TIDMCBX

RNS Number : 5641Z

Cellular Goods PLC

25 May 2021

Press release

25 May 2021

Cellular Goods PLC

("Cellular Goods" or "the Company")

Interim results

Cellular Goods, a UK-based provider of premium consumer products

based on lab-made cannabinoids (LSE: CBX), announces its half-year

results to 28 February 2021.

Highlights:

-- Raised GBP13 million before expenses through a significantly

oversubscribed flotation on the main market of the London Stock

Exchange on 26 February 2021, with proceeds received after the

period-end

-- Became the first provider of premium consumer products based

on lab-made cannabinoids to join the London Stock Exchange

-- Secured David Beckham's DB Ventures as a significant equity investor with a 5% shareholding

-- Loss before tax increased to GBP2.12m (H1 2020: GBP0.14m)

reflecting business set-up costs and a one-off non-cash charge for

share-based incentives for the team in the form of warrants

-- Net cash as at 28 February amounted to GBP1.433m (H1 2020:

GBP40,000). Net cash as at 25 May 2021 was GBP11.28m inclusive of

IPO proceeds

Post-period highlights

-- Commenced planned scale-up and investment in the Company's

operational infrastructure with five senior hires to strengthen

product development, marketing, and sales functions

-- Proprietary product formulations, supply chain and

manufacturing agreements, together with go-to-market sales

strategy, are at advanced stages of being developed and

finalised

-- Secured services of expert advisors from skincare, sports medicine, and veterinary sectors.

Outlook

-- On track for roll-out of the first consumer product range in

Autumn 2021, starting with the launch of three skincare products

followed by a 'movement' product range for the after-sport recovery

market in Spring 2022

-- With excellent progress being made across the business,

together with growing public acceptance and scientific validation

of the benefits of cannabinoids such as CBD and CBG, the Company

looks to the future with confidence

Commenting on the results, Alexis Abraham, chief executive of

Cellular Goods said: "The most significant milestone we achieved in

the first half was our heavily oversubscribed flotation on the

London Stock Exchange which has provided us with a strong

foundation and public profile to become the leading and front of

mind brand for consumer cannabinoid products.

"The notable support for an IPO of our size validates the

growing acceptance and potentially huge demand for

cannabinoid-based products over the long term. Though it is still

early days for Cellular Goods, we are making excellent progress in

executing on our strategy, have a strong balance sheet and there

are compelling industry fundamentals; all of this provides the

Board with great confidence."

For further information please contact:

Cellular Goods

Alexis Abraham +44 207 031 6871

Chief Executive

Neil Thapar

Investor Relations +44 787 645 5323

-------------------

Tennyson Securities

-------------------

Corporate Broker

Peter Krens +44 207 186 9030

-------------------

Novum Securities

-------------------

Corporate Broker

Colin Rowbury

Jon Belliss +44 207 399 9427

-------------------

Tancredi Intelligent Communication

-------------------

Media Relations

Helen Humphrey

Edward Daly +44 744 922 6720

Salamander Davoudi +44 786 143 0057

cellulargoods@tancredigroup.com +44 795 754 9906

-------------------

CHAIRMAN'S STATEMENT

Introduction

I am delighted to report the Company's first set of results

since its debut on the main market of the London Stock Exchange on

26 February 2021; this means that the period under review covers

only three days of activities as a listed plc.

No revenue was generated and a loss before tax of GBP2.12m was

incurred in the first half (H1 2020: GBP0.14m loss) as the

management team focussed on developing a business strategy and

raising capital to fund the expansion of the Company.

Our vision is to establish Cellular as the leading UK-based

brand for consumer products incorporating lab-made cannabinoids

which are legally compliant, independently tested for quality,

environmentally friendly, and not tested on animals.

A major milestone in realising that goal was achieved with our

stock market listing, which raised additional capital of GBP13m

before expenses and sparked an unprecedented level of public

interest in an initial public offering of our size. The IPO was

significantly oversubscribed, with more than 6,000 applications

received from small investors. Share allocations were scaled down

to maximise the opportunity for small investors to become

shareholders in Cellular Goods and gain exposure to a major new

trend in consumer products that is being driven by changing

attitudes to, and greater understanding of, the benefits of

cannabinoids.

Market size and strategy

According to BDS Analytics and Arcview Market Research, the

market for annual CBD sales in the USA will surpass $20 billion by

2024, while New York-based investment bank Cowen & Co estimated

that the US CBD market could be $15 billion per annum by 2025.

