TIDMBOIL

RNS Number : 6796Y

Baron Oil PLC

11 September 2020

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

11 September 2020

Baron Oil Plc

("Baron" or "the Company")

Interim Results for the six months ended 30 June 2020

Baron Oil Plc (AIM:BOIL), the AIM-quoted oil and gas exploration

company focused on opportunities in SE Asia, Latin America and the

UK, announces its unaudited interim financial information and

results for the six months ended 30 June 2020.

Operations

Timor-Leste

-- Work on the Chuditch PSC has been progressed as far as

possible in the absence of the original raw seismic data. SundaGas

has written to ANPM requesting a satisfactory response and remedy

of the situation.

Peru

-- As soon as free movement in Peru is restored the Company

intends to push on with the drilling of the El-Barco-3X well.

Assuming that COVID restrictions are lifted by the end of the

calendar year, between May and August 2021 is a realistic

target.

UK

-- Inner Moray Firth - On licence P2478 (the Dunrobin Prospect),

the original seismic field data has been located, copied and is

being validated. We look forward to receiving the results of the

studies being carried out by the large European exploration and

production company in due course.

-- Dorset - The Joint Venture has agreed to relinquish Licence

P1918 (the Colter Prospect); work on PEDL330 & PEDL 345

continues.

Financial

-- GBP2,500,000 (gross) Placing and Subscription at 0.1p per

share was announced on 14 February 2020.

-- Available cash balance (excluding monies held as security for

bank guarantees in Peru and Timor-Leste) at 30 June 2020 of

GBP1,798,000 (30 June 2019: GBP605,000; 31 December 2019:

GBP347,000).

-- Net loss after finance costs and tax of GBP703,000 (June

2019: net loss of GBP307,000; 2019 year: net loss of GBP1,674,000),

representing a loss of 0.02p per share (June 2019: 0.02p; year to

31 December 2019: 0.01p).

-- On 22 April 2020, the Company acquired a 33.33% interest in

SundaGas (Timor-Leste Sahul) Pte. Ltd at a cost of US$188,000,

which is fully impaired under associated company accounting rules.

Baron also paid a further US$333,000 in respect of a guarantee bond

deposit which is included in receivables.

-- The increase in administration expenses is largely accounted

for by higher professional fees related to fund raising activities

which includes legal, registrar and corporate advisory costs. In

addition, there is a non-cash charge of GBP63,000 in respect of

share-based payments arising on the issue of Placing warrants and

options.

Malcolm Butler, Executive Chairman commented...

"There are encouraging signs that industry activity is beginning

to move again, although oil and gas prices remain depressed. We are

pleased that the seismic data on the Dunrobin area has finally been

located, enabling reprocessing work to take place. Once the COVID

issues have been resolved, we believe the drilling of El Barco-3X

should be able to move forward. The situation in Timor-Leste is

very frustrating but we will keep shareholders informed of

progress."

For further information, please contact:

Baron Oil Plc +44 (0)20 7117 2849

Dr Malcolm Butler, Executive Chairman

Andy Yeo, Managing Director

Allenby Capital Limited +44 (0)203 328 5656

Nominated Adviser and Joint Broker

Alex Brearley, Nick Harriss, Nick Athanas

Turner Pope Investments (TPI) Limited +44 (0)20 3657 0050

Joint Broker

Andy Thacker, Zoe Alexander

TL-SO-19-16 Production Sharing Contract ("Chuditch PSC"),

offshore Timor-Leste - Indirect 25% interest

As outlined in Baron's AGM statement in June, since signing the

Chuditch PSC in November 2019, SundaGas has progressed the project

as far as possible in the absence of the original raw seismic

acquisition data to which it is entitled under the terms of the

Chuditch PSC. SundaGas has still not received these data.

The Board believes that the failure of Timor-Leste's public

institution responsible for managing and regulating petroleum and

mining activities, Autoridade Nacional do Petróleo e Minerais

("ANPM"), to provide these data is the result of a conflicting

seismic licensing and revenue sharing agreement, including the

Kyranis 3D volume recorded in 2012 over the Chuditch area,

understood to have been signed between ANPM and TGS, a provider of

multi-client seismic data, an agreement of which SundaGas had no

knowledge at the time of the signing of the Chuditch PSC.

Baron supports SundaGas in its efforts to work constructively

with ANPM and others to make progress with the Chuditch PSC.

