TIDMBPC

RNS Number : 3718W

Bahamas Petroleum Company PLC

23 April 2021

NEITHER THIS ANNOUNCEMENT NOR ANY PART OF IT CONSTITUTES AN

OFFER TO SELL OR ISSUE OR THE SOLICITATION OF AN OFFER TO BUY,

SUBSCRIBE OR ACQUIRE ANY SECURITIES IN ANY JURISDICTION IN WHICH

ANY SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL AND THE

INFORMATION CONTAINED HEREIN IS NOT FOR PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF IRELAND, SOUTH AFRICA OR

ANY JURISDICTION IN WHICH SUCH PUBLICATION OR DISTRIBUTION WOULD BE

UNLAWFUL.

23 April 2021

Bahamas Petroleum Company plc

("BPC" or the "Company")

Notice of Extraordinary General Meeting and Circular relating to

Proposed Open Offer and Placing, Change of Name, Share

Consolidation, General Share Issuance Authority and Amendments to

Conditional Convertible Note Facility; changes to Board and

Management

BPC, the Caribbean and Atlantic margin focused oil and gas

company, with production, appraisal, development and onshore and

offshore exploration assets across the region, is pleased to advise

of a comprehensive program of activities, following the drilling of

Perseverance #1, which will lay the foundations for building future

shareholder value elsewhere across its expanded portfolio,

predominantly by increasing production, and hence cashflow, from

operations in Trinidad and Tobago and Suriname.

Highlights

-- Near-term activity schedule focussed on significantly

increasing production and cashflow, including in particular:

o Saffron # 2 appraisal / production well to be drilled in May /

June 2021, budgeted cost $3m million, e xpected production in the

range of 200 - 300 bopd generating cashflows of US$1.8 - US$2.6

million per annum, and paving the way for a full-field development

projected to achieve in an initial phase average daily production

of 1,000 - 1,500 bopd / generate annualised cashflows of US$8 -

US$12 million; and longer-term an overall field development could

ultimately comprise up to 30 wells in total, with a peak projected

production of approximately 4,000 bopd ;

o Appraisal well and extended well test at Weg Naar Zee in

Suriname planned to be drilled in July 2021, budgeted cost US$0.7

million capital expenditure, and paving the way for an initial

field development projected to produce c.100 bopd / generate

annualised cashflows of US$1m per annum; and longer-term with a

full WNZ field development scenario projected to generate annual

cash flows for the Company in excess of US$2.5 million

o Ongoing production maintenance and enhancement work in

Trinidad and Tobago, from five producing fields with current

production averaging in the range of 450 - 500 bopd, currently

generating annual cashflows to BPC of approximately US$3 million

per annum, and with the potential for cashflow growth from enhanced

production levels and/or increased oil prices

o Low-cost continuation of exploration activities, including

maturation of exploration targets in Trinidad, a process for

farming out the Company's principal licences in The Bahamas

(alongside renewal of those licences), and initial technical work

in relation to the Company's licence in Uruguay (and consideration

of potential farm-out options in relation to that licence)

-- Cost cutting initiative commenced across the Company, with a

view to reducing the Company's ongoing cost of operations by at

least 20% - 30%

-- Recapitalisation of the Company through a proposed GBP6.9

million (c. US$9.6 million) o pen offer to Qualifying Shareholders

("Open Offer") of approximately 1.967 billion shares at a price of

0.35 pence per share on a 1 new share for every 2.46 shares held

basis, to enable all qualifying existing shareholders the first

opportunity to participate in the Company's future, with the

Company intending for any shares not taken up in the Open Offer to

be placed with institutional investors at the same price

("Placing")

-- Circular to launch the Open Offer and convene an

Extraordinary General Meeting ("EGM") to be held on 17 May 2021 (to

be posted by no later than Saturday, 24 April 2021 and posted on

the Company's website on the same date) for the purposes of seeking

shareholder approval to:

o Change the name of the Company to Challenger Energy Group

Plc

o Consolidate the shares of the Company on a 1:10 basis ("Share

Consolidation"), and expansion of the Company's post-share

consolidation authorised share capital

o Refresh the Company's general share issuance authority

o Ratify and approve agreed changes to the Company's Conditional

Convertible Note facility, including a partial early conversion of

notes

-- Eytan Uliel, the Company's Commercial Director, to become

Chief Executive Officer (subject to completion of required due

diligence and onboarding processes for new Company directors) ,

Simon Potter is to transition to a Non-Executive director role

effective 20 May 2021; Non-Executive directors Mr Adrian Collins

and Mr Ross McDonald to step down from the Board; Mr Stephen

Bizzell to join the Board as a Non-Executive director (subject to

completion of required due diligence and onboarding processes for

new Company directors)

Bill Schrader, Chairman of BPC, said:

"T he Company is focussed on restoration, renewal and

refreshment. In this context, the Company's forward business

strategy for the coming 12-18 months has been firmly set, on

significantly increasing oil production and thus cashflow from our

assets in Trinidad and Tobago and Suriname, which the Board

considers to be the most effective manner in which to restore value

and create a foundation for future value growth. In support of this

strategy, the Company is calling an Extraordinary General Meeting,

to put before shareholders a series of actions with a view to

'resetting' the Company and its capital structure, along with a

recapitalisation of the Company and a cost reduction

initiative.

At the same time, as a part of a natural renewal process and in

adherence with best practices for corporate governance, changes are

being implemented to the Company's board and management. I would

like to welcome both Eytan Uliel and Stephen Bizzell on their

prospective appointments to the Board, as respectively CEO and

non-executive director. Shareholders will already be familiar with

the contribution of Eytan to the organisation over the last seven

years, and Stephen is highly credentialled in the industry, having

successfully assisted many similar companies with significant

capital raisings and transformational corporate transactions, as

well as having actively supported the funding of this Company for

the past two years. Simon Potter stays with us as a non-executive

director, where his skills and experience remain available to the

organisation. I would like to thank both Ross McDonald and Adrian

Collins, who will be leaving the Board, for their valued

contributions, over respectively the last nine and ten years.

Finally, a huge expression of appreciation for the work undertaken

by Ben Proffitt over the last twelve years in support of both the

Board as Company Secretary and to the Company as Finance Director -

we wish him luck as he embarks on the next stage of his career.

Taken together, the steps being announced today represent what

the Board considers to be a coordinated approach to charting a

viable and value-restorative future course for the Company. We

thank shareholders for their ongoing support, and we look forward

to providing updates as to our progress over the coming

months."

Eytan Uliel, CEO designate, said:

"Our Company has a diverse full-cycle portfolio of production,

development and exploration assets. The work program for 2021 and

beyond is busy, and contains many value triggers. The re-set

proposed today will enable us to get after that value, through

building production and cashflow. I am excited by the prospect of

leading Challenger Energy Group, and I look forward to engaging

with all our stakeholders over the coming months."

Background and Strategic Context

From 2008 until May 2020, BPC had a singular focus on

high-impact hydrocarbon exploration assets in The Bahamas, and in

particular on four exploration licences located in the southern

territorial waters of The Bahamas (collectively referred to as the

"Southern Licences"). This culminated in the recent drilling of the

Perseverance #1 well in late 2020 / early 2021.