Meanwhile, the Centre for Medicinal Cannabis estimated that 1.3

million British consumers were using CBD products, the market was

growing at double digits annually, and could be worth almost GBP1bn

a year by 2025.

These growth projections, allied with the disparity in the

quality and consistency of products currently on the market, has

opened an opportunity for a supplier of premium cannabinoid-based

products with known and verifiable provenance to differentiate

itself in the market.

Cellular Goods was established to develop efficacy-led and

research-backed cannabinoid products leveraging lab-made

cannabinoids such as CBD and CBG; the manufacturing process does

not involve the cultivation or processing of the cannabis sativa

plant. The Company's strategic decision to source lab-made

cannabinoids offers significant quality advantages, is ethically

and environmentally friendly, and mitigates the regulatory risks

associated with the sourcing of plant-sourced cannabinoids.

Operational review

Solid progress has been made across the business since the IPO,

with a growing team executing on our growth strategy. The initial

focus is on two product verticals: a premium skincare range to be

launched this Autumn followed by topical athletic recovery products

in Q1 of 2022, with a pet care range anticipated in late 2022.

The initial skin care range comprises a serum, a face-oil and an

after-shaving moisturiser. Formulations for each of these products

are due to be finalised this week after several months of extensive

development in-house and at our UK-based contract manufacturer.

Cellular Goods has progressed from prototype development to the

advanced stages of formulation development and product testing.

These formulations are based on the Company's proprietary

formulations incorporating lab-made cannabinoids; compounds which

have demonstrated anti-inflammatory, anti-oxidant and

anti-microbial properties. The next and final step in the rigorous

product development process will commence shortly focusing on

product quality, consistency, performance and other key

attributes.

In line with industry best practice, the Company will conduct

trials and consumer surveys for all the new products to obtain

feedback to substantiate product claims. These steps are expected

to take approximately three months to complete after which all

notifications concerning cosmetic products will be filed in

accordance with UK/EU regulations. The culmination of this process

is the completion of all necessary steps for the approval and

release of the first product range.

Branding and packaging design for the skincare range, led by

creative director Sara Hemming, has gone through several iterations

and the packaging design has now been finalised and is ready for

launch upon completion of the requisite product development steps.

Hemming has an established track record, having worked with luxury

and lifestyle brands such as Stella McCartney and Jimmy Choo, and

as creative director for David Beckham.

Development of the first two products in the 'movement' range

for sports recovery and daily body maintenance is also moving at

pace. The formulations for this range are currently undergoing

in-vitro testing to validate the use of cannabinoid-based products

for relieving muscle strain and pain relief after physical

activity, an area which is already supported by a wealth of

anecdotal evidence.

The skincare range is expected to go on sale initially in the UK

and Europe direct to consumers through the Company's website and

leading social media channels, prioritising its marketing on

channels which produce the greatest customer engagement and return

on investment. The existing Company website is being redeveloped to

include a fully transactional platform in time for the market

launch. In addition, several micro-sites tailored for social media

are under development to maximise the online opportunity.

At the same time, the Company is continuing to evaluate the

optimal partners through whom to sell its products via third party

online retailers and traditional bricks-and-mortar players who will

contribute to broader exposure, and consumer recognition and

acceptance.

The Company is currently partnered with four leading cannabinoid

producers and moving forward on volume supply agreements to ensure

security of supply of cannabinoids including CBD and CBG. Purchase

orders relating to the initial run of skincare products have been

placed with two of these suppliers. We anticipate that these two

volume supply agreements will be executed in the next

fortnight.

All four of the producers have experience and expertise in the

manufacture of pharmaceutical grade cannabinoid compounds through

lab-based processes, thereby securing a consistent supply of

legally compliant raw materials that are not derived from plant

material.

In April 2021, the Company strengthened its operational

capability with the appointment of Istok Nahtigal as the head of

process and applied sciences with responsibility for developing,

monitoring and optimising the Company's relationships with its

manufacturing partners. Two further senior hires were made to the

product development team to support quality assurance and project

delivery. In addition, the Company also contracted three expert

consultants to advise on the development of athletic recovery, pet

care and skincare ranges.

Financial Review

No revenue was generated and a loss before tax of GBP2.12m was

incurred in the first half (H1 2020: GBP143,000 loss). These

reflect start-up costs of the business, professional fees

principally connected with the flotation and other expenses

relating to the development of the Company's business strategy.

Administrative expenses increased from GBP143,000 to GBP2.12m,

partly reflecting a one-off, non-cash charge of GBP1.227m for

share-based incentives to attract and retain management, advisers

and staff.

