TIDMCCJI

RNS Number : 2307D

CC Japan Income & Growth Trust PLC

28 June 2021

CC JAPAN INCOME & GROWTH TRUST PLC

HALF-YEARLY FINANCIAL REPORT

FOR THE SIX MONTHSED 30 APRIL 2021

INVESTMENT OBJECTIVE, FINANCIAL INFORMATION AND PERFORMANCE

SUMMARY

INVESTMENT OBJECTIVE

The investment objective of the Company is to provide shareholders

with dividend income combined with capital growth, mainly through

investment in equities listed or quoted in Japan.

FINANCIAL INFORMATION

At At

30 April 31 October

2021 2020

--------------------------------------------------------- ------------ ------------

Net assets (millions) GBP208.6 GBP184.4

--------------------------------------------------------- ------------ ------------

Net asset value ("NAV") per Ordinary Share ("Share")(1) 154.8p 136.8p

--------------------------------------------------------- ------------ ------------

Share price 145.0p 119.5p

--------------------------------------------------------- ------------ ------------

Share price discount to NAV(2) 6.3% 12.6%

--------------------------------------------------------- ------------ ------------

Ongoing charges(2) 1.04% 1.04%

--------------------------------------------------------- ------------ ------------

Gearing (net)(2) 21.1% 20.7%

--------------------------------------------------------- ------------ ------------

(1) Measured on a cum income basis.

(2) This is an Alternative Performance Measure ("APM'"). Definitions

of APMs used in this report, together with how these measures have been

calculated are disclosed in the half-yearly report.

PERFORMANCE SUMMARY

For the

For the six six months

months to to

30 April 30 April

2021 2020

% change(1) % change(1)

NAV ex-income total return per Share(2) +17.0% -16.3%

--------------------------------------------------------- ------------ ------------

NAV cum-income total return per Share(2) +15.5% -16.5%

--------------------------------------------------------- ------------ ------------

Share price total return(2,3) +24.0% -15.0%

--------------------------------------------------------- ------------ ------------

Tokyo Stock Exchange Price Index ("Topix") total

return +8.8% +7.5%

--------------------------------------------------------- ------------ ------------

Revenue return per Share 2.22p 2.84p

--------------------------------------------------------- ------------ ------------

(1) Total returns are stated in GBP sterling, including

dividend reinvested.

(2) These are APMs.

(3) The return excludes the accretion effect of the Subscription

Share with a closing price of 8.0p (equivalent to a 1.6p increment

per Ordinary Share as a 1 for 5 bonus issue) as at 30 April

2021.

Source: Coupland Cardiff Asset Management LLP April

2021 .

CHAIRMAN'S STATEMENT

Performance

In the first half of this financial year, I can report to

Shareholders that the fortunes of your Company have rebounded after

the very challenging year to 31 October 2020. Over the six months

to 30 April 2021 the Company's ex-income Net Asset Value ("NAV")

increased by 17.0%. The share price rose by 24.0% as measured by

total return to reflect the final dividend of 3.20p per Ordinary

Share. These figures exclude the accretion effect of the 1 for 5

bonus issue of Subscription Shares distributed to Shareholders

during the period. For reference, in sterling terms the Tokyo Stock

Exchange Price Index ("Topix") rose 8.8% over the period.

The Japanese stock market has gone through a style rotation to

benefit cyclical and value shares, eclipsing growth stocks and

resurrected by a recovery of world trade and hopes for a broader

reopening of the domestic economy. This has suited our mandate and

the portfolio has been well positioned to capture the upside from

this shift in sentiment. It is also pleasing to see our much better

relative performance against the Japanese investment trust peer

group over the period and in the calendar year to date, albeit that

our differentiated investment objective does not merit a strict

comparison, given our income bias.

Reflecting this performance, the Ordinary Share price discount

to NAV narrowed to 6.3% as at 30 April 2021, compared to 12.6% as

at 31 October 2020.

Subscription Shares - an update

On 18 February 2021, 26,947,000 Subscription Shares ("TSS") were

admitted to the London Stock Exchange (Ticker: CCJS). They were

issued as a free bonus to Shareholders on the basis of 1

Subscription Share for every 5 Ordinary Shares owned. The

Subscription Shares are designed to give Shareholders an

opportunity to benefit from a post-COVID-19 Japanese recovery by

giving them an option to exercise their Subscription Shares into

Ordinary Shares. The Subscription Shares have a limited life but

can be exercised by paying the Subscription Price of GBP1.61 for

new Ordinary Shares on a quarterly basis on the last business day

of May, August, November and February up until the last business

day of February 2023, whereupon they expire.

The trading volumes in the Subscription Shares have inevitably

been thin since launch being "out of the money" (the current share

price is below the Subscription Price). However, the closing price

of 8.0p on 30 April 2021 indicates the scope for incremental value

to Shareholders. Their value is predicated on the performance of

the Ordinary Shares over that period: if the Ordinary Share price

exceeds the Subscription Price, the TSS should trade "in the

money." If Shareholders then choose to exercise, the number of

shares in issue will increase and, as a result, market liquidity

should improve. Alternatively, Subscription Shareholders can sell

their TSS in the market.

I must add a word of warning regarding exercising the

Subscription Shares. Every quarter you will receive a "Corporate

Action Notice" from your stockbroker, Independent Financial Adviser

("IFA") or platform, or wherever your shares are held, triggered by

regulation and not by the Company. For most holders, it only makes

sense to exercise any Subscription Shares when the Ordinary Share

price is at or near the Subscription Price i.e. "in the money". A

small number of Shareholders elected to exercise at the end of May

2021 at the Subscription Price of GBP1.61, so we offered to return

their funds, not wishing to see them lose money, given that ,at

that date, the Ordinary Share price closed at GBP1.40.

If you are uncertain about your Subscription Share rights,

please consult your financial adviser or refer to the Prospectus

and Circular issued to Shareholders on 22 January 2021 which gives

full details and is available online at the Company's website

www.ccjapanincomeandgrowthtrust.com under the "Documents" tab.

Alternatively, Shareholders can contact the Company Secretary. The

telephone number for the Company Secretary is +44(0) 20 4513

9260.

Income & Interim Dividend

Earnings for the period were 2.22p per Ordinary Share compared

to 2.84p in the first half of 2020, a fall of 22%. Inevitably, the

revenue account suffered from the fallout of the COVID-19 pandemic,

particularly from the closure of hospitality and leisure businesses

and a sharp contraction in the Japanese economy in 2020. That said,

the outlook for dividends in Japan continues to look healthy. While

companies slashed earnings guidance in the pandemic, the dividend

picture has been relatively stable. The corporate sector is cash

rich and company managements are increasingly committed to

maintaining distribution policies, which in many cases now appear

to be on an upward trajectory, as discussed in the Investment

Manager's review. The strength of sterling has become something of

a headwind, where the sterling/yen cross rate rose by 12% over the

period impacting the conversion of yen dividend receipts.

