TIDMBOKU

RNS Number : 9055K

Boku Inc

07 September 2021

Boku, Inc.

("Boku" or the "Company" and, together with its subsidiaries,

the "Group")

Interim results for the six months ended 30 June 2021

Strong performance across the Group

Boku, a leading global mobile payment and mobile identity

company, is pleased to announce the following unaudited interim

results for the six months ended 30 June 2021.

Highlights

Group

-- Group Revenues for H1 2021 up 38% to $34.2 million (H1 2020:

$24.7 million*)

o Organic Group revenue growth strong at 21.0% (excluding acquired

Fortumo revenues)

-- Group Adjusted EBITDA(**) for H1 2021 of $10.3 million is 61%

higher than H1 2020 (H1 2020: $6.4 million)

-- Operating Profit increased to $2.3 million for H1 2021 (H1 2020:

$0.2 million)

-- Net Profit before tax increased to $1.9 million (H1 2020: $0.09

million)

-- Twelve-month earnout period relating to the 2020 acquisition

of Fortumo Holdings Inc ("Fortumo") completed on 30 June 2021.

$5.4 million has been held in escrow during the earnout period.

o The earnout payment, based on Fortumo Adjusted EBITDA** performance

for the 12 months period ended 30 June 2021, is expected to

be $2.16 million, subject to final confirmation, which will

be paid to Fortumo's former shareholders by 5 October 2021,

with the balance of $3.24 million returned to Boku.

-- Group cash of $48.6 million at 30 June 2021 (30 June 2020: $36.2

million***)

o $11.25 million of the $20.0 million debt used to acquire Fortumo

paid down by 30 June 2021 with $3 million of the revolver

and $0.9 million of the term loan paid down since the year

end.

-- The average daily cash balance - a measure which smooths out

the effect of carrier and merchant payments, was $38.0 million

in June 2021 (June 2020: $25.7 million)

Payments division

-- H1 2021 Payments revenue increased by 40% to $30.7 million

(H1 2020: $22.0 million)

o Organic Payments revenue* growth of 20% to $26.3 million

(excluding Fortumo revenues acquired 1 July 2020) compared

to $22.0 million in H1 2020

-- Payments Adjusted EBITDA (**) increased by 33% to $11.2 million

(H1 2020 $8.4 million (*) )

-- Total Payment Volume ("TPV")**** of $4.0 billion in H1 2021,

an increase of 29% on H1 2020 ($3.1 billion)

-- 20.8 million new users made their first transaction with the

Group during the first half of the year, 91% up on the same

period in the previous year (H1 2020)

o At Group level the number of new users increased materially

due to the inclusion of transactional merchants from Fortumo;

excluding Fortumo data, new users increased by 8% to 11.7

million

-- 29.7 million Monthly Active Users ("MAU") of the Boku platform

in June 2021 (June 2020: 20.3 million), a 46% increase.

o Organic growth in Monthly Active Users (excluding Fortumo)

of 28%

-- H1 2021 take rate (Total Payments revenue divided by TPV) stable

at 0.77%, in line with H2 2020 (including Fortumo volumes)

-- Launches in H1 2021 with Google, Netflix, Apple, DAZN, Spotify,

Epic Games, Amazon, Riot Games and Tinder across both Direct

Carrier Billing ('DCB') and eWallets.

-- Boku has materially expanded its regulated payment activities

and is currently authorized to process regulated payments in

49 countries in Europe and Asia.

Identity division

-- Identity revenues increased by 30% to $3.5 million in H1 2021

(H1 2020: $2.7 million) and Adjusted EBITDA** losses reduced

to $0.9 million from H1 2020 ($2.3 million loss), in line with

the Board's expectations. H2 2021 costs expected to increase

as further investment is made.

-- Identity connections added in Spain, Italy and Indonesia, together

with a strengthening of the global partnership with Vodafone

Group

-- Strong growth from key existing customers complemented by a

ramp up in transaction volumes from new mobile wallet customers

in Indonesia

* 2020 H1 comparative excludes any revenues from Fortumo Holdings

Inc ('Fortumo') which was acquired on 1 July 2020

** Adjusted EBITDA (Earnings before interest, taxation, depreciation

and amortization): Adjusted for stock option expenses, Forex

gains/losses, Exceptional items and 'other income' item in 2021.

See reconciliation to profit per the income statement

*** Comparative group cash balance at 30 June 2020 of $80.7 million

included $44.5 million of cash held to pay for the acquisition

of Fortumo on 1 July 2020. Excluding this cash, the balances

were $36.2 million

**** TPV is the US$ value of transactions processed by the Boku platform

***** Adjusted operating expenditure is Gross Profit less Adjusted

EBITDA

Jon Prideaux, Boku's CEO, commented :

"Our short run performance has been strong, we think our

long-term future is brighter still. With positive momentum in both

the Payments and Identity businesses, I am confident in our ability

to meet the revised, increased expectations over the full

year."

Enquiries:

Boku, Inc.

Jon Prideaux, Chief Executive Officer +44 (0)20 3934

Keith Butcher, Chief Financial Officer 6630

Peel Hunt LLP (Nominated Adviser and Broker) +44 (0)20 7418

Edward Knight / Paul Gillam / Nick Prowting 8900

IFC Advisory Limited (Financial PR & IR)

Tim Metcalfe / Graham Herring / Florence +44 (0)20 3934

Chandler 6630

Notes to Editors

Boku Inc. (AIM: BOKU) is a leading global provider of mobile

payment and identity solutions. Its Mobile First Payments Network

'M1ST' features 330+ mobile payment methods, including mobile

wallets, direct carrier billing, and real-time payments schemes,

reaching 5.7 billion mobile payment accounts in 90 countries - all

through a single integration.

