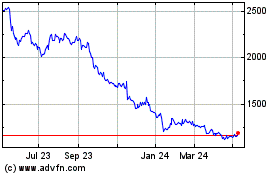

TIDMBRBY

RNS Number : 4632Y

Burberry Group PLC

13 May 2021

13 May 2021

Burberry Group plc

Preliminary results for 52 weeks ended 27 March 2021

The next chapter: growth and acceleration

"In the last three years we have transformed our business and

built a new Burberry, anchored firmly in luxury. We have

revitalised our brand image, renewed our product offer and elevated

our customer experience while making further progress on our

ambitious social and environmental agenda. In spite of COVID-19, we

achieved our objectives for the period and delivered a strong set

of results in FY21, ending the year with good full-price sales

growth. In this next chapter, supported by these foundations and

the strength of our teams, we will accelerate our growth and

deliver value creation while continuing to build a more inclusive

and sustainable future."

Marco Gobbetti, Chief Executive Officer

-- Recovery accelerated through the year leading to Q4 FY21 comparable store sales increasing 32% year on year and

-5% compared with Q4 FY19 despite an average 16% of stores being closed. Within this, full-price sales grew 63%

in the quarter (12% versus Q4 FY19) driven by Mainland China, Korea and the U.S.

-- For the full year revenue decreased 10% at CER, impacted by store closures and reduced tourism, with strong

recovery in the second half +8% at CER (-30% in H1 FY21): Within this, FY21 full-price comparable store sales

grew +7%, accelerating through the year driven by:

-- excellent response to product, with growth in our strategic categories and in selling prices

-- increasing brand strength attracting new and younger customers

-- local customer traction, thanks to innovative selling formats during lockdowns

-- Leveraged digital leadership, including opening our Social Retail store in Shenzhen Bay, driving double digit

comparable sales growth across all regions

-- Adjusted operating profit GBP396m, -8% CER, reported operating profit GBP521m up 176%

-- Full year dividend reinstated at FY19 levels of 42.5p on the back of strong cash generation

Period ended 27 March 28 March % change

Reported

GBP million 2021 2020 FX CER*

------------------------------- --------- --------- --------- -------

Revenue 2,344 2,633 (11) (10)

Retail comparable store

sales* (9%) (3%)

Adjusted operating profit* 396 433 (9) (8)

Adjusted operating profit

margin * 16.9% 16.4% +50bps +50bps

Adjusted Diluted EPS (pence)* 67.3 78.7 (14) (14)

Reported operating profit 521 189 176

Reported operating profit

margin 22.2% 7.2%

Reported diluted EPS (pence) 92.7 29.8 211

Free cash flow** 349 66

Dividend (pence) 42.5 11.3

------------------------------- --------- --------- --------- -------

*See page 20 for definitions of alternative performance

measures

Outlook**

In our next chapter we will focus on delivering growth whilst

continuing to enhance the quality of our business. Taking FY20 as

the base year, we expect revenue to grow at a high single digit

percentage compound annual growth rate at FY21 CER in the medium

term. This will be underpinned by the continued outperformance of

full-price sales. We will continue to strengthen brand equity by

exiting markdowns in mainline stores in FY22. This is a headwind

against our comparable store sales growth amounting to a mid-single

digit percentage in the full year.

In FY22 adjusted operating margin progression will be impacted

by operating expense normalisation and increased investment to

accelerate growth, with more meaningful margin accretion

thereafter.

We are focused on and continue to invest in our sustainability

and social goals by becoming carbon neutral by 2022, championing

diversity and inclusion and positively impacting one million people

in the communities in which we operate.

Further guidance is included in the Appendix.

**FY22 outlook on page 17

All metrics and commentary in the Group Financial Highlights and

Business and Financial Review exclude adjusting items unless stated

otherwise.

The following alternative performance measures are presented in

this announcement: CER, adjusted profit measures, comparable sales,

free cash flow, cash conversion, adjusted EBITDA and net debt. The

definition of these alternative performance measures are in the

Appendix on page 20.

Certain financial data within this announcement have been

rounded.

Enquiries

Investors and analysts 020 3367 4458

Julian Easthope VP, Investor Relations julian.easthope@burberry.com

Media 020 3367 3764

Andrew Roberts VP, Corporate Relations andrew.roberts@burberry.com

-- There will be a live webcast presentation today at 9.30am (UK time) for investors and analysts

-- The presentation can be viewed live on the Burberry website www.burberryplc.com

-- The supporting slides and an indexed replay will be available on the website later in the day

-- Burberry will issue its First Quarter Trading Update on 16 July 2021

-- The AGM will be held on 14 July 2021

Certain statements made in this announcement are forward-looking

statements. Such statements are based on current expectations and

are subject to a number of risks and uncertainties that could cause

actual results to differ materially from any expected future

results in forward-looking statements. Burberry Group plc

undertakes no obligation to update these forward-looking statements

and will not publicly release any revisions it may make to these

forward-looking statements that may result from events or

circumstances arising after the date of this document. Nothing in

this announcement should be construed as a profit forecast. All

persons, wherever located, should consult any additional

disclosures that Burberry Group plc may make in any regulatory

announcements or documents which it publishes. All persons,

wherever located, should take note of these disclosures. This

announcement does not constitute an invitation to underwrite,

subscribe for or otherwise acquire or dispose of any Burberry Group

plc shares, in the UK, or in the US, or under the US Securities Act

1933 or in any other jurisdiction.

Burberry is listed on the London Stock Exchange (BRBY.L) and is

a constituent of the FTSE 100 index. ADR symbol OTC:BURBY.

BURBERRY, the Equestrian Knight Device, the Burberry Check, and

the Thomas Burberry Monogram and Print are trademarks belonging to

Burberry.

www.burberryplc.com

Twitter: @BurberryCorp

LinkedIn: Burberry

GROUP FINANCIAL HIGHLIGHTS

Revenue

-- Revenue GBP2,344m -10% CER, -11% reported

-- Retail comparable store sales -9% (H1: -25%; H2: +5%), returning to growth in H2 FY21

Adjusted profit

-- Adjusted operating profit GBP396m, -8% CER, -9% reported

-- Gross margin before adjusting items up 270bps at CER and 260bps at reported rates, benefitting from full-price

and other mix effects and reduced inventory provisioning charges

-- Operating expenses before adjusting items -7% at both CER and reported rates, benefitting from cost management

and delivery of restructuring programmes

-- Adjusted diluted EPS 67.3p, -14% at both CER and reported

Reported profit measures

-- Operating profit GBP521m, up 176% after adjusting items of GBP125m credit (FY20: GBP244m charge)

-- Diluted EPS 92.7p, up 211% reported

Cash measures

-- Full year dividend declared at FY19 levels of 42.5p (FY20: 11.3p) with the progressive policy reinstated

-- Free cash flow of GBP349m (FY20: GBP66m) due to strong cash management

-- Cash net of overdrafts and borrowing of GBP919m at 27 March 2021 (28 March 2020: GBP587m Cash net of overdrafts

amounted to GBP1.2bn with borrowings of GBP297m. The GBP300m revolving credit facility (RCF) is currently undrawn,

and the UK Government sponsored COVID Corporate Financing Facility (CCFF) was repaid in February 2021

Summary income statement

Period ended 27 March 28 March % change % change

GBP million 2021 2020 Reported CER

FX

Revenue 2,344 2,633 (11) (10)

Cost of sales* (704) (859) (18)

----------------------------- --------- --------- ---------- ---------

Gross profit* 1,640 1,774 (8)

Gross margin * 70.0% 67.4% +260bps +270bps

Operating expenses* (1,244) (1,341) (7) (7)

Opex as a % of sales* 53.1% 51.0%

----------------------------- --------- --------- ---------- ---------

Adjusted operating profit* 396 433 (9) (8)

Adjusted operating margin

* 16.9% 16.4% +50bps +50bps

Adjusting operating

items 125 (244)

----------------------------- --------- --------- ---------- ---------

Operating profit 521 189 176

Operating margin 22.2% 7.2%

Net finance (charge)(**) (31) (20)

----------------------------- --------- --------- ---------- ---------

Profit before taxation 490 169 190

Taxation (114) (47)

Attributable profit 376 122

Adjusted profit before

taxation* 366 414 (12) (11)

Adjusted diluted EPS

(pence)* 67.3 78.7 (14) (14)

Diluted EPS (pence) 92.7 29.8 211

Weighted average number

of diluted ordinary shares

(millions) 405.1 409.0

----------------------------- --------- --------- ---------- ---------

* Excludes adjusting items. All items below adjusting operating

items on a reported basis

For detail, see Appendix. ** Includes adjusting finance charge

of GBP1m (FY20: GBP1m)

BUSINESS AND FINANCIAL REVIEW

FY21 was the third year of our journey to transform Burberry and

anchor our brand firmly in luxury. Against the backdrop of the

COVID-19 pandemic, our goal this year was to strengthen our

foundations, adapting to the environment and positioning the brand

for acceleration and growth.