During 2020, seeking to take advantage of the period of

inactivity and industry change occasioned by the Covid-19 pandemic,

the Company undertook a review of prevailing conditions in the oil

and gas exploration sector. Based on this review, and while

preparing for the drilling of Perseverance #1, the Company

initiated a revised business strategy with a view to creating a

broader, more diverse asset base. The objective was to create a

portfolio business with a range of assets across multiple

jurisdictions, a spread of operations across the industry spectrum

from production to exploration, and to deliver investors a

full-cycle exploration and production company centred on the

Caribbean and the Atlantic margin capable of complementing

high-impact exploration with growth in oil production and thus

cashflow.

In terms of execution of this revised strategy, the Company

completed two transactions in 2020: firstly, the successful

application for a high-impact exploration licence offshore Uruguay,

and secondly, a merger with Columbus Energy Resources PLC

("Columbus"), a company that owned and operated a range of

complementary assets in Trinidad and Suriname. A core rationale for

the Columbus transaction was the fact that the assets were already

in production and generating income, with the Company having

identified the potential to be able to grow that production, and

hence income, materially in the near-term. However, in taking the

first steps in creating the desired portfolio business through

2020, the Company's management structure, capital structure, and

market perception almost inevitably remained dominated by the

imminent drilling of Perseverance #1 in The Bahamas.

Drilling of the Perseverance #1 well was subsequently completed

in February 2021. However, the well did not result in a commercial

discovery, albeit the well did encounter hydrocarbons, and was

drilled safely and without environmental or safety incident.

Technical issues while drilling the well also meant that the

ultimate cost of the well will be considerably more than planned.

The Company is currently in the process of both completing the post

well technical analysis, and in parallel finalising payment terms

and schedule for remaining amounts invoiced, as well as resolving

various items in dispute, which process it expects to complete in

due course, thereby fully "closing out" the drilling program for

Perseverance #1.

With the Perseverance #1 well completed and with better

visibility of costs still to be paid (as set out in the Funding

Requirements section below), the Company is now in a better

position to consider the most advantageous plans for the various

other components of its asset portfolio, as well as the demand for

capital across the business. In particular, whilst the Company

believes that maturation of its offshore assets in The Bahamas and

Uruguay continue to be of significant longer-term value potential,

the Company's nearer-term focus, and immediate value creation

potential, will be driven largely by the ability to achieve a step

change in production and cashflow growth from its assets in

Trinidad and Suriname, realising low-cost exploration success in

Trinidad, continuing to expand a portfolio of complementary assets

along with sourcing the capital needed to collectively progress

these objectives.

It is in this context that the board of the Company ("Board")

considers it to be an appropriate time to enact certain fundamental

changes to the way that the Company operates going forward,

reflective of the fact that the assets in The Bahamas no longer

represent the sole or even dominant focus of the business.

To this end, a transition of the Company's Board and management

is occurring, alongside a change of name of the Company, a 'reset'

of the Company and its capital base, a recapitalisation, and

implementation of a cost reduction exercise. In aggregate, the

Board considers this overall Forward Strategy to be the approach

that will provide the Company with the best capacity and capability

to restore and create future shareholder value.

Key Business Value Drivers

As a consequence of activities undertaken during 2020, BPC is

now a Caribbean and Atlantic margin focused oil and gas company,

with a range of exploration, appraisal, development and production

assets and licences, located onshore in Trinidad and Suriname, and

offshore in the waters of The Bahamas and Uruguay.

In 2020, BPC commissioned a Competent Persons Report, which

certified net 2P reserves across BPC's portfolio of production

assets in Trinidad of 1.29 MMbbls, and net 2C contingent reserves

of 7.46 MMbbls across BPC's portfolio of assets in Trinidad and

Suriname (each at the Company working interest).

Approximately 80 staff are employed globally in the Company's

operations (the majority of whom are located in Trinidad and are

employed in active operations in that location). The Company owns

and operates two workover rigs that are employed in support of

production maintenance and enhancement activities in Trinidad.

Production Transformation and Cashflow Growth

The Company's forward business strategy for the coming 12-18

months is firmly focussed on restoring and creating future value

through significantly increasing oil production and thus cashflow

in its assets in Trinidad and Tobago and Suriname. To achieve this,

the Company is focussed on three principal activity sets:

a) Drilling of the Saffron #2 appraisal / production well in

Trinidad and, in the event of success with that well, rapidly

moving to develop the Saffron field, thereby significantly

increasing Company production and cashflow,

b) Drilling of the Weg Naar Zee (WNZ) appraisal well and

conducting an Extended Well Test (EWT) on that well in Suriname,

and, in the event of success, rapidly moving to drill additional

production wells across the WNZ field, thereby adding both further

production and cashflow, and

c) Maintaining, enhancing and developing production (and

resultant cashflow) at or from existing fields in Trinidad.

The Saffron Development in Trinidad

During 2020, an initial exploration well ("Saffron #1") was

drilled within the Bonasse licence in the South West Peninsula

("SWP") of Trinidad. This well discovered oil in both the Lower

Cruse and Middle Cruse reservoirs. High-quality light oil (circa

40-degree API) was also recovered to surface from the Lower Cruse

reservoir. The well encountered 2,363 ft of gross sands with six

reservoir intervals of interest with a 47 per cent. net / gross

ratio. On the basis of these results Columbus confirmed an

estimated a field resource (as established pre-drill by seismic) of

up to 11 MMbbls. Production was established from the Middle Cruse

interval but due to mechanical failures in the execution of the

Saffron #1 well, no production completion was established over the

discovered oil in the Lower Cruse.

The Company is now planning to drill an appraisal / production

well at the Saffron field. This well - Saffron #2 - is scheduled to

commence drilling in May 2021 and has been designed to establish

production from both the Middle and Lower Cruse reservoir horizons

(though initially only from the Lower horizons). As such, a number

of workstreams have already been completed to enable this to occur,

including a detailed well plan (benefitting significantly from the

drilling results and learnings from the drilling of Saffron #1),

civil works to establish the well pad, purchase of all long-lead /

major equipment items and contracts for required well services. The

well conductor was installed in March and mobilisation of rig and

associated equipment will commence this month and the well is

expected to spud on or around 23 May 2021, subject to the

successful completion of the Open Offer and Placing

("Fundraising"). The well design for Saffron #2 is for a total

drilled depth of approximately 4,500 ft, with drilling expected to

take up to 25-30 days to complete. The budget for the Saffron #2

appraisal well, inclusive of the production completion, is

approximately US$3 million.

The Saffron #2 appraisal well will be placed onto immediate

production given the ready proximity to oil sales infrastructure.

Expected production is in the range of 200 - 300 bopd. Based on a

US$60 / bbl oil price, this would generate, from this well alone,

cashflows to BPC of US$1.8 - US$2.6 million per annum, with a full

well payback of 12-18 months and a ROI of in excess of 200 per

cent..

Contingent on Saffron #2 well success, an initial program of

field development has been planned which could see a further five

to nine production wells drilled during H2 2021 (subject to

permitting, rig availability and capital availability), with field

development drilling continuing thereafter, through 2022 and 2023.

The current estimated overall field development would comprise up

to 30 wells in total, with a peak production projection of

approximately 4,000 bopd. The initial program of activity is

projected to achieve an average daily production of 1,000 - 1,500

bopd by the end of 2021 which, based on a US$60/bbl oil price,

which alone would generate annualised cashflows to BPC of US$8 -

US$12 million. For context, the projected full Saffron field

development scenario would generate annual cash flows for the

Company in excess of US$25 million per annum.