Customers that trust Boku to simplify sign-up, acquire new

paying users and prevent fraud include global leaders such as

Apple, Facebook, Google, Microsoft, Netflix, PayPal, Sony, Spotify

and Tencent.

Boku Inc. was incorporated in 2008 and is headquartered in

London, UK, with offices in the US, India, Brazil, China, Estonia,

France, Germany, Indonesia, Japan, Singapore, Spain, Taiwan and

Vietnam.

To learn more about Boku Inc., please visit:

https://www.boku.com .

Chief Executive Officer's Report

Into the M1ST

The Language of Selling

Willy Brandt the German Chancellor once said, "If I'm selling to

you, I speak your language. If I'm buying dann müssen sie Deutsch

sprechen". It's all very well to take your Visa card when you go on

holiday to Thailand, but, if you want to sell to Thais, accepting

Visa is not enough, you need accept PromptPay, Rabbit LinePay and

TrueMoney. That's how they want to pay.

Since 2009, approximately 1.7 billion people have joined the

global middle class and every year approximately 160 million more

join them. These people, this new middle class, are to be found

mostly in Asia, but also in the Middle East, Africa and Latin

America. In some respects they are like the traditional middle

class - they want to accumulate the same consumer goods, wear the

same branded clothes and get the latest gadgets and services. Their

accumulation of this stuff will be the prime motor of global growth

- it's estimated that whilst middle class spending in North

America, Europe and Japan will grow by an average of 0.5% per year,

the new middle class will increase their spending by 6%

annually.

Whilst the new middle class want the same things, they are also

different: they are Mobile First (or M1ST). This new middle class,

which we at Boku call the M1ST consumers, did not come to the

internet through the keyboard and the PC, they tapped on the glass

screen of a smartphone. 45% of consumers in the key emerging

markets have such devices. Importantly for our business, though,

they don't tend to pay with credit cards - card ownership is only

approximately 10%.

In China, for example, in 2020, 72% of all online spending was

on mobile wallets, specifically Alipay and WeChatPay. Credit and

debit cards combined accounted for just 17%. Globally mobile

wallets are the most used way that people buy things online, with

the 50% point passed in 2020. Wallets are also the most popular

payment method for the M1ST consumer. What's true in China is also

the same in India, with mobile wallets accounting for more payments

than cards. But India also illustrates another phenomenon: the

growth of Real Time Payments ("RTP"). India's UPI (Universal

Payment Interface) is the world's biggest RTP network; Thailand

with PromptPay and Brazil with PIX are other examples of countries

that have rapidly adopted such methods. Local payment methods are

complex, fragmented and unstandardised.

So what are merchants to do? The old playbook of supporting

international business on the back of Visa, MasterCard and perhaps

Amex and PayPal will no longer hack it. To reach the M1ST consumer

they need to accept the payment methods that they use.

It's the hard that makes it great

In the 1992 film A League of Their Own, the character of Jimmy

Duggan, a baseball coach (played by Tom Hanks) says to a player:

"It's meant to be hard. If it was easy everyone would do it. It's

the hard that makes it great".

Boku started its business by providing Direct Carrier Billing

("DCB") services and we have emerged as the market leader, with a

profitable growing cash generative business. It was hard to do. It

took a decade and considerable expenditure. To grow the Company

further we have also been focusing on implementing other more

mainstream payment methods like e-Wallets and Real Time

Payments.

Connecting to these different payment methods is not easy

either. There are no standards to follow. The tax, commercial and

regulatory issues are complex. To operate, a provider needs the

right combination of entities, licences, knowledge and

infrastructure. Merchants come to Boku because we provide these,

and through us they can access the consumers that they can't reach

any other way and will pay a premium over cards to do so. Because

it's hard.

With Boku now expanded beyond DCB, we now support a total of 330

payment methods in 89 countries. We call it the M1ST or Mobile

First Network. On Boku's M1ST network, users can be reached through

both eWallets and Real Time Payments, not just through mobile

operators. We have also implemented a unique multi-jurisdictional

regulatory framework, with appropriate licences obtained allowing

regulated payments to be processed in 49 countries. The M1ST

network allows us access to a Total Addressable Market (TAM)

conservatively estimated at 20 times that for DCB alone.

This is the Big Pond in which we are now swimming.

We differentiate ourselves through our mobile expertise and by

focusing on the consumer. We support the payment methods that the

M1ST consumer uses. With our decade-long heritage in supporting

mobile payments, we are well qualified to provide excellent

solutions for merchants looking to reach these high growth

consumers.

That mobile expertise is reflected in our dominance of Direct

Carrier Billing. It's a hard payment method to master, yet it's one

in high demand from merchants. DCB was the first mobile-first

payment method. Being the master of this technology has given us

payment connections to all of the planet's leading digital

companies. Apple, Amazon, Epic Games, Facebook, Google, Microsoft,

Netflix, Sony, Spotify, Tencent: all of them use Boku. We have the

most complete set of digital content merchants of any payment

provider.

Our challenge now having landed these customers is to expand the

relationships to achieve their potential. We need to cross sell

other M1ST payment methods. We've made a good start with a number

of merchants, including four of our tier one merchants, using Boku

for non DCB payment services, a figure that will grow over the

coming months.

The average international Boku merchant today uses about 30 out

of the 330 potential payment methods available worldwide through

Boku. To make a connection requires bespoke work, through

investment we will implement new tools that allow us to connect

merchants and payment methods more quickly.

