BlackRock Smll Cos Portfolio Update

April 30 2021 - 6:00AM

UK Regulatory

TIDMBRSC

The information contained in this release was correct as at 31 March 2021.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK SMALLER COMPANIES TRUST PLC (LEI:549300MS535KC2WH4082)

All information is at 31 March 2021 and unaudited.

Performance at month end is calculated on a capital only basis

One Three One Three Five

month months year years years

% % % % %

Net asset value* 4.3 6.9 62.0 26.6 82.4

Share price* 5.2 2.6 59.5 32.8 105.5

Numis ex Inv Companies + AIM Index 4.2 9.6 68.8 17.9 45.5

*performance calculations based on a capital only NAV with debt at par, without

income reinvested. Share price performance calculations exclude income

reinvestment.

Sources: BlackRock and Datastream

At month end

Net asset value Capital only (debt at par value): 1,854.55p

Net asset value Capital only (debt at fair value): 1,845.68p

Net asset value incl. Income (debt at par value)1: 1,863.41p

Net asset value incl. Income (debt at fair value)1: 1,854.54p

Share price: 1,786.00p

Discount to Cum Income NAV (debt at par value): 4.2%

Discount to Cum Income NAV (debt at fair value): 3.7%

Net yield2: 1.8%

Gross assets3: £999.5m

Gearing range as a % of net assets: 0-15%

Net gearing including income (debt at par): 8.3%

Ongoing charges ratio (actual)4: 0.7%

Ordinary shares in issue5: 48,829,792

1. Includes net revenue of 8.86p

2. Yield calculations are based on dividends announced in the last 12 months

as at the date of release of this announcement, and comprise the second

interim dividend of 19.7 pence per share (announced on 3 June 2020,

ex-dividend on 11 June 2020) and the first interim dividend of 12.8 pence

per share (announced on 5 November 2020, ex-dividend on 12 November 2020,

paid on 26 November 2020).

3. Includes current year revenue.

4. As reported in the Annual Financial Report for the year ended 29 February

2020 the Ongoing Charges Ratio (OCR) was 0.7%. The OCR is calculated as a

percentage of net assets and using operating expenses, excluding

performance fees, finance costs and taxation.

5. Excludes 1,163,731 ordinary shares held in treasury.

Sector Weightings % of portfolio

Industrials 28.0

Consumer Services 20.7

Financials 16.0

Consumer Goods 12.6

Technology 8.3

Basic Materials 5.6

Health Care 4.0

Oil & Gas 3.3

Telecommunications 1.5

-----

Total 100.0

=====

Country Weightings % of portfolio

United Kingdom 98.1

United States 1.3

Singapore 0.4

Guernsey 0.2

-----

Total 100.0

=====

Ten Largest Equity Investments % of portfolio

Company

Watches of Switzerland 2.4

Treatt 2.1

Stock Spirits Group 1.9

YouGov 1.9

Ergomed 1.8

Pets at Home 1.7

IntegraFin 1.7

Breedon 1.7

CVS Group 1.7

Grafton Group 1.6

Commenting on the markets, Roland Arnold, representing the Investment Manager

noted:

During March the Company's NAV per share rose by 4.3%1 to 1,854.55p, slightly

outperforming our benchmark index which returned 4.2%1; for comparison the FTSE

100 Index rose by 3.6%1 (all figures are on a capital only basis).

Equity markets continued to rise in March, with beneficiaries of the "reopening

trade" leading the market higher once again. The rollout of vaccinations

continued to gather pace in both the UK and US, and despite rising infection

rates in many parts of Europe, markets were firmly focused on the economic

restart. There was little surprise from the UK budget, which provided breathing

room and visibility for those sectors that have been most impacted by COVID-19

through business rates relief and extending the VAT cut for the hospitality

sector. One key positive included the 130% 'super deduction' tax incentive to

promote near-term investment. However, the proposed increase in corporation tax

to 25% will clearly have an impact. Sterling strength and optimism towards the

UK saw small & mid-caps outperform large caps.

The largest positive contributor was housebuilder Vistry, which reported an

excellent start to 2021 with sales running ahead of 2020. The sector remains

well supported by strong demand and firm pricing in the housing market, which

is reflected in the company's forward order book. Meanwhile housebuilders were

a key beneficiary of the UK budget at the start of March through the extension

of the stamp duty holiday and 95% mortgage guarantee scheme. Sumo Group, a

provider of creative and development services to the video game industry

reported more than 40% revenue growth during 2020, as publishers continued to

outsource game development to external parties. Elsewhere Robert Walters and IG

Design added to relative performance as the re-opening trade continued.

The rotation away from growth and into value caused a headwind for the Company

in March. A number of the largest detractors to performance were either shares

in our benchmark that we do not own which rose during the month, or companies

that we do own, such as Ergomed, which gave back some recent share price gains

despite no negative newsflow. Jadestone Energy fell with the wider oil & gas

sector as the oil price weakened on the back of concerns around the demand

outlook from China.

The vaccine rollout program continues to gather pace and the market focus

remains the 'reopening trade' and the pace at which the world can return to

some level of normality. With the UK continuing to make progress with its

vaccine rollout we are cautiously optimistic around the domestic recovery.

However, questions remain over the vaccine rollout elsewhere in the world and

the potential for new variants to resist the vaccine, and as such we cannot

ignore the possibility of market setbacks and sharp spikes in volatility.

Strengthening sterling and rising rates have caused a challenging headwind for

many global facing growth companies, which this Company owns, however we do not

believe this will be a long-term issue as we do not see persistent higher

levels of inflation ahead.

We therefore remain focused on bottom-up company fundamentals, with a bias

towards high quality market leading global businesses, which are operating in

attractive end markets and run by strong management teams. This is a style that

has demonstrably worked over the long term, and the positive trading updates

that we have heard from our companies in recent weeks reassure us that this is

the right strategy that will reward our shareholders over the long-term.

1Source: BlackRock as at 31 March 2021.

30 April 2021

ENDS

Latest information is available by typing www.blackrock.co.uk/brsc on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

April 30, 2021 07:00 ET (11:00 GMT)

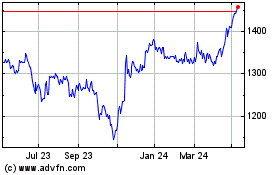

Blackrock Smaller (LSE:BRSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

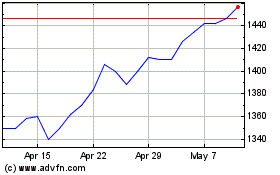

Blackrock Smaller (LSE:BRSC)

Historical Stock Chart

From Apr 2023 to Apr 2024