However, in order to fulfil the agreed specific technical aims of

the data reprocessing and its national training commitment, which

were previously agreed to by all parties, it is crucial for

SundaGas to access the original raw seismic data and be able to

closely direct the reprocessing work. Various seismic products

within Timor-Leste offshore now being marketed by TGS to third

parties will neither satisfy the Chuditch PSC obligations nor

provide the detailed local analyses required.

It should be noted that ANPM has also failed to take steps to

provide other necessary data required to fulfil the Chuditch PSC

obligations, such as raw 2D seismic data, that do not fall within

their agreement with TGS. This means that SundaGas has been unable

to make further progress in relation to the Chuditch PSC's 2020

work programme. SundaGas considers that these issues indicate that

ANPM is in breach of contract of the Chuditch PSC and is failing to

fulfil its obligations under Timor-Leste Petroleum Law.

Accordingly, SundaGas has also informed its partner in the Chuditch

PSC, TIMOR GAP, that it is unable to submit a 2021 work programme

and budget at this time.

During the first two years of the initial three-year term of the

Chuditch PSC, there is an obligation to reprocess 800 sq.

kilometres of 3D seismic and 2,000 line kilometres of 2D seismic

data and, if justified by the results of the reprocessing, drill a

well during the third year. The Board believes that, with ten

months having already elapsed since signing the Chuditch PSC, it

will be difficult, once the data access issues referred to above

have been satisfactorily resolved, to complete the required work

programme on the Chuditch PSC in sufficient time for a drilling

decision to be made.

Since June 2020, SundaGas has received no response or feedback

from ANPM on these specific matters. In seeking to expedite a

resolution to the situation, SundaGas has written to ANPM

requesting a satisfactory response and remedy of the data access

issues, the absence of which would mean that the project could not

move forward.

Peru - Block XXI, Onshore Licence - 100% interest

We continue to pursue efforts to drill the proposed 1,850 metre

El Barco-3X well to test for low-risk gas in the Mancora Sands and

higher-risk oil and gas in fractured basement, but progress has

been severely hampered by the ongoing COVID-19 issues. The Piura

region is one of the most infected areas in Peru and current

restrictions suggest that it will not open up for meetings until

early 2021. The local settlements of El Barco and Belisario remain

COVID free, since they have closed access to both villages. The

Company is required to hold three workshops to present its drilling

and environmental plans in Piura and in the villages and has to

complete negotiations to gain access to the site with the local

community President. None of this can take place until free

movement is allowed. Taking into account these issues, our current

indicative target for drilling El Barco-3X is between May and

August 2021.

Block XXI will remain in Force Majeure until the Company is able

to conclude the workshops and reach agreement regarding access to

the site with the local community. Baron will have approximately

six months left in which to drill when Force Majeure is lifted. The

pre-COVID estimate for site preparation and drilling of El Barco-3X

was US$1.2 million and updated estimates have been requested from

four drilling companies. The Company's aim continues to be to bring

in a new drilling and equity partner, but the previous negotiations

with an interested company based in Piura have been interrupted by

the COVID situation and have not yet been able to be resumed.

Meanwhile, the continuing focus is on ensuring that the licence

remains in good order and working with Perupetro to confirm the

three-year extension option for Block XXI, contingent on the

drilling of El-Barco-3X.

UK - Inner Moray Firth, Offshore Licence P2478 - Baron 15%

interest

Further to the update made in our 2020 AGM statement, Corallian

Energy Limited, the Operator of Licence P2478 which contains the

large Dunrobin and smaller Golspie prospects, has informed the

Joint Venture that the original seismic field data necessary to

perform specialised reprocessing has recently been located and

copied and is now being validated. Once this has been checked and

loaded, reprocessing work will be able to take place. The initial

Exclusivity period of the Work Sharing and Confidentiality

Agreement, which was signed with a large European exploration and

production company in April 2020, currently expires at the end of

September 2020 and we look forward to receiving the results of the

studies undertaken in due course.

UK - Dorset, Offshore Licence P1918; Onshore Licences PEDL330

& PEDL345 - Baron 8% interest

Licence P1918: The Joint Venture has agreed that in the present

oil price environment any development of the Colter South discovery

is sub-commercial and it has therefore been decided to give notice

to the UK Oil & Gas Authority to relinquish the licence at the

expiry date of the second term on 31 January 2021.

PEDL330 & PEDL345: The prospectivity of these onshore

Licences, to the south of Wytch Farm oilfield, remains under

evaluation in order to inform a decision on whether to request an

extension of the licences beyond the current term expiry date of 20

July 2021.