In summary, our strategy is to build the best network for

reaching M1ST consumers, in our selected countries. We will go wide

enough to cover the critical payment methods and deep enough to

solve problems that others do not; these deep connections will

attract new merchants. Once landed we must expand their usage of

our network and, to do that, we must develop our systems to be plug

and play.

Wide and Deep; Land and Expand; Plug and Play.

We have built this strategy on a firm foundation of delivery

over our life as a public company, during which time we have

consistently grown revenues and Adjusted EBITDA**.

This six-month period has been no different. The fundamental

strengths of our model have shown through with strong performance

in both divisions.

In Identity, revenues increased by 30% to $3.5 million on the

back of increases in both the core market of North America and also

internationally, especially within Asia, where mobile wallets are

using Boku's Authenticate service to confirm the phone numbers of

users. New connections have also been launched in UK, France,

Spain, Italy and Germany.

The Payments business, accounting for about nine tenths of the

Group's revenues and all of its profits, has performed particularly

well. Considering that the comparison is to the first half of 2020,

when the initial COVID lockdowns stimulated demand for digital

services, an organic year-on-year revenue growth rate of 20% is a

creditable performance. The Fortumo Holdings Inc business

('Fortumo'), acquired in July 2020, performed in line with

expectations, but below the top end of the challenging Adjusted

EBITDA** earnout target.

Launches have been made across a wide variety of customers

including Amazon, Apple, Tinder, DAZN, Netflix, Spotify, Google and

Epic Games.

Payment volumes increased to $4.0bn in the half year and, most

importantly, the number of monthly active users of our services

increased by 28% on an organic basis against the first half of 2020

and by a whopping 46% when you include Fortumo users. The number of

new users also increased, with just under 21 million users making

their very first transaction at a Boku Group platform. Once again,

this figure is flattered by the contribution from Fortumo -

nevertheless the organic growth in new users was 8%.

These improving non-financial KPIs have fed through to improved

financial performance in the half year. More detail is provided in

the CFO report, but I am pleased to report revenues up 38% to $34.2

million (20% growth on an organic basis). Group Adjusted

EBITDA**was also up by 61%. These results generate the funds that

we will need to continue our journey in the Big Pond.

Outlook

Our short run performance has been strong, we think our

long-term future is brighter still. With positive momentum in both

the Payments and Identity businesses, I am confident in our ability

to meet the revised, increased expectations over the full year.

Jon Prideaux

Chief Executive Officer

6 September 2021

Chief Financial Officer's Report

The first half of 2021 was a strong period for Boku with

revenues and Adjusted EBITDA** increasing in both its Payments and

Identity divisions.

Our Payments division again performed strongly with organic

growth increasing by 20% when compared to the same period in 2020

as we saw growth from existing and new DCB and e-wallet connections

to international merchants. When Fortumo revenues are added

(Fortumo was acquired on 1 July 2020) that revenue growth increased

to 40%. Fortumo has performed well since we acquired the business

on 1 July 2020 which consolidated our dominance in the carrier

billing market. It's more SME focused merchant base and platform

complements Boku's focus on the world's largest digital merchants.

Fortumo's platform and relatively low-cost Estonian base will allow

the Group to grow its headcount to take advantage of the many

opportunities in front of us, at a lower cost than prior to the

acquisition.

Boku's Identity division also performed strongly with revenues

growing by 30% and Adjusted EBITDA** losses continuing to reduce to

$0.9 million. The business had primarily a US footprint when

acquired and we are particularly pleased to see the growth coming

from new merchants in markets outside of the US as the supply

network we have been building out begins to bear fruit.

The strong revenue growth from both divisions, up 38% to $34.2

million (2020 H1: $24.7 million) has resulted in 61% growth in

Group Adjusted EBITDA** in H1 2021 to $10.3 million (H1 2020: $6.4

million) and we report an increased net profit before tax of $1.9

million and strong operating cashflows of $8.4 million before

working capital movements - see note 7. Cash used in operations of

$8.9 million (after working capital movements) is primarily due to

timing (cash collected early from carriers in prior period and paid

to merchants in current period).

Financial review - Strong revenue and Adjusted EBITDA** growth

in both divisions

Group Income Statement to Adjusted EBITDA**

We are pleased to report another significant increase in Group

Revenues up 38% to $34.2 million and Adjusted EBITDA**, up 61% to

$10.3 million for the first half of 2021, (H1 2020: $6.4

million).

Group revenues for H1 2021 included a full six months of Fortumo

revenues (acquired 1 July 2021). Excluding Fortumo revenues, growth

was 21% higher than the same period in 2020 (H1 2020 $24.7

million).

Group Adjusted operating expenditure***** of $21.0 million for

H1 2021 is higher than H1 2020 due to the inclusion of Fortumo

costs, additional headcount in Sales and Operations along with

annual pay rises and slightly higher platform costs as we completed

our migration from two physical data centres into a cloud based

environment (AWS). Identity payroll costs remained low in H1 2021

as the business refined its headcount base but are expected to rise

modestly in H2 2021. Coronavirus restrictions again kept our travel

and entertainment and marketing spend down, which we expect to

return to pre-pandemic levels in the longer term.

