111 ) ) ) 7,691

Issue of

shares 128 128 - - - - 256

Share issue ( 10 ( 10

expenses - ) - - - - )

Total

comprehensive ( 194 ( 194

loss ) - - )

------------------ ------------- -------------------- ---------------- -------------------- -------------------- ----------------

At 31 December ( 5,035 ( 133 ( 983

2019 3,365 10,418 111 ) ) ) 7,743

Issue of

shares 109 153 - - - - 262

Share issue ( 7

expenses - ( 7 ) - - - - )

Total

comprehensive ( 197 ( 104 ( 301

loss - ) ) - )

------------------ ------------- -------------------- ---------------- -------------------- -------------------- ----------------

At 30 June ( 5,232 ( 237 ( 983

2020 3,474 10,564 111 ) ) ) 7,697

Issue of

shares 125 175 - - - - 300

Share issue

expenses - ( 5 ) - - - - (5 )

Total

comprehensive ( 195 ( 147

loss - - ) 48 - )

--------------------

At 31 December ( 5,427 ( 189 ( 983

2020 3,599 10,734 111 ) ) ) 7,845

================== ============= ==================== ================ ==================== ==================== ================

CONDENSED CONSOLIDATED CASH

FLOW Six Months Six Months Year

Ended Ended Ended

31 Dec 31 Dec 30 Jun

20 19 20

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the ( 195 ( 194 ( 391

period ) ) )

Impairment of exploration and evaluation

assets - - 34

Exchange

movements 1 ( 4 ) 5

-------------------- -------------------- ----------------

( 194 ( 198 ( 352

) ) )

Movements in Working

Capital 73 46 35

-------------------- -------------------- ----------------

NET CASH USED IN OPERATING ( 121 ( 152 ( 317

ACTIVITIES ) ) )

-------------------- -------------------- ----------------

CASH FLOWS FROM INVESTING

ACTIVITIES

Exploration costs ( 99 ( 175

capitalised ( 152) ) )

-------------------- -------------------- ----------------

NET CASH USED IN INVESTING ( 152 ( 99 ( 175

ACTIVITIES ) ) )

-------------------- -------------------- ----------------

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from share

issue 300 256 518

Share issue ( 10 ( 17

costs (5 ) ) )

-------------------- -------------------- ----------------

NET CASH GENERATED IN INVESTING

ACTIVITIES 295 246 501

-------------------- -------------------- ----------------

NET INCREASE/(DECREASE) IN CASH AND CASH

EQUIVALENTS 22 ( 5 ) 9

Cash and cash equivalents at beginning

of the period 18 14 14

Effect of foreign exchange ( 5

rate changes ( 1 ) 4 )

CASH AND CASH EQUIVALENT AT THE

OF THE PERIOD 39 13 18

==================== ==================== ================

Notes:

1. INFORMATION

The financial information for the six months ended 31 December

2020 and the comparative amounts for the six months ended 31

December 2019 are unaudited. The financial information above does

not constitute full statutory accounts within the meaning of

section 434 of the Companies Act 2006.

The Interim Financial Report has been prepared in accordance

with IAS 34 Interim Financial Reporting as adopted by the European

Union.

The accounting policies and methods of computation used in the

preparation of the Interim Financial Report are consistent with

those used in the Group 2020 Annual Report, which is available at

www.botswanadiamonds.co.uk

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. DIVID

No dividend is proposed in respect of the period.

3. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the period available to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the period.

Diluted loss per share is computed by dividing the loss after

taxation for the period by the weighted average number of ordinary

shares in issue, adjusted for the effect of all dilutive potential

ordinary shares that were outstanding during the period.

The following table sets forth the computation for basic and

diluted earnings per share (EPS):

Six Months Six Months

Ended Ended Year Ended

31 Dec 31 Dec 30 Jun

20 19 20

GBP'000 GBP'000 GBP'000

Numerator

For basic and diluted EPS retained

loss (195) (194) (391)

============== ============== ==============

No. No. No.

Denominator

Weighted average number of ordinary

shares 702,728,751 621,741,536 642,643,820

============== ============== ==============

Loss per share - Basic and Diluted (0.03p) (0.03p) (0.06p)

============== ============== ==============

The following potential ordinary shares are anti-dilutive and

are therefore excluded from the weighted average number of shares

for the purposes of the diluted earnings per share:

No. No. No.