Shareholders should be aware that we have a policy of not hedging

currency so there is a risk of revenue leakage on currency

translation. Conversely, there is already evidence that a weaker

yen is stimulating Japanese corporate earnings and hence dividends.

The Board view hedging strategies as expensive with currency

movements notoriously difficult to predict.

The Company has been able to build a revenue reserve as a buffer

since inception in December 2015. The accumulated net revenue

reserve is 4.02p per share which together with the Special Reserve

could be utilised in the event of a revenue shortfall.

The Board has declared an unchanged interim dividend of 1.40p

per Ordinary Share, payable on 6 August 2021 with an ex-date of 8

July 2021.

Outlook

Although Japan has suffered considerably less from the pandemic

compared to many other countries, the slow roll out of vaccinations

and a recent resurgence of cases of COVID-19 saw a "state of

emergency" reimposed, albeit with light restrictions. As a result,

the domestic economy has struggled with hospitality, leisure and

travel at a standstill. Tourism was a major driver of domestic

demand in the pre COVID-19 world and even if the Olympics go ahead

there will be few foreign spectators.

Nevertheless, there are continued reasons for optimism. The bulk

of Japanese corporate earnings are derived from overseas and have

benefitted from the recovery in world trade, aided and abetted by

huge global stimulus. Exports have benefitted from a weaker yen.

Japan is a major cyclical beneficiary of global recovery, where

foreign institutions are underweight and the vaccine roll out is at

last gathering pace. Companies continue to improve rewards to

shareholders through the stability of their dividend distribution

policies with many increases evident on the back of a recovery in

corporate earnings. Despite Japan being relatively unaffected by

the pandemic, Prime Minister Suga's popularity has plummeted, but

the opposition are in disarray before the impending election and

there is little political animus to reverse the steady improvements

in Corporate Governance.

The prospects for Japanese investment returns still looks

promising and as of 25 June 2021, the Company offers a historic

yield of 3.3%. The full year dividend distribution is expected to

be at least maintained in the current financial year to 31 October

2021. We hope that portfolio performance will continue to

strengthen sufficiently to generate healthy total returns for

Shareholders, not least for the Subscription Shares, which can

potentially reward loyal Shareholders for their patience during the

difficult period of performance over the pandemic.

Keeping in touch

I would encourage you to keep in touch by looking at the

Company's website www.ccjapanincomeandgrowthtrust.com. This

provides regular updates including the Investment Manager's monthly

factsheets.

Harry Wells

Chairman

25 June 2021

INVESTMENT MANAGER'S REPORT

Performance Review

The ex-income Net Asset Value ("NAV") total return of the

Company increased 17.0% between 31 October 2020 and 30 April 2021.

During this period, the Company paid last year's second interim

dividend of 3.20p (in lieu of a final dividend), which represented

a 3.2% increase over last year's final dividend despite the

challenging economic and financial conditions resulting from the

COVID-19 pandemic.

The period from 31 October 2020 to 30 April 2021 has been

notable for sharp investor swings between optimism over the rollout

of a global immunisation programme and renewed risks as new

variants of the COVID-19 virus have emerged. Japan itself, which

managed the initial surge of infections in a relatively favourable

manner compared to many other regions, has suffered the negative

economic impact of the periodic reintroduction of restrictions.

The Japanese equity market has continued to make steady upward

progress since the announcement of the first successful vaccine

trial results in early November. However, there has been a notable

change in the style characteristics within the market. Research by

Nomura Securities, which has produced the style indices Topix

Growth and Topix Value since 2009, highlights the fact the move has

been a significant reversal of the strong growth trend that

dominated the majority of 2020 and indeed the previous five

years.

The style reversal in the market to favour value has been to the

benefit of some of the long-term holdings in the portfolio such as

leading mega-banks, Sumitomo Mitsui Financial Group and Mitsubishi

UFJ Financial Group, and trading companies Itochu and Mitsubishi

Corp. Currently, these are the main industries where this strategy

overlaps with 'deep value' investment styles. However, the Company

does not have exposure to deeply cyclical, debt laden sectors such

as airlines, iron and steel or shipping which have led the value

rally. Looking at previous periods when these sectors have risen

sharply, we believe that these rallies create nothing more than

short term trading opportunities as expectations for a turning

point in business conditions rise. But, we believe that their poor

record of consistently low capital efficiency and depressed

shareholder returns have a greater bearing on the long term

performance of the shares and consequently continue to

differentiate the stronger investment case for the banks and

trading companies compared to airlines or steel companies.

Since the announcement of the first successful vaccine in

November 2020, the Company has delivered a positive relative

performance. The recognition of the attributes of the banks and

trading companies has had a notable contribution and there has also

been a recent and more modest positive return from some of the REIT

holdings in the office segment (Invesco Office, UBS MidCity).

Employment related companies Dip and Technopro appear to have been

given some credit for their recovery potential. However, the

consumer staple companies Kao, Noevir and Pigeon have continued to

languish despite affirming their shareholder return attractions,

through projecting dividend increases in the face of the current

trading difficulties. Hikari Tsushin was the largest negative

contributor after its share price fell sharply in January, due to a

sharp spike in electricity spot prices which was detrimental to its

wholesale power business. Our conversations with the company

confirm that while material, the shortfall has been offset by the

strength in other parts of its business.

Portfolio Positioning

Trading activity in the portfolio has continued to reflect the

balance between the near-term intent to maximise the dividend

distributed to Shareholders and to establish holdings which have

the greatest long-term growth potential.

The disparity amongst different industries in terms of economic

activity is visible both in headline macroeconomic data and

corporate results. For example, while world trade volumes hit

historic highs in early 2021, benefitting many of Japan's exporters

and leading industrial companies, the number of international

tourists is down over 90% compared to the previous year. Individual

companies have consequently sought to adapt to very differing

circumstances.

In this environment, the Company exited holdings in Gakkyusha,

Yamada Holdings, Pigeon and Nomura, due to concerns over the

sustainability of their pre-COVID-19 business success, and sold

Hoya and Invesco Office REIT as valuations became less

attractive.

Holdings in the Mitsubishi UFJ Holdings and Sumitomo Mitsui

Financial Group as well as Sompo Insurance were increased as it

became clear that their business prospects were unlikely to be as

tumultuous as many initially feared. New positions have been

established in Nintendo (home entertainment games), Orix (financial

services), Open House (real estate services) and Asahi Holdings

(precious metal recycling and waste material processing). The

common theme amongst all these companies is their commitment to

delivering consistent shareholder returns despite the various

challenges they have faced during the last 18 months.

