TIDMCARR

RNS Number : 0928W

Carr's Group PLC

21 April 2021

21 April 2021

CARR'S GROUP PLC ("Carr's" or the "Group")

INTERIM RESULTS

For the 26 weeks ended 27 February 2021

"An improved H1 performance in a challenging environment"

Carr's (CARR.L), the Agriculture and Engineering Group,

announces its Interim Results for the 26 weeks ended 27 February

2021.

Financial highlights

Adjusted(1) Adjusted(1) +/-

H1 2021 H1 2020

Revenue (GBPm) 201.4 200.0 +0.7%

Adjusted(1) operating

profit (GBPm) 10.9 10.3 +5.3%

Adjusted(1) profit

before tax (GBPm) 10.4 9.6 +8.1%

Adjusted(1) EPS (p) 8.2 8.0 +2.5%

Net debt (2) (GBPm) 10.6 25.4 -58.5%

Statutory Statutory +/-

H1 2021 H1 2020

Revenue (GBPm) 201.4 200.0 +0.7%

Operating profit (GBPm) 10.7 11.2 -5.1%

Profit before tax (GBPm) 10.2 10.5 -3.2%

Basic EPS (p) 8.2 9.3 -11.8%

Interim dividend (p) 1.175 - N/A

Highlights

-- Initial business review complete following appointment of new CEO.

-- Group now structured in three divisions: Speciality Agriculture (feed blocks, minerals, and trace element boluses,

formerly Supplements), Agricultural Supplies (formerly UK Agriculture) and Engineering.

-- Resilient business model despite COVID-19 and Brexit uncertainty - all agricultural stores and manufacturing

facilities operational throughout.

-- Strong performance from Speciality Agriculture and Agricultural Supplies.

-- Engineering adversely impacted by low oil prices and travel restrictions in H1 but expected to be significantly

better in H2. Order book now stands at GBP44m, increased by 19% since year end and order intake now improving.

-- Business improvement programme initiated to simplify, standardise, and generate synergies between business units

in each division.

-- Reportable accident frequency rate reduced compared to last year and COVID-19 controls remain effective.

1 Adjusted results are consistent with how business performance

is measured internally and are presented to aid comparability Page

1 of performance. Adjusting items are disclosed in note 8.

2 Excluding leases. Further details of net debt can be found in note 12.

Outlook

A continued positive performance is forecast across the

Agricultural divisions together with an improved second half in the

Engineering division as the impact of COVID-19 begins to recede and

its order intake continues to increase. A programme of

simplification and standardisation is forecast to improve

performance over time. Trading since 27 February 2021 has been

positive and the Board's expectations for the current financial

year remain unchanged.

Hugh Pelham, Chief Executive Officer, commented:

"Despite a challenging operational environment with significant

headwinds experienced in Engineering we have delivered an improved

performance compared to the same period last year. Our Speciality

Agriculture and Agricultural Supplies divisions have performed

particularly strongly. The outlook for Engineering is for an

improved performance in the second half of the financial year.

"I have been fortunate to inherit some sound foundations from my

predecessor, Tim Davies. Carr's Group owns a portfolio of good

businesses with strong market positions.

"Our people have responded brilliantly to the challenge of

working in a COVID-19 environment. I would like to thank them for

their commitment and dedication in keeping all our stores, fuel

depots and manufacturing operations running in such difficult

times.

"An initial operating review has been conducted and the Group is

now structured in three divisions: Speciality Agriculture,

Agricultural Supplies and Engineering to create greater operational

efficiencies, market focus and provide greater transparency for

investors. The results of our Speciality Agriculture division

demonstrate the quality of our products in the feed block, minerals

and animal health markets.

"Actions have been taken to strengthen reporting and governance

systems within the business as part of a process to identify

opportunities for improvement.

"Considerable opportunity exists to optimise the current

portfolio through a process of standardisation, simplification and

seeking synergies between similar businesses. Growth can be

achieved through a mixture of geographic expansion, selling all our

service lines to our customer base, and acquisition and potential

industry consolidation.

"I am confident that the Group will continue to deliver a

resilient and improving set of results over time."

Enquiries:

Carr's Group plc Tel: +44 (0) 1228 554600

Hugh Pelham (Chief Executive Officer)

Neil Austin (Chief Financial Officer)

Powerscourt Tel: +44 (0) 20 7250 1446

Nick Dibden / Lisa Kavanagh / Sam Austrums

About Carr's Group plc:

Carr's is an international leader in manufacturing value added

products and solutions, with market leading brands and robust

market positions in Agriculture and Engineering, supplying

customers in over 50 countries around the world. Carr's operates a

decentralised business model that empowers operating subsidiaries

enabling them to be competitive, agile, and effective in their

individual markets whilst setting overall standards and goals.

Its Speciality Agriculture division manufactures and supplies

feed blocks, minerals and boluses containing trace metals and

minerals for livestock.

Its Agricultural Supplies division manufactures compound animal

feed, distributes farm machinery and runs a UK network of rural

stores, providing a one-stop shop for the farming community.

Its Engineering division designs and manufactures pressure

vessels, manufactures precision components from specialist steel

alloys, manufactures robotic manipulators, and provides engineering

design, assembly, and installation services for the nuclear,

defence and oil & gas industries.

INTERIM MANAGEMENT REPORT

HSE AND COVID-19

The health, safety and wellbeing of our employees and customers

is of paramount importance. We continue to follow Government

guidelines and maintain rigorous social distancing controls,

hygiene measures and shift-working practices across all

locations.

The reportable accident frequency rate compared to last year has

declined and various improvements in health, safety, and

environmental management systems across the Group have been

implemented.

The impact of the COVID-19 pandemic on the Group remains under

close review by the Board. The Group has successfully implemented a

range of measures and planned contingencies across all our

businesses which are designed to minimise the impact of the

pandemic, and as a result all our manufacturing facilities have

remained fully operational. However, we have been impacted by

delays in the progress of engineering projects and restrictions on

visiting customer sites.

Given the positive trading performance during the period the

Group has not utilised the Coronavirus Job Retention Scheme and

currently has no plans to do so.

RESULTS

In challenging market conditions, Carr's has delivered an

improved performance in the period.

During the 26 weeks ended 27 February 2021 revenues increased to

GBP201.4m (H1 2020: GBP200.0m).

Adjusted operating profit of GBP10.9m (H1 2020: GBP10.3m) was

5.3% up on the prior year. Adjusted profit before tax increased by

8.1% to GBP10.4m (H1 2020: GBP9.6m). The improvement in adjusted

profits is mainly attributable to improved performances in

Speciality Agriculture and Agricultural Supplies.

Adjusted earnings per share increased by 2.5% to 8.2p (H1 2020:

8.0p).

STRATEGIC AND OPERATIONAL REVIEW

The Group has commenced a strategic and operational review. As a

result of this, its activities are now structured into three

divisions:

1. Speciality Agriculture

2. Agricultural Supplies

3. Engineering

Our strategy is to continue to invest in established businesses

with distinct value propositions or new companies with proven

technology and strong growth prospects.

We will add value by:

-- Differentiating - investing in innovative technology,

patented processes / products and better customer service.

-- Optimising - simplifying, standardising and seeking synergies

between related companies in our portfolio.

-- Consolidating - creating scale and critical mass by

consolidating similar businesses in a market sector.

-- Growing - expanding our geographic presence, cross selling to

our customer base and developing new products.

Each division has developed an initial plan in these areas, and

these will be further refined over the coming months. The Group

will continue its strategic and operational review in the second

half of this financial year.