Loss per share amounted to 0.012 pence (H1 2020: a loss of 0.001

pence).

Net cash was GBP1.433m at 28 February 2021 and stood at

GBP11.28m at 25 May 2021 following receipt of net IPO proceeds.

Outlook

The tremendous public interest in Cellular Goods' launch on the

London Stock Exchange has provided a strong foundation for the

Company to execute on its long-term growth strategy.

Excellent progress is being made for the roll-out of the first

consumer product range starting with the launch of a trio of

skincare products in Autumn 2021 followed by a 'movement' line-up

for the sports recovery and daily body maintenance markets in Q1 of

2022.

With Cellular Goods on track to deliver on its launch strategy,

together with the continued tailwinds provided by growing public

acceptance and scientific validation of the benefits of

cannabinoids, the Company looks to the future with great

confidence.

STATEMENT OF COMPREHENSIVE INCOME

Period 1 September Period 1 September Year to 31

2020 to 28 2019 to 29 August 2020

Notes February 2021 February 2020

GBP GBP GBP

Revenue 4 - - -

Cost of sales - - -

------------------- ------------------- -------------

Gross profit - - -

Administrative

expenses (2,119,043) (142,747) (329,949)

------------------- ------------------- -------------

Operating loss 5 (2,119,043) (142,747) (329,949)

Finance income - - 63

------------------- ------------------- -------------

Loss before taxation (2,119,043) (142,747) (329,886)

Taxation - - -

------------------- ------------------- -------------

Loss for the period (2,119,043) (142,747) (329,886)

------------------- ------------------- -------------

Basic and diluted

loss per share

- pence 6 0.012 0.001 0.257

------------------- ------------------- -------------

All transactions arise from continuing operations.

The company has no other recognised gains or losses for the

current period.

The accompanying accounting policies and notes form an integral

part of these unaudited interim financial statements.

STATEMENT OF FINANCIAL POSITION

As at 28 As at 29 February As at 31

February 2020 August 2020

2021

Notes GBP GBP GBP

ASSETS

Current assets

Trade and other receivables 7 11,309,040 90,241 89,828

Cash and cash equivalents 1,433,055 39,909 9,224

------------ ------------------ -------------

TOTAL ASSETS 12,742,095 130,150 99,052

------------ ------------------ -------------

EQUITY AND LIABILITIES

Current liabilities

Trade and other payables 8 (657,044) (26,250) (182,291)

------------ ------------------ -------------

TOTAL LIABILITIES (657,044) (26,250) (182,291)

------------ ------------------ -------------

NET ASSETS/(LIABILITIES) 12,085,051 103,900 (83,239)

------------ ------------------ -------------

EQUITY ATTRIBUTABLE

TO SHAREHOLDERS

Share capital 9 504,750 128,750 128,750

Share premium 12,879,176 195,025 195,025

Retained earnings (1,298,875) (219,875) (407,014)

------------ ------------------ -------------

TOTAL EQUITY 12,085,051 103,900 (83,239)

------------ ------------------ -------------

The accompanying accounting policies and notes form an integral

part of these unaudited interim financial statements.

STATEMENT OF CHANGES IN EQUITY

Ordinary Share premium Retained earnings Total

share capital

GBP GBP GBP GBP

Balance at 1 September

2019 103,250 29,250 (77,128) (55,372)

Loss for the period - - (142,747) (142,747)

--------------- -------------- ------------------ ------------

Total comprehensive

income for the period - - (142,747) (142,747)

--------------- -------------- ------------------ ------------

Shares issued 25,500 165,775 - 191,275

--------------- -------------- ------------------ ------------

Total contributions

by owners 25,500 165,775 - 191,275

--------------- -------------- ------------------ ------------

Balance at 29 February

2020 128,750 195,025 (219,876) 103,900

--------------- -------------- ------------------ ------------

Balance at 1 March

2020 128,750 195,025 (219,876) 103,900

Loss for the period - - (187,139) (187,139)

--------------- -------------- ------------------ ------------

Total comprehensive

income for the period - - (187,139) (183,138)

--------------- -------------- ------------------ ------------

Balance at 31 August

2020 128,750 195,025 (219,876) (83,239)

--------------- -------------- ------------------ ------------

Balance at 1 September

2020 128,750 195,025 (407,014) (83,239)

Loss for the period - - (2,119,043) (2,119,043)

--------------- -------------- ------------------ ------------

Total comprehensive

income for the period - - (2,119,043) (2,119,043)

--------------- -------------- ------------------ ------------

Shares issued 376,000 13,784,000 - 14,160,000

Share issue expenses - (1,099,849) - (1,099,849)

Share-based payments - - 1,227,182 1,227,182

--------------- -------------- ------------------ ------------

Total contribution

by owners 376,000 12,684,151 1,227,182 14,287,333

--------------- -------------- ------------------ ------------

Balance at 28 February

2021 504,750 12,879,176 (1,298,875) 12,085,051

--------------- -------------- ------------------ ------------

The accompanying accounting policies and notes form an integral

part of these unaudited interim financial statements.

