BlackRock Frontiers Portfolio Update

April 09 2021 - 9:31AM

UK Regulatory

TIDMBRFI

The information contained in this release was correct as at 28 February 2021.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK FRONTIERS INVESTMENT TRUST PLC (LEI: 5493003K5E043LHLO706)

All information is at 28 February 2021 and unaudited.

Performance at month end with net income reinvested.

One Three One Three Five Since

month months year years years Launch*

% % % % % %

Sterling:

Share price -1.9 8.9 17.2 -17.5 36.9 69.6

Net asset value 1.3 6.7 14.1 -13.4 39.9 78.3

Benchmark (NR)** -1.1 -0.4 0.0 -10.1 33.0 47.5

MSCI Frontiers Index (NR) -1.7 1.5 -1.0 -4.9 40.7 57.2

MSCI Emerging Markets Index (NR) -1.0 6.5 24.3 18.5 102.6 71.4

US Dollars:

Share price -0.1 14.0 28.3 -16.2 37.4 52.7

Net asset value 3.2 11.7 24.9 -12.1 40.4 60.3

Benchmark (NR)** -0.7 3.0 8.0 -10.0 31.7 31.6

MSCI Frontiers Index (NR) 0.1 6.3 8.4 -3.5 41.2 40.9

MSCI Emerging Markets Index (NR) 0.8 11.5 36.0 20.3 103.2 53.7

Sources: BlackRock and Standard & Poor's Micropal

* 17 December 2010.

** The Company's benchmark changed from MSCI Frontier Markets Index to MSCI

Emerging ex Selected Countries + Frontier Markets + Saudi Arabia Index (net

total return, USD) effective 1/4/2018.

At month end

US Dollar

Net asset value - capital only: 167.70c

Net asset value - cum income: 169.15c

Sterling:

Net asset value - capital only: 119.96p

Net asset value - cum income: 120.99p

Share price: 117.25p

Total assets (including income): £229.1m

Discount to cum-income NAV: 3.1%

Gearing: nil

Gearing range (as a % of gross assets): 0-20%

Net yield*: 4.5%

Ordinary shares in issue**: 189,325,748

Ongoing charges***: 1.4%

Ongoing charges plus taxation and performance fee: 1.4%

*The Company's yield based on dividends announced in the last 12 months as at

the date of the release of this announcement is 4.5% and includes the 2020

final dividend of 4.25 cents per share declared on 11 December 2020 which paid

on 12 February 2021. Also included is the 2020 interim dividend of 2.75 cents

per share, announced on 28 May 2020 and paid to shareholders on 26 June 2020.

** Excluding 612,283 ordinary shares held in treasury.

***Calculated as a percentage of average net assets and using expenses,

excluding Performance fees and interest costs for the year ended 30 September

2020.

Sector Gross market Country Gross market value as

Analysis value as a % of Analysis a % of net assets*

net assets*

Financials 31.9 Saudi Arabia 14.1

Materials 16.6 Indonesia 12.6

Consumer Discretionary 15.6 Vietnam 10.6

Industrials 13.0 Kazakhstan 8.0

Energy 11.0 Thailand 7.4

Consumer Staples 8.9 Egypt 6.8

Real Estate 5.4 Greece 6.3

Information Technology 3.3 Philippines 5.5

Utilities 3.0 Chile 5.0

Communication Services 2.7 Malaysia 4.2

Health Care 2.6 Turkey 4.0

----- United Arab Emirates 3.9

114.0 Poland 3.9

----- Pakistan 3.5

Short positions -4.5 Qatar 3.0

===== Hungary 2.2

Peru 2.0

Romania 1.9

Panama 1.6

Pan-Emerging Europe 1.5

Ukraine 1.5

Colombia 1.4

Pan Africa 1.4

Kenya 1.2

Nigeria 0.5

-----

Total 114.0

-----

Short positions -4.5

=====

*reflects gross market exposure from contracts for difference (CFDs).