Despite the onset of the COVID-19 pandemic, which led to a

significant reduction in operating hours and an average of 18% of

our global store network closed in the financial year, we completed

the objectives for the first phase of our strategy, ending FY21

with strong full-price momentum.

Supported by the strong foundations we have built, we adapted

swiftly, driving performance through new product launches and

inspiring communications and shifted our focus to rebounding

economies and digital channels. As a result, we achieved +7% growth

in full-price comparable store sales in the year, with double-digit

growth across Americas, Korea and Mainland China and good traction

across our core strategic categories.

In terms of brand activity, we continued to reinforce our luxury

positioning through emotive campaigns and activations and adopted a

highly localised approach in every market. Recent examples include

the launch of our first locally produced campaign film for Lunar

New Year in January. This had an exceptional response from local

Chinese consumers and increased the number of new fans to our

WeChat page in a single month by 15x compared to our 2020 monthly

average. In addition, in February and from the start of the new

financial year in April respectively, we debuted Riccardo's first

dedicated menswear and womenswear presentations for AW21. These

presentations generated an extraordinary amount of conversation on

Instagram, with triple- and double-digit growth compared to our

SS21 Show, respectively. Similarly in March, we drove further brand

heat with the launch of our global campaign to celebrate our SS21

collection which generated social coverage almost double our SS20

campaign. Continuing to build brand momentum, these activations

have also attracted new and younger customers to the brand.

Our new collections have also resonated strongly, supporting

double digit growth in full-price sales to both new and repeat

customers. In addition, within full-price, our strategic pillars -

leather goods and outerwear - have returned to mid and high single

digit growth respectively for FY21. Strong performance in leather

goods has been supported by our new established shapes including

the Pocket, which was the focus of our first bag campaign and

programme of pop-ups earlier in the year, and the Olympia, our

newest shape and the focus of our upcoming bag campaign in May.

Across outerwear, we have focused on elevating and diversifying our

offer. For example, in January we launched Future Archive, a unique

capsule reinterpreting outerwear classics from the Burberry

archive. By successfully driving the performance of our strategic

pillars, we have supported high single digit growth in prices -

further demonstrating the strength of our brand.

In terms of distribution, we elevated the brand experience

across our full-price channels and leveraged our digital resources

to support both offline and online sales. Within Mainline, we

continued to invest in upgrading the store portfolio with 11 new

openings and 15 closures this year and developed our new store

concept, which we will begin to roll out in early FY22. In

addition, we increased our focus on in-person and virtual

appointments to mitigate the impact of reduced traffic and drive

traction with local customers. This contributed to growth in sales

to local clients in most regions. We also leveraged our digital

capabilities to bridge online and offline, including scaling our

omnichannel journeys (e.g. virtual appointments, virtual client

events) as well as pioneering social retail - launching our first

social retail store in Shenzhen Bay. Our Shenzhen store has

provided a testing ground for a number of innovative experiences

and concepts that we plan to roll out in the coming year to drive

further consumer engagement. In terms of online, we have continued

to capture the recent shifts in consumer behaviour through our

digital innovations to deliver double digit growth in full-price

online sales across all regions, from a strong base.

Building a more sustainable future

We maintained our focus on driving positive change and building

a more sustainable future through our Responsibility agenda. All of

our stores in Mainland China are now carbon neutral and we are on

track this year to use 100% renewable electricity and have a carbon

neutral footprint across all of our operations globally. In the

next 12 months, every product we make will have more than one

positive environmental or social attribute, achieved by driving

improvements at the sourcing and product manufacturing stage.

Stretching our ambitions, we now aim to be net-zero across our own

operations and extended supply chain by 2040 and will continue to

set leading standards for our industry and pioneer innovative

solutions to create real system change.

Embedding D&I

We also made strong progress on our commitment to build a more

diverse, equitable and inclusive organisation. We rolled out our

global Diversity and Inclusion strategy, with aspirational goals

supported by training and global programmes designed to attract and

retain diverse talent, foster an open and inclusive culture and

drive education and awareness. During the year, Burberry was the

first luxury company to partner with the Business Disability Forum,

Investing in Ethnicity, and the Stonewall Diversity Champions

Programme, and one of the first in our industry to join The

Valuable 500. We also became signatories of the British Retail

Consortium D&I Charter and BBC's Creative Allies initiative,

working collaboratively to achieve progress across the retail and

creative industries. To mark International Women's Day 2021, we

continued our support for London Youth and The Prince's Trust Women

Supporting Women initiative, providing resources and development

opportunities for young women. Our commitment to gender equality

was recognised by Burberry's inclusion in the 2021 Bloomberg

Gender-Equality Index, scoring 10 percentage points more than the

company average and reflected by a leading position in the latest

Hampton-Alexander Review report for women in leadership in the FTSE

100 for the third consecutive year.

Responding to COVID-19

Throughout the year, the health and wellbeing of our people has

been our priority. We implemented rigorous safety measures across

our sites whilst providing resources to support our teams. We also

further strengthened our support for the global effort to combat

the outbreak of COVID-19. Burberry and the Burberry Foundation

recently made donations to UNICEF's COVID-19 Vaccines Appeal,

building on our efforts earlier in the year to provide funding for

food charities, vaccine research and retool our trench coat factory

in Castleford, Yorkshire to manufacture non-surgical gowns and

source masks through our global supply chain. Following Burberry's

partnership with Marcus Rashford MBE and charities supporting youth

in the UK, USA and Asia, the Burberry Foundation also entered a

longer term partnership with London Youth, providing young people

in some of London's most deprived communities with the resources

and support to build resilience against the impacts of the COVID-19

pandemic.

UK withdrawal from the EU

We continue to adapt to the EU-UK Trade and Cooperation

Agreement to ensure minimal disruption to our operations and

customers. We have initiated a number of actions to mitigate duty

costs including collating evidence in support of claiming

preferential duty rates, streamlining product flows to minimise

movements of goods between the UK and EU, and establishing a

customs warehouse.

The next chapter: accelerate and grow

Having successfully navigated our transformation and established

a strong foundation, we are well-positioned to embark on the next

chapter of growth and acceleration. In this phase, we will leverage

our unique brand equity to deliver sustainable, high-quality growth

and continue to drive positive change. In terms of revenue, we will

accelerate growth by focusing on five levers: i) continuing to

build brand advocacy and community; ii) focusing on our core luxury

categories, outerwear and leather goods; iii) driving our store

performance through the roll-out of our new store concept and

scaling of new, omnichannel experiences; iv) supercharging online

sales by leveraging our leadership in digital; and v) increasing

our focus on full-price, including significantly reducing markdown

in Mainline by the end of FY22. This acceleration will support our

profitability through increased full-price and digital penetration,

improved sales density and continued tight cost control. As a

result, our ambition in the medium-term is to achieve high-single

digit compound revenue growth at FY21 CER on FY20 base- with

overperformance in full-price - and meaningful operating margin

accretion.