STATEMENT OF CASH FLOWS

6 months 6 months to Year to 31

to 28 February 29 February August 2020

2021 2020

GBP GBP GBP

Cashflow from operating activities

Loss before income tax (2,119,043) (142,748) (329,886)

Add: non-cash share-based payment

charge 1,227,182 - -

Increase in trade and other

receivables (247,712) (15,241) (12,877)

Increase in trade and other

payables 458,186 1,952 156,041

---------------- ------------- -------------

Net cash flows from operating

activities (681,387) (156,037) (186,722)

---------------- ------------- -------------

Cash flows from financing activities

Proceeds from issue of shares 2,166,000 191,275 191,275

Share issue expenses (60,782) - -

---------------- ------------- -------------

Net cash inflow from financing

activities 2,105,218 191,275 191,275

---------------- ------------- -------------

Net movement in cash and cash

equivalents 1,423,831 35,238 4,553

Opening cash and cash equivalents 9,224 4,671 4,671

---------------- ------------- -------------

Opening cash and cash equivalents 1,433,055 39,909 9,224

---------------- ------------- -------------

The accompanying accounting policies and notes form an integral

part of these unaudited interim financial statements.

NOTES TO THE FINANCIAL STATEMENTS

1. Information on the Company

The Company was incorporated in England and Wales on 25 August

2018 as Leaf Studios Limited, but subsequently re-registered as a

public limited company and renamed as Leaf Studios PLC. On 29

September 2020, the Company's name was changed to Cellular Goods

PLC.

The registered office is 9th Floor, 16 Great Queen Street,

London, WC2B 5DG. The principal activity of the Company is

establishing a biosynthetic CBD retail business. The Company gained

admission to the Official List (by way of a Standard Listing under

Chapter 14 of the Listings Rules) and trading on the London Stock

Exchange on 26 February 2021.

2. Basis of preparation and principal accounting policies

This condensed consolidated interim financial information was

approved for issue by the Board on 24 May 2021.

The Company's directors are responsible for the preparation of

the unaudited interim financial statements.

The preparation of unaudited interim financial statements in

conformity with IFRSs requires the use of estimates and assumptions

that affect the reported amounts of assets and liabilities at the

date of the unaudited interim financial statements and the reported

amounts of expenses during the period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual results ultimately may differ from those

estimates.

The Directors consider that in the proper preparation of the

unaudited interim financial statements there were no critical or

significant areas which required the use of accounting estimates

and exercise of judgement by management while applying the

Company's accounting policies.

This condensed consolidated interim financial information has

not been audited and does not include all of the information

required for full annual financial statements. The financial

figures included within this interim report have been computed in

accordance with IFRS applicable to interim periods, and this report

constitutes an interim financial report as set out in International

Accounting Standard 34: Interim Financial Reporting.

There is no material difference between the fair value of

financial assets and liabilities and their carrying amount.

The functional and presentational currency is UK Sterling.

3. Going concern

The Directors have assessed the current financial position of

the Company, along with future cash flow requirements, to determine

if the Company has the financial resources to continue as a going

concern for the foreseeable future.

The conclusion of this assessment is that it is appropriate that

the Company be considered a going concern. For this reason, the

Directors continue to adopt the going concern basis in preparing

the unaudited interim financial statements.

4. Revenue

The Company did not generate revenue during the period (29

February 2020 and 31 August 2020: nil).

5. Operating loss

Total administrative expenses include share-based payments of

GBP1,227,182. The related credit to equity is taken to retained

earnings.

6. Loss per share

Basic earnings per share is calculated by dividing the loss

attributable to equity holders of the company by the weighted

average number of Ordinary Shares in issue during the period.