Share options 11,410,000 11,410,000 11,410,000

============== ============== ==============

4. INTANGIBLE ASSETS

31 Dec 31 Dec 30 June

20 19

GBP'000 GBP'000 GBP'000

Exploration and evaluation assets:

Cost:

Opening balance 9,385 9,299 9,299

Additions 152 99 190

Exchange variance 48 - (104)

9,585 9,398 9,385

======== ======== ========

Impairment:

Opening balance 1,298 1,264 1,264

Provision for impairment - - 34

-------- -------- --------

1,298 1,264 1,298

======== ======== ========

Carrying Value:

Opening balance 8,087 8,035 8,035

======== ======== ========

Closing balance 8,287 8,134 8,087

======== ======== ========

Regional Analysis 31 Dec 31 Dec 30 Jun

20 19 20

GBP'000 GBP'000 GBP'000

Botswana 7,130 7,106 7,025

South Africa 1,109 1,022 1,038

Zimbabwe 48 6 24

8,287 8,134 8,087

========= ========= =========

Exploration and evaluation assets relate to expenditure incurred

in exploration for diamonds in Botswana, South Africa and Zimbabwe.

The directors are aware that by its nature there is an inherent

uncertainty in exploration and evaluation assets and therefore

inherent uncertainty in relation to the carrying value of

capitalized exploration and evaluation assets.

During the prior year, some licences held by the Group in its

subsidiary company Sunland Minerals (Pty) Ltd were relinquished.

Therefore, the directors decided to impair the costs of exploration

on these licences. Accordingly, an impairment of GBP34,394 (2019:

GBP435,139) had been recorded by the Group in the year ended 30

June 2020.

On 6 February 2017 the Group entered into an Option and Earn-In

Agreement with Vutomi Mining Pty Ltd and Razorbill Properties 12

Pty Ltd (collectively known as 'Vutomi'), a private diamond

exploration and development firm in South Africa. Pursuant to the

terms of the Agreement, Botswana Diamonds earned a 40% equity

interest in the project.

On 20 July 2020 the Company agreed to acquire the KX36 Diamond

discovery in Botswana, along with two adjacent Prospecting Licences

and a diamond processing plant. These interests are part of a

package held by Sekaka Diamonds. Botswana Diamonds plc acquired

100% of the shares of Sekaka. The vendor was Petra Diamonds. The

consideration comprised a cash payment of US$300,000 and a 5%

royalty on future revenues. The cash consideration is payable on a

deferred basis with US$150,000 payable on 27 November 2021 and the

balance on or before 27 November 2022. The acquisition was

completed on 30 November 2020.

The directors believe that there were no facts or circumstances

indicating that the carrying value of intangible assets may exceed

their recoverable amount and thus no impairment review was deemed

necessary by the directors.

The realisation of these intangible assets is dependent on the

successful discovery and development of economic diamond resources

and the ability of the Group to raise sufficient finance to develop

the projects. It is subject to a number of significant potential

risks, as set out below:

-- licence obligations;

-- exchange rate risks;

-- uncertainties over development and operational costs;

-- political and legal risks, including arrangements with

governments for licenses, profit sharing and taxation;

-- foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

-- title to assets;

-- financial risk management;

-- going concern; and

-- operational and environmental risks.

Included in additions for the period are GBP7,223 (June 2020:

GBP14,599) of wages and salaries and GBP30,210 (June 2020:

GBP76,910) of directors remuneration which has been capitalized.

This is for time spent directly on the operations rather than on

corporate activities.

5. SHARE CAPITAL

Deferred Shares - nominal value of 0.75p per share Number Share Capital Share Premium

GBP'000 GBP'000

At 1 July 2019 and 1 July 2020 239,487,648 1,796,157 -

At 30 June 2020 and 31 December 2020 239,487,648 1,796,157 -

============ ============== ==============

Ordinary Shares - nominal value of 0.25p per share Number Share Capital Share Premium

GBP'000 GBP'000

At 1 July 2019 576,555,235 1,441 10,300

Issued during the period 51,000,000 128 128

Share issue expenses - - (10)

At 31 December 2019 627,555,235 1,569 10,418

------------ -------------- --------------

Issued during the period 43,666,667 109 153

Share issue expenses - - (7)

At 30 June 2020 671,221,902 1,678 10,564

------------ -------------- --------------

Issued during the period 50,000,000 125 175

Share issue expenses - - (5)

At 31 December 2020 721,221,902 1,803 10,734

============ ============== ==============

Movements in share capital

On 18 July 2019, the Company raised GBP250,000 through the issue

of 50,000,000 new ordinary shares of 0.25p each at a price of 0.50p

per share to provide additional working capital and fund

development costs.

