BlackRock Smll Cos Portfolio Update

June 23 2021 - 6:31AM

UK Regulatory

TIDMBRSC

The information contained in this release was correct as at 31 May 2021.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK SMALLER COMPANIES TRUST PLC (LEI:549300MS535KC2WH4082)

All information is at 31 May 2021 and unaudited.

Performance at month end is calculated on a capital only basis

One Three One Three Five

month months year years years

% % % % %

Net asset value* 1.5 15.5 50.4 29.4 96.9

Share price* 2.6 15.7 53.0 33.2 115.8

Numis ex Inv Companies + AIM Index 1.1 11.3 53.2 19.2 52.1

*performance calculations based on a capital only NAV with debt at par, without

income reinvested. Share price performance calculations exclude income

reinvestment.

Sources: BlackRock and Datastream

At month end

Net asset value Capital only (debt at par value): 2,052.74p

Net asset value Capital only (debt at fair value): 2,042.91p

Net asset value incl. Income (debt at par value)1: 2,062.05p

Net asset value incl. Income (debt at fair value)1: 2,052.22p

Share price: 1,964.00p

Discount to Cum Income NAV (debt at par value): 4.3%

Discount to Cum Income NAV (debt at fair value): 4.8%

Net yield2: 1.7%

Gross assets3: £1,101.5m

Gearing range as a % of net assets: 0-15%

Net gearing including income (debt at par): 9.7%

Ongoing charges ratio (actual)4: 0.8%

Ordinary shares in issue5: 48,829,792

1. Includes net revenue of 9.31 p

2. Yield calculations are based on dividends announced in the last 12 months

as at the date of release of this announcement, and comprise the first

interim dividend of 12.8 pence per share (announced on 5 November 2020,

ex-dividend on 12 November 2020, paid on 26 November 2020) and the second

interim dividend of 20.5 pence per share (announced on 7 May 2021,

ex-dividend on 20 May 2021 and pay date 18 June 2021).

3. Includes current year revenue.

4. As reported in the Annual Financial Report for the year ended 28 February

2021 the Ongoing Charges Ratio (OCR) was 0.8%. The OCR is calculated as a

percentage of net assets and using operating expenses, excluding

performance fees, finance costs and taxation.

5. Excludes 1,163,731 ordinary shares held in treasury.

Sector Weightings % of portfolio

Industrials 29.2

Consumer Discretionary 21.5

Financials 16.1

Consumer Staples 11.5

Technology 7.4

Basic Materials 5.4

Health Care 3.7

Energy 3.3

Telecommunications 1.6

Real Estate 0.3

-----

Total 100.0

=====

Country Weightings % of portfolio

United Kingdom 98.4

United States 1.2

Guernsey 0.4

-----

Total 100.0

=====

Ten Largest Equity Investments % of portfolio

Company

Watches of Switzerland 2.4

Treatt 2.3

Impax Asset Management 2.2

CVS Group 1.9

Breedon 1.9

IntegraFin 1.7

Gamma Communications 1.6

Stock Spirits Group 1.6

YouGov 1.6

Pets At Home 1.6

Commenting on the markets, Roland Arnold, representing the Investment Manager

noted:

During May the Company's NAV per share rose by 1.5%1 to 2,052.74p,

outperforming our benchmark index which returned 1.1%1; for comparison the FTSE

100 Index rose by 0.8%1 (all figures are on a capital only basis).

Equity markets delivered another positive month in May as vaccine deployment

continued to make progress across many developed market countries. Following

April's resurgence of the growth factor being the primary driver of returns,

market leadership in May switched firmly back to value outperforming growth

following signs of rising inflation in both the UK and US. April CPI figures

showed that UK inflation "more than doubled" to 1.5% year-on-year, however, the

rise was in-line with consensus, with much of the increase coming from one-off

factors and the lower base effect. Therefore, while the rise appears to be

transitory the market was fast to react. UK lockdown easing continued with the

reopening of indoor dining and hotels on the 17th May, however, the newly

branded "delta" variant of the virus caused some concerns around the planned

return to normality.

Outperformance during May was driven by another month of positive updates from

many of our long-term core holdings. The largest positive contributor was

marketer of promotional products, 4imprint, which provided a solid trading

update. Since the full year results, which were reported in March, the business

has continued to see order intake accelerate; it now stands at 85% of 2019

levels. The result is an encouraging sign for the US economy, given that

4imprint generates almost 100% of its revenue from the US and provides us with

confidence that the company will return to its previous strategy of

consolidating its fragmented end market. Auction Technology Group, which we

purchased at IPO (Initial Public Offering) earlier in the year, reported

interim results showing impressive revenue growth as the traditional auction

house clients continue to see the benefits of moving online. Impax Asset

Management was once again a top contributor during the month as the recent

growth in AUM (Assets Under Management) shows no sign of slowing given the

strength of its franchise, market leading investment performance and the

structural growth/interest in sustainability which underpins the company's

investment philosophy.

Ergomed, the pharmaceutical services business, gave back some of its recent

strong performance having been an outstanding performer over the last year.

Other notable detractors included video game developer Team17 and digital

payments provider Eckoh, both of which have been top performers during the

COVID-19 pandemic. Importantly these are not businesses that we think were

simply COVID-19 lockdown beneficiaries, and we believe that the structural

changes that we are seeing in their markets will result in continued demand for

their products leading long term growth in profits and cashflows.

In the UK the successful vaccine rollout continues, but the pace of reopening

remains a key focus for investors. Like everyone we are monitoring the

situation closely, and whilst there is always a risk a 'variant of concern' may

cause the re-opening plan to falter (as we have just seen in the UK with the 4

week delay) at this time we still believe the vaccine will ultimately see us

return to a more normal way of life. The strength of trading shown in the

recent reporting season provides us with confidence in our current positioning

and the outlook for many businesses across the portfolio continues to improve.

We also continue to see evidence that those companies which went into the

COVID-19 crisis in a strong position (both financially and operationally) are

emerging even stronger. The ability of well financed market leading businesses

to improve their relative positions in times of stress has always been one of

our core beliefs, and this crisis has only reinforced that belief.

We continue to focus on bottom-up company fundamentals, with a bias towards

high quality market leading global businesses, which are operating in

attractive end markets and run by strong management teams. The road ahead

remains uncertain, and there is potential for sharp spikes in volatility.

However, as always, we believe that focusing on the micro will triumph over the

macro headwinds, and historically volatility has always created opportunity for

this strategy. We thank shareholders for their continued support.

1Source: BlackRock as at 31 May 2021

23 June 2021

ENDS

Latest information is available by typing www.blackrock.com/uk/brsc on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

June 23, 2021 07:31 ET (11:31 GMT)

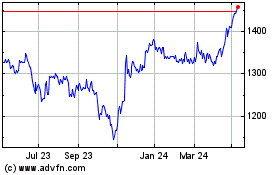

Blackrock Smaller (LSE:BRSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

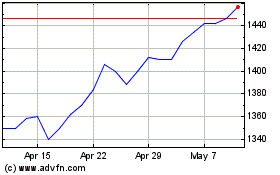

Blackrock Smaller (LSE:BRSC)

Historical Stock Chart

From Apr 2023 to Apr 2024