TIDMCCL

Carnival Corporation & plc Provides First Quarter 2021 Business Update

MIAMI, April 7, 2021 /PRNewswire/ -- Carnival Corporation & plc (NYSE/LSE: CCL;

NYSE: CUK) provides first quarter 2021 business update.

* U.S. GAAP net loss of $(2.0) billion and adjusted net loss of $(2.0)

billion for the first quarter of 2021.

* First quarter 2021 ended with $11.5 billion of cash and short-term

investments.

* Cash burn rate in the first quarter of 2021 was better than expected as the

company has identified and implemented opportunities to optimize its

monthly spend.

* Booking volumes for all future cruises during the first quarter of 2021

were approximately 90% higher than booking volumes during the fourth

quarter of 2020.

* Cumulative advanced bookings for full year 2022 are ahead of a very strong

2019, despite minimal advertising or marketing.

* Six of the company's nine brands are expected to resume limited guest

cruise operations by this summer.

+ AIDA resumed guest cruise operations in March sailing in the Canary

Islands.

+ Costa expects to resume guest cruise operations in May sailing to

Italian ports.

+ P&O Cruises (UK), Cunard and Princess Cruises will each offer a series

of UK cruises this summer.

+ Seabourn expects to resume guest cruise operations this summer sailing

from Greece.

Carnival Corporation & plc President and Chief Executive Officer Arnold Donald

noted, "We are focused on resuming operations as quickly as practical, while at

the same time demonstrating prudent stewardship of capital and doing so in a

way that serves the best interests of public health. Our highest responsibility

and therefore our top priority is always compliance, environmental protection

and the health, safety and well-being of everyone." Donald added, "Our

portfolio of brands have clearly been an asset as we resume operations this

summer with nine ships across six of our brands."

Donald continued, "Throughout the pause we have been positioning Carnival

Corporation to return to serving guests an operationally stronger company than

we were before. With an exciting roster of six new, more efficient ships by

December and with lower capacity from the exit of 19 less efficient ships, we

expect to capitalize on pent-up demand and achieve significant cost improvement

from the greater efficiency of our fleet, along with ongoing streamlining of

shoreside operations."

Update on Bookings

Donald added, "Booking volumes are accelerating. During the first quarter of

2021 they were approximately 90% higher than volumes during the fourth quarter

of 2020 reflecting both the significant pent up demand and long-term potential

for cruising."

Cumulative advanced bookings for full year 2022 are ahead of a very strong 2019

as of March 21, 2021. The company highlights this level of bookings was

achieved with minimal advertising and marketing. (Due to the pause in guest

cruise operations in 2020, the company's current booking trends will be

compared to bookings trends for 2019 sailings.)

Total customer deposits as of February 28, 2021 and November 30, 2020 were $2.2

billion, the majority of which are future cruise credits. During the quarter,

customer deposits on new bookings essentially offset the impact of refunds

provided. As of February 28, 2021, the current portion of customer deposits was

$1.8 billion, of which $0.7 billion relates to bookings for the remainder of

2021.

Resumption of Guest Operations

The company is uniquely positioned for a phased resumption in cruise travel

given its multiple brands which can each be restarted independently and

tailored to the environment of their respective source market. AIDA Cruises

("AIDA") resumed guest cruise operations in late March sailing in the Canary

Islands. Costa Cruises ("Costa") expects to resume operations in May sailing to

Italian ports. P&O Cruises (UK), Cunard and Princess Cruises will each offer a

series of cruises this summer sailing around UK coastal waters with P&O Cruises

(UK) kicking off the season in June followed by Cunard and Princess Cruises in

July. Seabourn also expects to resume guest cruise operations this summer

sailing from Greece. In addition, this summer Holland America Line and Princess

Cruises expect to offer land-based vacation options for travelers to experience

Alaska through a combination of tours, lodging and sightseeing.

Health and Safety Protocols

Initial cruises are taking place with adjusted passenger capacity and enhanced

health protocols developed with government and health authorities, and guidance

from the company's roster of medical and scientific experts. The company has

been working with a number of world-leading public health, epidemiological and

policy experts to support its ongoing efforts with enhanced health and safety

protocols to help protect against and mitigate the impact of COVID-19 during

cruise vacations. The company's brands have a comprehensive set of health and

hygiene protocols that facilitate a safe and healthy return to cruise

vacations. These enhanced protocols are modeled after shoreside health and

mitigation guidelines as provided by each brand's respective country, and

approved by all relevant regulatory authorities. Protocols will be updated

based on evolving scientific and medical knowledge related to mitigation

strategies. In addition to the jurisdictions associated with the restart plans

noted above, the company continues to work closely with governments and health

authorities in other parts of the world to ensure that its health and safety

protocols will also comply with the requirements of each location.

Increasing Liquidity

Carnival Corporation & plc Chief Financial Officer David Bernstein noted, "We

ended the first quarter with $11.5 billion in cash and short-term investments.

