BlackRock Frontiers Portfolio Update

July 20 2021 - 11:23AM

UK Regulatory

TIDMBRFI

The information contained in this release was correct as at 30 June 2021.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK FRONTIERS INVESTMENT TRUST PLC (LEI: 5493003K5E043LHLO706)

All information is at 30 June 2021 and unaudited.

Performance at month end with net income reinvested.

One Three One Three Five Since

month months year years years Launch*

% % % % % %

Sterling:

Share price 2.9 -2.1 30.4 -4.5 27.3 77.1

Net asset value 2.3 5.9 32.7 3.1 31.6 92.5

Benchmark (NR)** 2.1 3.4 9.7 0.5 32.0 57.6

MSCI Frontiers Index (NR) 5.6 14.0 23.9 23.4 51.4 82.0

MSCI Emerging Markets Index (NR) 4.0 4.9 26.0 31.7 78.5 79.5

US Dollars:

Share price 0.2 -2.0 45.8 -0.1 31.7 57.6

Net asset value -0.3 6.0 48.3 7.9 36.2 71.0

Benchmark (NR)** -0.8 3.6 22.7 5.1 36.4 40.7

MSCI Frontiers Index (NR) 2.7 14.1 38.5 29.1 56.5 61.3

MSCI Emerging Markets Index (NR) 1.3 5.0 40.9 37.8 84.5 59.0

Sources: BlackRock and Standard & Poor's Micropal

* 17 December 2010.

** The Company's benchmark changed from MSCI Frontier Markets Index to MSCI

Emerging ex Selected Countries + Frontier Markets + Saudi Arabia Index (net

total return, USD) effective 1/4/2018.

At month end

US Dollar

Net asset value - capital only: 176.29c

Net asset value - cum income: 177.72c

Sterling:

Net asset value - capital only: 127.62p

Net asset value - cum income: 128.65p

Share price: 120.50p

Total assets (including income): £243.6m

Discount to cum-income NAV: 6.3%

Gearing: nil

Gearing range (as a % of gross assets): 0-20%

Net yield*: 4.2%

Ordinary shares in issue**: 189,325,748

Ongoing charges***: 1.4%

Ongoing charges plus taxation and performance fee: 1.4%

*The Company's yield based on dividends announced in the last 12 months as at

the date of the release of this announcement is 4.2% and includes the 2020

final dividend of 4.25 cents per share declared on 11 December 2020 which paid

on 12 February 2021. Also included is the 2021 interim dividend of 2.75 cents

per share, announced on 01 June 2021 and paid to shareholders on 25 June 2021.

** Excluding 52,497,053 ordinary shares held in treasury.

***Calculated as a percentage of average net assets and using expenses,

excluding Performance fees and interest costs for the year ended 30 September

2020.

Sector Gross market Country Gross market value as

Analysis value as a % of Analysis a % of net assets

net assets

Financials 34.6 Saudi Arabia 18.6

Consumer Discretionary 15.3 Greece 9.0

Materials 13.8 Vietnam 8.2

Industrials 12.9 Thailand 7.7

Energy 10.8 Indonesia 7.4

Consumer Staples 6.1 Kazakhstan 7.1

Real Estate 4.4 Chile 5.9

Information Technology 3.4 Egypt 5.6

Health Care 2.7 Philippines 5.2

Utilities 1.5 Poland 4.9

Communication Services 1.3 United Arab Emirates 4.8

----- Hungary 4.8

106.8 Malaysia 4.1

----- Romania 2.3

Short positions -4.6 Peru 2.2

===== Kenya 1.8

Ukraine 1.8

Pakistan 1.7

Qatar 1.7

Panama 1.5

Nigeria 0.5

-----

Total 106.8

-----

Short positions -4.6

=====

*reflects gross market exposure from contracts for difference (CFDs).