Payments division

Payments division revenues, including Fortumo revenues (acquired

1 July 2020) increased 40.0% to $30.7 million.

Excluding Fortumo revenues, the Payments division revenues

increased by 20.0% to $26.3 million (H1 2020 $22.0 million). Total

Payment Volume ("TPV")**** increased by 29% to $4.0 billion (H1

2020: $3.1 billion). Gross margin of 95.9% remains high, but was

slightly lower than H1 2020 as we included Fortumo revenues which

have a slightly lower gross margin. These results were driven by a

46% increase in monthly active users to 29.7 million as we

completed multiple new connections with major merchants worldwide

in H1 2021 for both carrier billing and e-Wallets.

Average weighted take rate (revenue divided by TPV) for Payments

were broadly stable with H2 2020 rates at 0.7%, if we exclude

Fortumo. The addition of Fortumo revenues, who's merchants

primarily operate on the higher take rate settlement model helped

marginally raise the take rate. Since IPO, Boku has not reduced its

rates to any of its merchants nor has it lost a material merchant

or connection.

Adjusted Operating expenditure***** increased as we added

Fortumo costs, but also invested in operational headcount, sales

and marketing, however operational leverage remains strong and, as

a result, Payments Adjusted EBITDA** increased by 33% to $11.2

million (H1 2020: $8.4 million). This investment is expected to

continue in H2 and into 2022.

Fortumo earnout

Boku completed the acquisition of DCB payments company Fortumo

Holdings Inc ('Fortumo') on 1 July 2020, consolidating Boku's

leading position in the global DCB payments market, for a maximum

consideration of $45.0 million (enterprise value $41.0 million net

of acquired cash). $5.4 million of this consideration was placed

into an escrow account and was subject to Fortumo meeting earnout

targets.

The earnout payment, based on Fortumo Adjusted EBITDA**

performance for the 12 month earnout period ended 30 June 2021, is

expected to be $2.16 million, subject to final confirmation, which

will be paid to Fortumo's former shareholders by 5 October 2021,

with the balance of $3.24 million returned to Boku. The maximum

earnout target was a 'stretch target' Adjusted EBITDA**,

considerably higher than Fortumo was expected to achieve and which

the market was guided to.

The excess amount repayable to Boku over the fair value on the

Balance Sheet at 31 December 2020 of $1.08 million has been shown

as 'Other Income' in the Income Statement. It has been excluded

from Adjusted EBITDA** as a non-trading, non-recurring item.

Fortumo primarily focuses on providing mobile payment solutions

to over 400 small-to-medium sized enterprises, but also services

larger merchants including Google, Amazon, Epic and Tencent.

Identity division

Identity revenues recovered strongly in the first half, growing

30% to $3.5 million (H1 2020: $2.7 million) as we saw strong growth

from key existing customers complemented by a ramp up in

transaction volumes from new mobile wallet customers in new

geographies such as Indonesia. We continued to build out Identity

supply with new connections added in Spain, Italy and Indonesia,

together with a strengthening of the global partnership with

Vodafone Group.

A djusted operating expenditure***** for Identity remained low

in H1 2021 due to continued low travel and marketing spend as a

result of the COVID 19 pandemic although we expect H2 2021

operating expenses to be higher as we continue to invest in the

business. The strong revenue growth and low-cost base resulted in a

significantly reduced Adjusted EBITDA** loss of $0.9 million,

(2020: $2.0 million Adjusted EBITDA** loss). In light of the EBITDA

loss, an impairment review was performed which indicated that that

no impairment was needed for the Identity CGU.

Adjusted Operating Expenditure*****

Unaudited Unaudited

Period ended Period ended

30-Jun 30-Jun

2021 2020

$'000 $'000

Gross profit 31,279 22,448

Adjusted EBITDA** (10,308) (6,441)

Adjusted Operating Expenditure 20,971 16,007

---------------- ----------------------

Group Operating Profit

Group Operating Profit for H1 2021 improved by $2.1 million to

$2.3 million compared to $0.2 million for the same period in 2020.

This can be broken down as follows:

-- Other income of $1.08 million relates to the difference

between the fair value of contingent consideration as determined at

31 December 2020 (Annual report note 26: $3.24 million) and the

actual amount now agreed to be paid to Fortumo shareholders of

$2.16 million. This amount has been excluded from Adjusted EBITDA**

as a non-trading, non-recurring item.

-- Foreign Exchange movements resulted in a small loss of $0.04

million (H1 2020: $0.2 million gain)

-- Stock Option Expenses increased to $5.3 million from $3.0

million in H1 2020 as Boku issued Restricted Stock Units ("RSUs")

to newly joined Fortumo staff for the first time in the period in

line with its policy of offering all staff share based awards

annually. RSU and stock option charges are spread over three and

four years respectively, and in line with their vesting conditions,

from the date of grant.

-- Exceptional Items in the period were $0.03 million (2020:

$0.9 million). The H1 2020 comparative costs were primarily related

to the acquisition of Fortumo which completed on 1 July 2020.

-- Financing expenses increased to $0.370 million in 2021 (2020:

$0.164 million) primarily due to interest on the $20.0 million

loans used to finance the Fortumo acquisition which were taken out

on 30 June 2020. However, it should be noted that $11.25 million of

this debt had been paid down by 30 June 2021 and the interest

payments have been reducing as a result.

Balance Sheet and Cashflow

-- Like for Like Group cash balances were $48.6 million on 30

June 2021 (30 June 2020: $36.2 million***).

-- To part finance the acquisition of Fortumo which completed on

1 July 2020, Boku took on a debt facility of USD $20.0 million with

Citibank in June 2020 which was fully drawn at 30 June 2020. This

facility was split:

o $10 million term loan repayable over 4 years; and

o $10 million Revolving Credit Facility ("RCF") available to be

drawn down in EUR, GBP or USD.

o As at 30 June 2021 the $10 million RCF had been paid down in

full using surplus cash balances, with $3m repaid in the period and

the term loan had been paid down by $1.25 million in accordance

with the repayment terms ($937,500 repaid in the period).