SPECIALITY AGRICULTURE

Speciality Agriculture comprises our feed blocks, mineral

supplements and trace element boluses in the UK, Europe, North

America, and New Zealand.

H1 2021 H1 2020 % Change

Revenue GBP40.2m GBP36.6m +9.8%

Adjusted operating

profit GBP8.2m GBP6.5m +24.7%

Our businesses have performed strongly in all geographic areas

driven by strong livestock prices and more seasonal weather

patterns than prior years. Overall, 101,000 tonnes of feed blocks

and speciality minerals were sold worldwide, an increase of 8.4%

year on year. Sales revenues recovered in our animal health

business, Animax. Our project to automate the production process at

Animax continues with benefits expected in the next financial

year.

Our strategy remains to focus on molasses based feed blocks and

specialist animal health products where our patented manufacturing

processes deliver differentiated products. Initiatives to improve

processes, supply chain buying and upgrade our manufacturing plants

are underway. Growth opportunities to expand our presence in the

USA, Canada and Germany are the highest priority, as well as

developing more environmentally sustainable packaging for key

products lines.

AGRICULTURAL SUPPLIES

Agricultural Supplies comprises our Carr's Billington branded

agricultural stores, machinery, fuel and compound feed business and

our joint venture business Bibby Agriculture.

H1 2021 H1 2020 % Change

Revenue GBP137.7m GBP138.4m -0.5%

Adjusted operating

profit GBP3.3m GBP2.5m +33.5%

Total feed sales volumes increased to 318kt, an increase of 0.4%

compared to the prior year. Machinery revenues were also strong,

increasing by 29.1% year on year, and total retail sales also

increased by 4.3% with like-for-like sales showing an 8.1%

increase. Fuel volumes were down 2.5% versus the prior year, with

the main impact being felt in the first quarter of the financial

year.

Significant increases in raw material prices impacted the

profitability of the feed business in the first half, however,

margins were stronger in retail, fuel and machinery which helped

offset the impact of higher raw material costs.

In the UK specifically, the agreement of a trade deal with the

EU in December 2020 has significantly improved farmer confidence,

which has been further buoyed by strong farmgate prices. The UK

Agriculture Bill will also provide opportunities as farmers are

incentivised by efficiency and environmental schemes.

Our strategy remains to provide all a farmer needs and

differentiate ourselves through our product range, our customer and

technical service levels, having a local presence, and the quality

of our compound feeds. Operationally, a number of initiatives have

been implemented to standardise product range and prices, improve

supply chain arrangements and better manage raw material buying and

pricing. Further opportunities to grow exist through the opening of

new stores and industry consolidation.

ENGINEERING

Engineering comprises our fabrication and precision engineering

businesses in the UK, robotics businesses in the UK and Europe and

our engineering solutions businesses in the UK and USA.

H1 2021 H1 2020 % Change

Revenue GBP23.6m GBP24.9m -5.4%

Adjusted operating

profit GBP0.9m GBP1.2m -24.1%

The profitability of our engineering solutions business in the

USA and UK has been resilient with continued work with large

blue-chip customers in the nuclear and defence sectors. Additional

work has recently been secured in the defence sector.

The performance of our fabrication and precision engineering

businesses have been adversely affected by low oil & gas

prices. More positively, our fabrication business has received a

significant level of orders in the nuclear sector. A turnaround

plan is in place for the precision engineering business and

performance is expected to be significantly better in H2.

The performance of our robotics business has substantively

improved compared to H1 last year with exports to China expected to

resume in H2 2021.

Our overall Engineering order book at GBP44m (H1 2020: GBP47m)

is less than at the equivalent point last year but GBP7m higher

than at the end of 2020 (FY 2020: GBP37m). In the second half of

the prior year a significant number of orders were subsequently

cancelled following the outbreak of COVID-19.

Our strategy in the Engineering division is to provide

specialist high margin services primarily to the nuclear and

defence sectors. Our differentiators include patented MSIP(R),

Power Fluidics(TM) processes, the range of precision engineering

machinery, the product life and quality of our robotic manipulators

and a direct workforce with highly specialist welding

capabilities.

Opportunities to grow exist with our current customer base by

providing our full range of specialist services and by selectively

pursuing new customers in the nuclear and defence industries in

particular.

FINANCE REVIEW

Adjusted results

Revenue increased by 0.7% to GBP201.4m (H1 2020: GBP200.0m),

with an increase of 9.8% in Speciality Agriculture offset by a

reduction in both Engineering and Agricultural Supplies of 5.4% and

0.5% respectively.

Adjusted operating profit increased 5.3% to GBP10.9m (H1 2020:

GBP10.3m). Strong performances in Speciality Agriculture, up 24.7%,

and Agricultural Supplies, up 33.5%, were partially offset by a

reduction in Engineering of 24.1%. Central costs were higher at

GBP1.5m (H1 2020: credit of GBP0.1m) partly due to a change in

provision for a non-recoverable debt, phasing, increased costs for

performance related remuneration, and CEO handover costs.

Net finance costs of GBP0.5m (H1 2020: GBP0.7m) reduced year on

year due to lower borrowings. Net debt was GBP10.6m at the period

end (H1 2020: 25.4m), driven by a strong operating performance with

EBITDA of GBP12.6m and a reduction in working capital of GBP4.1m,

offset by dividends of GBP4.4m, net capital expenditure of GBP2.3m

and tax and interest of GBP1.9m. The Group's main banking

facilities run to 2023.

The Group's adjusted profit before tax increased by 8.1% to

GBP10.4m (H1 2020: GBP9.6m).

Adjusted earnings per share increased by 2.5% to 8.2p (H1 2020:

8.0p). The increase is proportionately lower than the increase in

profit before tax because of the higher effective tax rate, due to

a higher mix of overseas profits and the impact of minority

interests.

Adjusting items

The Group provides the adjusted profit measures referred to

above to present additional useful information on business

performance consistent with how business performance is measured

internally. These measures show underlying profits before certain

adjusting items.

In H1 2020, adjusting items were a net credit of GBP0.9m related

mainly to adjustments to contingent consideration (H1 2020: GBP2.1m

compared to H1 2021: GBP0.7m) partly offset by amortisation of

intangible assets. In H1 2021, they are a charge of GBP0.2m. Full

details of all adjusting items are given in note 8.

Statutory results

Reported operating profit on a statutory basis was GBP10.7m (H1

2020: GBP11.2m) and reported profit before tax was GBP10.2m (H1

2020: GBP10.5m). Basic earnings per share on a statutory basis was

8.2p (H1 2020: 9.3p).

Balance sheet and cash flow

Net cash generated from operating activities in the first half

was GBP14.1m (H1 2020: GBP4.9m). Net debt, excluding leases, fell

to GBP10.6m from GBP18.9m at the financial year end (H1 2020:

GBP25.4m). This is primarily related to strong working capital

management resulting in a working capital inflow of GBP4.1m

combined with improved EBITDA.

The Group's defined benefit pension scheme remains in surplus

but at a slightly decreased level of GBP7.8m compared to GBP8.0m at

29 August 2020.

Shareholder's equity

Shareholders' equity at 27 February 2021 was GBP119.0m (29

August 2020: GBP117.1m), with the increase primarily due to profit

retained by the Group for the period offset by foreign exchange

translation losses and dividends paid.