Throughout, we will be relentless in our focus on our

sustainability and social priorities. We are committed to

continuing to build not only a financially stronger Burberry but

also a better company. We will fuel the creativity of our

colleagues by championing diversity, equality and inclusion and

supporting their wellbeing. We will empower young people in our

communities, providing more of them with the skills, confidence and

opportunities to succeed. Lastly, we will create a more sustainable

future for luxury by further reducing our environmental impacts and

helping transform our industry.

Financial performance

-- Performance in the year was driven by full-price sales offset by both a planned reduction in markdown activity as

we further elevate the brand, and from outlets that were impacted by tourist flows. With no impact from space,

retail sales declined 9% at both CER and reported exchange rates. Wholesale declined 17% at CER and reported

exchange rates in the year with a good recovery in the second half. In total, the group saw revenue down 10% at

CER and 11% at reported exchange rates to GBP2,344m (FY20 GBP2,633m)

-- Group adjusted operating profit fell 8% at CER, with a strong recovery in H2 rising by 48% following the 71%

decline in H1. Gross margin increased in the year by 270bps CER (260bps reported), benefitting from full-price

and other mix effects and reduced charges for inventory provisioning. Adjusted operating expenses fell by 7% at

CER, with strong cost management and delivery of the restructuring programmes. This excludes GBP54m of rent

concessions negotiated during the COVID-19 crisis and GBP9m of government grants. During the year, we paid the UK

business rates in full and did not take advantage of the UK Government Coronavirus Job Retention Scheme. Reported

operating profit increased 176% including an adjusting item credit of GBP125m. FX was a minor headwind in the

year of GBP3m

-- We generated free cash flow in the year of GBP349m, significantly above the prior year level of GBP66m due to

lower lease payments, reduced capex and tax payments as well as tight management of working capital. Inventory in

particular was well controlled, with gross inventory 16% below last year and 7% down from FY19 levels,

benefitting from improved sell-through. Capital expenditure reduced to GBP115m (FY20 GBP149m) with some projects

impacted by COVID-19

Revenue analysis

Revenue by channel

Period ended 27 March 28 March % change

Reported

GBP million 2021 2020 FX CER

------------------------------ --------- --------- --------- -----

Retail 1,910 2,110 (9) (9)

Retail comparable store

sales growth (9%) (3%)

Wholesale 396 476 (17) (17)

Licensing 38 47 (19) (20)

--------- --------- --------- -----

Revenue 2,344 2,633 (11) (10)

------------------------------ --------- --------- --------- -----

Retail

FY21 Q1 Q2 Q3 Q4 FY Q4 FY21

v

Q4 FY19*

------ ----- ----- ---- -----

Comparable store sales

growth (45%) (6%) (9%) 32% (9%) (5%)

Comparable full-price

sales growth (38%) (1%) 9% 63% 7% 12%

------------------------ ------ ----- ----- ---- ----- ----------

*Q4 FY21 comparable store sales growth compared with Q4 FY19

-- Retail sales fell 9% at constant and reported exchange rates

-- Comparable store sales declined 9% (H1: -25%; H2: +5%). Underlying performance was strong with full-price sales

growth of 7% offset by store closures and a significant reduction in tourist traffic due to COVID-19, together

with the planned reduction in markdown activity in the second half of the year. Overall, markdowns had a low

single digit percentage adverse impact on FY21 sales growth

-- Comparable store sales grew 32% in the fourth quarter (-5% against Q4 FY19) as we began to anniversary the impact

from the pandemic and with a sequential acceleration in sales in Asia Pacific and Americas whilst EMEIA remained

impacted by lockdowns

-- Nil impact from space on FY21 revenue

Comparable store sales by region:

FY21 Q1 Q2 Q3 Q4 FY Q4 FY21

v

Q4 FY19

------ ------ ------ ------ ------

Group (45%) (6%) (9%) 32% (9%) (5%)

Asia Pacific (10%) 10% 11% 75% 18% 17%

EMEIA (74%) (39%) (37%) (26%) (44%) (44%)

Americas (70%) 21% (8%) 40% (9%) 15%

-------------- ------ ------ ------ ------ ------ ---------

Asia Pacific grew by 18% year on year

-- Asia Pacific saw the best regional performance in the year, led by Mainland China and Korea

-- Mainland China saw strong double digit growth with comparable store sales accelerating in the fourth quarter to

53% against FY19 driven by a successful Lunar New Year campaign

-- Korea also delivered strong double digit percentage growth with a significant improvement in comparable store

sales in the last quarter of the year

-- South Asia Pacific (SAP) declined by a double digit percentage, affected by limited tourist traffic and airport

store closures

-- Japan also fell, impacted by a lack of international travel

EMEIA fell by 44% year on year

-- EMEIA has been especially impacted by travel trends and store closures

-- Continental Europe saw a decline broadly in line with the regional average; however, local spend returned to

growth from the second quarter

-- The UK remained challenged with London performance weak given high tourist exposure

-- Middle East returned to growth in the second half of the year driven by strong local demand and improved tourist

flows

Americas declined by 9% year on year

-- Americas saw a robust performance in full-price sales from Q2 FY21, increasing 17% in the year

-- Within this, the US was particularly strong driven by attracting new younger customers to the brand

Digital performed well in the year with double digit percentage

growth driven by the Americas and Mainland China.

By product

-- Full-price sales grew across all product categories in FY21 and in the fourth quarter against Q4 FY19

-- Product performance was impacted by the pandemic with a shift towards casualisation and evergreen items

-- Outerwear was driven by strong performance in Coats and Jackets, Quilts and Downs with exceptional performance in

Mainland China and Korea

-- Within Ready-to-wear, Tops and Bottoms continued to outperform with a strong performance in Shirts and Jersey

within Men's and Knitwear within Women's

-- Leather goods remained a key focus in FY21 with the new bag pillars performing well. The new shapes continue to

account for more than 60% of our women's leather bag sales

-- Digital full-price sales saw high double digit percentage growth across all categories with a particularly strong

performance in Accessories driven by leather goods and shoes

Store footprint

The transformation of our distribution continued as we addressed

high priority programmes:

-- In FY21 we opened 17 stores and closed 23 stores

-- Key openings included 13 in Mainland China including our first Social Retail store in Shenzhen Bay

-- Cumulative 34 stores closed to date of the 38 planned closures from the non-strategic store rationalisation

programme

-- A cumulative 85 stores are now new or refurbished and aligned to our new creative vision, an increase of 21 in

the year

-- In support of our goal to be net-zero by 2040, we finance or refinance buildings that have achieved one of the

following certifications:

o Leadership in Energy and Environmental Design (LEED): Platinum

or Gold level

o Building Research Establishment Environmental Assessment

Method (BREEAM): Excellent or Outstanding level

Wholesale

Wholesale revenue declined 17% at CER and reported exchange

rates with a return to growth in the second half of the year with

sales up 8% at reported exchange rates.

Licensing

Licensing revenue fell 19% at reported exchange rates due to

lower sales from the COVID-19 fallout.

Operating profit analysis

Adjusted operating profit

Period ended 27 March 28 March % change

2021 2020

GBP million

Reported CER

FX

--------- --------- --------

Revenue 2,344 2,633 (11) (10)

Cost of sales* (704) (859) (18)

Gross profit* 1,640 1,774 (8)

Gross margin %* 70.0% 67.4% +260bps +270bps

Operating expenses* (1,244) (1,341) (7) (7)

Opex as a % of sales* 53.1% 51.0%

---------------------------- --------- --------- --------- --------

Adjusted operating profit* 396 433 (9) (8)

Adjusted operating margin

%* 16.9% 16.4% +50bps +50bps

---------------------------- --------- --------- --------- --------

*Excludes adjusting items

Adjusted operating profit declined 9% and margin increased by

50bps at reported exchange rates.