On 18 November 2019, a total of 1,000,000 warrants were

exercised at a price of 0.60p per warrant for GBP6,000.

On 28 January 2020, the Company raised GBP250,000 through the

issue of 41,666,667 new ordinary shares of 0.25p each at a price of

0.60p per share to provide additional working capital and fund

development costs. Each placing share has one warrant attached with

the right to subscribe for one new ordinary share at 0.6p per share

for a period of two years from 28 January 2020.

On 12 June 2020, a total of 2,000,000 warrants were exercised at

a price of 0.60p per warrant for GBP12,000.

On 7 September 2020, The Company raised GBP300,000 through the

issue of 50,000,000 new ordinary shares of 0.25p each at a price of

0.60p per share to provide additional working capital and fund

development costs. Each placing share has one warrant attached with

the right to subscribe for one new ordinary share at 0.6p per share

for a period of two years from 7 September 2020.

6. SHARE BASED PAYMENTS

WARRANTS

Dec 2020 Jun 2020 Dec 2019

Number of Warrants Weighted average Number of Warrants Weighted average Number of Warrants Weighted average

exercise price in exercise price in exercise price in

pence pence pence

Outstanding

at

beginning

of the

period 105,939,394 0.60 66,272,727 0.60 67,272,727 0.60

Issued 50,000,000 0.60 41,666,667 0.60 - -

Exercised - - (2,000,000) (1,000,000) 0.60

Expired - - - - - -

Outstanding

at end of

the period 155,939,394 0.60 105,939,394 0.60 66,272,727 0.60-

Further information of the warrants are detailed in Note 5

above.

7. POST BALANCE SHEET EVENTS

On 22 January 2021 the Company announced that it had raised

GBP363,000 via the placing of 60,500,000 new ordinary shares at a

placing price of 0.60p per share. Each placing share has one

warrant attached with the right to subscribe for one new ordinary

share at 0.6p per new ordinary share for a period of two years from

22 January 2021.

The net proceeds of the placing will fund ongoing diamond

exploration in South Africa and Botswana and will also provide the

Company with additional working capital.

On 16 February 2021 the Company announced it had entered into a

cooperation agreement to fund exploration of its prospecting

licence assets in Botswana with Diamexstrat Botswana Pty Ltd

("DESB"), which in turn has an alliance agreement with Burgundy

Diamond Mines Limited ("Burgundy" ASX: BDM). Botswana Diamonds

prospecting assets comprise the recently acquired Sekaka Diamonds

Exploration Pty Ltd database and Prospecting Licenses, as well as

the Prospecting Licences held by Botswana Diamonds subsidiary,

Sunland Minerals Pty Ltd.

Cooperation Agreement highlights;

- DESB (and its partner, Burgundy) can earn up to a 70% interest

in BOD's Botswana Sunland Minerals and Sekaka's Prospecting

Licences

- BOD can earn a 15% interest in Prospecting Licences held by

DESB (and partners) on the first US$1.5m spent on exploration by

DESB where BOD's database assists in the discovery of a primary

kimberlite

- On 3(rd) party Prospecting Licences where targets are

identified in BOD's database, a joint earn-in will be negotiated at

the time

- For new Botswana Prospecting Licences, DESB (and its partner, Burgundy) can earn up to 70%

8. APPROVAL

The Interim Report for the period to 31(st) December 2020 was

approved by the Directors on 29(th) March 2021.

9. AVAILABILITY OF REPORT

The Interim Statement will be available on the website at

www.botswanadiamonds.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KZGZFVVVGMZM

(END) Dow Jones Newswires

March 29, 2021 02:00 ET (06:00 GMT)

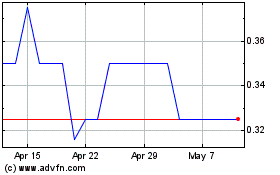

Botswana Diamonds (LSE:BOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Botswana Diamonds (LSE:BOD)

Historical Stock Chart

From Apr 2023 to Apr 2024