28 February 29 February 31 August

2021 2020 2020

GBP GBP GBP

Loss used to calculate basic and diluted

earnings per share (2,119,043) (142,747) (329,886)

Weighted average number of shares used

in calculating basic earnings per share 171,448,611 121,202,778 128,416,667

Weighted average number of shares used

in calculating diluted earnings per share 171,448,611 121,202,778 128,416,667

Basic loss per share (pence) (0.012) (0.001) (0.257)

------------ ------------ --------------

Diluted loss per share (pence) (0.012) (0.001) (0.257)

------------ ------------ --------------

7. Trade and other receivables

28 February 29 February 31 August

2021 2020 2020

GBP GBP GBP

VAT debtor 128,084 10,241 -

Prepayments 134,456 - -

Share capital unpaid 11,045,500 - -

Other debtors 1,000 80,000 89,828

------------ ------------ ----------

11,309,040 90,241 89,828

------------ ------------ ----------

There were no receivables that were past due or considered to be

impaired. There is no significant difference between the fair value

of the other receivables and the values stated above.

8. Trade and other payables

28 February 29 February 31 August

2021 2020 2020

GBP GBP GBP

Trade creditors 511,283 26,250 -

Accruals 145,761 - 182,291

------------ ------------ ----------

657,044 26,250 182,291

------------ ------------ ----------

All liabilities are payable on demand or have payment terms of

less than 90 days.

9. Share Capital

28 February 29 February 31 August

2021 2020 2020

GBP GBP GBP

504,750,000 (February 2020 and August

2020: 128,750,000) Ordinary shares of

GBP0.001 each 504,750 128,750 128,750

------------ ------------ ----------

In the six months to 28 February 2021, the Company issued

376,000,000 Ordinary shares of GBP0.001 each, at an average price

of GBP0.03766, raising GBP14,160,000 before share issue

expenses.

The Ordinary Shares have been classified as Equity. The Ordinary

Shares have attached to them full voting and capital distribution

rights.

10. Capital and reserves

Share capital represents issued Ordinary shares of GBP0.001

each, all of which are fully paid.

Share premium is the amount subscribed for share capital in

excess of nominal value less attributable share issue expenses.

Retained earnings is the cumulative loss of the Company

attributable to equity shareholders.

11. Share-based payments

The Company has issued 52,460,000 warrants to subscribe for

additional share capital of the Company. Each warrant entitles the

holder to subscribe for one ordinary equity share in the Company.

The right to convert each warrant is unconditional.

The right to subscribe for ordinary shares in the Company is

subject to minimum vesting periods of up to three years. Relevant

warrants are subject to a lock-in period of 12 months from 26

February 2021, the Company's date of admission to trading on the

London Stock Exchange. This restriction applies to all warrants,

exercised or otherwise.

Equity-settled share-based payments are measured at fair-value

(excluding the effect of non-market-based vesting conditions) as

determined through use of the Black-Scholes technique, at the date

of issue.

Warrants issued Weighted 28 February 29 February 31 August

Average Exercise 2021 2020 2020

price

Number Number Number

At the beginning of the

period -

pence - - -

Issued in the period -

pence 2.903p 52,460,000 - -

------------------ ------------ ------------ ----------

At the end of the period

- pence 2.903p 52,460,000 - -

------------------ ------------ ------------ ----------

The total share-based payment charge for warrants in the period

was GBP1,227,182, all of which has been charged to administrative

expenses. The share-based payment charge was calculated using the

Black-Scholes model. All warrants have an exercise period between

one and three years from the date of issue.

Volatility for the calculation of the share-based payment charge

in respect of the warrants issued was determined by reference to

movements in the relative share prices of a selected peer-group of

companies listed on the London Stock Exchange.

The inputs into the Black-Scholes model for the warrants issued

in the period are as follows:

28 February

2021

Warrants

issued

Weighted average share price at grant date - pence 5.0

Weighted average exercise prices - pence 2.9

Weighted average volatility 75%

Expected life in years 2.13

Weighted average contractual life in years 2.13

Risk-free interest rate 1.5%

Expected dividend yield 0%

Weighted average fair-value of warrants granted (pence) 2.63

------------

The warrants were issued in three placements.

The share price at the date of grant for each of these was 5

pence.

The warrant exercise prices at the date of grant were 1 pence or

5 pence.

The share-based payment charge has been simultaneously credited

to retained earnings.

The total number of warrants issued to directors was

24,000,000.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUMCAUPGUMC

(END) Dow Jones Newswires

May 25, 2021 02:00 ET (06:00 GMT)

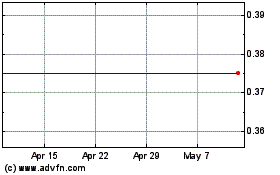

Cellular Goods (LSE:CBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cellular Goods (LSE:CBX)

Historical Stock Chart

From Apr 2023 to Apr 2024