Outlook

We believe that many of the existing portfolio companies have

clearly demonstrated that they will not backtrack on their

commitment to deliver steady returns to shareholders. For example,

the Japanese solar power business, West Holdings recently announced

a 13 for 10 stock split but confirmed that it will maintain the

same Y50 per share as a full year dividend on the increased

capital. Consequently, this represents a 30% increase on their

original forecast for the current year and a 44% increase on the

dividend they paid in the prior year. In another positive move, NTT

announced its intention to pay a Y55 final dividend rather than the

Y50 it originally forecast which will result in a 10.5% increase

for the full year. Shin-Etsu Chemical paid an additional Y10 per

share in its second half dividend (Y130 compared to original

forecast of Y120) for a full year increase of 13.6% on financial

year 2020, reflecting the strength of their PVC and silicon wafer

businesses. Similarly, Tokyo Electron and Murata increased their

financial year 2020 dividend payments by a further Y41 and Y5

respectively resulting in annual increases of 32.8% and 18.5%.

Strong financial markets had a favourable impact on the results of

SBI Holdings and the Japan Exchange Group. SBI increased their

final dividend by 25% above forecast to Y100 and Japan Exchange

announced the additional payment of a Y10 special dividend together

with a Y20bn share buyback programme, equivalent to 1.4% of their

outstanding equity. It is notable that many companies have

announced seemingly conservative forecasts for financial year 2021

due to the general uncertainty about the near-term trends but are

anticipating increases in capital investment to match longer term

ambitions.

Dividends from Japanese companies in general have demonstrated

greater resilience to the impact of the pandemic than many other

regions and hence the Japanese equity market has maintained its

record of delivering superior growth in shareholder distributions

over recent years. We believe that this positive trend is set to

continue, given the continuing underlying improvements in corporate

governance and capital efficiency that became evident under the

policies established by former Prime Minister Abe. The regular

review of the Corporate Governance Code along with the revisions to

eligibility criteria for inclusion in the indices of the Tokyo

Stock Exchange are notable recent initiatives that are having a

clear influence on corporate attitudes and medium-term management

policies which underpin this investment strategy and have allowed

it to recover after the seismic events of early 2020.

Richard Aston

Coupland Cardiff Asset Management LLP

25 June 2021

TOP TEN SECTORS AND HOLDINGS

As at 30 April 2021

TOP 10 SECTORS

% of net

Sector assets

------------------------------ ---------

Information & Communications 13.2

------------------------------ ---------

Chemicals 12.5

------------------------------ ---------

Real Estate 10.7

------------------------------ ---------

Services 9.9

------------------------------ ---------

Banks 8.5

------------------------------ ---------

Electrical Appliances 7.7

------------------------------ ---------

Wholesale 7.0

------------------------------ ---------

Insurance 5.0

------------------------------ ---------

Securities & Commodities 4.3

------------------------------ ---------

Other Products 4.2

------------------------------ ---------

Other Sectors 16.1

------------------------------ ---------

Other net assets 0.9

------------------------------ ---------

Total 100.0

------------------------------ ---------

TOP 10 EQUITY HOLDINGS

% of net

Company Sector assets

Sumitomo Mitsui Financial Group Banks 4.5

--------------------------------- ------------------------------ ---------

SBI Holdings Securities & Commodities 4.2

--------------------------------- ------------------------------ ---------

Itochu Corp Wholesale 4.1

--------------------------------- ------------------------------ ---------

Shin-Etsu Chemical Chemicals 4.1

--------------------------------- ------------------------------ ---------

Asahi Holdings Nonferrous Metals 4.0

--------------------------------- ------------------------------ ---------

Mitsubishi UFJ Financial Group Banks 4.0

--------------------------------- ------------------------------ ---------

Nippon Telegraph & Telephone Information & Communications 3.9

--------------------------------- ------------------------------ ---------

Softbank Information & Communications 3.7

--------------------------------- ------------------------------ ---------

Tokyo Electron Electrical Appliances 3.7

--------------------------------- ------------------------------ ---------

GLP J-REIT Real Estate 3.5

--------------------------------- ------------------------------ ---------

Other equity holdings n/a 59.4

--------------------------------- ------------------------------ ---------

Other net assets 0.9

----------------------------------------------------------------- ---------

Total 100.0

----------------------------------------------------------------- ---------

TOP TEN CONTRACTS FOR DIFFERENCE ("CFDs")

Absolute Absolute Market

Value value as value

a %

Company Sector GBP'000 of net assets GBP'000

Sumitomo Mitsui Financial

Group Banks 1,882 0.9 (48)

------------------------------ ------------------------------ --------- -------------- --------

SBI Holdings Securities & Commodities 1,773 0.9 401

------------------------------ ------------------------------ --------- -------------- --------

Itochu Corp Wholesale 1,709 0.8 488

------------------------------ ------------------------------ --------- -------------- --------

Shin-Etsu Chemical Chemicals 1,706 0.8 606

------------------------------ ------------------------------ --------- -------------- --------

Asahi Holdings Nonferrous Metals 1,681 0.8 63

------------------------------ ------------------------------ --------- -------------- --------

Mitsubishi UFJ Financial

Group Banks 1,680 0.8 23

------------------------------ ------------------------------ --------- -------------- --------

Nippon Telegraph & Telephone Information & Communications 1,637 0.8 5

------------------------------ ------------------------------ --------- -------------- --------

Softbank Information & Communications 1,563 0.7 (27)

------------------------------ ------------------------------ --------- -------------- --------

Tokyo Electron Electrical Appliances 1,531 0.7 809

------------------------------ ------------------------------ --------- -------------- --------

GLP J-REIT Real Estate 1,451 0.7 414

------------------------------ ------------------------------ --------- -------------- --------

Top ten 16,613 7.9 2,734

-------------------------------------------------------------- --------- -------------- --------

Other 24,794 11.9 1,574

Total 41,407 19.8 4,308

-------------------------------------------------------------- --------- -------------- --------

INTERIM MANAGEMENT REPORT

The Directors are required to provide an Interim Management

Report in accordance with the Financial Conduct Authority ("FCA")

Disclosure Guidance and Transparency Rules. The Chairman's

Statement and the Investment Manager's Report in this half-yearly

report provide details of the important events which have occurred

during the period and their impact on the financial statements. The

following statements on related party transactions, going concern

and the Directors' Responsibility Statement, together, constitute

the Interim Management Report for the Company for the six months

ended 30 April 2021. The outlook for the Company for the remaining

six months of the year ending 31 October 2021 is discussed in the

Chairman's Statement and the Investment Manager's Report.

