TIDMBSRT

RNS Number : 4154U

Baker Steel Resources Trust Ltd

03 December 2021

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

3 December 2021

30 November 2021 Unaudited NAV Statement

Net Asset Value

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value per share at 30 November 2021:

Net asset value per Ordinary Share: 97.4 pence

The NAV per share has decreased by 0.3% against the unaudited

NAV at 29 October 2021, mainly due a fall in the value of Tungsten

West Plc on AIM during the month after the initial strong price

performance following its IPO in October 2021, albeit the share

price still remains at 10% above the IPO price.

The Company had a total of 106,462,502 Ordinary Shares in issue

with a further 700,000 shares held in treasury as at 30 November

2021 .

Investment Update

The Company's top 12 investments were as follows as a percentage

of NAV:

30 November 31 December 2020

2021

Bilboes Gold Limited 20.0% 19.5%

Futura Resources Ltd 16.1% 16.2%

Tungsten West Plc 15.2% 13.2%

Cemos Group plc 13.9% 14.5%

Polar Acquisition Ltd 9.0% 8.9%

First Tin Ltd 5.2% 3.9%

Nussir ASA 3.9% 3.4%

Silver X Mining Corporation 3.4% 4.5%

Kanga Potash 2.8% 2.7%

Azarga Metals Corp 2.6% 2.7%

Prism Diversified 1.6% 1.5%

Metals Exploration plc 1.6% 1.9%

Listed Precious Metal Shares 1.9% 3.9%

Other Investments 1.8% 2.4%

Net Cash, Equivalents and

Accruals 1.0% 0.8%

First Tin Limited ("First Tin") (formerly Anglo Saxony Mining

Limited

In November 2021 First Tin signed a Sale & Purchase

Agreement (SPA) to acquire ASX listed company Aus Tin Mining Ltd's

(ASX: ANW) ('Aus Tin') subsidiary company Taronga Mines Pty Ltd

which owns the Taronga Tin Project in New South Wales. Under the

terms of the SPA Aus Tin will receive 60 million shares in First

Tin, or a minimum of 22.6% of the shares in First Tin on completion

of an IPO on the London Stock Exchange early in 2022. The IPO aims

to raise at least GBP20 million at an issue price of not less than

30p per share. In addition, Aus Tin will receive A$1.35 million

cash.

Aus Tin completed a pre-feasibility study on Taronga in 2014

which contains estimated resources containing 57,000 tonnes tin,

28,000 tonnes copper and 4.4 million ounces silver. Once the

acquisition has been completed, First Tin plans to fast-track mine

development for Taronga by initiating a definitive feasibility

study immediately thereafter.

First Tin holds two advanced stage tin projects in Germany:

Tellerhauser and Gottesberg, with combined resources of 216,000t

tin plus significant copper, zinc, indium and magnetite. A

pre-feasibility study (PFS) has shown the Tellerhauser project to

be viable and a definitive feasibility study (DFS) is planned to

commence in early 2022, along with a drilling programme designed to

increase the resource base and convert inferred mineralisation to

indicated status.

The addition of the Taronga project to First Tin's portfolio

will increase the total resource base of the company to over

273,000 tonnes tin, equivalent to the fourth largest undeveloped

tin resource worldwide and it will possess the second largest OECD

tin portfolio according to International Tin Association

figures.

Silver X Mining Corp. ("Silver X")

During November 2021 the Company signed an assignment and

assumption agreement with Silver X Mining Corp. (TSX-V: AGX),

pursuant to which Silver X agreed to assume all of the obligations

of its wholly-owned subsidiary, Mines & Metals Trading (Peru)

PLC, as envisaged in the Company's US$4 million unsecured

convertible debenture signed in June 2019.

In addition, during November 2021, Silver X repaid the US$1

million bridging loan provided by the Company in 2020 together with

accrued interest and arrangement fees in the amount of

CAD$1,668,518.

Silver X's Recuperada project in Peru comprises 11,261 Ha of

mining concessions centred around a 600 tonne per day processing

plant. In October 2021 Silver X secured the environmental

permitting approval required to increase production capacity to 720

tonnes per day. Installation of a new crushing circuit and

flotation cells has commenced, and it expects full commissioning by

December 31, 2021.

Silver X's current focus is on expanding and improving its

understanding of its central Tangana mining unit. Recent channel

sampling at Tangana has been extremely promising and included 1,034

g/t AgEq over 2 metres. A 10,000 metres drilling campaign is due to

start in the first quarter of 2022 to evaluate these structures for

delivery of an upgraded resource statement targeted for first half

of 2022.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Numis Securities Limited +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure are set

out in the Company's Prospectus dated 26 January 2015.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVMZMGZDZVGMZM

(END) Dow Jones Newswires

December 03, 2021 02:00 ET (07:00 GMT)

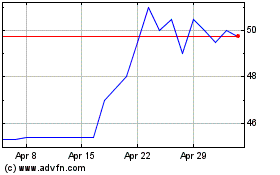

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Apr 2023 to Apr 2024