A first interim dividend of 1.175 pence per ordinary share will

be paid on 8 June 2021 to shareholders on the register on 30 April

2021. The ex-dividend date will be 29 April 2021.

GOVERNANCE

The Group announces that, with effect from today, Kristen Eshak

Weldon has been appointed as the Board's Representative for

Employee Engagement. Kristen was appointed to the Board in October

2020 and takes on the role from Alistair Wannop who will be

standing down from the Board in January 2022. Kristen is currently

Global Head of ESG and Impact Investing at Partners Capital. Prior

to this she served on the Executive Committee of Louis Dreyfus

Company and co-headed the London office of Blackstone's Hedge Fund

Solutions business. The Board considers that Kristen's experience

of stakeholder engagement places her well to ensure that wider

views across the workforce are fully understood and considered by

the Board in its decision-making processes.

PRINCIPAL RISKS AND UNCERTAINTIES

The Group has a process in place to identify and assess the

impact of risks on its business, which is reviewed and updated

quarterly. The principal risks and uncertainties for the remainder

of the financial year are not considered to have changed materially

from those included on pages 28 to 30 of the Annual Report and

Accounts 2020 (available on the Company's website at

http://investors.carrsgroup.com ), with the exception of Brexit

where the risk has reduced following the UK-EU trade agreement

which took effect from 31 December 2020.

OUTLOOK

A continued positive performance is forecast across the

Agricultural divisions together with an improved second half in the

Engineering division as the impact of COVID-19 begins to recede and

its order intake continues to increase. A programme of

simplification and standardisation is forecast to improve

performance over time. Trading since 27 February 2021 has been

positive and the Board's expectations for the current financial

year remain unchanged.

CONDENSED CONSOLIDATED INCOME STATEMENT

For the 26 weeks ended 27 February 2021

26 weeks 52 weeks

26 weeks ended ended ended

27 February 29 February 29 August

2021 2020 2020

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

-------------------------------------------- ------ -------------------- ------------------- ---------------------

Continuing operations

Revenue 6,7 201,435 199,957 395,630

Cost of sales (173,412) (172,924) (343,381)

Gross profit 28,023 27,033 52,249

Net operating expenses (19,547) (17,685) (41,042)

Share of post-tax results of associate and

joint ventures 2,196 1,892 2,633

Adjusted (1) operating profit 6 10,869 10,322 16,247

Adjusting items 8 (197) 918 (2,407)

-------------------------------------------- ------ -------------------- ------------------- ---------------------

Operating profit 6 10,672 11,240 13,840

Finance income 135 178 313

Finance costs (633) (905) (1,656)

Adjusted (1) profit before taxation 6 10,371 9,595 14,904

Adjusting items 8 (197) 918 (2,407)

-------------------------------------------- ------ -------------------- ------------------- ---------------------

Profit before taxation 6 10,174 10,513 12,497

Taxation (1,714) (1,382) (1,575)

Profit for the period 8,460 9,131 10,922

-------------------------------------------- ------ -------------------- ------------------- ---------------------

Profit attributable to:

Equity shareholders 7,574 8,565 9,533

Non-controlling interests 886 566 1,389

8,460 9,131 10,922

-------------------------------------------- ------ -------------------- ------------------- ---------------------

Earnings per share (pence)

Basic 9 8.2 9.3 10.3

Diluted 9 7.9 9.1 10.2

Adjusted (1) 9 8.2 8.0 11.9

Diluted adjusted (1) 9 8.0 7.9 11.8

1 Adjusted results are consistent with how business performance

is measured internally and is presented to aid comparability of

performance. Adjusting items are discussed in note 8. An

alternative performance measures glossary can be found in note

18.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the 26 weeks ended 27 February 2021

26 weeks ended 52 weeks

27 February Ended

2021 26 weeks ended 29 August

(unaudited) 29 February 2020 2020

(unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

----------------------------------------------------------- ------ ---------------- ------------------ -----------

Profit for the period 8,460 9,131 10,922

----------------------------------------------------------- ------ ---------------- ------------------ -----------

Other comprehensive (expense)/income

Items that may be reclassified subsequently to profit or

loss:

Foreign exchange translation losses arising on

translation of overseas subsidiaries (1,752) (2,778) (2,552)

Net investment hedges 76 210 (54)

Taxation (charge)/credit on net investment hedges (14) (40) 10

Items that will not be reclassified subsequently to profit

or loss:

Actuarial (losses)/gains on retirement benefit asset:

- Group 14 (295) (1,187) 142

- Share of associate - - 408

Taxation credit/(charge) on actuarial (losses)/gains on

retirement benefit asset:

- Group 56 202 (27)

- Share of associate - - (96)

Other comprehensive expense for the period, net of tax (1,929) (3,593) (2,169)

------------------------------------------------------------------- ---------------- ------------------ -----------

Total comprehensive income for the period 6,531 5,538 8,753

----------------------------------------------------------- ------ ---------------- ------------------ -----------

Total comprehensive income attributable to:

Equity shareholders 5,645 4,972 7,364

Non-controlling interests 886 566 1,389

6,531 5,538 8,753

----------------------------------------------------------- ------ ---------------- ------------------ -----------

CONDENSED CONSOLIDATED BALANCE SHEET

As at 27 February 2021

As at As at As at

27 February 29 February 29 August

2021 2020 2020

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

---------------------------- ------ ------------------------------------ ------------- ---------------------------

Non-current assets

Goodwill 11 31,530 32,070 32,041

Other intangible assets 11 9,118 9,315 9,171

Property, plant and

equipment 11 35,609 36,767 38,259

Right-of-use assets 11 16,265 15,870 14,856

Investment property 11 155 161 158

Investment in associate 14,860 13,846 14,307

Interest in joint ventures 11,492 10,392 10,551

Other investments 72 74 73

Financial assets

- Non-current receivables 20 21 20

Retirement benefit asset 14 7,807 6,643 8,037

Deferred tax assets - 410 -

126,928 125,569 127,473

---------------------------- ------ ------------------------------------ ------------- ---------------------------

Current assets

Inventories 43,392 48,915 40,961

Contract assets 7,885 8,412 8,114

Trade and other receivables 59,496 60,537 51,686

Current tax assets 2,058 328 1,535

Financial assets

- Derivative financial

instruments - - 3

- Cash and cash equivalents 12 24,838 29,318 17,571

137,669 147,510 119,870

---------------------------- ------ ------------------------------------ ------------- ---------------------------

Total assets 264,597 273,079 247,343

---------------------------- ------ ------------------------------------ ------------- ---------------------------

Current liabilities

Financial liabilities

- Borrowings 12 (8,580) (26,855) (11,420)

- Leases (2,965) (2,557) (2,778)

Contract liabilities (3,019) (2,351) (1,061)

Trade and other payables (67,704) (62,520) (55,522)

Current tax liabilities (494) (158) (33)

---------------------------- ------ ------------------------------------ ------------- ---------------------------

(82,762) (94,441) (70,814)

---------------------------- ------ ------------------------------------ ------------- ---------------------------

Non-current liabilities

Financial liabilities

- Borrowings 12 (26,815) (27,896) (25,021)

- Leases (12,177) (12,666) (11,171)

Deferred tax liabilities (4,830) (4,634) (4,783)

Other non-current

liabilities (1,370) (2,537) (1,385)

(45,192) (47,733) (42,360)

---------------------------- ------ ------------------------------------ ------------- ---------------------------

Total liabilities (127,954) (142,174) (113,174)

---------------------------- ------ ------------------------------------ ------------- ---------------------------

Net assets 136,643 130,905 134,169

---------------------------- ------ ------------------------------------ ------------- ---------------------------