PRINCIPAL AND EMERGING RISKS AND UNCERTAINTIES

A detailed explanation of the principal and emerging risks and

uncertainties to the Company are detailed in the Company's most

recent Annual Report for the year ended 31 October 2020, which can

be found on the Company's website at

www.ccjapanincomeandgrowthtrust.com

Since the publication of the 2020 annual financial report on 26

February 2021, the COVID-19 pandemic continues to be a serious

threat to most parts of the global economy and the Board continues

to monitor the situation closely and is in regular contact with the

Investment Manager and the Company's other service providers in

order to assess and mitigate the impact on the Company's investment

objectives, investment portfolio and shareholders. Otherwise, in

the view of the Board, these principal and emerging risks and

uncertainties are substantially unchanged from the year end and are

as much applicable to the remaining six months of the financial

year, as they are to the six months under review.

The Board has a dynamic risk management register and associated

risk heat map in place to help identify principal and emerging

risks in the business and oversee the effectiveness of internal

controls and processes. These key risks fall into four

categories:

-- Strategic and business risks, including risks associated with the economy;

-- Financial risks;

-- Operational risks, including business interruption due to COVID-19; and

-- Regulatory and compliance risks.

RELATED PARTY TRANSACTIONS

The Company's Investment Manager is Coupland Cardiff Asset

Management LLP. Coupland Cardiff Asset Management LLP is considered

a related party under the Listing Rules. The Investment Manager is

entitled to receive a management fee payable monthly in arrears at

the rate of one-twelfth of 0.75% of Net Asset Value per calendar

month. Investment management fees paid during the six-month period

to 30 April 2021 were GBP780,000. There is no performance fee

payable to the Investment Manager. There have been no changes to

the related party transactions that could have a material effect on

the financial position or performance of the Company since the year

ended 31 October 2020.

GOING CONCERN

The Board has a reasonable expectation that the Company has

adequate resources to continue in operational existence for at

least twelve months from 25 June 2021. In reaching this conclusion,

the Directors have considered the liquidity of the Company's

portfolio of investments as well as its cash position, income and

expense flows. The Company's net assets as at 30 April 2021 were

GBP208.6 million (30 April 2020: GBP174.5 million). As at 30 April

2021, the Company held GBP207.0 million (30 April 2020: GBP165.6

million) in quoted investments. In addition, as at 30 April 2021,

the Company had gross exposure to Contracts for Difference of

GBP41.4 million (30 April 2020: GBP33.1 million). The total

expenses (excluding finance costs and taxation) for the six months

ended 30 April 2021 were GBP1.1million (30 April 2020: GBP1.0

million). The Company has a GBP12 million (or equivalent in

Japanese yen) bank overdraft facility with Northern Trust Company

and as at 30 April 2021, GBP2.7 million had been utilised on the

Japanese yen bank account.

In light of the COVID-19 pandemic, the Directors have fully

considered and assessed the Company's portfolio of investments. A

prolonged and deep market decline could lead to falling values to

the investments or interruptions to cashflow. However, the Company

currently has more than sufficient liquidity available to meet any

future obligations.

The market and operational risks associated with the COVID-19

pandemic, and the ongoing economic impact of measures introduced to

combat its spread, were discussed and are continually monitored by

the Board.

The Investment Manager, Administrator and other key service

providers are providing regular updates on operational resilience.

The Board is satisfied that the key service providers have the

ability to continue to operate efficiently in a remote or virtual

working environment, as had been demonstrated since March 2020.

DIRECTORS' STATEMENT OF RESPONSIBILITY FOR THE HALF-YEARLY

REPORT

The Directors confirm to the best of their knowledge that:

-- The condensed set of financial statements contained within

the half-yearly financial report has been prepared in accordance

with FRS 104 Interim Financial Reporting.

-- The Interim Management Report includes a fair review of the

information required by 4.2.7R and 4.2.8R of the FCA's Disclosure

Guidance and Transparency Rules.

Harry Wells

Chairman

For and on behalf of the Board of Directors

25 June 2021

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

SIX MONTHS TO 30 APRIL 2021

Six months to 30 Six months to 30 April Year ended 31 October

April 2021 (Unaudited) 2020 (Unaudited) 2020 (Audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ----- -------- -------- -------- -------- --------- --------- -------- --------- -----------

Gains/(losses)

on investments - 26,199 26,199 - (38,952) (38,952) - (29,495) (29,495)

Currency

gains - 415 415 - 376 376 - 302 302

Income 4 3,861 - 3,861 4,743 - 4,743 8,553 - 8,553

Investment

management

fee (156) (624) (780) (147) (590) (737) (285) (1,140) (1,425)

Other expenses (305) - (305) (266) - (266) (556) - (556)

Return on

ordinary

activities

before finance

costs and

taxation 3,400 25,990 29,390 4,330 (39,166) (34,836) 7,712 (30,333) (22,621)

Finance costs 5 (28) (82) (110) (35) (89) (124) (63) (166) (229)

Return on

ordinary

activities

before

taxation 3,372 25,908 29,280 4,295 (39,255) (34,960) 7,649 (30,499) (22,850)

Taxation 6 (386) - (386) (474) - (474) (853) - (853)

Return on

ordinary

activities

after taxation 2,986 25,908 28,894 3,821 (39,255) (35,434) 6,796 (30,499) (23,703)

---------------- ----- -------- -------- -------- --------- -------- --------- -----------

Return per

Ordinary

Share 10 2.22p 19.23p 21.45p 2.84p (29.14)p (26.30)p 5.04p (22.64)p (17.60)p

---------------- ----- -------- -------- -------- -------- --------- --------- -------- --------- -----------

The total column of this statement is the profit and loss account of the

Company. All revenue and capital items in the above statement derive from

continuing operations.

Both the supplementary revenue and capital columns are both prepared under

guidance from the Association of Investment Companies. There is no other

comprehensive income and therefore the return for the year is also the total

comprehensive income for the period.