The Weg Naar Zee Project in Suriname

In October 2019, a Production Sharing Contract ("PSC") was

entered into with Staatsolie Maatschappij Suriname N.V, the

Suriname state-owned petroleum company ("Staatsolie"), to secure an

onshore appraisal / development project contained in the Weg Naar

Zee Block ("WNZ"). BPC holds a 100 per cent. working interest in

WNZ, however, Staatsolie has the right to participate in the

development phase with up to a 50 per cent. working interest,

subject to Staatsolie reimbursing BPC for pro-rata share of costs

incurred up to that point and funding its own share of costs

thereafter.

WNZ is a large block (900 km(2)) in a proven hydrocarbon

province with 70 historic wells and 2D seismic coverage. Up to 24

MMbbls STOIIP (15 degrees API) has been identified in eight pools

(of which around half is in a single pool) with the recently

completed CPR assessing 2C resources of 1.1 MMbbls and 3C resources

of 3.5 MMbbls.

An extended well test ("EWT") has been designed to appraise the

producibility of the discovered resource in the WNZ block, and to

assess whether the asset is suitable for application of enhanced

oil recovery techniques used by BPC in Trinidad. To date, approval

from Staatsolie to proceed with the planned drilling program has

been received as has approval from NIMOS (the Surinamese

environmental regulator). The proposed well site has been scouted,

various in-country contractors and well equipment has been sourced,

and rig tenders have been received from a number of suppliers.

The Company is thus ready to proceed with drilling of a first

WNZ well, albeit operational challenges arising from the Covid-19

situation in Suriname have resulted in the decision to move the

projected well spud date to July 2021.

This first well will target the largest of the undrained pools

(twinning with an existing successful production well), will be

drilled to a total depth of less than 1,000 ft., is expected to

take around 10 days to complete, and has an estimated cost of

US$0.6 million. The EWT to follow is expected to run through to the

end of 2021, and cost approximately an additional $150,000.

On successful production, the forward EWT program for the

balance of 2021 at WNZ could include the potential for drilling a

further four production wells (subject to permitting, rig

availability and capital availability), with field development

drilling continuing thereafter, through 2022 to 2024. The current

estimated overall field development could ultimately comprise up to

approximately 50 wells in total over time, at a cost of

approximately $300,000 per well (albeit with most wells paid for

from cashflow generated by the project itself), with peak

production projected to be approximately 900 to 1,000 bopd. A

successful WNZ initial field development of four additional

production wells is projected to produce around 100 bopd which,

based on a US$60/bbl oil price, would result in cash flows to BPC

of US$1m per annum. For context, the projected full WNZ field

development scenario would generate anticipated annual cash flows

for the Company in excess of US$2.5 million (based on the same oil

price assumption).

Growth of Existing Production in Trinidad and Tobago

In Trinidad and Tobago, the Company has five producing fields -

comprising of some 250 wells (of which over 80 are producing) -

with current production averaging in the range of 450 - 500 bopd.

This represents a stabilisation of natural production decline and,

at currently prevailing oil prices, results in positive operating

cashflows in Trinidad (at a US$60/bbl oil price, 500 bopd of stable

production from these fields results in annual cashflows to BPC of

approximately US$3 million per annum, which approximately equates

to the Company's operating costs and overhead in Trinidad).

The Company uses its two owned and operated workover rigs to

complete incremental workover projects across its fields of

operation and in the last two months has added an additional 50

bopd to the baseline production, which serves to offset natural

production decline from these aged reservoirs. Projects undertaken

include both wellbore damage clean outs and addition of new oil

zones. An additional 10 workover projects are planned for Q2 2021

on the Goudron and Inniss-Trinity fields that will primarily access

zones that have previously not been adequately produced through

recompletions and additional perforations. Further similar projects

will be shortlisted and scheduled for execution throughout the

remainder of 2021.

The Company has recently undertaken full-field asset reference

plans for each of the operating fields, that has revealed potential

unswept or compartmentalised oil that may be recovered through

either further workovers or infield drilling, and accordingly plans

are being put in place to capture that oil in order to enhance and

grow production.

High-Impact Exploration

Whilst the Company's forward business strategy for the coming

12-18 months is firmly focussed on restoring and creating future

value through significantly increasing oil production and thus

cashflow from its assets in Trinidad and Tobago and Suriname,

pursuing high-impact exploration activities in an effective

low-cost manner, as a means of complementing production growth and

cashflow generation with longer term value growth, remains a

component of the Company's overall strategy and business.

In this regard, the Company is focussed on three principal

exploration activity sets:

(a) Maturing the exploration prospect represented by the

Company's extensive licence position in the South West Peninsula of

Trinidad,

(b) Seeking a farm-out of the Company's licences in The Bahamas, and

(c) Progressing the initial low-cost technical work required to

mature the exploration prospectivity represented within the

recently acquired OFF-1 licence in Uruguay.

The South West Peninsula of Trinidad

The South West Peninsula (SWP) of Trinidad, in which the Company

has a large licence position, represents the Company's main

exploration acreage in Trinidad with numerous prospects consisting

of both stacked shallow and deeper reservoirs. The area is assessed

internally by BPC as having a resource level amounting to

approximately 230 MMbbls, containing up to nine Saffron-sized

prospects.

BPC is undertaking reprocessing of the entire 3D seismic grid

over the area in 2021. Re-processing commenced in April 2021 and is

anticipated to be complete within six months. Results from this

reprocessing work, along with existing data, will support the

selection of future low-cost exploration drill targets.

The Bahamas

The newly acquired technical data from Perseverance #1 will

facilitate valuable updates and refinements to basin modelling,

biostratigraphy and geochemistry. In particular, the significance

of the new geothermal gradient data placing the oil maturation

window deeper stratigraphically has critical implications for the

deeper Jurassic play that produces oil in the Eastern Gulf of

Mexico from an analogous play type (and which is the current focus

for several companies actively exploring in the region or in deep

water Mexico). Additionally, data derived from Perseverance #1

provides a modern-day well tie to recalibrate existing 3D mapping

of the Aptian intervals untested in closures and structures

elsewhere in the licence areas.

As a result of this information the primary focus of the ongoing

post-well evaluation work is on the deeper Jurassic pre-salt

clastic, structural play and the extent to which potential

multiple-target drilling locations can be optimised to access and

evaluate untested shallower closures whilst testing this primary,

deeper play.

Given these technical results, since announcing the outcome of

the well the Company has had a number of discussions with industry

counterparties in relation to a potential farm-out of the licences,

and the Company has now formally launched an entirely new farm-out

process via Gneiss Energy. The farm-out is seeking to introduce a

funding and operating partner for the next stage of exploration

activity in The Bahamas.

Concurrent with the farm-out process, the Company will seek to

renew its 100 per cent interest in the Southern Licences by

extending the licences in to the third exploration period. The

third exploration period for the Southern Licences would last for

three years and will require a further exploration well to be

drilled before the period expires, failing which the licences would

be forfeited (i.e., "drill or drop"). An extension of the licences

will attract an annual licence fee (the amount to be determined

during the renewal process) and requires a relinquishment of 50 per

cent. of the licence area. Notification of renewal of the licences

has been submitted to the appropriate Ministry, and the area to be

relinquished has been identified as being the area equivalent to

that over the shallower water depths covered by the Southern

Licences (less than circa 200 feet).

