TIDMBPC

RNS Number : 7017X

Bahamas Petroleum Company PLC

06 May 2021

6 May 2021

Bahamas Petroleum Company plc

("BPC" or the "Company")

Saffron-2 - Rig Mobilisation and Operational Readiness

Update

BPC, the Caribbean and Atlantic margin focused oil and gas

company, with production, appraisal, development and onshore and

offshore exploration assets across the region, is pleased to

provide the following update on the upcoming drilling of the

Saffron #2 well in Trinidad and Tobago.

Highlights

-- Rig mobilisation to the field will commence on 9th May 2021,

targeting commencement of Saffron-2 drilling on or around 23 May

2021

-- All equipment (including various re-usable items from

Perseverance-1) have been mobilised to Trinidad, along with

necessary contractor personnel

-- Design of the Saffron-2 well includes a production

completion, allowing for immediate oil production and sales on a

successful well, with anticipated rates of 200 - 300 bopd, which it

is estimated would provide more than US$1.8 million per annum of

cashflow to the Company. Based on these pre-drill estimates,

Saffron-2 would have a payback of 12-18 months and an ROI of in in

excess of 200 per cent.

-- Following a successful Saffron-2 well, a further five to nine

production wells are currently planned to be drilled in H2 2021 as

part of an overall field development of up to 30 wells

-- These further five to nine wells are projected to deliver

average daily production of up to 1,000 - 1,500 bopd, which it is

estimated would provide US$8 million - $12 million of annual

cashflows going forward (based on a US$60 / bbl oil price)

Saffron #2 - Operational Readiness

A number of workstreams have already been completed to enable

drilling of the Saffron-2 well to progress. This includes:

-- Ministry approval to drill

-- Completion of a detailed well plan

-- Civil works completed to establish the well pad

-- Purchase of all long-lead / major equipment items

-- Contracts entered into for all required well services and

supplies, including with Schlumberger for cementing, wireline

logging and drilling mud, with Weatherford for the liner hanger

system, and with NOV for the drilling fluid handling system

-- Installation of the well conductor

-- Detailed HSE planning, including Covid-19 mitigation and response protocols

The Company can confirm that mobilisation of the drilling rig to

the field is scheduled to commence on 9 May 2021, with rig-up

activities to be completed on or around 17 May 2021. The rig - Well

Service Rig #4 - is being supplier by Well Services Petroleum

Company Ltd ("WSPC"), one of the oldest and largest onshore

drilling companies in Trinidad. The rig was selected and contracted

based on the experience of WSPC, and in particular their superior

ability to handle drilling fluids. BPC has paid the initial

mobilisation fee to WSPC, with no further fees payable until and

unless the Saffron-2 well is spud. Spud is expected to occur on or

around 23 May 2021, subject to successful completion of the current

open offer and placing process, and subject to passage of the

various resolutions that have been proposed at the Extraordinary

General Meeting to be held on 17 May 2021 .

Saffron # 2 - Well Potential

The intention is to place the Saffron-2 appraisal well onto

immediate production, with ready proximity to oil sales

infrastructure, and expected production is in the range of 200 -

300 bopd. Based on a US$60/bbl oil price, this would generate

cashflows to BPC of US$1.8 million - US$ 2.6 million per annum,

with a full well payback of 12-18 months and a ROI of in excess of

200 per cent.

Saffron - Full-field Potential

Contingent on Saffron-2 well success, an initial program of

field development has been planned (the "Initial Program") which

could see a further five to nine production wells drilled during H2

2021 (subject to permitting, rig availability and capital

availability of $7 million to $12 million with the rest anticipated

to be available from operational cashflow), with field development

drilling continuing thereafter, through 2022 and 2023.

The Initial Program is projected to achieve an average daily

production of 1,000 - 1,500 bopd by the end of 2021 which, based on

a US$60/bbl oil price would generate annual cashflows to BPC of

US$8 million - US$12 million.

Thereafter, field development drilling would continue through

2022 and 2023. The current estimated overall field development

would comprise up to 30 wells in total, with a peak production

projection of approximately 4,000 bopd. The current full Saffron

field development scenario would generate annual incremental cash

flows for the Company in excess of US$25 million.

Eytan Uliel, CEO Designate of BPC, commented:

"I am pleased to advise that rig mobilisation has been confirmed

for the drilling of the Saffron-2 well, all major contractors and

suppliers are in place, and we are operationally ready such that

drilling activity can commence around 23 May 2021."

"A successful Saffron-2 well will be a profitable well in and of

itself, but more importantly will further our understanding of the

Saffron field and enable us to plan for additional field evaluation

and appraisal work, as well as to assess the optimal full-field

development plan. In a success case, this well can be quickly

brought into production, potentially adding 200-300 bopd of oil

sales and $1.8 million or more of annual cashflow. A full-field

Saffron development could see peak production of 4,000 bopd and

around $25 million of annual cashflow - a material project by any

measure, and one we are thus eager to get after."

Regulatory Statements

In accordance with the AIM Note for Mining and Oil & Gas

Companies, BPC discloses that Mr Nathan Rayner, the Company's

Operations Director, is the qualified person who has reviewed the

technical information contained in this announcement. He is a

qualified Petroleum Engineer, a member of the Society of Petroleum

Engineers, and a member of the Institution of Engineers, Australia.

He has over 20 years' experience in the oil and gas industry.

Nathan Rayner consents to the inclusion of the information in the

form and context in which it appears.

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

For further information, please contact:

Bahamas Petroleum Company plc Tel: +44 (0) 1624

Eytan Uliel, Chief Executive Officer 647 882

Designate

Strand Hanson Limited - Nomad Tel: +44 (0) 20 7409

Rory Murphy / James Spinney / R ob Patrick 3494

Shore Capital Stockbrokers Limited - Tel: +44 (0) 207 408

J oint Broker 4090

Jerry Keen / Toby Gibbs

Investec Bank Plc - J oint Broker Tel: +4 4 (0) 207

Chris Sim / Rahul Sharma 597 5970

Gneiss Energy - Financial Adviser Tel: +44 (0) 20 3983

Jon Fitzpatrick / Paul Weidman / Doug 9263

Rycroft

CAMARCO Tel: +44 (0) 020 3757

Billy Clegg / James Crothers / Hugo Liddy 4980

Notes to Editors

BPC is a Caribbean and Atlantic margin focused oil and gas

company, with a range of exploration, appraisal, development and

production assets and licences, located onshore in Trinidad and

Tobago, and Suriname, and offshore in the waters of The Bahamas and

Uruguay. In Trinidad and Tobago, BPC has five (5) producing fields,

two (2) appraisal / development projects and a prospective

exploration portfolio in the South West Peninsula. In Suriname, BPC

has on onshore appraisal / development project. BPC's exploration

licence in each of Uruguay and The Bahamas are highly prospective

and offer high-impact value exposure within the overall portfolio

value.

BPC is listed on the AIM market of the London Stock Exchange. www.bpcplc.com

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDAAMTTMTBMTAB

(END) Dow Jones Newswires

May 06, 2021 02:00 ET (06:00 GMT)

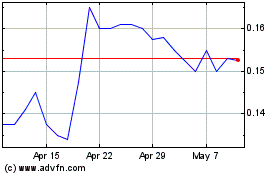

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Apr 2023 to Apr 2024