Shareholders' equity

Share capital 15 2,330 2,312 2,312

Share premium 15 9,613 9,165 9,176

Other reserves 2,363 4,379 4,436

Retained earnings 104,741 98,655 101,202

---------------------------- ------ ------------------------------------ ------------- ---------------------------

Total shareholders' equity 119,047 114,511 117,126

Non-controlling interests 17,596 16,394 17,043

Total equity 136,643 130,905 134,169

---------------------------- ------ ------------------------------------ ------------- ---------------------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the 26 weeks ended 27 February 2021

Foreign Exchange

Share Premium Treasury Equity Reserve Retained Total Non- Total

Share Share Reserve Compensation Other Reserve Earnings Shareholders' Controlling Equity

Capital Reserve Equity Interests

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ------------------------- ------------------- ------------------ ------------------------------ ------------------ ------------------ ------------ --------------------------- ----------------------- ----------

At 30 August 2020

(audited) 2,312 9,176 (45) 734 3,550 197 101,202 117,126 17,043 134,169

Profit for the

period - - - - - - 7,574 7,574 886 8,460

Other comprehensive

expense - - - - (1,690) - (239) (1,929) - (1,929)

--------------------- ------------------------- ------------------- ------------------ ------------------------------ ------------------ ------------------ ------------ --------------------------- ----------------------- ----------

Total comprehensive

(expense)/income - - - - (1,690) - 7,335 5,645 886 6,531

Dividends paid - - - - - - (4,390) (4,390) (368) (4,758)

Equity-settled

share-based payment

transactions - - - (426) - - 646 220 35 255

Allotment of shares 18 437 - - - - - 455 - 455

Purchase of own

shares held in

trust - - (9) - - - - (9) - (9)

Transfer - - 53 - - (1) (52) - - -

--------------------- ------------------------- ------------------- ------------------ ------------------------------ ------------------ ------------------ ------------ --------------------------- ----------------------- ----------

At 27 February 2021

(unaudited) 2,330 9,613 (1) 308 1,860 196 104,741 119,047 17,596 136,643

--------------------- ------------------------- ------------------- ------------------ ------------------------------ ------------------ ------------------ ------------ --------------------------- ----------------------- ----------

At 1 September 2019

(audited) 2,299 9,165 - 1,577 6,146 199 93,771 113,157 16,125 129,282

Profit for the

period - - - - - - 8,565 8,565 566 9,131

Other comprehensive

expense - - - - (2,608) - (985) (3,593) - (3,593)

--------------------- ------------------------- ------------------- ------------------ ------------------------------ ------------------ ------------------ ------------ --------------------------- ----------------------- ----------

Total comprehensive

(expense)/income - - - - (2,608) - 7,580 4,972 566 5,538

Dividends paid - - - - - - (3,344) (3,344) (294) (3,638)

Equity-settled

share-based payment

transactions - - - (933) - - 659 (274) (3) (277)

Allotment of shares 13 - - - - - - 13 - 13

Purchase of own

shares held in

trust - - (13) - - - - (13) - (13)

Transfer - - 12 - - (1) (11) - - -

--------------------- ------------------------- ------------------- ------------------ ------------------------------ ------------------ ------------------ ------------ --------------------------- ----------------------- ----------

At 29 February 2020

(unaudited) 2,312 9,165 (1) 644 3,538 198 98,655 114,511 16,394 130,905

--------------------- ------------------------- ------------------- ------------------ ------------------------------ ------------------ ------------------ ------------ --------------------------- ----------------------- ----------

At 1 September 2019

(audited) 2,299 9,165 - 1,577 6,146 199 93,933 113,319 16,229 129,548

Profit for the

period - - - - - - 9,533 9,533 1,389 10,922

Other comprehensive

(expense)/income - - - - (2,596) - 427 (2,169) - (2,169)

--------------------- ------------------------- ------------------- ------------------ ------------------------------ ------------------ ------------------ ------------ --------------------------- ----------------------- ----------

Total comprehensive

(expense)/income - - - - (2,596) - 9,960 7,364 1,389 8,753

Dividends paid - - - - - - (3,344) (3,344) (588) (3,932)

Equity-settled

share-based payment

transactions - - - (843) - - 691 (152) 15 (137)

Excess deferred

taxation on

share-based

payments - - - - - - (27) (27) (2) (29)

Allotment of shares 13 11 - - - - - 24 - 24

Purchase of own

shares held in

trust - - (58) - - - - (58) - (58)

Transfer - - 13 - - (2) (11) - - -

--------------------- ------------------------- ------------------- ------------------ ------------------------------ ------------------ ------------------ ------------ --------------------------- ----------------------- ----------

At 29 August 2020

(audited) 2,312 9,176 (45) 734 3,550 197 101,202 117,126 17,043 134,169

--------------------- ------------------------- ------------------- ------------------ ------------------------------ ------------------ ------------------ ------------ --------------------------- ----------------------- ----------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the 26 weeks ended 27 February 2021

26 weeks ended 26 weeks ended 52 weeks ended

27 February 2021 29 February 2020 29 August 2020

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

--------------------- ------ -------------------------------------------- ---------------------------------------------- -----------------------------------------------

Cash flows from

operating activities

Cash generated from

continuing

operations 16 15,956 7,840 22,639

Interest received 57 111 176

Interest paid (625) (897) (1,696)

Tax paid (1,300) (2,139) (3,059)

--------------------- ------ -------------------------------------------- ---------------------------------------------- -----------------------------------------------

Net cash generated 14,088 4,915 18,060

from operating

activities

--------------------- ------ -------------------------------------------- ---------------------------------------------- -----------------------------------------------

Cash flows from

investing activities

Contingent/deferred (131) (1,596) (2,659)

consideration paid

Dividends received 368 294 701

from associate and

joint ventures

Other loans - 382 718

Purchase of (780) (845) (1,459)

intangible assets

Proceeds from sale 125 141 421

of property, plant

and equipment

Purchase of (1,645) (2,569) (6,569)

property, plant and

equipment

Purchase of own (9) (13) (58)

shares held in trust

Net cash used in (2,072) (4,206) (8,905)

investing activities

--------------------- ------ -------------------------------------------- ---------------------------------------------- -----------------------------------------------

Cash flows from

financing activities

Proceeds from issue 455 13 24

of ordinary share

capital

New financing and 5,609 2,500 1,889

movement on RCF

Lease principal (1,556) (1,569) (3,171)

repayments

Repayment of (1,200) (1,247) (2,459)

borrowings

(Decrease)/increase (604) 114 (14,508)

in other borrowings

Dividends paid to (4,390) (3,344) (3,344)

shareholders

Dividends paid to (368) (294) (588)

related party

--------------------- ------ -------------------------------------------- ---------------------------------------------- -----------------------------------------------

Net cash used in (2,054) (3,827) (22,157)

financing activities

--------------------- ------ -------------------------------------------- ---------------------------------------------- -----------------------------------------------

Effects of exchange (373) (410) (989)

rate changes

--------------------- ------ -------------------------------------------- ---------------------------------------------- -----------------------------------------------

Net 9,589 (3,528) (13,991)

increase/(decrease)

in cash and cash

equivalents

Cash and cash

equivalents at

beginning of the

period 10,304 24,295 24,295

--------------------- ------ -------------------------------------------- ---------------------------------------------- -----------------------------------------------

Cash and cash

equivalents at end

of the period 19,893 20,767 10,304

--------------------- ------ -------------------------------------------- ---------------------------------------------- -----------------------------------------------

Cash and cash

equivalents consist

of:

Cash and cash

equivalents per the

balance sheet 24,838 29,318 17,571

Bank overdrafts (4,945) (8,551) (7,267)

included in

borrowings

--------------------- ------ -------------------------------------------- ---------------------------------------------- -----------------------------------------------

19,893 20,767 10,304

--------------------- ------ -------------------------------------------- ---------------------------------------------- -----------------------------------------------

Statement of Directors' responsibilities

We confirm that to the best of our knowledge:

-- the condensed consolidated financial statements have been prepared in accordance with IAS 34 Interim Financial

Reporting as adopted by the European Union ("EU") pursuant to Regulation (EC) No 1606/2002 as it applies in the

EU and in accordance with international accounting standards in conformity with the requirements of the Companies

Act 2006; and

-- the interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed consolidated financial statements; and a

description of the principal risks and uncertainties for the

remaining six months of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period; and any changes in the related party

transactions described in the last Annual Report that could do so.