-- The average daily cash balance - a measure which smooths out

the effect of carrier and merchant payments, was $38.0 million in

June 2021 (June 2020: $25.7 million).

-- We assessed our goodwill and intangibles for impairment and

deemed that no impairment exists at 30 June 2021.

Principal Risks and Uncertainties

The principal risks and uncertainties facing the Group remain

broadly consistent with the Principal Risks and Uncertainties

reported in Boku's 2020 Annual Report. Since the 2020 Annual

Report, the Board have been monitoring and mitigating the effects

of global events on the Group's business.

Going concern (including consideration of COVID-19)

In carrying out the going concern assessment, the Directors have

considered a number of scenarios, taking account of the possible

continued impact of the COVID-19 pandemic, in relation to revenue

forecasts for the next 12 months. Given the current uncertainties,

it is not yet fully clear when the global economic activity will

fully return to pre pandemic levels, therefore, we continue to

prepare the business for varying levels of performance. To that

end, we have continued to model the effects of differing levels of

sales performance along with the measures we can take to ensure

that the Group remains within its available working capital.

In reaching their going concern assessment, the Directors have

considered the foreseeable future, a period extending at least 12

months from the date of approval of this interim financial report.

This assessment has included consideration of the forecast

performance of the business, as noted above, the payment of

contingent consideration, and the cash and financing facilities

available to the Group. Considering all this analysis, the

Directors are satisfied that, the Group has sufficient cash

resources over the period of at least 12 months from the date of

approval of the interim consolidated financial statements. As such,

the interim consolidated financial statements have been prepared on

a going concern basis.

Looking Ahead

We expect the strong revenue growth in the Payments division to

continue in the second half and into 2022. To fully exploit the

'big pond' opportunity and to build out the Boku 'mobile first'

(M1ST) network to deliver that, we expect Adjusted operational

expenditure***** in the Payments division to increase more quickly

in the second half and into 2022 as we invest in sales and

marketing as well as technology and operational headcount. However,

we do expect Adjusted Operating expenditure***** to flatten again

in FY23 and beyond after this one- time investment.

We also expect the strong revenue growth in Boku's Identity

division to continue in 2022. The Identity business was initially

more adversely impacted by Covid-19 than Payments with volumes from

existing merchants reduced as their businesses slowed and direct

sales and marketing events were difficult. However, costs were

carefully managed and the supply side investments we made delivered

revenue growth in the first half which we look to support in the

second half and into 2022 with modestly increased operational

expenses investment primarily in headcount as the business

continues to grow revenues and moves towards cash breakeven.

With both divisions performing strongly in the first half and

with a substantial opportunity to expand our addressable market in

Payments we are confident for the future.

Keith Butcher

Chief Financial Officer

6 September 2021

* 2020 H1 comparative excludes any revenues from Fortumo Holdings

Inc ('Fortumo') which was acquired on 1 July 2020

** Adjusted EBITDA (Earnings before interest, taxation, depreciation

and amortization): Adjusted for stock option expenses, Forex

gains/losses, Exceptional items and 'other income' item in 2021.

See reconciliation to profit per the income statement

*** Comparative group cash balance at 30 June 2020 of $80.7 million

included $44.5 million of cash held to pay for the acquisition

of Fortumo on 1 July 2020. Excluding this cash, the balances

were $36.2 million

**** TPV is the US$ value of transactions processed by the Boku platform

***** Adjusted operating expenditure is Gross Profit less Adjusted

EBITDA

Consolidated Statement of Comprehensive Income

Note (Unaudited) (Unaudited) Period ended

Period ended 30-Jun 2021 30 -Jun 2020

$'000 $'000

============================================= ======= ============================= ===========================

Revenue 3 34,224 24,690

Cost of sales (2,945) (2,242)

============================================= ======= ============================= ===========================

Gross profit 31,279 22,448

Other Income (non-recurring) 8 1,080 -

Administrative expenses (30,083) (22,227)

============================================= ======= ============================= ===========================

Operating profit analysed as:

Adjusted EBITDA** 10,308 6,441

Other Income 8 1,080 -

Depreciation and amortisation (3,742) (2,455)

Share Option expense (5,297) (3,009)

Foreign exchange (gains)/losses (38) 164

Exceptional items (included in administrative

expenses) (35) (920)

============================================= ======= ============================= ===========================

Operating profit 2,276 221

Finance income 4 14 30

Finance expense 4 (370) (164)

============================================= ======= ============================= ===========================

Profit before tax 1,920 87

Tax expense (190) (51)

============================================= ======= ============================= ===========================

Net Profit for the period attributable to equity

holders of the parent company 1,730 36

====================================================== ============================= ===========================

Other comprehensive losses net of tax

Items that will or may be reclassified to

profit or loss

Foreign currency translation loss (863) (427)

Total comprehensive loss for the period (863) (427)

====================================================== ============================= ===========================

Total comprehensive profit /(loss) for the period

attributable to equity holders of the parent

company 867 (391)

====================================================== ============================= ===========================

Profit/(loss) per share for loss attributable to the

owners of the parent during the year

====================================================== ============================= ===========================

Basic EPS ($) 0.0059 (0.0001)

====================================================== ============================= ===========================

Fully diluted EPS ($) 0.0057 (0.0001)

====================== ========= =================

**Earnings before interest, tax, depreciation, amortisation,

share-based payment, foreign exchange gains/(losses), other income

and exceptional items.