As at the date of this document, applicants representing various

environmental groups have been granted leave to apply (amongst

other matters) for a judicial review of the Government of The

Bahamas' decision to issue an Environmental Authorisation to the

Company for the drilling of the already completed Perseverance #1

well. The Company has been joined as a party to that action. In

order for the applicants to continue to pursue this action, the

Supreme Court of The Bahamas had ordered that by 31 March 2021 the

applicants were required to post the sum of $200,000 as security

for costs. Thus far, the applicants have failed to do so, albeit

the applicants have asserted that they have secured access to the

funds to enable them to do so, and a process is ongoing to

establish an appropriate joint account between the Company's and

the applicants' legal advisers for deposit of those security funds,

consistent with common practice in The Bahamas. On establishment of

the joint account, if security for costs is posted by the

applicants, the judicial review process will continue, but no date

has been set for the substantive hearing of that review, which it

is presently estimated would not occur before June / July 2021.

Alternatively, if the joint account is established and the

applicants nonetheless fail to post the required security, the

judicial review action will be stayed.

Uruguay

In June 2020, following a competitive bid process, the Company

was notified that it was the successful applicant for the OFF-1

offshore block in Uruguay. Subsequently, the Company has been

advised by ANCAP, the Uruguayan state-owned oil and gas company,

that the signing of the licence for the OFF-1 offshore block

presently awaits presidential approval, which has been delayed due

to the Covid-19 pandemic situation. The Company expects the formal

licence execution within Q2 2021 and will thereafter commence

initial desk-top and enhanced technical work. In the interim,

technical work undertaken independent of the Company by ANCAP has

sought to highlight exploration prospectivity across the circa

15,000 km(2) licence area. This involves detailed mapping of

several play types and prospects, notably the syn-rift play

potential within the Company's OFF-1 block. The prospect and lead

screening includes the specific identification of the syn-rift

Lenteja prospect with a P(50) estimated ultimate recovery volume

(EUR) of 1.359 billion barrels and an upside case of several

billion barrels recoverable (Source: ANCAP 2021), located in just

80 metres of water. This volume estimate aligns well with the

earlier guidance provided by BPC of the potential within its

OFF-1 licence area in excess of a billion barrels.

The Company expects near-term activities in Uruguay to be

low-cost (previously indicated by the Company to be in the range of

US$200,000 per annum), and whilst there is no drilling obligation

during the initial four-year exploration term, the Company will be

working to reconfirm attractive volumetrics and mature a range of

drillable prospects encompassing syn-rift and Guyana analogue plays

from reprocessed and improved 2D seismic imaging that has revealed

new exploration upside previously unable to be mapped due to poor

data quality.

New Business Opportunities

The Company continues to screen and evaluate potential new

business opportunities in line with its objectives to expand and

differentiate its existing asset portfolio, with a view to creating

a broader, diverse asset base and to grow production and cashflow.

The Company will continue to seek opportunities that further

leverage a portfolio business with a range of assets across

multiple jurisdictions, a spread of operations across the industry

spectrum from production to exploration, and to deliver investors a

full-cycle exploration and production company centred on the

Caribbean and the Atlantic margin.

Forward Strategy and Corporate Changes

As indicated above, following the completion of the Perseverance

#1 well in The Bahamas, the Company considers that its key value

drivers, and hence forward business strategy for the coming 12-18

months, will relate primarily to significantly increasing oil

production and thus cashflow in its assets in Trinidad and Tobago

and Suriname.

In support of this forward business strategy the Company is

proposing various changes and actions which can be summarised as

follows:

-- A transition of the Board and the senior management of the

Company coupled with a comprehensive cost savings exercise across

the Group (with a view to reducing overhead by 20 per cent. - 30

per cent. in the coming months), along with introduction of

revised, aligned incentivisation arrangements for ongoing / new

management and Board;

-- A 'reset' of the Company and its capital base, to be implemented by way of:

o a change of name of the Company to Challenger Energy Group PLC

(the change of name of the Company being the subject of a

Resolution at the EGM);

o A share consolidation whereby it is proposed that the existing

Ordinary Shares of 0.002 pence each in the capital of the Company

("Existing Ordinary Shares") will be subject to a 1 for 10

consolidation resulting in new Ordinary Shares of 0.02 pence each

in the capital of the Company (the "New Ordinary Shares") (the

"Share Consolidation") (the Share Consolidation being the subject

of a resolution at the EGM);

o An increase to the post-Share Consolidation authorised share

capital of the Company;

o The approval of a new general share issuance authority;

and

o An agreed early conversion of part of the Conditional

Convertible Notes currently on issue, along with a reapproval of

the ability to issue shares in satisfaction of future conversions

under the Conditional Convertible Note Facility, as required

(each the subject of resolutions to be proposed at the EGM

("Resolutions")); and

-- A recapitalisation of the Company, seeking to raise up to, in

aggregate, approximately GBP6.9 million of new equity by way of an

Open Offer to holders of Existing Ordinary Shares (other than

treasury shares) on the Company's register of members at the Record

Date (other than certain Overseas Shareholders) ("Qualifying

Shareholders") (and a Placing of any Open Offer Shares not taken

up).

When taken together, this set of actions represent what the

Board considers to be a coordinated approach to charting a viable

and value-restoring future course for the Company.

A circular in relation to the Open Offer and a Notice of

Extraordinary General Meeting, including explanatory notes in

relation to the resolutions to be put to holders of Existing

Ordinary Shares ("Shareholders") at the EGM, will be posted to

shareholders on 24 April 2021] and will be posted to the Company's

website at the same time. The EGM will be held at IOMA House Hope

Street Douglas, Isle of Man IM11AP at 11:00 a.m. on 17 May

2021.

Detailed below is a brief explanation for each of the elements

above.

Changes to the Board and Management

With the drilling of Perseverance #1 in The Bahamas completed,

and with the near-term focus on the Company shifting toward

significant growth in profitable production and thus cashflow from

operations in Trinidad and Suriname (and in parallel pursuing a

renewal of licences and farm-out for those licences in The Bahamas)

the Board considers that it is an appropriate time for changes to

be made to the Company's Board and executive management team, as

follows:

(a) Mr Simon Potter, the Company's Chief Executive Officer since

2011, will step down from this role effective 20 May 2021 (or

immediately following completion of the Open Offer and the Placing

if later). Thereafter, Mr Potter will remain on the Board of the

Company in the capacity of non-executive director, with a remit to

provide ongoing support to the Company's executive team given Mr

Potter's long history with the Company, and his deep industry

knowledge and experience.

(b) Mr Eytan Uliel, the Company's Commercial Director since

2014, will replace Mr Potter as Chief Executive Officer of the

Company effective 20 May 2021(or immediately following completion

of the Open Offer and the Placing if later, and will join the Board

on, and subject to, completion of required due diligence and

onboarding processes for new Company directors).

(c) Mr Adrian Collins, initially Chairman and then a

non-executive director of the Company since 2011, has advised of

his resignation from the Board, to take effect from 20 May 2021 (or

immediately following completion of the Open Offer and the Placing

if later).

(d) Mr Ross MacDonald, a non-executive director of the Company

since 2012, has advised of his resignation from the Board, to take

effect from such time as Mr Stephen Bizzell joins the Board of the

Company (as detailed in point (e) below).