-- Gross margin increased 270bps at CER (260bps reported). Business performance accounted for around two thirds of

the gross margin improvement benefitting from full-price, channel and regional (predominantly Mainland China)

mix. The gross margin benefited from COVID provisions taken in the PY by around 80 bps

-- Adjusted operating expenses fell by 7% against last year, benefitting from strong cost management and delivery of

the restructuring programmes. The 2017 cost savings programme has delivered savings of GBP150m since inception

including an incremental GBP25m in FY21

-- In July 2020 we announced a cost reduction programme to deliver the planned GBP55m savings with GBP45m of

associated costs. This programme remains on track and we achieved the targeted GBP35m of savings in FY21 with an

associated cost of GBP22m that was presented as an adjusting item. We expect the remaining GBP20m benefit from

the cost reduction programme will be achieved in FY22, with further costs of GBP23m to be incurred

Adjusted operating profit amounted to GBP396m including a GBP3m

FX headwind in FY21.

Adjusting items(*)

Adjusting items were a credit of GBP124m (FY20: GBP245m

charge).

Adjusting items* 27 March 28 March

Period ended 2021 2020

GBP million

---------

The impact of COVID-19

Inventory provisions 22 (68)

Rent concessions 54 -

Store impairments 47 (157)

Government grants 9 -

Receivable impairments 5 (11)

Assets under the course of construction

impairment - (10)

Related other sundry items - 5

--------- ---------

COVID-19 adjusting items** 137 (241)

Restructuring costs (30) (10)

Profit on sale of property 18 -

BME deferred consideration income - 2

Disposal of beauty business - 5

Adjusting operating items 125 (244)

Adjusting financing items (1) (1)

Adjusting items 124 (245)

----------------------------------------- ---------

*For more details see note 7 of the Financial Statements

** COVID-19 adjusting item includes a GBP22m credit (FY20:

GBP68m charge) that has been recognised through COGS relating to

inventory provisions

The major adjusting items are as follows:

-- Impact of the COVID-19 pandemic: the majority of adjusting items relate to rent concessions across our retail

network and impairment reversals to the carrying value of stores and inventory due to positive trading in FY21.

In addition, COVID-19 related government grants were also treated as an adjusting item

-- Restructuring costs: GBP22m related to the organisational changes announced in July 2020 and the final charge of

GBP8m relating to the cost-efficiency programme announced in 2017

-- Profit on sale of property: relates to the sale of a property in France

Adjusted profit before tax*

After an adjusted net finance charge of GBP30m (FY20 GBP19m),

adjusted profit before tax was GBP366m (FY20 GBP414m).

*For detail on adjusting items see note 7 of the Financial

Statements

Taxation*

The effective tax rate on adjusted profit increased to 25.4%

(FY20: 22.3%). This was higher than normal due to COVID-19

impacting the geographical shift in profits towards higher tax

jurisdictions. The reported tax rate on FY21 profit before taxation

was 23.3% (FY20: 27.9%).

* For detail see note 9 of the Financial Statements

Cash flow

Represented statement of cash flows

The following table is a representation of the cash flows,

excluding the impact of adjusting items, to highlight the

underlying movements.

Period ended 27 March 28 March

GBP million 2021 2020

Adjusted operating profit 396 433

Depreciation and amortisation 277 331

Working capital (25) (66)

Other 29 (73)

---------------------------------------- --------- --------

Cash inflow from operations 677 625

Payment of lease principal and related

cash flows (155) (244)

Capital expenditure (115) (149)

Proceeds from disposal of non-current 27 3

assets

Interest (27) (19)

Tax (58) (150)

---------------------------------------- --------- --------

Free cash flow 349 66

---------------------------------------- --------- --------

Free cash flow was GBP349m (FY20 of GBP66m) and cash conversion

was 111% (2020: 52%) reflecting strong cash discipline. We had the

following key flows:

-- Working capital saw a GBP25m outflow. Within this, inventories reduced 16% in gross terms due to disciplined

inventory control, generating an inflow of GBP21m in the year (FY20 inflow of GBP27m), with significantly lower

payables outflow more than offsetting higher receivables outflow compared to prior year

-- Lease related payments fell GBP89m including benefit of GBP54m of COVID-19 related rent concessions

-- Capital expenditure reduced to GBP115m (2020: GBP149m) as projects were impacted by the pandemic

-- Tax paid reduced to GBP58m against the prior year in which payments were elevated mostly due to the accelerated

collection by HMRC in the UK

Cash net of overdrafts at 27 March 2021 was GBP1.2bn (28 March

2020: GBP0.9bn). We repaid the RCF in June 2020 and in September

issued a GBP0.3bn Sustainability Bond after obtaining a public

investment grade credit rating. For short term security, we

borrowed GBP0.3bn under the Government backed CCFF during the year,

repaying this early, in February 2021.

Our net debt(*) including reported lease liabilities was GBP101m

(28 March 2020: GBP538m). Net Debt / adjusted EBITDA was 0.1x on a

rolling 12 months period (28 March 2020 0.7x), significantly below

our target range of 0.5x to 1.0x.

Progressive dividend policy reinstated with the full year

dividend declared at FY19 levels of 42.5p.

*For a definition of net debt see page 21.

Period ended 27 March 28 March

GBP million 2021 2020

Adjusted EBITDA - rolling

12 months 673 764

Cash net of overdrafts (1,216) (887)

RCF drawn - 300

Bond 297 -

Lease debt 1,020 1,125

--------- ---------

Net Debt 101 538

Net Debt/Adjusted EBITDA 0.1x 0.7x

--------- ---------

APPIX

Detailed guidance for FY22

Item Financial impact

Markdown policy We will be exiting markdowns in mainline stores

in FY22. This will lead to a headwind against

our comparable store sales of mid-single digits

in the full year with Q1 FY21 comp impacted

by HSD

---------------------------------------------------------

Wholesale revenue H1 wholesale to increase by around 50%

---------------------------------------------------------

Impact of retail We expect space to be broadly neutral in the

space on revenues year

---------------------------------------------------------

Tax We expect the adjusted tax rate to be around

22%

---------------------------------------------------------

Capex Expected to be in the range GBP180m to GBP190m

- increasing due to investment in store refurbishments,

digital and IT

---------------------------------------------------------

Currency Headwind on revenue of GBP96m and GBP34m on

adjusted operating profit at 30 April spot rates

---------------------------------------------------------

Dividend Resumption of progressive dividend policy

---------------------------------------------------------

Calendar Please note that FY22 is a 53 week year with

an additional week in Q4

---------------------------------------------------------

Note : guidance based on CER at FY21 rates

Retail/wholesale revenue by destination*

Period ended 27 March 28 March % change

GBP million 2021 2020 Reported FX CER

---------------------------- --------- --------- ------------ -----

Asia Pacific (94% retail)* 1,203 1,041 16 16

EMEIA (59% retail)* 628 960 (35) (35)

Americas (86% retail)* 475 585 (19) (15)

Total 2,306 2,586 (11) (10)

---------------------------- --------- --------- ------------

* Mix based on FY21

Retail/wholesale revenue by product

division

Period ended 27 March 28 March % change

GBP million 2021 2020 Reported FX CER

-------------------- --------- --------- ------------- -----

Accessories 841 948 (11) (11)

Women's 653 796 (18) (18)

Men's 668 715 (7) (6)

Children's & other 144 127 14 15

Total 2,306 2,586 (11) (10)

-------------------- --------- --------- -------------

Store portfolio

Directly-operated stores

--------------------------------------- ----------

Stores Concessions Outlets Total Franchise

stores

----------------- ------- ------------ -------- ----------

At 28 March

2020 218 149 54 421 44

Additions 11 1 5 17 -

Closures (15) (5) (3) (23) -

At 27 March

2021 214 145 56 415 44

------- ------------ --------

Store portfolio by region*

Directly-operated stores

--------------------------------------- ----------

Stores Concessions Outlets Total Franchise

At 27 March stores

2021

----------------- ------- ------------ -------- ----------

Asia Pacific 97 90 22 209 7

EMEIA 56 46 18 120 37

Americas 61 9 16 86 -

Total 214 145 56 415 44

------- ------------ --------

*Excludes the impact of pop up stores

Adjusted operating 27 March 28 March % change % change

profit* 2021 2020 Reported CER

Period ended FX

GBP Millions

Retail/wholesale 361 390 (7) (6)