Consolidated Statement of Financial Position

Note ( Unaudited) (Audited)

30-Jun 2021 31-Dec 2020

$'000 $'000

====================================================== ===== ============== =============

Non-current assets

Property, plant and equipment 2,887 3,771

Intangible assets 64,413 65,559

Deferred income tax assets 480 483

====================================================== ===== ============== =============

Total non-current assets 67,780 69,813

============================================================= ============== =============

Current assets

Trade and other receivables 89,270 92,535

Cash and cash equivalents 5 47,887 61,290

Restricted cash 5 734 1,414

====================================================== ===== ============== =============

Total current assets 137,891 155,239

============================================================= ============== =============

Total assets 205,671 225,052

============================================================= ============== =============

Current liabilities

Trade and other payables 115,901 136,779

Loans and borrowings 6 1,125 1,438

Lease liabilities 6 870 1,436

====================================================== ===== ============== =============

Total current liabilities 117,896 139,653

============================================================= ============== =============

Non-current liabilities

Other payables 1,786 862

Deferred tax liabilities 221 228

Loans and borrowings 6 7,250 10,813

Lease Liabilities 6 1,540 1,742

====================================================== ===== ============== =============

Total non-current liabilities 10,797 13,645

============================================================= ============== =============

Total liabilities 128,693 153,298

============================================================= ============== =============

Net assets 76,978 71,754

============================================================= ============== =============

Equity attributable to equity holders of the company

Share capital 29 29

Share premium 244,410 240,053

Foreign exchange reserve (1,170) (307)

Retained losses (166,291) (168,021)

====================================================== ===== ============== =============

Total equity 76,978 71,754

============================================================= ============== =============

Consolidated Condensed Statement of Cash Flows

Note (Unaudited) (Unaudited) Period ended

Period ended 30-Jun 2020

30-Jun 2021 $'000

$'000

================================================================= ===== ================= =========================

Cash (used in)/from operations 7 (8,886) 5,561

Income taxes paid (188) (60)

================================================================= ===== ================= =========================

Net cash (used in)/ from operating activities (9,074) 5,501

================================================================= ===== ================= =========================

Investing activities

Purchase of property, plant and equipment (205) (395)

Purchased of software development (2,348) (1,392)

Restricted cash (net) 680 40

Interest received 14 30

================================================================= ===== ================= =========================

Net cash used in investing activities (1,859) (1,717)

Financing activities

Repayment of lease liabilities (994) (1,077)

Issue of common stock on exercise of options and RSUs 1,031 284

Interest paid on borrowings (191) (15)

Proceeds from issue of new ordinary shares for acquisition - 25,129

Share issue costs - (654)

Proceeds from line of credit - 20,000

Loan issue costs - (501)

Repayment of line of credit (3,937) (2,092)

Net cash (used in)/ from financing activities (4,091) 41,074

================================================================= ===== ================= =========================

Net (decrease)/increase in cash and cash equivalents (15,024) 44,858

Effect of foreign currency translation on cash and cash

equivalent 1,621 259

Cash and cash equivalents at beginning of period 61,290 34,747

================================================================= ===== ================= =========================

Cash and cash equivalents at end of period 47,887 79,864

----------------------------------------------------------------- ----- ----------------- -------------------------

Notes to the Consolidated Financial Information

1. Corporate Information

The consolidated financial information represents the results of

Boku Inc. ("the Company") and its subsidiaries (together referred

to as "the Group").

Boku Inc. is a company incorporated and domiciled in the United

States of America. The registered office of the Company is located

at 735 Battery St, 2nd Floor, San Francisco, CA 94111, United

States.

The Company's shares are listed on the AIM Market of the London

Stock Exchange ("AIM").

The principal business of the Group is the provision of mobile

billing and identity solutions for mobile network operators and

merchants. These solutions enable merchants to accept online

payments, simplify transactions and avoid fraud, especially on

mobile devices.

The Board of Directors approved this interim financial

information on 6 September 2021.

2. Basis of preparation and accounting policies

These interim consolidated financial statements have been

prepared using accounting policies based on International Financial

Reporting Standards (IFRS and IFRIC Interpretations) issued by the

International Accounting Standards Board ("IASB"). They do not

include all disclosures that would otherwise be required in a

complete set of financial statements and should be read in

conjunction with the 31 December 2020 Annual Report. The financial

information for the half years ended 30 June 2021 and 30 June 2020

does not constitute full financial statements and both periods are

unaudited.

The annual financial statements of Boku Inc., ('the group') are

prepared in accordance with IFRS as issued by the IASB. The Annual

Report and Financial Statements for 2020 have been issued and are

available on the group's investor relations' website:

https://www.boku.com/investor-relations/reports-documents. The

Independent Auditors' Report on the Annual Report and Financial

Statements for the year ended 31 December 2020 was unqualified and

did not draw attention to any matters by way of emphasis.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 31 December 2020 annual financial statements, except for

those that relate to new standards and interpretations effective

for the first time for periods beginning on (or after) 1 January

2021 and will be adopted in the 2021 financial statements. There

are deemed to be no new and amended standards and/or

interpretations that will apply for the first time in the next

annual financial statements that are expected to have a material

impact on the Group.

Going concern

The interim consolidated financial statements have been prepared

on a going concern basis. The ability of the Group to continue as a

going concern is contingent on the ongoing viability of the Group.

The Group meets its day-to-day working capital requirements through

its cash balances and has a bank facility that it can use. The move

to remote working and social distancing has increased the

importance of mobile payment solutions to our customers, potential

customers and wider consumer market base and as a result the Group

saw continued revenue growth in the current period.