The Directors are listed in the Annual Report and Accounts 2020,

with the exception of the following changes in the period: Hugh

Pelham was appointed on 4 January 2021, and Tim Davies resigned on

12 January 2021. Kristen Eshak Weldon was appointed on 1 October

2020 and was included in the list of Directors in the Annual Report

and Accounts 2020. A list of current Directors is maintained on the

website: www.carrsgroup.com

On behalf of the Board

Hugh Pelham Neil Austin

Chief Executive Officer Chief Financial Officer

21 April 2021 21 April 2021

Unaudited notes to condensed interim financial information

1. General information

The Group operates across three divisions of Speciality

Agriculture, Agricultural Supplies and Engineering. The Company is

a public limited company, which is listed on the London Stock

Exchange and is incorporated and domiciled in the UK. The address

of the registered office is Old Croft, Stanwix, Carlisle, Cumbria

CA3 9BA.

These condensed interim financial statements were approved for

issue on 21 April 2021.

The comparative figures for the financial year ended 29 August

2020 are not the Company's statutory accounts for that financial

year. Those accounts have been reported on by the Company's auditor

and delivered to the Registrar of Companies. The report of the

auditor was (i) unqualified, (ii) did not include a reference to

any matters to which the auditor drew attention by way of emphasis

without qualifying their report, and (iii) did not contain a

statement under section 498 (2) or (3) of the Companies Act

2006.

2. Basis of preparation

These condensed interim financial statements for the 26 weeks

ended 27 February 2021 have been prepared in accordance with IAS

34, 'Interim financial reporting' as adopted by the EU pursuant to

Regulation (EC) No 1606/2002 as it applies to the EU.

The annual financial statements of the Group for the year ending

28 August 2021 will be prepared in accordance with International

Financial Reporting Standards (IFRSs) adopted pursuant to

Regulation (EC) No 1606/2002 as it applies in the EU and in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006. As required by the

Disclosure Guidance and Transparency Rules of the Financial Conduct

Authority, this condensed set of financial statements has been

prepared applying the accounting policies and presentation that

were applied in the preparation of the Company's published

consolidated financial statements for the year ended 29 August 2020

which were prepared in accordance with IFRSs as adopted by the

EU.

The Group is expected to have a sufficient level of financial

resources available through operating cash flows and existing bank

facilities for a period of at least 12 months from the signing date

of these condensed consolidated interim financial statements. The

Group has operated within all its banking covenants throughout the

period. In addition, the Group's main banking facility is in place

until November 2023 and an invoice discounting facility is in place

until August 2023.

Detailed cash forecasts continue to be updated regularly for a

period of at least 12 months from the reporting period end. These

forecasts are sensitised for various worst case scenarios including

a COVID-19 outbreak resulting in a short term closure, delays on

order books, and reduced payments from customers. The results of

this stress testing showed that, due to the stability of the core

business, the Group would be able to withstand the impact of these

severe but plausible downside scenarios occurring over the period

of the forecasts.

In addition, several other mitigating measures remain available

and within the control of the Directors that were not included in

the scenarios. These include withholding discretionary capital

expenditure and reducing or cancelling future dividend

payments.

Consequently, the Directors are confident that the Group will

have sufficient funds to continue to meet its liabilities as they

fall due for at least 12 months from the signing date of these

condensed consolidated interim financial statements. The Group

therefore continues to adopt the going concern basis in preparing

its condensed consolidated interim financial statements.

3. Accounting policies

The accounting policies adopted are consistent with those of the

previous financial year except for:

Taxation

Income taxes are accrued based on management's estimate of the

weighted average annual income tax rate expected for the full

financial year based on enacted or substantively enacted tax rates

at 27 February 2021. Our effective tax rate was 21.1% (H1 2020:

19.1%) after adjusting for results from associate and joint

ventures, which are reported net of tax, and adjustments to

contingent consideration (note 8) which is treated as non-taxable.

The higher effective tax rate is due to a higher mix of overseas

profits.

4. Significant judgements and estimates

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing these condensed interim financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the consolidated financial

statements for the 52 weeks ended 29 August 2020, with the

exception of changes in estimates that are required in determining

the provision for income taxes as explained in note 3.

5. Financial risk management

The Group's activities expose it to a variety of financial

risks: market risk (including currency risk and price risk), credit

risk and liquidity risk.

The condensed interim financial statements do not include all

financial risk management information and disclosures required in

the annual financial statements; they should be read in conjunction

with the Group's annual financial statements as at 29 August 2020.

The impact of COVID-19 is discussed further in the interim

management report.

6. Operating segment information

The Group's chief operating decision-maker ("CODM") has been

identified as the Executive Directors. Management has determined

the operating segments based on the information reviewed by the

CODM for the purposes of allocating resources and assessing

performance.

The CODM considers the business from a product/services

perspective. Following a strategic and operational review

reportable operating segments have been identified as Speciality

Agriculture, Agricultural Supplies and Engineering. Central

comprises the central business activities of the Group's head

office, which earns no external revenues. Performance is assessed

using operating profit. For internal purposes the CODM assesses

operating profit before material adjusting items (note 8)

consistent with the presentation in the financial statements. The

CODM believes this measure provides a better reflection of the

Group's underlying performance. Sales between segments are carried

out at arm's length.

The following tables present revenue, profit, asset and

liability information regarding the Group's operating segments for

the 26 weeks ended 27 February 2021 and the comparative

periods.

26 weeks ended

27 February Speciality Agricultural

2021 Agriculture Supplies Engineering Central Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total segment

revenue 44,075 137,687 23,565 - 205,327

Inter segment

revenue (3,888) (3) (1) - (3,892)

------------------- -------------------- ------------------- ----------------

Revenue from

external

customers 40,187 137,684 23,564 - 201,435

----------------- ------------------- -------------------- ------------------- ----------------

Adjusted(1)

EBITDA(2) 7,885 3,466 2,205 (1,404) 12,152

Depreciation,

amortisation

and

profit/(loss)

on disposal of

non-current

assets (785) (1,320) (1,283) (91) (3,479)

Share of

post-tax

results

of associate

and joint

ventures 1,054 1,142 - - 2,196

Adjusted(1)

operating

profit 8,154 3,288 922 (1,495) 10,869

Adjusting items

(note 8) (245) - 78 (30) (197)

----------------- ----------------- ------------------- -------------------- ------------------- ----------------

Operating profit 7,909 3,288 1,000 (1,525) 10,672

----------------- ------------------- -------------------- -------------------

Finance income 135

Finance costs (633)

----------------

Adjusted(1)

profit before

taxation 10,371

Adjusting items

(note 8) (197)

----------------- ----------------- ------------------- -------------------- ------------------- ----------------

Profit before

taxation 10,174

----------------

Segment gross

assets 49,348 112,686 78,421 24,142 264,597

----------------- ------------------- -------------------- ------------------- ----------------

Segment gross liabilities (11,497) (56,126) (28,591) (31,740) (127,954)

--------------- --------------- ---------------- --------------- -------------

1 Adjusted results are consistent with how business performance

is measured internally and is presented to aid comparability of

performance. Adjusting items are disclosed in note 8.