Licensing 35 43 (20) (21)

-------------------- --------- --------- ---------- ---------

Adjusted operating

profit 396 433 (9) (8)

Adjusted operating

margin 16.9% 16.4% +50bps +50bps

-------------------- --------- --------- ---------- ---------

*For additional detail on adjusting items see note 7 of the

Financial Statements

Exchange rates

Spot rates Average effective

exchange rates

30 April FY21 FY20

GBP1= 2021

----------------------- ----------- --------- ---------

Euro 1.15 1.12 1.14

US Dollar 1.39 1.30 1.27

Chinese Yuan Renminbi 9.03 8.85 8.88

Hong Kong Dollar 10.82 10.08 9.89

Korean Won 1,545 1,514 1,504

----------------------- ----------- --------- ---------

Profit before tax reconciliation

Period ended 27 March 28 March % change % change

2021 2020 Reported CER

GBP million FX

Adjusted profit before

tax 366 414 (12) (11)

Adjusting items*

COVID-19 related items 137 (241)

Restructuring costs (30) (10)

Profit on sale of property 18 -

BME deferred consideration

liability - 2

Disposal of Beauty

operations - 5

Adjusting financing

items (1) (1)

---------------------------- --------- --------- ---------- ---------

Profit before tax 490 169 190

---------------------------- --------- --------- ---------- ---------

Alternative performance measures

Alternative performance measures (APMs) are non-GAAP measures.

The Board uses the following APMs to describe the Group's financial

performance and for internal budgeting, performance monitoring,

management remuneration target setting and for external reporting

purposes.

APM Description and purpose GAAP measure reconciled to

Constant This measure removes Results at reported rates

Exchange the effect of changes

Rates (CER) in exchange rates compared

to the prior period. It

incorporates both the

impact of the movement

in exchange rates on the

translation of overseas

subsidiaries' results

and also on foreign currency

procurement and sales

through the Group's UK

supply chain.

--------------------------------- -------------------------------------------

Comparable The year-on-year change Retail Revenue:

sales in sales from stores trading Period ended 27 March 28 March

over equivalent time periods YoY% 2021 2020

and measured at constant ------------------- --------- ---------

foreign exchange rates. Comparable sales* (9%)* (3%)

It also includes online Change in space - (1%)

sales. This measure is FX - 1%

used to strip out the ------------------- --------- ---------

impact of permanent store Retail revenue (9%) (3%)

openings and closings,

or those closures relating *Includes full-price comp +7%

to refurbishments, allowing

a comparison of equivalent

store performance against

the prior period. The

measurement of comparable

sales has not excluded

stores temporarily closed

as a result of the COVID-19

outbreak

Full-price sales:

Net sales of Group's

directly operated mainline

comparable stores excluding

Markdown sales.

--------------------------------- -------------------------------------------

Q4 FY21 The change in sales over Retail Revenue:

vs Q4 FY19 two years measured at % change Q4 FY21

comparable constant foreign exchange vs Q4 FY19

sales rates. It also includes ----------------- ------------

online sales. The measurement Reported growth (2%)

of comparable sales has Comparable

not excluded stores temporarily sales (5%)

closed as a result of Change in space 5%

the COVID-19 outbreak. CER retail 0%

This measure reflects FX (2%)

the two year aggregation ----------------- ------------

of the growth rates.

--------------------------------- -------------------------------------------

Adjusted Adjusted profit measures Reported Profit:

Profit are presented to provide A reconciliation of reported

additional consideration profit before tax to adjusted

of the underlying performance profit before tax and the Group's

of the Group's ongoing accounting policy for adjusted

business. These measures profit before tax are set out

remove the impact of those in the financial statements.

items which should be

excluded to provide a

consistent and comparable

view of performance .

--------------------------------- -------------------------------------------

Free Cash Free cash flow is defined Net cash generated from operating

Flow as net cash generated activities:

from operating activities Period ended 27 March 28 March

less capital expenditure GBPm 2021 2020

plus cash inflows from -------------------- --------- ---------

disposal of fixed assets Net cash generated

and including cash outflows from operating

for lease principal payments activities 592 456

and other lease related Capex (115) (149)

items. Lease principal

and related

cash flows (155) (244)

Proceeds from

disposal of

non-current

assets 27 3

-------------------- --------- ---------

Free cash

flow 349 66

-------------------- --------- ---------

Cash Conversion Cash conversion is defined Net cash generated from operating

as free cash flow pre-tax/adjusted activities:

profit before tax. It ---------------------------------------

provides a measure of Period ended 27 March 28 March

the Group's effectiveness GBPm 2021 2020

in converting its profit ----------------- --------- ---------

into cash. Free cash

flow 349 66

Tax paid 58 150

----------------- --------- ---------

Free cash

flow before

tax 407 216

----------------- --------- ---------

Adjusted profit

before tax 366 414

Cash conversion 111% 52%

------------------------------------ ----------------------------------------------

Net Debt Net debt is defined as Cash net of overdrafts:

the lease liability recognised Period ended 27 March 28 March

on the balance sheet plus GBPm 2021 2020

borrowings less cash net ----------------- --------- ---------

of overdrafts. Cash net of

overdrafts 1,216 887

Lease liability (1,020) (1,125)

Borrowings (297) (300)

----------------- --------- ---------

Net debt (101) (538)

------------------------------------ ----------------------------------------------

Adjusted Adjusted EBITDA is defined Reconciliation from operating

EBITDA as operating profit, excluding profit to adjusted EBITDA:

adjusting operating items, Period ended 27 March 28 March

depreciation of property, GBPm 2021 2020

plant and equipment, depreciation ---------------------- --------- ---------

of right of use assets Operating profit 521 189

and amortisation of intangible Adjusted operating

assets. Any depreciation items (125) 244

or amortisation included Amortisation

in adjusting operating of intangible

items are not double-counted. assets 33 26

Adjusted EBITDA is shown Depreciation

for the calculation of of property,

Net Debt/EBITDA for our plant and equipment 72 84

gearing ratios. Depreciation

of right-of-use

assets 172 221

---------------------- --------- ---------

Adjusted EBITDA 673 764

------------------------------------ ----------------------------------------------

GROUP INCOME STATEMENT

52 weeks 52 weeks

to to

27 March 28 March

2021 2020

Note GBPm GBPm

---------------------------------------------- ---- --------- ---------

Revenue 4 2,343.9 2,633.1

Cost of sales (681.4) (927.6)

---------------------------------------------- ---- --------- ---------

Gross profit 1,662.5 1,705.5

Net operating expenses 5 (1,141.4) (1,516.8)

---------------------------------------------- ---- --------- ---------

Operating profit 521.1 188.7

Financing

---------------------------------------------- ---- --------- ---------

Finance income 3.1 7.6

Finance expense (33.3) (26.6)

Other financing charge (0.7) (1.2)

---------------------------------------------- ---- --------- ---------

Net finance expense 8 (30.9) (20.2)

---------------------------------------------- ---- --------- ---------

Profit before taxation 6 490.2 168.5

Taxation 9 (114.3) (46.9)

---------------------------------------------- ---- --------- ---------

Profit for the year 375.9 121.6

---------------------------------------------- ---- --------- ---------

Attributable to:

Owners of the Company 375.7 121.7

Non-controlling interest 0.2 (0.1)

---------------------------------------------- ---- --------- ---------

Profit for the year 375.9 121.6

---------------------------------------------- ---- --------- ---------

Earnings per share

Basic 10 93.0p 29.8p

Diluted 10 92.7p 29.8p

---------------------------------------------- ---- --------- ---------

GBPm GBPm

Reconciliation of adjusted profit before

taxation:

Profit before taxation 490.2 168.5

Adjusting operating items:

Cost of sales 6 (22.3) 68.3

Net operating expenses 6 (102.9) 176.1

Adjusting financing items 6 0.7 1.2

---------------------------------------------- ---- --------- ---------

Adjusted profit before taxation - non-GAAP

measure 365.7 414.1

---------------------------------------------- ---- --------- ---------

Adjusted earnings per share - non-GAAP

measure

Basic 10 67.5p 78.9p

Diluted 10 67.3p 78.7p

---------------------------------------------- ---- --------- ---------

Dividends per share

Interim 11 - 11.3p

Proposed final (not recognised as a liability

at 27 March/28 March) 11 42.5p -

---------------------------------------------- ---- --------- ---------

GROUP STATEMENT OF COMPREHENSIVE INCOME

52 weeks 52 weeks

to to

27 March 28 March

2021 2020

Note GBPm GBPm

--------------------------------------------- ---- --------- ---------

Profit for the year 375.9 121.6

Other comprehensive income(1) :

Cash flow hedges 23 - 2.7

Net investment hedges 23 - (1.2)

Foreign currency translation differences (51.4) 18.5

Actuarial gains on post-employment benefit

plans 1.0 -

Tax on other comprehensive income:

Cash flow hedges 9 - (0.5)

Net investment hedges 9 - 0.2

Foreign currency translation differences 9 2.4 (0.9)

Actuarial gains on post-employment benefit

plans (0.2) -

--------------------------------------------- ---- --------- ---------

Other comprehensive (loss)/income for

the year, net of tax (48.2) 18.8

--------------------------------------------- ---- --------- ---------

Total comprehensive income for the year 327.7 140.4

--------------------------------------------- ---- --------- ---------

Total comprehensive income attributable

to:

Owners of the Company 327.7 140.4

Non-controlling interest - -

--------------------------------------------- ---- --------- ---------

327.7 140.4

--------------------------------------------- ---- --------- ---------

1. All items included in other comprehensive income, with the

exception of Actuarial gains on post-employment benefit plans, may

subsequently be reclassified to profit and loss in a future

period.

GROUP BALANCE SHEET

As at As at

27 March 28 March

2021 2020

Note GBPm GBPm

------------------------------------- ---- --------- ---------

ASSETS

Non-current assets

Intangible assets 12 237.0 247.0

Property, plant and equipment 13 280.4 294.9

Right-of-use assets 14 818.1 834.0

Investment properties 2.4 2.5

Deferred tax assets 137.1 171.5

Trade and other receivables 15 45.0 53.7

1,520.0 1,603.6

------------------------------------- ---- --------- ---------

Current assets

Inventories 16 402.1 450.5

Trade and other receivables 15 276.9 252.1

Derivative financial assets 2.2 6.7

Income tax receivables 39.7 50.4

Cash and cash equivalents 17 1,261.3 928.9

------------------------------------- ---- --------- ---------

1,982.2 1,688.6

------------------------------------- ---- --------- ---------

Total assets 3,502.2 3,292.2

------------------------------------- ---- --------- ---------

LIABILITIES

Non-current liabilities

Trade and other payables 18 (99.4) (102.3)

Lease liabilities 19 (809.6) (910.0)

Borrowings 22 (297.1) (300.0)

Deferred tax liabilities (0.8) (0.1)

Retirement benefit obligations (1.0) (1.9)

Provisions for other liabilities and

charges 20 (31.8) (28.6)

------------------------------------- ---- --------- ---------

(1,239.7) (1,342.9)

------------------------------------- ---- --------- ---------

Current liabilities

Trade and other payables 18 (392.9) (447.5)

Bank overdrafts 21 (45.4) (41.6)

Lease liabilities 19 (210.0) (215.5)

Derivative financial liabilities (2.6) (4.8)

Income tax liabilities (27.9) (7.9)

Provisions for other liabilities and

charges 20 (24.0) (13.2)

(702.8) (730.5)

------------------------------------- ---- --------- ---------

Total liabilities (1,942.5) (2,073.4)

------------------------------------- ---- --------- ---------

Net assets 1,559.7 1,218.8

------------------------------------- ---- --------- ---------

EQUITY

Capital and reserves attributable to

owners of the Company

Ordinary share capital 23 0.2 0.2

Share premium account 223.0 220.8

Capital reserve 23 41.1 41.1

Hedging reserve 23 4.7 4.7

Foreign currency translation reserve 23 196.4 245.2

Retained earnings 1,091.2 702.2

------------------------------------- ---- --------- ---------

Equity attributable to owners of the

Company 1,556.6 1,214.2

Non-controlling interest in equity 3.1 4.6

------------------------------------- ---- --------- ---------

Total equity 1,559.7 1,218.8

------------------------------------- ---- --------- ---------

GROUP STATEMENT OF CHANGES IN EQUITY

Attributable to

owners

of the Company

-----------------------------

Ordinary Share

share premium Other Retained Non-controlling Total

capital account reserves earnings Total interest equity

Note GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------------- ---- -------- -------- --------- --------- ------- --------------- -------

Balance as at 30 March

2019 0.2 216.9 272.3 965.6 1,455.0 5.0 1,460.0

----------------------------------- ---- -------- -------- --------- --------- ------- --------------- -------

Adjustment on initial

application of IFRS 16 - - - (57.1) (57.1) (0.4) (57.5)

Adjustment on initial

application of IFRIC 23 - - - (4.4) (4.4) - (4.4)

----------------------------------- ---- -------- -------- --------- --------- ------- --------------- -------

Adjusted balance as at

31 March 2019 0.2 216.9 272.3 904.1 1,393.5 4.6 1,398.1

----------------------------------- ---- -------- -------- --------- --------- ------- --------------- -------

Profit for the year - - - 121.7 121.7 (0.1) 121.6

Other comprehensive income:

Cash flow hedges 23 - - 2.7 - 2.7 - 2.7

Net investment hedges 23 - - (1.2) - (1.2) - (1.2)

Foreign currency translation

differences 23 - - 18.4 - 18.4 0.1 18.5

Tax on other comprehensive

income 23 - - (1.2) - (1.2) - (1.2)

----------------------------------- ---- -------- -------- --------- --------- ------- --------------- -------

Total comprehensive income

for the year - - 18.7 121.7 140.4 - 140.4

----------------------------------- ---- -------- -------- --------- --------- ------- --------------- -------

Transactions with owners:

Employee share incentive

schemes

Value of share options

granted - - - 2.8 2.8 - 2.8

Value of share options

transferred to liabilities - - - 0.1 0.1 - 0.1

Tax on share options

granted - - - (0.6) (0.6) - (0.6)

Exercise of share options - 3.9 - - 3.9 - 3.9

Purchase of own shares

Share buy-back - - - (150.7) (150.7) - (150.7)

Dividends paid in the

year - - - (175.2) (175.2) - (175.2)

----------------------------------- ---- -------- -------- --------- --------- ------- --------------- -------

Balance as at 28 March

2020 0.2 220.8 291.0 702.2 1,214.2 4.6 1,218.8

----------------------------------- ---- -------- -------- --------- --------- ------- --------------- -------

Profit for the year - - - 375.7 375.7 0.2 375.9

Other comprehensive income:

Foreign currency translation

differences 23 - - (51.2) - (51.2) (0.2) (51.4)

Actuarial gains on post-employment

benefit plans - - - 1.0 1.0 - 1.0

Tax on other comprehensive

income 23 - - 2.4 (0.2) 2.2 - 2.2

----------------------------------- ---- -------- -------- --------- --------- ------- --------------- -------

Total comprehensive income

for the year - - (48.8) 376.5 327.7 - 327.7

----------------------------------- ---- -------- -------- --------- --------- ------- --------------- -------

Transactions with owners:

Employee share incentive

schemes

Value of share options

granted - - - 12.1 12.1 - 12.1

Tax on share options

granted - - - 0.7 0.7 - 0.7

Exercise of share options - 2.2 - Ð 2.2 - 2.2

Acquisition of additional

interest in subsidiary 26 - - - (0.2) (0.2) (1.5) (1.7)