Market Exposure

31.03 30.04 31.05 30.06 31.07 31.08 30.09 31.10 30.11 31.12 31.01 28.02

2020 2020 2020 2020 2020 2020 2020 2020 2020 2020 2020 2020

% % % % % % % % % % % %

Long 106.4 105.9 109.6 109.8 110.3 110.2 107.8 106.9 107.3 107.9 110.4 114.0

Short 2.5 2.6 2.5 1.5 1.1 0.0 0.0 0.0 0.0 1.1 1.1 4.5

Gross 110.9 108.9 108.5 112.1 111.3 111.4 110.2 107.8 106.9 107.3 109.0 118.5

Net 103.3 103.9 103.3 107.1 108.3 109.2 110.2 107.8 106.9 107.3 106.8 109.5

Ten Largest Investments

Company Country of Risk Gross market value as a

% of net assets*

Mobile World Vietnam 3.8

FPT Vietnam 3.3

Bk Rakyat Indonesia 3.3

JSC Kaspi Kazakhstan 3.1

CP All PCL Thailand 3.1

National Commercial Bank Saudi Arabia 3.1

PTT Exploration & Production Public Thailand 3.0

Yanbu National Petrochemical Saudi Arabia 2.8

Tupras Turkey 2.6

Sahara International Petrochemical Saudi Arabia 2.6

*These percentages reflect portfolio exposure gained from both the equity

holdings and exposure through contracts for differences where relevant.

Commenting on the markets, Sam Vecht and Emily Fletcher, representing the

Investment Manager noted:

The Company's NAV returned +3.2%1 versus the Company's benchmark (the MSCI

Emerging ex Selected Countries + Frontier Markets + Saudi Arabia Index

("Benchmark Index")), which returned -0.7% in February2. For reference, the

MSCI Emerging Markets Index ended the month +0.8% and the MSCI Frontier Markets

Index +0.1%2 over the same period (all performance figures are on a US Dollar

basis with net income reinvested).

February saw the hope of eventual reopening spread further through frontier

markets. Whilst the majority of countries are still at early stages with their

vaccination programs, frontier markets have started to price the expectation of

reopening.

For emerging markets, February was a volatile month with markets driven by a

rotation favouring cyclicality to the detriment of growth and momentum. The

rotation was more muted within the smaller markets, but sufficient to see many

of our "reopening" and more cyclical trades benefit. Indicators suggest that US

household wealth actually rose substantially through 2020 and as a result of

this pent-up demand, we expect to see a sharp acceleration in growth as the

economy reopens. At the same time, what started as price rises due to supply

side constraints in the commodities sector, has been met with this strong

emergence of demand, causing the majority of both soft and hard commodities to

reach prices that we haven't seen for multiple years. There is, as yet, little

sign of inflation picking up in the vast majority of markets, however, but we

do expect some pick up over the next quarters.

Kazakhstan was the best performing country for the month. Uranium miner,

Kazatomprom, rose 27% as investors concluded that a shift towards lower carbon

sources of energy would likely results in an increased emphasis on nuclear

energy, particularly in China, benefiting Uranium prices. Fintech, Kaspi rose

12% as the company continued to show very strong growth trends, building on its

very high market share in payments in Kazakhstan. February was also a good

month for Vietnam. IT outsourcer, FPT, rose 22% after reporting better than

expected results, with profits up 13% compared with the previous year, despite

the COVID impact. Soy milk producer, Quang Ngai Sugar, rose 14% following the

increase in sugar prices in Vietnam.

Our position in wind energy stock, Terna Energy, was the weakest performer over

the month, falling 14% as the company's Texas operations froze in the

abnormally cold weather. This meant that Terna was forced to purchase

electricity on grid at extremely high prices to cover its contract obligations.

Whilst this had a significant impact on the company, the maximum liability for

this event is known and we continue to think the company offers a very

interesting growth profile through its Greek assets.

We have increased our exposure our exposure to a number of companies which are

currently benefiting from the strong trends in commodity prices, including

Titan Cement and methanol producer, Sahara International Petrochemical. This

has been funded from a reduction some of the exposure that we had to "carry"

countries, those with greater debt loads, who are more reliant on foreign

capital investment, such as Indonesia and the Philippines. We believe that

frontier markets continue to look very attractive both on a relative and

absolute basis, containing some of the best valued companies globally with a

number of markets still trading significantly below their average 10 year price

to book valuations.

Sources:

1BlackRock as at 28 February 2021

2MSCI as at 28 February 2021

09 April 2021

ENDS

Latest information is available by typing www.blackrock.com/uk/brfi on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on BlackRock's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

April 09, 2021 10:31 ET (14:31 GMT)

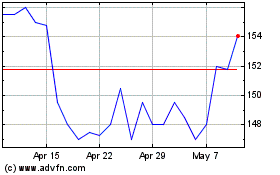

Blackrock Frontiers Inve... (LSE:BRFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackrock Frontiers Inve... (LSE:BRFI)

Historical Stock Chart

From Apr 2023 to Apr 2024