Carnival Prices $2.41 Billion Notes Offering for Refinancing

July 22 2021 - 6:08AM

Dow Jones News

By Dave Sebastian

Carnival Corp. said it has priced its offering of $2.41 billion

in first-priority senior secured notes due 2028 to refinance part

of its existing 11.5% notes and to extend maturities.

The cruise operator said Wednesday evening that it expects the

offering of the new notes to close July 26. The new notes will pay

interest semiannually on Feb. 1 and Aug. 1 each year starting 2022

at an annual rate of 4%, it said. They will mature on Aug. 1, 2028,

Carnival said.

Carnival expects to use net proceeds from the offering to fund

its tender offer to buy up to $2 billion in 11.5% first-priority

senior secured notes due 2023 and the related consent solicitation,

as well as the payment of accrued and unpaid interest on those

notes accepted for purchase and related fees and expenses. The

company said the new notes' 4% interest rate will replace existing

debt carrying an 11.5% coupon and generate $135 million in interest

savings each year.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

July 22, 2021 06:54 ET (10:54 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

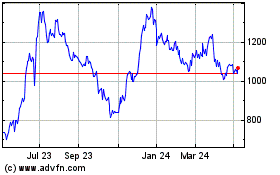

Carnival (LSE:CCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

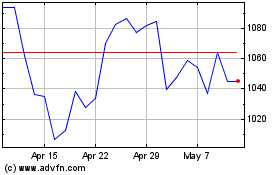

Carnival (LSE:CCL)

Historical Stock Chart

From Apr 2023 to Apr 2024