(2) Earnings before interest, tax, depreciation, amortisation,

profit/(loss) on the disposal of non-current assets and before

share of post-tax results of associate and joint ventures.

The following tables have been restated to present Speciality

Agriculture and Agricultural Supplies separately. This is to aid

comparability with the segmental information presented for the

current period to 27 February 2021.

26 weeks ended

29 February Speciality Agricultural

2020 Agriculture Supplies Engineering Central Group

(restated) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total segment

revenue 39,909 138,445 24,919 - 203,273

Inter segment

revenue (3,311) (4) (1) - (3,316)

------------------- -------------------- --------------------------- ----------------

Revenue from

external

customers 36,598 138,441 24,918 - 199,957

---------------- ------------------- -------------------- --------------------------- ----------------

Adjusted(1)

EBITDA(2) 6,211 2,840 2,492 195 11,738

Depreciation,

amortisation

and

profit/(loss)

on disposal

of

non-current

assets (640) (1,302) (1,277) (89) (3,308)

Share of

post-tax

results of

associate and

joint

ventures 967 925 - - 1,892

Adjusted(1)

operating

profit 6,538 2,463 1,215 106 10,322

Adjusting

items (note

8) 1,068 (74) (76) - 918

--------------- ---------------- ------------------- -------------------- --------------------------- ----------------

Operating

profit 7,606 2,389 1,139 106 11,240

---------------- ------------------- -------------------- ---------------------------

Finance income 178

Finance costs (905)

----------------

Adjusted(1)

profit before

taxation 9,595

Adjusting

items (note

8) 918

--------------- ---------------- ------------------- -------------------- --------------------------- ----------------

Profit before

taxation 10,513

----------------

Segment gross

assets 49,098 121,952 83,786 18,243 273,079

---------------- ------------------- -------------------- --------------------------- ----------------

Segment gross liabilities (10,574) (70,122) (30,896) (30,582) (142,174)

--------------- --------------- ---------------- --------------- -------------

52 weeks ended

29 August 2020 Speciality Agricultural Central

(restated) Agriculture Supplies Engineering GBP'000 Group

GBP'000 GBP'000 GBP'000 GBP'000

Total segment

revenue 66,948 280,740 53,020 - 400,708

Inter segment

revenue (5,058) (8) (12) - (5,078)

------------------- -------------------- --------------------------- ---------------

Revenue from

external

customers 61,890 280,732 53,008 - 395,630

---------------- ------------------- -------------------- --------------------------- ---------------

Adjusted(1)

EBITDA(2) 7,914 6,884 6,754 (781) 20,771

Depreciation,

amortisation

and

profit/(loss)

on disposal

of

non-current

assets (1,366) (2,665) (2,944) (182) (7,157)

Share of

post-tax

results of

associate and

joint

ventures 1,061 1,572 - - 2,633

Adjusted(1)

operating

profit 7,609 5,791 3,810 (963) 16,247

Adjusting

items (note

8) 730 (688) (2,449) - (2,407)

--------------- ---------------- ------------------- -------------------- --------------------------- ---------------

Operating

profit 8,339 5,103 1,361 (963) 13,840

---------------- ------------------- -------------------- ---------------------------

Finance income 313

Finance costs (1,656)

---------------

Adjusted(1)

profit before

taxation 14,904

Adjusting

items (note

8) (2,407)

--------------- ---------------- ------------------- -------------------- --------------------------- ---------------

Profit before

taxation 12,497

---------------

Segment gross

assets 47,367 98,046 83,852 18,078 247,343

---------------- ------------------- -------------------- --------------------------- ---------------

Segment gross liabilities (8,845) (44,664) (31,156) (28,509) (113,174)

---------------- --------------- ---------------- --------------- -------------

1 Adjusted results are consistent with how business performance

is measured internally and is presented to aid comparability of

performance. Adjusting items are disclosed in note 8.

(2) Earnings before interest, tax, depreciation, amortisation,

profit/(loss) on the disposal of non-current assets and before

share of post-tax results of associate and joint ventures.

7. Disaggregation of revenue

The following table presents the Group's reported revenue

disaggregated based on the timing of revenue recognition.

26 weeks 26 weeksended 52 weeks

ended 29 February ended

27 February 2020 29 August

2021 2020

Timing of revenue recognition GBP'000 GBP'000 GBP'000

------------------------------- ------------- -------------- -----------

Over time 18,464 16,054 34,790

At a point in time 182,971 183,903 360,840

201,435 199,957 395,630

------------------------------- ------------- -------------- -----------

8. Adjusting items

26 weeks 26 weeks 52 weeks

ended ended ended

27 29 February 29 August

February 2020 2020

2021 GBP'000 GBP'000

GBP'000

--------------------------------- ---------------------------------------------- ------------- --------------------

Amortisation of acquired

intangible assets (i) 621 687 1,380

Adjustments to contingent

consideration (ii) (671) (2,147) (937)

Restructuring/closure costs

(iii) 247 542 1,964

197 (918) 2,407

--------------------------------- ---------------------------------------------- ------------- --------------------

(i) Amortisation of acquired intangible assets which do not

relate to the underlying profitability of the Group but rather

relate to costs arising on acquisition of businesses.

(ii) Adjustments to contingent consideration arise from the

revaluation of contingent consideration in respect of acquisitions

to fair value at the period end. Movements in fair value arise from

changes to the expected payments since the previous period end

based on actual results and updated forecasts. Any increase or

decrease in fair value is recognised through the income

statement.

(iii) Restructuring/closure costs include redundancy costs and

impairments of assets to recoverable amounts.

9. Earnings per share

Adjusting items disclosed in note 8 that are charged or credited

to profit do not relate to the underlying profitability of the

Group. The Board believes adjusted profit before these items

provides a useful measure of business performance. Therefore, an

adjusted earnings per share is presented as follows:

26 weeks 26 weeks 52 weeks

ended ended ended

27 February 29 February 29 August

2021 2020 2020

GBP'000 GBP'000 GBP'000

----------------------- --------------------------------- ---------------------------------- ------------------------------------

Earnings 7,574 8,565 9,533

Adjusting items:

Amortisation of

acquired intangible

assets 621 687 1,380

Adjustments to

contingent

consideration (671) (2,147) (937)

Restructuring/closure

costs 247 542 1,964

Taxation effect of the

above (167) (225) (639)

Non-controlling

interest in the above - (29) (273)

Earnings - adjusted 7,604 7,393 11,028

----------------------- --------------------------------- ---------------------------------- ------------------------------------

Number Number Number

----------------------- --------------------------------- ---------------------------------- ------------------------------------

Weighted average

number of ordinary

shares in issue 92,588,219 92,214,566 92,346,828

Potentially dilutive

share options 2,813,125 1,669,575 1,384,216

95,401,344 93,884,141 93,731,044

----------------------- --------------------------------- ---------------------------------- ------------------------------------

Earnings per share

(pence)

Basic 8.2p 9.3p 10.3p

Diluted 7.9p 9.1p 10.2p

Adjusted 8.2p 8.0p 11.9p

Diluted adjusted 8.0p 7.9p 11.8p

10. Dividends

An interim dividend of GBP2,079,551 (H1 2020: GBP1,034,348) that

related to the period to 29 August 2020 was paid on 2 October 2020.

