Brooks Macdonald Group PLC Brooks Macdonald welcomes statement by the JFSC (9797C)

October 23 2020 - 3:00AM

UK Regulatory

TIDMBRK

RNS Number : 9797C

Brooks Macdonald Group PLC

23 October 2020

23 October 2020

BROOKS MACDONALD GROUP PLC

Brooks Macdonald Group plc welcomes statement by the JFSC

The Jersey Branch of Brooks Macdonald Asset Management

(International) Limited ("International"), a subsidiary of Brooks

Macdonald Group plc ("Brooks Macdonald" or "the Group"), and the

Group, welcome today's announcement by the Jersey Financial

Services Commission ("JFSC", "Commission") of the resolution of an

investigation by the JFSC into International's compliance with the

Code of Practice for Investment Business ("the IB Code") in

relation to certain historic investments . The scope and period of

the investigation can be found in the JFSC's public statement.

The Group announced in July 2017 its decision to deal

proactively with certain legacy matters arising from the former

Spearpoint business which it acquired in 2012. These matters

related to both a number of portfolios managed formerly by

Spearpoint, then by International's Jersey Branch, and a

Dublin-based fund, for which Spearpoint acted as investment

manager. While the Group accepts no legal liability in these

matters, Brooks Macdonald is committed to treating customers fairly

and seeking to protect its clients' best interests.

The Group developed a plan to resolve these matters and

accordingly made a total provision of GBP12.0 million in the

financial results for the years to 30 June 2017 and 30 June 2018.

As at 30 June 2020, the remaining balance of the provision was

GBP0.6 million. The Group is not making a further provision in

relation to these matters and it intends to deal with any residual

issues as part of business as usual. The Group has continued to be

in discussions with all stakeholders, including relevant

regulators, as it seeks to bring these matters to a conclusion.

A public statement has been published on the JFSC's website

today which states that the Commission found certain breaches of

the IB Code, and that the JFSC has concluded its investigation. The

statement also acknowledges that International has engaged openly

and co-operatively with the JFSC in respect of the

investigation.

Having fully acknowledged that these breaches occurred, the

Group and International are pleased to have resolved these

discussions with the Commission.

Caroline Connellan, CEO of Brooks Macdonald Group plc

commented:

"I am pleased the JFSC's investigation has concluded and that

both our co-operation and the significant investment and

improvement we have made in our risk management and operational

framework have been recognised. Since we first announced our

response to the legacy issues in July 2017, we have sought to deal

proactively with these matters in a way that reflects our deep

commitment to treating customers fairly. Today's announcement

supports the continued reinvigoration of our International business

under the leadership of Andrew Shepherd."

Enquiries to:

Brooks Macdonald Group plc www.brooksmacdonald.com

Caroline Connellan, CEO 020 7659 3492

Ben Thorpe, Group Finance Director

Brooks Macdonald Asset Management (International)

Ltd

Andrew Shepherd, CEO 01534 715589

Peel Hunt LLP (Nominated Adviser and Broker)

Adrian Trimmings / Rishi Shah / John Welch 020 7418 8900

MHP Communications

Reg Hoare / Simon Hockridge / Charlie Barker 020 3128 8540

Notes to editors

Brooks Macdonald Group plc, through its various subsidiaries,

provides leading investment management services in the UK and

internationally. The Group, which was founded in 1991 and began

trading on AIM in 2005, had discretionary Funds under Management of

GBP13.7 billion as at 30 September 2020.

Brooks Macdonald offers a range of investment management

services to private high net worth individuals, pension funds,

institutions, charities and trusts. The Group also provides

financial planning as well as offshore investment management and

acts as fund manager to two regulated OEICs (the IFSL Brooks

Macdonald Fund and the SVS Cornelian Investment Funds) providing a

range of risk-managed multi-asset funds and a specialised absolute

return fund.

The Group has twelve offices across the UK and the Channel

Islands including London, East Anglia, Hampshire, Leamington Spa,

Leeds, Manchester, Taunton, Tunbridge Wells, Scotland, Wales,

Jersey and Guernsey.

LEI: 213800WRDF8LB8MIEX37

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKZMZGNZMGGZM

(END) Dow Jones Newswires

October 23, 2020 04:00 ET (08:00 GMT)

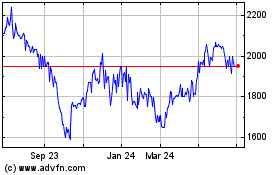

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

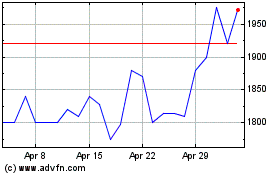

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Apr 2023 to Apr 2024