Baker Steel Resources Trust Ltd Net Asset Value(s) (9811R)

July 11 2022 - 1:00AM

UK Regulatory

TIDMBSRT

RNS Number : 9811R

Baker Steel Resources Trust Ltd

11 July 2022

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

11 July 2022

30 June 2022 Unaudited NAV Statement

Net Asset Value

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value per share at 30 June 2022:

Net asset value per Ordinary Share: 80.4 pence.

The NAV per share has decreased by 7.6% against the unaudited

NAV at 31 May 2022 largely due to falls in the market for mining

shares which have affected both the share prices of the listed

portion of the portfolio as well as the pricing of certain of the

unlisted shares when they are adjusted for market movements as part

of the Company's normal review of the unlisted positions at the

half year as described below.

The Company had a total of 106,462,502 Ordinary Shares in issue

with a further 700,000 shares held in treasury as at 30 June

2022.

Investment Update

The Company's top 10 investments were as follows as a percentage

of NAV:

30 June 2022 31 December 2021

Futura Resources Ltd 27.2% 18.1%

Cemos Group plc 20.5% 18.6%

Bilboes Gold Limited 15.3% 13.1%

Tungsten West Plc 7.5% 14.7%

First Tin plc 5.5% 7.7%

Kanga Potash 5.5% 4.1%

Polar Acquisition Ltd 4.4% 7.5%

Nussir ASA 3.5% 3.6%

Silver X Mining Corporation 3.0% 2.8%

Prism Diversified 1.4% 1.1%

Listed Precious Metal Shares 2.7% 3.3%

Other Investments 3.4% 3.3%

Net Cash, Equivalents and

Accruals 0.1% 1.1%

Half Year Review of Unlisted Investments

The Company has carried out its usual half yearly review of

general market movements in mining equities, taking into

consideration company-specific factors, as well as an assessment of

whether these should impact the carrying values of its unlisted

holdings.

The Investment Manager maintains an index of comparable listed

companies for each unlisted investment, for comparison purposes and

as a benchmark against which the valuation of a particular unlisted

stock might have moved during the period had it been listed. The

following investments have been adjusted on this basis compared to

the valuation at the end of May 2022 in Sterling terms:

-- Cemos - down 9%

-- Bilboes Gold - down 11%

-- Nussir - down 20%

In addition, the Investment Manager has updated its royalty

models for the royalty interests it owns in Futura Resources and

Polar Acquisition Limited ("PAL") to take account of the latest

estimated production profiles of the underlying projects and

commodity prices. The net present values produced by these royalty

models are then discounted for development risk to arrive at a

valuation. As announced in March 2022 the valuation of PAL's

royalty has been discounted an additional 50% to take account of

the Prognoz silver project being located in Russia. At 30 June

2022, the valuation of the PAL royalty has been decreased further

in line with the 13% fall in the silver price during the first half

of 2022. The valuation of the Futura royalty has not changed as it

is based on long term coal prices which have not been adjusted and

remain significantly lower than the current market prices.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Numis Securities Limited +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure are set

out in the Company's Prospectus dated 26 January 2015.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVDZGMNKMDGZZG

(END) Dow Jones Newswires

July 11, 2022 02:00 ET (06:00 GMT)

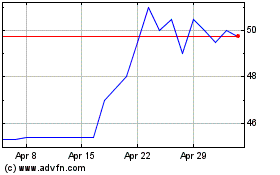

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Apr 2023 to Apr 2024