Baron Oil plc

Consolidated Income Statement

for the six months ended 30 June 2020

6 months 6 months

to to Year to

30 June 30 June 31 December

2020 2019 2019

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue - - -

Cost of sales - - -

Gross loss - - -

Exploration and

evaluation

expenditure (67) (53) (160)

Intangible asset

impairment (120) (6) (1,047)

Receivables impairment (14) (8) 16

Administration expenses 5 (367) (227) (442)

Profit/(loss) arising on

foreign exchange 37 (13) (41)

Operating loss (531) (307) (1,674)

------------------------- ----- ---------------------- ---------------------- ------------------------

Income from interest in

associated

undertaking (15) - -

Impairment of investment

in associated

undertaking (159) - -

Loss before interest and

taxation (705) (307) (1,674)

------------------------- ----- ---------------------- ---------------------- ------------------------

Finance cost - (1) (1)

Finance income 2 1 1

Loss on ordinary

activities

before taxation 6 (703) (307) (1,674)

Income tax

(expense)/benefit 7 - - -

Loss on ordinary

activities

after taxation (703) (307) (1,674)

------------------------- ----- ---------------------- ---------------------- ------------------------

Loss on ordinary

activities

after taxation is

attributable

to:

Equity shareholders (703) (307) (1,674)

Non-controlling

interests - - -

Loss on ordinary

activities

after taxation (703) (307) (1,674)

------------------------- ----- ---------------------- ---------------------- ------------------------

Earnings/(loss) per

share:

basic 8 (0.02)p (0.02)p (0.01)p

------------------------- ----- ---------------------- ---------------------- ------------------------

Diluted 8 (0.02)p (0.02)p (0.01)p

------------------------- ----- ---------------------- ---------------------- ------------------------

Baron Oil plc

Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2020

6 months 6 months

to to Year to

30 June 30 June 31 December

2020 2019 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Loss on ordinary activities

after

taxation attributable to the

parent (703) (307) (1,674)

Other comprehensive income

Currency translation

differences 88 6 (69)

Total comprehensive income for

the period (615) (301) (1,743)

-------------------------------- ---------------------- ---------------------- --------------------------

Total comprehensive income

attributable

to :

Owners of the company (615) (301) (1,743)

-------------------------------- ---------------------- ---------------------- --------------------------

Baron Oil plc

Consolidated Statement of Financial Position

at 30 June 2020

30 June 30 June 31 December

2020 2019 2019

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment - - -

Intangibles 14 1,101 5

Goodwill - - -

Investment in associated

company - - -

14 1,101 5

----------------------------------- ----- ---------------------- ---------------------- ----------------------

Current assets

Receivables 311 139 49

Cash and cash equivalents 1,798 605 347

Cash held as security for

bank guarantees 134 130 125

2,243 874 521

----------------------------------- ----- ---------------------- ---------------------- ----------------------

Total assets 2,257 1,975 526

----------------------------------- ----- ---------------------- ---------------------- ----------------------

Equity and liabilities

Capital and reserves attributable

to owners of the parent

Called up share capital 9 1,107 482 482

Share premium account 32,189 30,507 30,507

Share option reserve 137 74 74

Foreign exchange translation

reserve 1,731 1,718 1,643

Retained earnings (32,954) (30,884) (32,251)

Total equity 2,210 1,897 455

----------------------------------- ----- ---------------------- ---------------------- ----------------------

Current liabilities

Trade and other payables 36 73 64

Taxes payable 11 5 7

47 78 71

----------------------------------- ----- ---------------------- ---------------------- ----------------------

Total equity and liabilities 2,257 1,975 526

----------------------------------- ----- ---------------------- ---------------------- ----------------------

Baron Oil plc

Consolidated Statement of Cash Flows

for the six months ended 30 June 2020

6 months 6 months

to to Year to

30 June 30 June 31 December

2020 2019 2019

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Operating activities 10 (675) (478) (724)

Investing activities

Return from investment and

servicing of finance 2 1 1

Acquisition of intangible

assets (183) (1,035) (1,047)

(181) (1,034) (1,046)

------------------- -------------------------- --------------------------

Financing activities

Proceeds from issue of share

capital 2,307 408 408

Net cash (outflow)/inflow 1,451 (1,104) (1,362)

Cash and cash equivalents

at the beginning of the

period 347 1,709 1,709

Cash and cash equivalents

at the end of the period 1,798 605 347

=================== ========================== ==========================

As at 30 June 2020, bank deposits include amounts totalling US$160,000

(30 June and 31 December 2019: US$160,000) that are being held

in respect of guarantees and are not available for use until the

Group fulfils certain licence commitments in Peru. This is not

considered to be available cash and has therefore been excluded

from the cash flow statement.