Market Exposure

31.07 31.08 30.09 31.10 30.11 31.12 31.01 28.02 31.03 30.04 31.05 30.06

2020 2020 2020 2020 2020 2020 2021 2021 2021 2021 2021 2021

% % % % % % % % % % % %

Long 110.3 110.2 107.8 106.9 107.3 107.9 110.5 114.0 105.7 108.5 105.3 106.8

Short 1.1 0.0 0.0 0.0 0.0 1.1 1.1 4.5 3.4 2.5 2.3 4.6

Gross 111.4 110.2 107.8 106.9 107.3 109.0 111.6 118.5 109.1 111.0 107.6 111.4

Net 109.2 110.2 107.8 106.9 107.3 106.8 109.4 109.5 102.3 106.0 103.0 102.2

Ten Largest Investments

Company Country of Risk Gross market value as a

% of net assets

National Commercial Bank Saudi Arabia 5.1

Kaspi Kazakhstan 4.0

FPT Vietnam 3.4

Emaar Properties United Arab Emirates 3.4

Mobile World Vietnam 3.4

Saudi British Bank Saudi Arabia 3.3

LPP Poland 2.9

CP All Thailand 2.8

National Bank of Greece Greece 2.4

United International Transport Saudi Arabia 2.4

Commenting on the markets, Sam Vecht and Emily Fletcher, representing the

Investment Manager noted:

The Company's NAV returned -0.3%1 versus the Company's benchmark (the MSCI

Emerging ex Selected Countries + Frontier Markets + Saudi Arabia Index

("Benchmark Index")), which returned -0.8% in June2. For reference, the MSCI

Emerging Markets Index ended the month +1.3% and the MSCI Frontier Markets

Index +2.7%2 over the same period (all performance figures are on a US Dollar

basis with net income reinvested).

Market performance during the month remained under pressure amid currency

weakness, discussions of potential FED tapering, COVID-19 resurgence in various

countries (especially ASEAN), and slow vaccine roll-out. High COVID-19 cases

continue to restrict the recovery in many emerging and frontier markets.

Commodity-heavy markets did better on the back of rising oil prices. We

continue to believe the coming months will remain challenged by COVID-19

newsflow while our base case for broad based economic normalization in H2 2021

remains unchanged. We believe Frontier assets remain very attractively valued

in this context.

Latin American equities were up 2.4% in June with Colombia posting the

strongest return (+5.6%). Conversely, Peru lagged in the context of the

presidential election of the leftist candidate Pedro Castillo. Brent crude

rose 10.8% over the month which bolstered market performance in the Middle East

with Saudi Arabia (+4.0%). Vietnam also had a strong month (+5.0%).

For the second month running our positions in Vietnam and Poland contributed

the most to the portfolio in June. In Poland, apparel retailer LPP (+10.6%) was

the biggest contributor after strong Q1 earnings numbers. In Vietnam, our

holdings in retailer Mobile World (+9.8%) and IT services company FPT Corp

(+4.5%) both contributed strongly. Elsewhere, our holding in Kazakhstan

payments company Kaspi (+15.6%) was the single largest stock contributor.

We made a few changes to the portfolio in June. We added to Saudi Arabia where

we expect economic growth to accelerate driven by increased government spending

on the back of a renewed drive to shift the economy away from oil. We added

exposure in financials which should benefit from increased spending and loan

activity. We also added other stocks which we believe are geared to a pickup

in growth and yet not too USD sensitive. We exited our position in Colombia

based on concerns around the fiscal deficit announced for next few years. Oil

production in the country is in decline which offsets any benefits from a

higher oil price thereby making it difficult to foresee any significant trade

balance improvement. We remain cautious the ASEAN countries where COVID-19

cases are escalating anew, and where true cases may prove to be a multiple of

the reported numbers. Lockdowns have returned which are once again slowing the

economic recovery. As the same time vaccination progress across the region

continues slowly.

Globally the economy is recovering quickly and supported by a very

accommodative policy mix in the developed world with extraordinary levels of

both fiscal and monetary support. We believe this backdrop is inflationary

given the broad spending plans across private and public spending, which are

being reflected in rising commodity prices. While we see the potential for

higher rates globally, which could put global equity multiples under pressure,

we note that frontier markets are at a very different starting point given a

number of markets are still trading significantly below their average 10-year

price to book valuations. We believe that frontier markets continue to look

very attractive against this backdrop both on a relative and absolute basis.

Sources:

1BlackRock as at 30 June 2021

2MSCI as at 30 June 2021

20 July 2021

ENDS

Latest information is available by typing www.blackrock.com/uk/brfi on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on BlackRock's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

July 20, 2021 12:23 ET (16:23 GMT)

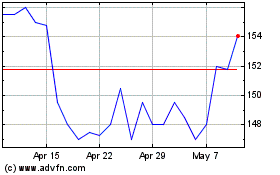

Blackrock Frontiers Inve... (LSE:BRFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackrock Frontiers Inve... (LSE:BRFI)

Historical Stock Chart

From Apr 2023 to Apr 2024