CONDENSED STATEMENT OF FINANCIAL POSITION

AS AT 30 APRIL 2021

30 April 30 April 31 October

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

------------------------------------------ ----- ------------- ------------- -----------

Fixed assets

Investments at fair value through profit

or loss 3 207,036 165,644 180,927

------------------------------------------ ----- ------------- ------------- -----------

Current assets

Cash and cash equivalents - 11,162 2,463

Cash collateral in respect of Contracts

for Difference ("CFDs") - 101 41

Amounts due in respect of CFDs 5,534 530 3,014

Other debtors 3,121 5,532 3,100

8,655 17,325 8,618

------------------------------------------ ----- ------------- ------------- -----------

Creditors: amounts falling due within

one year

Bank overdraft (5,346) - -

Cash collateral in respect of contracts

for difference ("CFDs") (242) - -

Amounts payable in respect of CFDs (1,226) (6,646) (4,969)

Other creditors (304) (1,808) (216)

(7,118) (8,454) (5,185)

------------------------------------------ ----- ------------- ------------- -----------

Net current assets 1,537 8,871 3,433

------------------------------------------ ----- ------------- ------------- -----------

Net assets 208,573 174,515 184,360

------------------------------------------ ----- ------------- ------------- -----------

Capital and reserves

Share capital 8 1,348 1,348 1,348

Share premium 98,067 98,437 98,437

Special reserve 64,671 64,671 64,671

Capital reserve

-Revaluation gains on investment held

at period end 23,243 3,565 14,746

-Other capital reserves 15,833 847 (1,578)

Revenue reserve 5,411 5,647 6,736

Total Shareholders' funds 208,573 174,515 184,360

------------------------------------------ ----- ------------- ------------- -----------

NAV per share - Ordinary Shares (pence) 11 154.81p 129.53p 136.84p

------------------------------------------ ----- ------------- ------------- -----------

Approved by the Board of Directors and authorised for issue on 25 June

2021 and signed on their behalf by:

Harry Wells

Director

CC Japan Income & Growth Trust plc is incorporated in England and Wales

with registration number 9845783.

CONDENSED STATEMENT OF CHANGES IN EQUITY

SIX MONTHS TO 30 APRIL 2021 (Unaudited)

Share Share Special Capital Revenue

capital premium reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- --------- --------- --------- ---------

Balance at 1 November

2020 1,348 98,437 64,671 13,168 6,736 184,360

Return on ordinary

activities after taxation - - - 25,908 2,986 28,894

Dividends paid - - - - (4,311) (4,311)

Ordinary Shares issue

costs - (370) - - - (370)

Balance at 30 April

2021 1,348 98,067 64,671 39,076 5,411 208,573

----------------------------- --------- --------- --------- --------- --------- ---------

SIX MONTHS TO 30 APRIL

2020 (Unaudited)

Share Share Special Capital Revenue

capital premium reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- --------- --------- --------- ---------

Balance at 1 November

2019 1,348 98,437 64,671 43,667 6,003 214,126

Return on ordinary

activities after taxation - - - (39,255) 3,821 (35,434)

Dividends paid - - - - (4,177) (4,177)

Balance at 30 April

2020 1,348 98,437 64,671 4,412 5,647 174,515

----------------------------- --------- --------- --------- --------- --------- ---------

YEARED 31 OCTOBER

2020 (Audited)

Share Share Special Capital Revenue

capital premium reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- --------- --------- --------- ---------

Balance at 1 November

2019 1,348 98,437 64,671 43,667 6,003 214,126

Return on ordinary

activities after taxation - - - (30,499) 6,796 (23,703)

Dividends paid - - - - (6,063) (6,063)

Balance at 31 October

2020 1,348 98,437 64,671 13,168 6,736 184,360

----------------------------- --------- --------- --------- --------- --------- ---------

The Company's distributable reserves consist of the Special reserve,

Revenue reserve and Capital reserve attributable to realised profits.

CONDENSED STATEMENT OF CASH FLOWS

SIX MONTHS TO 30 APRIL 2021

Six months Six months

to 30 April to 30 April

2021 2020

Year ended

31 October

(Unaudited) (Unaudited) 2020 (Audited)

GBP'000 GBP'000 GBP'000

-------------------------------------------- ------------- ------------- ----------------

Operating activities cash flows

Return on ordinary activities before

finance costs and taxation* 29,390 (34,836) (22,621)

Adjustment for:

(Gains)/losses on investments (18,381) 30,685 23,290

CFD transactions (5,980) 4,250 48

(Increase)/decrease in other debtors (84) 125 (380)

Increase/(decrease) in other creditors 87 (17) (75)

Tax withheld on overseas income (386) (474) (853)

------------- ------------- ----------------

Net cash flow from/(used in) operating

activities 4,646 (267) (591)

-------------------------------------------- ------------- ------------- ----------------

Investing activities cash flows

Purchases of investments (58,804) (46,039) (92,584)

Proceeds from sales of investments 51,139 59,398 99,458

Net cash flow (used in)/from investing

activities (7,665) 13,359 6,874

-------------------------------------------- ------------- ------------- ----------------

Financing activities cash flows

Share issue costs (370) - -

Equity dividends paid (4,311) (4,177) (6,063)

Finance costs paid (109) (124) (229)

Net cash used in financing activities (4,790) (4,301) (6,292)

(Decrease)/increase in cash and cash

equivalents (7,809) 8,791 (9)

------------- ------------- ----------------

Cash and cash equivalents at the beginning

of the period/year 2,463 2,472 2,472

Cash and cash equivalents at the end

of the period/year (5,346) 11,263 2,463

-------------------------------------------- ------------- ------------- ----------------

* Cash inflow from dividends was GBP3,418,000 (30 April 2020: GBP4,880,000

and 31 October 2020: GBP7,396,000).

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. GENERAL INFORMATION

CC Japan Income & Growth Trust plc (the "Company") was incorporated

in England and Wales on 28 October 2015 with registered number 9845783,

as a closed-ended investment company. The Company commenced its operations

on 15 December 2015. The Company intends to carry on business as an

investment trust within the meaning of Chapter 4 of Part 24 of the Corporation

Tax Act 2010.

The Company's investment objective is to provide Shareholders with dividend

income combined with capital growth, mainly through investment in equities

listed or quoted in Japan.

The principal activity of the Company is that of an investment trust

company within the meaning of section 1158 of the Corporation Tax Act

2010.

The Company's shares were admitted to the Official List of the UK Listing

Authority with a premium listing on 15 December 2015. On the same day,

trading of the Ordinary Shares commenced on the London Stock Exchange.

The Company's registered office is 1st Floor, Senator House, 85 Queen

Victoria Street, London, EC4V 4AB.

2. ACCOUNTING POLICIES

The interim financial statements have been prepared in accordance with

FRS 104 Interim Financial Reporting and the Statement of Recommended

Practice "Financial Statements of Investment Trust Companies and Venture

Capital Trusts" issued by the Association of Investment Companies in

October 2019.

This half-yearly Financial Report is unaudited and does not include

all the information required for full annual financial statements. The

half-yearly Financial Report should be read in conjunction with the

Annual Report and Accounts of the Company for the year ended 31 October

2020. The Annual Report and Accounts for the year ended 31 October 2020

were prepared in accordance with FRS 102 The Financial Reporting Standard

applicable in the UK and Republic of Ireland ("FRS 102") and received

an unqualified audit report. The financial information for the year

ended 31 October 2020 in this half-yearly Financial Report has been

extracted from the audited Annual Report and Accounts for that year

end. The accounting policies in this Half-yearly Financial Report are

consistent with those applied in the Annual Report for the year ended

31 October 2020.

The interim financial statements have been presented in GBP sterling

(GBP).