Baron Oil plc

Consolidated Statement of Changes in Equity

for the six months ended 30 June 2020

6 months 6 months

to to Year to

30 June 30 June 31 December

2020 2019 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Opening equity 455 1,790 1,790

Shares issued net of costs 2,307 408 408

Loss for the period (703) (307) (1,674)

Share based payments 63 - -

Foreign exchange translation 88 6 (69)

Closing equity 2,210 1,897 455

========== ====================== ======================

Baron Oil plc

Notes to the Interim Financial Information

1. General Information

Baron Oil Plc is a company incorporated in England and Wales and

quoted on the AIM Market of the London Stock Exchange. The

registered office address is Finsgate, 5-7 Cranwood Street, London

EC1V 9EE.

The principal activity of the Group is that of oil and gas

exploration and production.

These financial statements are a condensed set of financial

statements and are prepared in accordance with the requirements of

IAS 34 and do not include all the information and disclosures

required in annual financial statements and should be read in

conjunction with the Group's annual financial statements as at 31

December 2019. The financial statements for the half period ended

30 June 2020 are unaudited and do not comprise statutory financial

statements within the meaning of Section 435 of the Companies Act

2006.

Statutory financial statements for the year ended 31 December

2019, prepared under IFRS, were approved by the Board of Directors

on 28 April 2020 and delivered to the Registrar of Companies.

2. Basis of Preparation

This consolidated interim financial information have been

prepared in accordance with International Financial Reporting

Standards ("IFRS") as adopted by the European Union and on the

historical cost basis, using the accounting policies which are

consistent with those set out in the Company's Annual Report and

Financial Statements for the year ended 31 December 2019. This

interim financial information for the six months to 30 June 2020,

which complies with IAS 34 'Interim Financial Reporting', was

approved by the Board on 10 September 2020.

3. Accounting Policies

Except as described below, the accounting policies applied are

consistent with those of the annual financial statements for the

period ended 31 December 2019, as described in those annual

financial statements.

The preparation of financial statements requires management to

make estimates and assumptions that affect the amounts reported for

assets and liabilities as at the balance sheet date and the amounts

reported for revenues and expenses during the period. The nature of

estimation means that actual outcomes could differ from those

estimates. Estimates and assumptions used in the preparation of the

financial statements are continually reviewed and revised as

necessary. Whilst every effort is made to ensure that such

estimates and assumptions are reasonable, by their nature they are

uncertain, and as such, changes in estimates and assumptions may

have a material impact in the financial statements.

i) Carrying value of property, plant and equipment and of

intangible exploration and evaluation fixed assets.

Valuation of petroleum and natural gas properties: consideration

of impairment includes estimates relating to oil and gas reserves,

future production rates, overall costs, oil and natural gas prices

which impact future cash flows. In addition, the timing of

regulatory approval, the general economic environment and the

ability to finance future activities through the issuance of debt

or equity also impact the impairment analysis. All these factors

may impact the viability of future commercial production from

developed and unproved properties, including major development

projects, and therefore the need to recognise impairment.

ii) Commercial reserves estimates

Oil and gas reserve estimates: estimation of recoverable

reserves include assumptions regarding commodity prices, exchange

rates, discount rates, production and transportation costs all of

which impact future cashflows. It also requires the interpretation

of complex geological and geophysical models in order to make an

assessment of the size, shape, depth and quality of reservoirs and

their anticipated recoveries. The economic, geological and

technical factors used to estimate reserves may change from period

to period. Changes in estimated reserves can impact developed and

undeveloped property carrying values, asset retirement costs and

the recognition of income tax assets, due to changes in expected

future cash flows. Reserve estimates are also integral to the

amount of depletion and depreciation charged to income.

Baron Oil plc

Notes to the Interim Financial Information

4. Segmental information

United South South Total

Kingdom America East

Asia

Six months ended 30 June GBP'000 GBP'000 GBP'000 GBP'000

2020

Unaudited

Revenue

Sales to external customers - - - -

_______ _______ _______ _______

Segment revenue - - - -

Segment result (332) (197) (174) (703)

Total net assets 2,067 143 - 2,210

United South South Total

Kingdom America East

Asia

Six months ended 30 June GBP'000 GBP'000 GBP'000 GBP'000

2019

Unaudited

Revenue

Sales to external customers - - - -

_______ _______ _______ _______

Segment revenue - - - -

Segment result (217) (82) (8) (307)

