TIDMBWNG

RNS Number : 4179E

Brown (N.) Group PLC

05 November 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA, NEW ZEALAND

OR ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF

THE RELEVANT LAWS OF SUCH JURISDICTION

5 November 2020

N Brown Group plc

("N Brown" or the "Group" or the "Company")

Publication of Prospectus

Further to the announcement made by N Brown on 5 November 2020

relating to the Capital Raising, the Company announces that the

combined prospectus, circular and AIM admission document in respect

of the Capital Raising (the "Prospectus") was approved today by the

Financial Conduct Authority and has been published on the Company's

website at https://www.nbrown.co.uk/investors , subject to certain

access restrictions.

The Prospectus, which contains the notice convening a closed

General Meeting to be held at Griffin House, 40 Lever Street,

Manchester, United Kingdom, M60 6ES at 10:00 a.m. on 23 November

2020, will be posted to Qualifying Shareholders that have elected

to receive hard copies of shareholder documentation on 5 November

2020.

A copy of the Prospectus has also been submitted to the National

Storage Mechanism and will be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

The Prospectus is not, subject to certain exceptions, available

(whether through the Company's website or otherwise) to

shareholders in the United States or any other restricted

jurisdiction.

Capitalised terms not otherwise defined in this announcement

shall have the meaning set out in the Appendix to the announcement

titled "Placing and Open Offer to raise c. GBP100 million" released

by the Company earlier today.

For further information:

N Brown Group plc

Sian Scriven, Corporate Communications

Manager

Joint Sponsor and Lead Financial Adviser

to N Brown +44 (0) 7825 593

Rothschild & Co 118

Andrew Thomas / Alistair Allen / Adam

Young / Shannon Nicholls

+44 (0) 161 827 3800

Global Co-ordinator, Joint Sponsor, +44 (0) 20 7280 5000

Joint Financial Adviser and Joint Corporate

Broker to N Brown

Jefferies

Philip Noblet / Lee Morton / Max Jones

/ Harry Le May

Proposed Nominated Adviser and Joint +44 (0) 20 7029 8000

Corporate Broker to N Brown

Shore Capital

Dru Danford / Stephane Auton / Daniel

Bush / John More

Financial PR Advisers +44 (0) 20 7408 4090

MHP Communications

Andrew Jaques / Simon Hockridge / James 0203 128 8789

Midmer nbrown@mhpc.com

IMPORTANT NOTICES

This announcement is not intended to, and does not constitute,

an offer to sell or the solicitation of an offer to subscribe for

or buy, or an invitation to subscribe for or to purchase any

securities, or an offer to acquire any securities, or the

solicitation of any vote, in any jurisdiction.

This announcement has been issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by any of

the Banks or by any of their respective affiliates or agents or any

of their respective directors, officers, employees, members,

agents, advisers, representatives or shareholders as to, or in

relation to, the accuracy or completeness of this announcement or

any other written or oral information made available to any

interested party or its advisers, and any liability therefore is

expressly disclaimed.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this announcement. The Prospectus will give

further details of the New Ordinary Shares being offered pursuant

to the Capital Raising and will, following publication, be

available on the Company's website. Investors should not acquire

any New Ordinary Shares except on the basis of the information

contained in the Prospectus. This announcement is for informational

purposes only and does not purport to be complete. No reliance may

be placed by any person for any purpose on the information

contained in this announcement or its accuracy or completeness. The

information in this announcement is subject to change.

Each of the Banks is authorised and regulated in the United

Kingdom by the FCA. None of the Banks will regard any person

(whether or not a recipient of this document) other than the

Company as its customer in relation to the Capital Raising and none

of them will be responsible for providing the protections afforded

to its customers to any other person or for providing advice to any

other person in relation to the Capital Raising.

The contents of this announcement are not to be construed as

legal, business, financial or tax advice. Each investor or

prospective investor should consult his, her or its own legal

adviser, business adviser, financial adviser or tax adviser for

legal, financial, business or tax advice.

The New Ordinary Shares have not been, and will not be,

registered under the Securities Act, or under the securities laws

of any State or other jurisdiction of the United States and may not

be offered, sold, pledged, taken up, resold, transferred or

delivered, directly or indirectly, in or into the United States

except pursuant to an applicable exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and in compliance with any applicable securities

laws of any State or other jurisdiction of the United States. There

will be no public offer of the New Ordinary Shares in the United

States.

The Open Offer (subject to certain limited exceptions) is only

being extended to Qualifying Shareholders, and as such the Capital

Raising (subject to certain limited exceptions) is not being

extended into the United States or any other Excluded Territory.

This announcement is for information purposes only and is not

intended to and does not constitute or form part of any offer or

invitation to sell, allot or issue, or any offer or invitation to

purchase or subscribe for, or any solicitation to purchase or

subscribe for, or an offer to acquire, any securities of the

Company in the United States, Australia, Canada, Japan, New

Zealand, the Republic of South Africa or in any other jurisdiction

where the extension or availability of the Capital Raising would

result in a requirement to comply with any governmental or other

consent or any registration filing or other formality which the

Company regards as unduly onerous or otherwise breach any

applicable law or regulation. This announcement and any other

document relating to the Capital Raising may not be sent into,

distributed or otherwise disseminated (including by custodians,

nominees or trustees or others that may have a contractual or legal

obligation to forward such documents) in the United States by use

of the mails or by any means or instrumentality of interstate or

foreign commerce (including, without limitation, email, facsimile

transmission, the internet or other form of electronic

transmission) or any facility of a national securities exchange of

the United States.

Information for Distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the New Ordinary Shares have been subject to a product approval

process, which has determined that they are: (i) compatible with an

end target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, each

as defined in MiFID II; and (ii) eligible for distribution through

all distribution channels as are permitted by MiFID II (the "Target

Market Assessment"). Notwithstanding the Target Market Assessment,

distributors should note that: the price of the New Ordinary Shares

may decline and investors could lose all or part of their

investment; the New Ordinary Shares offer no guaranteed income and

no capital protection; and an investment in the New Ordinary Shares

is compatible only with investors who do not need a guaranteed

income or capital protection, who (either alone or in conjunction

with an appropriate financial or other adviser) are capable of

evaluating the merits and risks of such an investment and who have

sufficient resources to be able to bear any losses that may result

therefrom. The Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Capital Raising.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the New Ordinary

Shares. Each distributor is responsible for undertaking its own

target market assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PDIBXBDBIGGDGGU

(END) Dow Jones Newswires

November 05, 2020 08:11 ET (13:11 GMT)

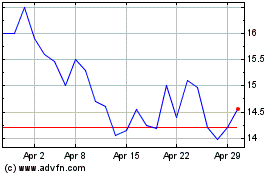

Brown (n) (LSE:BWNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

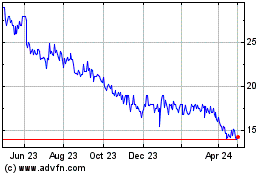

Brown (n) (LSE:BWNG)

Historical Stock Chart

From Apr 2023 to Apr 2024