3. INVESTMENTS

As at 31

As at 30 As at 30 October

April 2021 April 2020 2020

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ----- ------------- ------------- -----------

Investments listed on a recognised

overseas investment exchange 207,036 165,644 180,927

--------------------------------------------- ------------- -----------

207,036 165,644 180,927

-------------------------------------------- ------------- ------------- -----------

Fair Value Measurements of Financial Assets and Financial Liabilities

The financial assets and liabilities are either carried in the balance

sheet at their fair value, or the balance sheet amount is a reasonable

approximation of fair value (due from brokers, dividends receivable,

accrued income, due to brokers, accruals and cash and cash equivalents).

The valuation techniques for investments and derivatives used by the

Company are explained in the accounting policies notes 2 (b and c) in

the Annual report for the year ended 31 October 2020.

The table below sets out fair value measurements using fair value hierarchy

in accordance with "Amendments to FRS 102: Fair Value Hierarchy Disclosure

(March 2016)" published by the FRC.

Level 1 Level 2 Level 3 Total

30 April 2021 (Unaudited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ----------- ----------- ---------- ----------

Assets:

Equity investments 207,036 - - 207,036

CFDs - Fair Value gains - 5,534 - 5,534

Liabilities:

CFDs - Fair Value losses - (1,226) - (1,226)

------------------------------------ ----------- ----------- ----------

Total 207,036 4,308 - 211,344

------------------------------------ ----------- ----------- ---------- ----------

Level 1 Level 2 Level 3 Total

30 April 2020 (Unaudited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ----------- ----------- ---------- ----------

Assets:

Equity investments 165,644 - - 165,644

CFDs - Fair Value gains - 530 - 530

Liabilities:

CFDs - Fair Value losses - (6,646) - (6,646)

------------------------------------ ----------- ----------- ----------

Total 165,644 (6,116) - 159,528

------------------------------------ ----------- ----------- ---------- ----------

Level 1 Level 2 Level 3 Total

31 October 2020 (Audited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ----------- ----------- ---------- ----------

Assets:

Equity investments 180,927 - - 180,927

CFDs- Fair Value gains - 3,014 - 3,014

Liabilities:

CFDs - Fair Value losses - (4,969) - (4,969)

------------------------------------ ----------- ----------- ---------- ----------

Total 180,927 (1,955) - 178,972

------------------------------------ ----------- ----------- ---------- ----------

There were no transfers between levels during the period to 30 April

2021 (30 April 2020: nil and 31 October 2020: nil).

Categorisation within the hierarchy has been determined on the basis

of the lowest level input that is significant to the Fair Value measurement

of the relevant asset as follows:

Level 1 - valued using quoted prices in active markets for identical

assets.

Level 2 - valued by reference to valuation techniques using observable

inputs including quoted prices.

Level 3 - valued by reference to valuation techniques using inputs that

are not based on observable market data. There are no Level 3 investments

as at 30 April 2021 (30 April 2020: nil and 31 October 2020: nil).

4. INCOME

Six months Six months Year ended

to 30 April to 30 April 31 October

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

--------------------------- -------------- ------------- ------------

Income from investments:

Overseas dividends 3,861 4,743 8,553

-------------- ------------- ------------

3,861 4,743 8,553

--------------------------- -------------- ------------- ------------

Overseas dividend income is translated into sterling on receipt.

5. FINANCE COSTS

Six months Six months Year ended

to 30 April to 30 April 31 October

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

-------------------------------------------- ------------- ------------- ------------

Interest paid - 100% charged to revenue 8 13 21

CFD finance cost and structuring fee -

20% charged to revenue 20 22 41

Structuring fees - 20% charged to revenue - - 1

------------- ------------- ------------

28 35 63

-------------------------------------------- ------------- ------------- ------------

CFD finance cost and structuring fee -

80% charged to capital 80 87 164

Structuring - 80% charged to capital 2 2 2

------------- ------------- ------------

82 89 166

-------------------------------------------- ------------- ------------- ------------

Total finance costs 110 124 229

-------------------------------------------- ------------- ------------- ------------

6. TAXATION

Six months to 30 April Six months to 30 April

2021 (Unaudited) 2020 (Unaudited)

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- -------- -------- -------- ------------ ---------- ----------

Analysis of tax charge in the

period:

Overseas withholding tax 386 - 386 474 - 474

-------- -------- -------- ------------ ----------

Total tax charge for the period 386 - 386 474 - 474

--------------------------------- -------- -------- -------- ------------ ---------- ----------

Year ended 31 October

2020 (Audited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

--------------------------------- -------- -------- --------

Analysis of tax charge in the

year:

Overseas withholding tax 853 - 853

-------- --------

Total tax charge for the year 853 - 853

--------------------------------- -------- -------- --------

7. INTERIM DIVID

During the six months ended 30 April 2021, the Company paid a dividend

of 3.20p per Ordinary Share in respect of the year ended 31 October

2020.

The Directors have declared an interim dividend for the six months ended

30 April 2021 of 1.40p (2020: 1.40p) per Ordinary Share. The dividend

will be paid on 6 August 2021, to Ordinary Shareholders on the register

at the close of business on 9 July 2021. The Ordinary Shares will go

ex-dividend on 8 July 2021.

8. SHARE CAPITAL

Share capital represents the nominal value of shares that have been

issued. The share premium includes any premiums received on issue of

share capital. Any transaction costs associated with the issuing of

shares are deducted from share premium.

As at 30 April 2021 As at 30 April As at 31 October

(Unaudited) 2020 (Unaudited) 2020 (Audited)

No of shares GBP'000 No of shares GBP'000 No of shares GBP'000

------------------- ---------------------- ------------- ------------------ ----------- ------------------ -----------

Allotted, issued &

fully paid:

Ordinary Shares of

1p

Opening balance 134,730,610 1,348 134,730,610 1,348 134,730,610 1,348

------------------- ---------------------- ------------- ------------------ ----------- ------------------ -----------

Closing balance 134,730,610 1,348 134,730,610 1,348 134,730,610 1,348

------------------- ---------------------- ------------- ------------------ ----------- ------------------ -----------

On 18 February 2021, the Company issued 26,946,122 Subscription Shares

to qualifying Shareholders on the register of members of the Company

by close of business on 15 February 2021, pursuant to the terms of the

Bonus Issue. None of the Subscription Shares were exercised during the

period to 30 April 2021.

Since the period end, the Company has not issued any new Ordinary Shares

or Subscription Shares.