(e) Consistent with the broadened operating remit of the Company

and the geographies in which it does business, the Chairman intends

to seek to supplement the revised Board's capabilities over the

coming months, as necessary with the addition of suitably qualified

directors. As part of this process, Mr Stephen Bizzell, principal

of Australian investment and financial advisory firm Bizzell

Capital Partners, the provider and arranger of the Company's

Conditional Convertible Notes facility, has indicated his intention

to join the Board of the Company (which will occur on, and subject

to, completion of required due diligence and onboarding processes

for new Company directors).

(f) Therefore, assuming the above changes are completed, the

Board of the Company will comprise William Schrader (Non-Executive

Chairman), James Smith (Deputy Non-Executive Chairman), Simon

Potter (Non-Executive Director), Stephen Bizzell (Non-Executive

Director) and Eytan Uliel (CEO), with the potential for the

additional of further independent Directors in the future, as may

be deemed appropriate.

(g) The various committees of the Board will be appropriately

restructured to reflect the revised composition of the Board, and a

further announcement will be made in this regard in due course.

(h) Mr Benjamin Proffitt, the Company's Finance Director and

Company Secretary since 2010, will step down from this role once a

suitable replacement has been recruited, allowing ample time for an

orderly transition of key financial and secretarial functions

within the Company.

(i) As appropriate with the ongoing level of HSE/ESG delivery,

operations management, commercial impact and requirement for

Government and stakeholder relations in each of the jurisdictions

of operation - Trinidad and Tobago, Suriname, The Bahamas and

Uruguay - the CEO will make recommendations to the Board as to the

appropriate management structure, skills maintenance and staffing

levels appropriate, with a view to implementing any further

management and organisational changes in the coming 3-4 months.

The revised Board membership and all relevant personnel will be

working in the coming months to deliver a comprehensive cost

savings exercise across the Company, with a view to reducing

overhead by 20 per cent. - 30 per cent., whilst at the same time

ensuring a smooth and seamless transition of both the Board and

executive team. As part of the cost savings exercise, it is the

intention that part of the existing compensation of the Board and

members of the senior management group will, for at least the next

6 months, be satisfied in shares.

Change of Name

From 2008 to mid-2020, the Company's only business was the

various licences held by the Company in The Bahamas. In this

context, the Company's name, "Bahamas Petroleum Company plc", was

entirely appropriate.

Since mid-2020, however, the Company's operations and business

strategy have expanded considerably, such that it now includes

assets and operations in Trinidad and Tobago, Suriname and Uruguay,

in addition to those in The Bahamas. As detailed in this document,

the near-term focus of the Company has shifted toward a rapid

build-up of profitable production from operations in Trinidad and

Tobago and Suriname, initial technical work in Uruguay, and in

parallel pursuing a farm-out (and renewal) for those licences in

The Bahamas. The Company in the future may also become involved in

assets and operations in other jurisdictions.

As such, the Board considers that the name of the Company,

referring solely to The Bahamas, is no longer an accurate

representation of the Company's overall business or strategic

direction.

Accordingly, the Board is proposing to change the name of the

Company to Challenger Energy Group PLC.

A 'reset' of the Company's capital base

The Company's current capital base is, in large part, a

reflection of the last several years' focus on fundraising

necessary to secure the funding needed for Perseverance #1. At

present, the Company has approximately 4.85 billion shares on

issue. At the same time, the Company has used up almost all of its

current share issuance capacity, such that the Company has no

ability to respond flexibly to opportunities to secure new assets

or secure new capital. Finally, for the reasons detailed in in the

Financial Information section below, in order to execute on its

planned 2021 work programs, the Company requires the infusion of

fresh capital.

To address these issues, the Company is proposing to 'reset' its

capital base by way of a 1:10 share consolidation and then increase

the post-share consolidation authorised share capital of the

Company, the approval of a new general share issuance authority,

and a reapproval of the ability to issue shares in satisfaction of

the agreed partial early conversion of Conditional Convertible

Notes currently on issue and in satisfaction of future potential

conversions of Conditional Convertible Notes that remain on issue

or may in the future be issued under the Company's Conditional

Convertible Note facility (all these matters are the subject of

resolutions at the EGM).

Share Consolidation

The Board is of the view that it would benefit the Company and

shareholders to reduce the number of ordinary shares on issue with

a resulting adjustment in the market price of such shares. This is

expected to assist in reducing the volatility in the Company's

share price and enable a more consistent valuation of the Company,

thus making the Company's shares more attractive to long-term

institutional shareholders whilst not impacting overall

liquidity.

It is thus proposed that all existing ordinary shares will be

subject to a 1 for 10 consolidation.

New Ordinary Shares issued pursuant to the Share Consolidation

will have exactly the same rights as those currently accruing to

existing ordinary shares under the Company's Articles, including

those relating to voting and entitlement to dividends.

General share issuance authority

At the EGM, Shareholders will be asked to increase the Company's

authorised share capital post share consolidation, and thereafter

to approve a temporary authority for the Company to issue up to

750,000,000 new ordinary shares (on a post-share consolidation

basis). If this authority was ultimately to be used in its entirety

(and assuming the consolidation of the Company's share base is

approved, the Open Offer is fully taken up or any Ordinary Shares

not taken up are successfully placed, and the various other actions

described in this document are completed) this would represent a

total potential dilution of approximately 50 per cent. on a fully

diluted basis, without the need for seeking further shareholder

approval, and with such capacity to be in place until the end of

2022.

The rationale for the proposed temporary general issuance

authority is directly related to the Company now embarking on a

course to restore value through a strategy aimed at significantly

increasing production and thus cashflow, and which will necessarily

involve the need to secure fresh capital over time, and which may

also include the issuance of additional ordinary shares to secure

access to new assets or portfolios of assets complementary to this

strategy. In the absence of a near term value uplift from The

Bahamas, it is this activity - and the ability to execute on this

activity quickly and flexibly - which the Board consider offers the

best opportunity for Shareholder value restoration and creation

over the coming 12-18 months.

Further, as discussed below, it is intended that the

implementation of revised incentivisation arrangements - considered

essential to the ability of the Company to continue to retain key

existing employees and attract, retain and incentivise future

employees - will be conducted under this general share issuance

authority .

Approval of early conversion of Conditional Convertible Notes

and ratification of the amended terms of the Conditional

Convertible Note facility

In September 2019, the shareholders of BPC approved the Company

entering into a GBP10.25 million convertible loan facility (the

"Conditional Convertible Note") with Bizzell Capital Partners Pty

Ltd (an Australian based investment and investment management

firm), and the terms contained within that facility. The facility

has been amended and extended on several occasions, including on 26

November 2020, when the Conditional Convertible Note facility was

expanded to a total of GBP15 million of available funding.

Subsequent to this date, GBP3 million of Convertible Notes were

drawn down.

On 15 February 2021, and as announced as that time, certain key

terms of the Conditional Convertible Note facility were further

amended by mutual agreement, including, amongst other matters, to

reduce the conversion price of all Convertible Notes issued and to

be issued under the facility from 2.5 pence to 0.8 pence per

Existing ordinary share (this price will change to 8 pence per New

Ordinary Share on completion of the Share Consolidation), and to

amend the manner and timeline in which interest payments will be

made. These variations were entered into with the facility provider

to reflect the changed business environment of the Company, most

notably the re-rating of the Company share price following the

results of the Perseverance #1 well.