At this time, we believe we have enough liquidity to get us back to full

operations and we will be pursuing refinancing opportunities to reduce interest

expense and extend maturities. We have successfully identified and implemented

actions to optimize our monthly cash burn rate and we will continue to do so."

The company's monthly average cash burn rate for the first quarter of 2021 was

$500 million, which was better than expected primarily due to the timing of

capital expenditures. The company expects the monthly average cash burn rate

for the first half of 2021 to be approximately $550 million, which is better

than previously expected. This is a result of the company's efforts to optimize

its monthly spend despite higher restart related spend. This monthly average

cash burn rate includes ongoing ship operating and administrative expenses,

estimated restart spend, working capital changes (excluding changes in customer

deposits), interest expense and capital expenditures (net of export credit

facilities), and excludes scheduled debt maturities as well as other cash

collateral to be provided. As the company continues to resume guest cruise

operations, it expects to incur incremental spend relating to bringing ships

out of pause status, returning crew members to its ships and implementing

enhanced health and safety protocols.

Due to the pause in guest operations, the company has taken significant actions

to preserve cash and secure additional financing to increase its liquidity.

Since March 2020, the company has raised $23.6 billion through a series of

transactions, including the following transactions since the beginning of the

first quarter 2021:

* Borrowed $1.5 billion under export credit facilities in December 2020

* Issued $3.5 billion of senior unsecured notes in February 2021

* Completed a $1.0 billion public equity offering of its common stock in

February 2021

During the remainder of fiscal 2021, the company expects to refinance debt at

lower interest rates and extend maturities.

As of February 28, 2021, the company's outstanding debt maturities are as

follows:

(in billions) 2Q 2021 3Q 2021 4Q 2021 1Q 2022

Principal payments on $ 0.4 $ 0.5 $ 0.3 $ 0.6

outstanding debt (a)

(a) Excluding the revolving facility. As of February 28,

2021, borrowings under the revolving facility were $3.1

billion. The

maturities for these borrowings are currently extended

through September 2021. The company may re-borrow such

amounts subject to satisfaction of the conditions in

the revolving facility agreement.

The pause in guest operations continues to have a material negative impact on

all aspects of the company's business, including the company's liquidity,

financial position and results of operations. The company expects a net loss on

both a U.S. GAAP and adjusted basis for the second quarter 2021 and full year

ending November 30, 2021.

Conference Call

The company has scheduled a conference call with analysts at 10:00 a.m. EDT (3:

00 p.m. BST) today to discuss its business update. This call can be listened to

live, and additional information can be obtained, via Carnival Corporation &

plc's website at www.carnivalcorp.com and www.carnivalplc.com.

Carnival Corporation & plc is one of the world's largest leisure travel

companies with a portfolio of nine of the world's leading cruise lines. With

operations in North America, Australia, Europe and Asia, its portfolio features

- Carnival Cruise Line, Princess Cruises, Holland America Line, P&O Cruises

(Australia), Seabourn, Costa Cruises, AIDA Cruises, P&O Cruises (UK) and

Cunard.

Additional information can be found on www.carnivalcorp.com,

www.carnivalsustainability.com, www.carnival.com, www.princess.com,

www.hollandamerica.com, www.pocruises.com.au, www.seabourn.com,

www.costacruise.com, www.aida.de, www.pocruises.com and www.cunard.com.

Cautionary Note Concerning Factors That May Affect Future Results

Some of the statements, estimates or projections contained in this document are

"forward-looking statements" that involve risks, uncertainties and assumptions

with respect to us, including some statements concerning future results,

operations, outlooks, plans, goals, reputation, cash flows, liquidity and other

events which have not yet occurred. These statements are intended to qualify

for the safe harbors from liability provided by Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All

statements other than statements of historical facts are statements that could

be deemed forward-looking. These statements are based on current expectations,

estimates, forecasts and projections about our business and the industry in

which we operate and the beliefs and assumptions of our management. We have

tried, whenever possible, to identify these statements by using words like

"will," "may," "could," "should," "would," "believe," "depends," "expect,"

"goal," "anticipate," "forecast," "project," "future," "intend," "plan,"

"estimate," "target," "indicate," "outlook," and similar expressions of future

intent or the negative of such terms.