9. FINANCIAL COMMITMENTS

As at 30 April 2021, there were no commitments in respect of unpaid

calls and underwritings (30 April 2020: nil and 31 October 2020: nil).

10. RETURN PER ORDINARY SHARE

Total return per Ordinary Share is based on the return on ordinary activities,

including income, for the period after taxation of GBP28,894,000 (30

April 2020: loss of GBP35,434,000 and 31 October 2020: loss of GBP23,703,000).

Based on the weighted average number of Ordinary Shares in issue for

the period to 30 April 2021 of 134,730,610 (30 April 2020: 134,730,610,000

and 31 October 2020: 134,730,610,000), the returns per Ordinary Share

were as follows:

As at 30 April 2021 As at 30 April 2020 As at 31 October 2020

(Unaudited) (Unaudited) (Audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

----------------- -------- -------- ------- -------- --------- --------- --------- --------- -----------

Return per

Ordinary Share 2.22p 19.23p 21.45p 2.84p (29.14)p (26.30)p 5.04p (22.64)p (17.60)p

----------------- -------- -------- ------- -------- --------- --------- --------- --------- -----------

11. NET ASSET VALUE PER SHARE

Total shareholders' funds and the NAV per share attributable to the

Ordinary Shareholders at the period end calculated in accordance with

the Articles of Association were as follows:

As at 30 April As at 30 April As at 31 October

2021 (Unaudited) 2020 (Unaudited) 2020 (Audited)

---------------------------------- -------------------- -------------------- ---------------------

Net Asset Value (GBP'000) 208,573 174,515 184,360

---------------------------------- -------------------- -------------------- ---------------------

Ordinary Shares in issue 134,730,610 134,730,610 134,730,610

---------------------------------- -------------------- -------------------- ---------------------

NAV per Ordinary Share 154.81p 129.53p 136.84p

---------------------------------- -------------------- -------------------- ---------------------

12. RELATED PARTY TRANSACTIONS

Transactions with the Investment Manager and the Alternative Investment

Fund Investment Manager ("AIFM")

The Company provides additional information concerning its relationship

with the Investment Manager and AIFM, Coupland Cardiff Asset Management

LLP. Investment management fees for the six-month period to 30 April 2021

were GBP780,000 (30 April 2020: GBP737,000 and 31 October 2020: GBP1,425,000).

The fees outstanding at the period ended 30 April 2021 were GBP131,000

(30 April 2020: GBP102,000 and 31 October 2020: GBP116,000).

Research purchasing agreement

The Markets in Financial Instruments Directive II ("MiFID II") treats

investment research provided by brokers and independent research providers

as a form of "inducement" to investment managers and requires research

to be paid separately from execution costs. In the past, the costs of

broker research were primarily borne by the Company as part of execution

costs through dealing commissions paid to brokers. With effect from 3

January 2018, this practice has changed, as brokers subject to MiFID II

are now required to price, and charge for, research separately from execution

costs. Equally, the rules require the Investment Manager, as an investment

Manager, to ensure that the research costs borne by the Company are paid

for through a designated Research Payment Account ("RPA") funded by direct

research charges to the Investment Manager's clients; including the Company.

The estimated research charge for the period 1 January 2021 to 31 December

2021, as budgeted by the Investment Manager, is approximately GBP28,000

(2020: GBP30,000).

Directors' fees and shareholdings

Directors' fees are payable at the rate of GBP25,000 per annum for each

Director other than the Chairman, who is entitled to receive GBP37,500.

The Chairman of the Audit Committee is also entitled to an additional

fee of GBP5,125 per annum and the senior independent director is entitled

to an additional fee of GBP1,000.

The Directors had the following ordinary shareholdings in the Company,

all of which were beneficially owned.

Ordinary

Shares Subscription

As at 30 Shares Ordinary Shares Ordinary Shares

April 2021 As at 30 April As at 30 April As at 31 October

(Unaudited) 2021 (Unaudited) 2020 (Unaudited) 2020 (Audited)

--------------------- ------------- ------------------ ------------------ ------------------

Harry Wells 40,000 8,000 40,000 40,000

Kate Cornish-Bowden 40,000 8,000 30,000 30,000

John Scott 62,500 12,500 62,500 62,500

Peter Wolton 67,250 13,449 60,000 67,250

Mark Smith* - - 10,000 10,000

*Mr Mark Smith retired from the Board on 26 March 2021.

13. POST BALANCE SHEET EVENTS

There are no post balance sheet events other than as disclosed in this

half-yearly financial report.

14. STATUS OF THIS REPORT

These interim financial statements are not the Company's statutory accounts

for the purposes of section 434 of the Companies Act 2006. They are

unaudited. The half-yearly financial report will be made available to

the public at the registered office of the Company. The report will

also be available on the Company's website www.ccjapanincomeandgrowthtrust.com

The information for the year ended 31 October 2020 has been extracted

from the last published audited financial statements, unless otherwise

stated. The audited financial statements have been delivered to the

Registrar of Companies. The Auditors reported on those accounts and

their report was unqualified, did not draw attention to any matters

by way of emphasis and did not contain a statement under sections 498(2)

or 498(3) of the Companies Act 2006.

GLOSSARY AND ALTERNATIVE PERFORMANCE MEASURES ("APM")

Administrator The Company's administrator, the current

such administrator being PraxisIFM

Fund Services (UK) Limited.

AIC Association of Investment Companies.

Alternative Investment Fund or "AIF" An investment vehicle under AIFMD.

Under AIFMD (see below) the Company

is classified as an AIF.

Alternative Investment Fund Managers A European Union Directive which came

Directive or "AIFMD" into force on 22 July 2013 and has

been implemented in the UK.

Annual General Meeting or "AGM" A meeting held once a year, which

Shareholders are entitled to attend,

and where they can vote on resolutions

to be put forward at the meeting and

ask Directors questions about the

Company.

CFD or Contract for difference A financial instrument, which provides

exposure to an underlying equity with

the provider financing the cost to

the buyer with the buyer receiving

the difference of any gain or paying

for any loss.

Custodian An entity that is appointed to safeguard

a company's assets.

Depositary Certain AIFs must appoint depositaries

under the requirements of AIFMD. A

depositary's duties include, inter

alia, safekeeping of the Company's

assets and cash monitoring. Under

AIFMD the depositary is appointed

under a strict liability regime.

Dividend Income receivable from an investment

in shares.

Discount (APM) The amount, expressed as a percentage,

by which the share price is less than

the Net Asset Value per share.

As at 30 April 2021

--------------------------------- ------------ ---------------- --------

NAV per Ordinary Share a 154.8

Share price b 145.0

Discount (b÷a)-1 6.3%

----------------------------------------------- ---------------- --------

Ex-dividend date The date from which you are not entitled

to receive a dividend which has been

declared and is due to be paid to

Shareholders.