Purchase of own shares

Held by ESOP trusts - - - (0.1) (0.1) - (0.1)

Balance as at 27 March

2021 0.2 223.0 242.2 1,091.2 1,556.6 3.1 1,559.7

----------------------------------- ---- -------- -------- --------- --------- ------- --------------- -------

GROUP STATEMENT OF CASH FLOWS

52 weeks 52 weeks

to to

27 March 28 March

2021 2020

Note GBPm GBPm

------------------------------------------------- ---- --------- ---------

Cash flows from operating activities

Operating profit 521.1 188.7

Amortisation of intangible assets 12 32.9 26.4

Depreciation of property, plant and equipment 13 71.4 83.3

Depreciation of right-of-use assets 14 172.4 221.1

COVID-19-related rent concessions 1 (54.1) -

Impairment charge of intangible assets 12 8.8 11.6

Net impairment (reversal)/charge of property,

plant and equipment 13 (7.5) 26.4

Net impairment (reversal)/charge of right-of-use

assets 14 (33.7) 140.3

(Gain)/loss on disposal of property,

plant and equipment and intangible assets (22.7) 0.7

Gain on disposal of right-of-use assets (1.1) (2.1)

Gain on disposal of Beauty operations - (5.0)

Loss/(gain) on derivative instruments 3.8 (3.1)

Charge in respect of employee share incentive

schemes 12.1 2.8

(Payment)/receipt from settlement of

equity swap contracts (1.5) 0.2

Decrease in inventories 20.9 27.4

Increase in receivables (39.0) (9.8)

Decrease in payables and provisions (7.2) (84.0)

------------------------------------------------- ---- --------- ---------

Cash generated from operating activities 676.6 624.9

Interest received 2.9 7.2

Interest paid (30.1) (26.0)

Taxation paid (58.0) (150.3)

------------------------------------------------- ---- --------- ---------

Net cash generated from operating activities 591.4 455.8

Cash flows from investing activities

Purchase of property, plant and equipment (72.9) (85.3)

Purchase of intangible assets (41.9) (63.5)

Proceeds from sale of property, plant

and equipment 27.2 3.0

Initial direct costs of right-of-use

assets (2.9) (5.6)

Net cash outflow from investing activities (90.5) (151.4)

Cash flows from financing activities

Dividends paid in the year 11 - (175.2)

Payment of deferred consideration for

acquisition of non-controlling interest 18 (2.6) (2.7)

Proceeds from borrowings 22 595.1 300.0

Repayment of borrowings 22 (599.8) -

Payment of lease principal (152.2) (228.4)

Payment on termination of lease - (9.7)

Payment to acquire additional interest

in subsidiary from non--controlling interest 26 (1.7) -

Issue of ordinary share capital 2.2 3.8

Purchase of own shares through share

buy-back 23 - (150.7)

Purchase of own shares by ESOP trusts (0.1) -

------------------------------------------------- ---- --------- ---------

Net cash outflow from financing activities (159.1) (262.9)

Net increase in cash and cash equivalents 341.8 41.5

Effect of exchange rate changes (13.2) 8.5

Cash and cash equivalents at beginning

of year 887.3 837.3

------------------------------------------------- ---- --------- ---------

Cash and cash equivalents at end of year 1,215.9 887.3

------------------------------------------------- ---- --------- ---------

As at As at

27 March 28 March

2021 2020

Note GBPm GBPm

------------------------------------- ---- --------- ---------

Cash and cash equivalents as per the

Balance Sheet 17 1,261.3 928.9

Bank overdrafts 21 (45.4) (41.6)

------------------------------------- ---- --------- ---------

Cash net of overdrafts 1,215.9 887.3

------------------------------------- ---- --------- ---------

NOTES TO THE FINANCIAL STATEMENTS

1. Basis of preparation

The financial information contained within this report has been

prepared in accordance with international accounting standards in

conformity with the requirements of the Companies Act 2006 and

International Financial Reporting Standards adopted pursuant to

Regulation (EC) No. 1606/2002 as it applies in the European Union,

IFRS Interpretations Committee (IFRS IC) interpretations and parts

of the Companies Act 2006 applicable to companies reporting under

IFRS. This financial information does not constitute the Burberry

Group's (the Group) Annual Report and Accounts within the meaning

of Section 435 of the Companies Act 2006.

Statutory accounts for the 52 weeks to 28 March 2020 have been

filed with the Registrar of Companies, and those for 2021 will be

delivered in due course. The reports of the auditors on those

statutory accounts for the 52 weeks to 28 March 2020 and 27 March

2021 were unqualified, did not contain an emphasis of matter

paragraph and did not contain a statement under either section

400(2) or section 498(3) of the Companies Act 2006.

Going concern

The impact of the COVID-19 pandemic on the global economy and

the operating activities of many businesses, including the luxury

market, has resulted in a volatile climate and continued

uncertainty. The further impact of this pandemic on the Group is

uncertain at the date of signing these financial statements. In

considering the appropriateness of adopting the going concern basis

in preparing the financial statements, the directors have assessed

the potential cash generation of the Group and considered a range

of downside scenarios. This assessment covers from the date of

signing the financial statements up to 1 October 2022 for any

indicators that the going concern basis of preparation is not

appropriate.

The directors have assessed the potential cash generation of the

Group against a range of projected scenarios (including a severe

but plausible downside). These scenarios were informed by a

comprehensive review of the macroeconomic scenarios using third

party projections of scientific, epidemiological and macroeconomic

data for the luxury fashion industry:

-- The Group central planning scenario reflects a balanced projection with a continued focus on growing markets,

maintaining momentum built in FY2020/21 as part of the customer strategy.

-- As a sensitivity, this central planning scenario has been flexed to reflect a 26% downgrade to revenues in FY

2021/22, as well as the associated consequences for EBITDA and cash. Management consider this represents a severe

but plausible downside scenario appropriate for assessing going concern. This was designed to test an even more

challenging trading environment as a result of COVID-19 together with the potential impacts of one or more of the

Group's other principal risks.

The severe but plausible downside modelled the following risks

occurring simultaneously:

-- A significant impact on revenue in FY 2021/22 compared to the central planning scenario caused by the impact of a

reputational incident such as negative sentiment propagated through social media.

-- A longer-term decrease in revenue caused by a resurgence of the pandemic and store re-closures.

-- The impact of prolonged recovery of travel to 2019 levels.

In addition, the potential impact of other principal risks,

including the impact of foreign exchange volatility, were

considered. The directors have also considered mitigating actions,

which may be taken to reduce discretionary and other operating cash

outflows. The directors have also considered the Group's current

liquidity and available facilities. Details of cash, overdrafts,

borrowings and facilities are set out in notes 17, 21 and 22

respectively of these financial statements, which includes access

to a GBP300.0 million revolving credit facility, currently undrawn

and not relied upon in this going concern assessment.

In all the scenarios assessed, taking into account current

liquidity and available facilities, the Group was able to maintain

sufficient liquidity to continue trading. On the basis of the

assessment performed, the directors consider it is appropriate to

continue to adopt the going concern basis in preparing the

consolidated financial statements for the 52 weeks ended 27 March

2021.

Accounting policies

The principal accounting policies applied in the preparation of

the consolidated financial statements are consistent with those set

out in the statutory accounts for the 52 weeks to 28 March 2020,

with the exception of the following:

IFRS 16 Leases - COVID-19-Related Rent Concessions

The COVID-19-Related Rent Concessions amendment to IFRS 16

Leases was adopted by the IASB on 28 May 2020 and endorsed by the

European Union on 12 October 2020. The amendment applies to

accounting periods from 1 June 2020 but early application is

permitted and the Group has elected to apply the amendment in the

current year. The amendment allows for a simplified approach to

accounting for rent concessions occurring as a direct result of

COVID-19 and for which the following criteria are met:

-- The revised consideration is substantially the same, or less than, the consideration prior to the change;

-- The concessions affect only payments originally due on or before 30 June 2021; and

-- There is no substantive change to other terms and conditions of the lease.