Forward-looking statements include those statements that relate to our outlook

and financial position including, but not limited to, statements regarding:

. Pricing . Estimates of ship depreciable lives and

residual values

. Booking levels . Goodwill, ship and trademark fair values

. Occupancy . Liquidity and credit ratings

. Interest, tax and fuel . Adjusted earnings per share

expenses

. Currency exchange rates . Impact of the COVID-19 coronavirus global

pandemic

on our financial condition and results of

operations

Because forward-looking statements involve risks and uncertainties, there are

many factors that could cause our actual results, performance or achievements

to differ materially from those expressed or implied by our forward-looking

statements. This note contains important cautionary statements of the known

factors that we consider could materially affect the accuracy of our

forward-looking statements and adversely affect our business, results of

operations and financial position. Additionally, many of these risks and

uncertainties are currently amplified by and will continue to be amplified by,

or in the future may be amplified by, the COVID-19 outbreak. It is not possible

to predict or identify all such risks. There may be additional risks that we

consider immaterial or which are unknown. These factors include, but are not

limited to, the following:

* COVID-19 has had, and is expected to continue to have, a significant impact

on our financial condition and operations, which impacts our ability to

obtain acceptable financing to fund resulting reductions in cash from

operations. The current, and uncertain future, impact of the COVID-19

outbreak, including its effect on the ability or desire of people to travel

(including on cruises), is expected to continue to impact our results,

operations, outlooks, plans, goals, reputation, litigation, cash flows,

liquidity, and stock price.

* As a result of the COVID-19 outbreak, we may be out of compliance with one

or more maintenance covenants in certain of our debt facilities, with the

next testing date of November 30, 2022.

* World events impacting the ability or desire of people to travel have and

may continue to lead to a decline in demand for cruises.

* Incidents concerning our ships, guests or the cruise vacation industry as

well as adverse weather conditions and other natural disasters have in the

past and may, in the future, impact the satisfaction of our guests and crew

and lead to reputational damage.

* Changes in and non-compliance with laws and regulations under which we

operate, such as those relating to health, environment, safety and

security, data privacy and protection, anti-corruption, economic sanctions,

trade protection and tax have in the past and may, in the future, lead to

litigation, enforcement actions, fines, penalties and reputational damage.

* Breaches in data security and lapses in data privacy as well as disruptions

and other damages to our principal offices, information technology

operations and system networks, including the recent ransomware incidents,

and failure to keep pace with developments in technology may adversely

impact our business operations, the satisfaction of our guests and crew and

may lead to reputational damage.

* Ability to recruit, develop and retain qualified shipboard personnel who

live away from home for extended periods of time may adversely impact our

business operations, guest services and satisfaction.

* Increases in fuel prices, changes in the types of fuel consumed and

availability of fuel supply may adversely impact our scheduled itineraries

and costs.

* Fluctuations in foreign currency exchange rates may adversely impact our

financial results.

* Overcapacity and competition in the cruise and land-based vacation industry

may lead to a decline in our cruise sales, pricing and destination

options.

* Inability to implement our shipbuilding programs and ship repairs,

maintenance and refurbishments may adversely impact our business operations

and the satisfaction of our guests.

The ordering of the risk factors set forth above is not intended to reflect our

indication of priority or likelihood.

Forward-looking statements should not be relied upon as a prediction of actual

results. Subject to any continuing obligations under applicable law or any

relevant stock exchange rules, we expressly disclaim any obligation to

disseminate, after the date of this document, any updates or revisions to any

such forward-looking statements to reflect any change in expectations or

events, conditions or circumstances on which any such statements are based.

CARNIVAL CORPORATION & PLC

NON-GAAP FINANCIAL MEASURES

Three Months Ended February 28/

29,

(in millions) 2021 2020

Net income (loss)

U.S. GAAP net income (loss) $ (1,973) $ (781)

(Gains) losses on ship sales and 3 928

impairments

Restructuring expenses - -

Other 15 3

Adjusted net income (loss) $ (1,954) $ 150

Explanations of Non-GAAP Financial Measures

Non-GAAP Financial Measures

We use adjusted net income (loss) as a non-GAAP financial measure of our cruise

segments' and the company's financial performance. This non-GAAP financial

measure is provided along with U.S. GAAP net income (loss).

We believe that gains and losses on ship sales, impairment charges,

restructuring costs and other gains and losses are not part of our core

operating business and are not an indication of our future earnings

performance. Therefore, we believe it is more meaningful for these items to be

excluded from our net income (loss), and accordingly, we present adjusted net

income (loss) excluding these items.

The presentation of our non-GAAP financial information is not intended to be

considered in isolation from, as substitute for, or superior to the financial

information prepared in accordance with U.S. GAAP. It is possible that our

non-GAAP financial measures may not be exactly comparable to the like-kind

information presented by other companies, which is a potential risk associated

with using these measures to compare us to other companies.

CONTACT: Media Contact: Roger Frizzell, +1 305 406 7862; investor Relations

Contact: Beth Roberts, +1 305 406 4832

END

(END) Dow Jones Newswires

April 07, 2021 09:15 ET (13:15 GMT)

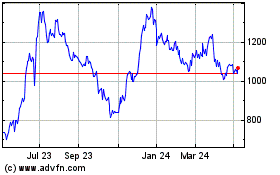

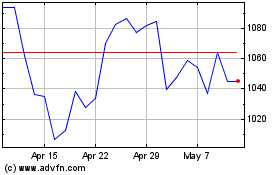

Carnival (LSE:CCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carnival (LSE:CCL)

Historical Stock Chart

From Apr 2023 to Apr 2024