At that time, a further GBP2 million of Convertible Notes were

committed on an unconditional basis, and were due for draw down and

funding at the end of February 2021. As yet, however, the Company

has not drawn down on these funds, pending ongoing negotiations

with the provider of the Conditional Convertible Note facility in

the context of the Company's overall financial requirements and in

anticipation of the Fundraising detailed in this document.

The Company and the provider of the Conditional Convertible Note

have now mutually agreed further amendments to the terms of the

Conditional Convertible Note facility, as follows:

(a) Of the GBP3 million of Convertible Notes that have already

been drawn down, GBP2.5 million (and all accrued interest in

respect of those Convertible Notes, amounting to approximately

GBP113,000) will be converted by the noteholders into approximately

74.7 million New Ordinary Shares (that is, at a conversion price

equal to the Open Offer issue price), with such conversion to occur

concurrent with (and subject to) closing of the Open Offer,

(b) The date for funding and issue of the GBP2 million of

Convertible Notes previously committed on an unconditional basis

and initially intended to be drawn / funded at the end of February

2021 has now been rescheduled to be no later than 14 June 2021

(that is, concurrent with the anticipated completion of the

drilling of the Saffron #2 well, but not dependent on the

completion or outcome of the Saffron #2 well), as well as now

expressed to be conditional on the Open Offer process having

successfully secured at least GBP5 million,

(c) Convertible Notes remaining on issue after the closing of

the Open Offer, and those to be issued by 14 June 2021 as described

above, will continue to be governed by the terms and conditions of

the Conditional Convertible Note facility as amended (and with the

conversion price of those Convertible Notes amended in accordance

with the share consolidation to 8 pence per share),

(d) The balance of the Conditional Convertible Note, under which

up to a further GBP10 million of funding is potentially available

to the Company on a conditional basis, will remain unchanged, and

will be available for draw down (subject to satisfaction of

conditions) until the end of July 2021 (that is, broadly speaking

in line with the potential need for funding for the start of

Saffron field development expenditure, in the event of success with

Saffron #2), and

(e) As indicated previously, Mr Stephen Bizzell will join the

Board of the Company being a right afforded under the terms of the

Conditional Convertible Note facility (with such to occur on, and

subject to, completion of required due diligence and onboarding

processes for new Company directors).

The Directors believe the Conditional Convertible Note facility,

as amended, continues to represent a useful and flexible component

of the overall package of funding sources available to meet the

ongoing capital needs of the Company in the current commercial

environment.

New Incentivisation Arrangements

As the Company embarks on the above-noted process of Board and

executive management transition, the Board considers it appropriate

that incentive arrangements for the ongoing / future Board and

management / employee team of the Company - especially those

charged with executing the Company's future business and strategy -

be appropriately refreshed.

This is because the existing incentive arrangements for the

Company's Board and team of executives and employees has, to-date,

been entirely conditional on, and singularly linked to, the

delivery of the Perseverance #1 well in The Bahamas

(notwithstanding a significant expansion of the Company asset

portfolio and business since mid-2020). The non-commercial result

of Perseverance #1 means that the options previously issued to the

Company's current Board and team of executives and employees are

substantially 'out of the money', and hence the holders of those

options will for all intents and purposes receive no future

benefit. This is entirely appropriate: the incentive arrangements

operated as intended, such that there has been an alignment of

interests between the value outcome for shareholders with that of

Board / management.

However, going forward, it is imperative that the Company

continues to have dedicated, competent people at work on delivering

the planned work programs and executing the Company's future

strategy focussed on production and cashflow growth. Equally, the

Company must continue to be able to recruit, retain and incentivise

high-quality personnel, whether that be existing employees, or new

ones. BPC operates in a competitive global job market for skilled

and talented personnel, and thus it is essential that the Company

has the ability to offer fair, market-based incentive arrangements

which serve to align management with the creation of shareholder

value.

To ensure this, the Company is thus proposing to issue new

options only to certain key continuing members of the Board /

executive / employee group. These new options will be granted in

three tranches, with new vesting and exercise conditions linked

directly to delivery of production growth and shareholder value

growth - that is, linked directly to and consistent with

strategy.

The new options to be allocated only to key continuing members

of the Board / executive / employee group will be in various

tranches, each tranche having an exercise price at a premium to the

Issue Price and that steps up further with each tranche, and

certain of the tranches will have vesting criteria based on

achieving production outcomes and shareholder value creation. The

detailed terms and allocation of the new options will be determined

by the Board following recommendation from the Remuneration

Committee, and will be advised by the Company at that time.

Of the intended allocation of new options, both initially and

over time, only a very small proportion will be to non-executive

Board members, with the vast majority of options to be allocated

to, or available for future allocation amongst, key executive

management and other critical employees. That is, to incentivise

those people directly responsible for delivery of the future of

this Company, and with their aggregate reward directly linked to

building production and generating future value creation for all

Shareholders.

The implementation of these revised option arrangements will be

conducted under the Company's general share issuance authority

(assuming this is approved at the Extraordinary General Meeting).

As such, these revised option arrangements, which as noted will be

fully disclosed once allocated, do not require specific approval of

shareholders outside of the approval of the general share issuance

authority. However, the allocation of the new options will likely

be deemed a related party transaction in accordance with the AIM

Rules for Companies, and for which a fairness opinion will be

obtained as required.

A recapitalisation via an Open Offer (and potential shortfall

Placing)

In order to pursue activities designed to increase production

and cashflow, the Company requires fresh capital, which it intends

to secure via an Open Offer (and a subsequent placing of any New

Ordinary Shares not taken up under the Open Offer (the

"Placing")).

The Company is progressing its recapitalisation via an Open

Offer because the Board considers it important to provide the

Company's loyal and supportive Shareholders with the first

opportunity to participate in the future of the Company.

Under the Open Offer, qualifying shareholders will have the

ability to subscribe for, in aggregate, up to approximately GBP6.9

million (before expenses) in Open Offer shares without the Company

having to produce a prospectus (in accordance with the Prospectus

Rules) which would have both cost and timing implications for the

Company.

The Open Offer provides an opportunity for all qualifying

shareholders to participate in the fundraising by acquiring Open

Offer Shares pro rata to their current holdings of existing

Ordinary Shares. Qualifying Shareholders are also being given the

opportunity to apply for excess shares through an Excess

Application Facility, provided that they take up their Open Offer

entitlement in full.

Qualifying Shareholders will be able to subscribe for shares

under the Open Offer Shares at a price of 0.35 pence per share (on

a pre-share consolidation basis, which equates to 3.5 pence per

share on a post share consolidation basis), pro rata to their

holdings of Existing Ordinary Shares on the basis of 1 Open Offer

share for every 2.46 Existing Ordinary Shares.

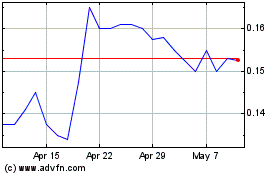

The issue price of shares under the Open Offer represents a

discount of approximately 35 per cent. to both the closing share

price on 20 April 2021 and the average VWAP of the Company's shares

in the 30 trading days to 20 April 2021.

To the extent all of the shares available for subscription under

the Open Offer are not fully taken up, the Company intends to

appoint its brokers and advisers, together or individually, to

place any Open Offer Shares not taken up to institutional investors

at the same price as the Open Offer and via the Placing.