This included the deferred first interim dividend that, under

normal circumstances, would have been paid in May 2020. This was

deferred due to the uncertainty associated with the COVID-19

pandemic. A final dividend of GBP2,310,612 (H1 2020: GBP2,310,140)

in respect of the period to 29 August 2020 was paid on 15 January

2021.

11. Intangible assets, property, plant and equipment,

right-of-use assets and investment property

Other Property, Right-of-use Investment

intangible plant and assets property

Goodwill assets equipment GBP'000 GBP'000

GBP'000 GBP'000 GBP'000

---------------- ------------------ -------------------------- ---------------- --------------- --------------------

26 weeks ended

27 February

2021

Opening net

book amount

at 30 August

2020 32,041 9,171 38,259 14,856 158

Exchange

differences (511) (52) (570) (17) -

Additions - 780 1,628 1,818 -

Disposals and

transfers - - (1,748) 861 -

Depreciation

and

amortisation - (781) (1,960) (1,253) (3)

---------------- ------------------ -------------------------- ---------------- --------------- --------------------

Closing net

book amount

at 27 February

2021 31,530 9,118 35,609 16,265 155

---------------- ------------------ -------------------------- ---------------- --------------- --------------------

26 weeks ended

29 February

2020

Opening net

book amount

at 1 September

2019 32,877 9,318 41,917 - 164

Transition to

IFRS 16 - - (4,409) 15,903 -

Exchange

differences (807) (99) (911) (48) -

Additions - 845 2,569 1,263 -

Disposals - - (90) - -

Depreciation,

amortisation

and impairment - (749) (2,309) (1,248) (3)

---------------- ------------------ -------------------------- ---------------- --------------- --------------------

Closing net

book amount

as at 29

February 2020 32,070 9,315 36,767 15,870 161

---------------- ------------------ -------------------------- ---------------- --------------- --------------------

Transfers include assets refinanced under a lease and finance

leased assets that became owned assets on maturity of the lease

term.

Capital commitments contracted, but not provided for, by the

Group at the period end amounts to GBP632,000 (2020:

GBP1,559,000).

12. Borrowings

As at As at As at

27 29 29

February February August

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------------------- -------------------------- ----------------------------- ------------------------------

Current 8,580 26,855 11,420

Non-current 26,815 27,896 25,021

--------------------------- -------------------------- ----------------------------- ------------------------------

Total borrowings 35,395 54,751 36,441

Cash and cash equivalents

as per the balance sheet (24,838) (29,318) (17,571)

--------------------------- -------------------------- ----------------------------- ------------------------------

Net debt (excluding

leases) 10,557 25,433 18,870

--------------------------- -------------------------- ----------------------------- ------------------------------

Undrawn facilities 35,324 22,412 35,083

--------------------------- -------------------------- ----------------------------- ------------------------------

Current borrowings include bank overdrafts of GBP4.9m (2020: GBP8.6m). Undrawn facilities

include overdraft facilities of GBP2.5m (2020: GBP2.5m) that are renewable on an annual basis.

26 weeks 26 weeks

ended ended

27 February 29 February

Movements in borrowings are analysed as follows: 2021 2020

GBP'000 GBP'000

-------------------------------------------------- ------------- -----------------------------

Balance at start of period (excluding leases) 36,441 49,519

Exchange differences (235) (362)

New bank loans/RCF drawdown 4,000 2,500

Repayments of borrowings (1,200) (1,247)

(Decrease)/increase in other borrowings (604) 114

Loan forgiven (715) -

Release of deferred borrowing costs 30 30

Net increase to bank overdraft (2,322) 4,197

-------------------------------------------------- ------------- -----------------------------

Balance at end of period 35,395 54,751

-------------------------------------------------- ------------- -----------------------------

New bank loans/RCF drawdown excludes re-financing of assets

under new finance lease arrangements. The balance of GBP49.5m at

the start of the comparative period excludes finance leases of

GBP2.9m which were previously included within borrowings as at 31

August 2019 however, on transition to IFRS 16 'Leases' on 1

September 2019, these were presented separately to borrowings on

the face of the balance sheet.

13. Financial instruments

IFRS 13 requires financial instruments that are measured at fair

value to be classified according to the valuation technique

used:

Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities

Level 2 - inputs, other than Level 1 inputs, that are observable

for the asset or liability, either directly (i.e. as prices) or

indirectly (i.e. derived from prices)

Level 3 - unobservable inputs

Transfers between levels are deemed to have occurred at the end

of the reporting period. There were no transfers between levels in

the above hierarchy in the period.

All derivative financial instruments are measured at fair value

using Level 2 inputs. The Group's bankers provide the valuations

for the derivative financial instruments at each reporting period

end based on mark to market valuation techniques.

Contingent consideration is measured at fair value using Level 3

inputs. Fair value is determined considering the expected payment,

which is discounted to present value. The expected payment is

determined separately in respect of each individual earn-out

agreement taking into consideration the expected level of

profitability of each acquisition.

The significant unobservable inputs are the projections of

future profitability, which have been based on budget and forecast

information for the current year and future periods, and the

discount rate, which has been based on the incremental borrowing

rate. A significant amount of the contingent consideration payable

is included within current liabilities and has therefore not been

discounted. A reasonable change in the discount rate applied would

not have a material impact on the balances recognised within

non-current liabilities.

The following table presents a reconciliation of the contingent

consideration liability measured at fair value on a recurring basis

using significant unobservable inputs (level 3).

As at As at

27 29 As at

February February 29 August

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------------------- ---------------------------- ------------------------------- --------------------------

Fair value at the start of

the period 3,422 7,954 7,954

Exchange differences (12) (175) (184)

Payments made to vendors

(including legal costs) (131) (1,473) (2,513)

Change in fair value (671) (3,027) (1,835)

Fair value at the end of

the period 2,608 3,279 3,422

--------------------------- ---------------------------- ------------------------------- --------------------------

14. Retirement benefit asset

The amounts recognised in the Income Statement are as

follows:

26 weeks 52 weeks

26 weeks ended Ended ended

27 February 29 February 29 August

2021 2020 2020

GBP'000 GBP'000 GBP'000

------------------------------------- --------------------------- -------------------------- ----------------------

Administrative expenses 9 9 13

Net interest on the net defined

benefit asset (74) (70) (139)

Total income (65) (61) (126)

------------------------------------- --------------------------- -------------------------- ----------------------

Net interest on the defined benefit retirement asset is

recognised within interest income.

The amounts recognised in the Balance Sheet are as follows:

As at As at As at

27 29 29 August

February February 2020

2021 2020

GBP'000 GBP'000 GBP'000

----------------------------- ---------------------------- ---------------------------- ---------------------------

Present value of funded

defined benefit obligations (62,685) (67,203) (65,834)

Fair value of scheme assets 70,492 73,846 73,871

----------------------------- ---------------------------- ---------------------------- ---------------------------

Surplus in funded scheme 7,807 6,643 8,037

----------------------------- ---------------------------- ---------------------------- ---------------------------

Actuarial losses of GBP295,000 (2020: GBP1,187,000) have been

reported in the Statement of Comprehensive Income. The surplus has

decreased over the period since 29 August 2020 due to changes in

market conditions contributing to an overall reduction in the

scheme surplus.