The Directors have prepared cash-flow forecasts covering a

period of at least 12 months from the date of approval of the

financial statements, with the forecasts and projections, taking

account of reasonable possible changes in trading performance. They

show that the Group expects to be able to operate within the level

of its current cash resources and bank facilities. Further

information on the Group's borrowings and available facilities is

given in Note 6.

Furthermore, in carrying out the going concern assessment, the

directors have considered a number of scenarios, taking account of

the possible the continued impact of the pandemic, including

changes in sales volumes and the timing of settlement of existing

debts together with cost savings associated with these changes and

the directors have the ability to identify further cost savings if

necessary, to help mitigate any impact on cash outflows.

Having assessed the principal risks and the other matters

discussed in connection with the going concern statement, the

Directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future. For these reasons, they continue to adopt the going concern

basis of accounting and deem there to be no emphasis over going

concern, in preparing the financial information.

3. Segmental analysis

(a) Revenue from operations (Unaudited) (Unaudited)

30-Jun 2021 30-Jun 2020

$'000 $'000

============================= ============ ============

Revenue arises from: 34,224 24,690

============ ============

Provision of services

============================= ============ ============

(b) Operating segments

The Group's main operating segments are based on its main

revenue generating activities. For each of the segments, the Group

CEO and CFO review internal management reports to profit before

taxation, monthly. The following summary describes the operations

in each of the Group's reportable segments.

Payments business segment: provision of a payment platform which

enables mobile phone users to buy goods and services and charge

them to their mobile phone bill or prepaid balance. Boku also

provides connections to eWallets and other local payments methods

for its international merchants.

Identity business segment: Provision of identity services which

are used to simplify transactions or combat fraud.

Operating segment information under the primary reporting format

is disclosed below:

H1 2021 Payments Identity Total

$'000 $'000 $'000

----------------- ------------------------- ------------------

Fee Revenue 30,705 3,519 34,224

Cost of sales (1,255) (1,690) (2,945)

---------------------------------------------------- ----------------- ------------------------- ------------------

Gross Profit 29,450 1,829 31,279

Other Income 1,080 - 1,080

---------------------------------------------------- ----------------- ------------------------- ------------------

Administrative Expenses (25,966) (4,117) (30,083)

---------------------------------------------------- ----------------- ------------------------- ------------------

Operating Profit/(loss) analysed as:

Adjusted EBITDA** 11,171 (863) 10,308

Other income 1,080 - 1,080

Depreciation and amortisation (3,168) (574) (3,742)

Stock Option expense (4,592) (705) (5,297)

Foreign exchange gains/(losses) 73 (111) (38)

Exceptional items (included in administrative

expenses) - (35) (35)

Operating Profit/(loss) 4,564 (2,288) 2,276

Finance income 14 - 14

Finance expense (370) - (370)

---------------------------------------------------- ----------------- ------------------------- ------------------

Profit/(loss) before tax 4,208 (2,288) 1,920

---------------------------------------------------- ----------------- ------------------------- ------------------

H1 2020 Payments Identity Total

$'000 $'000 $'000

---------------- ---------------------- -----------------

Fee Revenue 22,032 2,658 24,690

Cost of sales (391) (1,851) (2,242)

--------------------------------------------------------- ---------------- ---------------------- -----------------

Gross Profit 21,641 807 22,448

Administrative Expenses (18,914) (3,313) (22,227)

--------------------------------------------------------- ---------------- ---------------------- -----------------

Operating loss analysed as:

Adjusted EBITDA** 8,478 (2,037) 6,441

Depreciation and amortisation (2,042) (413) (2,455)

Stock Option expense (2,928) (81) (3,009)

Foreign exchange gains/(losses) 139 25 164

Exceptional items (included in administrative expenses) (920) - (920)

Operating Profit/(loss) 2,727 (2,506) 221

Finance income 30 - 30

Finance expense (154) (10) (164)

--------------------------------------------------------- ---------------- ---------------------- -----------------

Profit/(Loss) before tax 2,603 (2,516) 87

--------------------------------------------------------- ---------------- ---------------------- -----------------

4. Finance income and expenses

(Unaudited) (Unaudited)

30-Jun 2021 30-Jun 2020

$'000 $'000

=============================================================== ================ ============

Finance income 14 30

================ ============

Interest income from bank deposits

=============================================================== ================ ============

Total 14 30

=============================================================== ================ ============

Finance expenses

Interest on bank loans 243 -

Interest on lease liabilities 116 149

Other interest payable (including interest paid for factoring) 11 15

Total 370 164

=============================================================== ================ ============

Net finance expenses 356 134

=============================================================== ================ ============

5. Cash and cash equivalents and restricted cash

(Unaudited) (Audited)

30-Jun 2021 31-Dec 2020

$'000 $'000

Cash and cash equivalents 47,887 61,290

========================== ============ ============

Restricted cash 734 1,414

========================== ============ ============

Total cash 48,621 62,704

========================== ============ ============

The restricted cash primarily includes e-money received but not

yet paid to merchants (in transit), cash held in the form of a

letter of credit to secure a lease agreement for the Company's San

Francisco office facility and a certificate of deposit held at a

financial institution to collateralise Company credit cards.