Assuming full take-up under the Open Offer (or full placing of

any Open offer Shares not taken up under the Open Offer) the issue

of the Open Offer Shares will raise gross proceeds of GBP6.9

million for the Company.

Mr Eytan Uliel (the Company's incoming Chief Executive Officer)

has confirmed his intention to participate for his pro rata

entitlement in the Open Offer in respect of any Ordinary Shares

held. Certain other members of the Company's continuing Board and

senior management have also confirmed their intention to

participate in the Open Offer to varying extents.

Further details in relation to the Open Offer will be included

in the Open Offer circular, to be posted to shareholders no later

than 24 April 2021, and to be posted on the Company's website at

the same time.

Financial Information

Funding Requirements

Over the balance of 2021, the Company presently estimates that

it will have a requirement for total potential funding of between

US$22.5 - US$40 million depending on the range of activities

undertaken. The higher end of this funding range (that is,

approximately US$40 million over the balance of 2021) includes up

to $20 million of drilling and business costs that represent

discretionary or enhanced activity in a success case (that is, the

decision to incur these expenses is at the Company's discretion,

and will depend not only on capital availability but positive

technical outcomes from planned drilling activities).

The total range of activities to be considered during the

balance of 2021 (based upon the level of funding available and the

final estimate of costs, in respect of which certain elements are

unknown at this time and some of which would be incurred in 2022)

is summarised as follows:

(a) drilling and evaluation of the Saffron #2 well planned to be

drilled in May / June 2021: US$3 million capital expenditure - as

noted previously, the Company is projecting a successful Saffron #2

to produce in the range of 200 - 300 bopd and based on a US$60 /

bbl oil price, this well would generate cashflows to BPC of US$1.8

- US$ 2.6 million per annum, with a full well payback of 12-18

months and a ROI of in excess of 200 per cent;

(b) drilling an extra 5-9 production wells at the Saffron

project, the decision for which will depend on the technical

outcomes of the Saffron #2 well and the pace of which will depend

on permitting, rig availability and capital availability: US$12 -

US$20 million capital expenditure, of which an estimated US$7m -

US$12 million would require capital funding, with the balance

anticipated to be able to be funded from cashflow generated by the

project - as noted previously, this initial program of activity is

projected to achieve an average daily production of 1,000 - 1,500

bopd by the end of 2021 which, based on a US$60/bbl oil price,

alone would generate annualised cashflows to BPC of US$8 - US$12

million going forward; the current estimated overall field

development could ultimately comprise up to 30 wells in total, with

a peak projected production of approximately 4,000 bopd ;

(c) the EWT project (including drilling and evaluation) at Weg

Naar Zee in Suriname planned to be drilled in July 2021: US$0.7

million capital expenditure;

(d) drilling an extra 4 production wells at the WNZ project in

Suriname, a decision and pace for which will depend on the

technical outcomes of the initial well at WNZ and on permitting,

rig availability and capital availability: US$2 million capital

expenditure - as noted previously, such an initial field

development is projected to produce around 100 bopd which, based on

a US$60/bbl oil price, would result in cash flows to BPC of US$1m

per annum, and with a projected full WNZ field development scenario

anticipated to generate annual cash flows for the Company in excess

of US$2.5 million ;

(e) proceeding with in-fill drilling well opportunities at

existing producing fields in Trinidad, the decision for which will

be taken in H2 2021, and will largely be dependent on capital

availability at that time: up to $6 million capital

expenditure;

(f) completion of the seismic reinterpretation work in the SWP

of Trinidad, with a view to delineating additional drillable

prospects: US$0.3 million capital expenditure;

(g) drilling up to two exploration wells targeting discoveries

from Saffron lookalike prospects by the end of 2021 based upon the

results of high grading the 3D data set, and capital availability:

up to $6 million capital expenditure;

(h) following the completion and outcome of the drilling of

Perseverance #1, a final reconciliation payment to a fund managed

by Lombard Odier ($4 million) is due in June 2021, and the Company

is in the process of finalising residual costs, payment terms,

schedule and resolving various items in dispute relating to the

drilling of Perseverance #1, which process it expects to complete

in due course but is expected to amount to approximately $14

million payable through into H2 2021 (although the Company expects

to achieve a discount/reductions to this amount as a result of

commercial negotiations and agreed resolutions to items in dispute

and/or be able to satisfy part of this amount in the form of

shares, and has assumed an aggregate 20 per cent. - 30 per cent.

reduction in cash required for settlements on this basis);

(i) realising business development opportunities to expand the

portfolio based upon projected value generation (to be

determined);

(j) any incremental costs associated with renewal of the

Company's licences in The Bahamas, including community programs,

and ongoing legal costs as may be required to continue to

successfully defend the Company's licences in the event of ongoing

environmental challenges in The Bahamas (to be determined), and

(k) corporate overhead costs up to $4 million, although as noted

previously, the Company is initiating a cost reduction exercise

across its business with a view to reducing corporate overhead

costs by 20 per cent. - 30 per cent.

It is the intention of the Board and management to undertake as

much activity as possible but at all times remaining within the

overall funding capacity of the Company. In other words, given the

discretionary / success-based nature of much of the Company's

intended activity, capital availability will be a core determinant

in the decision to proceed with particular items of work, and the

timing of those decisions.

Funding Sources

The Company presently considers that it has sufficient financial

resources available to it to meet the lower end of the above-noted

required funding range (that is, approximately US$22.5 million)

through the balance of 2021. The Company's expectation in this

regard includes and assumes:

(a) cash at hand, proceeds of fee rebates described below, and

expected amounts of not as yet received funds under the Conditional

Convertible Note facility (approximately $10 million);

(b) assumed surplus income from production based on an assumed

US$60/bbl oil price and current projected production through the

balance of 2021 (including from Saffron #2) (approximately $3

million);

(c) the proceeds of the Open Offer (assuming full take of the

Open Offer and/or a successful Placing of any Open Offer Shares not

taken up) ($9.7 million);

(d) successful implementation of the cost cutting program being

initiated across the Company, resulting in overall cost reduction

in the range of 20 per cent. - 30 per cent. (approximately $2

million); and

(e) completion of negotiations in relation to licence renewals

in The Bahamas and completion of invoicing, payment scheduling and

resolution of disputes and final settlement of estimated costs

associated with the completed drilling of Perseverance #1, such

that the aggregate amount of cash payments required in respect of

licence fees and 'close-out' of Perseverance #1 are consistent with

the description in (h) above (approximately $4.5 million).

In circumstances where current funding assumptions (as

summarised above) do not materialize or do not materialize in the

timeframe expected (for example if the GBP2 million currently

expected under the Conditional Convertible Note facility is not

received, or if expected surplus income from production, and/or the

proceeds of the Open Offer (assuming full take of the Open Offer

and/or a successful Placing of any Open Offer Shares not taken up)

are not available, or the Company is unable to negotiate expected

reductions in cash required for settlements as described above,

absent securing capital from alternative sources, the Company would

not have sufficient financial resource available to undertake all

of the work and meet the obligations projected in the $22.5

million, and would be required to manage cash resources

accordingly.

In circumstances where the Saffron #2 well is not a success, the

Company will be required to secure capital from alternative sources

or the Company would be required to effect greater reductions to

overheads, negotiate greater reductions in cash required for

settlements as described above and/or not proceed with or defer

discretionary expenditure on all or some of the work as summarised

above.