Total assets 1,762 135 - 1,897

United South South Total

Kingdom America East

Asia

Year ended 31 December 2019 GBP'000 GBP'000 GBP'000 GBP'000

Audited

Revenue

Sales to external customers - - - -

_______ _______ _______ _______

Segment revenue - - - -

Segment result (1,575) (57) (42) (1,674)

Total assets less liabilities 320 135 - 455

Baron Oil plc

Notes to the Interim Financial Information

(continued)

6 months 6 months

5. Administration expenses to to Year to

30 June 30 June 31 December

2020 2019 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Directors' and employee benefit

expense 160 141 258

Share-based payment 63 - -

Legal and professional fees 114 56 133

Other expenses 30 30 51

367 227 442

====================== ====================== ======================

6. Loss from operations

6 months 6 months

to to Year to

30 June 30 June 31 December

2020 2019 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

The loss on ordinary activities

before taxation includes:

Auditors' remuneration

Audit 13 11 21

Other non-audit services 1 1 5

Exploration and evaluation

expenditure - - 160

Impairment of intangible

assets 120 6 1,047

Impairment of foreign tax

receivables 14 8 (16)

(Profit)/Loss on exchange (37) 13 41

7. Income tax expense

There was no tax expense during the period (30 June 2019: nil;

31 December 2019: nil).

Baron Oil plc

Notes to the Interim Financial Information

(continued)

8. Earnings/(loss) per Share

6 months 6 months

to to Year to

30 June 30 June 31 December

2020 2019 2019

Unaudited Unaudited Audited

Pence Pence Pence

Earnings/(loss) per ordinary

share

Basic (0.02) (0.02) (0.01)

Diluted (0.02) (0.02) (0.01)

The earnings/(loss) per ordinary share is based on the Group's

loss for the period of GBP703,000 (30 June 2019: GBP307,000; 31

December 2019: GBP1,674,000) and a weighted average number of

shares in issue of 3,545,718,838 (30 June 2019: 1,440,221,731;

2019: 1,685,313,686).

9. Called up Share Capital

On 20 February 2020, the Company issued 735,714,280 Ordinary Shares

of 0.025p each at 0.1p per share, plus a further 1,764,285,720

Ordinary Shares of 0.025p each at 0.1p per share on 11 March 2020,

together yielding net proceeds after costs of GBP2,307,000.

10. Reconciliation of operating loss

to net cash outflow from operating activities

6 months 6 months

to to Year to

30 June 30 June 31 December

2020 2019 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Profit/(loss) for the period (703) (307) (1,674)

Depreciation and amortisation 279 6 1,047

Share based payments 63 - -

Income from interest in associated

undertaking 15 - -

Finance income shown as an

investing activity (2) (1) (1)

Foreign currency translation (41) 50 (4)

(Increase)/decrease in receivables (262) 364 454

Tax paid 20 (70) -

Increase/(decrease) in payables (44) (520) (546)

______ ______ _______

(675) (478) (724)

Baron Oil plc

Notes to the Interim Financial Information

(continued)

11. Related party transactions

During the period, the Company purchased technical services amounting

to GBP1,346 (30 June 2019: GBP3,523; 31 December 2019: GBP9,915)

from Tedstone Oil and Gas Limited, a company controlled by Mr

Jon Ford, a director.

During the preceding year to 31 December 2019, the Company purchased

administrative services amounting to GBP2,500 (30 June 2019: GBP2,500)

from Langley Associates Limited, a company controlled by Mr Geoff

Barnes, who was previously a director. There were no such payments

in the six month period ended 30 June 2020.

12. Financial Information

The unaudited interim financial information for period ended 30

June 2020 do not constitute statutory financial statements within

the meaning of Section 435 of the Companies Act 2006. The comparative

figures for the year ended 31 December 2019 are extracted from

the statutory financial statements which have been filed with

the Registrar of Companies and which contain an unqualified audit

report and did not contain statements under Section 498 to 502

of the Companies Act 2006.

Copies of this interim financial information document are available

from the Company at its registered office at Finsgate, 5-7 Cranwood

Street, London EC1V 9EE. The interim financial information document

will also be available on the Company's website www.baronoilplc.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPURCBUPUGRU

(END) Dow Jones Newswires

September 11, 2020 02:00 ET (06:00 GMT)

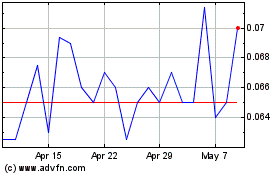

Baron Oil (LSE:BOIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baron Oil (LSE:BOIL)

Historical Stock Chart

From Apr 2023 to Apr 2024