The Group's associate's defined benefit pension scheme is closed

to future service accrual and the valuation for this scheme has not

been updated for the half year as any actuarial movements are not

considered to be material.

15. Share capital

Allotted and fully paid ordinary Number Share capital Share premium Total

shares of 2.5p each of shares GBP'000 GBP'000 GBP'000

------------------------------------ ------------ -------------- ---------------------- -------------------

Opening balance as at 30

August 2020 92,465,833 2,312 9,176 11,488

Proceeds from shares issued:

- LTIP 309,823 7 - 7

- Share save scheme 421,744 11 437 448

At 27 February 2021 93,197,400 2,330 9,613 11,943

------------------------------------ ------------ -------------- ---------------------- -------------------

Opening balance at 1 September

2019 91,942,005 2,299 9,165 11,464

Proceeds from shares issued:

- LTIP 513,604 13 - 13

At 29 February 2020 92,455,609 2,312 9,165 11,477

------------------------------------ ------------ -------------- ---------------------- -------------------

309,823 shares were issued in the period to satisfy the share

awards under the LTIP scheme which were exercised in December

2020.

421,744 shares were issued in the period to satisfy the share

awards under the share save scheme with exercise proceeds of

GBP447,611. The related weighted average price of the shares

exercised in the period was GBP1.061 per share. At the period end

the Company holds 50,045 of these shares in treasury.

As announced on 1 April 2021 the Company's issued share capital

had increased to 93,544,724 shares of which 75,955 shares were held

in treasury. The increase in issued share capital was due to the

issue of 347,324 shares under the share save scheme with exercise

proceeds of GBP368,511 and a related weighted average exercise

price of GBP1.061 per share.

16. Cash generated from continuing operations

26 weeks 26 weeks 52 weeks

ended ended ended

27 February 29 February 29 August

2021 2020 2020

GBP'000 GBP'000 GBP'000

----------------------------------------- ------------------------ ------------------------- ----------------------

Profit for the period from continuing

operations 8,460 9,131 10,922

Adjustments for:

Tax 1,714 1,382 1,575

Tax credit in respect of R&D (180) (240) (250)

Depreciation and impairment of property,

plant and equipment 1,960 2,309 4,567

Depreciation and impairment of

right-of-use assets 1,253 1,248 2,462

Depreciation of investment property 3 3 6

Intangible asset amortisation 781 749 1,513

Loss/(profit) on disposal of property,

plant and equipment 103 (51) 265

Profit on disposal of right-of-use

assets - - (37)

Adjustments to contingent consideration (671) (2,147) (937)

Net fair value charge/(credit) on share

based payments 255 (277) (137)

Release of loan provision - - (783)

Other non-cash adjustments (157) (618) (504)

Interest income (135) (178) (313)

Interest expense and borrowing costs 663 935 1,716

Share of results of associate and joint

ventures (2,196) (1,892) (2,633)

IAS 19 income statement charge

(excluding interest):

Administrative expenses 9 9 13

Changes in working capital (excluding

the effects of

acquisitions):

(Increase)/decrease in inventories (2,783) (3,348) 4,811

(Increase)/decrease in receivables (7,872) (4,976) 3,862

Increase/(decrease) in payables 14,749 5,801 (3,479)

Cash generated from continuing

operations 15,956 7,840 22,639

----------------------------------------- ------------------------ ------------------------- ----------------------

17. Related party transactions

The Group's significant related parties are its associate and

joint ventures, as disclosed in the Annual Report and Accounts

2020.

Rent Net management Dividends

Sales Purchases receivable charges receivable Amounts Amounts

to from from (from)/to from owed from owed to

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------- -------- --------------- ----------- --------------------- -------------------- ----------------- --------------------

26 weeks to

27 February 2021

Associate 346 (60,865) 10 (69) 368 368 (20,539)

Joint

ventures 373 (229) - 82 - 1,623 (102)

26 weeks

to

29

February

2020

Associate 280 (55,183) 10 (69) 294 214 (24,334)

Joint

ventures 238 (143) - 80 - 1,756 (2)

----------- -------- --------------- ----------- --------------------- -------------------- ----------------- --------------------

18. Alternative performance measures

The Interim Results include alternative performance measures

("APMs"), which are not defined or specified under the requirements

of IFRS. These APMs are consistent with how business performance is

measured internally and therefore the Directors believe that these

APMs provide stakeholders with additional useful information on the

Group's performance.

Alternative performance

measure Definition and comments

----------------------- ----------------------------------------------------------

EBITDA Earnings before interest, tax, depreciation, amortisation,

profit/(loss) on the disposal of non-current assets

and before share of post-tax results of the associate

and joint ventures. EBITDA allows the user to

assess the profitability of the Group's core operations

before the impact of capital structure, debt financing

and non-cash items such as depreciation and amortisation.

----------------------- ----------------------------------------------------------

Adjusted EBITDA Earnings before interest, tax, depreciation, amortisation,

profit/(loss) on the disposal of non-current assets,

before share of post-tax results of the associate

and joint ventures and excluding items regarded

by the Directors as adjusting items. This measure

is reconciled to statutory operating profit and

statutory profit before taxation in note 6. EBITDA

allows the user to assess the profitability of

the Group's core operations before the impact

of capital structure, debt financing and non-cash

items such as depreciation and amortisation.

----------------------- ----------------------------------------------------------

Adjusted operating Operating profit after adding back items regarded

profit by the Directors as adjusting items. This measure

is reconciled to statutory operating profit in

the income statement and note 6. Adjusted results

are presented because if included, these adjusting

items could distort the understanding of the Group's

performance for the period and the comparability

between the periods presented.

----------------------- ----------------------------------------------------------

Adjusted profit Profit before taxation after adding back items

before taxation regarded by the Directors as adjusting items.

This measure is reconciled to statutory profit

before taxation in the income statement and note

6. Adjusted results are presented because if included,

these adjusting items could distort the understanding

of the Group's performance for the period and

the comparability between the periods presented.

----------------------- ----------------------------------------------------------

Adjusted earnings Profit attributable to the equity holders of the

per share Company after adding back items regarded by the

Directors as adjusting items after tax divided

by the weighted average number of ordinary shares

in issue during the period. This is reconciled

to basic earnings per share in note 9.

----------------------- ----------------------------------------------------------

Adjusted diluted Profit attributable to the equity holders of the

earnings per share Company after adding back items regarded by the

Directors as adjusting items after tax divided

by the weighted average number of ordinary shares

in issue during the period adjusted for the effects

of any potentially dilutive options. Diluted earnings

per share is shown in note 9.

----------------------- ----------------------------------------------------------

Net debt The net position of the Group's cash at bank and

borrowings. Details of the movement in borrowings

is shown in note 12.

----------------------- ----------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKKBKFBKDBQB

(END) Dow Jones Newswires

April 21, 2021 02:00 ET (06:00 GMT)

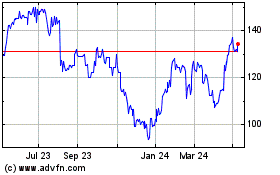

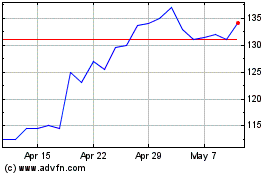

Carr's (LSE:CARR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carr's (LSE:CARR)

Historical Stock Chart

From Apr 2023 to Apr 2024