Equally, in the event of success with the Saffron #2 well in

Trinidad, and/or success with the WNZ well and EWT in Suriname, the

Company will need additional funding to pursue development of those

projects and for general working capital purposes, presently

estimated to be $15 - $20 million in additional funding required

through the balance of 2021.

In any of the above-noted circumstances where the Company would

look to secure funding by way of alternative sources to meet any

funding shortfall / incremental funding needs, there can be no

assurance that the Company would be successful in securing any such

alternative funding.

However, the Board believes there are a wide range of potential

funding sources available to the Company, and as such the Company

is confident that it will be able to secure additional funding, if

and when required. In particular, those additional sources of

funding that may become available to the Company, and which would

increase the Company's overall financial capacity with a view to

placing the Company in a position where it would have sufficient

funds available to meet its requirements, including:

-- Assuming the GBP2 million is provided in June 2021, undrawn

availability under the remaining limit of the Company's Conditional

Convertible Note facility, which is up to GBP10 million.

Availability of this portion of funding under the Conditional

Convertible Note facility remains conditional, primarily on the

Company and the provider of the facility agreeing and documenting

suitable security arrangements. In this regard, the following

points are noted:

o As noted previously, GBP3 million has already been advanced to the Company under this facility (notwithstanding that security documentation has not been agreed), and of which GBP2.5 million will be converted into Ordinary Shares coincident with and on the same price basis as the Open Offer.

o A further GBP2 million has been committed under this facility.

These funds, initially scheduled to be advanced at the end of

February 2021, have been rescheduled to now be due coincident on

completion of, but not dependent on the results of, the drilling of

Saffron #2 (and provided that the Open Offer has been successfully

completed).

o The availability of the remainder of the facility (subject to

conditionality) has been extended to the end of July 2021, to

accommodate for the expected Saffron timeline, and

o Mr. Stephen Bizzell will be joining the board of the Company in due course.

Given the foregoing, the Company considers the Conditional

Convertible Note facility to be a viable and important part of its

overall funding sources, and considers that a material amount of

further funding could become available under the facility in the

future, particularly in the event of a successful outcome with the

Saffron #2 well so as to enable a rapid development of that project

in particular;

-- Increased income from production, whether as a result of

higher levels of production or a higher oil price than the

US$60/bbl assumed in the Company's forecasting;

-- Proceeds from a successful farm-out of the Company's assets

in The Bahamas - as noted elsewhere in this document, the Company

has engaged Gneiss Energy in relation to this process, which is

underway;

-- Proceeds and/or offset of costs in relation to other assets

in the Company's portfolio. Specifically, the Company considers

that in the event of a successful Saffron #2 well a viable

alternative to development of that project at 100 per cent. would

be a farm-out of that project to fund the overall development

costs, and given the recently enhanced view of the prospectivity of

the Company's asset in Uruguay (as detailed in Section 2.3.3 of

this letter) the Company considers that a farm-in to this asset may

be a viable near-term option;

-- Proceeds from any asset sales, the Company noting that assets

in Trinidad regularly transact, should the Company elect to

consider this as an option;

-- The offset of costs from any successful "drill for equity" type arrangements, and

-- Proceeds from any other financial facilities that may become

available to the Company in the period, such as a reserve-based

lending facility and/or a production prepay facility (the Company

being in active discussions with various providers of these types

of facilities).

If currently anticipated funding is not available and no

suitable funding from other sources is able to be secured to enable

the Company to undertake the work program and meet the obligations

detailed in this document, the Company would need to scale back the

intended work program (which is largely discretionary in nature at

the upper end of the funding requirement), and/or reschedule that

work program, and/or cut overhead and operating costs to match the

Company's actual capital availability, and/or further revise

payment terms, amounts and schedules in relation to residual

amounts to be paid to close-out Perseverance #1.

Finally, the Company notes that it has negotiated an agreed cash

rebate of advisory and fundraising fees paid by the Company

previously, amounting to approximately GBP500,000 (thus increasing

the amount of cash available to the Company) and has settled a

number of current corporate creditors through the issuance of, in

aggregate, 340.5 million new Existing Ordinary Shares on a

pre-Share Consolidation basis (which will become 34.05 million New

Ordinary Shares on a post Share Consolidation basis) (the "Fee

Shares"). Application has been made for 149,385,766 of the Fee

Shares (the "First Tranche Fee Shares") to be admitted to trading

on the AIM market of the London Stock Exchange and it is expected

that admission will take place, and trading in the First Tranche

Fee Shares will commence on or around 27 April 2021 at 08:00 a.m.

The remaining 191,114,234 Fee Shares (the "Second Tranche Fee

Shares") will be admitted to trading on 21 May 2021 upon, and

conditional on, the closing of the Open Offer and Placing.

Total Voting Rights

Following admission of the First Tranche Fee Shares, BPC's

issued share capital will consist of 4,987,934,115 ordinary shares,

with each ordinary share carrying the right to one vote. The

Company does not hold any ordinary shares in treasury. This figure

of 4,987,934,115 ordinary shares may therefore be used by

shareholders in the Company, as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure Guidance

and Transparency Rules.

Notice of Extraordinary General Meeting

A notice convening the Extraordinary General Meeting to be held

at the Company's registered office at IOMA House, Hope Street,

Douglas, Isle of Man, IM1 1AP at 11:00 a.m. on 17 May 2021 will be

set in the Circular.

At the Extraordinary General Meeting, the following resolutions

will be proposed:

1. As an ordinary resolution, to consolidate every ten (10)

Existing Ordinary Shares into one (1) New Ordinary Share, thereby

reducing the total issued share capital of the Company from

approximately 4.85 billion shares to approximately 485 million

shares.

2. As an ordinary resolution to increase the authorised share

capital of the Company to GBP400,000 divided into 2,000,000,000 New

Ordinary Shares of 0.02 pence each.

3. As a special resolution, to change the name of the Company to Challenger Energy Group PLC.

4. As a special resolution, to authorise a general share

authority such that the directors may, prior to 31 December 2022,

issue up to 750 million New Ordinary Shares (on a post-share

consolidation basis) without the need for further Shareholder

approval (and from within which general share authority the

proposed new incentive arrangements for continuing and future

executives and management will be implemented).

5. As a special resolution, to ratify the amendments previously

made to the Company's Conditional Convertible Note facility, to

authorise the agreed early conversion of part of the Convertible

Notes currently on issue, and to approve the current and future

issue of New Ordinary Shares pursuant to that facility.

All of these resolutions are to be proposed on an

inter-conditional basis: that is, the Company is seeking to

comprehensively reposition and recapitalise at the same time, and

the resolutions being proposed should thus be regarded as a

"package", each alongside with and integral to the other changes

being made.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Record Date for entitlement under 6:00 p.m. on 21 April 2021

the Open Offer

Announcement of the Open Offer 7:00 a.m. on 23 April 2021

------------------------------------

Ex-entitlement date of the Open 8:00 a.m. on 23 April 2021

Offer

------------------------------------

Publication and posting of this 23 April 2021

Circular (inclusive of the Notice

of Extraordinary General Meeting)

and the Application Form and Proxy

Form

------------------------------------

Open Offer Entitlements and Excess as soon as practicable after

CREST Open Offer Entitlements credited 8:00 a.m. on 26 April 2021

to stock accounts in CREST of Qualifying

CREST Shareholders

------------------------------------

Latest recommended time and date 4:30 p.m. on 6 May 2021