TIDMBSRT

RNS Number : 4126U

Baker Steel Resources Trust Ltd

06 April 2021

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

6 April 2021

31 March 2021 Unaudited NAV Statement

Net Asset Value

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value per share at 31 March 2021:

Net asset value per Ordinary Share: 97.4 pence

The NAV per share has increased by 2.3% against the unaudited

NAV at 26 February 2021, partly due to an alteration to certain

carrying values at the 2020 year end, and an increase in the

carrying value of the convertible loan to Azarga Metals Corp

following the increase in its share price on the TSX-V

exchange.

The Company had a total of 106,462,502 Ordinary Shares in issue

with a further 700,000 shares held in treasury as at 31 March 2021

.

Amendment to Unaudited NAV for 31 December 2020

Since publication of the unaudited NAV for 31 December 2020,

additional market information has become available which, together

with a small number of audit adjustments accepted by the Company,

has led to changes to the carrying values of certain investments.

The audit is almost complete and the Company expects to publish its

audited results shortly.

In arriving at the unaudited NAV for 31 December 2020, it was

decided to apply a discount for execution risk to the value of the

cash offer made for Bilboes Gold Ltd. It has now been decided that

the offer is the best reflection of Fair Value at the year end,

regardless of whether the transaction completes or not and

therefore the discount for execution risk has been removed. This

has a resulted in a 17% increase in the valuation of Bilboes,

equivalent to a 3.7% increase in NAV.

In valuing Polar Acquisition Limited's (PAL) royalty over the

Prognoz Silver project owned by Polymetal International, the

Company applies a discount rate relevant to silver royalties in its

net present value calculation and then applies a further discount

for development risk to take account of the project's stage of

development. Overall, this came to an annual discount rate of

approximately 7%. However, in valuing its liability for the royalty

at 31 December 2020, Polymetal used a discount rate of 9% which it

applies for fair value calculation purposes across all its mining

assets. It has been decided to bring the Company's discount rate in

valuing the Prognoz royalty in line with Polymetal's, which has

resulted in the reduction of the valuation of PAL by 19.4% and a

consequent 2.8% reduction in NAV.

There have also been smaller adjustments to the carrying values

of Tungsten West and Cemos Group, to take account of an additional

interest accrual and an exchange rate error respectively.

The above changes result in the unaudited December 2020 NAV

being increased by 1.8% to 97.2 pence per share. These adjustments

have all been taken into account in the NAV at 31 March 2021

above.

Investment Update

The Company's top 12 investments were as follows as a percentage

of NAV:

31 March 2021 31 December 31 December

2020(revised) 2020(previous)

Bilboes Gold Limited 19.3% 19.5% 16.9%

Futura Resources Ltd 16.0% 16.2% 16.5%

Cemos Group plc 13.6% 14.5% 14.6%

Tungsten West Limited 13.1% 13.2% 12.6%

Polar Acquisition Ltd 8.8% 8.9% 11.2%

Anglo Saxony Mining Limited 5.2% 3.9% 4.0%

Mines & Metals Trading

Peru PLC 4.3% 4.5% 4.5%

Azarga Metals Corp 4.0% 2.7% 2.8%

Nussir ASA 3.4% 3.4% 3.5%

Sarmin Minerals Exploration 2.7% 2.7% 2.7%

Metals Exploration plc 1.7% 1.9% 1.9%

Black Pearl Limited Partnership 1.2% 1.2% 1.2%

Listed Precious Metal Shares 2.9% 3.9% 3.9%

Other Investments 2.9% 2.7% 2.8%

Net Cash, Equivalents and

Accruals 0.9% 0.8% 0.8%

Tungsten West Limited ("Tungsten West")

During March 2021 Tungsten West released the findings of its

Bankable Feasibility Study (BFS) which covers the restart of its

Hemerdon Tungsten Mine in Devon, UK. The BFS shows a GBP45m initial

capital requirement for a mine expected to produce on average GBP34

million of EBITDA per annum for over 20 years. This results in an

after tax NPV(5%) of GBP272 million based on current spot Tungsten

prices with an IRR of 33%. The ore reserve estimate in the BFS is

63.3 million tonnes at 0.18% WO(3) , such that Hemerdon has the

second largest JORC compliant tungsten ore reserve in the world

outside China.

The BFS business plan includes an aggregates business, which

processes waste rock from tungsten and tin production into several

different aggregate products. This has a double benefit of

providing both an additional and stable source of income, but also

reducing the amount of waste rock needed to be stored at site from

an environmental point of view. Sales of aggregates have already

commenced from existing waste stockpiles.

Tungsten West is in the process of appointing advisers for the

project finance debt raising and an equity raising to finance the

recommencement of mine operations. Tungsten West's objective is to

start work in the second half of this year, targeting commercial

production in approximately 18 months. A listing of Tungsten West

in 2021 is being considered.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Numis Securities Limited +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure are set

out in the Company's Prospectus dated 26 January 2015.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVZZGGDVKMGMZM

(END) Dow Jones Newswires

April 06, 2021 02:00 ET (06:00 GMT)

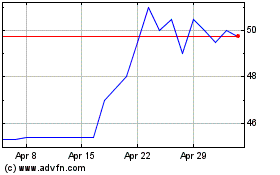

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Apr 2023 to Apr 2024