Lessees are not required to assess whether eligible rent

concessions are lease modifications, allowing the lessee to account

for eligible rent concessions as if they were not lease

modifications. During the period, the Group has agreed rent

concessions both in the form of rent forgiveness in which the

landlord has agreed to forgive all or a portion of rents due with

no obligation to be repaid in the future, and rent deferrals in

which the landlord has agreed to forego rents in one period with a

proportional increase in rents due in a future period.

The Group has chosen to account for eligible rent forgiveness as

negative variable lease payments. The rent concession has been

recognised once a legally binding agreement is made between both

parties by derecognising the portion of the lease liability that

has been forgiven and recognising the benefit in the Income

Statement. As a result, the Group has recognised GBP54.1 million in

COVID-19-related rent concessions in the Income Statement within

'net operating expenses' in the current period. This has been

presented as an adjusting item (refer to note 7). In the Statement

of Cash Flows, the forgiveness results in lower payments of lease

principal. The negative variable lease payments in the Income

Statement is a non-cash item which is added back to calculate cash

generated from operating activities.

Rent deferrals do not change the total consideration due over

the life of the lease. Deferred rent payments are recognised as a

payable until the period the original rent payment is due. As a

result, the Group has recognised GBP4.3 million within other

payables. Payments relating to rent deferrals are recognised as

payments of lease principal when the payment is made.

Standards not yet adopted

Certain new accounting standards and interpretations have been

published that are not mandatory for the 52 weeks to 27 March 2021

and have not been early adopted by the Group. These standards are

not expected to have a material impact on the entity in the current

or future reporting periods and on foreseeable future

transactions.

Key sources of estimation uncertainty

Preparation of the consolidated financial statements in

conformity with IFRS requires that management make certain

estimates and assumptions that affect the measurement of reported

revenues, expenses, assets and liabilities and the disclosure of

contingent liabilities.

If in the future such estimates and assumptions, which are based

on management's best estimates at the date of the financial

statements, deviate from actual circumstances, the original

estimates and assumptions will be updated as appropriate in the

period in which the circumstances change.

Estimates are continually evaluated and are based on historical

experience and other factors, including expectations of future

events that are believed to be reasonable under the

circumstances.

The COVID-19 pandemic (COVID-19) has had a major impact on the

global economy throughout the current year. While the adverse

impact on the Group's operations and financial position has

significantly diminished during the course of the financial year,

at the date of signing these financial statements, there remains

significant uncertainty regarding the timing of any global recovery

from COVID-19, and the return to previous levels of footfall in

city centres, travel and tourism in some locations. As a result,

the impact of COVID-19 on the Group's assets remains a significant

source of estimation uncertainty.

The key areas where the estimates and assumptions applied have a

significant risk of causing a material adjustment to the carrying

value of assets and liabilities within the next financial year are

discussed below.

Impairment, or reversals of impairment, of property, plant and

equipment and right-of-use assets

Property, plant and equipment and right-of-use assets are

reviewed for impairment if events or changes in circumstances

indicate that the carrying amount may not be recoverable. When a

review for impairment is conducted, the recoverable amount of an

asset or a cash generating unit is determined based on value-in-use

calculations prepared using managementÕs best estimates and

assumptions at the time.

Last year end, management recorded impairments of retail

property, plant and equipment and right-of-use assets, based on the

estimated impact of COVID-19 on the Group. At that time, the impact

of COVID-19 was at its highest and many of the Group's retail

stores worldwide were closed. Since last year end, the rate of

recovery has exceeded management estimates, indicating a potential

impairment reversal. Therefore, management has updated their

assumptions as at 27 March 2021, reflecting their latest plans over

the next three years to March 2024, followed by longer-term growth

rates of mid-single digits. This has resulted in net reversals of

impairments.

Management has also reviewed the remaining retail property,

plant and equipment and right-of-use assets, not covered by the

above reassessment, for any indications of impairment. No new

impairments of property, plant and equipment and right-of-use

assets outside the scope of the reassessment of last year's

assumptions were identified.

Refer to notes 13 and 14 for further details of retail property,

plant and equipment, right-of-use assets and impairment reviews

carried out in the period and for sensitivities relating to this

key source of estimation uncertainty.

Inventory provisioning

The Group manufactures and sells luxury goods and is subject to

changing consumer demands and fashion trends. The recoverability of

the cost of inventories is assessed every reporting period, by

considering the expected net realisable value of inventory compared

to its carrying value. Where the net realisable value is lower than

the carrying value, a provision is recorded. When calculating

inventory provisions, management considers the nature and condition

of the inventory, as well as applying assumptions in respect of

anticipated saleability of finished goods and future usage of raw

materials.

Last year end, management recorded provisions against inventory,

based on the estimated impact of COVID-19 on the Group. As noted

above, performance during the current year has exceeded the

estimates made at last year end and hence management has updated

their assumptions regarding future performance. This has resulted

in a release of inventory provisions, both relating to inventory

sold during the current year, where this was for a higher net

realisable value than had been assumed, and relating to assumptions

regarding the net realisable value of inventory held at 27 March

2021.

Management has also reviewed the remaining inventory, not

covered by the above reassessment, and provisions have been

recorded where appropriate based on future trading

expectations.

Refer to note 16 for further details of the carrying value of

inventory and inventory provisions and for sensitivities relating

to this key source of estimation uncertainty.

Uncertain tax positions

In common with many multinational companies, Burberry faces tax

audits in jurisdictions around the world in relation to transfer

pricing of goods and services between associated entities within

the Group. These tax audits are often subject to inter-government

negotiations. The matters under discussion are often complex and

can take many years to resolve. Tax liabilities are recorded based

on management's estimate of either the most likely amount or the

expected value amount depending on which method is expected to

better reflect the resolution of the uncertainty. Given the

inherent uncertainty in assessing tax outcomes, the Group could, in

future periods, experience adjustments to these tax liabilities

that have a material positive or negative effect on the Group's

results for a particular period.

During the next year it is possible that some or all of the

current disputes are resolved. Management estimates that the

outcome across all matters under dispute or in negotiation between

governments could be in the range of a decrease of GBP11 million to

an increase of GBP15 million relative to the current tax

liabilities recognised at 27 March 2021. This would have an impact

of approximately 3% to 4% on the Group's effective tax rate.

Key judgements in applying the Group's accounting policies

Judgements are those decisions made when applying accounting

policies which have a significant impact on the amounts recognised

in the Group financial statements. Key judgements that have a

significant impact on the amounts recognised in the Group financial

statements for the 52 weeks to 27 March 2021 and the 52 weeks to 28

March 2020 are as follows:

Where the Group is a lessee, judgement is required in

determining the lease term at initial recognition where extension

or termination options exist. In such instances, all facts and

circumstances that may create an economic incentive to exercise an

extension option, or not exercise a termination option, have been

considered to determine the lease term. Considerations include, but

are not limited to, the period assessed by management when

approving initial investment, together with costs associated with

any termination options or extension options. Extension periods (or

periods after termination options) are only included in the lease

term if the lease is reasonably certain to be extended (or not

terminated). Where the lease term has been extended by assuming an

extension option will be recognised, this will result in the

initial right-of-use assets and lease liabilities at inception of

the lease being greater than if the option was not assumed to be

exercised. Likewise, assuming a break option will be exercised will

reduce the initial right-of-use assets and lease liabilities.

During the 52 weeks to 27 March 2021, significant judgements

regarding breaks and options in relation to individually material

leases resulted in approximately GBP91.7 million in undiscounted

future cash flows not being included in the initial right-of-use

assets and lease liabilities.

2. Translation of the results of overseas businesses

The results of overseas subsidiaries are translated into the

Group's presentation currency of Sterling each month at the

weighted average exchange rate for the month according to the

phasing of the Group's trading results. The weighted average

exchange rate is used, as it is considered to approximate the

actual exchange rates on the date of the transactions. The assets

and liabilities of such undertakings are translated at the closing