6. Loans and borrowings

(Unaudited) (Audited) 31-Dec 2020

30-Jun 2021 $'000

$'000

======================================== ============ =====================

Current

Bank loans (secured) net of loan costs 1,125 1,438

Obligations under lease contracts 870 1,436

Total 1,995 2,874

Non-current

Bank loans (secured), net of loan costs 7,250 10,813

Obligations under lease contracts 1,540 1,742

---------------------------------------- ------------ ---------------------

Total 8,790 12,555

======================================== ============ =====================

Principal terms and the debt repayment schedule of the Group's

loan and borrowings are as follows:

On 17(th) June 2020 the Group entered into a Loan Security

Agreement with a financial institution and borrowed $20,000,000

($10,000.000 Revolver facility and $10,000,000 Term loan) which was

used to part finance the acquisition of Fortumo on 1 July 2020

(further information on this borrowing is in the Chief Financial

Officer's report). As at 30 June 2021 the Group had repaid the $10

million Revolver in full (with $3.0 million repaid in the period)

and repaid $1,250,000 of the term loan (with $937,500 repaid in the

period).

The balance of current lease liabilities at period end was

$870,458 (31 December 2020: $1,436,366) and non-current liabilities

$1,540,485 (31 December 2020: $1,742,100).

7. Cash from operations

(Unaudited) (Unaudited) 30-Jun 2020

30-Jun 2021 $'000

$'000

========================================================= ============ =======================

Profit after tax 1,730 36

Add back:

Tax expense 190 51

Amortisation of intangible assets 2,541 1,267

Depreciation of property, plant and equipment 1,201 1,189

Finance income (14) (30)

Finance expense (includes interest on lease liabilities) 370 164

Exchange (gain)/ loss (1,691) 439

Share based payment expenses 4,023 2,899

Cash from operations before working capital changes 8,350 6,015

Decrease/(increase) in trade and other receivables 3,132 (7,952)

(Decrease)/ increase in trade and other payables (20,368) 7,499

--------------------------------------------------------- ------------ -----------------------

Cash (used in)/ generated from operations (8,886) 5,562

8. Post balance sheet events

Fortumo was acquired on 1 July 2020 for a maximum consideration

of $45.0 million (the "Total Maximum Consideration"), which

includes Boku acquiring $4.0 million of net working capital. The

Total Maximum Consideration comprised $37.8 million in cash along

with approximately $1.8 million in restricted stock units payable

to the selling equity holders of Fortumo (the "Vendors") plus

further consideration of up to $5.4 million in cash, representing

12% of the total maximum consideration, held in escrow, subject to

certain Adjusted EBITDA** earnout, working capital and indemnity

conditions being satisfied in the period 1 July 2020 to 30 June

2021.

The earnout payment, based on Fortumo Adjusted EBITDA**

performance for the 12 months period ended 30 June 2021, is

expected to be $2.16 million, subject to final confirmation, which

will be paid to Fortumo's former shareholders by 5 October 2021,

with the balance of $3.24 million returned to Boku. This has

resulted in a $1.08 million decrease in the contingent

consideration payable, reported on 31 December 2020.

The difference of $1.08 million between the expected fair value

of the Fortumo earnout escrow amount as at 31 December 2020 of

$3.24 million and the actual amount agreed to be paid to Fortumo

shareholders of $2.16 million has been shown as 'Other Income' in

the Income Statement. This amount has been excluded from adjusted

EBITDA** as a non-trading, non-recurring item.

9. Cautionary Statement

Boku has made forward-looking statements in this financial

information, including statements about the market and benefits of

its products and services; financial results; product development

plans; the potential benefits of business relationships with third

parties and business strategies. The Group considers any statements

that are not historical facts as "forward-looking statements". They

relate to events and trends that are subject to risk and

uncertainty that may cause actual results and the financial

performance of the Group to differ materially from those contained

in any forward-looking statement. These statements are made by the

directors in good faith based on the information available to them

and such statements should be treated with caution due to the

inherent uncertainties, including both economic and business risk

factors underlying any such forward-looking information.

INDEPENDENT REVIEW REPORT TO BOKU INC.

Introduction

We have been engaged by Boku Inc. (the "Company") to review the

condensed set of financial statements in the half-yearly financial

report for the six months ended 30 June 2021 which comprises the

consolidated statement of Comprehensive income; consolidated

statement of financial position; consolidated condensed cash flow

statement; and associated notes.

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the interim financial information.

Directors' Responsibilities

The interim financial report, including the financial

information contained therein, is the responsibility of and has

been approved by the directors. The directors are responsible for

preparing the interim financial report in accordance with the rules

of the London Stock Exchange for companies trading securities on

AIM, which require that the financial information must be presented

and prepared in a form consistent with that which will be adopted

in the Company's annual financial statements having regard to the

accounting standards applicable to such annual financial

statements.

Our Responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly report

based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity', issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2021 is not prepared, in all material respects, in accordance

with the rules of the London Stock Exchange for companies whose

shares are admitted to trading on AIM.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on AIM and for no other purpose. No person is entitled to rely on

this report unless such a person is a person entitled to rely upon

this report by virtue of and for the purpose of our terms of

engagement or has been expressly authorised to do so by our prior

written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we

hereby expressly disclaim any and all such liability.

BDO LLP

Chartered Accountants & Registered Auditors, London, United

Kingdom

6 September 2021

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SSIFAMEFSELU

(END) Dow Jones Newswires

September 07, 2021 02:00 ET (06:00 GMT)

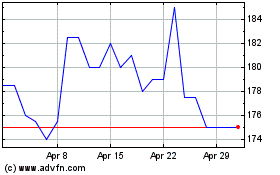

Boku (LSE:BOKU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boku (LSE:BOKU)

Historical Stock Chart

From Apr 2023 to Apr 2024