BP Earnings Boosted by Higher Oil Prices, Margins in 2Q -- Commodity Comment

August 03 2021 - 2:24AM

Dow Jones News

By Jaime Llinares Taboada

BP PLC on Tuesday reported better-than-expected earnings for the

second quarter, raised the dividend and declared a $1.4 billion

share buyback. Here's what the British oil-and-gas major had to

say:

On 2Q results:

"Underlying replacement cost profit was $2.8 billion, compared

with $2.6 billion for the previous quarter. This result was driven

by higher oil prices and margins offset by a lower result in gas

marketing and trading."

On market outlook:

"The oil market is expected to continue its rebalancing process.

Global stocks are expected to decline and reach historical levels

(in terms of days of forward cover) in the first half of 2022."

"Oil demand is expected to recover in 2021 on the back of a

bright macroeconomic outlook, increasing vaccination roll-out and

gradual lifting of Covid-19 restrictions around the world. The

expectation is that demand reaches pre-Covid levels sometime in the

second half of 2022."

"OPEC+ decision making on production levels is a key factor in

oil prices and market rebalancing."

"Global gas demand is expected to recover to above 2019 levels

by end 2021, and LNG demand to increase as a result of higher Asian

imports."

"Industry refining margins are expected to be broadly flat

compared to the second quarter, with recovery in demand offset by

growth in net refining capacity. In lubricants, industry base oil

and additive supply shortages are expected to continue in the

second half."

On BP outlook:

"Looking ahead, we expect third-quarter reported upstream

production to be higher than the second quarter reflecting the

completion of seasonal maintenance activity and the ramp-up of

major projects. Within this, we expect production from oil

production & operations to be higher."

"If Covid restrictions continue to ease, we expect higher

product demand across our customer business in the third quarter.

Realized refining margins are expected to improve slightly

supported by stronger demand and wider North American heavy crude

oil differentials. In Castrol, industry base oil and additive

supply shortages are expected to continue."

"We continue to expect divestment and other proceeds for the

year to reach $5 [billion]-6 billion during the latter stages of

2021. As a result of the first half year divestments, our target of

$25 billion of divestment and other proceeds between the second

half of 2020 and 2025 is now underpinned by agreed or completed

transactions of around $14.9 billion with over $10 billion of

proceeds received."

"BP continues to expect capital expenditure, including inorganic

capital expenditure, of around $13 billion in 2021."

"For full year 2021 we expect reported upstream production to be

lower than 2020 due to the impact of the ongoing divestment

programme."

"However, underlying production should be slightly higher than

2020 with the ramp-up of major projects, primarily in gas regions,

partly offset by the impacts of reduced capital investment and

decline in lower-margin gas assets."

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

August 03, 2021 03:12 ET (07:12 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

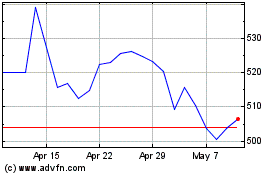

Bp (LSE:BP.)

Historical Stock Chart

From Mar 2024 to Apr 2024

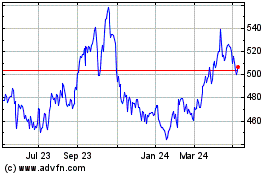

Bp (LSE:BP.)

Historical Stock Chart

From Apr 2023 to Apr 2024