Financial Conduct Authority or ("FCA") The independent body that regulates

the financial services industry in

the UK.

Gearing (APM) A way to magnify income and capital

returns, but which can also magnify

losses. A bank loan is a common method

of gearing.

As at 30 April 2021 GBP'000

--------------------------- ----------- --------

CFD Notional Market Value a 41,407

Non-base cash borrowings b 2,615

NAV c 208,573

Gearing (net) ((a+b)/c) 21.1%

---------------------------- ---------- --------

Gross assets (APM) The Company's total assets including

any leverage amount.

Index A basket of stocks which is considered

to replicate a particular stock market

or sector.

In the Money The Subscription Shares are "In the

Money" when the Ordinary Share price

trades at a level that exceeds the

Subscription Price.

Investment trust A closed end investment company which

is based in the UK and which meets

certain tax conditions which enables

it to be exempt from UK corporation

tax on its capital gains. This Company

is an investment trust.

Leverage (APM) An alternative word for "Gearing".

Under AIFMD, leverage is any method

by which the exposure of an AIF is

increased through borrowing of cash

or securities or leverage embedded

in derivative positions.

Under AIFMD, leverage is broadly similar

to gearing, but is expressed as a

ratio between the assets (excluding

borrowings) and the net assets (after

taking account of borrowing). Under

the gross method, exposure represents

the sum of the Company's positions

after deduction of cash balances,

without taking account of any hedging

or netting arrangements. Under the

commitment method, exposure is calculated

without the deduction of cash balances

and after certain hedging and netting

positions are offset against each

other. Under both methods, the AIFM

has set maximum limits of leverage

for the Company of 200%. A leverage

percentage of 100% equates to nil

leverage.

Gross Commitment

As at 30 April 2021 GBP'000 GBP'000

--------------------------- ----------- --------- -----------

Security Market value a 207,036 207,036

CFD Notional market value b 41,407 41,407

Cash and cash equivalents c 7,793 5,525

NAV d 208,573 208,573

Leverage (a+b+c)/d 123% 122%

---------------------------- ---------- --------- -----------

Market liquidity The extent to which investments can be bought

or sold at short notice.

Net assets An investment company's assets less its liabilities

Net Asset Value ("NAV") Net assets divided by the number of Ordinary

per Ordinary Share Shares in issue (excluding any shares held in

treasury)

Ordinary Shares The Company's Ordinary Shares in issue.

A measure, expressed as a percentage of average

Ongoing charges (APM) net assets, of the regular, recurring annual

costs of running an investment company.

Out of the Money The Subscription Shares are "Out of the Money"

when the Ordinary Shares trade at less than the

Subscription Price.

Portfolio A collection of different investments constructed

and held in order to deliver returns to Shareholders

Premium (APM) and to spread risk.

The amount, expressed as a percentage, by which

the share price is more than the Net Asset Value

per share.

Share buyback A purchase of a company's own shares. Shares

can either be bought back for cancellation or

held in treasury.

Share Price The price of a share as determined by buyers

and sellers on the relevant stock exchange.

Subscription Shares A Subscription Share confers the right (but not

Subscription Price the obligation) to subscribe for one Ordinary

Treasury shares Share on exercise of the rights attached to the

Subscription Share and on payment of the Subscription

Price of GBP1.61 at the end of each calendar

quarter between 31 May 2021 and 28 February 2023.

Total return (APM) The Subscription Price is set at GBP1.61 being

the price that holders of the Subscription Shares

can pay to exercise these shares into New Ordinary

Shares of the Company on a quarterly basis up

until the end of February 2023.

A company's own shares held in Treasury account

by the Company but which are available to be

resold in the market.

A measure of performance that takes into account

both income and capital returns.

NAV

Period ended 30 April 2021 Share price ex-income

---------------------------------------- ----------- ------------- -----------

Opening at 1 November 2020 (in

pence) a 119.5 133.2

Closing at 30 April 2021 (in

pence) b 145.0 152.6

Price movement (b÷a)-1 c 21.3% 14.6%

Dividend reinvestment d 2.7% 2.4%

Total return (c+d) 24.0% 17.0%

---------------------------------------- ----------- ------------- -----------

Volatility A measure of how much a share moves up and down

in price over a period of time.

COMPANY INFORMATION

DIRECTORS, INVESTMENT MANAGER AND ADVISERS

DIRECTORS INVESTMENT MANAGER

Harry Wells (Chairman) Coupland Cardiff Asset Management

Kate Cornish-Bowden (Audit LLP

Chair) 31-32 St James's Street

John Scott London

Peter Wolton SW1A 1HD

Website - www.couplandcardiff.com

BROKER REGISTERED OFFICE

Peel Hunt LLP 1st Floor, Senator House

100 Liverpool Street 85 Queen Victoria Street

London London

EC2M 2AT EC4V 4AB

Website - www.praxisifm.com

DEPOSITARY AND CUSTODIAN COMPANY SECRETARY AND ADMINISTRATOR

Northern Trust Global Services PraxisIFM Fund Services (UK) Limited

SE 1st Floor, Senator House

10 Rue du Château d'Eau 85 Queen Victoria Street

L-3364 Leudelange London

Grand-Duché de Luxembourg EC4V 4AB

REGISTRAR AUDITOR

Link Asset Services, Ernst & Young LLP

The Registry, 25 Churchill Place

34 Beckenham Road Canary Wharf

Beckenham London

Kent BR3 4TU E14 5EY

COMPANY SECURITY INFORMATION/IDENTIFICATION CODES

ISIN GB00BYSRMH16 / GB00BM90B010 (Subscription Shares)

SEDOL BYSRMH1 / BM90B01 (Subscription Shares)

TICKER CCJI LDN / CCJS (Subscription Shares)

WEBSITE www.ccjapanincomeandgrowthtrust.com

BLOOMBERG CCJI LDN / CCJS (Subscription Shares)

GIIN 6 HEK HT - 99 999 -SL - 826

* Registered in England and Wales with registration number

9845783

Enquiries:

Brian Smith / Ciara McKillop 020 4513

9260

PraxisIFM Fund Services (UK) Limited

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DELFLFQLZBBE

(END) Dow Jones Newswires

June 28, 2021 02:00 ET (06:00 GMT)

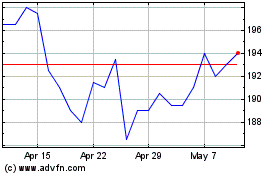

Cc Japan Income & Growth (LSE:CCJI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cc Japan Income & Growth (LSE:CCJI)

Historical Stock Chart

From Apr 2023 to Apr 2024